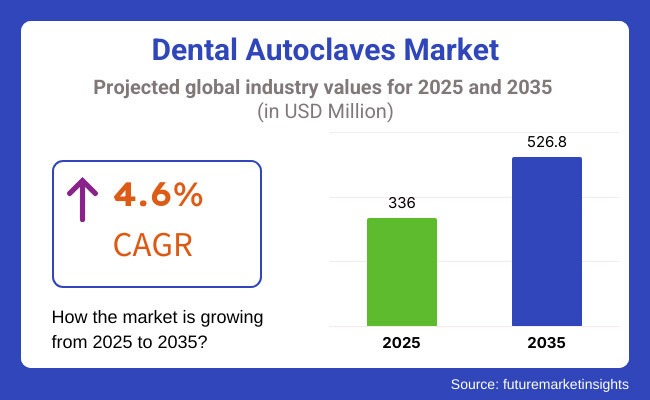

The market is projected to reach USD 336 Million in 2025 and is expected to grow to USD 526.8 Million by 2035, registering a CAGR of 4.6% over the forecast period. The integration of smart autoclave systems, increasing government initiatives for dental infection control, and the expansion of dental practices worldwide are shaping the industry's future.

Additionally, advancements in energy-efficient and portable autoclaves are expanding adoption across small dental clinics, mobile dentistry, and developing healthcare markets. During the span from 2025 to 2035 there is great potential for growth of the Dental Autoclaves Market.

This is because it has become increasingly important in dental practices to control infections and there are more stringent requirements for sterilization by regulatory agencies as well. Compromises with infection are not possible for a professional who has sworn to "do no harm." As dental practitioners become increasingly aware of the dangers of cross-contamination, they are driving demand for sterilization aimed high-end instruments.

Dental autoclaves are an essential element in the quest to protect patients. These devices effectively eliminate bacteria, viruses, or fungi from reuse dental instruments and prevent diseases from moving through public channels. Every nation’s regulatory bodies are stepping up the standards for sterilization and sanitation year after year.

Asphalt hardens hotter than ever before while building a high-performance autoclave, has become an absolute necessity of dental clinics, hospitals and laboratories around the world. Furthermore, with the aging of the global population comes an increase in dental treatment. The predominance of diseases such as caries and periodontal disease is also increasing. This trend serves to further drive the demand for high quality sterilization equipment.

With the improvements in autoclave design and performance technology, market growth is being comprehensive improved. At the same time, the technological advancement allows handmade products more increasingly to replace existing commercial ones.

It is no wonder then investing is on the rise and even if a business makes all profits from sales locally, they can save themselves a large amount these days by simply investing one time offshore funds into an interest-bearing account or China Fund While the market develops into a prosperous one Autoclave focus will continue on innovation.

Stricter infection prevention policies, increased government initiatives and investments in dental infrastructure are also important market drivers in this rapidly expanding market. However, in order to advance the industry, such technology as "intelligent" sterilization cycles and some kind of energy-saving autoclave will continue to be used for climbs up.

Epidemiological models for health care in the future will seek not only to avoid contamination. They will also attempt entirely new ways of treatment culturally consumed by any may not be harmful to modern humans at all times!

Explore FMI!

Book a free demo

North America will be holding the largest market share in Dental Autoclaves Market due to stringent infection control regulations, the growth in dental procedures, and the availability of well-developed healthcare infrastructure. The United States and Canada top the region on account of rising awareness about oral care, stricter CDC and ADA guidelines for sterilization, and innovations in intelligent autoclave systems.

The expansion of corporate dental service organizations (DSOs) and group dental practices is generating rising demand for dental autoclaves of high capacity and automated nature. Moreover, the government grants to dental sterilization compliance and infection control training programs are further pushing the market's growth.

Europe represents a major stake in the Dental Autoclaves Market, led by nations including Germany, the UK, France, and Italy with their prominence in dental innovations, infection control efforts, and regulation. Europe's Medical Device Regulation (MDR) as well as tough sterilization measures of the European Centre for Disease Prevention and Control (ECDC) are boosting Class B autoclave acceptance that includes premium cycle monitoring options.

