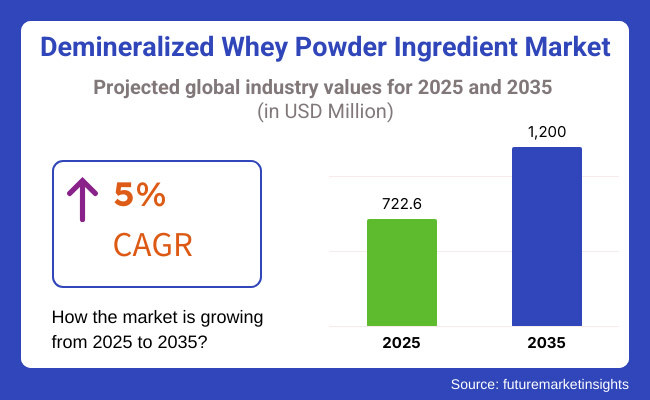

The global demineralized whey powder ingredient market is expected to grow from USD 722.6 million in 2025 to USD 1,200 million in 2035, representing a CAGR of 5% over the forecast period. It is primarily driven by the need for protein ingredients with high purity for various end-use industries, including clinical nutrition, infant nutrition, functional foods, and sports nutrition supplements.

To catch up with the changing demand of consumers, companies are channeling investments into advanced processing technologies that increase bio-availability, protein level, and solubility and decrease the mineral level in the whey powder. Demineralized whey powder (DWP) is a high-added-value dairy ingredient produced by membrane filtration and enzymatic demineralization to make it more digestible and functional.

Its utility in infant formula is widespread owing to its resemblance to human milk composition, but its applications are quickly advancing in other nutrition and functional food verticals. With consumers' growing understanding of precision nutrition, bioactive peptides, and gut health, DWP is progressively being incorporated into specialty foods, hybrid protein formulations, and High-Performance Sports Nutrition products.

One of the major driving factors of the high protein industry is the growing demand for innovative protein sources in medical nutrition, Pharmaceuticals, and dietary supplements. The aging population (particularly in developed parts of the world, such as North America, Europe, and Japan) is increasingly seeking protein-enriched formulations with neuroprotective properties, a significant factor contributing to DWP adoption.

In addition, sustainability challenges in dairy processing are spurring upcycled whey protein extraction innovations that position DWP as a key ingredient in alternative plant-based dairy varieties, hybrid meat products, and circular economy food systems. Along with the growth aspect, the industry for demineralized whey powder ingredients faces threats like raw material price volatility and supply chain instability caused by volatility in the dairy industry.

Regulation worldwide on formulating infant nutrition and dairy ingredients challenges manufacturers on a regional but global food safety quality level. Furthermore, DWP faces competition from plant-based protein alternatives that are rapidly gaining traction among vegan and lactose-intolerant consumers.

Artificial intelligence (AI) in food formulation as per unacquainted needs implies customizable & tailored whey protein isolates with tailored mineral reduction levels, one of the emerging trends and opportunities in the industry. Thus, there is an increasing pace of incorporation of DWP in probiotic-fortified beverages as well as infant food formulations of low allergenic potential and aging-medicine-oriented nutritional products.

This is further supported by the growing need for clean-label and functionality-driven "bioactive peptides-high" ingredient-based studies as the entry point to pave their way toward new product categories in the clinical and performance nutrition domain. Innovations in food engineering and sustainable practices from food manufacturers will lead to the healthy growth of the demineralized whey powder ingredient industry in the next decade.

Explore FMI!

Book a free demo

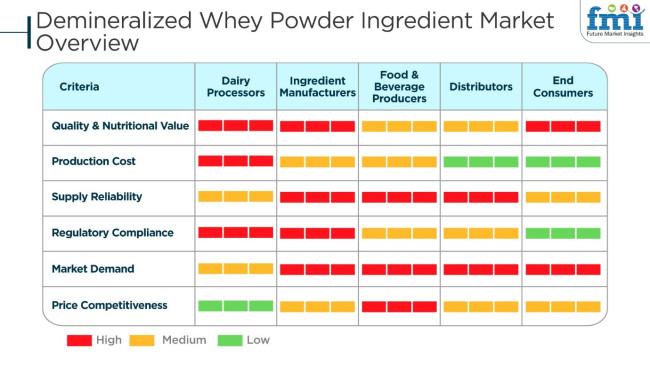

The industry of demineralized whey powder ingredient is having positive growing demand because of functional benefits in infant formula, dairy foods, sports nutrition, and bakery applications. Dairy processors emphasize high-quality raw materials and streamlined production to ensure purity and nutritional quality. Ingredient makers emphasize levels of demineralization, protein content, and regulatory compliance to ensure compatibility for infant nutrition and specialty diet products.

