The global dental consumables market is valued at USD 46.8 billion in 2025. It is expected to grow at a CAGR of 5.6% and reach USD 80.8 billion by 2035. The dental sector around the world is set to grow steadily. This increase is because more people understand the importance of seeking preventive and cosmetic dental treatments.

Advances in dental technology, coupled with an aging population requiring more dental care, are driving growth in the industry. More dental problems and a growing interest in cosmetic dentistry are big reasons for this growth.

In 2024, significant changes happened in the global dental supplies segment. These changes were due to new technology, updated rules, and shifting consumer demands. Many dentists began using new digital tools. Intraoral scanners and 3D-printed dental prosthetics were more common. These tools make dental procedures more accurate and quicker, improving how dental work is done.

More dental professionals are using less invasive procedures and body-safe products, which is helping the industry expand. Currently, North America and Europe are leading the segment because of advanced healthcare systems and greater dental care awareness. However, the Asia-Pacific region is expected to grow quickly as people have more money to spend and better access to dental services.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 46.8 Billion |

| Industry Size (2035F) | USD 80.8 Billion |

| CAGR (2025 to 2035) | 5.6% |

Explore FMI!

Book a free demo

The dental consumables landscape around the world is growing steadily. This growth is happening because more people want cosmetic and restorative dental work. Additionally, the use of new digital techniques and less invasive procedures is increasing.

The main groups getting benefits from all this are those who make dental products, dental clinics, and countries where healthcare is becoming more available. As regulations get tougher and technology advances, there will be a focus on creating new biocompatible materials and using AI for better diagnostics. These changes will help make dental care more efficient and lead to better outcomes for patients.

Adopt Digital and AI-Based Dentistry

Invest in digital diagnostics, 3D printing, and computerized workflows to improve treatment accuracy, decrease procedure time, and enhance patient satisfaction. R&D in intelligent dental materials and automation should be given top priority by companies to remain competitive in a rapidly tech-enabled sector.

Grow in High-Growth Emerging Markets

Align industry strategy with the emerging demand for cost-effective and quality dental care in Asia-Pacific, Latin America, and the Middle East. Build localized manufacturing centers, regional clinic partnerships, and focused pricing structures to seize growth in these fast-emerging regions.

Strengthen Supply Chain Resilience and Sustainability

Diversify supply strategies and invest in sustainable, biocompatible materials to manage raw material shortages and meet changing regulations. Create strategic alliances with environmentally friendly suppliers and dental associations to establish a robust, future-proof supply chain while strengthening brand reputation.

| Risk | Probability & Impact |

|---|---|

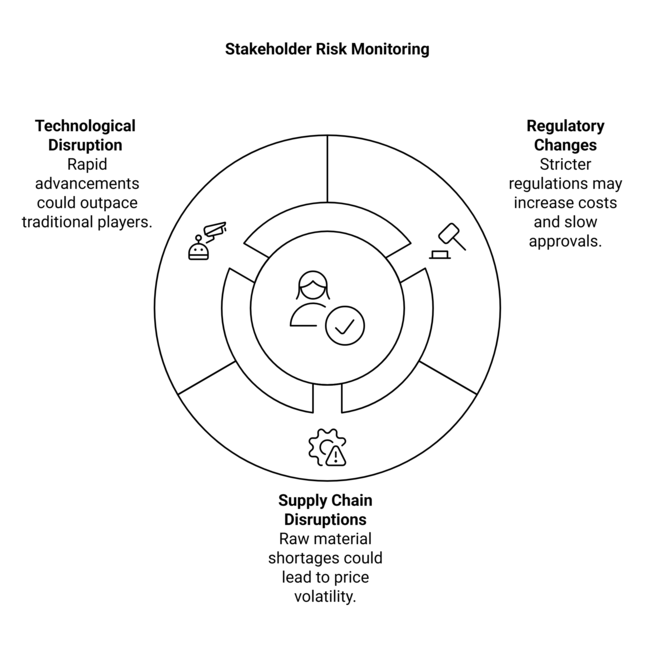

| Regulatory Changes & Compliance Burdens - Stricter regulations on biocompatibility and sustainability may increase costs and slow product approvals. | High Probability, High Impact |

| Supply Chain Disruptions - Raw material shortages, especially for zirconia and polymer-based composites, could lead to price volatility and delays. | Medium Probability, High Impact |

| Technological Disruption & Competition - Rapid advancements in AI, robotics, and digital dentistry could outpace traditional players that fail to innovate. | High Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Digital & AI Integration | Accelerate AI-powered diagnostics and 3D printing adoption. |

| Supply Chain Stability | Diversify supplier base and secure alternative sources for key raw materials. |

| Emerging Industry Expansion | Establish regional partnerships and evaluate pricing models for high-growth sector. |

To stay ahead, companies must changing dental consumables sector, the business needs to give top priority to digitalization, enhance supply chain resilience, and grow in high-growth emerging sectors.

