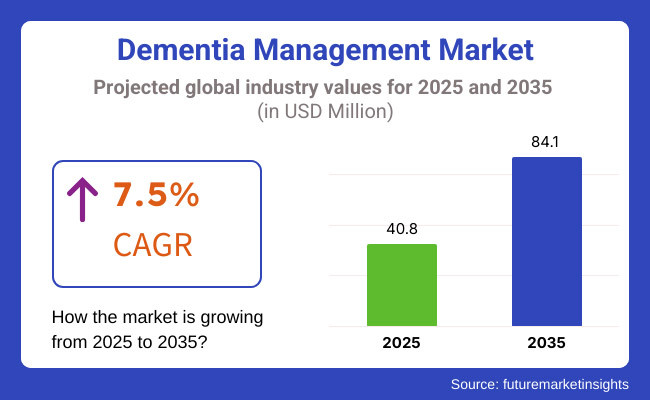

The market is projected to reach USD 40.8 Million in 2025 and is expected to grow to USD 84.1 Million by 2035, registering a CAGR of 7.5% over the forecast period. The development of disease-modifying drugs, increasing adoption of assistive technologies, and integration of AI-powered cognitive assessment tools are shaping the industry's future.

Additionally, expanding access to memory clinics, early intervention programs, and personalized dementia care solutions is creating new market opportunities. The market of Dementia Management stands poised for a significant expansion from 2025 to 2035, with an increasing number of cases reaching increasingly high levels.

People seek innovative treatments and family caregivers are demanding rapid throughput systems that can spot infections quickly or stop them in their tracks. Dementia management is undergoing a reshaping, characterized by forces such as Pharmaceutical R&D focusing on novel dosage forms specifically for disease progression.

Digital health solutions, including AI-driven diagnostic tools and remote monitoring systems, are proliferating which means elderly who didn't used to be able to leave home can now get treatment right at their doorstep.

With the recognition of non-pharmacological interventions growing and treatment modalities multiplying, care for dementia patients is being transformed to offer more holistic and personalized approaches which align with modern needs.

Demographic changes are being driven further by the market, with a particular increase in the geriatric population. This group makes elderly people more likely to develop dementia. Dementia research, health policy services for patients is being funded more and more by governments and healthcare organizations.

This friendly climate for new ideas stimulates yet further improvement in the general standard of care afforded to residents and travelers from abroad everywhere. With the gradual extension of community health care, people's understanding of dementia management solutions is expanding both in the home and out in society worldwide.

In addition, regulatory approvals for the new treatment strategies and early diagnostics associated with dementia are improving patient outcomes. Furthermore, AI is being widely employed both in its infancy to diagnose dementia earlier and also as a tool in drawing up advanced plans for treatment later on.

As the dementia burden continues to increase, healthcare participants are working with one another to promote research, develop better infrastructure which can take in patients, caregivers, families all affected by an equal and disease-bringing loss of income and ensure a better quality of life for them.

Explore FMI!

Book a free demo

The Dementia Management Market is headed for North America. High healthcare fees, combined with the ever-increasing FDA approvals for drugs to treat dementia and diagnostic tools powered by AI technology mean that this area will be dominant in the future.

The United States and Canada is the region's leader in large part thanks to increased investment for neurodegenerative disease research, a labyrinthine pharmaceutical R&D pipeline, and home-based care services expanding in order to cater more effectively for dementia patients.

The USA National Institute on Aging (NIA) and Alzheimer’s Association are financing studies into biomarker-based diagnostics, gene therapies and more. On top of that, adoption of AI-enabled cognitive assessment platforms and VR (virtual reality) therapy continues to rise. This facilitates earlier detection, cognitive rehabilitation for patients in need of help, as well as improving patients' involvement in their own care.

Europe is home to a significant portion of the Dementia Management Market, with countries such as Germany, the UK, France, and Italy playing leading roles in government-funded national dementia strategies, clinical trials for new treatments and digital health integrations.

It is being driven primarily by the European Alzheimer’s Plan and the WHO Dementia Strategy, both of which encourage early diagnosis skills, community care programs and victim-centered healthcare infrastructure.

Growth is spurred on by some clinics’ specialization in memory disorders; there are increasing numbers where housekeeping-related assistant devices like smart home monitoring systems are used as overhead tech and wearable cognitive tracking equipment also drives this up pace further into the future.