Food and beverage manufacturers prioritize consistency, solubility, and economy, rendering whey powder a key component of dairy, confectionery, and protein-fortified products. Distributors are central to supply chain management in international supply chains, facilitating continuous supply to manufacturers at guaranteed quality and competitive prices.

Final consumers increasingly prefer high-protein, lactose-free, and clean-label nutrition, necessitating the demand for demineralized whey powder in fortified and functional food applications. The industry is anticipated to expand with increasing use of nutritional and infant formula solutions across the world.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global demineralized whey powder ingredient industry.

This analysis highlights key shifts in industry performance and indicates revenue realization patterns, providing stakeholders with a clearer view of the industry growth trajectory over the year. The first half of the year, or H1, spans from January to June, while the second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.8% (2024 to 2034) |

| H2 2024 | 5.1% (2024 to 2034) |

| H1 2025 | 5.2% (2025 to 2035) |

| H2 2025 | 5.5% (2025 to 2035) |

The above table presents the expected CAGR for the global demineralized whey powder ingredient demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is projected to grow at a CAGR of 4.8%, followed by a slight increase to 5.1% in the second half (H2) of the same year. Moving into 2025, the CAGR is expected to rise to 5.2% in H1 and maintain a steady increase to 5.5% in H2.

In the first half (H1 2025), the industry witnessed an increase of 4 BPS, while in the second half (H2 2025), the industry observed a rise of 4 BPS, indicating a consistent upward trend. These variations suggest strong industry momentum, driven by advancements in dairy protein extraction technologies, increasing demand for high-purity whey ingredients, and regulatory support for sustainable dairy processing innovations across key global markets.

Between 2020 and 2024, the demineralized whey powder (DWP) market grew steadily, led by increasing demand in infant nutrition and technological advancements in whey processing. The infant formula industry led consumption as parents demanded high-quality, easily digestible proteins. Furthermore, use in sports nutrition, functional foods, and pharmaceuticals increased owing to DWP's increased bioavailability and lower allergenic nature.

The industry had a CAGR of 4.8%, with the highest growth in North America and Europe, led by stringent regulatory requirements for high-purity protein ingredients. Fluctuating dairy prices and supply chain disruptions were challenges, but advancements in whey processing technologies provided support to the stability of the industry.

Between 2025 and 2035, the industry is anticipated to achieve a 5% CAGR through next-gen dairy protein innovations and precision fermentation. Companies are producing protein blends, combining DWP with plant proteins for enhancing nutritional content. Asia-Pacific is providing opportunities for exports, particularly in China, South Korea, and India.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing applications as demineralized whey powder in infant nutrition and dairy nutritional products | Growing uses in plant-based and hybrid nutritional systems, sports nutrition, and medical foods |

| Driven by demand mainly from the infant nutrition industry owing to low mineral levels and excellent digestibility | Growing application in functional foods and beverages as a proteinaceous and lactose-reduced functional ingredient |

| North America and Europe as major consumers with consistent demand for high-end dairy-based products | Asia-Pacific and Latin America with high growth driven by rising birth rates and demand for low-cost dairy substitutes |

| Regulations on demineralization processes and infant food products | Stringent global quality requirements and regulatory adherence for ingredient purity and safety |

| Supply chain limitations as a result of dairy production and raw material supply variability | Enhanced supply chain resilience through diversified sources of milk and new whey processing technologies |

| R&D aimed at maximizing demineralization methods to enhance product consistency | Greater investment in innovative membrane filtration and enzyme treatment processes for greater purity and functional benefits |

| Increased concern about sustainable dairy sourcing and production methods | Enhanced focus on green processing, carbon footprint minimization, and sustainable dairy farm practices |

Demineralized whey powder ingredient marketing has so many risks, and they include raw material availability, regulatory compliance, supply chain disruptions, price volatility, and industry competition.