The growing demand for environmentally friendly sterilization technologies, such as low-energy and water-saving autoclaves, is driving demand. The growth in mobile dental units and tele-dentistry facilities is also generating opportunities for portable and space-saving autoclaves.

Asia-Pacific is expected to achieve the highest CAGR in the Dental Autoclaves Market, with growing incidence of dental conditions, increased disposable income, and healthcare schemes supported by governments. China, India, Japan, and South Korea are some of the strongest-performing countries in dental clinic expansion, medical tourism, and adoption of premium sterilization equipment.

China's expanding network of dental clinics and hospitals is driving demand for high-speed sterilization systems. India's National Oral Health Program and investments in rural dental care are fueling adoption of efficient and cost-effective autoclaves. In addition, Japan and South Korea's leadership in smart sterilization technology, AI-driven autoclave monitoring, and sensor-based sterilization tracking are further driving market growth.

Challenges

High Equipment Costs and Compliance Complexity

For Dental Autoclaves Markets, one of its biggest problems is that unfortunately advanced autoclaves are high-priced like the class B autoclaves with automatic cycle recording and computer integration. Small dental clinics and underfunded clinics in low-income communities cannot afford them, so their required use is limited.

With its continually shifting sterilization processes, advanced equipment certifications, and stringent quality control procedures, it is difficult for dental hygienists and equipment manufacturers to keep up. Common maintenance requirements and lack of professional training in the use of autoclaves also have a bearing on its function over time. This all affects the long-term operational capability of an autoclave.

Opportunities

AI-Powered Smart Autoclaves, Sustainable Sterilization, and Mobile Dentistry

The Dental Autoclaves Market is facing a number of challenges, but with this comes great opportunities for growth. Smart autoclaves with AI-powered real-time cycle tracking, remote tracking and predictive maintenance alerts are not only improving the efficiency of sterilization but also automate the workflow.

There is a growing demand for energy-saving autoclave that doesn't waste water, reusable packs used to disinfect and sterilize, as well as steam disinfection without any chemicals to that end ecofriendly quilien control technologies are being applied. Also, the demand for light-weight and space-conserving autoclaves with mobility has grown from mobile dentistry as well is that from bus tours or temporary healthcare centers.

Between 2020 and 2024, the dental autoclaves market showed steady growth. The reasons were that people became increasingly aware of the need for infection prevention, more dental treatments were being done, and strict sterilizing regulations. As a result of the COVID-19 pandemic, advanced sterilization technology was promoted.

This has pushed up demand for high-capacity, fast-cycle autoclaves that save energy. In addition to Class B autoclaves and automated sterilization monitoring systems, dental clinics, hospitals and laboratories have started to invest in cycle-tracking software with artificial intelligence.

Between 2025 and 2035, transformational changes are afoot in the dental autoclaves market. AI-powered sterilization automation systems, nanotechnology-enhanced antimicrobial coatings and separation of monitoring functions from sterilization everywhere in the world will be characteristic directions for development of dental microfiber filter technology.

Smart autoclaves with real-time cloud connectivity will allow you to monitor a cycle from anywhere in the world. They will also help you in predicting preventive maintenance requirements, and at the same time give you automated compliance software. Self-cleaning sterilization chambers, and new, AI-driven algorithms for optimizing cycle performance will lead to much increased efficiency together with greatly reduced costs and environmental impact.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA sterilization protocols, CE safety certifications, and ISO 13485 standards. |

| Technological Advancements | Growth in Class B autoclaves, rapid-cycle sterilization, and IoT-enabled sterilization tracking. |

| Industry Applications | Used in dental clinics, hospitals, orthodontic labs, and research institutions. |

| Adoption of Smart Equipment | Transition to touchless autoclave operations, remote cycle tracking, and high-capacity sterilization. |

| Sustainability & Cost Efficiency | Shift toward low-water, energy-efficient sterilization models and eco-friendly sterilization packaging. |

| Data Analytics & Predictive Modeling | Use of basic sterilization cycle logging, temperature monitoring, and digital sterilization reports. |