Meanwhile, pharmaceutical advancements toward monoclonal antibodies and therapies aimed at slowing the progression of tau tangles (accumulated in brains affected by dementia) are shaping the future of Alzheimer’s care.

Driven by an aging population, improved healthcare services, and government-sponsored dementia awareness campaigns, the Asia-Pacific region possesses the potential to achieve a growth rate of up to 20% in terms of CAGR with respect for Dementia Care Technology Market.

Countries like China, Japan, India and South Korea have taken the lead in telemedicine dementia care services; robot-assisted care for dementia patients, and cognitive health tracking technology that uses artificial intelligence.

The Healthy Aging Initiative in China and Japan's National Strategy on Dementia have promoted memory screening programs and patient support systems driven by technology. Indian investment in services for elderly people living at home has made home-based cognitive therapies feasible opening up access to affordable dementia care solutions.

Along the same lines, South Korea's advances in wearable neuro-monitoring tools together with AI-based analysis of human speech for identification of those suffering from dementia, etc., are already driving the making of new markets.

Challenges

High Treatment Costs and Limited Early Diagnosis Capabilities

In the field of dementia management, one major problem is the high cost for treatment and caregiving, especially long-term care at home in advanced cases of dementia. Neuroimaging services that use highly sophisticated techniques to diagnose dementia are also expensive for sufferers of the disease.

Very few patients in low-income countries can get onto more advanced use of treatment methods such as this, so early intervention and management of chronic diseases become impossible.

The instant recognition of symptoms and general availability of early diagnosis is a continuing challenge. Standardized dementia management protocols are not then available across all medical systems; this can have an impact on levels of care as well as therapeutic effects.

Opportunities

AI-Driven Diagnostics, Wearable Health Monitoring, and Drug Innovations

The Dementia Management Market presents significant growth opportunities, but challenges remain. Dementia screening tools based on artificial intelligence (AI) have evolved. The development of hardware-assisted programs has substantially augmented early disease detection and risk assessment. New models using machine learning techniques for speech analysis, eye movement tracking and gait recognition help in identifying potential Alzheimer's sufferers sooner.

Disease monitoring for patients is getting better and better. It is increasingly possible to measure various health variables over extended periods using wearable technologies. Examples include pharmaceutical and non-pharmaceutical intervention forms. Future developments in digital therapeutics (DTx), cognitive training apps, and virtual reality (VR)-based cognitive rehabilitation promise that we will soon see more non-drug dementia management solutions.

Pharmaceutical breakthroughs include new treatments in the fight against amyloids and tau proteins (lex), gene editing research, and regenerative medicine approaches expand the range of potential treatment options. Combined therapy strategies and precisely targeted approaches based on individual genetic predispositions are expected to end an entire era in traditional aging care services where dementia has lost all meaning.

The smart home trend has arrived, talking appliances that can remind people to take their medicine, AI “Angel”-like personal assistants which never leave your side and 100% safe home safety monitoring (for fire alarm statistics see Safe@Home).

Over the years from 2020 to 2024, dementia management costs have been escalating due to increases in the prevalence of dementia. In addition, full adoption of digital health solutions and advanced early diagnostics also made their own mark.

The North American and European increasingly aging populations also boosted demand for drugs for dementia (the only provision available today is largely supportive), as well needed artificial intelligence driven cognitive monitoring tools.

Major developments (many still at the experimental stage) included drugs licensed by the FDA for Alzheimer's (such as anti-amyloid therapies), wearable devices that monitor cognitive changes, and early-state dementia proprietary AI screening tools.

Between 2025 and 2035, the dementia management market is set to change drastically. When AI-powered cognitive health platforms, gene-editing-based neuroregeneration therapies and block chain-backed dementia patient database are taken into account, this becomes feasible. Real-time X-ray image recognition accuracy will reach or exceed that of an experienced doctor, reaching an artificial intelligence level.

Personalized R&D revenues to create innovative treatments for personalised medicine is also already being applied in medical science generally although in China this remains an uncertain concept.

Real-time medical advice and diagnosis via image recognition on X-rays for non-Japanese speakers Thanks to a Chinese network that amasses real X-ray image data from doctors all over the country, the International Medical School can be established.

