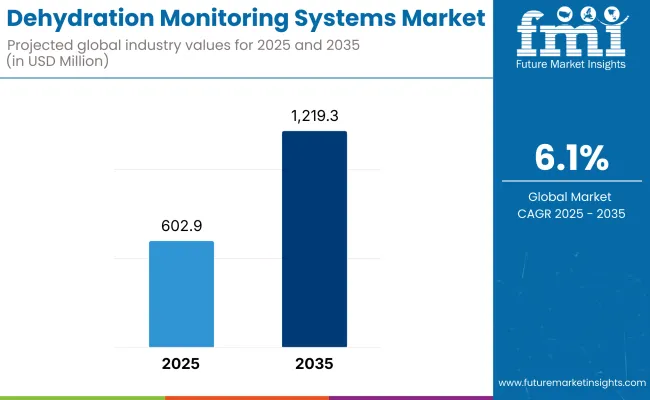

The Dehydration monitoring systems market is expected to reach approximately USD 602.9 million in 2025 and expand to around USD 1,219.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Dehydration monitoring systems are advanced medical devices or wearable technologies that are used to track and monitor an individual dehydration status in a real-time. Other systems are being developed to read physiological signals like electrolyte concentrations, skin humidity, body temperature, and bioelectrical impedance to detect dehydration or overhydration before it is apparent to the individual.

They have also been used fairly regularly during hospital admissions, athletic settings, care for older adults, and in patients with chronic diseases in whom adequate hydration is one of the most important objectives. By providing continuous or periodic monitoring, these systems prevent complications due to dehydration such as renal failure, heatstroke and electrolyte imbalances.

Growing awareness about the importance of hydration with respect to overall health has led to the growing prevalence of dehydration monitoring systems. Since older people become increasingly susceptible to dehydration, as the population ages this need has never greater. Rising prevalence of chronic conditions such as diabetes and kidney disorders had given rise to the need for regular monitoring of hydration levels.

| Metric | Value (USD Million) |

|---|---|

| Industry Size (2025E) | USD 602.9 Million |

| Industry Value (2035F) | USD 1,219.3 Million |

| CAGR (2025 to 2035) | 6.1% |

From 2020 to 2024, the Dehydration Monitoring Systems market experienced a steady rise in demand, driven by increased global health awareness and the growing emphasis on preventive healthcare. Throughout much of this time, the COVID-19 pandemic had a substantial effect on healthcare systems around the world, and continuous monitoring of patients, including hydration status, became all the more important, especially in critical care settings.

That led hospitals and healthcare providers to adopt technologies that allowed for better patient assessment and the early detection of fluid imbalances in patients, particularly those with respiratory conditions, fever or intensive treatment protocols.

The pandemic led to the gradual transition toward remote health monitoring and home-based care, which accelerated the use of painless and easy to use dehydration monitoring devices. Dehydration is already a problem for the elderly, and so the healthcare systems rapidly started focusing on anything that could help monitor older people as they increasingly appear in care facilities or are geriatrically observed at home.

The North America dehydration monitoring systems market has been extensively analysed and is expected to grow due to rising awareness of hydration-related health issues, developed healthcare infrastructure, and increasing adoption of wearable monitoring technologies.

The United States is leading by virtue of continuous innovation in digital health, backing for chronic disease management, and the large aging population. Growing emphasis on preventive health care along with strong presence of medical device manufacturing companies underpins steady market growth.

Although rigid regulatory frameworks can hinder rapid-evolving spaces, the high demand in both the clinical and personal health market-particularly among athletes and elderly care suppliers-will continue driving the development of user-friendly and efficient hydration monitoring solutions.

Europe's Dehydration Monitoring Systems Market is driven by strong public health infrastructure, strict healthcare regulations and increased awareness regarding complications arising from fluid imbalance. Germany, France and the UK lead the pack with significant efforts to invest in hospital and homecare technologies. Initiatives promoting early diagnosis and preventive care, particularly among elderly populations and individuals with chronic conditions are benefitting the region.

Growing research activity in non-invasive and continuous monitoring systems is also driving growth. While challenges remain in the regulatory environment, increasing interest in wearable health technologies and a growing demand for patient-centric monitoring solutions are driving adoption across hospitals, sports medicine and personal wellness segments.

