The depth filtration market is anticipated to be valued at USD 2.81 billion in 2025. It is expected to grow at a CAGR of 8.5% during the forecast period and reach a value of USD 6.35 billion in 2035.

The depth filtration market is projected to witness steady growth in 2024 owing to rising pharmaceutical and biopharmaceutical industry demand. While drug production and water treatment fell within tighter regulatory frameworks, firms invested more in efficient filtration solutions. The food and beverage industry also expanded its use, which was largely seen in beverage clarification and the eradication of microbes.

Conversely, the wastewater treatment industry beckoned with government projects to fight global water scarcity. Region-wise, demand remained unchanged in North America and Europe owing to stringent compliance regulations, whereas Asia-Pacific dominate the growth due to increasing industrialization as well as expanding healthcare infrastructure.

Looking ahead to 2025 and beyond, the industry is expected to continue its upward trajectory. In the coming years, demand for high-end filtration systems will be spurred by the pharmaceutical industry's shift to biologics and cell therapies. Furthermore, growing concerns about water quality and environmental sustainability will propel adoption in municipal and industrial wastewater treatment.

Next Generation technolgies like nanofiber based filtration media will improve efficiency and also increase the areas of application. Uncertainties regarding raw material prices may pose cost-related issues but product innovations along with capacity expansions to meet growing demand will be a particular focus for manufacturers. Asia-Pacific is expected to lead the industry with a fast level of urbanization as well as with higher health-care spending.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 2.81 Billion |

| Projected Industry Size in 2035 | USD 6.35 Billion |

| CAGR (2025 to 2035) | 8.5% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, end-users, and distributors in North America, Europe, Asia-Pacific, and Latin America

Regional Variance

High Variance in Adoption

Convergent and Divergent Perspectives on ROI

Consensus

Synthetic polymer-based filtration media was preferred by 67% of global stakeholders for its high dirt-holding capacity and chemical resistance.

Regional Variance

Shared Challenges

85% of stakeholders cited rising raw material costs (polymer prices up 22%, cellulose up 15%) as a major concern.

Regional Differences

Manufacturers

Distributors

End-Users

Alignment

72% of global manufacturers plan to invest in R&D for advanced filtration technologies, focusing on extended filter lifespan and higher retention efficiency.

Divergence

North America

67% of respondents said increased FDA scrutiny on pharmaceutical filtration processes significantly impacted procurement strategies.

Europe

80% viewed the EU's Circular Economy Plan as a catalyst for demand for sustainable filtration solutions.

Asia-Pacific & Latin America

Only 34% felt that regulations directly impacted purchase decisions, citing lower enforcement standards compared to North America and Europe.

High Consensus

Key Variances

Strategic Insight

| Country/Region | Key Regulations & Certifications Impacting the Industry |

|---|---|

| United States |

|

| Canada |

|

| European Union |

|

| Germany |

|

| France |

|

| United Kingdom |

|

| China |

|

| Japan |

|

| South Korea |

|

| India |

|

| Brazil |

|

| Australia |

|

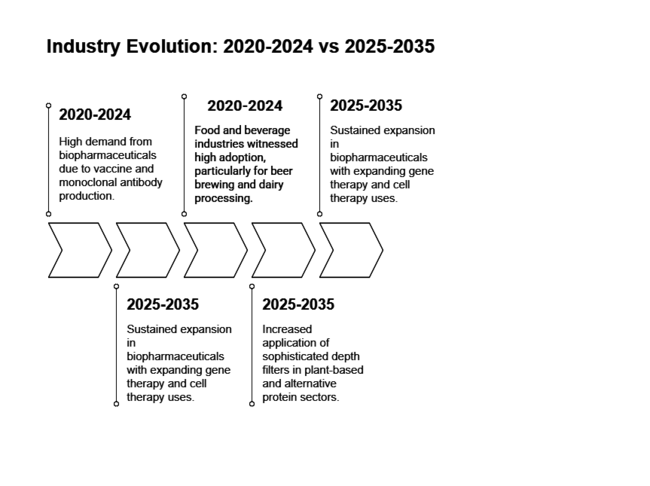

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| High demand from biopharmaceuticals due to vaccine and monoclonal antibody production. | Sustained expansion in biopharmaceuticals with expanding gene therapy and cell therapy uses. |

| The water treatment industry grew due to increased interest in water purity and regulatory enforcement. | Improvements in filtration media to increase efficiency and sustainability of water purification. |

| Food and beverage industries witnessed high adoption, particularly for beer brewing and dairy processing. | Increased application of sophisticated depth filters in plant-based and alternative protein sectors. |

| Advancements were targeted at enhancing filter life and capacity. | Sophisticated filtration systems with IoT integration to maximize efficiency and monitoring. |

| North America and Europe dominated innovation, whereas Asia-Pacific witnessed high industrial uptake. | Asia-Pacific will lead growth because of growing pharmaceutical and manufacturing industries. |

| Mergers and acquisitions among major players heightened industry concentration. | Ongoing strategic partnerships and investments in R&D to design high-performance filtration solutions. |

Cartridge filters dominated the depth filtration market, accounting for over 49% of total revenue in 2022. These filters provide consistent, cost-effective solutions across industries, including water treatment, paint filtering, and chemical processing. Their enhanced filtration efficiency, achieved through increased dirt-holding capacity, precise micron control, and graded density, makes them a preferred choice.

Growing industrial applications, particularly in pharmaceuticals and food processing, are set to sustain their dominance until 2035. Manufacturers are focusing on developing high-efficiency variants to meet evolving regulatory standards and the increasing demand for premium filtration solutions. Investments in research and advanced materials will further strengthen industry growth in the coming years.

Diatomaceous earth remains a leading segment in filtration media, gaining prominence in water treatment due to its exceptional filtering properties. Subjected to stringent pre-processing tests, it exhibits high resistance to oil and heat, making it invaluable for municipal and industrial water treatment plants. Its ability to eliminate microorganisms and fine particulates from raw water enhances its appeal for safe drinking water production.

Rising concerns about waterborne pollutants and strict potable water regulations are accelerating its adoption. Continuous advancements in diatomaceous earth processing methods are expected to boost filtration efficiency, thereby increasing demand across industries, including pharmaceuticals and food processing, through 2035.

Final product processing remains the dominant application segment in filtration, primarily due to the demand for high-purity outputs in the pharmaceutical, food, and beverage industries. This segment ensures the effective removal of impurities, particulates, and contaminants before products reach consumers. With stringent regulatory standards emphasizing product quality and safety, manufacturers are increasingly adopting advanced filtration technologies.

The rising production of biopharmaceuticals, coupled with the need for sterile, particle-free formulations, is set to drive growth. Investments in high-capacity, sustainable filtration systems will further support the segment’s expansion, ensuring compliance with evolving regulations and catering to increasing consumer preferences for quality-assured products.

The USA depth filtration market is projected to expand at a CAGR of ~7.8% from 2025 to 2035, fueled by the rapid expansion of quick-service restaurants (QSRs) and the adoption of advanced food warmers integrated with filtration systems. The growing demand for sterile and high-efficiency filters in food processing is driven by stringent FDA food safety regulations, which require QSR chains to maintain strict hygiene and contamination control measures.

The rise of IoT-enabled filtration technologies in smart food warming systems is another key factor shaping industry growth. These advanced systems ensure extended food preservation, quality control, and real-time monitoring, reducing food wastage and operational inefficiencies. Additionally, the Environmental Protection Agency’s (EPA) industrial wastewater treatment regulations are encouraging QSR chains to invest in sustainable filtration solutions, particularly those designed for oil and grease separation.

The increasing shift toward automation in commercial kitchens, including robotic food handling and AI-powered quality assessment systems, is also contributing to the demand for high-performance filtration solutions. As major QSR chains continue to expand their presence and modernize their operations, the need for advanced, cost-effective, and sustainable filtration systems is expected to surge, positioning the United States as a key hub for filtration innovations.

The UK is set to expand at a CAGR of ~7.1% from 2025 to 2035, driven by the rapid growth of QSR outlets and the increasing use of energy-efficient food-warming technologies. The British Standards Institution (BSI) BS 6920 mandates stringent filtration quality controls in food service equipment, ensuring hygiene and compliance.

As post-Brexit regulations evolve, local QSR brands are investing in specialized filtration solutions tailored to meet new safety and hygiene requirements. The growing emphasis on automation in commercial kitchens is further accelerating the adoption of advanced filtration systems, particularly in self-cleaning fryers and smart food warming units. The UK’s sustainability push in the food service sector is fueling demand for eco-friendly and reusable filtration systems.

Many QSR operators are prioritizing biodegradable filter media to reduce their environmental footprint while ensuring compliance with stringent food safety laws. As the adoption of high-tech filtration solutions continues to rise, the industry is expected to see significant expansion, with increasing investments in smart, automated, and sustainable filtration technologies.

France is anticipated to expand at a CAGR of ~7.3% from 2025 to 2035, driven by the rise of premium QSR chains and advanced filtration technologies in food warming systems. ANSES food safety regulations and AFNOR standards (NF T 90-520) require high-efficiency filters in food processing and catering equipment, compelling QSRs to upgrade their filtration infrastructure. The country’s thriving patisserie, bakery, and gourmet fast-food sectors are also increasing the demand for temperature-controlled food warmers with superior filtration systems to maintain hygiene and quality.

Additionally, the shift toward automated food preparation and service, including AI-powered dispensers and robotic kitchens, is boosting the need for smart filtration solutions. France’s growing focus on sustainability is further driving the adoption of eco-friendly and reusable filter media. As QSR operators continue to invest in advanced filtration technologies to comply with strict EU food safety directives, the industry is poised for sustained growth.

Germany is expected to register a CAGR of ~7.5% from 2025 to 2035, supported by the increasing adoption of automated QSRs and high-tech food warming solutions. The country’s DIN standards (DIN 19643, DIN 58356) enforce strict filtration quality requirements in food processing, compelling QSRs and self-service restaurants to adopt advanced filtration systems. The rapid growth of robotic kitchens and contactless food service technologies is further fueling demand for high-efficiency filtration solutions in food warming systems.

Germany’s strong commitment to energy efficiency is also driving the adoption of sustainable filter media. The increasing focus on automated cooking and serving systems in fast-food chains necessitates the use of high-performance filters to maintain air and food quality, prevent contamination, and optimize operational efficiency. As QSR operators continue prioritizing automation and sustainability, the industry is expected to witness steady growth.

Italy is poised to grow at a CAGR of ~7.0% from 2025 to 2035, fueled by the expansion of QSR chains and increasing demand for stringent filtration in food equipment. The Italian National Institute of Health (ISS) mandates strict compliance for food-grade filtration systems, particularly in pizza chains and gelato outlets. The rising emphasis on hygiene and antimicrobial filtration in high-volume QSRs is prompting the adoption of innovative filtration products.

Additionally, Italy’s focus on sustainability is encouraging QSRs to integrate biodegradable filtration media into their operations. The adoption of energy-efficient filtration systems in commercial kitchens is also growing as businesses look to optimize costs while meeting regulatory standards. As the QSR industry continues to expand, investments in high-quality filtration technologies are expected to rise, enhancing food safety and operational efficiency.

South Korea is forecast to grow at a CAGR of ~6.9% from 2025 to 2035, driven by the increasing adoption of technologically advanced QSRs and smart food warming solutions. The Ministry of Food and Drug Safety (MFDS) mandates strict filtration regulations in food handling equipment, compelling QSR chains to invest in self-cleaning and automated filtration systems. With the rise of AI-integrated food warmers in Korean convenience stores and self-service QSRs, the demand for high-performance filtration solutions is surging to ensure food hygiene and extended shelf life.

The sector is also witnessing a shift toward sustainable and energy-efficient filtration systems in response to South Korea’s environmental regulations. The growing presence of robotic kitchens and automated food dispensing units is further driving innovation in filtration technologies. As QSR brands continue to integrate smart, automated filtration into their food service infrastructure, the industry is expected to see significant advancements in high-efficiency and eco-friendly filtration solutions.

Japan is projected to expand at a CAGR of ~6.7% from 2025 to 2035, driven by the increasing number of compact QSRs and the integration of smart filtration technologies in automated food service equipment. The Pharmaceuticals and Medical Devices Agency (PMDA) and JIS B 9920 standards enforce strict compliance in food warmers and filtration units, ensuring safety in high-density urban eateries and vending machines. The demand for filtration-enhanced self-heating food containers is also rising, particularly in Japan's high-tech restaurant ecosystem.

As the country continues to push for innovation in automated dining solutions, QSR operators are increasingly investing in AI-driven filtration systems that optimize food preservation and air quality. Additionally, the push for sustainable food service solutions is driving demand for reusable and biodegradable filtration media. As urbanization and automation reshape Japan’s food service industry, the adoption of advanced filtration solutions is expected to experience steady growth.

China is expected to achieve a CAGR of ~8.2% from 2025 to 2035, driven by the rapid expansion of QSR chains and stringent government-led food safety regulations. The National Medical Products Administration (NMPA) and GB/T 5750 to 2023 standards regulate food-grade filtration systems, ensuring compliance in large-scale restaurant chains. The increasing adoption of robotic food preparation units and IoT-enabled warmers is further fueling demand for advanced filtration technologies.

