The dental 3D printing material industry will have continued growth from 2025 to 2035, maintaining a 3.9% CAGR, reaching USD 126.33 million by 2025 and USD 182.42 million by 2035. Breakthroughs in high-speed 3D printing and AI-based design automation will increase efficiency even more.

Some of the driving factors behind the growth of the industry are the rising incidence of dental ailments, increased awareness of digital dentistry, and constant developments in materials.

Resin-based materials, biopolymers, and metallic printing materials are experiencing increased demand. Dental clinics and labs are also increasingly using 3D printing to improve efficiency and accuracy in prosthetics, crowns, bridges, and orthodontics.

The dental 3D printing material industry saw continued growth in 2024, driven by increased adoption of metal-based and resin-based materials in dental labs and clinics.

One of the dominant trends of 2024 was the surge in demand for biocompatible resins to produce temporary bridges, crowns, and denture bases.

Improved photopolymer materials promoted more accurate printouts and strengthened them, enabling enhanced digital workflows.

This led to an increasing demand for biocompatible and high-strength resins in their field as dentists wanted to increase prosthetic durability and patient comfort.

Large dental labs and clinics accelerated their adoption of 3D printing technologies that cut the turnaround time for crowns, bridges, and implants.

As a result, investment in dental 3D printing was on the rise in Europe and Asia-Pacific, as major players increased production capacity.

Overall, the sector is poised for steady growth, driven by evolving dental care trends and continuous material innovation, which is expected to evolve further as dental practices embrace the digital age.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 126.33 million |

| Industry Value (2035F) | USD 182.42 million |

| CAGR | 3.9% |

Explore FMI!

Book a free demo

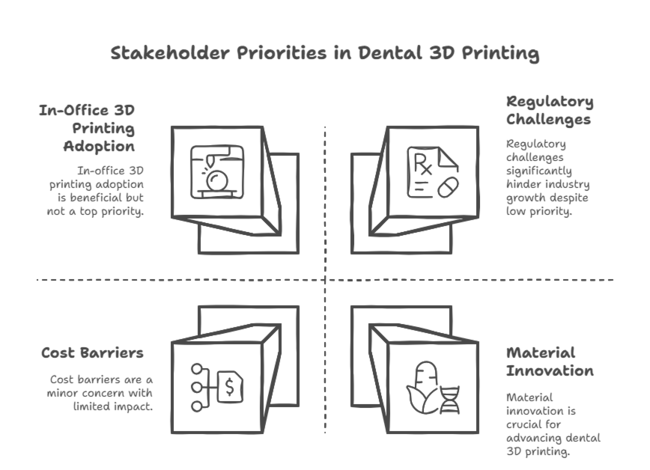

In its recent report, Future Market Insights conducted a detailed survey of leading stakeholders in the dental 3D printing material industry, such as manufacturers, dental professionals, and industry experts, among others.

Material innovation continues as the No. 1 priority with stakeholders seeking stronger, biocompatible, and lower-cost resins, according to the survey.

Entering the materials segment, a considerable number of respondents pointed towards the trend for resin-based printing materials due to increased precision and ease of use in dental use cases.

Another important finding was the increasing use of 3D printing in dental offices. Even though large-scale dental labs continue to dominate, independent dental practitioners are making a transition to in-office 3D printing to enhance turnaround times, lower third-party supplier dependency, and cut costs. Digital dentistry is evolving, a trend that is especially significant in North America and Europe.

The survey also noted costs and regulatory hurdles as large obstacles to broader use. Although 3D printing technology has seen improvements in efficiency, observers note that initial setup costs, as well as stringent medical regulations, continue to rank among the most significant concerns for stakeholders.

Yet, as technology advances and awareness grow, stakeholders expect increased affordability and regulatory clarity in the forthcoming years.

| Country | Impact of Policies and Mandatory Certifications |

|---|---|

| United States | The FDA regulates 3D-printed medical devices, including dental materials, under existing medical device frameworks. Manufacturers must comply with quality system regulations and, depending on the device classification, may need to submit pre-material notifications or approvals. |

| Australia | The Therapeutic Goods Administration (TGA) oversees 3D-printed medical devices. Manufacturers are required to demonstrate compliance with essential principles, including risk management and material biocompatibility. Utilizing standards like ISO 10993 for biocompatibility is recommended. |

| European Union | The European Medicines Agency (EMA) and national competent authorities regulate medical devices, including those produced via 3D printing. Compliance with the Medical Device Regulation (MDR) is mandatory, requiring conformity assessments and CE marking before industry entry. |

| United Arab Emirates (Dubai) | Aiming to streamline procedures and enhance the quality of concrete mixes used in licensed factories. This proactive measure positions Dubai as a leader in adopting conformity marking strategies for 3D printers used in construction. |

The top companies in the global industry compete on the basis of pricing, innovation, partnerships, geographic expansion, and other strategies.

