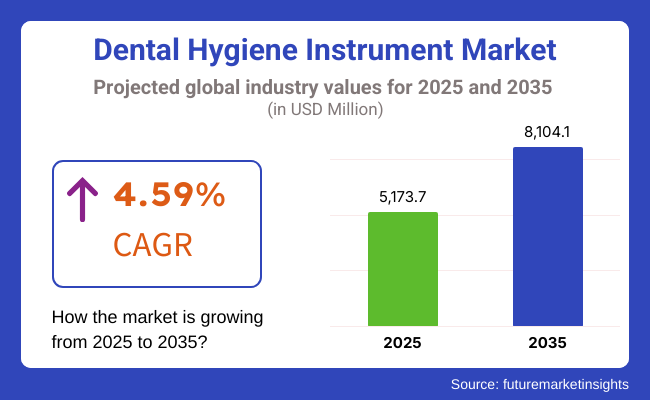

The growth potential of the dental hygiene instrument market will be immense from 2025 to 2035 due to increasing oral health awareness and advances in dental technology, not to mention the elderly requiring dental care. The market is expected to account for a valuation of USD 5173 million in 2025 and then expand to approximately USD 8104 million by 2035, with a CAGR of 4.59% during this period.

Some growth drivers include increasing dental disorders' prevalence, such as periodontitis and cavities; increased investments in dental infrastructure; and the uptake of new dental hygiene equipment like ultrasonic scaler machines and smart toothbrushes. Some of these new emerging opportunities for market players will include eco-friendly and biodegradable dental instruments and increased adoption of home-based oral hygiene solutions.

High costs associated with advanced dental instruments, regulatory complexities in medical device approvals, and lack of access to modern dental care in certain regions. Stringent regulatory requirements for new dental technologies add to the cost and time required for product approvals, slowing down innovation and entry.

Technological advancements in dental instruments, increased adoption of AI and automation in dental procedures, and rising consumer demand for eco-friendly and sustainable dental hygiene solutions. Emerging markets, especially in Asia and Latin America, present a lucrative growth opportunity with a growing investment in dental care infrastructure and consumer education.

According to the World Health Organization, oral diseases are among the most prevalent diseases globally, affecting nearly half the world's population. Furthermore, the rise of digital dentistry such as teledentistry and remote dental consultations is providing new channels for growth as they provide more accessible access to professional dental care for underserved populations.

This includes designing ultrasonic scalers that increase efficacy and minimize patient discomfort in the dental office. Embracing innovation, new-gen ultrasonic devices have become advanced with precision, design, low noise, and patient comfort. AI powered toothbrush manufacturers and real-time oral health tracking devices are transforming oral health at home. Smart toothbrush is an example which has sensors that can predict and access the provided oral care, it even helps to improve oral health care.

Governments regulate dental instruments through regulatory agencies and other health regulator arms to ensure compliance with health regulations. The increasing usage of sterilization and infection control guidelines are anticipated to register the highest CAGR growth for the current forecast period.

Explore FMI!

Book a free demo

The period spanning 2020 to 2024 saw steady growth in the dental hygiene instrument market, driven by the increasing awareness of oral health, rising incidences of periodontal diseases, and the greater adoption of professional dental cleaning tools. The demand for ultrasonic scalers, hand instruments, and electric toothbrushes rose with changing trends toward improved dental care practices and preventive dentistry.

Innovations such as AI-integrated smart toothbrushes and antimicrobial-coated instruments improved efficiency and patient outcome. However, hindrances to the industry included the high cost of the advanced instruments, regulatory compliance on infection control, as well as supply chain disruptions hindering the availability of dental equipment.

In 2025 to 2035, AI-enabled dental hygiene tools, smart self-cleaning instruments, and sustainable materials for dental care products will drive the landscape. The regulatory authorities shall enforce stricter hygiene as well as sterilization regulations on reusable instruments for patient safety. The second aspect of sustainability would promote the use of biodegradable and recyclable dental instruments, while increased automation will improve efficiency in professional cleanings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| FDA and CE approvals focused on infection control and sterilization of reusable instruments. Increased regulations on antimicrobial coatings. | Stricter global regulations on reusable instrument sterilization. AI-integrated hygiene tools require compliance with digital health standards. |

| Growth in ultrasonic scalers, ergonomic hand instruments, and antimicrobial coatings. Introduction of AI-powered smart toothbrushes. | AI-driven dental hygiene automation enhances cleaning precision. Development of self-sterilizing dental instruments and bioactive materials for plaque prevention. |

| High demand for electric toothbrushes, professional scalers, and flossing devices. Increasing preference for home-use dental hygiene innovations. | Increased adoption of AI-powered toothbrushes with personalized feedback. Expansion of minimally invasive dental hygiene tools for at-home and clinical use. |

| Rising awareness of oral health, increasing prevalence of periodontal diseases, and expansion of professional dental care services. | Growth in smart dental care, integration of nanotechnology in hygiene tools, and AI-powered diagnostics for oral disease prevention. |

| Some manufacturers introduced biodegradable toothbrushes and recyclable floss picks. Efforts to reduce plastic waste in dental care products. | Widespread adoption of biodegradable dental instruments. AI-optimized production reduces material waste and improves supply chain sustainability. |

| Dependence on dental instrument manufacturers in North America, Europe, and Asia. Supply chain disruptions impacted product availability. | Growth in localized production to reduce environmental impact. AI-driven supply chain automation enhances inventory management. |