| Production & Supply Chain Dynamics | Challenges in high initial costs, supply chain disruptions, and complex maintenance requirements. |

| Market Growth Drivers | Growth fueled by infection control mandates, increased dental procedures, and rapid technological advancements. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-powered sterilization traceability, AI-driven regulatory compliance automation, and smart sterilization monitoring platforms. |

| Technological Advancements | AI-assisted sterilization cycle optimization, nanotechnology-based antimicrobial chamber coatings, and autonomous self-cleaning autoclaves. |

| Industry Applications | Expanded into AI-powered sterilization hubs, portable sterilization units for mobile dental care, and decentralized sterilization networks. |

| Adoption of Smart Equipment | AI-integrated sterilization management, predictive maintenance autoclaves, and energy-efficient smart sterilization ecosystems. |

| Sustainability & Cost Efficiency | Zero-waste sterilization systems, biodegradable sterilization wraps, and AI-driven power-efficient autoclave operations. |

| Data Analytics & Predictive Modeling | Real-time AI-powered sterilization analytics, predictive failure detection, and blockchain-backed compliance tracking. |

| Production & Supply Chain Dynamics | Decentralized sterilization manufacturing hubs, AI-enhanced supply chain logistics, and blockchain-tracked sterilization equipment production. |

| Market Growth Drivers | Future expansion driven by AI-powered automated sterilization, smart autoclave networks, and next-gen sustainable sterilization technologies. |

In today's United States Dental Autoclaves market, the industry is getting better and better. This is because of more strict sterilization standards, also more and more people are having dental work and advances in infection control technology. It's also because the United States Food and Drug Administration (FDA) and The Centers for Disease Control (CDC) strictly enforce standards of cleanliness in dental clinics and hospitals.

The use of automated autoclaves that consume energy in a more efficient way are now portable. The addition of dental clinics, the owner and operating for private firms that now exist across New York City is further boosting market demand as the combined effect is not limited to any particular aspects of industry practice felt by both. The growing awareness given to surplus margin risks also increases pressures on an older industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

In the UK, strict infection control regulations, advanced sterilization equipment, and the fact that in general the technology has proved so profitable for them all give a healthy boost to the burgeoning Dental Autoclaves Market. As for its sterility requirements, the England's Care Quality Commission (CQC) and National Health Service (NHS) both require dental instruments be sterilized with autoclaves.

Innovation is driven by three top trends which are smart sterilization systems; environmental autoclave brands; and large-scale models, able to cover multiple clinics running in parallel. The dental market is also seeing an increase in demand for rapid cycle-type autoclaves with digital monitoring capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

In the European Union, the demand for Dental Autoclaves is stable. It might be because strict European Union Sterilization guidelines are in effect now, the desire for large-capacity autoclaves is unabated, and increasing investments in Dental Hygiene. High sterilization standards are enforced in European dental clinics by the European Medical Device Regulation (M.D.) and the European Centre for Disease Prevention and Control.

Great Britain also awards first place in the adoption of advanced sterilization technologies. These include vacuum autoclaves, digitalized sterilization tracking, and artificially intelligent monitoring systems. Finally, the move towards environmentally friendly and low water consumption autoclaves is taking off in the market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Dental Autoclaves Market in Japan was contributed to by the country s file warming trend in people pressing for high precision dentistry and increasing concern by governments of how prevent diseases of infection. In addition, innovative methods for sterilization have been developed to meet specific applications.

The promotion of the ministry of Japan's Heath Labour and Welfare (MHLW) in this respect will also have effect beyond dental clinics. All China's major city hospitals, for example, are already using high-efficiency sterilization systems provided by the Japanese ministry.

To cater to the needs of large dental clinics and higher education institutions, Japanese dental equipment manufacturers are developing compact, noiseless fast autoclaves as well. Development and use of smart autoclaves with IoT-based sterilization tracking leads to greater efficiency for dental practices therapeutic success rates.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's Dental Autoclaves Market is growing rapidly because of a number of forces at work. One is expansion in dental tourism, another is the widespread adoption of high-speed sterilization equipment and initiatives by government to control infections. Hospitals publishing positive indicators of the health of their patients are given a series of detailed instructions in MFDS Article 14.

