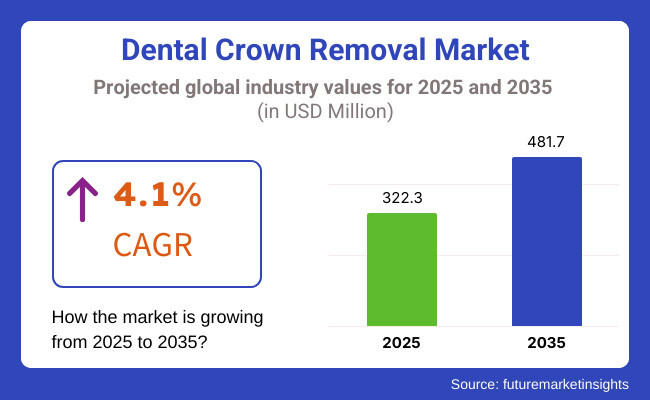

The market is projected to reach USD 322.3 Million in 2025 and is expected to grow to USD 481.7 Million by 2035, registering a CAGR of 4.1% over the forecast period. The introduction of laser-assisted crown removal, ultrasonic devices, and AI-driven dental treatment planning is shaping the industry's future.

Additionally, rising awareness of dental aesthetics, increasing prevalence of dental disorders, and expansion of dental tourism are driving market opportunities. The Dental Crown Removal Market is expected to grow during the period 2025 to 2035. This is being fueled by the increasing emphasis on restorative dental and the expansion of minimally invasive techniques.

Dental crowns are vital elements within tooth structure. They can be worn out or decayed and replaced by new ones; the beheaded root may need retreatment. The new paradigm for extracting crown restorations (mechanical, ultrasonic or laser), is born out of this need. Dental practitioners are increasingly looking for effective yet gentle options that provide benefits to patients.

As new crown removal technologies like improved force-controlled extraction of teeth and precisely targeted laser instruments come into use, the procedure will be easier for patients, anaesthetic risks minimized and damage to other structures avoided Practitioners are now focusing more than ever before on ways of avoiding or minimizing trauma as they remove crowns and other restorations.

In addition, the extension of cosmetic dentistry and availability of dental restoration procedures throughout the world contribute broadly to the development of the dental restorations market. The public's focus on aesthetic dental treatments, along with the rising disposable income and the increasing accessibility to advanced dental care, has led to multiple people calling for high-quality dental restorations and tooth replacement surgery.

In particular, digital dentistry technologies such as CAD/CAM-based restorations and 3D imaging improve the placement and removal precision of crowns and so stimulate market growth. Besides the growing number of dental practices, the older population receiving regular teeth extractions cost rise; and dental tourism industries in emerging economies are propelling demand for advanced removal solutions for dental crowns.

As innovative dental instruments continue to receive accreditation from regulatory bodies and minimally invasive methods for crown removal take off, analysts anticipate the market will witness extensive technological change, which will make dental procedures more efficient and patient-friendly than ever before.

Explore FMI!

Book a free demo

North America is expected to be the leading market for dental crown removal, benefited from their widespread adoption of aesthetic dentistry techniques and constant increases in implant and restoration-related dental care. This situation has led in part to the development of advanced technologies for removing crowns - both old and new.

The United States and Canada are the key markets for this trend since modern dental care landed in these countries hundreds of years ago. There is now strong availability of dental clinics, rising insurance coverage for restorative treatments and growing demand from AI-assisted dental solutions.

Standing in the way of wider use for this technique are the American Dental Association (ADA) and Centers for Disease Control and Prevention (CDC), which are thoroughly promoting best practices for minimally invasive dental crown removal, increasing demand for precision removal tools, such as sectioning burs, air abrasion systems and ultrasonic crown splitters.

Also, as the public increasingly prefers metal-free and ceramic crowns that must be removed with specific techniques, there is a market for innovative crown removal solutions.

In the dental crown removal market, Europe has a significant share. Leading in restorative dentistry experience, digital scanning for crown replacement, and the exploration of new techniques for removing antique crowns are such countries as Germany, the UK, France, and Italy.