Immediate steps should be to speed up AI and 3D printing adoption, acquiring alternative raw materials sources to safeguard against supply disruptions, and partnering strategically with regions to capture developing demand in Asia-Pacific and Latin America. This intelligence indicates a move towards tech-enabled efficiency and regulatory flexibility, necessitating an active R&D investment strategy and a new go-to-sector strategy.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Dental Clinics & Labs):

Alignment:

Divergence:

North America:

Western Europe:

Asia-Pacific:

High Consensus:

Key Variances:

Strategic Insight:

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States (USA) | The FDA (Food and Drug Administration) regulates dental materials under Class I, II, and III medical devices, requiring 510(k) clearance or Premarket Approval (PMA) for new dental products. |

| European Union (EU) | The Medical Device Regulation (MDR 2017/745) enforces stringent biocompatibility and safety requirements, increasing compliance costs for manufacturers. The CE Marking is mandatory for all dental consumables before they can be sold in the EU. |

| United Kingdom (UK) | Post-Brexit, the UK has adopted its own UKCA (UK Conformity Assessed) certification, replacing the EU’s CE Mark for medical devices, including dental consumables. |

| China | The National Medical Products Administration (NMPA) requires approval for all dental materials, with a focus on toxicity and long-term durability testing. Recent policies encourage domestic manufacturing over imports, affecting international brands. |

| Japan | Regulated by the Pharmaceuticals and Medical Devices Agency (PMDA) under the Ministry of Health, Labour and Welfare (MHLW), requiring Shonin (Approval) or Ninsho (Certification) depending on the product class. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) mandates product registration and clinical evaluations for dental consumables. KFDA (Korea Food and Drug Administration) certification is required. |

| India | The Central Drugs Standard Control Organization (CDSCO) classifies dental products under the Drugs and Cosmetics Act, requiring Import Licenses (Form MD-14/15) for foreign brands. |

| Brazil | The ANVISA regulates all dental consumables as medical devices, requiring RDC 185/2001 compliance for registration. ISO 13485 certification is highly recommended for international manufacturers entering the Brazilian segment. |

| Australia | The Therapeutic Goods Administration (TGA) mandates all dental consumables to be listed in the Australian Register of Therapeutic Goods (ARTG) before commercialization. |

The USA dental consumables landscape is predicted to grow at a CAGR of 5.9% during the 2025 to 2035 period, slightly over the global average due to swift digital adoption and growing demands for dentistry in the elderly population. Regulatory compliance is a segment entry barrier, as the American Dental Association (ADA) and Food and Drug Administration (FDA) have stringent quality and safety standards.

Key reasons for growth in the segments include increasing demand for CAD/CAM-based restorations, AI-powered diagnostics, and high demand for clear aligners. More patients are covered under medicare advantage dental plans, and procedure volumes continue to increase. Challenges such as supply chain instability, high treatment costs, and a shortage of qualified dental workers must be addressed. Increased investment in training and automation will be essential.

Dental consumables in the UK are expected to grow at 5.2% CAGR, as the rising cosmetic dentistry trend in the region is coupled with UK. Changes to regulations after Brexit have also made things complicated, as the UK has now adopted UKCA certification, meaning products must be approved separately from the EU.

Due to limited NHS funding for dental services, the majority of British dental care is either paid for out-of-pocket or through private insurance. There is a growing demand for digital dentistry solutions like intraoral scanners, CAD/CAM restorations, and AI-powered diagnostics. Sustainability in dental materials is a key area in which mercury-free fillings and biodegradable dental products are emerging as popular trends.

Public healthcare support and a high level of dental insurance coverage under France’s universal healthcare system. The French dental consumables market is anticipated to grow at a CAGR of 5.5% in 2025. The government launched 100% Sante, which guarantees full reimbursement of important dental procedures, thereby increasing patient volumes and the demand for affordable health restorations and orthodontic options.

Many sustainability initiatives are already happening with eco-friendly packaging and recyclable dental materials. Technology adoption, such as 3D printing and AI-assisted diagnostics, is increasing but at a slower rate compared to Germany and the USA However, it struggles with slow regulatory approvals, expensive labor, and limits on advertising dental services.

