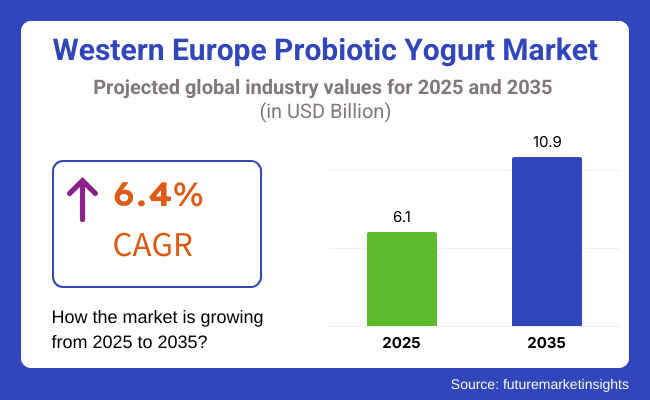

The Western Europe probiotic yogurt market is poised to exhibit USD 6.1 billion in 2025. The industry is slated to depict 6.4% CAGR from 2025 to 2035, witnessing USD 10.9 billion by 2035. The industry is facing tremendous growth with a mix of changing consumer taste, rising awareness about health, and technological advances. Increased awareness of the gut and well-being is among the key reasons behind the growing industry.

With more consumers becoming aware of the connection between gut health and immune system function, probiotics, especially in yogurt, have become increasingly popular as a natural means to enhance gut health. This increasing awareness of the necessity of a balanced microbiome has seen consumers move toward functional foods, with the product leading the way due to its established benefits.

In addition, the rising demand for healthier and more nutritious foods is driving the industry growth of the product. Western European consumers, especially millennials and Generation Z, are increasingly looking for foods that deliver beyond mere basic nutritional value.

The product is viewed as a convenient, pleasant, and functional snack that harmonizes with the healthy consumer's lifestyle. These consumer segments are typically in search of foods that aid digestion, increase immunity, and improve mental health, all of which probiotics in yogurt have been associated with. The trend of clean-label products, which are seen as more natural and less containing artificial additives, is also helping drive the demand for the product in the region.

Moreover, the industry has gained a broader appeal through the provision of a huge selection of probiotic yogurt products such as lactose-free and plant-based yogurts. Manufacturers have since adjusted by launching substitutes that serve those who observe a vegan or dairy-free diet and still meet their needs in terms of benefits provided by probiotics. This flexibility in product range, coupled with strong marketing and the support of scientific research, continues to fuel expansion in Western European markets.

Explore FMI!

Book a free demo

The industry is witnessing different trends and buying characteristics across the various end-use segments. In the retail segment, consumers are gravitating more towards the product because of health benefits, with key emphasis on gut health, immunity, and overall wellbeing.

In this segment, there is a rising trend for organic, natural, and clean-label products. Consumers are valuing transparency in labeling and choosing brands that offer straightforward information regarding ingredients and origin. Moreover, consumers are increasingly demanding low-sugar, high-protein, and plant-based options as health-aware consumers look for products that suit their dietary needs.

In the foodservice industry, restaurants, cafes, and health-oriented restaurants are adding the product to smoothies, desserts, and breakfast items, responding to the increasing demand for functional foods. The buying criteria in this category are based on consistency, flavor, and the capacity to deliver value-added benefits such as digestive health.

Commercial purchasers tend to look for bulk packs that preserve the probiotics' effectiveness while providing competitive pricing.Purchasing trends in these segments are driven by considerations of health benefits, product quality, flavor, dietary limitation, and trust in brand name, propelling the sustained development of the Western European industry.

Between 2020 and 2024, the Western European industry underwent significant changes, led primarily by the global trend towards health and shifting consumer attitudes. The COVID-19 outbreak was key in speeding up the emphasis on gut health and immunity, compelling customers to look for functional foods that could benefit overall health.

At this time, there was a significant increase in demand for the product, especially among consumers with health awareness. In response, retailers broadened their portfolio to encompass numerous flavors, low-sugar varieties, and value-added organic lines, meeting the increasing demand for healthier and more transparent products. In addition, there was an increasing popularity of plant-based probiotic yogurt products, as vegan diets and lactose intolerance increased, leading to diversification in the industry.

During 2025 and 2035, the Western European industry will witness change in reaction to a number of emerging trends. One of the most notable is the ongoing demand for personalized nutrition. Microbiome research advances are likely to result in more specific probiotic yogurt products formulated to meet particular health requirements, including enhanced digestion, immune function, and mental well-being. Sustainability will also be important, with consumers increasingly valuing eco-friendly packaging, responsible sourcing, and less food waste.

