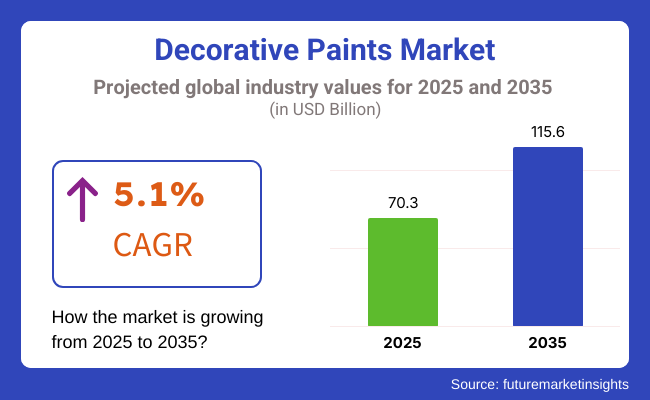

The market for decorative paint will significantly develop between 2025 and 2035. Construction activities are being carried out across the globe and this; in turn have propelled the demand for decorative paints in commercial, industrial, and residential applications. The market value is projected to rise steadily to an estimated USD 115.6 Billion by 2035 end, registering a CAGR of 5.1% over the assessment period (2025 to 2035), and will reach to approx. USD 70.3 Billion by 2025.

The high demand of this growth in aesthetic value and Interior design. Perhaps to the extent, decorative coatings have also become a new taste for decorating residence and workplace. Moreover, manufacturers are also well-aware of sustainability patterns hence continuously creating low VOC (Volatile organic compound) paint products to correspond their needs to influence higher consumer demand and regulations.

New paint technologies such as self-cleaning paints, antimicrobial coatings, and colour-stable finishes are posing substantial growth opportunities amid the rapid pace of urbanization across emerging economies. Recent technological applications, including automated painting systems and airless spraying, are also gaining ground; they can achieve even more on bigger areas, making decorative paints cheaper and even more beneficial.

Consequently, the decorative paints market is considered an integral component of the worldwide construction and home enhancement sectors, and its path of progress is underpinned by modernization tendencies and evolving consumer preferences.

Explore FMI!

Book a free demo

Strong construction activity in both the United States and Canada has made North America another prominent market for decorative paints. Rapidly rising refurbishment of older buildings and increasing demand for energy-efficient houses are expected to fuel more applications of advanced decorative coatings.

High-rise residential buildings, luxury apartment complexes and commercial real estate developments are driving the market’s footprint beyond the coastline, to include nearby architectural projects.

In addition, government schemes for green building certifications and energy-efficient structures are boosting the demand for eco-friendly paints. Truly some tanks capable of satisfying EHS standards whilst offering world-class durability and a stunning look, manufacturers North America have been hard at work developing superior waterborne and solvented cost-free formulations.

The launch of smart washes that change colour or texture with the environment is also consolidating the region’s strong presence in state-of the-art decorative solutions. Increasing renovation and remodelling activities along with an established distribution channel ensures consistent growth of decorative paints in North America.

The market for decorative paints in Europe accounts for a large portion of the global share owing to high attention in the region toward sustainability, energy efficiency, and aesthetic trends. EU countries including Germany, France and the UK are especially advanced in the adoption of sustainable building standards and significantly influence the demand for low-VOC or eco-friendly decorative coatings.

Moreover, the region's rich historical and cultural heritage drives a consistent demand for decorative paints in the restoration of iconic landmarks, heritage buildings, and historic sites. Incentives provided by government policies for green construction and eco-label certifications have pushed manufacturers to produce products with better performance and lesser environmental impact.

In addition, European customers are increasingly turning towards digital colour matching technologies, allowing buyers to develop personalised paint colours and finishes. These developments are increasing customer satisfaction, while confirming Europe as a market leader in decorative paint innovation and quality.

Decorative paints are expected to witness the fastest growth in the Asia-Pacific region, led by urbanization, rising disposable income, and thriving construction activities in China, India, and Southeast Asia. The region’s huge population and emerging middle class have driven demand for new housing and interior design, providing for profitable openings for decorative paint producers

As the largest construction market in the world, China is realizing increased demand for high-end decorative paints, such as functional finishes and complex coatings. Likewise, the swift infrastructure development in India, aided by government initiatives like Smart Cities Mission, is propelling the use of eco-friendly decorative coatings.