Raw material availability is a big issue as demineralized whey powder comes from cheese and dairy production. The availability of whey and processing efficiency can be influenced by variations in milk supply, seasonal changes, and livestock health. Furthermore, climate change and feed costs are affecting dairy production, which in turn affects whey output.

Regulatory compliance is tough to deal with, especially in areas like infant nutrition, pharmaceuticals, and functional food. Organizations such as FDA (USA), EFSA (Europe), and Codex Alimentarius are the ones who set the rules for food. The organizations specify a very strict guideline for purity, dematerialization levels (40%, 70%, or 90%), and safety from microbiological organisms.

If a manufacturer does not meet these requirements, they might have to deal with product recalls, lawsuits, or export restrictions.

Price volatility is a major worry, as a result of variation in dairy prices, processing costs, and energy use. The increased demand for infant formula and sports nutrition can lead to price surges which will affect the end users' affordability.

The industry competition is very fierce because big dairy ingredient suppliers are contending across the board with regard to quality, innovation, and pricing. The companies that provide ultra-filtration (advanced filtration) and are engaged in sustainable sourcing of raw materials are thus capable of staying ahead of the pack. But, plant-based protein powders acting as alternatives for whey products are the only thing these companies have to deal with in this situation.

Gut-health-focused blends are leading the charge of protein solutions, and, sad to say, DWP holds 75.0% of the industry share. Whereas traditional whey proteins suffer from higher mineral content, which can lead to some consumers experiencing bloating or digestive distress, DWP provides a low-mineral, highly digestible protein source, making it ideal for lactose-sensitive consumers, IBS individuals, or those following gut-healing dietary protocols.

In Europe and North America, major brands, including Nestlé Health Science, Herbalife, and Optimum Nutrition, are using DWP in joint-function protein-fortifying probiotic supplements to develop dual-function options for digestive health. Clinical studies on the balancing effect of protein-fermented peptides in gut microbiome and the demand for DWP-infused digestive enzyme blends, prebiotic protein shakes, and symbiotic meal replacements have propelled the growth of the industry.

Demineralized whey powder (DWP) represented 62.3 percent of the bakery/confectionery industry (the fastest-growing application). DWP's neutral taste, improved solubility, texture and water retention properties, and increased shelf life are widely used as functional ingredients in baked goods and confectionery products.

In bakery products, big players such as Grupo Bimbo, Mondelez International, and Barry Callebaut are adopting DWP in cakes, cookies, muffins, and bread to enhance protein content while ensuring that they remain soft and airy. The flour's low mineral content also makes it well-suited for delicate formulations, preventing off-flavors from developing in high-quality pastries and artisan-baked products.

The 50% demineralized whey powder (DWP) segment occupies a 24.7% share of the industry, growing for applications in infant nutrition, dairy processing, and sports nutrition. This middle-course variant has around 30% to 70% DWP with a balanced mineral profile needed for functions to make it useful for formulations where both functionality and moderate mineral content are required.

Theraplix - 50% DWP in follow-up formula, Toddler milk energy density 50% DWP helps meet protein requirements in follow-up formulas and toddler milk whilst maintaining levels of calcium and phosphorus compatible with bone mineralization (44-46). This has further involved the increased adoption of premium baby food products with high digestibility.

Friesland Campina and Lactalis Ingredients are also adding 50% DWP to processed cheese, yogurt, and recombined dairy products in the dairy processing sector to improve texture, stability, and protein fortification.

In terms of product type, the report segments the industry into 90% demineralized whey powder (DWP), capturing a 14.5% share in the industry, and further estimates the industry into infant nutrition, medical foods, and high-end confectionery applications. Its ultra-low mineral content makes it an excellent lactose and protein source in hypoallergenic infant formula for infants with sensitive digestion or metabolic disorders.

Leading companies like Arla Foods Ingredients and Agropur provide 90% DWP for specialty clinical nutrition, such as diets designed for kidney dialysis, post-surgical recovery, and metabolic disorders. Moreover, premium chocolate and confectionery brands, including Barry Callebaut and Lindt, utilize it to improve the mouthfeel, sweetness, and solubility of higher-end milk chocolates and caramel-based products.