The European Federation of Periodontology (EFP) and national dental associations are promoting efficient, patient-friendly and cost-effective crown removal methods, increasing demand for laser-assisted, air-driven and ultrasonic removal devices.

The market for specialized crown removal kits, burs and precision instruments is expanding rapidly as more people prefer less invasive treatments and same-day dentistry grows in popularity. In addition, the rapid growth of CAD/CAM-based restorations will increase the use of such tools. Meanwhile, there is a sustained demand for cosmetic dental corrections and greater numbers of failed crowns caused either by wear or trauma.

The Dental Crown Removal Market will have its highest CAGR in the Asia-Pacific region. This will be fueled by ever higher demands for budget-friendly dental treatments in that part of the world, an upsurge in dental tourism there, and expanding healthcare infrastructure.

At the same time several leading countries such as China, India Japan and South Korea are seeing a wide range of instances where restorative dentistry adoption has increased; even more variety in the types of cosmetic dentistry procedure that people do.

Various new minimally invasive dental crown removal technologies were invented which make use of computerized tools. For example, China's rapid urbanization and growing middle-class population drive up demand for premium dental treatment and special dental tools.

In India, the expansion of the private dental care sector with its increasing awareness of oral aesthetics has set off a demand for high-precision crown removal systems. Moreover, Japan and South Korea lead in robot-assisted dentistry, AI-based dental diagnosis and digital scanning. They further reduce-rather than enhance-the time it takes to remove crowns.

Challenges

High Equipment Costs and Risk of Crown or Tooth Damage

One of the most significant issues in the Dental Crown Removal Market is the expense of high-end removal devices, especially laser-assisted, ultrasonic, and AI-based tools. Small dental clinics cannot afford to implement high-end removal solutions, thereby restricting market penetration in economically sensitive areas.

Besides, risk to fracture the crown, damage enamel, or unnecessary trauma to tooth structure during procedure of removal persists as an issue. Inappropriate techniques or dated removal instrumentation enhances patient distress and procedural mishap, warranting improved training and tool specificity.

Opportunities

AI-Integrated Treatment Planning, Ultrasonic Tools, and Digital Workflow Integration

Despite adversity, the Dental Crown Removal Market offers tremendous growth prospects. The evolution of AI-based dental workflow solutions, in which machine learning helps decide the optimal removal method based on crown type, tooth anatomy, and patient history, is enhancing treatment precision and effectiveness.

The presence of ultrasonic crown removers, piezoelectric surgical equipment, and air-driven micro-abrasion systems is facilitating the process of minimally invasive removal to be made more effective with reduced procedural time and patient pain. The incorporation of digital impressions, intraoral scanners, and CAD/CAM-supported crown replacement is also making crown removal and replacement planning more efficient.

The increasing use of tele-dentistry consultations for pre-removal evaluations, 3D printing of personalized crown removal instruments, and the integration of smart dental chairs with built-in crown removal capabilities are opening up new horizons for technological innovation in dental offices.

Between 2020 and 2024, the market for dental crown extraction grew steadily due to a growing need in restorative dentistry, not only for crown removal equipment but also machines that can perform less invasive procedures with more favourable outcomes.

In response to an expanding old population and the rising awareness of oral hygiene, as well as a trend away from metals and temporary crowns, precision crown removal tools were launched. Ultrasonic crown removers, air-driven high-torque hand pieces, and laser debonding made for faster work, lighter-handed patients and less damage to the underlying tooth structure.

From 2025 to 2035, the dental crown removal market will go through a radical transformation, with AI-powered robotic-assisted crown removal, laser-integrated debonding tools and IoT-enabled smart dental hand pieces.