The urban residential complex is on the rise, with increased focus on home improvement and DIY activities, escalating the need for a consumer-friendly, low-maintenance decorative paint. The trend is also being observed in Asia-Pacific with increasing e-commerce platform of paint products, where consumers conveniently can get a wider variety of colours, finishes, and application tools.

Volatility in Raw Material Prices and Environmental Regulations

The Decorative Paints Market confronts formidable difficulties owing to fluctuating prices of general materials and stringent ecological rules. Spiraling costs for key parts like pigments, resins, and solvents directly influence profit, compounding choices regarding cost for producers.

Furthermore, developing laws on volatile natural compounds and other risky emissions compel organizations to put resources into maintainable formulations and eco-accommodating options. Satisfying natural principles likewise builds working costs and constricts the accessibility of certain crude materials.

To overcome these obstacles, makers should focus advance work on making water-based and low-VOC answers while enhancing supply chain methodologies to mitigate the effect of cost unpredictability.

Additionally, venture in substitute crude materials and groundbreaking creation forms will be fundamental for keeping benefit while meeting developing natural standards. Building associations with maintainable providers and embracing roundabout monetary standards can assist reduce industry reliance on conventional, high-valued crude materials.

Technological Innovations and Growing Demand for Sustainable Paints

The widespread embrace of paints that are eco-friendlier and longer-lasting introduces many possibilities for industry expansion. Advancements combining nanotechnology and perceptive coatings are giving rise to self-cleaning, antimicrobial, and energy-efficient paints, bolstering their desirability in residential and commercial applications alike.

Furthermore, the rising implementation of sustainable architecture standards and green construction projects stimulates demand for decoratively painted surfaces that are beneficial for the planet. Companies allocating resources into plant-derived paints, recyclable containers, and virtual colour-selection tools will gain a competitive edge. In addition, the ascent of online commerce and direct product sales to customers is transforming circulation models, allowing manufacturers to reach more audiences and offer personalized remedies.

Newly introduced AI-aided digital simulation of how coatings will appear on walls and customized shade selection assists are also improving client engagement and satisfaction. Moreover, strategic ties with architects and designers will unlock fresh paths for market growth by guaranteeing creative applications of decorative paints in advanced infrastructure.

Between 2020 and 2024, the Decorative Paints Market underwent a period of immense transformation accelerated by growing urban centers worldwide, increasingly preferred trends in home refurbishment taking root, and more disposable earnings flowing into budding economies.

The global pandemic dramatically amplified an already skyrocketing domestic enhancement boom further, driving immense necessities for internal and external paints as inhabitants seriously centered on improving living spaces. Concurrently, government projects advancing eco-friendly real estate and energy-efficient structures increased the embrace of low-VOC and water-based paints amongst manufacturers.

Yet interruptions to the supply chain and scarcities of raw materials posed troubles for producers, disrupting scheduled manufacturing and squeezing net incomes.

Companies moreover intensified their concentration on electronic marketing and online sales to achieve broader client bases since shopper habits progressively shifted towards electronic platforms, some adapting longer with more complex sentences to describe concepts while others opted for shorter phrases to make points concisely.

Furthermore, innovations in quick-drying and weather-resistant coatings helped spread applications into commercial and industrial spheres, steering diversified income streams for premier paint manufacturers.

Heading into 2025 to 2035, the market will see ongoing innovation in eco-friendly formulas, digital customization, and smart coatings. AI-powered colour recommendation systems and AR-based visualization tools will enhance buyer experience, allowing more personalized choices.

Proliferation of bio-based and carbon-neutral paints will align with worldwide sustainability goals, reducing environmental effect of decorative coatings. Moreover, demand for functional paints with antimicrobial, anti-pollution, and heat-reflective properties will climb, propelled by mounting health and climate concerns.

Integration of automation into paint production and application has considerable potential to enhance efficiency and consistency while reducing waste. Cutting-edge robotic solutions customized for large-scale construction projects could streamline painting with unprecedented precision, lowering labor expenses substantially.