Pricing approaches range from cost-effective, mass-market materials to premium, high-performance resins. Many also have bulk pricing or subscription-based supply models to secure their customers.

Innovation is a driving force, as the focus of R&D efforts is on biocompatible, durable, and aesthetically superior materials. The collaborations are crucial as firms collaborate with 3D printer makers to achieve material compatibility, dental labs via exclusive supply contracts, and universities for research.

Geographical expansion is the other strategic move, where companies venture into growing segments like India, Brazil, and Southeast Asia and establish local manufacturing centers to reduce supply lines.

Regulatory approval continues to be of prime importance, with companies getting approvals from bodies like the FDA, CE Mark, and China's NMPA.

Key companies focused on expanding product portfolios and strengthening their market presence in 2024. Stratasys Ltd. partnered with dental labs and brought them easier access to top-notch 3D-printed dental prosthetic ventures, meanwhile reasserting their industry supremacy on solutions focused on precision.

The shift presented the industry with the opportunity to deliver better patient outcomes through material science.

Formlabs also announced new 3D printing materials and accessories, designed to maximize throughput and reduce production costs. By doing so, the company established itself as a leader in dental 3D printing materials to address dental applications, fuelling the increase of high-performance resins which also represented a transition to more sustainable, cost-effective production practices across the industry.

B9Creations released its new B9 Dent XL 3D printer, reinforcing its commitment to high-speed, high-accuracy dental printing solutions. This launch was according to a wider industry trend aimed at making next-generation printers accessible for both colossal dental labs and small stake clinics.

The highlights of 2024 in the dental 3D printing material industry illustrate a combined shift towards automation, additional material development, and greater access. To respond to the increasing need for custom-made, higher-quality dental restorations, key players are continuing to fine-tune their strategies, setting a foundation for further advancements in the coming years.

Stratasys Ltd.

3D Systems Corporation

EnvisionTEC (Desktop Metal)

Formlabs

Dentsply Sirona

Henkel AG & Co. KGaA (Loctite 3D Printing)

Carbon, Inc.

BASF SE (Forward AM)

With rising adoption of digital dentistry solutions, developments in 3D printing technologies, and a growing focus on personalized dental care, the United States 3D printing materials sector for dental is steadily growing.

Consequently, the use of 3D printing in dentistry has enhanced the quality of patient care and improved efficiency. Furthermore, partnerships between dental laboratories and 3D printing companies have increased access to personalized dental prostheses.

The USA industry is being driven forward by emphasis on innovation and quality assurance, strengthening its presence in the global dental 3D printing materials scene.

The dental 3D printing materials industry in the United States is estimated to grow at a CAGR of 4.2% from 2025 to 2035.

The United Kingdom is a lucrative market for global dental 3D printing material companies with a 34.8% share in 2025, and the trend is expected to continue through 2035 with a CAGR of 4.2%.

The dental 3D printing material segment in the UK is consistently expanding due to the rising upsurge of digital dentistry across various private clinics and dental hospitals across the country.

A gradually growing number of NHS hospitals are leveraging digital workflows and 3D printing to provide patients with easier access to advanced treatment.

Recognizing the advantages of 3D-printed crowns, bridges and aligners, dental practitioners in the UK are reporting an increase in demand for biocompatible and long-lasting materials.

Furthermore, an advanced dental lab and research institution in this area designed innovative biomaterials with several material formulations.

Several dental tech startups developing cost-effective and scalable 3D printing solutions are also based in the UK.

China is projected to dominate the global dental 3D printing material industry value with USD 13.69 million in 2035, and the trend is expected to continue through 2035 with a CAGR of 6.8%.

China is witnessing the most rapid growth in the dental 3D printing materials industry owing to its explosive dental sector, government encouragement of healthcare innovation, and growing middle-class purchasing power seeking superior treatments.

Firms such as shining 3D and Union Tech in China are concentrating on creating low-cost, high-quality dental 3D printing materials both locally and export-oriented. Government investments in digital healthcare and AI-based dental solutions further boost adoption.

With an increasing focus on affordable and scalable digital dentistry, China is poised to become a leading global player in the dental 3D printing materials segment.

The value of Germany's dental 3D printing materials industry is estimated to reach USD 5.10 million by 2035, growing at a CAGR of 2.3% from 2025 to 2035.

Germany’s industry for dental 3D printing materials is uplifted by the country’s strong engineering and manufacturing sectors, resulting in multiple high-quality 3D printing materials.