The use of bio-reactive adhesives in new non-invasive crown removal methods can reduce the time and discomfort for patients as well as the risk to their enamel. With painless removal systems based on ultrasound, it will heighten precision even more as well as make for an altogether improved experience for the patient.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA sterilization standards, CE certification for dental instruments, and ISO 13485 quality requirements. |

| Technological Advancements | Growth in ultrasonic removers, high-speed cutting handpieces, and laser-assisted debonding tools. |

| Industry Applications | Used in dental clinics, hospitals, orthodontic labs, and restorative dentistry centers. |

| Adoption of Smart Equipment | Transition to high-torque air-driven handpieces, laser-based debonding, and ergonomic manual removal tools. |

| Sustainability & Cost Efficiency | Shift toward biodegradable disposable removal tools, eco-friendly sterilization, and ergonomic energy-efficient designs. |

| Data Analytics & Predictive Modeling | Use of basic chairside monitoring, digital impression tracking, and manual force estimation. |

| Production & Supply Chain Dynamics | Challenges in high manual labor costs, precision instrument durability, and limited global standardization. |

| Market Growth Drivers | Growth fueled by rising dental restoration procedures, increased adoption of metal-free crowns, and technological advancements in dental tools. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed instrument traceability, AI-driven regulatory compliance, and smart crown removal tracking systems. |

| Technological Advancements | AI-powered robotic precision removers, bio-responsive adhesive detachment, and non-invasive ultrasonic removal systems. |

| Industry Applications | Expanded into AI-driven smart removal handpieces, decentralized robotic dental units, and digital twin-guided crown removal procedures. |

| Adoption of Smart Equipment | AI-assisted real-time pressure sensors, smart IoT-connected dental instruments, and automated non-invasive debonding systems. |

| Sustainability & Cost Efficiency | Zero-waste dental instruments, AI-optimized crown removal force calibration, and self-sterilizing reusable tools. |

| Data Analytics & Predictive Modeling | AI-powered predictive force application, blockchain-tracked sterilization compliance, and real-time dental instrument diagnostics. |

| Production & Supply Chain Dynamics | Decentralized AI-driven instrument manufacturing, sustainable dental tool supply chains, and blockchain-secured material sourcing. |

| Market Growth Drivers | Future expansion driven by AI-integrated dental robotics, precision non-invasive removal methods, and self-regulating dental instruments. |

In the United States, the Dental Crown Removal Market is expanding steadily. Increasing demand for restorative dental procedures, growing acceptance of minimally invasive treatment technology, dental instrument improvements have permitted greater success in dental root-canal care. Dental crown removal devices are regulated by the American Dental Association (ADA) and the FDA, ensuring the safety and efficiency of the procedures.

As more dental restorations are performed and crown replacements are made, demand is growing for high-precision removal tools. For instance, air-driven and ultrasonic crown removers are starting to play an increasingly important role in this field. Besides, the development of laser-assisted crown removal technology is increasing efficiency and reducing patient pain.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

Advanced dental technologies, digital dentistry, and education about tooth health given by government has contributed to the growing dental crown removal market in the United Kingdom.

Furthermore, the United Kingdom's Care Quality Commission (CQC) as well as National Health Service (NHS) expect dental service will open up opportunities for individuals to take care of themselves in a preventive, rather than waiting until something dangerous happens to restorative status e.g replacing crowns.

The move to painless, non-invasive methods of crown removal has seen lasers and AI-powered dental tools enter the marketplace. Furthermore, cosmetic dentistry is on the rise and dental tourism: These developments only further increase demand for advanced crown-removal devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The Dental Crown Removal Market in the European Union is witnessing stable growth. This is due to rising demand for dental restoration procedures, strict EU medical device regulations and the development of convenient dental tools. Both the European Medical Device Regulation (MDR) and European Dental Association (EDA) impose strict safety criteria upon dental instruments.

Germany, France, and Italy are at the forefront of innovative crown removal technology adoption. This includes smart torque-controlled hand pieces, ultrasonic scalers and 3D-guided removal tools. As a further sign it is set to become even more advanced practically, the increasing investment going into digitalized and AI-driven dental equipment is being used to improve the precision necessary for surgical procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Now, technological advancements in dental equipment, increasing focus on minimally invasive dentistry and a growing elderly population with restorative oral care needs are all contributing to the expansion of the Dental Crown Removal Market in Japan. It also promotes the use of next-gen crown removal apparatus.