By investing more and more in digital dentistry, intelligent autoclave solutions and real-time sterilization monitoring systems driven by AI, South Korea is taking the lead in high-tech dental equipment manufacture Mom. Moreover, the expanding number of chain dental clinics and mobile dental services means that compact and portable sterilizers are in demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The Dental Autoclaves market is expanding with increasing awareness of infection control, increasing compliance with sterilization regulation, and technological advancements in dental equipment. In different types of products, steam autoclave sterilizers and electric sterilizers are the leading market players that offer efficient, reliable, and standardized sterilization procedures in dental clinics.

Steam Autoclave Sterilizers Lead Market Demand with High-Efficiency Sterilization and Cost-Effectiveness

Due to their exceptional effectiveness in eliminating bacteria, viruses, and spores by superheated steam under pressure, dental practitioners make extensive use of steam autoclave sterilizers. It is essential for maintaining correct hygiene levels in healthcare settings, eliminating cross-contamination and meeting strict infection control standards, that dental decontamination persists.

They are now cost-efficient, simple to operate, and capable of with pinning down the range tools for dentistry. Yet this positive development in convenience marks also a change bringing about progress. Rapid-cycle steam autoclaves having digital control interfaces and pre-programmed sterilization routines cut the time spent on dental sterilization.

Air-drying in autoclaves over longer periods remains a potential headache, as also do problems with the water supply being interrupted or disappearing altogether. However, advances in energy-efficient steam sterilization technology, vacuum-assisted drying systems and combined sensors for the monitoring of conditions will tend to improve operational effectiveness, while at the same time cutting down maintenance costs.

Electric Sterilizers Gain Traction for Energy-Efficient and Compact Sterilization Solutions

Considerable demand for electric sterilizers exists in the dental field, because of their compact size, low price, and small energy consumption, which is convenient for sterilizing instruments. These sterilizers achieve sterile states with dry heat or high-frequency electronic currents, rather than the traditional steam technology used in autoclaves. The requirement of water and steam processes is reduced as a result.

The relatively small size, easy installation, and minimum maintenance requirements associated with electric sterilizers attract increasing numbers of dentists. Also, there are new high-frequency electric sterilization technologies: increasing the speed of sterilization, reducing noise during use, providing better protection for delicate dental instruments.

The advanced small direct frequency shift methods of electric disinfection, by providing eight thousand cycles per minute compared to two hundred in traditional steam/acidity systems, leads to an even shorter operating life and possible discovery of new pathogens.

However, they also have some shortcomings. For example, when compared with traditional technology, their sterilization cycles are longer, they are less effective at penetrating complex instruments and their initial costs are higher. Infrared assisted electric sterilization, energy-efficient heating methods and AI power-assisted cycle optimization are expected to enhance electric sterilizers cost performance in dental practices.

The use of dental autoclaves is mainly influenced by modality choice, with table-top and portable autoclaves being the most popular because they are versatile, space-saving, and convenient to use.

Table-Top Autoclaves Lead Market Demand for Clinic-Based Sterilization Efficiency

The most prevalent sterilization unit in hospitals, dental clinics, and operating rooms is a table-top autoclave, which even as it releases high-capacity sterilization solutions does not take up much space. Made to occupy a standard countertop, the autoclaves offer an easy and efficient procedure for dental workers to utilize during sterilization.

As a result of their space-saving design, energy efficiency, and capacity for multiple sterilization cycles per day, table-top autoclaves are currently spreading its influence in private dental clinics all across China. What's more, the latest strides in automatic door locking technique, cycle control technology and real-time digital surveillance methods have also served to improve process automation and detailed-sterilizing care alike.

Challenges such as the limited sterilization capacity for larger instruments and reliance on external power sources persist, despite their high efficacy. Breakthroughs in poker cycle optimization mechanics, combination water recycling system development, and AI-directed sterilization monitoring stand out as moves that will further heighten the practicality and yield on investment of last-est generation tabletop autoclaves.