AI-driven predictive models of cognitive decline, as well neuro-stimulation-based restoration memory and so prevent symptoms taking hold Noninvasive brain stimulation therapies, such as transcranial magnetic stimulation (TMS) and deep brain stimulation (DBS), will further enhance neural plasticity as well as memory retention.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA drug approvals for dementia, digital health regulations, and ethical AI guidelines. |

| Technological Advancements | Growth in biomarker-based diagnostics, AI-powered memory tracking, and pharmacological dementia treatments. |

| Industry Applications | Used in memory care centers, hospitals, home-based dementia care, and pharmaceutical research. |

| Adoption of Smart Equipment | Integration of wearable cognitive trackers, AI chatbots for dementia support, and remote telemedicine services. |

| Sustainability & Cost Efficiency | Transition toward non-invasive diagnostics, remote dementia care solutions, and AI-driven cost-efficient memory care. |

| Data Analytics & Predictive Modeling | Use of biometric-based cognitive assessments, AI-powered early dementia risk detection, and telehealth-based patient tracking. |

| Production & Supply Chain Dynamics | Challenges in high dementia care costs, limited access to new therapies, and long regulatory approval processes. |

| Market Growth Drivers | Growth fueled by aging population, increasing dementia diagnosis rates, and AI-driven digital health innovations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed dementia patient records, AI-powered regulatory compliance, and global cognitive health standardization. |

| Technological Advancements | Gene therapy for neuroprotection, AI-driven cognitive decline prediction, and non-invasive neurostimulation therapies. |

| Industry Applications | Expanded into AI-assisted home-based dementia monitoring, digital therapeutics for cognitive enhancement, and decentralized neurorehabilitation centers. |

| Adoption of Smart Equipment | Neurostimulation-based cognitive enhancement, AI-driven real-time dementia risk assessment, and blockchain-secured patient monitoring networks. |

| Sustainability & Cost Efficiency | Zero-carbon healthcare monitoring devices, AI-optimized dementia home care, and smart caregiving automation. |

| Data Analytics & Predictive Modeling | Quantum computing-powered cognitive simulations, AI-enhanced neuroplasticity modeling, and predictive analytics for pre-symptomatic dementia intervention. |

| Production & Supply Chain Dynamics | AI-driven pharmaceutical R&D, decentralized dementia care platforms, and predictive supply chain optimization for memory-enhancing drugs. |

| Market Growth Drivers | Future expansion driven by gene-editing neuroprotection, decentralized memory care solutions, and AI-personalized dementia treatment protocols. |

As the United States Dementia Management Market continues on the rise, increasing dementia prevalence, substantial investment in cognitive health research and digital therapeutics advances are all helping drive its growth. The Alzheimer’s Association and the National Institute on Aging (NIA) are underwriting clinical trials, early diagnosis programs and AI-powered dementia care solutions.

Telemedicine, wearable monitoring devices and AI-driven cognitive assessment tools are increasing patient support. Home-based care services expanding and government-sponsored dementia management programs are now along the way of introduction to facilitate access for patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

The Dementia Management Market in the United Kingdom is expanding due to growing government initiatives for dementia care, increasing research funding and the rise of smart healthcare solutions. The UK National Health Service (NHS) and the Dementia Research Institute are both focused on early intervention strategies, digital health solutions as well as family support programs for caregivers.

AI-powered dementia diagnostics, personalized therapy solutions and digital tools to enhance memory for dementia sufferers now proliferate markets. In addition, remote patient monitoring and applications of behavioural therapy are driving demand in the market further.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

As investment in neurological research capital, the increasing aging population and strong regulatory support for dementia-friendly healthcare systems amid the European Union's market grew more steadily. Breakthroughs in dementia diagnosis and care innovations are funded by the European Brain Research Institute (EBRI) and Horizon Europe program.

Advanced dementia treatment facilities, digital health integration and AI-assisted cognitive therapy programs is leading the way in Germany, France, and Italy. In addition, the adoption of non-pharmacological interventions - such as music and art therapy - in dementia management is expanding across Europe's care centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

The rise in the Dementia Management Market in Japan is mainly due to an aging population, strong government support for dementia research and the widespread use of robotic elderly care. To prevent and provide early intervention for dementia, the Japanese Ministry of Health, Labor and Welfare (MHLW) has set up related programs through the country.