3D printing technologies are rapidly being adopted in dental clinics and laboratories to improve precision and efficiency in dental procedures.

In addition, strong regulatory frameworks guarantee high quality of materials, which has further benefitted practitioners and patients. Germany's focus on technology advancement and quality standards drive the industry for dental 3D printing materials forward.

The dental 3D printing materials industry in India is estimated to grow at a CAGR of 7.5% from 2025 to 2035 and the estimated value of India's dental 3D printing materials industry in 2035 is approximately USD 11.42 million.

India’s dental 3D printing materials industry is growing at a rapid speed owing to rising demand for advanced dental care solutions, increasing implementation of digital technologies in dental clinics, and government support for healthcare innovation.

The increasing affordability of 3D printing technologies has allowed even smaller clinics to add these solutions, improving access to high-quality dental care.

Moreover, within the country, local manufacturers are now offering affordable solutions for Indian dental professionals.

With a vibrant industry and strong emphasis on technological adoption, India is set to record lucrative growth in the dental 3D printing materials industry over the forthcoming years.

The dental 3D printing materials industry in India at a CAGR of 3.6% from 2025 to 2035. Dental 3D printing materials sector in France is increasing at a moderate but steady rate, aided by government-backed healthcare initiatives and rising consumer demand for advanced dental care.

In France, dental clinics and laboratories are 3D printing restorations to perfect treatment quality and productivity. The in-depth expertise of material science companies, like Arkema and BASF Forward AM, strengthens the offering of dental printing materials in France.

The sector is also being widened by the government's attention towards integration of dental technology in public healthcare.

Over the assessment period, dental 3D printing material sales are predicted to soar at a robust CAGR of 3.4%. Italy’s dental 3D printing materials market is thriving, thanks to the country’s solid dental prosthetics and cosmetic dentistry industry.

With many Italian dental labs focusing on custom restorations, they offer opportunities to develop aesthetically pleasing and high-strength 3D printing materials. Although the adoption of 3D printing in smaller dental practices is slower in comparison to Germany or France, cost-effective digital solutions are promoting more widespread use. Next generation dental printing materials are also being developed by research institutions and universities in Italy.

The Japanese dental 3D printing materials industry is projected to grow at a CAGR of 3.3% over the forecast period. The Japanese dental 3D printing materials industry is an established but slow growing segment.

Japan has one of the world's highest dental care standards, but adoption rates are slow due to a lack of strict regulations. This trend has started to disappoint Japanese dental professionals after implant treatment products and is being replaced with titanium and zirconia-based products.

Japan has recently started adopting 3D printing for restorative and prosthetic applications, including crowns, bridges, and dentures.

However, cultural conservatism toward new medical technologies has slowed its widespread adoption in dental practice.

The dental 3D printing material industry is projected to reach a valuation of 3.5% CAGR over the forecast period. The dental 3D printing materials segment in Australia and New Zealand shows steady growth.

Restorations, implants, and aligners all rely on 3D printing technology. With a growing need for trained dental professionals in 3D printing applications, dental schools in Australia and New Zealand are already incorporating digital dentistry into their curricula. But the population is smaller, which limits segment growth.

The total demand for dental 3D printing materials in South Korea is predicted to rise at a healthy CAGR of 5.2% through 2035. The South Korean dental 3D printing material market is one of the rapid growth ones around the world, driven by a high adoption rate of digital workflows and a progressive cosmetic dentistry sector.

The growth in this industry has been further bolstered by government initiatives that, in turn, support dental technology advancements. High-performance materials tailored for orthodontics, implants, and full-mouth restorations have been developed thanks to the presence of local dental 3D printing companies including Graph Inc. and Medit.

Due to consumer preferences in South Korea, the demand for aesthetic dentistry has soared, fuelling the growth of high-strength and transparent materials for clear aligners as well as crowns.

Various types of materials are involved in the dental 3D printing industry, including photopolymers that are the most utilized, metals, and ceramics.

They have benefits of high precision and detail accuracy which makes photopolymers ideal for applications such as crowns, bridges, and dentures.

Due to their strength, durability, and biocompatibility, dental implants are typically made of metals such as cobalt-chrome and titanium.

Moreover, it is up-to-date with the latest practices and trends in the field of prosthodontics, which includes the use of ceramics for restorations like crowns and bridges, due to their superior aesthetic properties and biocompatibility with human tissues. These materials are vital in providing dental solutions that are not only of high quality and durable but also patient-friendly.

Based on product type, the dental 3D printing industry is segmented into equipment, materials, and services.

The equipment consists of 3D printers and scanners that are essential for the detailed designing and manufacturing of dental parts.