The Asia-Pacific demand for Dehydration Monitoring Systems is witnessing significant growth, primarily due to rising health awareness, increasing occurrence of heat-related diseases, and an expanding geriatric population. Countries such as China, India, and Japan see massive demand driven by lifestyle shifts and greater emphasis on digital health solutions.

The hot and humid climates, in addition to increasing athletic participation and chronic disease prevalence, have expanded the demand for assessment of hydration on a regular basis. Government programs for modernizing health care and investing in wearable technologies also aid growth. With improved access to health care and greater digital adoption across emerging economies, the region should represent strong future opportunities.

The Dehydration Monitoring Systems market faces several barriers that hinder its full-scale adoption and growth.

Cost prohibitions - In general, one of the major hurdles limiting adoption of advanced monitoring devices, particularly those that leverage real-time analytics and wearable technology. Although these devices have demonstrated significant efficacy, they remain financially inapproachable to numerous healthcare providers and individuals, especially those in low resource settings.

This hampers market penetration in developing regions where dehydration is prevalent health concern. A prominent challenge when it comes to dehydration monitoring is the low awareness and poor knowledge of these technologies among healthcare providers as well as the public. Chronic fluid deficiency is a long-term health risk that few are aware of, and even fewer healthcare organizations are prepared to address, as hydration monitoring is often viewed as less critical than other conditions requiring more immediate medical attention.

This factors into underutilization, particularly in the non-critical care setting. The market also faces regulatory complexities and slow approval processes. Unlike general-purpose software, medical devices must undergo extensive validation and even clinical trials before they are able to be marketed, and even then they must be approved by relevant health authorities. These regulatory demands can postpone product launches, raise costs and deter smaller companies from bringing their products to market.

The Dehydration Monitoring Systems market is witnessing emerging opportunities driven by shifts in healthcare priorities and technological advancements.

An important opportunity is in the increasing elderly demographic, which are at a higher risk for dehydration due to age-induced physiological changes and decreased sensation of thirst. This demographic trend leads to an immediate need for regular accurate monitoring, particularly within the dynamics of many homecare or long-term care facilities where early detection of fluid imbalance is crucial.

One more valuable opportunity comes from the high incidence of chronic diseases (e.g., kidney diseases, diabetes, cardiovascular disease) that necessitate fluid management. One such example is the real-time monitoring for common diseases that, because of the low-resource nature of healthcare providers, will be compounded by dehydration and are more difficult to manage, leading to worse outcomes and increasing mortality rates in regions that are already susceptible to disaster.

This factor is also attributed to the growing demand for personalized healthcare. They want devices that enable them to better control their health. Real-time hydration status monitoring devices allow users to alter their lifestyles, thereby driving demand in the fitness, wellness, and preventive healthcare sector.

Application in Geriatric and Chronic Care

Dehydration monitoring systems are gaining significant traction in geriatric care facilities and chronic disease management due to the heightened vulnerability of elderly individuals and patients with long-term health conditions. With aging, thirst perception generally dulls, kidney function is impaired, fluid homeostasis is somehow disrupted; these so combined leave oldies susceptible to complications because of dehydration.

Proper hydration on the other hand could be so vital in chronic diseases such as diabetes or kidney diseases where failure could lead to havoc such as electrolyte imbalance, hypotension, or acute kidney injury. Real-time management tractor systems allow the monitoring of caregivers and clinical staff to identify early signs of imminent fluid loss and act on them. This will ensure safer patient management, reduce suspicions about hospitalization, and improve general quality of care in long-term facilities.

Integration with Broader Health Ecosystems

Increased integration of Dehydration Monitoring Systems with wearables, fitness trackers, and broader health ecosystems is a high-impact trend influencing the growth of Dehydration Monitoring Systems market. This holistic approach enables real-time hydration data to be correlated with other critical parameters including heart rate, temperature, and activity levels.

This is possible because it combines the hydration-monitoring process into a more comprehensive health care system, thus allowing users to receive a more individual-oriented health status evaluation. This integration fosters more accurate clinical insights, early detection of fluid imbalances, and proactive intervention for healthcare providers. This trend reflects the movement of connected, preventative, and patient-centered health care delivery models.

From 2020 to 2024, the growth of dehydration monitoring systems was steady due to rising awareness regarding the health threats posed by fluid imbalance and the growing awareness for early diagnosis and prevention. Hydration assessment in clinical, home, and fitness settings now stands to benefit from greatly non-invasive monitoring technology and wearable devices.

