The global dehydrated onion market is characterized by moderate concentration; with multinationals, regional players, and new brands stimulating the sector. The two big multinational corporations, Olam Food Ingredients (ofi) and Sensient Natural Ingredients, together account for around 42% of the market owing to their vertically integrated supply chain and global distribution networks.

Regional players like Kings Dehydrated Foods Pvt. Ltd. and Jain Farm Fresh Foods Limited own approximately 30%, enjoying domestic sourcing at lower prices and well-established export channels. Other regional players and specialist processors like Maharaja Dehydration Private Limited and Mahuva Dehydration, which specialize in customized dehydration processing and providing foodservice customers, account for 20%.

New players and new domestic operators such as Suszarnia Warzyw Jaworski Sp. J. and Tanbo Food Ingredients command 8%, often by centering their focus on specialty items, organic produce, and B2C supply. The biggest five contenders jointly command 55% of the global dehydrated onions business, and it would signal severely competitive yet relatively consolidated business space with geography concentration and specialties being crucial success factors.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 42% |

| Key Companies | Olam Food Ingredients (ofi), Sensient Natural Ingredients |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | Jain Farm Fresh Foods Limited, Kings Dehydrated Foods Pvt. Ltd. |

| Market Structure | Smaller Regional Players |

|---|---|

| Industry Share (%) | 20% |

| Key Companies | Maharaja Dehydration Private Limited, Mahuva Dehydration |

| Market Structure | Emerging Market Players |

|---|---|

| Industry Share (%) | 8% |

| Key Companies | Suszarnia Warzyw Jaworski Sp. J., Tanbo Food Ingredients |

The global dehydrated onions market is moderately consolidated, with multinationals dominating bulk exports, while regional players maintain strongholds in localized markets.

White onions dominate the dehydrated onions market with the biggest share of 45% owing to a milder taste, high demand in processed food, and higher dehydration yield. Major players like the Olam Group and Jain Farm Fresh lead in the exports of white dehydrated onion powder used mainly for soups, sauces, and spice mixes. Red onions gaining prominence in the dehydrated ingredient market account for about 41% export mainly into Europe and North America.

Dehydrated onion powder (26%) is the most consumed form and finds comprehensive application in the seasonings, snacks, and instant food formulation arena. Sensient Natural Ingredients supply bulk powder to processed food manufacturers. Diced (19%) and granules (17%) target key food service and frozen meal producers while minced (15%) onion has culinary and ready-to-cook applications. Flakes (8%) are mostly used in the B2C and gourmet markets especially in Europe and The USA.

Air drying (41%) is the dominant dehydration method because of its low cost and relative retention of the properties of onions. Air drying is used mostly by leading manufacturers such as Jain Farm Fresh and Kings Dehydrated Foods for bulk production. Freeze-drying (23%) is reserved for top-end spice mixes and functional foods. Vacuum drying (12%) is meant for specialized applications, while others (24%) are infrared drying and spray drying- used for niche formulation.

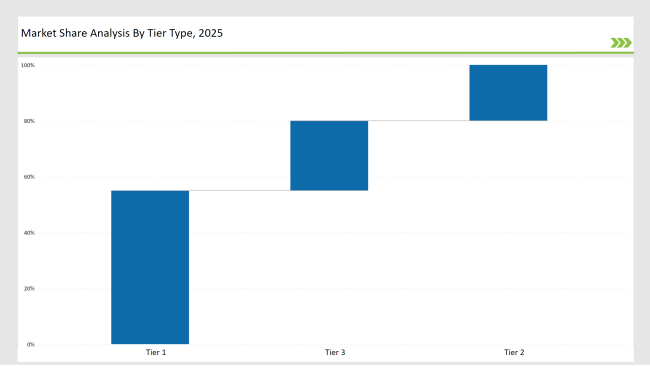

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Olam Food Ingredients (ofi), Sensient Natural Ingredients |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Jain Farm Fresh Foods Limited, Kings Dehydrated Foods Pvt. Ltd. |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Maharaja Dehydration Private Limited, Mahuva Dehydration |

| Brand | Key Focus |

|---|---|

| Olam Food Ingredients (ofi) | Expansion of onion dehydration capacity in India and the USA. to strengthen supply chain resilience. |

| Sensient Natural Ingredients | Launched new low-sodium dehydrated onion blends targeting processed food manufacturers. |

| Jain Farm Fresh Foods Limited | Developed blockchain-based onion traceability solutions to enhance food safety and export compliance. |

| Kings Dehydrated Foods Pvt. Ltd. | Established a dehydrated onion processing unit in UAE, targeting Middle Eastern demand. |

| Maharaja Dehydration | Introduced pre-seasoned dehydrated onion granules for institutional food manufacturers. |

| Mahuva Dehydration | Focused on sustainability by transitioning to solar-powered dehydration units. |

| Oceanic Foods Ltd. | Launched a freeze-dried onion powder targeting the premium seasoning market. |

| Suszarnia Warzyw Jaworski Sp. J. | Partnered with European spice brands for vacuum-dried onion granules. |

| Tanbo Food Ingredients | Entered the Asian QSR market, securing deals with major fast food chains. |

| Private Label Expansion | Retailers launched store-branded dehydrated onion products, increasing market competition. |

Organic, non-GMO, and clean-label dehydrated onions are increasingly popular commodities as demand rises across the United States and Europe for premium, transparent food ingredients. Companies like Sensient Natural Ingredients and Jain Farm Fresh are ramping up their offerings of certified organic products that meet this heightened demand.

With growth in online bulk orders and private label offerings in dehydrated onions for the B2C and foodservice retail segments, supermarkets and food distributors will produce store-branded dehydrated onions; for example, Olam Food Ingredients provides custom private label products to large retailers and direct-to-consumer platforms.

The industry moves toward energy-efficient dehydration, with hybrid drying and solar-powered dehydration plants featured in many strategic investments to reduce operation costs and increase product shelf life. Companies Mahuva Dehydration and Oceanic Foods Ltd. capture opportunities with low-energy processing technologies to remain cost-competitive while improving sustainability.

With increasing dependency on dehydrated onions, snack producers, spice manufacturers, and plant-based food brands increasingly come into the realms of processed food and seasoning manufacturers. Companies like Tanbo Food Ingredients and Suszarnia Warzyw Jaworski Sp. J. seek to improve their bulk supply chain networks in response to rising demand.

Rising demand from processed food manufacturers, seasoning companies, and plant-based food sectors is boosting dehydrated onion consumption.

Olam Food Ingredients, Sensient Natural Ingredients, Jain Farm Fresh Foods Limited, and Kings Dehydrated Foods Pvt. Ltd. are the leading companies.

Companies are adopting energy-efficient dehydration processes and using eco-friendly packaging to meet sustainability standards.

Supply chain disruptions, fluctuating onion prices, food safety regulations, and competition from fresh onions are key challenges.

Stricter EU and USA import requirements are pushing manufacturers to adopt blockchain-based traceability and advanced quality certifications.

Companies are investing in freeze-dried and vacuum-dried onions, pre-seasoned blends, and infused flavor onion powders.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Catechins Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.