Due to AI-powered robotic caregivers, brain training apps, as well as digital dementia risk assessment tools, patient care is being improved. In addition, the development of neuroprotective drugs and wearable health monitoring solutions is driving market growth further forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

For South Korea's Dementia Management Market, blooming government dementia awareness programmes increasing telemedicine investment and AI-assisted healthcare technology advances are all injecting impetus into wheal development. The Ministry of Health and Welfare in South Korea is calling on people to "catch the very early stage of dementia", putting an emphasis on cognitive rehabilitation programmes.

South Korea's smart-home solutions include dementia monitoring which can adapt itself to individual needs, cognitive therapy services that are tailored personally and wearable devices with built-in bio-measurement functions. Now, to top that, healthcare provision for dementia patients is involving AI-driven virtual assistants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

The Dementia Management Market is growing as a result of the fact that the proportion of global dementia victims is increasing, aging populations are on the rise and advances in neurodegenerative diseases research augur well. Of the various kinds of dementia, Alzheimer's disease Dementia and Vascular Dementia dominate the market, generating demand for specifically targeted therapies and disease-modifying treatments.

Alzheimer’s disease Dementia Leads Market Demand with Growing Cases and Drug Development Focus

Dementia of Alzheimer type is the most common form of dementia among the aged in the world. It is characterized by progressive memory loss, cognitive decline and personality changes, caused by the accumulation of beta-amyloid plaques and tau tangles in the brain.

As the burden of Alzheimer's disease continues to grow and new therapies are developed for earlier diagnosis and detection of biomarkers, demand for cholinesterase inhibitors, monoclonal antibody combined treatments, as well as neuro-protective agent’s increases. Also, the marketing authorization of new drugs that directly target amyloid-β and tau proteins as they cause disease is driving this expanding market and attracting investment in people with Alzheimer's disease.

A variety of challenges remain in the field of treatment, such as the effectiveness of treatment, high criminal rate for clinical trials and high cost of drugs. But progress in precision medicine, artificial intelligence (AI)-driven drug discovery as well as expediently achieving a therapeutic effect through gene therapy are expected to diversify treatment methods and improve the results achieved by patients.

Vascular Dementia Gains Traction Due to Rising Cardiovascular-Related Cognitive Decline

Vascular dementia, the second most common form of dementia known to man, is caused by impaired blood flow to the brain from a stroke, small vessel disease, or other cardiovascular condition. Over time this will cause progressive cognitive decline and lead to trouble concentrating on complex tasks as well as reduced executive functioning in general.

Rising levels of hypertension, diabetes and heart disease-key risk factors for vascular dementia are behind the growing call for earlier intervention strategies; new drugs that can protect neurons from injury, and cognitive rehab that incorporates brain imaging technology. Moreover, advances in depth-of-field imaging (3-D), which is used mainly to visualize the carotid arteries, are opening up treatment options for stroke-related dementia cases which heretofore were impossible to treat.

Despite increasing awareness, the challenges remain: few impromptu, FDA-sanctioned treatments are suitable for vascular dementia in any case. However, expectations are high as ongoing research in cerebrovascular health news, anti-inflammatory therapies and combo drug strategies to name a few different lines of attack--promises to raise treatment efficacy significantly at least slow down diseases.

The demand for dementia treatments is mostly because of the effectiveness of drug class, cholinesterase inhibitors and glutamate inhibitor being the two most common methods that now improve people's cognitive ability as well as slow down deteriorative diseases.

Cholinesterase Inhibitors Lead Market Demand for Cognitive Symptom Management

There are four commonly used cholinesterase inhibitors, donepezil, rivastigmine, galantamine, and huperzine A. Donepezil (Aricept) and rivastigmine (Exelon) certainly represent the most advanced studies so far in the treatment of mild to moderate Crohn’s disease both Alzheimer's dementia or Lewy Body type (which is a form of Parkinson’s disease with a mental component). By slowing decomposition of acetylcholine in the brain these drugs can help to stave off at least some memory problems among sufferers.

The increasing use of cholinesterase inhibitors in the management of early dementia is driven by their ability to temporarily stabilize cognitive function along with enhancing life quality. Meanwhile, research on combination treatments such as those involving a cholinesterase inhibitor and disease modifying drugs is expected to improve treatment efficacy even further.

However, in spite of these benefits challenges such as side effects, limited long-term effectiveness and high prescription costs still remain. But advances in extended-release formulations, transdermal patches and individualized dosing strategies are improving patient compliance and therefore treatment effectiveness.

Glutamate Inhibitors Gain Popularity for Slowing Cognitive Decline in Moderate to Severe Dementia

Glutamate inhibitors such as memantine are commonly used in moderate to severe dementia. They rein in aberrant glutamate activity which could help protect neurons from excitotoxic injury. This class of drugs improves learning, memory and day-today functioning. They are vital to the management regimen plan for late-stage Alzheimer or mixed dementia sufferers.

The addition of glutamate inhibitors to therapy using a cholinesterase inhibitor can improve symptoms and offer added protection to the nervous system. In addition, recent exploration into NMDA receptor modulators and drugs that target synaptic plasticity are expected further broaden the horizon for treatment of neurodegenerative diseases.

Despite their effectiveness, there are still challenges. For example: with inconsistent patient response or in early-stage dementia the benefits may be too limited; and drug interactions can be potential limiting factors. Breakthroughs like personalized strategies developed within the artificial intelligence interface, targeted glutamate modulation and double-acting neuroprotective drugs are going to further enhance the utility of glutamate inhibitors in the clinical setting.

Due to the growing number of cases of Alzheimer’s disease and other dementias, improvements in early diagnosis, and evolving new medication methods and digital health solutions, the Dementia Management Market is rising. Aged populations worldwide have caused the market to explode.

Investment in research on neurodegenerative illness is increasing while new technology and patient care modules are being developed to lower costs for both patients and insurers. To achieve early detection, symptom control and improve patient quality of life, businesses concentrate on such items as pharmaceutical treatment programs, cognitive assessment tools, wearable monitoring equipment and AI-driven health management systems.

This market includes major pharmaceutical companies as well as medical device manufacturers and digital health innovators. All contributing to new approaches built around biomarker-based diagnostics, personalized treatment plans, novel combinations of existing medicines with non- drug treatments for better outcomes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Biogen Inc. | 18-22% |

| Eli Lilly and Company | 12-16% |

| Eisai Co., Ltd. | 10-14% |

| Roche Holding AG | 8-12% |

| Novartis AG | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Biogen Inc. | Develops Alzheimer’s drugs, including Aducanumab (Aduhelm) and Lecanemab, for early-stage dementia treatment. |

| Eli Lilly and Company | Specializes in amyloid-targeting therapies, such as Donanemab, for Alzheimer’s disease management. |

| Eisai Co., Ltd. | Manufactures neurodegenerative disease drugs in collaboration with Biogen, focusing on cognitive decline treatments. |

| Roche Holding AG | Provides diagnostic tools, biomarkers, and investigational drug candidates for dementia treatment. |

| Novartis AG | Focuses on neuroprotection research and combination therapies for managing dementia symptoms. |

Key Company Insights

Biogen Inc. (18-22%)

Biogen is a leader in dementia drug development, pioneering anti-amyloid beta monoclonal antibodies for Alzheimer’s disease treatment.

Eli Lilly and Company (12-16%)

Eli Lilly specializes in disease-modifying Alzheimer’s treatments, investing in next-generation drugs for early intervention.

Eisai Co., Ltd. (10-14%)

Eisai is actively engaged in dementia research and treatment collaborations, focusing on neurological health and cognitive function therapies.

Roche Holding AG (8-12%)

Roche provides diagnostic solutions and investigational drugs, integrating biomarkers and AI for early dementia detection.

Novartis AG (6-10%)

Novartis develops cognitive-enhancing therapies and neuroprotective drugs, aiming for comprehensive dementia care.

Other Key Players (30-40% Combined)

Several biopharmaceutical firms, digital health companies, and medical device providers contribute to advancements in dementia detection, treatment, and care solutions. These include:

The overall market size for the Dementia Management Market was USD 40.8 Million in 2025.

The Dementia Management Market is expected to reach USD 84.1 Million in 2035.

Increasing global prevalence of dementia, advancements in drug development and digital health solutions, and rising investments in elderly care services will drive market growth.

The USA, Japan, Germany, China, and the UK are key contributors.

Alzheimer’s disease Dementia and Vascular Dementia, are expected to lead in the Dementia Management Market.

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Hadron Therapy Market Growth - Trends & Forecast 2025 to 2035

Wound Irrigation Systems Market Growth – Trends & Forecast 2025 to 2035

Western Europe Medical Recruitments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.