The materials segment includes the supplies, such as photopolymers, metals, and ceramics, utilized in the printing process.

Finally, services are defined as products such as design, prototyping and manufacturing solutions offered by niche 3D printing companies for the dental sector.

Digital dentistry is efficient and advanced with all of these products and services.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth due to increasing adoption of digital dentistry and 3D printing technologies. | Expected to witness rapid expansion with advancements in materials, faster printing technologies, and automation. |

| Photopolymers dominated the materials segment due to their precision and affordability. | Ceramics and metals are likely to gain more traction for their strength and biocompatibility. |

| Equipment sales, including 3D printers and scanners, increased as dental clinics and labs integrated digital workflows. | AI-driven 3D printing and fully automated dental manufacturing systems, including advanced 3D printers and production facilities, will enhance efficiency and reduce costs. |

| North America and Europe led the industry due to early adoption and strong healthcare infrastructure. | The Asia-Pacific region is expected to grow significantly, driven by rising dental care awareness and investments. |

| The industry was driven by demand for dental crowns, bridges, and implants. | Expansion into personalized orthodontics, full dentures, and regenerative dentistry is anticipated. |

Technological advancements, increasing demand for dental 3D printing, and rising disposable income are the key factors driving growth in the dental 3D printing industry.

Strong adoption was witnessed in the industry from 2020 to 2024, especially in developed economies like North America and Europe where digital dentistry became a core practice.

Going forward, high growth potential of emerging economies such as Asia-Pacific and Latin America will be a driving factor that will create opportunities in the global dental consumables industry owing to the rise in investments in the healthcare sector and awareness towards dental health in these economies from 2025 to 2035.

Industry growth will be primarily driven by factors like aging population, rising number of dental disorders, and increasing inclination toward cosmetic dentistry.

Further technology cost reductions of 3D printing along with biocompatible materials innovation will contribute to making these more affordable and accessible.

Government initiatives to enable advanced healthcare solutions will also add up to the private sector investments that will drive adoption.

Nevertheless, macroeconomic challenges, regulatory hurdles and significant upfront investments in 3D printing resources might pose challenges.

The overall dental 3D printing industry anticipated considerable growth as robust healthcare spending and technological innovations drive demand for customized dental solutions.

Automation, AI-based design applications, and sustainable material developments are some areas to follow closely as digital dentistry covers new ground in 2024 and beyond.

Emerging sectors like Asia-Pacific and Latin America are expected to offer great and growing opportunities for dental 3D printing owing to surging investments in the healthcare sector and rising prevalence of dental disorders.

Local demand presents an enormous opportunity for companies that can provide affordable, high-precision solutions to meet local needs.

The development of biocompatible materials, such as better zirconia ceramics and bioresorbable polymers with improved durability and decreased cost, will be the key in sustaining this competitive advantage.

Such tools can be utilized to improve data collection methods; from visual inspections to analysis of nozzle space this becomes especially important as we integrate AI-driven automation into our 3D printing processes.

In addition, the growth of customized dental solutions based on the patient's need such as tailor-made implants and orthodontic devices is creating an opportunity for on-demand production.

To capitalize on these opportunities, companies should build direct partnerships with large dental chains and clinics for a consistent demand pipeline. Moving to a subscription-based business model, like leasing or pay-per-use for 3D printers, would require a smaller upfront investment from small and mid-sized dental practices, thus bringing 3D printing technology to them sooner. Industry entry speed is a key factor: Early achievement of FDA, CE, and ISO certification will help expedite access to industry and promote trust among dentists.

Establishing decentralized manufacturing hubs closer to critical industries will minimize logistics costs and time lags. In addition, provide total restoration and removable denture offerings to tap the increasing aging population.

Through implementing these strategies, stakeholders can achieve sustainable growth and maintain their competitive edge in the dynamic dental 3D printing landscape.

The most commonly used materials include photopolymers, metals like titanium and cobalt-chrome, and ceramics such as zirconia and alumina.

Industries such as dentistry, orthodontics, and prosthodontics benefit greatly by using 3D printing for crowns, bridges, implants, and dentures.

Advancements in biocompatible materials, AI-driven automation, increasing demand for customized dental solutions, and expanding dental care awareness contribute to growth.

Leading companies include Stratasys Ltd., 3D Systems Corporation, Dentsply Sirona, Formlabs, and Carbon, Inc.

Future developments will include AI-driven automation, faster and more precise printing, enhanced material options, and greater adoption of sustainable, eco-friendly solutions.

Metals, Ceramics, Resins

Removable Partial Dentures, Dental Crowns & Bridges, Dental Implants

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.