As demand for highly purified dairy proteins reaches new heights, the industry for 90% DWP should continue to swell, especially in the regulated nutrition markets.

| Country | CAGR (%) (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.9% |

| Canada | 4.6% |

| India | 5.7% |

| Japan | 3.8% |

The USA is a top industry for demineralized whey powder ingredients, particularly functional and clinical nutrition. Clinical applications of whey are gaining traction, with doctors prescribing bioactive whey protein for recovery from surgery, metabolic disorder treatment, and geriatric nutrition. Consumers are seeking personalized protein products specifically designed to address individual disease states.

Neuroprotective whey technology is a topmost trend in the USA It encompasses study on whey-derived peptides that are advantageous to cognitive function, particularly among geriatric populations. Cross-sector alliances between dairy and biotech businesses have infused protein purification technology innovations that ensure whey proteins with augmented bioavailability and targeted health impacts.

FMI believes that the USA industry is set to grow at 5.4% CAGR during the research period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Medical Nutrition Demand | Whey bioactive proteins assist with recovery and nutrition in aging. |

| Neuroprotective Applications | Scientific research of whey peptides for mental disorders. |

| Protein Purification Advances | High-purity protein solutions improve functional applications. |

| Personalized Nutrition Trends | Completely customized formulations target individual nutritional needs. |

The UK industry is expanding with greater demand for hybrid protein foods. Food manufacturers are incorporating demineralized whey powder in plant protein food to create environmentally friendly dairy alternatives. As consumers increasingly turn flexitarian and vegan, hybrid protein beverages, meal substitutes, and non-dairy yogurts are gaining ground.

Low-carbon precision fermentation technologies are revolutionizing the sector with low-carbon and sustainable whey proteins. Startups are emphasizing low environmental impact with equivalent nutritional value. Rising consumer demand for high-protein and sustainable diets is propelling the UK to become a prime industry for new dairy products.

FMI opines that the UK industry will grow at 4.9% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Hybrid Protein Production | Combining plant and dairy proteins elevates nutritional value. |

| Flexitarian and Vegan Market Demand | Customers seek sustainable protein. |

| Precision Fermentation | Technology reduces the carbon footprint of whey protein. |

| Functional Dairy Free | Dairy-free high-protein product sales rise, propelling industry growth. |

Canada is witnessing increased demand for whey proteins based on gut health. Probiotic beverages based on dairy, digestive supplements, and enzyme-enriched sports supplements complement demineralized whey powder with functional foods. Clients like their proteins to be gut-friendly. Therefore, they are investing in bioactive peptides to manage the gut-brain axis.

Health Canada regulatory guidance propels clinical research on whey protein's impact on gut health. The industry is witnessing the introduction of second-generation protein foods for microbiome and improved nutrient absorption. FMI opines that the Canadian industry will grow at 4.6% CAGR during this study.

Growth Factors in Canada

| Key Drivers | Details |

|---|---|

| Gut-Health Innovation | Whey proteins enhance microbiome efficiency and digestion. |

| Functional Food Growth | Probiotic-enriched dairy beverages have become the consumer choice. |

| Enzyme-Fortified Sports Nutrition | High-performance foods aid nutrient absorption. |

| Regulatory Support | Government encouragement encourages research on gastrointestinal health. |

The Indian industry is changing with increased health awareness and demand for protein-fortified food. Urban households are adding whey proteins to daily diets through fortified dairy, infant formula, and functional beverages. Enhanced disposable incomes of middle-class consumers have promoted improved affordability and availability of good-quality protein supplements.

Government initiatives in food fortification and dairy industry growth fuel industry growth. Indian firms are focusing on establishing local dairy supply chains to meet growing demand. Iconic dairy brands are developing product innovation in the form of high-protein variants of common foods. FMI expects the Indian industry to grow at 5.7% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Rising Protein Consciousness | Consumers prefer high-protein foods. |

| Nutrition Fortification Policies | Government policies support nutritional fortification. |

| Dairy Industry Expansion | Local farmers improve supply chain effectiveness. |

| Growth of Functional Drinks | Urban consumers require whey-based drinks. |

The Japanese industry is evolving towards the premium applications of high-value proteins, particularly in specialist health foods and functional drinks. High-quality, well-digestible proteins are much appreciated in traditional Japanese diets, so demineralized whey is a valuable ingredient in healthy product formulation.