Role of Ergonomic Instrument Designs and Antimicrobial Coatings in Purchasing Decisions

Lightweight and balanced handles with wider grips and textured surfaces have enabled the use of silicone or resin-coated readymade handles, which provides more comfort and better control, and leads to more frequent use. More than 60% of dental professionals suffer from hand strain, making it important to consider ergonomics when choosing instruments.

Silver-ion and copper-based treatments, for example, are types of antimicrobial coatings that reduce bacterial adhesion and cross-contamination. These coatings, which are made using expensive raw materials with rigorous sterilization procedures, will find increasing usage as infection control measures, especially in high dental volume practices and teaching institutions, driving demand for instruments with ergonomic and microorganism-resistant properties.

Purchasing Decisions based on Reusable vs Disposable Dental Hygiene Tools

Reusable stainless steel instruments are still the gold standard for durability and cost-effectiveness but must be regularly sterilized and maintained. Disposable instruments, commonly used in infection-prone environments such as mobile medical units or nursing homes, entirely remove any risk of cross-contamination but are more expensive in the long term.

Tightened post-COVID infection control regulations have also raised demand for single-use hygiene kits and plastic-free disposables. One of the most dominant trends in modern dental practices is a hybrid approach that uses a combination of reusable (rotary) and disposable tools that match the requirements of a procedure.

| Key Factors | Details |

|---|---|

| Key Buyers | General dentists, dental hygienists, periodontists, orthodontists, endodontists, dental schools, hospitals, mobile dental clinics, government healthcare programs, and dental supply distributors. |

| Top Features End Users Look At | Scalpel-sharp cutting edges for scalers and curettes, ergonomic lightweight handles to reduce hand strain, corrosion-resistant stainless steel or titanium coating for longevity, easy sterilization compatibility (autoclave safe), antimicrobial coatings for infection control, and color-coded instruments for procedure differentiation. |

| Top Concerns of End Users | Manual instruments need sharpened often, due to wear after re-sterilization instruments can break or get worn down, manual instruments must comply with regulatory standards in infection control, there is a shortage of ecologically friendly disposable options, and the application of ultrasonic scalers to existing dental units is challenging. |

| Pricing Influence among End Users | Cost vs. longevity - dentists know it well, and see it every day in their chairs, with premium brands filling their high-end clinics. Individual practitioners seek cost-effective yet durable instruments, while group dental practices and hospitals prefer bulk buying. Buying decisions are affected by the warranty, sharpening services, and trade-in programs. |

| Preferred Distribution Channels | Dentists primarily obtain instruments from authorized dental distributors, directly from manufacturers, online marketplaces and dental trade shows. Big clinics and hospitals negotiate bulk contracts, while independent practitioners favor flexible ordering options and discounts. |

| Countries | CAGR (2024 to 2034) |

|---|---|

| United States | 3.7% |

| Germany | 4.5% |

| India | 9.4% |

The growth in the USA is attributed to growing awareness of oral health and preventive care in keeping teeth healthy. Understanding the causes of dental disease, progress in the use of more sophisticated dental instruments, and the growth of an aging population all help with this increase. The other factors include advancing technology in digital advancements such as intraoral scanners and systems for computer-aided design and computer-aided manufacturing (CAD/CAM), which improve diagnostic accuracy and treatment outcomes, helping to drive growth.

Growth Factors in the USA

| Key Factor | Details |

|---|---|

| Rising Prevalence of Dental Diseases | Rising prevalence of dental caries and periodontal diseases propels the need for advanced tools. |

| Technological Advancements | Technological advances like 3D printing and digital imaging all improve treatment accuracy and patient outcomes. |

| Aging Population | An expanding geriatric population will require frequent dental care, which will drive demand for hygiene instruments. |

| Preventive Care Focus | A movement towards preventative dentistry will encourage more regular check-ups and cleanings, increasing instrument consumption. |

| Professional Dental Services Demand | Rising demand for professional dental cleaning and maintenance services supports market growth. |

The market is well positioned to expand regarding dental hygiene instruments. This is compounded by the excellent health infrastructure in place to back high-quality dental care. The reasons behind the optimistic outlook for this market are the increasing incidences of dental diseases among the people, the increasing number of the aging population, and the emergence of technological innovations in dental instruments.

