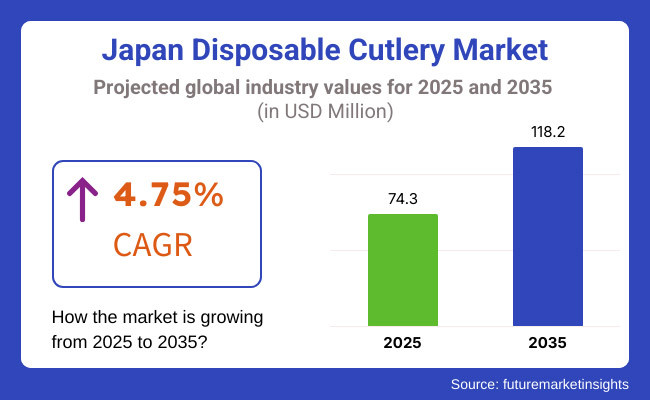

The Japan disposable cutlery market is anticipated to be valued at USD 74.3 million in 2025. It is expected to grow at a CAGR of 4.75% during the forecast period and reach a value of USD 118.2 million in 2035.

Industry Outlook

Japan disposable cutlery is one-time-use eating utensils such as forks, knives, spoons, and chopsticks in plastic, wood, or biodegradable materials for foodservice, take-out, and catering. Commonly applied in restaurants, fast food, and convenience stores, its usage increases because of food delivery culture and stringent environmental policies to ensure sustainability.

The industry is manufacturing and supplying disposable cutlery used in foodservice. Its expansion is driven by increased demand for food delivery and takeout, consumer behavior influenced by convenience, and strict environmental regulations that favor biodegradable and compostable solutions, driving companies towards eco-friendly and innovative cutlery solutions.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market was supported by strong demand in food delivery, takeout and convenience stores, and disposable cutlery was commonly used for consumer convenience. | Stronger government policies to regulate plastic waste minimization and customers' growing inclination toward green products will force companies towards reusable, compostable, and biodegradable cutlery. |

| Plastic-based disposable cutlery held the largest market share owing to its cost-effectiveness, durability, and convenience. | Wooden, paper-based, edible, and plant-based bioplastics will take over the market, replacing traditional plastic raw materials. |

| Rising environmental consciousness encouraged some players to find alternative materials, though adoption was slow because of higher costs of production and absence of enforcement by regulators. | Environment-friendly materials will be mainstream, catalyzed by government regulation, business sustainability ambitions, and lowered costs from innovation. |

| The e-commerce and lifestyle-driven food delivery boom created more demand for disposable cutlery, in spite of increased environmental awareness. | The foodservice sector will lead in sustainable packaging, with opt-in programs for disposable cutlery, and moving toward compostable and reusable alternatives. |

| Plastic cutlery began to be phased out by retailers and restaurants with bamboo, wood, and paper-based cutlery being substituted as consumers increasingly sought sustainable options. | Major food chains, retailers, and packaging manufacturers will completely adopt zero-waste strategies, prohibiting single-use plastics and investing in closed-loop recycling and biodegradable cutlery products. |

| Recycling was still challenging because plastic cutlery is difficult to sort, it tends to get contaminated, and recycling facilities are inefficient. | Next-generation waste management technologies will enhance the recyclability of disposable cutlery, facilitating higher material recovery and lower landfill waste. |

| The government imposed preliminary restrictions on plastic cutlery, inviting businesses to cut down on single-use plastics voluntarily. | Strict plastic ban and legislation, such as compulsory compostable packaging regulations, will compel companies to make the transition to sustainable disposable cutlery alternatives. |

| Cost savings was a primary issue, with most businesses reluctant to invest in sustainable products due to increased production costs. | The economic difference between conventional plastic cutlery and sustainable alternatives will decrease, making environmentally friendly alternatives more financially viable. |

| Reusable cutlery was only adopted by upscale restaurants and environmentally aware consumers, with little effect on mainstream foodservice. | Reusable cutlery schemes will become prevalent in fast-food restaurants, corporate cafeterias, and mass events, decreasing demand for disposable alternatives. |

| Compostable and biodegradable cutlery alternatives were present but not popular due to increased costs and limited consumer awareness. | Consumer education and government support will propel the large-scale adoption of biodegradable and compostable cutlery, facilitated by certified eco-labeling and green packaging efforts. |

| Firms concentrated on product design enhancement for enhanced usability, but sustainability was not the top priority. | Material innovation will gain pace with the introduction of edible, water-soluble, and totally biodegradable cutlery, enhancing sustainability without diminishing functionality. |

High-Quality and Aesthetic Designs Elevating User Experience

Japan’s disposable cutlery market is evolving with a focus on premium quality and visually appealing designs that enhance the dining experience. Companies develop sleek, ergonomic, and artistically crafted cutlery that mimics the feel of traditional utensils, offering a refined touch to convenience dining.

Consumers prefer stylish, high-gloss finishes, intricate patterns, and culturally inspired designs that align with Japan’s strong appreciation for aesthetics. Businesses also introduce textured grips and balanced weight distribution to provide a more comfortable and enjoyable eating experience, transforming disposable cutlery from a mere utility into an extension of dining culture.

Smart and Functional Innovations Redefining Convenience

Technological advancements and functional designs are reshaping disposable cutlery, making it more practical and interactive for modern consumers. Companies integrate heat-sensitive materials that change color with temperature, adding an engaging element to food presentation. Businesses also introduce multi-functional cutlery, such as chopstick-spoon hybrids or collapsible designs, catering to the fast-paced lifestyles of urban consumers.

Self-sanitizing coatings and antibacterial properties enhance hygiene, ensuring a safer and more convenient eating experience. By blending technology with usability, brands create disposable cutlery that meets the evolving expectations of both consumers and businesses in Japan.

| Metric | Value |

|---|---|

| Top Product Type | Spoon |

| Market Share in 2025 | 57.1% |

Disposable spoons continue to be the most preferred type of cutlery, expected to hold 57.1% of the market share in 2025. Their versatility makes them ideal for soups, yogurts, desserts, and takeaway meals, making them indispensable in foodservice outlets. Their widespread usage ensures continued demand across various dining settings.

As delivery and takeaway services expand, disposable spoons remain essential for meals that require utensils. Their hygienic, single-use nature minimizes contamination risks, ensuring a safe and convenient dining experience. Additionally, the shift toward eco-friendly alternatives like biodegradable and wooden spoons is further supporting growth in this segment.

| Metric | Value |

|---|---|

| Top End Use | Foodservice Outlets |

| Market Share in 2025 | 62.0% |

The foodservice sector is projected to account for 62.0% of the disposable cutlery market in 2025, maintaining its dominant position. Restaurants, cafes, catering businesses, and food trucks rely on disposable cutlery to streamline operations, eliminating the need for dishwashing while ensuring quick service for customers.

With fast food, takeout, and delivery services on the rise, disposable cutlery plays a crucial role in modern dining habits. Consumers favor ready-to-eat meals that require minimal clean-up, making disposable utensils an essential convenience. As sustainability concerns grow, foodservice providers are increasingly adopting biodegradable and compostable alternatives to meet eco-friendly demands.

According to FMI research, the Japan disposable cutlery market relies heavily on thermoforming, die-cutting, and injection molding due to their precision, efficiency, and ability to produce high-quality disposable utensils. Thermoforming is widely used for its cost-effectiveness and ability to create lightweight yet durable cutlery, making it ideal for large-scale foodservice applications.

Meanwhile, injection molding dominates premium disposable cutlery production due to its ability to create intricate designs with superior strength and heat resistance. Die-cutting is also prevalent, particularly in eco-friendly paper-based disposable cutlery, aligning with Japan’s sustainability initiatives. These processes ensure high performance, aesthetic appeal, and compliance with Japan’s strict food safety regulations.

The Japanese disposable cutlery industry is fragmented, with several companies competing for dominance. Despite the presence of established players, no single entity has achieved overwhelming control. The industry continues to evolve as businesses focus on innovation, sustainability, and cost-effective production to differentiate themselves and capture consumer demand in an increasingly competitive environment.

Leading companies leverage technological advancements and efficient supply chains to expand their reach. They prioritize high-quality materials and advanced manufacturing techniques to enhance product durability and appeal. By offering a diverse range of disposable cutlery options, they cater to the varying preferences of consumers while ensuring compliance with environmental regulations and industry standards.

Sustainability plays an important role in shaping competition within this sector. Companies invest heavily in biodegradable and compostable materials to meet the growing demand for eco-friendly products. Moreover, government policies and consumer awareness drive innovation, compelling businesses to adopt greener alternatives without compromising convenience, affordability, or durability in disposable cutlery offerings.

Strategic partnerships and acquisitions contribute to the evolving competitive landscape. Industry leaders collaborate with suppliers, retailers, and distribution networks to strengthen their market presence. This approach allows companies to optimize production, streamline logistics, and ensure consistent product availability, reinforcing their competitive advantage in a highly dynamic and fragmented business environment.

Despite strong competition, companies that successfully integrate sustainability, efficiency, and technological advancements maintain a leadership position. Continuous investment in research and development, along with proactive adaptation to consumer preferences, helps leading players retain their influence. This ongoing evolution ensures that innovation remains at the forefront, shaping the future of disposable cutlery in Japan.

The Japanese disposable cutlery market is growing due to the expansion of the foodservice industry and increasing consumer demand for convenience. The rise in takeout and food delivery services has driven the need for high-quality, durable, and sustainable cutlery options, prompting manufacturers to develop innovative solutions that balance functionality with environmental responsibility.

Sustainability concerns are reshaping the market as businesses shift towards biodegradable plastics, bamboo, and other plant-based materials. Government regulations and corporate initiatives promoting eco-friendly alternatives have encouraged the adoption of recyclable and compostable cutlery. As consumers become more environmentally conscious, brands are investing in research and development to create durable yet sustainable disposable cutlery options.

The market is highly competitive, with domestic and international players focusing on product differentiation and branding. Established companies leverage advanced manufacturing techniques to enhance product quality, while new entrants explore niche markets with innovative designs. Strategic partnerships between foodservice providers and cutlery manufacturers are also influencing market dynamics, ensuring a steady demand for disposable solutions.

Urbanization and fast-paced lifestyles continue to drive demand for disposable cutlery, particularly in densely populated regions like Kanto and Kansai. The growth of online food delivery platforms has further boosted sales, as restaurants and vendors prioritize lightweight, cost-effective, and sustainable packaging solutions. As consumer preferences evolve, companies must adapt by offering eco-friendly and functional alternatives.

Rengo Co., Ltd.

Oji Holdings Corporation

Daio Paper Corporation

Marumitsu Co., Ltd.

Japan Pulp and Paper Co., Ltd. (JPP)

Green Earth Industries/Greenwise Co., Ltd.

International Players (e.g., Dart Container Corporation)

The Japan disposable cutlery market is expected to reach USD 74.3 million in 2025 and grow to USD 118.2 million by 2035, at a CAGR of 4.75%.

Sales prospects are strong, driven by rising demand for sustainable cutlery, food delivery growth, and government regulations promoting biodegradable alternatives.

Key manufacturers include Hime-Pla Inc, Koizumi and Co., Ltd., Haso Ltd., Gold Plast, Dopla S.p.A., Anchor Packaging, Apollo Funds, Biopak, D&W Fine Pack, Dart Container Corporation, Hotpack Global.

The foodservice outlets segment is expected to lead, accounting for 62.0% of the market share in 2025.

The market is segmented by product type into spoon, fork, and knife.

Based on the fabrication process, the market is segmented into thermoforming, die cutting, and injection molding.

The market are categories based on cutlery type, including wrapped cutlery and dispensed cutlery.

Based on sales channel, the market is segmented into direct sales, distributors, e-retail, and retailers.

Based on end use, the market is segmented into foodservice outlets, institutional food services, and household use.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.