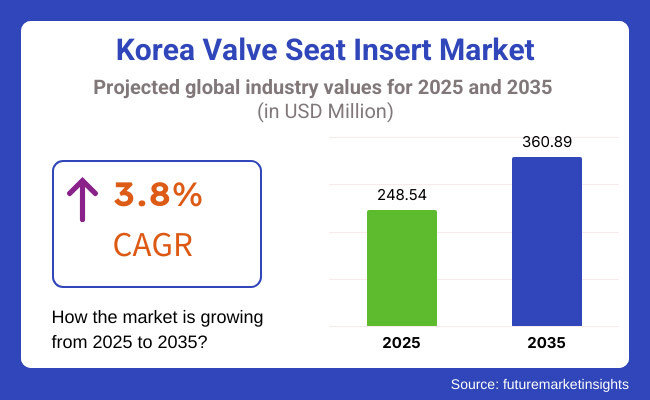

The Korean valve seat insert industry will grow at a CAGR of 3.8% during the forecast period, reaching USD 248.54 million in 2025 and USD 360.89 million by 2035. Although the adoption of electric vehicles may pose a challenge, growth will be supported by innovation driven by high-performance internal combustion engines and emerging marine applications.

Taking a look back to 2024, Korea's valve seat insert industry was growing steadily, mainly due to demand from the automotive and marine industries. As the leading and outstanding consumer, the auto industry experienced a heightened trend towards multi-valve engine ideas, particularly for light commercial vehicles and passenger vehicles.

The trend was spurred by strict government regulation that pushed producers to improve fuel combustion, engine efficiency, and durability. Regionally, the leading production and consumption poles were South Gyeongsang and North Jeolla, supported by automobile manufacturing clusters and industrial bases.

Moreover, the maritime industry emerged as another key contributor in determining the growth scenario. The ever-growing maritime tourism further boosted the need for pleasure vessels and commercial vessels, and this increased the need for high-performance valve seat inserts for marine engines.

This trend was most evident in coastal regions, where tourism and shipbuilding industries thrived.In the future, the industry will continue to grow upwards, driven by technology advancements in internal combustion engines and growing marine applications.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Multi-valve engine adoption-led growth among passenger and light commercial vehicles. | Demand for valve seat inserts to continue, though EV shift may temper growth. |

| Marine tourism expansion and rising demand for commercial and recreational boats. | Shipbuilding expansion to continue, with growing need for fuel-saving marine engines. |

| South Gyeongsang & North Jeolla became leading manufacturing bases. | These sectors to remain central, with other manufacturing areas potentially increasing. |

| Move to high-strength and wear-resistant material to improve engine longevity. | Emphasis on lightweight, high-performance materials for increased efficiency and lifespan. |

| Aging fleets of motor vehicles fueled greater demand for replacement valve seat inserts. | Aftermarket to continue, though growing EV demand could constrain sales. |

| Supply chain disruptions, volatile raw material prices, and economic downturn. | EV sector growth, tightened regulations, and possible segment saturation. |

| Expansion of industrial uses, improvement in high-performance engines, and marine demand expansion. | Prioritize high-tech internal combustion technologies, growth in the marine sector, and potential exports. |

The macroeconomic conditions like industrial production, world trade, raw material supply, and regulatory regimes have a significant impact on the valve seat insert segment. Korea's economic growth and industrialization will be central to maintaining the demand for combustion engine parts.

A consistent GDP growth rate along with robust manufacturing output will facilitate OEM as well as aftermarket sales. The motor industry continues to be a leading impetus, as internal combustion motors continue to have the majority in spite of an ongoing trend toward electric mobility.

Price volatility of materials, especially iron, steel, and nickel alloys, may affect production expenses and profitability. Increasing energy costs and supply chain interruptions may lead to further cost pressures, driving manufacturers to look for more efficient production processes.