Meanwhile, state-of-the-art automated equipment deployed on production lines optimizes processes, minimizing inventory issues and waste. Looking ahead, as autonomous vehicles smarterly forecast demand, manufacturers will better calculate limitations, tailoring output and minimizing surplus. Overall, innovative automation strategically applied across the industry should maximize productivity and enhance competitiveness.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter VOC regulations and bans on harmful chemicals |

| Technological Advancements | Growth in water-based paints and digital colour-matching tools |

| Consumer Preferences | Rise in DIY home improvement and demand for premium finishes |

| Integration with Sustainability | Growth in low-VOC and recyclable paint products |

| Supply Chain and Manufacturing | Challenges in raw material supply and cost fluctuations |

| Market Competition | Expansion of global brands and private-label offerings |

| Market Growth Drivers | Urbanization, home renovations, and infrastructure development |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of eco-friendly standards and incentives for carbon-neutral paints. |

| Technological Advancements | AI-powered colour recommendations, AR-based paint visualization, and smart coatings. |

| Consumer Preferences | Increased preference for sustainable, self-cleaning, and health-focused decorative coatings. |

| Integration with Sustainability | Widespread adoption of bio-based and carbon-neutral decorative paints. |

| Supply Chain and Manufacturing | Adoption of automation, robotics, and AI-driven quality control in paint production. |

| Market Competition | Increased competition from eco-friendly start-ups and digital-first paint brands. |

| Market Growth Drivers | Green construction initiatives, climate-conscious consumer behaviour, and digital transformation. |

The United States decorative paints market is expanding because of high demand for home remodelling, rising commercial building projects, and the growing popularity of environmentally friendly paints. The USA housing market and real estate industry are major drivers of demand for interior and exterior decorative coatings.

In response to stricter EPA (Environmental Protection Agency) regulations and greater awareness about indoor air quality, consumers are increasingly opting for low-VOC, water-based paints. Growing trend of do it yourself (DIY) home improvements and smart coatings with anti-bacterial and self-cleaning effects is also anticipated to drive the market significantly.

The commercial and hospitality sectors also play a major role, as hotels, offices, and retail spaces make forays into high-performance decorative coatings to boost both durability and aesthetics. There’s also a rising trend in architecture toward energy-efficient, reflective coatings.

Constant investments in sustainable coatings and increasing demand for premium decorative paints from consumers will drive the decorative paints market in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The United Kingdom decorative paints market is observing growth due to rise in home improvement activities, increasing usage of sustainable coatings, and government measures promoting the use of environment-friendly construction materials. The connected UK construction industry and the pre-eminence of restoration and refurbishment activities have served as the fundamental factors substantiating demand for high-quality decorative paints.

This trend will become even more significant when following the UK’s stringent environmental laws placing stricter controls over the types of coatings water-based and low-VOC paints manufacturers can use. Furthermore, demand for specialty decorative paints with traditional finishes is being spurred on by heritage and historic building conservation projects.

The cultivation and tendency of DIY culture in the UK is further contributing to the growth of the market as consumers prefer to buy decorative paints via online channels and through home improvement retailers. Textured finishes, antibacterial coatings and heat-reflective paints are increasingly popular innovations.

Sector Development Recent investments being done in sustainable architecture and smart coatings are expected to help UK decorative paints market grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union decorative paints market is growing steadily with the help of robust environmental regulations, growing construction activity, and the demand for high-performance coatings. Germany, France, and Italy are major contributors, led by residential and commercial construction activities.

The demand for bio-based, low-VOC and waterborne decorative paints has increased due to the EU's focus on sustainability. We are Mona and Althea, and we work in the EU Green Deal and Energy Efficiency Directive which promotes environment-friendly and energy-saving coatings for buildings

As the largest construction and architectural coatings market in Europe, Germany is seeing high demand for decorative paints in both new and renovation projects. France and Italy enjoy similar success when it comes to luxury and designer decorative coatings, especially in the high-end residential segment.

As the EU has increased environmental regulations on sustainable housing and green building certifications, decorative paints market will have stable growth during forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

In Japan, the growing demand for high-quality, long-lasting coatings, home improvement activity, strong regulatory support for green paint addressed to the consumers and the use of environment-friendly decorative paint in both interiors and exteriors are driving the Japanese decorative paint market. Japan's coating industries is amongst the most technically advanced worldwide, phasing out of low-VOC, high-performance and technologically advanced decorative coatings.

Construction projects in Japan have shown a declining trend and an increasingly aging population means that there is a rise of renovation and refurbish projects which are creating demand for weather resistant and durable exterior paints. Moreover, earthquake codes demand coating of buildings for structural strength and resistance against environmental destruction.

Similarly, anti-bacterial, self-cleaning and air-purifying paints are rising in popularity, most notably in the healthcare and hospitality spaces. Japan has increasingly turned to thermal insulation and heat-reflective coatings as a focus on energy efficiency in the energy market grows.

Japan Decorative paints market will continue to grow with constant innovation in functional & eco-friendly coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The South Korean decorative paints market is experiencing consistent growth, fuelled by growing residential and commercial building, consumer demand for home remodelling, and high demand for high-end coatings. Urbanization and infrastructure development in the country are major drivers of market growth.

Preferring premium and designer decorative paints, South Korean customers are also likely to go for a "custom" finish, textured coatings, smarts paints that have elements, which can destroy pollution or anti-bacterial elements in their nature. The growing trend towards sustainable decorative coatings and low VOC systems are also driving demand for eco-friendly construction and smart cities.

Reinforcing trends toward bio-based and waterborne paints are government regulations that promote green building standards. The expansion of digital and e-commerce sales channels also means premium decorative paints are more readily available to consumers.

As high-performance coatings continue to evolve and the demand for decorative finishes becomes more innovative, the South Korean decorative paints industry is anticipated to see stable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Water-based paints and solvent-based paints segments are among the major share-holders in the decorative paints market, given the growing residential, commercial, and industrial customers demanding high-quality, long-lasting, and aesthetic coatings.

The decorative paints have a vital role to play in terms of enhancing the surface aesthetics, increasing the lifespan, and guarding the surfaces from environmental stress, thus being irreplaceable in architectural, interior design, and infrastructure sectors.

Water-based coats have emerged as one of the most extensively embraced ornamental paint alternatives, furnishing diminished harmfulness, simple use, and decreased natural impact. Unlike solvent-based paints, water-based arrangements contain low quantities of volatile natural combinations (VOCs), confirming better indoor air quality and more secure working conditions.

The developing interest for water-based paints in private and business development, impelled by eco-cognizant shoppers and strict natural guidelines, has fueled selection of water-based layers, as engineers and homeowners need maintainable, scent-free, and fast-drying arrangements.

Studies demonstrate that water-based paints enhance surface strength, give better adherence, and guarantee long-enduring shading maintenance, making them perfect for indoor and outside applications.

The extension of water-based ornate paints in the top notch coatings portion, highlighting propelled anti-microbial, climate opposition, and stain-confirmation plans, has fortified advertise request, guaranteeing more prominent selection in top of the line home enhancement, lodging, and business spaces.

The incorporation of nanotechnology in water-based paints, highlighting self-cleaning, anti-growth, and ultra-durable layers, has additionally boosted selection, guaranteeing better surface insurance and diminished support costs.

The advancement of keen water-based paints, highlighting temperature-receptive and light-reflective layers that manage indoor temperatures and lessen vitality utilization, has idealized advertise development, guaranteeing more prominent selection in energy-proficient structures and keen city ventures.

The selection of water-based ornamental paints in DIY home redesign activities, highlighting easy-to-apply, low-smell, and quick-drying plans, has fortified advertise development, guaranteeing more noteworthy shopper commitment and item advancement.

In spite of their preferences in natural supportability and simplicity of use, water-based paints look challenges, for example, bring down opposition to extraordinary climate conditions, potential chipping in high-activity regions, and more extended drying occasions contrasted with solvent-based options.

Be that as it may, rising advances in polymer-based waterborne layers, AI-helped shading customization, and half and half water-solvent plans are improving strength, flexibility, and execution, guaranteeing proceeded with advertise development for water-based ornamental paints.

While solvent-based paints have long served architects seeking tough, weather-resistant coatings, environmental concerns now drive many contractors toward greener options. Solvent emissions pose risks to both applicators and inhabitants, with potential long-term effects on health.

Water-based innovations increasingly rival solvent formulas in resilience against sun, surf and stress fractures, bonding like traditional formulations while avoiding volatile components. Sustainability strides let builders protect structures for generations to come through non-toxic, high-performance finishes tolerating whatever nature demands.

The rising demand for solvent-reliant coatings in ornamental applications outdoors and in industry, with improved resistance to moisture, UV rays, and contact with chemicals, has driven adoption of top-performing solvent-containing formulas, as infrastructure designers seek coverings guaranteeing extended life even in urban settings undergoing stress. Research shows that paints using solvents penetrate surfaces more thoroughly, stop water more effectively, and brush off impacts more forcefully, ensuring greater strength in difficult climates.

The spreading use of solvent-containing decorative coatings in commercial spaces, offering glossy, satin, and semi-gloss styles, has strengthened marketplace want, making certain higher acceptance in shopping centers, offices, and public works.

The integration of hybrid solvent-containing coatings, combining alkyd, acrylic, and polyurethane-based structures for enhanced environmental compliance and lower VOC emissions, has further lifted adoption, ensuring better alignment with rules and wider reach.

Advances in weather-resistant solvent paints touting anti-corrosion, UV blocking, and heat reflection properties have maximized market increases, enabling higher acceptance in coastal regions, industries, and altitude areas.

The adoption of solvent decorative paints in renovations and restoration projects offering fade-proof and rapid drying finishes has reinforced marketplace growth, guaranteeing improved hardiness and aesthetic appeal in historic and commercial buildings.

While solvent paints offer benefits including resilience to wear from environmental elements and protective surface shielding, they are hampered by volatile organic compound volumes, lengthy drying intervals, and ecological issues concerning emissions discharge and disposal handling.

Nevertheless, developing technologies in low-VOC solvent solutions, biodegradable solvent recipes, and progressive defensive coatings are elevating eco-friendliness, effectiveness, and adaptable applicability confirmation, substantiating continuing commercial center growth for solvent decorative paints.

Simultaneously, compact yet descriptive sentences interspersed with more convoluted constructions enhance readability and engage the audience on intriguing subject areas.

The emulsion-based paints and distemper paints segments represent two major market drivers, as homeowners, businesses, and commercial developers increasingly deploy advanced decorative coatings to enhance interior aesthetics, improve surface durability, and meet cost-efficient renovation needs.

The emulsion-based paints and distemper paints segments represent two major market drivers, as homeowners, businesses, and commercial developers increasingly deploy advanced decorative coatings to enhance interior aesthetics, improve surface durability, and meet cost-efficient renovation needs.

The emulsion-based paints and distemper paints segments dominate major portions of the decorative coatings market, as homeowners, businesses, and commercial developers increasingly opt for advanced decorative solutions to enhance interior aesthetics, bolster surface endurance, and meet cost-efficient renovation necessities. Emulsion paints have skyrocketed in demand due to their unmatched cleanability and durability lasting years on end.

Unlike archaic distemper paints with a reputation for lackluster performance in the long term, contemporary emulsion finishes give surfaces a smooth matte or lustrous patina while promising bold aesthetic appeal and robust protection from damage.

As more and more homeowners of refined sensibilities demand paints with innovative features like being stain-resistant, mold and mildew-growth-resistant, and free of offensive odors, top emulsion products providing uncompromised strength and reliability have spread like wildfire.

Concurrently, an unbelievable resistance to fading has cemented emulsion paints preeminence among styles coveted for their surety to preserve vibrant and life-like hues even after prolonged exposure to sun and elements eroding lesser paints.

Homeowners now seek options providing enduring beauty and ease of upkeep. Research indicates these paints allow walls to breathe more freely, amplify moisture resistance, and offer superior opacity for more complete and long-lasting coverage.

The development of intelligent emulsion paints containing light-reflecting, self-cleaning, and air-purifying formulations has strengthened market demand by ensuring broader acceptance in eco-friendly home decor and green building certification.

Integration of digital color-matching technologies using artificial intelligence for customized paint creation and visualization tools in real-time has further boosted adoption by guaranteeing greater customer engagement and personalized interior design solutions.

Despite advantages in durability, aesthetics, and washability, emulsion paint confronts challenges such as higher expenses compared to traditional distemper paint and potential cracking in extreme conditions alongside complex application needs. Emerging innovations in plant-based emulsions, quick-drying formulas, and AI-powered analysis of paint performance, however, are improving efficiency, affordability, and user experience to ensure the continued growth of the emulsion paint market.

Distemper paints have become widely embraced, especially for reasonably priced commercial and residential jobs where customers seek budget-friendly, user-friendly, resilient wall coverings. Unlike glossy emulsion paints, distemper formulations impart an understated matte finish, letting economical indoor embellishment retain visual allure irrespective of constraints.

Soaring interest in low-cost dwellings, pedagogical facilities, and rustic regions catalyzed by cost-effective, extensive-coverage, and swift-drying recipes—has ushered sweeping acceptance of conventional and modern acrylic-based distemper paints as contractors elevate affordable options permitting expeditious project finalization above all else.

The boom in cutting-edge acrylic distemper products, touting strengthened bonding to surfaces, longer-lasting shades, and superior moisture resistance, has amplified marketplace desire, cementing broader acceptance in semi-durable interior coatings.

While distemper paints offer value and ease of application, deficiencies persist such as diminished toughness against emulsions, restricted cleanability, and diminished stain resistance. However, emerging innovations in polymer-fortified distemper mixtures, water-sealed coatings, and anti-fungal distemper variations are bettering quality, longevity, and cost-benefit, ensuring continuous industry growth for distemper-focused decorative coatings.

The decorative paints industry is growing owing to increased demand for aesthetic home designs, eco-friendly coatings and technologically advanced formulations. In order to make sure that the paint used is durable, environmental-friendly, and visually appealing, companies are focusing on low-VOC (volatile organic compound) paints, antimicrobial coatings, as well as smart color-changing technologies.

Global players like global coatings manufacturers and local players like regional decorative paint suppliers, contribute to technological advances in their systems water-based paints, self-cleaning coatings, digital colour-matching systems, and environmental impact.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AkzoNobel N.V. | 15-20% |

| PPG Industries, Inc. | 12-16% |

| Sherwin-Williams Company | 10-14% |

| Asian Paints Limited | 8-12% |

| Nippon Paint Holdings Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| AkzoNobel N.V. | Develops Dulux-brand decorative paints, sustainable coatings, and weather-resistant exterior paints. |

| PPG Industries, Inc. | Specializes in eco-friendly architectural coatings, antimicrobial decorative paints, and advanced color technology. |

| Sherwin-Williams Company | Manufactures interior and exterior paints, smart coatings, and water-based low-VOC paint solutions. |

| Asian Paints Limited | Provides luxury decorative paints, DIY-friendly coatings, and weatherproof exterior finishes with strong market presence in Asia. |

| Nippon Paint Holdings Co., Ltd. | Offers anti-fungal, washable, and high-durability decorative coatings, integrating sustainable formulations. |

Key Company Insights

AkzoNobel N.V. (15-20%)

AkzoNobel dominates in the decorative paints market, with sustainable high-performance coatings marketed under the Dulux brand and AI-enabled colour-matching systems.

PPG Industries, Inc. (12-16%)

PPG produces low-VOC decorative paints, eco-friendly coatings and high-color custom digital coatings.

Sherwin-Williams Company (10-14%)

Sherwin-Williams offers long-lasting and durable decorative paints and coatings with weatherproof, smart, and energy-efficient features.

Asian Paints Limited (8-12%)

Asian Paints manufactures high-durability and luxury decorative coatings and is one of the strongest brands in Asia and emerging markets.

Nippon Paint Holdings Co., Ltd. (5-9%)

Nippon Paint makes washable, high-end coatings for residential and commercial environments, and self-cleaning, more sustainable paint technologies.

Multiple manufacturers of decorative coatings are also involved in next-gen paint recipes, AI-enabled color-matching as well as smart home-friendly coatings. These include

The overall market size for Decorative Paints Market USD 70.3 Billion In 2025.

The Decorative Paints Market expected to reach USD 115.6 Billion in 2035.

The demand for the Decorative Paints Market will be driven by increasing urbanization, rising construction activities, and growing consumer preference for aesthetically pleasing interiors and exteriors. Environmental concerns and innovations in eco-friendly, low-VOC paints will further boost market growth.

The top 5 countries which drives the development of Decorative Paints Market are USA, UK, Europe Union, Japan and South Korea.

Emulsion-Based and Distemper Paints Drive Market to command significant share over the assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.