Germany’s dental consumables segment is expected to grow at 5.8% CAGR owing to its developed healthcare infrastructure, better insurance penetration, and rigorous regulatory system. It is a center for dental technology and R&D and has some of the best dental manufacturers who produce high-quality implants, CAD/CAM materials, and digital dentistry innovations.

Their presence has resulted in a consolidation of suppliers in the industry, as it has proven difficult for some of the smaller manufacturers to comply with the EU MDR regulations. Germany operates is a leader against these trends, rapidly transitioning to AI-assisted diagnostics, digital impressions, and chairside restorations-enhancing efficiency and patient outcomes across the board. There are challenges in the form of labor shortages and rising operational expenses for dental clinics.

The dental consumables sector in Italy is expected to grow at a CAGR of 5.4%, driven by the growing demand for cosmetic dentistry, the aging population, and rising private expenditure on dental care. There is a high number of private dental clinics in the country, and aesthetic treatments such as veneers, teeth whitening, and aligners have gained popularity. The adoption of digital dentistry is on the rise, but cost-conscious clinics continue to rely on traditional workflows.

The demand for zirconia and ceramic restorations, which are driven by the tooth's aesthetic preference, is robust in the sector. But Italy faces several hurdles which including an aging body of dental professionals. Regardless of these pain points, Italy is an important European segment for dental consumables, especially for high-quality restorative and cosmetic treatments.

The dental consumable sector is growing in South Korea at a CAGR of 6.0% due to the focus on advanced dental technology, government reimbursement programs, and the growth of the cosmetic dentistry segment. Clinics extensively utilize AI-assisted diagnostics, 3D printing, and CAD/CAM systems, which makes the country a leader in adopting digital dentistry.

Dental tourism is a big part of the growth, attracting a flow of patients from China, Japan, and Southeast Asia for affordable, high-quality implants and orthodontics. On a wider scale, reimbursement hurdles and pricing pressures on domestic manufacturers are major challenges. The dental sector in South Korea is highly competitive, with many local brands expanding into the global industry.

The Japanese dental consumables sector is estimated to grow at a CAGR of 5.3% over the forecasted period of 2025 to 2035, mainly concerning the growing geriatric population in the country. The elderly population is more than 28% of the total population, so the need for dental implants, prosthetics, and periodontal treatment is increasing. Preventive dentistry is actively promoted by the Japanese government, which subsidizes routine check-ups, fluoride treatments, and periodontal care.

This incentive has led to increasing interest in less invasive treatment options, sealants, and other advanced dental hygiene products. Nevertheless, the price of restorative and cosmetic dental treatment continues to prevent the segment from expanding, causing many patients to travel to neighboring countries such as South Korea and China to pay less.

The dental consumables landscape in China is forecast to grow at a CAGR of 6.2% from 2025 to 2035, primarily driven by the rise in disposable incomes, urbanization, and awareness of oral health. Dental aesthetics are booming in urban centers such as Beijing, Shanghai, and Guangzhou, where patients demand clear aligners, teeth whitening products, and ceramic restorations. Cosmetic dentistry has gained a lot of traction from social media and more aesthetically conscious younger consumers.

Still, local competition is fierce, and local manufacturers dominate the segment due to their ability to offer lower-cost options. While premium international brands continue to dominate the sector for high-end implants and orthodontic solutions, local brands are steadily gaining ground and posing a challenge to foreign companies.

The Australian & New Zealand dental consumables landscape is estimated to grow at a CAGR of 5.6% through 2025 to 2035, due to increased government initiatives, high penetration of private insurance, and rising awareness among patients about oral health. In both Australia and New Zealand, public dental services are covered under the CDBS and public dental programs, respectively, and these schemes guarantee a volume of public dental service to meet demand for basic dental consumables.

Dental treatment prices in both countries are still high, motivating many patients to choose between mid-range or alternative solutions instead of premium materials. The influence of private dental insurance is notable on industry growth, as it covers a considerable share of treatment procedures and purchasing behavior toward higher-end dental consumables.

India’s dental consumables sector has one of the highest global growth rates, with an expected CAGR of 6.5% for the period between 2025 and 2035. Increasing disposable incomes, urbanization, and a rising focus on oral health combined with the growing phenomenon of dental tourism are driving the segment. Dental tourism is a big driver, as international patients look for low-cost but high-quality treatments, such as dental implants, root canals, and cosmetic work.

Delhi, Mumbai, Chennai, and Bangalore are fast becoming hotbeds for low-cost dental treatments, attracting the Middle East, Africa, and First World citizens. In India, the majority of dental treatments are self-funded, unlike in Western sectors where health insurance covers them leading to significant price sensitivity in consumer behavior.

Restorative products held an industry share of around 29.6% in the global sector in 2025 and the segment is set to grow at a CAGR of 4.1% throughout the forecast period. Technological innovations and growing awareness toward oral healthcare have significantly bolstered the dental consumables market, which is anticipated to grow faster than ever in future.

The restorative industry remains highly dominant, growing alongside the increasing adoption of dental implants, prosthetics, and restorative materials. Advancements in biocompatible materials, digital workflows and 3D printing systems are allowing for more efficient and economical treatments. Periodontics segment is also slowly growing since dental sutures and haemostats are critical devices in oral surgeries.

Based on the rising trend for at- home dental care, there is demand for retail dental products like whitening solutions, floss, mouthwashes, etc. Orthodontics and endodontics are also showing robust growth, led by clear aligners, advancements in root canal treatments, and sealing material.

This is driven by the need for greater procedural efficiency within dental clinics, evident in the growing adoption of dental anesthesia solutions, aspiration products, and mixing tips. Physical market players also must remain competitive by putting an emphasis on sustainability, patient-friendly innovations, and AI-driven dental technologies.

Dental Clinics hold a global industry value of 36.6% during the year 2025 and segment is grow at a CAGR of 5.7%. There is broad utilization of dental consumables among hospitals, dental clinics, group dental practices, and ambulatory surgical centers. Dental clinics are the leading segment of this sector, owing to the sheer number of routine check-ups, restorations, and cosmetic treatments performed.

The growth of group dentistry and consolidation is increasing the adoption of high-quality dental consumables and digital technologies. Complex dental surgeries are increasingly being performed at hospitals and ambulatory surgical centers, which directly contributes to the growing demand in the hospital segment for anesthesia and endodontic products. Dental tourism is fuelled in emerging economies which is contributing to the demand for dental care in the specialized dental care centers.

Dental consumables market is witnessing intense competition and top players in the dental consumables market are implementing aggressive strategies to fortify their foothold in the market. Major companies, including Dentsply Sirona, 3M, Danaher, and Straumann, are competing based on factors such as pricing competitiveness, product innovation, and strategic partnerships.

The most successful companies are not only continuing to grow, they are also leveraging their position in high-growth regions such as Asia-Pacific and Latin America, where growing dental healthcare demand and increasing disposable income provide new opportunities.These regions have the potential to provide high growth rates over the coming decade.

Dentsply Sirona - ~15-20%

Dominates in dental implants, prosthetics, and CAD/CAM materials.

Straumann Group - ~10-15%

Leader in premium dental implants and regenerative solutions.

3M - ~8-12%

Strong in dental adhesives, restorative materials, and infection control.

Danaher (Envista, Nobel Biocare, Kerr) - ~10-14%

Significant presence in implants, orthodontics, and endodontics.

Zimmer Biomet - ~6-9%

Focus on dental implants and bone grafting materials.

Henry Schein - ~5-8%

Major distributor with a broad consumables portfolio.

GC Corporation, Mitsui Chemicals (Tokuyama Dental), and Ivoclar Vivadent - ~4-7% each

Strong in Asia-Pacific for ceramics, cements, and composites.

Other Players (Small & Regional Brands) - ~15-20%

Includes local manufacturers and emerging digital dentistry startups.

Mergers & Acquisitions

Product Launches & Innovations

Partnerships & Collaborations

Regulatory & Industry Expansion

Dental consumables are materials used by dentists during multiple dental treatments, such as restorations, implants, orthodontic procedures, and preventive dental treatments. These materials enhance the efficiency, accuracy, and convenience of treatments.

Restorative materials, implants, crowns, bridges, dental adhesives, anesthetics, impression trays, and orthodontic devices are deemed essential products. They are all needed for everyday activities in the majority of dental clinics.

Technology is revolutionizing dentistry with the addition of digital workflows, CAD/CAM systems, 3D printing, and AI tools. These technologies improve the accuracy, customization, and speed of dental procedures, enhancing the efficiency of procedures as well as patient results.

Rising global attention on oral care, coupled with the aging of the population and the growth in dental tourism, is fueling the demand for premium dental supplies. Furthermore, new developments in dental procedures and increasing popularity in cosmetic dentistry are also pushing this trend.

The employment of superior consumables enhances treatment results, lessens discomfort, and provides improved overall dental health. Patients enjoy more efficient treatments, quicker recovery times, and longer-lasting outcomes as a result of improved materials and procedures.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.