Tighter government regulations on emissions and fuel efficiency will drive automakers to optimize combustion engines, maintaining demand for high-performance valve seat inserts. Outside of automotive uses, the marine and industrial machinery segments will ensure long-term stability since these sectors will continue to depend on robust internal combustion engines.

Though trends in electrification will slow down growth in some segments, the demand for fuel-efficient and high-durability engine components will ensure that the valve seat insert industry remains viable until 2035.

The OEM segment will maintain dominance in Korea's valve seat insert industry in the forecast period between 2025 and 2035. The auto manufacturers are giving greater emphasis to reliable and high-performance parts so that OEM valve seat inserts are going to remain high in demand.

Due to internal combustion engine advancements, companies are adopting advanced materials and precisely engineered parts to reduce fuel consumption and improve durability. OEMs are also gaining from strict government regulations, which demand adherence to emission standards, resulting in a greater emphasis on optimized engine performance.

The aftermarket industry will also witness steady growth due to aging fleets of vehicles and the growing demand for replacement parts. Most internal combustion engine vehicles will continue to run, generating a consistent demand for high-quality valve seat inserts.

Customers in the aftermarket industry favor economical solutions, resulting in a surge of wear-resistant and durable inserts with extended service life. The trend towards maintenance and refurbishment of aged vehicles, especially in the commercial and off-highway sectors, will also contribute to sector growth.

Iron alloys will lead the valve seat insert sector through the forecast period and will hold a share of close to 55%. The materials are still the favorite choice as they are cost-effective, have high durability, and can withstand high temperatures and wear.

Car manufacturers and manufacturers of industrial equipment continue to depend on iron alloy valve seat inserts for improved engine efficiency and increased component life. Iron alloys have especially firm applications in gasoline and diesel engines, where mechanical and thermal stress calls for good performance.

Steel-based valve seat inserts will also see consistent demand, especially in heavy-duty and high-performance applications. Steel can tolerate harsh operating conditions and is thus a preferred option for industrial machines and commercial vehicles.

Nickel-based alloys are, meanwhile, on the rise because of their high corrosion-resistance and high-temperature performance. These alloys will be increasingly used in marine engines and industrial processes where exposure to harsh environments is typical.

Other new materials will also come to the fore as manufacturers seek creative solutions to increase engine efficiency and longevity. But iron alloys will still be the industry leader by 2035, with further development improving their wear resistance and lifespan.

Gasoline engines will contribute to almost 60% of the valve seat insert demand over the forecast period. The extensive application of gasoline-powered light commercial vehicles and passenger cars guarantees consistent demand for high-performance valve seat inserts.

Gasoline engine technology is being optimized by manufacturers at all times to enhance fuel efficiency and minimize emissions, which consequently fuels the demand for heat-resistant and durable valve seat inserts. Although penetration of electric cars is on the increase, gasoline engines will still be dominant, especially in hybrid vehicles that utilize internal combustion engines and electricity.

Diesel engines will also make a notable contribution to the industry, especially for heavy commercial trucks, industrial equipment, and off-highway. These engines demand strong valve seat inserts withstood high pressures and long life cycle operations.

Gas engines, often applied to industrial and power generation applications, will see constant demand as industries will continue to require fuel-efficient and low-emission options. The expansion of the maritime industry will also further increase demand for gas engines, as ship owners seek efficient and durable engine parts.

Although electric options are on the horizon, internal combustion engines will continue to play an integral role in the automotive and industrial environments up to 2035, with resulting demand for valve seat inserts.

The end-use sector for valve seat inserts will continue to be dominated by the automotive sector and this trend is expected to continue as automotive vehicles sales, mainly passenger vehicles, continue to grow and the demand for light commercial vehicles (LCV) and heavy commercial vehicles (HCV) remains strong.

Even with the move to electrification, gasoline engines still hold the crown in the automotive world, and passenger cars will be outselling all other vehicle segments combined. The increasing fuel efficiency and emissions regulations nudge the automakers to optimize the combustion engines, further substantiating the continuing demand for the sophisticated valve seat inserts.

Similarly, there will remain demand for high-performance engine components for light commercial vehicles that are used for inner-city logistics and low-volume freight applications. Heavy commercial vehicles will be diesel-powered, and this will enhance the industry for long-lasting valve seat inserts made for harsh operating conditions.

The two-wheeler and off-highway segments will also drive industry growth, with off-highway equipment needing durable engine components for use in construction, agriculture, and mining. The marine industry will continue to be an important end-use industry, with growing maritime tourism and commercial shipping activity spurring demand for high-performance engine components.

Industrial machinery will also remain a prominent user of valve seat inserts, especially in manufacturing and power generation applications. Although other propulsion technologies will affect certain segments, internal combustion engines will continue to be essential in various industries, providing a stable valve seat insert industry through 2035.

South Gyeongsang will remain a dominant distribution center for the valve seat insert industry because of its robust industrial base and automotive production. Major automobile manufacturing plants in the province will create consistent demand for OEM valve seat inserts.

With numerous engine component manufacturers and suppliers in the region, there exists an established supply base, both local and export-oriented. In addition, South Gyeongsang's shipbuilding sector will drive demand since marine engines need high-durability valve seat inserts. Research and development investment will also lead to innovation, enhancing material efficiency and wear resistance.

With the province growing its industrial base further, the need for heavy machinery and diesel engines will be an added source of growth. While the growth in electric vehicles should eventually influence demand, industrial demand and hybrid demand will keep the industry alive to make South Gyeongsang a key part of Korea's valve seat insert industry through 2035.

With the growing establishments of automotive parts manufacturing industry and improving industrial activity, North Jeolla will continue to remain a leading and dominating participant of Korea’s valve seat insert industry.

This province is appreciated for its elevated and defined infrastructure that supports the production and distribution of engine parts, thereby promising a continuous supple of valve seat inserts segments. Additionally, the marine industry of North Jeolla will also become a major contributor in the sector, especially through the development of commercial and fishing boat activities.

Although electrification trends will affect some applications in the automotive sector, the province's heavy reliance on internal combustion engines in industrial, marine, and heavy-duty industries will keep demand intact. As long as the government continues to extend support to manufacturing and technology development, North Jeolla will experience steady growth in the valve seat insert industry until 2035.

South Jeolla's valve seat insert industry will be driven by its growing marine and industrial machinery industries. The province is heavily maritime, with growing demand for commercial and recreational ships necessitating dependable engine parts.

Shipbuilding operations in South Jeolla will continue to drive the demand for high-performance valve seat inserts, especially those that are made of long-lasting and heat-resistant materials. The increasing industrial machinery industry in the region will also contribute towards industry growth since manufacturers of industrial equipment look for effective engine solutions for heavy-duty use.

While South Jeolla has the highest output of ships globally, as province industries turn toward maximizing fuel economy and emissions cutbacks, industry uptake of more advanced valve seat insert materials will increase. Through 2035, South Jeolla will maintain a substantial sector contribution, ignoring possible obstacles provided by electrification.

Jeju's valve seat insert sector will be led by its expanding tourism and marine sectors. The province boasts a booming maritime industry, with more recreational boats, ferries, and fishing boats needing strong and high-performance engine parts. Maritime tourism, which is growing with a constant flow of tourists, will see constant demand for valve seat inserts applied to marine engines.

Further, Jeju's industrial and power generation industries are based on internal combustion engines for many purposes, enhancing sector stability. Yet, Jeju's emphasis on green energy solutions and sustainability efforts can become problematic since the province heavily supports electric mobility and alternative solutions to power generation.

Regardless of this, hybrid marine engines and industrial usage will continue to necessitate superior valve seat inserts. Although the industry for Jeju won't expand as quickly as for industrial-burdened areas, marine and industrial demand will provide stable sales up to 2035.

FMI carried out a wide-ranging survey with major stakeholders of the valve seat insert industry, such as OEMs, aftermarket vendors, material producers, and industrial engine specialists. It was done with an intention to evaluate industry trends, challenges, and opportunities from 2025 through 2035.

Industry players emphasized that amid a gradual move toward electric, demand for high-performance valve seat inserts is still robust, particularly in diesel and gasoline engines. Most OEMs said that improvements in internal combustion engine technology would remain the driving force behind the demand for wear-resistant and durable valve seat inserts.

Aftermarket vendors stressed that older vehicle fleets and growing engine overhauls would continue steady demand. But they also mentioned that adoption of hybrid cars would provide opportunities, as these engines continue to need optimized combustion components.

Material producers who took part in the survey noted that iron alloys are still the preferred option, but nickel-based alloys are increasingly being sought after for high-performance use. Raw material price volatility was a concern raised by some players, which may impact production costs and supply chain reliability. In spite of these issues, manufacturers are looking into new material solutions to improve engine efficiency and longevity.

Government policies have a major impact on the valve seat insert industry in South Korea, especially through the imposition of strict emissions regulations and fuel economy standards. These policies stimulate the development of internal combustion engine technologies, thus impacting the demand for high-performance valve seat inserts.

| Regulation | Impact on Valve Seat Insert Industry |

|---|---|

| Light-Duty Vehicle Emissions Standards | South Korea has adopted aggressive emissions regulations for light-duty vehicles, following California's Non-Methane Organic Gases (NMOG) Fleet Average System. Such regulations require the creation of advanced valve seat inserts to meet reduced emission levels. |

| Nonroad (Off-Road) Emissions Standards | Since 2004, South Korea has controlled nonroad engine emissions, such as construction and agricultural equipment. In 2015, harmonization with the USA Tier 4 requires high-quality valve seat inserts to comply with very strict emission standards in these sectors. |

| Fuel Economy and Greenhouse Gas (GHG) Standards | 2030 adopted targets call for 27.8% less GHG emissions in cars and 12% less in light trucks than in 2020 levels. These tight standards necessitate more efficient engine parts, such as valve seat inserts, to improve fuel efficiency. |

| Industrial Boiler Emission Limits | Post-2020 standards place more stringent limits on industrial boiler emissions of sulfur dioxide and nitrogen oxides. Compliance requires the use of rugged valve seat inserts that can withstand higher operational stresses. |

The South Korean valve seat insert sector is not controlled by any one player, and the industry is fragmented with small firms and established ones playing a role in making it a competitive sector. This is due to the variant demand across industries such as automotive, marine, and industrial machinery, as well as with regard to technological advancements and changing consumer behaviors, providing space for established leaders and new players to coexist.

In 2024, the valve seat insert industry witnessed significant mergers, acquisitions, and alliances to consolidate industry shares and increase global presence. A number of major players made strategic acquisitions of local producers to boost production capacity and enter new segments.

Partnerships between material suppliers and valve seat insert manufacturers were also dominant, with a focus on creating advanced materials to comply with strict emission regulations and enhance engine performance.

As the valve seat insert segment expands, new players in 2025 will look to implement innovative strategies in order to make their mark. Sustainable production processes and green materials will be an important strategy to follow, in keeping with the international push towards environmental stewardship.

Utilizing cutting-edge technologies like additive manufacturing (3D printing) can provide the benefits of customization and quick prototyping, enabling new players to address customized client needs in an efficient manner. Moreover, the adoption of competitive pricing models without sacrificing quality will be important for new players to gain industry share in this competitive industry.

Stricter emissions regulations, engine efficiency improvements, and growth in automotive, marine, and industrial sectors.

Regulations push manufacturers to develop durable, high-performance components that meet emission and fuel efficiency standards.

Raw material price fluctuations, competition from alternative engines, and supply chain disruptions.

Primarily automotive, with growing demand in marine and industrial machinery.

By using sustainable materials, 3D printing, OEM partnerships, and competitive pricing strategies.

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.