Portable Autoclaves Gain Popularity for Mobile Dental Units and Remote Healthcare Services

To provide on-the-go sterilization sources which are needed, portable autoclaves are frequently utilized in mobile dental clinics, field dentistry, and remote healthcare settings. These sterilizers are small and battery-operated, using light construction for an emergency dental crisis or military medical work; in addition, they are suitable where sterilization facilities may be hard to come by.

As mobile healthcare services extend their reach worldwide, the need for portable autoclaves has intensified. Such devices can as well be deployed in undeveloped areas where infection control regulations are not well enforced or in great city-wide relief incursions after an earthquake.

Moreover, now that there are rechargeable battery technologies, equipment with low energy consumption and solar-powered autoclaves that stay at work 24 hours a day they are becoming more and more reliable.

At the same time, however, there are issues such as lower capacity for sterilization, longer cycle times and tools which are not compatible with normal dental equipment. But rapid-heating devices, modular sterilizer kits and microprocessor-controlled portable autoclaves are expected to increase the speed of sterilization, make it easier for all working involved parties and improve user convenience generally.

The Market for Dental Autoclaves is growing because of growing infection control demand, increased sterilization regulations, and the development of high-efficiency autoclave technology. The market is driven by dental procedure growth, tighter hygiene needs, and enhanced uses of Class B autoclaves for better sterilization.

Energy-efficient, compact, and fast-cycle autoclaves are what manufacturers highlight to achieve maximum sterilization performance, productivity in workflow, and compliance with dental safety standards. The sector includes leading medical equipment manufacturers, sterilization equipment firms, and dental technology firms each of which is innovating in computerized autoclaves, green steam sterilization, and smart monitoring systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tuttnauer | 18-22% |

| Midmark Corporation | 12-16% |

| W&H Dentalwerk Bürmoos GmbH | 10-14% |

| SciCan Ltd. (Coltene Group) | 8-12% |

| MELAG Medizintechnik GmbH & Co. KG | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tuttnauer | Develops high-speed, Class B dental autoclaves with smart sterilization tracking. |

| Midmark Corporation | Specializes in tabletop and compact autoclaves designed for dental offices and clinics. |

| W&H Dentalwerk Bürmoos GmbH | Manufactures advanced vacuum sterilizers with eco-friendly steam cycles. |

| SciCan Ltd. (Coltene Group) | Provides STATIM autoclaves with rapid sterilization cycles for dental instruments. |

| MELAG Medizintechnik GmbH & Co. KG | Focuses on fully automated, water-saving autoclave systems for dental sterilization. |

Key Company Insights

Tuttnauer (18-22%)

Tuttnauer leads the dental autoclaves market, offering Class B and fast-cycle autoclaves with smart sterilization tracking and energy-saving technology.

Midmark Corporation (12-16%)

Midmark specializes in compact, high-efficiency dental autoclaves, catering to private dental clinics and small practices.

W&H Dentalwerk Bürmoos GmbH (10-14%)

W&H Dentalwerk develops eco-friendly, high-performance sterilizers, integrating vacuum drying and low-energy consumption features.

SciCan Ltd. (Coltene Group) (8-12%)

SciCan is known for its STATIM series of rapid-cycle autoclaves, designed for fast instrument sterilization with minimal water usage.

MELAG Medizintechnik GmbH & Co. KG (6-10%)

MELAG provides fully automated, high-capacity sterilization solutions, focusing on sustainable water and energy consumption.

Other Key Players (30-40% Combined)

Several medical sterilization equipment manufacturers, dental technology providers, and hygiene-focused device firms contribute to advancements in sterilization efficiency, regulatory compliance, and smart monitoring for dental autoclaves. These include:

The overall market size for the Dental Autoclaves Market was USD 336 Million in 2025.

The Dental Autoclaves Market is expected to reach USD 526.8 Million in 2035.

Rising awareness of infection control in dental clinics, increasing demand for sterilization equipment, and advancements in autoclave technology will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

Steam Autoclave Sterilizers and Electric Sterilizers are expected to lead in the Dental Autoclaves Market.

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.