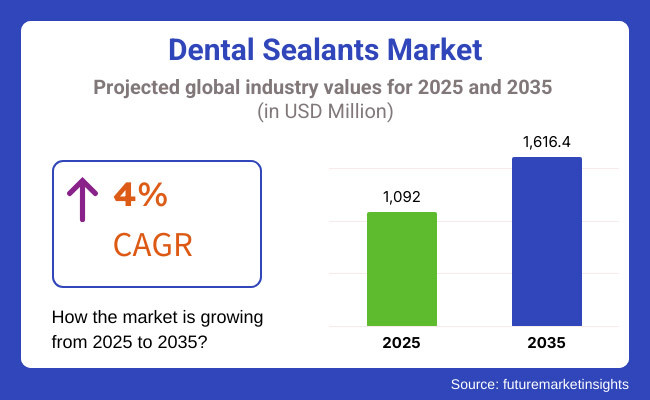

The market is projected to reach USD 1,092 Million in 2025 and is expected to grow to USD 1,616.4 Million by 2035, registering a CAGR of 4% over the forecast period. The adoption of fluoride-releasing sealants, expansion of school-based sealant programs, and increasing availability of BPA-free, resin-based, and glass ionomer sealants are shaping the industry's future.

Additionally, rising dental insurance coverage, growth in mobile dentistry services, and the development of long-lasting bioactive sealants are creating new market opportunities. Between 2025 and 2035, marked results can be expected for the Dental Sealants Market.

The cause is the increasing prevalence of dental caries globally paired with improving public awareness about the importance of preventive dental care. Dental sealants are paper thin translucent coatings which are placed on random biting surfaces. Located primarily in the grooves of molars and premolars, they represent a resting place for any plaque or food that might chance to enter the area.

As a result, this greatly lessens the risk children face from cavities breaking out in their teeth. One important factor behind the market's rising success is growing emphasis on childhood dental care. It is being intensified mainly through programs to improve the oral health of schoolchildren themselves.

Governments and healthcare organizations put forward campaigns that recommend dental sealants as an affordable way to stop dentists drilling holes in your teeth. This approach is particularly suitable for children and those who are hard to reach.

Moreover, the continuing price erosion of dental care, broadening coverage against preventative dental procedures offered by various insurance carriers and a wide-ranging network of dental professionals all help get new technologies into practical use more rapidly.

Discoveries concerning dental materials and diagnostic techniques are continually re-creating the future face of the dental sealant market Formation of biocompatible, BPA-free and longer-lasting formulations will greatly enhance patient safety and treatment efficacies. Innovations in nanotechnology and resin based sealants have improved adhesion and durability, reducing the number of times that sealants need to be reapplied.

With that diagnostic information, high-risk patients are identified and can be sealed in time. From that point on all needed preventive seals are attempted by the patient. More and more sealant treatments now follow treatments with minimal invasiveness and laser and patients feel more comfortable. Such varieties of improvement should continue to move the market into steady growth.

North America and Europe are the most likely to accept them while Latin America and Asia-Pacific will experience sudden expansion thanks to good health infrastructure and increasing awareness about dental hygiene prompting greater demand for dental care.

Explore FMI!

Book a free demo

Due to strong preventive dentistry initiatives, growing use of sealants in children and encouraging government programs North America will likely dominate the Dental Sealants Market. Among the United States and Canada, the latter two lead the region due to high realization of oral health throughout society Public health dental programs associated with schools are widespread.

The Centers for Disease Control and Prevention (CDC) and American Dental Association (ADA) have been actively promoting the application of sealants in children, which increases demand for resin-based and fluoride-releasing sealants. In addition, small advances such as minimally invasive dentistry and artificial intelligence (AI)-enhanced diagnostics for dental caries have been used to expand the market.

Countries such as Germany, the UK, France, and Italy occupy a large part of the Dental Sealants Market on account of Europe leading in preventive dentistry as well as the establishment and efficiency management within dental insurance and innovation in biocompatible sealant materials.