Furthermore, flavor innovation, functional ingredients, and delivery formats will be the drivers of growth, with the product emerging as a leading part of the broader functional food and beverage industry. The industry will most probably see continued growth, especially with an increase in plant-based and clean-label offerings for a wide range of diet types.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 (Short-Term Trends) | 2025 to 2035 (Long-Term Trends) |

|---|---|

| The COVID-19 pandemic led to a surge in demand for functional foods, especially the product , as consumers sought ways to boost their immune systems and improve gut health. | With advancements in microbiome research, the industry will likely see a shift toward more personalized products. These will cater to individual health needs, such as specific digestion or immunity support, enhancing product relevance for consumers. |

| An upsurge in preference for plant-based diets, fueled by veganism, lactose intolerance, and concerns for sustainability, led to strong growth in plant-based yogurts produced from alternatives su ch as soy, almond, and coconut. | Consumers will increasingly look for sustainable and ethically sourced products. This will encompass environmentally friendly packaging, organic labels, and reduced carbon footprints, thus making sustainability a key selling proposition for probiotic yogurt brands. |

| There was significant growth in the demand for clean-label products from consumers, with preferences for natural ingredients and clarity on labels, especially in the post-pandemic scenario when consumers turned health-conscious. | The product in the next decade will carry advanced functional ingredients like prebiotics, adaptogens , and extra vitamins. This will address the need for more health-promoting products that offer more than simple probiotics. |

| Health-aware consumers began demanding lower-sugar or sugar-free alternatives, resulting in product reformulations and more products that fit into improved nutritional profiles. | The customization trend will increase, with probiotic yogurt brands providing more varieties of flavors , textures, and functional ingredients to accommodate individual consumers' tastes and their health needs. |

The Western Europe probiotic yogurt market, although expanding strongly, is threatened by a number of risks that might affect its future growth. One of the major risks is regulatory uncertainty. As probiotics and their associated health claims are increasingly popular, governments and regulators may tighten product claims, labeling, and food use of probiotics. This may result in higher compliance expenses for manufacturers and slower industry growth.

Another key risk is supply chain disruption. The procurement of high-quality ingredients for the product, like certain bacterial strains or plant-based substitutes, is based on a sophisticated global supply chain. Geopolitical tensions, climate change, or economic recessions could affect ingredient availability or drive up costs, impacting the pricing and manufacturing of these products.

Consumer trend shifts are also a threat. Even though the trend for healthy and functional foods is robust, consumer tastes are always changing.

Spoonableyogurt is consumed more extensively in Western Europe than its drinkable equivalent. Spoonable yogurt has been a standard in the region for many years because of its versatility and greater popularity. It is frequently employed as a breakfast food, snack, or addition to a healthy meal, providing consumers with numerous flavors, textures, and nutritional advantages.

The rich texture of spoonable yogurt, coupled with the health attributes due to probiotics, is very popular with people from diverse backgrounds. It is also offered with diverse fat content such as low-fat, full-fat, and fat-free forms that appeal to customers with varied demands.

The convenience of this product, as well as its adaptation for various nutritional requirements, such as low-sugar, lactose-free, and plant-based alternatives, has supported its widespread popularity throughout Western Europe.

Flavoredyogurt is extensively consumed in Western Europe because of the synergy of taste preference, convenience, and increased demand for functional but tasty food. Variety and taste are probably the most compelling drivers of the consumption of flavored yogurt.

Consumers appreciate having the option to choose from a broad selection of flavors, ranging from classic fruit flavors such as strawberry, blueberry, and peach, to more unusual ones like mango or tropical mixtures. This diversity guarantees that everyone will find something they like, whether they have a sweet tooth or like less intense flavors.

Another strong reason for flavoredyogurt's popularity among Western Europeans is the increasing preference for functional foods that provide nutritional benefits without detracting from flavor. With more health-conscious consumers, the demand is rising for foods that are nutritious but also give in to the urge for indulgence.

The Western European industry is highly competitive, with the large multinationals competing with specialist smaller firms for industry share. Danone is the leading company with its established brands including Activia, which has become the term that people associate with digestive health.

The company is still innovating, with emphasis on new flavor, sustainability, and the growth of plant-based products to address the increasing demand for dairy-free products. Arla Foods, the other large competitor, is also growing its presence with an emphasis on organic and lactose-free yogurt, targeting the growing number of health-oriented and dietary-restricted consumers.

Conversely, Chr. Hansen and Danisco are principal suppliers of probiotic cultures and ingredients and supply necessary probiotics to most yogurt producers in the region. Their emphasis on high-quality, science-supported cultures for immunity and digestion makes them essential partners in the supply chain. Both companies continuously innovate their offerings to respond to the need for more targeted, effective probiotic solutions.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Arla Foods, Inc. | 12-15% |

| BioGaia AB | 5-8% |

| Lifeway Foods, Inc. | 6-9% |

| Danone | 18-22% |

| Mother Dairy Fruit & Vegetable Pvt. Ltd. | 5-7% |

| General Mills Inc. | 7-10% |

| i -Health Inc. | 3-5% |

| Lallemand Inc. | 4-6% |

| Chr. Hansen Holding A/S | 8-11% |

| Danisco A/S | 5-8% |

| Company Name | Key Offerings/Activities |

|---|---|

| Arla Foods, Inc. | Offers a wide range of products with a focus on organic, low-sugar, and lactose-free variants to meet the health-conscious consumer demand. |