Furthermore, top dental instrument manufacturers in the country combined with a strong interest in research and development toward dental technologies play paramount roles in pushing the growth of this market.

Growth Factors in Germany

| Key Factor | Details |

|---|---|

| Advanced Healthcare System | Germany has a well-established healthcare infrastructure, which ensures that patients have a rapid access to high quality dental care, thus driving demand of hygiene instruments. |

| High Dental Disease Prevalence | Craniofacial diseases are among most prevalent diseases in the world, and the demand for hygiene instruments is expected to increase significantly. |

| Technological Innovation | Innovations in dental technology keep improving the efficiency and efficacy of hygiene tools. |

| Aging Demographic | Increasing geriatric population base leads to a surge in demand for specific dental hygiene instruments as they need certain types of dental care. |

| Strong Manufacturing Base | Germany hosts major dental instrument manufacturers, ensuring market availability and fostering innovation. |

The robustness of the Indian dental hygiene instrument market is on account of the intensifying awareness around oral health, growing disposable income, and better access to dental health services. Such factors include a big base population, higher incidence rates of dental diseases, and government initiatives regarding the promotion of oral health among the public. In addition, upsurge in dental tourism coupled with setting up of state-of-the-art dental clinics laced with modern instruments are promising ventures for the future of this market.

Growth Factors in India

| Key Factor | Details |

|---|---|

| Large Population Base | A large population means an expansive potential customer base for dental hygiene products and services |

| Rising Oral Health Awareness | Increased demand for instruments is attributed to public awareness programs educating patients about proper dental hygiene. |

| Economic Growth | Increased disposable income allows consumers to spend more on dental care and hygiene product. |

| Government Initiatives | The market growth is supported by national oral health programs and subsidies administered to better access dental care. |

| Dental Tourism | Increasing demand for good quality dental hygiene instruments owing to India having a recognized status as dental tourism, is also projected to drive the market over the forecast period. |

Japan's dental hygiene instrument market is expanding, influenced by an aging population, high standards of oral healthcare, and technological advancements. The market is projected to grow at a CAGR of 4.5% from 2024 to 2034.

The country's focus on preventive dental care and the integration of advanced technologies, such as laser dentistry and digital imaging, are key drivers. Moreover, government healthcare policies supporting dental health and the presence of skilled dental professionals further enhance market growth.

Growth Factors in Japan

| Key Factor | Details |

|---|---|

| Aging Population | The rise in the ageing population intensifies the need for dental care and hygiene instruments. |

| Preventive Care Emphasis | There is a strong cultural emphasis on preventive dentistry that leads to frequent dental visits and more frequent instrument use. |

| Technological Adoption | The integration of advanced dental technologies enhances treatment precision and efficiency. |

| Government Support | The market size is driven by favorable policies and oral health initiative. |

| Skilled Workforce | A skilled dental workforce is essential in making quality care and professional hygiene instruments increasingly adopted in children's clinics. |

The dental hygiene instrument market in Brazil is experiencing growth due to increasing awareness of oral health, a rise in disposable incomes, and government efforts to improve access to dental care. The Brazilian population has a high prevalence of dental caries and periodontal diseases, driving demand for both preventive and curative dental instruments.

The expansion of private dental clinics, along with government-backed initiatives such as the "Brasil Sorridente" program, has improved access to professional dental care. Moreover, the rise of cosmetic dentistry and a strong cultural emphasis on aesthetic appearance further propel the demand for advanced hygiene instruments.

Growth Factors in Brazil

| Key Factor | Details |

|---|---|

| High Prevalence of Dental Diseases | Oral health problems are prevalent, leading to a higher need for hygiene instruments. |

| Government Oral Health Initiatives | Initiatives such as Brasil Sorridente increase access to dental care, spurring the demand for instruments from professionals. |

| Growth of Private Dental Clinics | The growth of private dental practices increases access to and adoption of high-quality dental tools. |

| Increasing Disposable Income | Higher income levels lead to increased spending for preventive and professional dental care. |

| Cosmetic Dentistry Trend | The increasing demand for aesthetic and teeth whitening procedures is further expected to accelerate the industry for specialized dental hygiene instruments. |

Dental scaler instruments are among the most popular applications for hygiene instruments that are essential in plaque, tartar, and calculus buildup arrests on tooth surfaces and below the gumline. North America and Europe still dominate due to the high public awareness of oral health, regular visits to the dentist, and a good adoption of advanced scaling technologies.

However, demand is rising within Asia-Pacific owing to growing preventive focus in dental care and more expansion of dental clinics. Future trends include AI-integrated scalers for precision cleaning, ergonomic scaler designs for enhanced comfort, and antimicrobial coatings for cross-contamination prevention.

From cavity preparation and scaling to polishing, an array of dental procedures is performed using dental handpieces, which makes them another lucrative segment to invest in. The increasing demand for electric and air-driven handpieces is attributable to the high accuracy and efficiency that these handpieces afford in carrying out procedures, as well as added comfort for patients. Other handpieces equipped with the latest fiber optics and LED systems improve visibility and accuracy during procedures, thus decreasing treatment time.

In North America and Europe, the adoption of advanced dental equipment and strict infection control protocols justify their dominance in this segment, whereas the Asia-Pacific region is expected to experience high growth owing to increasing disposable incomes, growth in dental tourism, as well as high investments in dental clinics. Future innovation pathways include smart handpieces with real-time diagnostics, cordless handpieces using wireless power transfer capabilities, and AI-driven automation to increase precision of treatment in dental procedures.

Periodontitis is becoming more widespread, general awareness of oral hygiene is on the rise, and preventive dentistry is gaining ground, fuelling demand for scaling and cleaning instruments. The developed regions North America and Europe lead the segment because of regular professional visits for dental care and strong insurance cover for preventive care as opposed to flourishing growth in Asia-Pacific arising out of rising oral health awareness and increased access to professional dental care.

Trends of the future may bring along AI-powered ultrasonic scalers, laser-assisted cleaning systems, and smart oral-hygiene instruments for personalized dental-care recommendations.

Growing incidence of periodontal diseases, an increasing geriatric population, and rising consumer demand for nonsurgical periodontal treatment are some of the factors contributing to the market's growth. Periodontal care adoption is high in North America and Europe due to their awareness and accessibility of specialized periodontists, while the developing Asia-Pacific region is rapidly progressing because of governmental oral health initiatives coupled with growing investments in dental infrastructure. Future innovations would include laser-assisted periodontal therapy, smart probes with real-time bacterial detection, and biodegradable antimicrobial periodontal treatments.

The dental hygiene instrument industry is highly competitive, with key global players and emerging brands driving innovation and growth. Increasing awareness of oral health, technological advancements in dental tools, and growing demand for professional and at-home dental care solutions have fueled significant expansion.

Companies are investing in ultrasonic scalers, smart toothbrushes, and ergonomic dental hand instruments to maintain a competitive edge. The landscape is shaped by well-established dental equipment manufacturers and oral care brands, each contributing to the evolving landscape of dental hygiene solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dentsply Sirona | 22-26% |

| Hu-Friedy (Cantel Medical) | 18-22% |

| Colgate-Palmolive | 10-14% |

| Procter & Gamble (Oral-B) | 8-12% |

| Young Innovations, Inc. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dentsply Sirona | Provides a wide range of dental hygiene instruments, including ultrasonic scalers, hand instruments, and air polishing devices, focusing on professional dental care. |

| Hu-Friedy (Cantel Medical) | Offers high-quality dental hand instruments, hygiene scalers, and periodontal tools, emphasizing durability and ergonomic designs. |

| Colgate-Palmolive | Develops consumer oral care products, including electric toothbrushes, flossing tools, and professional dental hygiene solutions. |

| Procter & Gamble (Oral-B) | Specializes in smart toothbrushes and advanced oral hygiene solutions, integrating AI technology for personalized dental care. |

| Young Innovations, Inc. | Manufactures preventive dental care products, including prophy angles, handpieces, and fluoride varnishes for dental professionals. |

Key Company Insights

Other Key Players (25-35% Combined)

The market is expected to reach USD 5,173.7 million in 2025.

The dental hygiene instrument market is expected to garner a revenue of USD 8,104.1 million in 2035.

Rising awareness about oral health, increasing dental disorders, advancements in dental technology, and growing demand for preventive dental care will propel the market.

The leading companies in the dental hygiene instrument market include Dentsply Sirona, Hu-Friedy (Cantel Medical), Colgate-Palmolive, Procter & Gamble (Oral-B), and Young Innovations, Inc.

Scaling instruments and ultrasonic scalers are expected to command a significant share over the assessment period.

The landscape is segmented based on product type into Periodontal Probes, Dental Hand Instruments, Dental Handpieces, Tongue Deplaquing Tools, Air Polishing Systems, Prophy Angles, Dental Scalers, Mouth Mirrors, and Accessories & Consumables.

The application segmentation includes Oral Examination, Periodontal Care, Restorative Care, Scaling and Cleaning, Orthodontic Care, and Fluoride & Sealant Application.

The lanscape is divided into Disposable and Reusable dental hygiene instruments.

The end user includes Hospitals, Dental Clinics, Group Dental Practices, Ambulatory Centers, and Academic & Research Institutions.

Geographically, the market is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.