The European Federation of Periodontology (EFP), as well as national oral health programs, is pushing for the use of BPA-free and environmentally-friendly dental materials. This trend helps increase demand for glass ionomer sealant and bioactive sealants.

Better schools and governmental measures provide a foundation for dental education; more money, both in the form of direct subsidies from wealthy countries to poor ones, increases market potential further still. Moreover, "metal-free" sealant application tools such as lasered bonding techniques and materials made of pure plastics or ceramics are starting to have an impact on product usage.

The Asia-Pacific region is projected to experience a higher CAGR in the Dental Sealants Market with raising childhood dental caries outbreaks, people s awareness of preventive dental treatments and improved healthcare availability. In countries like China, India, Japan and South Korea where government-sponsored dental care programs are more common; money put towards oral health education has increased as well as the application of fluoride being used for prevention.

China has expanded its network of community dental clinics and school-based dental programmes for students. It also drives national sealant applications covering the mass. In India, the National Oral Health Policy (ByNP) and increasing number of mobile dental units are providing access to affordable dental sealant options.

In addition, technological breakthroughs in Japan and South Korea on nano-sealants, antimicrobial coatings and intelligent dental applications further drive market growth for advanced regional markets.

Challenges

Limited Access in Low-Income Regions and Sealant Durability Issues

In rural and low-income areas, oral health care is often inaccessible. Due to this fact, preventive therapy like dental sealants is not as highly regarded as other types of cure or medical care. Also, many people in these settings simply do not realize the benefits of paradental materials, which has affected their use and spread within deprived areas.

Moreover, the long-lasting sealing and retention of sealants presents long-term challenges. Since traditional resin-based materials function well to stick with the enamel surface, poor risk of carie individuals may backfire twice over age-wise. Improved materials that hold up for longer and lack the hygroscopic elements defining tooth decay remain a priority at this time.

Opportunities

AI-Integrated Preventive Care, Fluoride-Releasing and Antimicrobial Sealants

Despite challenges, the Dental Sealants Market presents significant growth opportunities. The integration of AI-powered diagnostic tools for early cavity detection and personalized sealant application recommendations is enhancing preventive precision and efficiency in dentistry.

The development of fluoride-releasing, antimicrobial, and self-healing bio active sealants is transforming long-term dental protection, reducing the need for regular reapplications. At the same time, ongoing research into such areas as light-cured and nano-enhanced sealants is bringing advances in material strength, adhesion, and bio compatibility.

Tele dentistry, mobile dental services and government-supported oral health screenings are expanding sealant use to rural and impoverished areas. 3D-printable and adjustable dental sealants are further extending the possibilities of tailored preventive therapy.

The dental sealants market saw steady growth between 2020 and 2024 thanks to a shifting emphasis on preventive dental care, the tendency of patients to choose less invasive treatments, and a new round of government oral health programmes.

Demand for fluoride-releasing, light-cured and resin-based sealants grew more intense as the incidence of dental caries increased notably in children and young adults. Later Advances in self-adhesive, antibacterial and nanotechnology-enhanced sealants made for improved longevity, security and ease of application.

From 2025 to 2035, the dental sealants market will be totally transformed by predictive caries risk assessment through AI, bioactive and self-repairing sealants, smart coatings based on nanotechnology.

AI-assisted robotic sealant application and customized 3D-printed sealant layers can provide both accuracy and efficiency in the field of preventive dentistry. Enzyme-activated sealants will reduce the risk of caries significantly by releasing antibacterial agents in response to cavity-causing bacteria.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA and CE approval for BPA-free, fluoride-releasing, and biocompatible sealants. |

| Technological Advancements | Growth in light-cured, self-etching, and fluoride-releasing resin sealants. |

| Industry Applications | Used in pediatric, preventive, and general dentistry for cavity prevention. |

| Adoption of Smart Equipment | Transition to LED curing lights, automated sealant dispensers, and ergonomic applicators. |

| Sustainability & Cost Efficiency | Shift toward BPA-free, eco-friendly, and durable sealants with enhanced adhesion. |

| Data Analytics & Predictive Modeling | Use of basic caries risk assessment, fluoride exposure tracking, and patient dental history integration. |

| Production & Supply Chain Dynamics | Challenges in high costs, supply chain disruptions, and limited adoption in developing regions. |

| Market Growth Drivers | Growth fueled by rising dental caries prevalence, government oral health initiatives, and increased preventive dentistry awareness. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed dental treatment tracking, AI-driven regulatory compliance, and advanced safety certifications for smart sealants. |

| Technological Advancements | AI-powered predictive caries detection, self-healing bioactive sealants, and nanotechnology-based smart coatings. |

| Industry Applications | Expanded into AI-driven preventive dental care, real-time caries monitoring, and 3D-printed patient-specific sealant applications. |

| Adoption of Smart Equipment | AI-assisted robotic application, wireless sensor-integrated sealants, and precision nano-sealant deposition technologies. |

| Sustainability & Cost Efficiency | Biodegradable sealant formulations, AI-optimized sealant placement, and carbon-neutral manufacturing. |

| Data Analytics & Predictive Modeling | AI-driven real-time sealant wear tracking, blockchain-secured oral health data, and predictive analytics for cavity prevention. |

| Production & Supply Chain Dynamics | Decentralized smart sealant manufacturing, AI-driven logistics optimization, and blockchain-secured material sourcing. |

| Market Growth Drivers | Future expansion driven by AI-enhanced preventive care, bioactive sealant innovations, and next-gen smart dental coatings. |

In the USA, dental sealants market are in growth with the people's increasing concern for preventing oral diseases and school-based acceptance of sealant programs, as well as development in dental bonding materials. Among cavity-prevention measures for children and teenagers, the American Dental Association (ADA) and Centers for Disease Control and Prevention (CDC) both actively promote dental sealants.

Market demand is being boosted by a greater focus on minimally invasive and fluoride-releasing sealants. At the same time, technological advances in light-cured sealants are increasing both their durability and effect.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The United Kingdom's Dental Sealants Market is growing with government-promoted oral healthcare programs, growth in dental care accessibility, and public awareness for preventive dentistry. The National Health Service in the UK operates free dental sealant programs among children, fostering adoption rates across public healthcare clinics.

The movement towards resin-modified and glass ionomer-based sealants is enhancing outcomes. Furthermore, an increase in community and mobile dental services is providing better access to preventive applications of sealants among rural regions and schools.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Through efficient public health policies supporting cavity prevention such as those advocating increased use of dental sealants among children by pediatric dentists and increased investment in dental material research, the European Union Dental Sealants Market has been growing steadily. The European Federation of Periodontology and European Academy of Paediatric Dentistry promote and advocate the universal use of sealants to keep the prevalence of caries low.

Several companies have developed advanced materials to prevent pit and fissure caries based on nano-technology health control techniques, and Germany, France, and Spain are the most active nations in this respect. In addition, it has brought about the widespread adoption of dental sealants that some have made use of national reimbursement programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Japan's Dental Sealants Market is growing because of greater government focus on preventive dental care, more visits to the pediatric dentist, and technological advances such as bioactive sealant technology. The Ministry of Health, Labour and Welfare (MHLW) of Japan encourages early intervention in order to reduce tooth decay rates.

In order to provide long-term dental care, self-adhesive dental sealants which also emit fluoride are becoming common in Japanese dental clinics. Moreover, assisted by AI-driven diagnostics and digital dentistry, placing a sealant becomes even more efficient.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

South Korea's stable and moderate growing demand for our oral care services remains to be seen. These are backed by government-run oral health reports, a rising trend of cosmetic and preventive dentistry; and however slight this statistic may seem to indicate at present, an increase in per capita dental awareness The South Korean Ministry of Health and Welfare is promoting dental sealants as one component of national preventive healthcare program.

As school-based dental programs expand and insurance coverage for sealant treatments is made more widely accessible it brings us closer to our potential market. In addition, improvements in biocompatible and nano-technology enhanced sealants are lengthening product life and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The Dental Sealants Market has been expanding over these years, with more attention is paid to preventive oral care and a marked increase in the number of patients having caries notice. Materials that make sealant more durable, stronger adhesion and able to bond Despite rising expenses caused by higher case volumes expectancy has increased among.

The different kinds of products available in this market are Glass Ionomer and Polyacid modified Resin Sealants. Both offer long-term protection to the tooth from decay as well as setting up a better bonding situation with enamel.

Glass Ionomer Sealants Lead Market Demand for Fluoride Release and Long-Term Protection

Glass ionomer sealants are also suitable for old age patients, and people who have abnormally weak tooth enamel, because they provide a continuous supply of fluoride for teeth that reinforces them and helps prevent demineralization.

Low cost, ease of use, and biocompatibility are driving factors in the adoption of glass ionomer sealants by community dental programs as well as school-based oral health activities. And today's resin-modified glass ionomer is becoming wear more water-resistant, stronger er conditions for teeth with high chewing pressures.

Despite their advantages, obstacles such as reduced wear resistance compared with resin-based sealants and the possibility of gradual fluoride loss still exist. Nevertheless, upcoming products featuring nano-reinforced glass ionomer technology, dual-cure formulations, and the ability for self-bonding are expected to increase sealant life spans (longevity) and improve clinical performance.

Polyacid Modified Resin Sealants Gain Traction for Enhanced Durability and Aesthetic Appeal

Polyacid-modified resin (compomers) sealants are a blend of resin-based adhesive strength and fluoride releasing abilities from the glass ionomer material. They are then a good choice for both children and adults.

As time goes by, this solvent-based technology will lead to improvements and continuous update to improve useful properties such as hardness, wear resistance and aging characteristics. This will allow for permanent molars as well as high wear areas to be sealed with the sealant rather than using mercury filings on them.

The growing popularity of these sealants in dental services and cosmetic dentistry for their tooth-colored appearance, strong bonding ability, long-term resistance to chewing forces. Rising high cross-linked light-cured systems are also being deployed.

These types of resins will need to be fully cross-linked before they can be cracked with a hammer, but they are far less elastic. Advances in light-cured compomer formulations will improve efficacy, setting time and patient comfort.

However, shortcomings such as sticking to moisture during application and less fluoride release than glass ionomer remains a worry. Future technology development seen in hydrophilic resin formulations, self-etching agents and new ways of polymerising the material is expected to improve hit rate and acceptance.

The demand for dental sealants is primarily driven by end-user preferences, with hospitals and dental clinics emerging as the most widely used treatment settings due to their high patient volumes, access to advanced dental materials, and integration of preventive dental programs.

Hospitals Lead Market Demand for Comprehensive Dental Care and Preventive Treatments

Hospitals are the main adopters of dental adhesive systems. They have been used in many areas of pediatric dentistry, and by public health programs. Sealants can be used in outreach efforts to children, only one place anything like "outreach" might work well as an adverb.

In the field of preventive dentistry, sealants have become an important tool. They have been not only greatly reduced the frequency of dental cavities in children, in some cases they have also actually prevented them from occurring at all. Now we must do more to help them along this path.

The increasing use of dental sealants in hospitals stems from government-supported oral health programs, people's ability to get major surgical insurance that covers preventive dental treatment, and improved links between pediatricians and dentists.

Furthermore, advances in hospital-based dental sealant programs, software programs that can assess caries risk through AI, and automatic application tools for sealants are raising the efficiency and reach of treatment. Although strongly adopted in certain quarters, there are still issues such as affordability, long time to a visit and public compliance with dental hygienety.

However, such partnerships as extending public-private collaboration from city level to villages and townships, mobile dental care units which go directly into the countryside to provide services irrespective of distance, school-based hospital total health cooperatives will probably help raise both the penetration of treatment and demand for people who want to take some advices before they have problems.

Dental Clinics Gain Popularity for Personalized Preventive Treatments and Long-Term Sealant Maintenance

With personalized dental care, a full range of optional procedures and routine preventive treatment, the vast majority of dental clinics offer dental sealants. In terms of the follow up this allows for high patient retention. The dental sealant is now found in general and pediatric dental surgeries as well as private practices: it is used to prevent early stages of decay and support dental health overall for both children aged 4 to 5, and adults.

Rising patient awareness, a greater availability of advanced material for sealant work and the digital integration of imaging in risk assessments are key drivers accelerating demand at clinics for dental sealants. On top of traditional preventive procedures in the dental chair, technology for light-curing and integration with digital workflows improve treatment outcomes in clinic-based preventive dentistry as never before.

Yet, obstacles continue to be in the way. These include patient resistance to preventive treatments, competing procedures for restorations and insurance coverage issues, among other things as well. With advances in resin-modified sealants, restorative applications that are truly minimally invasive and AI-assisted preventive care strategies, it is anticipated the uptake of new ideas will be further increased while patients remain compliant.

The Dental Sealants Market is growing with rising demand for preventive dental care, the development of resin-based sealants, and greater awareness of protection against cavities in children and adults. The market is stimulated by growing oral health programs, school dental programs, and rising access to minimally invasive dental care.

Fluoride-releasing, light-cured, and bioactive sealants are the focus areas for companies in order to provide long-term prevention against cavities, adhesion, and re mineralization of enamel. The market features top dental products producers, resin technologies suppliers, and preventive dental care experts, all of whom contribute innovations in nano filled sealants, antibacterial formulations, and BPA-free dental coatings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 18-22% |

| Dentsply Sirona | 12-16% |

| Ivoclar Vivadent | 10-14% |

| Ultradent Products, Inc. | 8-12% |

| GC Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Develops Clinpro™ Sealant with color-change technology and fluoride release for enhanced cavity protection. |

| Dentsply Sirona | Specializes in light-cured resin-based sealants designed for long-lasting adhesion and wear resistance. |

| Ivoclar Vivadent | Manufactures Helioseal® F, a fluoride-releasing, high-viscosity sealant for durable fissure protection. |

| Ultradent Products, Inc. | Provides UltraSeal XT® plus, a hydrophobic, BPA-free, and nanofilled dental sealant for enhanced retention. |

| GC Corporation | Focuses on GC Fuji Triage™, a glass ionomer sealant with fluoride release for high-risk caries patients. |

Key Company Insights

3M Company (18-22%)

3M leads the dental sealants market, offering fluoride-releasing and color-changing sealants for improved application accuracy and cavity prevention.

Dentsply Sirona (12-16%)

Dentsply Sirona specializes in resin-based, light-cured sealants, ensuring strong adhesion and long-lasting protection against caries.

Ivoclar Vivadent (10-14%)

Ivoclar Vivadent provides high-viscosity, fluoride-releasing sealants, emphasizing durability and caries prevention.

Ultradent Products, Inc. (8-12%)

Ultradent is known for its hydrophobic, nanofilled sealants, integrating high-flow and BPA-free formulations for improved retention.

GC Corporation (6-10%)

GC Corporation focuses on glass ionomer-based sealants, offering long-term fluoride release and self-adhesive properties for pediatric and high-risk patients.

Other Key Players (30-40% Combined)

Several dental product manufacturers, resin technology developers, and preventive care specialists contribute to advancements in sealant adhesion, remineralisation, and antimicrobial protection. These include:

The overall market size for the Dental Sealants Market was USD 1,092 Million in 2025.

The Dental Sealants Market is expected to reach USD 1,616.4 Million in 2035.

Rising awareness of preventive dental care, increasing prevalence of dental caries, and growing adoption of sealants in pediatric dentistry will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

Glass Ionomer and Polyacid Modified Resin Sealants are expected to lead in the Dental Sealants Market.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.