Nevertheless, accessibility limited in low-resource areas, and, to some extent, a lack of awareness by some circles in health care served as hindrances to wider acceptance during that period.

Looking ahead to 2035, the market is set for rapid growth in response to continuous innovation in sensor technologies and digital health infrastructure investment and the holistic integration of hydration tracking into health management systems. Preventive health care, particularly chronic disease management and personalized wellness solutions, will be the triggers to propel dehydration monitoring into the forefront of health care worldwide.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early-stage adoption of clinical validation and approval processes began for non-invasive hydration monitoring tools in select healthcare systems and wellness programs. |

| Technological Advancements | Wearable technologies using bioimpedance, temperature sensors, and skin conductivity gained attention for offering real-time dehydration assessment in non-clinical settings. |

| Consumer Demand | Rising awareness among fitness communities, aging populations, and chronic disease patients drove steady adoption of personal hydration tracking systems. |

| Market Growth Drivers | Concerns over heat-related illness, fluid imbalance, and hospital readmissions supported early demand, especially in elderly care and athletic performance management. |

| Sustainability | Limited focus on environmental impact led to higher reliance on disposable devices and non-recyclable materials within commercial dehydration monitoring products. |

| Supply Chain Dynamics | Device availability was uneven globally, with lower adoption in under-resourced regions due to high costs and inadequate distribution networks. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory frameworks are expected to evolve, emphasizing device safety, data accuracy, and remote patient monitoring integration in standard clinical practices. |

| Technological Advancements | Emerging advancements will focus on AI-driven analysis, multi-sensor platforms, and miniaturized biosensors for accurate, continuous hydration monitoring across different age groups. |

| Consumer Demand | Broader consumer interest will emerge from sectors like pediatrics, military, and occupational health, where personalized, preventive hydration monitoring is increasingly critical. |

| Market Growth Drivers | Future growth will be driven by climate change effects, aging demographics, and increased prevalence of kidney-related disorders requiring proactive hydration management. |

| Sustainability | Future devices will emphasize eco-friendly components, reusable sensor modules, and low-energy consumption to align with global sustainability goals in healthcare technology. |

| Supply Chain Dynamics | Expanded supply chains with localized production, digital health platforms, and remote delivery models will improve accessibility and reduce regional disparities in device availability. |

Market Outlook

Increasing emphasis on personal wellness and integration of digital health has led to the rising adoption for dehydration monitoring systems in the United States. The rise of technologically advanced healthcare infrastructure aids in mass deployment of smart wearables. High awareness in the public about heat-related and hydration-related complications created a significantly high demand especially among athletes and people who are active.

Other significant contributing factors include government-backed chronic condition management initiatives and the widespread use of remote healthcare tools. Furthermore, with the rising adoption of personalized health trackers, along with the growing number of these devices in home and clinical care solutions, the penetration of the industry into preventive care and chronic care applications has only strengthened.

Market Growth Factors

Market Forecast

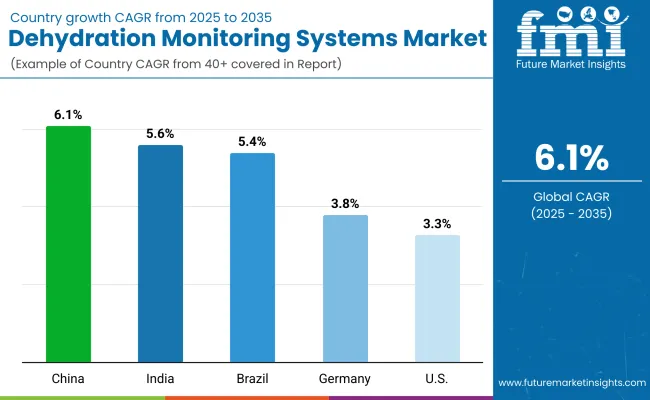

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

Market Outlook

Urbanisation, changing lifestyles and increasing prevalence of dehydration-related diseases in urban Chinese population are driving the dehydration monitoring systems market in China. There is a growing number of consumers who are health conscious in metropolitan areas and who need solutions for continuous monitoring.