| BioGaia AB | Famous for its probiotic strains in various dairy items, including yogurt. Emphasizes promoting gut health with science-based probiotics. |

| Lifeway Foods, Inc. | Offers a range of probiotic yogurt beverages, highlighting the utilization of kefir, a fermented milk beverage, with various health benefits such as digestive aid. |

| Danone | A dominant company in the probiotic yogurt segment with big brands such as Activia , targeting digestive well-being, immunity, and sustainability in manufacturing. |

| Mother Dairy Fruit & Vegetable Pvt. Ltd. | Produces products aiming at the Indian and Western European markets with a focus on quality and freshness, as well as lactose-free requirements. |

| General Mills Inc. | Provides a broad portfolio of probiotic yogurt brands, such as Yoplait, with a focus on health benefits, taste, and innovation in product offerings like plant-based and high-protein variants. |

| i -Health Inc. | Probiotic specialists with a range of products with various flavors and formulations to suit consumer requirements. |

| Lallemand Inc. | Leading provider of probiotics, supplying probiotic cultures to yogurt and dairy product manufacturers with emphasis on digestive health benefits. |

| Chr. Hansen Holding A/S | Develops and supplies natural probiotic cultures and ingredients for yogurt manufacturers with an emphasis on sustainability and health. |

| Danisco A/S | Recognized for offering innovative probiotic cultures and functional ingredients to yogurt producers, with emphasis on health benefits and product innovation. |

Arla Foods, Inc. focuses on producing high-quality products with an emphasis on organic, lactose-free, and low-sugar variants, catering to the growing demand for healthier, functional dairy options in Western Europe. As one of the largest dairy companies in the region, Arla has invested in sustainable farming practices and is continuously expanding its product offerings to meet the diverse dietary preferences of consumers.

BioGaia AB is a key player in the industry, focusing on its high-quality probiotic strains that support digestive health and overall well-being. BioGaia is known for providing probiotic cultures to yogurt manufacturers, and its research-driven approach helps ensure that the probiotics used in yogurt products deliver scientifically validated health benefits.

Lifeway Foods, Inc. is a prominent producer of probiotic dairy products, particularly kefir-based yogurt drinks, which are growing in popularity across Western Europe. Known for its strong focus on gut health, Lifeway’s products offer consumers a convenient, functional food option, combining probiotics with the health benefits of fermented dairy.

Danone continues to dominate the industry with its flagship brand, Activia, which has been a leader in promoting digestive health. The company’s commitment to sustainability, plant-based options, and ongoing product innovation helps maintain its strong position in the competitive landscape.

Mother Dairy Fruit & Vegetable Pvt. Ltd. offers a range of products in the Western European industry, focusing on freshness and quality. The company’s offerings cater to consumers seeking affordable yet healthy options, and it is committed to delivering nutritious products while expanding its footprint in Europe.

General Mills Inc. is a major player in the industry with its well-known brand, Yoplait. The company is focusing on expanding its range of yogurt options, including plant-based and high-protein variants, to cater to the evolving preferences of health-conscious consumers.

i-Health Inc. is known for its innovative probiotic formulations that are integrated into yogurt products, targeting specific health benefits such as improved digestion and immunity. The company focuses on scientific research to deliver probiotics that support gut health, making it a trusted player for consumers seeking functional dairy options.

Lallemand Inc. specializes in providing high-quality probiotic cultures to yogurt manufacturers, ensuring the effective delivery of beneficial bacteria for digestive health. The company is recognized for its expertise in probiotics and continues to play a significant role in the formulation of functional dairy products across Western Europe.

Chr. Hansen Holding A/S is a leading supplier of natural probiotic cultures to yogurt producers, with a focus on improving gut health and immunity through its innovative probiotic strains. Chr. Hansen’s commitment to sustainability and advanced probiotic research enables yogurt manufacturers to create high-quality, health-focused products that cater to the growing demand for functional foods.

Danisco A/S (part of DuPont) provides advanced probiotic cultures to yogurt manufacturers, focusing on delivering probiotic benefits for digestion, immunity, and overall health. Danisco’s solutions are integral to the development of high-quality products in Western Europe, and its focus on innovation allows it to stay ahead in the competitive probiotic industry.

The industry is expected to reach USD 6.1 billion in 2025.

The market is projected to witness USD 10.9 billion by 2035.

Flavored products are widely consumed.

Leading companies include Arla Foods, Inc., BioGaia AB, Lifeway Foods, Inc., Danone, Mother Dairy Fruit & Vegetable Pvt. Ltd., General Mills Inc., i-Health Inc., Lallemand Inc., Chr. Hansen Holding A/S, and Danisco A/S.

In terms of product type, the industry is classified into drinkable probiotic yogurt and spoonable probiotic yogurt.

With respect to flavor, the industry is bifurcated into regular/unflavored and flavored.

By sales channel, the industry is divided into hypermarkets/supermarkets, convenience stores, specialty stores, online retailers, wholesalers, grocery stores, and other retail formats.

By country, the market is segregated into the UK, Germany, Italy, France, and Spain.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.