AI-powered diagnostics; Robotic-assisted dental tools; And a laser-guided crown remover are all being implemented in Japanese dental clinics respectively, so as to improve accuracy and reduce patient pain. Rising in popularity is the business mode of digital dentistry, CAD/CAM restorations, Drive market innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Dental Crown Removal Market in South Korea is witnessing moderate growth, as dental tourism grows steadily and state subsidies for healthcare become increasingly common. Furthermore, adoption of sophisticated dental equipment has increased.

Driven by these trends, a climate conducive to innovation-setting up production facilities abroad emerges all over Asia. The South Korean ministry of food and drug safety (MFDS) regulates dental devices so as to ensure that they conform to international standards.

Most regions nowadays have advanced dental centers for cosmetic and restorative dentistry along with digital workflow integration. Demand for automated and smart crown removal tools is growing. At the same time, highly technological educational programs and investment in research foster a new era of devices and techniques in dentistry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The Dental Crown Removal Market is growing with the development of dental restoration techniques, replacements for aging crowns and more and more people preferring minimally invasive techniques for their body has increased.

The market is mainly for implement type two removal methods, conserve and semi-processed type. The purposes of these types require that the removal crown can be smoothly taken out while at the same time not harming dental structure.

Conservative Techniques Lead Market Demand for Minimally Invasive and Reusable Crown Removal

Conservative crown removal methods are generally employed as they are intended to maintain both the crown and the underlying tooth structure so that re-cementation or re-use of the crown is possible. Conservative methods employ specific instruments like crown removers and ultrasonic scalers to carefully remove the crown without inflicting any damage upon it.

Increased use of conservative methods in reconstructive and cosmetic dentistry is spurred by their capacity to alleviate patient pain, conserve enamel loss, and provide cost-efficient crown reattachment. In addition, technological breakthroughs in ultrasonic and laser technology-based crown removal systems are enhancing crown removal efficiency and accuracy.

Though they have benefits, some drawbacks like time-consuming procedures, inability to extract well-bonded crowns, and specialized skills requirements exist. But the advancement of micro-fracturing technologies, force application using artificial intelligence, and enhanced adhesive dissolution agents will further promote conservative crown removal methods.

Semi-Conservative Techniques Gain Traction for Efficient Removal with Limited Crown Damage

Semi-conservative crown removal methods compromise on efficiency and the preservation of teeth, which renders them suitable where partial crown loss is tolerable but the internal tooth integrity must be preserved. These methods mainly entail sectioning or controlled crown fracturing as well as safeguarding the external dental structure as much as possible.

Increased use of semi-conservative methods in full-mouth rehabilitation and crown replacement therapy is based on their decreased procedure time, increased accuracy, and flexibility for temporary and permanent crown removal. Furthermore, the development of high-precision fiber-reinforced sectioning instruments, high-precision drills, and ultrasonic-assisted separation techniques is making crown removal faster and more accurate.

Challenges like the necessity of crown reconstruction after removal, however, persist as problems. Advances in AI-assisted crown segmentation, ultrasonic high-frequency cutting, and precision-sectioning devices should address safety concerns as well as facilitate greater acceptance rates.

The requirement for dental crown removal comes mainly from instrument ease of use and efficiency, with manual and automatic systems becoming the most popular given their versatility, precision, and capability to accommodate different clinical applications.

Manual Systems Lead Market Demand for Cost-Effective and Controlled Crown Removal

Manual crown removal systems are still the most prevalent in dental clinics, providing cost-effectiveness, portability, and controlled force delivery. They consist of crown spreaders, forceps, and spring-loaded mechanical removers, enabling dentists to modify pressure and technique according to specific cases.

The increased need for manual crown removal instruments in small clinics and general dental practices is fueled by their cost-effectiveness, consistency, and low reliance on electrical power. Moreover, the evolution of ergonomic instrument designs, titanium-coated forceps, and advanced grip control mechanisms is enhancing practitioner comfort and patient protection.