The country relies on imports of foreign whey proteins, with leading dairy firms importing demineralized whey of high purity from Europe and the USA Improved fermentation technology enables domestic production of bioactive whey peptides to meet Japanese dietary needs. Increased application in sports nutrition and elderly population supplements continues to drive industry growth. FMI opines that the Japanese industry will grow at 3.8% CAGR during the forecast period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| High-Growth Protein Demand | Consumers demand high-quality, digestible, and functional protein sources. |

| Import Dependency | The industry relies on whey protein imports from major suppliers. |

| Aging Population Initiative | Whey proteins address older nutrition and muscle maintenance. |

| Fermentation Innovations | R&D enhances the bioavailability of whey peptides. |

The industry is experiencing consistent growth, supported by increasing demand from infant nutrition, sports supplements, and medical nutrition applications. The need for these specialized nutritional applications is met through advances in whey processing technologies that enhance protein content and digestibility and reduce minerals.

Industry leaders Lactalis Ingredients, FrieslandCampina, Arla Foods Ingredients, Glanbia Nutritionals, and Euroserum dominate the industry by virtue of extensive R&D, advanced filtration techniques, and supply chain expansion. Such companies aim to optimize the extraction of whey protein and maintain high nutritional profiles while observing the rigorous standards for infant and medical applications.

Also gaining attention are small start-ups and niche providers catering to organic, non-GMO, and sustainable whey sourcing. Sustainability remains a key aspect of competitiveness, with all big companies making investments in environmentally friendly dairy practices, carbon footprint reduction, and circular processing techniques. Whosoever stays focused on innovative protein formulation, regulatory compliance, and ethical sourcing will take an active part in this ever-changing environment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lactalis Ingredients | 20-25% |

| FrieslandCampina | 15-20% |

| Fonterra Co-operative Group | 10-15% |

| Arla Foods Ingredients | 8-12% |

| Glanbia plc | 5-10% |

| Other Company (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lactalis Ingredients | Global leader in whey processing, supplying high-purity demineralized whey powders for infant and clinical nutrition. |

| FrieslandCampina | Focuses on premium-grade demineralized whey for specialized nutrition, leveraging advanced filtration technologies. |

| Fonterra Co-operative Group | Expanding its whey protein portfolio with sustainable and high-quality dairy solutions. |

| Arla Foods Ingredients | Develops advanced whey-based ingredients for functional food and sports nutrition sectors. |

| Glanbia plc | Offers a diverse range of demineralized whey solutions, targeting performance nutrition and dairy applications. |

Key Company Insights

Lactalis Ingredients (20-25%)

Market champion with state-of-the-art whey processing technologies to supply the infant and medical nutrition industries.

FrieslandCampina (15-20%)

The company's emphasis is on having a presence across the globe with premium demineralized whey powders, sustainability, and high-quality formulations.

Fonterra Cooperative Group (10-15%)

Promoting dairy innovation with sustainable sourcing and expanding its whey protein portfolio.

Arla Foods Ingredients (8-12%)

Concentrating on functional whey-based solutions for sports nutrition and medical applications.

Glanbia plc (5-10%)

Focusing performance nutrition with high-quality demineralized whey and dairy protein solutions.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 722.6 million in 2025.

The industry is predicted to reach USD 1,200 million by 2035.

The key players in the industry include Lactalis Ingredients, FrieslandCampina, Fonterra Co-operative Group, Arla Foods Ingredients, Glanbia plc, Saputo Inc., Volac International Ltd., Euroserum, Sachsenmilch Leppersdorf GmbH, and Carbery Group.

India, slated to observe 5.7% CAGR during the study period, is poised for fastest growth.

50% demineralized whey is being widely used.

By product, the industry is segmented into 40% demineralized whey, 50% demineralized whey, 70% demineralized whey, and 90% demineralized whey.

By application, the industry is segmented into dietary supplements, bakery & confectionery, infant food, pharmaceuticals, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.