Chinese administration’s push for strengthening community healthcare infrastructure as well as technology-driven wellness services further facilitates integration. Tech-savvy health devices have become an enormous consumer base - and this includes hydration tracking devices. Local production capabilities and early-stage digital health innovation hubs drive access to these devices across the income spectrum - particularly within expanded city-based preventive health initiatives.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook

In Germany, the landscape of dehydration monitoring systems is increased due to an aging population that requires continuous health monitoring. Strict regulatory standards guarantee that only high-precision, clinically validated technologies receive adoption, with demand slanted toward hospitals and eldercare facilities. The health-conscious culture and early adoption of med-tech in geriatric care is a conducive environment.

Statutory health insurance reimbursement for early detection tools also promotes usage. Furthermore, the focus on non-invasive medical devices further encourages the underlying technological advancements, allowing for integration of dehydration systems into larger diagnostic ecosystems for use in publicly-held healthcare facilities and rehabilitation stations that service the elder and mobility compromised populations.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The dehydration monitoring systems industry in Brazil is fueled by a hot and humid climate, creating a risk of fluid imbalance, especially in rural and semi-urban areas. It also indicates a need for hydration tracking tools targeted at outdoor sports and physical activity such as football, which is so popular among both men and women.

Public health facilities are starting to implement hydration assessment tools within community-based clinics. Furthermore, the rise in incidence of dengue and other febrile illnesses that may result in dehydration has promoted continuous monitoring in the management of infectious diseases. The reach of such technologies is being further enhanced by investments in digital health services in under-served areas.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.4% |

Market Outlook

Due to frequent heatwaves and high exposure to climate-related health problems, India has experienced an increasing demand for dehydration monitoring applications. The healthcare spectrum has broadened, particularly in semi-urban regions, leading to an increased acceptance of portable and non-invasive diagnostic devices.

Public health campaigns increasingly emphasize the need to hydrate, especially for children and manual laborers. During summer months, affordable healthcare technologies are being used in primary health centers and schools. As the fitness industry and health insurance penetration grow in tandem, the role of hydration tracking as a tool in both preventive care and real-time monitoring contexts is increasing in value.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Wearable dehydration monitoring devices are anticipated to lead due to their convenience.

Wearable dehydration monitor devices are expected to dominate due to their ease of use, non-invasiveness and increasing use in preventive and continuous healthcare. Such devices enable real time monitoring of hydration status, making them applicable in sports, elderly care, and chronic disease management and more.

Integration with digital health platforms and smart devices increases utility by tracking long-term data or offering personalized feedback. Growing fitness awareness, remote patient monitoring, and early detection of fluid imbalance requirements have also contributed to the demand. Their intuitive design and constant monitoring potential ensure their wide preference among clinical and consumer domains.

Biomedical dehydration monitoring sensors are gaining momentum for their precision and suitability in clinical environments.

Biomedical dehydration monitoring sensors are stirring interest due to their accuracy and clinical applicability. These sensors can be integrated into medical devices or included in diagnostic equipment to measure hydration through biochemical markers like sodium concentration, osmolality, and bioelectrical impedance.

They are critically important in intensive care units, dialysis centers, and emergency departments, where immediate fluid assessment can greatly impact treatment outcomes. Intelligent Planets: Miniaturized Sensor Systems and Integration with Electronic Health Records Professional healthcare is still growing and recurring due to the precision and clinical relevancy of biomedical sensors.

Disease diagnosis is expected to hold a dominant position due to the rising prevalence of chronic conditions.

The disease diagnosis segment is anticipated to dominate the market owing to the increasing prevalence of chronic diseases such as kidney diseases, diabetes, and cardiovascular disorders. Because of these health issues, close monitoring of fluid balance is necessary to prevent complications such as electrolyte imbalances or acute kidney injury.

Especially applicable for older patients and those during hospital or outpatient treatments, dehydrated patient monitoring systems help doctors or caregivers track dehydration stages for early intervention. Amidst the growing focus on precision medicine and preventive healthcare, these devices are being embedded in diagnostic pathways to enable accurate and real-time hydration measurements. Their clinical importance and role in enhancing patient outcomes ensure they remain in high demand.

Athletic performance optimization is another major application gaining rapid adoption.

Another key application experiencing rapid uptake, especially among professional athletes, sports organizations, and fitness enthusiasts, is athletic performance optimization. We must also remember that hydration is vital in supporting endurance, energy levels and thermoregulation during activity. To avoid a decline in performance, cramps or the onset of heat-related injuries, make use of dehydration monitoring systems that provide real-time hydration status feedback.

