The Dental Simulator Market shows predicted market expansion from 2025 through 2035 on account of rising needs for sophisticated dental training solutions. Market expansion occurs because educational institutions together with professional training centres continue to adopt dental simulators.

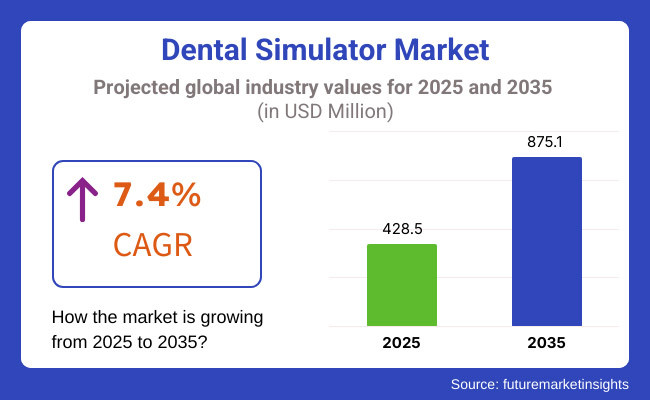

The training devices serve as a harmless landscape where trainees can improve their dexterity prior to actual hands-on operations. The market value for dental simulation systems will reach USD 428.5 million in 2025 yet analysts expect it to reach USD 875.1 million by 2035 based on a 7.4% compound annual growth rate (CAGR) throughout the forecast period.

Market expansion occurs because dental simulation systems now merge virtual reality (VR) and augmented reality (AR) technologies to enhance their capabilities. These technological advancements create training programs which provide enhanced realistic educational experiences through their interactive and immersive functions.

The need to meet competency-based education demands and dental professional accreditation requirements has led institutions to buy superior simulation models.

The high initial installation costs of advanced dental simulators act as barriers for smaller health care institutions and developing regions who want to implement them because of their limited adoption potential. Manufacturers have started developing more affordable training systems that prevent sacrifices to educational quality.

The Dental Simulator Market shows two divisions according to technology and application sectors while major demand exists in dental schools and hospitals alongside research institutions. These technology categories include virtual simulators together with mechanical simulators and hybrid models which lead the market segment.

Virtual simulators use AR and VR technologies to deliver complete training experiences for students who receive immediate evaluation while developing their competencies without physical patient interactions. Mechanical simulators deliver practical training through real equipment which helps students develop their hand skills and improve their correct procedure execution.

Hybrid training environments combine digital and physical components to establish a full educational platform which links virtual engagement with traditional hands-on instruction. The highest marketplace demand exists within dental schools because pre-clinical education heavily depends on simulators.

Market growth receives significant contribution from hospitals and professional development centres because dental professionals need ongoing skill enhancement to maintain their practice proficiency. The advancement of technology leads simulation-based training to become a vital educational tool for dental education and professional development programs.

Explore FMI!

Book a free demo

North America accounted for the largest share in overall dental simulator market owing to the presence of established dental education institutions and well developed digital training technologies. The USA and Canada frequently spend billions on modern training methods and you can see with them that there will be more demand with virtual and hybrid simulators.

Additionally, accreditation organizations focus on practical skill development, leading institutions to invest in high-fidelity simulators. The cost of complex systems does remain a barrier to wider adoption, particularly for smaller institutions.

Additionally, North America also see an increase in the use of artificial intelligence (AI) in the simulation software, improving the learning procedure. Investments in research and development continue across the region, leading to innovation and market growth.

Germany, the UK and France drive reliable sources of demand in Europe, a second major market for dental simulators. The European region has a high standard for dental education and dentists must show high competency before licensure. This has resulted in a drive towards simulation-based training programs.

Pioneering simulation technologies and dental tools are particularly common in Germany, where many dental technology companies are engaged. Promoting medical education and innovation by the government as well as demand for digital and mechanical simulators further boost the growth of the market. The market is also being driven by sustainability considerations, with European institutions favouring computers and simulator models that are eco-friendly and energy-efficient.

The dental simulator market in the Asia-Pacific region is expanding at the most rapid rate, owing to reform in dental education and growing number of dental institutions in the countries such as China, India, and Japan. As the demand for enhancing healthcare training standards continues, dental schools in these countries are highly incorporating state-of-the-art simulation systems.

Emerging Markets in demand for cost-efficient training methods is higher in fast-changing markets. Despite financial constraints, a growing number of dental students and government-supported initiatives to improve healthcare education offer opportunities for growth. Further, local manufacturers with budget-friendly simulation technologies help to overcome the fears associated with cost thereby propelling the regional growth.

Challenge: High Initial Costs and Technological Adaptation

These dental simulators utilize the latest technologies such as virtual reality (VR), artificial intelligence (AI) and haptic feedback systems to facilitate that dental training. Though, these high-tech features make the simulators costly which restricts their action among dental schools and training institutes with limited budget.

Many institutions are saddled with the cost of acquiring and maintaining these systems, as well as training faculty to effectively use the tools. Furthermore, replacing existing curricula to include dental simulators requires costly infrastructure upgrades - an added financial burden. The rate of adoption in the emerging markets is additionally slow, limiting further industry expansion.

Opportunity: Rising Demand for Advanced Dental Training Solutions

The increased focus on practical dental education creates an opportunity for the dental simulator market. Universities and training centres are investing more and more of these simulation-based learning to fine-tune students’ clinical skills in an environment free from risk.

With VR-based simulators, students can practice complex procedures and become more confident and accurate before ever treating a real patient. Cloud-based training modules and remote learning solutions further drives accessibility. This is especially true in developed regions, where government initiatives to support digital learning in healthcare education continue to increase and fuel demand.

Due to the rise in popularity of digital learning during the shift towards virtual learning between 2020 and 2024, dental simulators were introduced, with a steady rise in use in dental institutions worldwide. VR powered training modules were adopted widely by the market, enhancing student engagement and procedural accuracy.

But high source of simulators restricted widespread adoption in developing economy. As regulatory frameworks started to acknowledge simulation-based training as a valid replacement of conventional dental practice, it urged manufacturers to focus on building more effective products.

From 2025 to 2035, the ownership structure will transition toward AI-powered simulators with customized training modules. Haptics will also see improvements and sophisticated systems providing precise feedback for intricate processes will become the norm.

The use of greener simulator materials will be steered by sustainability issues and will minimize environmental footprint. Also, remote dental competency education platforms will widen the training solutions available throughout the globe.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments started acknowledging simulation-based training in dentistry but lacked uniform regulations. |

| Technological Advancements | VR and 3D printing enhanced dental simulation models, offering lifelike training experiences. |

| Training Applications | Simulators focused on basic dental procedures, including cavity filling and tooth extractions. |

| Market Adoption | Adoption remained concentrated in high-income regions due to cost barriers. |

| Environmental Sustainability | Simulators relied on plastic-based models, leading to waste concerns. |

| Production & Supply Chain Dynamics | Limited players dominated the market, leading to high prices and slow innovation. |

| Market Growth Drivers | Growth stemmed from dental school investments and the expansion of VR-based learning. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulatory bodies will establish global standards for simulation-based dental education, promoting mandatory adoption in dental schools. |

| Technological Advancements | AI-driven simulators with real-time feedback and adaptive learning will improve training outcomes. |

| Training Applications | Expanded applications will include advanced implantology, endodontics, and maxillofacial surgery simulations. |

| Market Adoption | Lower-cost simulators and government subsidies will increase accessibility in emerging markets. |

| Environmental Sustainability | Manufacturers will introduce biodegradable and reusable training materials to meet sustainability goals. |

| Production & Supply Chain Dynamics | Increased competition and technological partnerships will drive affordability and faster product evolution. |

| Market Growth Drivers | Demand will surge as dental licensure exams incorporate simulation-based assessments, making simulators a necessity for training. |

USA dental simulator market is growing due to the growing adoption of cutting-edge dental training technologies with educational institutions and private dental clinics. An important factor driving the growth of the dental education market is the growing focus on simulation-based learning, which allows students to practice in a structured environment before treating live patients.

With the help of haptic feedback systems, VR and AI in dental simulators, clinicians can further enhance precision training, making dental simulators a preferred choice in a modern dentistry program.

In addition, organizations like the American Dental Association (ADA) are focusing on competency-based education, leading to an increased drive in the uptake of dental simulators. The use of high-fidelity simulators that closely mimic real-world conditions is more advantageous than ever as the complexity and variability of dental procedures increases, and institutions are investing in the quality of simulators for greater training efficiency.

Moreover, the growing demand for continuing education programs for dental professionals and the fast-paced digitalization of dental practices are also taking the market to new heights. Moreover, in order to sustain the market in the long run, dental schools and research institutes are partnering with technology providers to create cutting-edge training solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The UK dental simulator market is anticipated to move at a steady pace, as there is increasing focus on contemporary dental education and skills-based learning. VR-based simulation technologies in dental institutions are increasing student competency while decreasing reliance on traditional patient-based training.

In addition, new guidelines from the General Dental Council (GDC) support the increased use of simulators in dental education to improve learning outcomes and patient safety.

However, with better digital dentistry and 3D imaging, the need for high-fidelity simulators flying higher with better visibility is on the rise. Moreover, the increasing emphasis on minimally invasive dental treatment as well as precision dentistry has triggered higher investments in AI-powered as well as augmented reality (AR) training technologies.

UK continues to be a key player on the stage of the international dental simulation market with government initiatives greatly appreciating technological innovations in medical education.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

The dental simulator market in the European Union is experiencing significant growth, primarily driven by demand for advanced training solutions in dental education and clinical practice. With a growing demand for standardized training methods, countries like Germany, France, and Italy have been pioneers in the implementation of virtual simulations technologies.

Simulation-based education can facilitate better clinical competence, and this is being recognised by organisations such as the European Federation of Periodontology (EFP) and the Council of European Dentists (CED).

AI-Powered and Haptic-Enabled Simulators and why will it matter for Student Skills Enhancement and Patient Safety Research has shown that consistent and standardized practice leads to success in an increasingly complex work life and identify patients safety as a global concern.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

The Japan dental simulator market is developing at a decent rate due to technological enhancement and investments in the digital dental training. It is one of the world's leaders in robotics and AI, and these technologies are undergoing extensive integration in various dental simulation systems to improve accuracy and training delivery.

The proximity of leading dental equipment manufacturers and research institutions has hastened the design and deployment of next-generation simulators featuring ultra-realistic patient scenarios and real-time feedback systems.

As Japan faces population decline through aging and growing awareness about dental care, educational institutions have been increasingly relying on skill-based education with the help of computer-assisted simulation systems. Moreover, the need for remote and online systems dental learning higher is growing as a result of the digital shift being made to the country’s medical education.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The South Korean dental simulator market is growing due to a South Korean medical education technology and digital dentistry-intensive environment. Higher education institutions and training establishments are introducing haptic-enabled VR simulators to enhance student competency in how to perform highly complex procedures.

The rising demand for skilled professionals in the dental field is likely to spur the investments in simulation platforms with real-time feedback and interactive learning experience.

Moving forward, government measures encouraging AI-enabled medical training and integration of digital health technologies will boost the acceptance of dental simulators. Furthermore, the Korea Dental Association (KDA) has been pushing for a greater adoption of simulation-based learning in dental education, which is expected to further bolster market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

One of the key components of the dental simulator market is the hardware segment, which provides the physical components necessary to create a realistic training experience. So there are simulators with high precision that dental schools, training institutions, and professionals use to develop practical skills before real patients.

These stereo scoping simulators incorporate features such as artificial sets of teeth, motion-tracking sensors, hand piece controllers, and haptic feedback capabilities to help the user emulate realistic dental procedures quite closely.

Such features enhance dexterity and precision during cavity preparations, crown placements, endodontic procedures, and more. In recent decades, this growing need for high-fidelity dental training has fuelled the development of sophisticated, computerized simulation systems with real-time feedback mechanisms which have been shown to enhance the learning experience leading to better outcomes overall.

Hardware evolution in technology with robotic-assisted simulators, high-resolution 3D imaging, and virtual reality (VR) integration has added another dimension to the evolution of dental training. But, as its name suggests, these innovations enable students to practice complex surgical procedures in a safe environment, helping to prepare them more effectively for clinical practice.

To provide a more dynamic and thorough learning environment, institutions are increasingly investing in next-generation dental training simulators. DVR's Updated Training software is constantly evolving with new hardware, shaping what lies ahead for the dental simulation market.

Extensive Industrial Applications of Software Segment to Lead Market

The evolution of dental simulators lies within powerful software that can serve as intuitive, AI-based training and simulation environments that leverage precision for training along with assistance for better execution of procedures.

Incorporating procedure simulations in real-time, case studies where the learners have to observe, indulge, and interact, through simulation software that generates an artificial output in the context of the training process.

The new-age solution for dental students is the ability to practice in a virtual environment using the aforementioned modalities before working on actual human subjects. In addition, cloud-based simulated platforms make remote education a real possibility, increasing access and flexibility of dental education within and across institutions globally.

This comprehensive approach helps assess performance by tracking how users interact with the software, how accurate their treatment was, and what analytics-driven feedback they received to enable better learning. Several platforms even come with customizable training modules to allow the educator to customize the simulation based on the proficiency level of their students.

Moreover, AI-enabled modelling improves visualization of dental anatomy, which aids trainees in gaining better insights into patient-specific scenarios. With growing interest in digital dentistry, software-based advancements will continue to play a role in enhancing simulation functionalities to improve clinical preparedness and treatment accuracy.

DE is one of the most rapidly growing application areas for dental simulators. This emerging trend toward competency-based education and hands-on learning has bolstered adoption of high-fidelity simulators in dental schools and other training institutes.

Sponsored By: By incorporating simulation-based learning into dental curricula, institutions prepare students for future clinical experiences while honing technical skills, hand-eye coordination, and clinical confidence before caring for real patients. Such training modules mimic real-life clinical situations where students get to practice different procedures such as restorative dentistry, prosthodontics and endodontics in a controlled environment.

To set realistic conditions for practice, however, institutions invest in high-performance dental simulators fitted with haptic feedback, 3D visualization, and virtual patient interactions. These systems bridge the gap between theoretical knowledge and clinical application, preparing students for real-world dentistry.

With the growth of dental education around the world, the demand for simulation-based training tools is also high, establishing this segment as a fundamental driver in the dental simulator market. Such systems also provide AI-assisted learning, tailor-made training modules, and remote simulation options that boost the productivity of these approaches, leading to better dental education quality overall.

Diverse industrial applications to fuel growth in treatment planning segment.

Digital technologies facilitate diagnosis, visualize the procedure, and analyse pre-treatment stages, enhancing the treatment planning portion of the entire process, wherein dental simulators play a strategic role. Complex procedures, treatment planning, and diagnosis can be rehearsed in these simulators by dentists before they are attempted in real life.

Combining 3D imaging with the power of artificial intelligence (AI) to provide analytic tools based on both AR and the unique features of each patients anatomy allows dentists to assess variations unique to each patient, improving the precision of predicting treatment outcomes.

Real use cases include tools for simulation software integrated to improve the surgical planning in orthodontics, prosthodontics, and implantology. They assist practitioners in optimizing workflows, minimizing procedural errors and enhancing patient care by providing real-time visualizations of dental structures and treatment pathways.

This has transformed the current landscape where AI-driven diagnostic tools and digital workflow integration are on the rise propelling the need for simulation-assisted treatment planning for precision-driven decision-making in modern dentistry.

With the industry gradually moving towards personalized and less invasive approaches, the importance of simulation-based planning in dental procedures is only increasing which indicates great prospects for the dental simulator industry.

The dental simulator market consists of several players with various products, and the competition among global players dominates this market. Leading players in this space trigger innovative transformation with high-fidelity dental training simulators, virtual reality (VR)-based solutions, and AI-driven evaluation systems.

This ensures development through immersive and interactive experiences, and has been used by dental schools, professional training centres, and research institutions. The field hosts established players with complex R&D structures and newcomers with new approaches to digital simulation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nissin Dental Products Inc. | 15-20% |

| Dentsply Sirona | 12-16% |

| KaVo Dental (Envista Holdings) | 10-14% |

| Simodont (MOOG Inc.) | 7-11% |

| HRV Simulation | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nissin Dental Products Inc. | Develops high-precision dental simulation models for pre-clinical training, including advanced typodonts and haptic-based simulators. |

| Dentsply Sirona | Offers digital dental simulators integrating VR and AI for realistic procedural training, focusing on endodontics and prosthodontics. |

| KaVo Dental (Envista Holdings) | Manufactures dental training units and patient simulators with ergonomic designs for universities and professional training centres. |

| Simodont (MOOG Inc.) | Provides VR-based haptic dental simulators that replicate real-world tooth resistance and tactile feedback for enhanced skill development. |

| HRV Simulation | Specializes in mixed-reality dental training simulators with AI-driven performance assessment tools for personalized feedback. |

Key Company Insights

Nissin Dental Products Inc. (15% to 20%)

Nissin Dental Products Inc., the leader in high-fidelity dental simulation, offers a complete portfolio of typodont models and haptic-enabled training systems. The company’s simulators facilitate hands-on training in restorative dentistry, orthodontics and oral surgery. Nissin boasts a comprehensive network in academia around the world and centres its product development on an agenda guided by clinical realism and skill acquisition.

Dentsply Sirona (12-16%)

Dentsply Sirona is a leader in digital dental simulation with artificial intelligence and virtual reality fitted in its training solutions. Its simulators allow for real-time performance tracking and offer personalized learning pathways for students and professionals. With heavy investment in research and development, the accuracy of dental procedure simulations also makes the company a choice for educational institutions.

KaVo Dental (Envista Holdings) (10-14%

Envista Holdings-KaVo Dental - Manufacturer of high quality dental training systems including patient simulators along with ergonomically designed workstations. You can see these products are widely used in dental schools devoted to preclinical education. In more detail, they focus on digital integration and modular offerings for adaptability to changing dental curricula.

Simodont (MOOG Inc.) (7-11%)

MOOG Inc. owns Simodont, a leader in virtual reality-based haptic dental simulators. Its solutions provide ultra-realistic tactile feedback, enabling users to feel tooth resistance and tissue textures during simulated training. Simodont’s simulators are used by many of the universities that offer immersive and interactive learning experiences.

HRV Simulation (4-8%)

HRV Simulation develops cutting-edge mixed-reality dental training systems with AI-powered analytics. The company’s solutions enable students to receive real-time feedback, improving precision and efficiency in clinical procedures. HRV Simulation is rapidly gaining traction due to its focus on adaptive learning technologies and performance-based assessments.

Other Key Players (40-50% Combined)

Beyond the dominant companies, several manufacturers and technology firms contribute to the growth of the dental simulator market. These players focus on simulation software, digital workflow integration, and cost-effective training solutions:

The overall market size for Dental Simulator Market was USD 428.5 Million in 2025.

The Dental Simulator Market is expected to reach USD 875.1 Million in 2035.

The growing emphasis on dental education and hands-on training, along with advancements in simulation technology, fuels the Dental Simulator Market during the forecast period.

The top 5 countries which drives the development of Dental Simulator Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Hardware Segment to command significant share over the forecast period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.