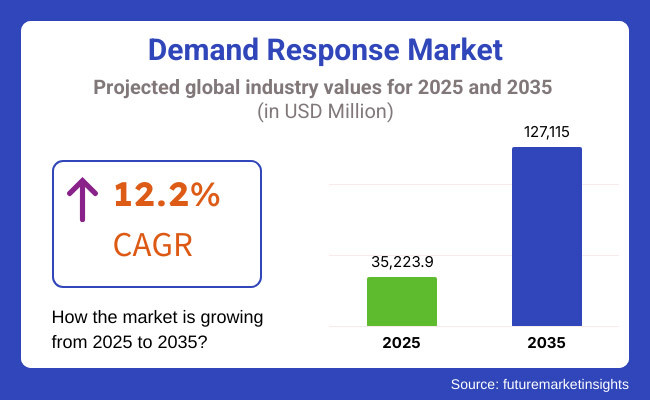

The Global Demand Response market is projected to grow significantly, from USD 35,223.9 million in 2025 to USD 127,115.0 million by 2035 an it is reflecting a strong CAGR of 12.2%.

As organizations are increasingly demanding energy efficient solutions to manage consumption, the Demand Response Market is growing. Businesses are turning more and more to the grid operators and energy aggregators to adjust their demand according to grid conditions. To guarantee smooth integration with energy networks and lower operating costs while preserving grid stability, third-party partnerships are becoming essential.

Market growth is driven by government regulations and sustainability initiatives. For example, the FERC (USA) and EU energy directives are regulations that call for energy efficiency and incentivize industries to implement demand response programs. To comply with these policies, an investment in automated solutions that allow to adjust energy status in real time is needed.

Smart energy grids are growing in adoption, fuelling the growth of AI-led and Cloud-based demand response platforms. Micro-Energy Management - Technologies make it possible for companies to collect, analyse, and improve energy consumption in real time. It focuses on automating demand-side energy adjustments to limit costs and carbon emissions.

The increased penetration of distributed energy resources (DERs) and renewables like solar and wind means that there is a growing need for flexible load management solutions. Overall, demand response platforms play a significant role in balancing energy supply and demand, and maintaining grid reliability while helping business customers take advantage of dynamic pricing and reduce peak loads.

High Demand Response Market in North America, owing to stringent regulations coupled with government incentives and presence of key solution providers. Other countries are experiencing similar boost in adoption owing to rising industrial energy requirements and sustainability initiatives, including India and Australia.

The demand response adoption worldwide is increasingly being encouraged by expanding ecosystems for business, both regulatory and non-regulatory.

Explore FMI!

Book a free demo

| Company | Schneider Electric |

|---|---|

| Contract/Development Details | Partnered with a regional utility company to implement a demand response program aimed at optimizing energy consumption during peak periods, involving the deployment of advanced metering infrastructure and customer engagement platforms. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 25 |

| Renewal Period | 5 years |

| Company | Siemens AG |

|---|---|

| Contract/Development Details | Secured a contract with a national grid operator to provide a comprehensive demand response management system, integrating renewable energy sources and enhancing grid stability through real-time load balancing and automated demand response capabilities. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 40 |

| Renewal Period | 7 years |

Growing integration of renewable energy requires flexible load management solutions

Due to the rise of renewable energies like solar and wind, power grids must employ load management solutions in order to stabilize the grid. Renewable energy sources are variable and intermittent unlike conventional energy, thus demand adjustment is necessary on a dynamic basis.

Demand response (DR) solutions help industrial and commercial buildings decrease or offset energy use during peak hours, and thus help avoid blackouts while using renewable energy in an optimal way. Energy storage systems, when paired with DR packages, provide added functionality to the grid, allowing it to store excess renewable energy and draw on it as required.

Across the globe, governments are deploying renewable energy policies aiming at businesses to take part in demand response programs. For instance, in 2024, the USA Department of Energy awarded USD 200 million to fund grid modernization projects that pair demand response with renewables.

Increasing industrial and commercial energy consumption drives demand-side optimization

The unprecedented industrialization and urbanization has also increased energy demand tremendously by various industrial and commercial sectors. Factories, data centers and office buildings are some of the biggest consumers of electricity and can also be a big part of spikes in peak demand.

For these entities, demand response solutions can provide a way to optimize energy consumption by shifting non-critical loads when demand is high, alleviating pressure on the grid and lowering the cost of operation. Advanced AI-based DR platforms enable enterprises to automate adjustments, relieving them to respond to real-time price signals and grid matters.

DSO systems offer demand-side energy optimization which will drive the development of capabilities and regulations that the governments are pushing to put in place for guaranteeing grid reliability. In 2023, National Development and Reform Commission (NDRC) of China issued a new policy that categorized industrial firms consuming over 50 GWh yearly to participate in demand response programs.

Growing demand for automated demand response (ADR) in commercial buildings

Commercial Buildings Are Increasingly Using Automated Demand Response (ADR) ADR allows buildings to automate HVAC controls, lighting and non-essential loads to respond to on-the-fly grid conditions without human intervention. This allows for energy optimization in real-time without compromising on occupant comfort.

The cloud-based ADR platforms, fused with IoT-enabled smart meters (as a part of the facility energy consumption monitoring systems), enables facility managers to monitor and control energy consumption remotely.

Governments everywhere are bringing regulations and incentives to promote ADR in their regions. The USA Federal Energy Regulatory Commission (FERC) also proposed updated policies in 2024 requiring large commercial buildings to implement automated load-shifting programs, with 500 million dollars of funding set for deployment.

High precision manufacturing requirements increase production costs and complexity

In developing regions, the lack of energy infrastructure often inhibits the uptake opportunity of Demand Response (DR) programs. Most national grids date back long before computers, and still lack the digital ability to dynamically adjust to demand in real time.

Developing countries experience frequent load shedding, power outages, fluctuations in voltage, and gas and electricity grid inefficiencies compared to more developed economies equipped with smart grids and automated systems that operate relatively seamlessly, making DR more challenging to achieve.

Moreover, the lack of smart meter deployment on a large scale keeps utilities and consumers out of touch with real-time energy consumption data, essential for efficient demand-side management. Data connection during DR operations is limited in nature.

In many areas, internet connectivity is weak, or IoT infrastructure is insufficient to connect with automated DR platforms, cloud-based solutions, and real-time energy monitoring. Without these technological enablers, which help to identify potential breakdown capacity and communicate with customers, utilities and commercial entities are unable to implement demand response strategies efficiently.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced energy efficiency mandates promoting demand response programs. |

| Grid Modernization | Utilities integrated smart meters and IoT sensors to enable real-time demand response. |

| Renewable Energy Integration | Demand response played a crucial role in stabilizing renewable energy adoption. |

| Consumer Participation | Increased consumer incentives encouraged voluntary participation in demand response programs. |

| Market Growth Drivers | Rising electricity costs and grid reliability concerns fueled market expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven regulatory frameworks dynamically adjust energy distribution policies. |

| Grid Modernization | Fully autonomous smart grids predict and manage energy fluctuations with AI. |

| Renewable Energy Integration | AI-driven energy trading platforms optimize demand-side flexibility. |

| Consumer Participation | Real-time, AI-driven automation allows seamless energy optimization without manual intervention. |

| Market Growth Drivers | Proliferation of decentralized energy generation and smart energy storage systems. |

Tier 1 vendors are the market leaders that include Huawei, Cisco, Nokia, Ericsson, and ZTE that have comprehensive service offerings across wireless, wired, and cloud-based telecom networks. Let us look through some of the telecom companies that are spurring mass 5G developments, automation and AI based tele communication services for enterprises and consumers alike.

They have built their dominance with strong R&D, partnerships with many telecom operators, and continued investments in next-gen telecom tech on a broad scale. In addition to their dedicated access plays, Tier 1 players also contribute to national telecom infrastructure projects, providing services for government-led initiatives in expanding broadband access and digital connectivity.

These Tier 2 vendors hit the specific region or a specialized telecom infrastructure segment. Ciena, Fujitsu and Juniper Networks are other companies providing more advanced networking equipment (fiber optic transmission, SDN (Software-Defined Networking), optical networking).

These vendors serve telecom operators needing tailored network solutions for enterprise and urban connectivity. Although Tier 2 vendors do not have the global scale that Tier 1 firms do, they are critical for regional 5G infrastructure deployment, cloud networking, and private telecom networks for enterprises in healthcare, manufacturing, and financial services.

The Tier 3 organizations are smaller organizations that offer niche telecom capabilities across a range of areas, including network security, edge computing, small cell infrastructure, and rural broadband access. These vendors target emerging markets and offer affordable, flexible products and services that close the digital divide in the hinterlands.

Although Tier 3 companies do not possess significant individual market share, their impact and contribution to network innovation and localized deployments are critical to expanding telecom infrastructure in underserved markets and regions. They are still competitive because of their agility to adopt new technologies and forge partnerships with Tier1 and Tier2 companies.

The section highlights the CAGRs of countries experiencing growth in the Demand Response market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.0% |

| China | 14.2% |

| Germany | 10.5% |

| Japan | 11.8% |

| United States | 12.5% |

The country is experiencing swift deployment of smart meters and real-time energy management solutions in urban regions to collect data from unavoidable electricity consumption in order to increase energy efficiency. As electricity demand increases and cities continues to grow, utilities and consumers can look for smart grid technologies to monitor and control energy consumption for a brighter future.

Smart meters allow for bidirectional communication between consumers and power providers, which significantly contributes to load balancing and addressing peak demand pressures on the grid. Real-time energy management solutions also enable industries, commercial buildings, and domestic and household sectors to monitor usage patterns, respond to demand response programs, and cut energy costs.

The Indian Government is aggressively promoting smart metering under the Revamped Distribution Sector Scheme (RDSS), which will replace 250 million conventional meters with smart meters by 2025. India is anticipated to see substantial growth at a CAGR 15.0% from 2025 to 2035 in the Demand Response market.

ADR solutions are becoming mainstream and American is at the forefront of this revolution with seamless, real-time load adjustment capabilities that redefine energy management on every level. ADR systems give automated signals to consumers that participate in the corresponding market, which needs to lower or shift electricity demand at the time of critical peak load.

This is key to grid stability, reducing energy costs, and reproduction of gas-based power generation. ADR programs provide large commercial and industrial users with the opportunity to optimize their energy consumption based on price signals, as well as financial incentives for providing demand response. ADR adoption across the USA is further catalyzed by the emergence of smart grids, digital infrastructure and IoT-based demand-response solutions.

The USA Department of Energy (DOE) has invested heavily in Demand Response (ADR) projects to improve grid flexibility. Recent federal efforts include an USD 80 million commitment to demand-side energy programs, with a focus on California, Texas and New York, where peaks in electricity demand can threaten the reliability of the grid. USA Demand Response market is anticipated to grow at a CAGR 12.5% during this period.

China is adopting AI-based demand response (DR) systems that boost grid reliability and optimize the distribution of energy. The world leader in electricity consumption, China struggles to match supply and demand - especially now that a growing share of the supply will derive from renewable sources.

By utilizing AI-powered DR solutions, utilities can analyze real-time data and anticipate consumption patterns and automate load adjustments to alleviate stress on the grid during peak hours. AI-driven energy optimization helps industries, commercial buildings, and residential consumers save money and energy!

The China government has focused on AI for smart grid development in the 14th Five-Year Plan with more than USD 10 billion invested in digital grid infrastructure. Pilot AI-driven DR projects in cities such as Shanghai and Shenzhen showed a 10-15 percent gain in grid stability and efficiency. Demand Response market in China accounts for 42.8% of global market share and continues to grow at a high CAGR between 2025 and 2035.

The section provides detailed insights into key segments of the Demand Response market. The Solution category includes System and Services. Industry such as Manufacturing, Agriculture, Government Buildings, Colleges and Universities, Commercial Buildings, Hospital, Data Centers and Others. Services segment is growing quickly. The Commercial Buildings Vendors hold largest market share in Demand Response.

Companies, utilities, and government entities are looking for efficient energy management tools, and the Demand Response (DR) market is rising to meet this demand. Consulting, implementation, real-time monitoring, and automated demand response (ADR) services are critical for the optimization of energy consumption and compliance with energy regulations.

To further optimize the use of demand response using real-time data, utilities and large-scale energy consumers increasingly are outsourcing demand response program management to specialized service providers who can manage their load adjustments on high-demand hours without compromising their operations between them.

The trends such as AI-based analytics, cloud-native disaster recovery (DR) platforms and Internet of Things (IoT)-based energy management services have catalyzed the growth of the services segment.

Governments across the globe are rolling out financial incentives and policy measures to encourage the uptake of demand response services.

In the United States, at the moment, there is funding through the Department of Energy (DOE) with USD 50 million dedicated to demand response service expansion, emphasizing areas such as commercial campuses and industrial facilities. Services are anticipated to see substantial growth at a CAGR 14.3% from 2025 to 2035 in the Demand Response market.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Services (Solution) | 14.3% |

The commercial buildings segment dominates the Demand Response (DR) market, owing to large energy consumption patterns and its capacity to execute large energy load shifts. Demand-side management programs are typically signed with office complexes, shopping malls, hotels and retail chains to reduce electricity costs, and thus, to benefit from incentive-based DR programs.

Today, advanced building management systems (BMS) and automated DR (ADR) solutions enable commercial buildings to efficiently optimize energy usage without sacrificing tenant comfort or operational productivity. Integration of smart meters, IoT-based energy controls, and AI-powered analytics have raised participation rates among commercial consumers even higher.

Governments are pushing demand response programs for commercial buildings to enhance grid reliability. For example, in California state energy regulators instituted mandatory DR participation requirements for commercial customers with peak demand of more than 500 kW, resulting in a 30% increase in engagement in automated DR programs.

Commercial Buildings is projected to dominate the Demand Response market, capturing a substantial share of 27.8% in 2024.

| Segment | Value Share (2025) |

|---|---|

| Commercial Buildings (End User) | 27.8% |

The demand response market is highly competitive, fueled by technologies and growing regulatory mandates for energy efficiency. Thus, companies compete on automating capabilities, AI driven analytics, and grid integration to increase demand-side energy management. As VPPs and DERs proliferate, competitive dynamics are shifting toward real-time energy optimization. Partnerships among utilities, tech firms, and energy aggregators that are driving innovation and market expansion.

The Global Demand Response industry is projected to witness CAGR of 12.2% between 2025 and 2035.

The Global Demand Response industry stood at USD 35,223.9 million in 2025.

The Global Demand Response industry is anticipated to reach USD 127,115.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.7% in the assessment period.

The key players operating in the Global Demand Response Industry Siemens AG, Schneider Electric, General Electric (GE), Honeywell International Inc., Enel X, AutoGrid Systems, Eaton Corporation, Itron Inc., CPower Energy Management, EnergyHub.

In terms of solution, the segment is divided into System and Services.

In terms of send user, the segment is segregated into Manufacturing, Agriculture, Government Buildings, Colleges and Universities, Commercial Buildings, Hospital, Data Centers and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Semiconductor Substrate Market Insights - Trends & Forecast 2025 to 2035

Hyperscale Cloud Market Trends - Growth & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Unattended Ground Sensors (UGS) Market Trends - Forecast 2025 to 2035

Total Carbon Analyzers Market Growth - Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.