Although they are advantageous, problems like increased procedure time, increased risk of crown fracture, and more physical effort still exist. However, breakthroughs in adjustable-torque manual systems, self-aligning grip technology, and non-slip mechanical forceps should lead to greater accuracy and convenience when performing manual crown removal procedures.

Automatic Systems Gain Popularity for Faster and Minimally Invasive Crown Removal

Automatic crown removal systems are becoming increasingly popular because they can shorten procedure time, minimize crown damage, and enhance patient comfort. These systems utilize ultrasonic, pneumatic, or motor force application mechanisms to enable rapid and controlled crown removal.

The increasing use of automatic crown removal devices in large-volume dental offices and specialized prosthodontic clinics is driven by their ability to remove well-bonded or zirconia crowns without applying undue force. Further, advancements in laser-assisted removal, AI-based torque regulation, and smart feedback systems are enhancing precision and minimizing the possibility of tooth or crown damage.

Despite challenges, like increased expenses, maintenance needs of devices, and specialized training requirements, market penetration is expected to increase through innovations in miniaturized battery-powered automatic removers, artificial intelligence-based ultrasonic force modulation, and adaptive removal tools of multiple modes.

The market for Dental Crown Removal is growing on account of increasing demand for effective, non-surgical, and reusable crown removal instruments in restorative dentistry. The market is influenced by enhanced dental restoration procedures, growth in minimally invasive procedures, and increasing use of ergonomic and precise crown removal instruments.

Companies target air-powered, ultrasonic, and mechanical systems for crown removal to increase efficiency, patient comfort, and accuracy in procedures. The market features top dental equipment companies, surgical instrument companies, and specialty dental tool companies, all of which contribute to innovations in adjustable force crown removers, high-speed oscillating tools, and damage-free debonding technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Komet Dental | 18-22% |

| 3M Company | 12-16% |

| Hu-Friedy (A division of Steris) | 10-14% |

| NSK Dental | 8-12% |

| J&J Instruments, Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Komet Dental | Produces rotary and oscillating crown removers for precise and controlled removal of dental restorations. |

| 3M Company | Specializes in dental adhesives, debonding tools, and non-damaging crown removal systems. |

| Hu-Friedy (Steris Corporation) | Manufactures high-quality mechanical and air-driven crown removers with ergonomic designs. |

| NSK Dental | Develops high-speed, ultrasonic crown removal handpieces for efficient and patient-friendly procedures. |

| J&J Instruments, Inc. | Focuses on affordable, durable manual crown removers for general and specialized dental practices. |

Key Company Insights

Komet Dental (18-22%)

Komet Dental leads the crown removal market, offering rotary and oscillating instruments designed for high-precision and damage-free crown removal.

3M Company (12-16%)

3M specializes in dental adhesives and non-invasive crown debonding systems, ensuring safe and effective removal.

Hu-Friedy (Steris Corporation) (10-14%)

Hu-Friedy provides ergonomic, mechanical crown removers, focusing on dental professional comfort and precision.

NSK Dental (8-12%)

NSK is known for ultrasonic and high-speed oscillating tools, integrating cutting-edge technology for effortless crown removal.

J&J Instruments, Inc. (6-10%)

J&J Instruments offers cost-effective, manual crown removers, making high-quality tools accessible to dental clinics worldwide.

Other Key Players (30-40% Combined)

Several dental tool manufacturers, endodontic instrument providers, and surgical instrument companies contribute to advancements in crown removal precision, patient comfort, and tool longevity. These include:

The overall market size for the Dental Crown Removal Market was USD 322.3 Million in 2025.

The Dental Crown Removal Market is expected to reach USD 481.7 Million in 2035.

Increasing dental restoration procedures, rising demand for minimally invasive removal techniques, and advancements in crown removal tools will drive market growth.

The USA, Germany, China, Japan, and France are key contributors.

Conservative and Semi-Conservative Techniques are expected to lead in the Dental Crown Removal Market.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.