China’s push for food safety modernization, supported by government policies, is encouraging QSR chains to invest in high-efficiency filtration systems. Additionally, the rise of cloud kitchens and centralized food production hubs is boosting the need for industrial-grade filtration solutions to maintain hygiene and product quality. As automation and food safety regulations continue to evolve, the industry is poised for significant growth.

The depth filtration market witness significant fluctuations in 2024 as industry players strive to retain their grip on the industry as demand for filtration solutions increases among end-user industries like pharmaceuticals, biotech, food and beverage, and water treatment. The key players in the industry here include Merck KGaA, Pall Corporation (Danaher), Sartorius AG, 3M Company, and Eaton Corporation, who have been setting the pace with regard to innovation and growth.

Merck KGaA, Darmstadt, Germany has an estimated 25% share and is one of the three largest players by volume of share, supported by a comprehensive line of filtration products and solutions. 2024 - A new generation of single-use filters specifically for biopharmaceuticals applications was released, as the trend toward low-cost, high-efficiency filtration in the drug manufacturing sector continued.

Danaher subsidiary Pall Corporation are one of the major players to take up to about 22% of the industry segment. In 2024, Pall introduced a new series of depth filters with next-generation microbial retention capabilities specifically for the biotechnology and pharmaceutical industries.

The firm also announced a strategic collaboration with a leading biotech company to develop custom filtration solutions for cell and gene therapy applications together. Silicon Valley, CA, October 14 -- This collaboration was reported by the Filtration Industry Analyst and specifically seeks to address the unique challenges of advanced therapeutic manufacturing.

Sartorius AG has maintained its 20% of the share. In the year 2024, Sartorius has mainly considered innovation and sustainment of product ecology. A new range of eco-friendly depth filters was introduced which are made from renewable materials, complying with global sustainability goals.

Sartorius would also acquire a smaller filtration technology company to further bolster its capacity in the biopharmaceutical sector. This acquisition confirms, through a press release from Sartorius's official website, that the company has strengthened its foothold in the fast-growing biologics arena.

3M Company is a company with a share of approximately 15%, which has focused its endeavors on technology development and strategic partnerships in the year 2024. The company has introduced a new line of depth filters with improved chemical resistance for food and beverage as well as water treatment applications.

3M has also partnered with a large water treatment firm to explore and develop innovative filtration technologies to treat wastewater on an industrial scale. This partnership, as reported by Water Technology Online, will ultimately meet the increasingly stringent regulatory requirements on water quality and sustainability.

Eaton Corporation, with 8% of the industry share, has the goal of expanding its presence into both industrial and life science applications. In 2024, the company launched a new line of depth filters built specially for heavy-duty applications within the oil and gas industry having an improved dirt-holding capacity. Separately, Eaton has with one of the premier arms of the pharmaceutical industry for developing filtration systems for mass vaccine production.

In 2024, the depth filtration market is defined by a high focus on innovation, sustainability, and strategic partnerships. Key players are adopting acquisitions, technological innovations, and regional developments as some of the pivotal strategies to sustain their position in the global healthcare laboratory industry. Digital technologies, including IoT and AI, have entered filtration systems, allowing intelligent filtration with real-time monitoring and optimization, maximizing efficiency in all applications.

Increasing demand in biopharmaceuticals, food and beverage processing, and water treatment is driving adoption. Advancements in filtration technology and stringent regulatory requirements further support expansion.

Biopharmaceuticals, food and beverage, chemicals, water treatment, and industrial manufacturing sectors depend on filtration for efficient contaminant removal and product purification.

High initial investment, filter clogging, and limited reusability pose challenges. However, advancements in filter media and design are improving efficiency and cost-effectiveness.

Filtration captures particles throughout the filter medium, ensuring high dirt-holding capacity. In contrast, membrane filtration retains particles on the surface, making it better suited for fine particle removal.

Companies such as Merck KGaA, Pall Corporation, Sartorius AG, 3M, and Eaton Corporation are recognized for their advanced filtration technologies and extensive product portfolios.

By media type, the industry is segmented into diatomaceous earth, cellulose, activated carbon, perlite, and others.

In terms of product, the sector is segmented into cartridge filters, capsule filters, filter sheets, filter modules, and others.

By application, the industry is segmented into final product processing, cell clarification, and raw material filtration.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.