Athletic specific wearable solutions allow for continuous monitoring in training and competition. Not only is the emerging field of sports science growing, but also awareness on performance-linked hydration and investments into athlete wellness is pushing the use of such devices forward. Those systems will become a critical, foundational tool on the hierarchy of modern training and performance management protocols.

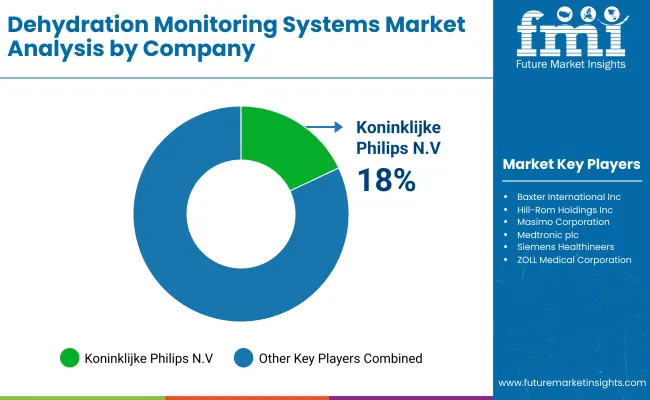

The competitive landscape of the Dehydration Monitoring Systems industry is evolving with growing emphasis on preventive healthcare, chronic disease management, and real-time health tracking. Prominent firms are innovating wearables and biomedical sensors that provide reliable hydration evaluations for both clinical and consumer applications.

To this effect, players are broadening existing portfolios with integrated solutions featuring biosensing, data analytics, and remote monitoring capabilities. Differentiation is driven by technology, specifically in smart wearables and non-invasive monitoring tools.

Moreover, the companies are significantly spending on research activities that improve the device accuracy and usability in various settings including, the elder care, sports medicine, and outpatient diagnostics support the long-term growth of the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Koninklijke Philips N.V. | 18-22% |

| Baxter International Inc. | 14-18% |

| Hill-Rom Holdings, Inc. | 10-14% |

| Masimo Corporation | 8-12% |

| Otsuka Holdings Co., Ltd. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Philips N.V. | Offers integrated wearable sensors and remote monitoring solutions for real-time hydration tracking across hospitals and homecare settings. |

| Baxter International Inc. | Provides clinical-grade dehydration diagnostic tools and fluid management systems for renal care and surgical settings. |

| Hill-Rom Holdings | Develops advanced monitoring beds and smart devices that track patient hydration levels and prevent fluid imbalance in critical care. |

| Masimo Corporation | Specializes in non-invasive hydration monitoring using optical sensor technology suited for high-risk patients and emergency care. |

| Otsuka Holdings | Produces biomedical sensors and wearable patches for monitoring electrolyte balance and fluid loss in chronic care and rehabilitation. |

Key Company Insights

Other Key Players (25-35% Combined) Additional contributors to the Dehydration Monitoring Systems market include:

These companies play a critical role in expanding global access to aflatoxin detection, prevention, and treatment solutions, particularly in agricultural economies and high-risk geographies.

Dehydration monitoring mobile devices, wireless dehydration monitoring chemical sensors, biomedical dehydration monitoring sensors, optical dehydration monitoring sensor systems, wearable dehydration monitoring devices, dehydration monitoring wristbands, dehydration monitoring head bands and dehydration monitoring adhesive chest patch.

Disease diagnosis, drug abuse detection and athletic performance optimization.

Retail Outlets, supermarkets, hypermarkets and online sales

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

The global dehydration monitoring systems industry is projected to witness CAGR of 6.1% between 2025 and 2035.

The global Dehydration Monitoring Systems industry stood at USD 568.3 million in 2024.

The global Dehydration Monitoring Systems industry is anticipated to reach USD 1,219.3 million by 2035 end.

China is expected to show a CAGR of 6.1% in the assessment period.

The key players operating in the global dehydration monitoring systems industry are Philips N.V., Baxter International Inc., Hill-Rom Holdings, Masimo Corporation, Otsuka Holdings, Abbott Laboratories, GE HealthCare, Medtronic plc, Siemens Healthineers, ZOLL Medical Corporation and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Types, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Types, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Types, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Types, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Types, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Types, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Types, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Types, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monitoring Tool Market Insights – Growth & Forecast 2024-2034

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Global Brain Monitoring Market Insights – Trends & Forecast 2024-2034

Flare Monitoring Market

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Yield Monitoring Systems Market

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Lactate Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA