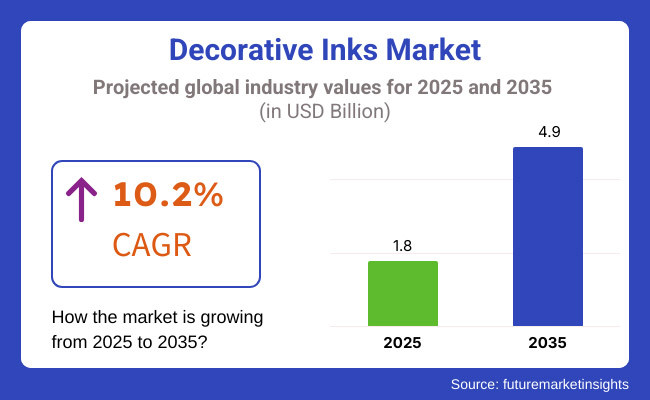

The decorative inks market is slated to reach USD 1.8 billion in 2025. Witnessing a CAGR of 10.2% from 2025 to 2035, the industry is expected to hit USD 4.9 billion by 2035.

The growing focus on aesthetics and customization is fueling the adoption of high-quality decorative inks in industries like packaging, automotive, furniture, and textiles. For instance, luxury packaging brands prefer to select metallic and UV-curable inks for the purpose of boosting their products' appeal.

Likewise, automotive companies utilize these inks for dashboard trims and car wraps, which are both durable and stylish. Eco-friendly, long-lasting, and high-performance inks are among the main drivers of the industry as firms are in demand of both sustainable and visual solutions that are good-looking.

Decorative ink industry is undergoing a revolution with the impact of technological breakthroughs such as digital printing, UV-curable inks, and bio-based formulations. Industry players now need inks offering improved adhesion, UV blocking, and resistance to chemicals to make the most out of the prolonged slip-ups-free use of the colors.

The fashion sector is capitalizing on digital printing to produce fine fabric patterns, which are the results of designers being able to produce garments with precision high-quality textile printing.

The good durability green inks are being used by the ceramic and glass industries in home décor products like tiles, mugs, and bottles, which have no fade, and long-lasting features. The packaging industry is another top user of smart containers with QR codes, stunning holographic elements, and decorative interactive features. For instance, some of premium beverage companies implement inks that when applied heat change color creating a fun aspect in their brands.

Even though the demand is increasing, the sector faces some obstacles such as the high initial cost of advanced printing technology. Digital and UV-curable printing modes provide the highest efficiency; however, their procurement costs and operation costs are much higher, which, therefore, makes them less accessible for small and medium-sized businesses.

Furthermore, manufacturers are shifting to more sustainable materials due to stricter environmental regulations on VOC emissions and the absence of hazardous chemicals in the ink formulations. The shift to water-based and bio-based inks is one of the sustainable steps to be taken, but it will incur a lot of R&D investment and operational cost.

Explore FMI!

Book a free demo

The information in the table can help those interested in the decorative ink market design their research-related endeavors in accordance with the broader interests of the stakeholder community. Printing companies and packaging manufacturers pay lots of attention to the vibrancy and consistency of colors since, without vivid and uniform colors, they're unable to produce quality prints and present the brand effectively.

Adhesion and durability are also rated highly by packaging manufacturers, and there is a particular focus on inks and coatings that will suit a wide variety of substrates.

Marketing agencies prioritize customization and flexibility that aids the quick deployment of creative and innovative designs over process efficiency and adhesion. These factors are often rated medium by end users as they weigh ornamental achievement against prices.

Cost efficiency is rated medium across all groups, suggesting that pricing competitiveness is a widespread concern. This table shows that sectors of the ink industry are different in the performance and quality they seek, and ink manufacturers can use this information to best understand how to adapt their own products to the demands of the market.

The decorative inks industry characterized by a remarkable growth trend between 2020 and 2024, spurred by increasing demand from packaging, textiles, ceramics, and automobiles, was thus transformed by digital printing on one hand and sustainable inks and associated measures on the other.

Companies are giving importance to sustainability, and are now going ahead with water-based, UV-curable, and bio-based inks to mitigate environmental degradation. The decorative inks would also need to address parameters like durability, rich color schemes, and finishes to ensure branding, personalization, and product appeal.

From 2025 onward, technologies will be more readily imbued into inks even during the years 2030. Functionally smart inks and pigments such as thermochromic and photochromic inks would do well for interactive textiles and packaging.

The next step is increasing efforts toward sustainability with bio-derived pigments and recyclable ink formulations being the standard. Due to technological advances in digital printing, manufacturing will now be faster, less expensive, and much more conducive to tailoring.

| 2024 to 2025 | 2025 to 2035 |

|---|---|

| Stringent VOC emissions and REACH and EPA conformity. | Climate shifts favor the way toward biodegradable and aqueous inks. |

| Digital printing and UV-curable ink chemistry become prevalent. | Nanotechnology, smart inks, and AI-driven printing solutions flourish. |

| Strong demand in packaging, textiles, and automotive sectors. | Expansion into electronics, wearable technology, and architectural applications. |

| More water-based and solvent-free inks are used. | More focus on the circular economy, recyclability, and bio-based raw materials is increased. |

| Increased demand for aesthetically enhanced products and brand differentiation. | Rising demand for brands to integrate conductive, antimicrobial, interactive printing functional properties. |

The decorative ink market is subject to stringent environmental regulations and compliance concerning VOC emissions, as well as the use of hazardous substances. Compliant inks incur expensive reformulation costs, switching to water-based and UV-curable formulations, while non-compliance means market bans and fines. Brands that wait too long to make the shift to more sustainable formulations risk losing consumers and falling behind new legal requirements.

Decorative inks are based on volatile raw materials, such as pigments, solvents, and resins. Production costs are affected by price swings resulting from crude oil fluctuations, supply shortages or trade tariffs. Decorative ink sales are also affected by economic cycles as packaging, automotive, and home décor industries experience downturns that influence sales, causing revenue variability.

Cost-driven commodity inks and high-margin specialty formulations characterize the market. Basic CMYK inks follow a cost-plus pricing model, whereas value-based pricing applies to premium decorative inks based on additional performance and sustainability benefits.

Suppliers employ tiered pricing, providing low-price standard inks plus high-end custom formulations, challenges with that base requirement - luxury packaging, cosmetics, and textiles - to name a few. Differentiation of products is made by bundling inks with technical support or workflow integration, which justifies higher prices.

Long-term contracts, volume discounts and subscription-based ink supply models are used by manufacturers to stabilize pricing. Loyalty incentives, rebates and performance-based pricing-charging more for inks that boost productivity-are key for ink companies to stay competitive in a changing market.

The ceramic tiles segment dominates with growth in adoption of digitally printed tiles in residential and commercial space. Another area for extensive growth in decorative printing is using high-quality inks with vibrant colors and high durability, because consumers are looking for elaborate and customized designs on tile. Recent developments in inkjet printing technology have made it even better, allowing manufacturers to utilize high-resolution, low-cost detailed patterns.

Asia Pacific is a fast-growing region due to rapid urbanization and infrastructure development primarily in China and India. Furthermore, the focus on sustainable and energy-efficient printing solutions has spurred the evolution of water-based as well as UV-curable decorative inks for ceramic tiles. Fujifilm Holdings Corporation offers high-performance digital ceramic printing inks with vibrant color accuracy.

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 9.8% |

| European Union | 10% |

| China | 11% |

| Japan | 9.3% |

| South Korea | 10.5% |

FMI is of the opinion that the decorative inks industry in the USA is slated to grow at 9.5% CAGR during the study period. The USA industry for decorative ink is growing at a high rate due to increasing adoption across industries such as packaging, textiles, and window treatments. Being a green consumer goods and packaging leader, the demand for these products continues to increase.

Growth factors in the USA

| Key Drivers | Details |

|---|---|

| Flexible Packaging | Sustainable, lightweight packaging materials in food & beverage and cosmetics industries drive growth. |

| Digital Printing Advancements | Digitally printed high-quality personalized products are dominating traditional manufacturing processes. |

| Sustainability Initiatives | Increase in demand for water-based and bio-based inks due to the need to meet environmental regulations and reduce VOC emissions. |

| Personalization Demand Boom | Increased customer demand for personalized products leads to a boom in demand for decoration inks. |

The UK industry is commanded by increasing demand for low-impact, green inks, especially in the print media segment. Government emphasis on green ink development and formulation and innovation in new printing technologies drive the industry. FMI is of the opinion that the decorative ink market in the UK is slated to grow at 9.8% CAGR during the study period.

Growth factors in The UK

| Key Drivers | Details |

|---|---|

| Green Ink Formulations | Regulatory pressure for environmentally friendly and recyclable formulations, especially in plastic and paper packaging. |

| Technology Advances in Imprint | RFID tags and thermoelectric labels are at the forefront of decoration in textile, packaging, and consumer products industries. |

| UV-Curable Inks | Growing growth of UV-curable inks due to strength, smudge resistance, and high-speed printing efficiency. |

| Interior Decoration Trends | Seasonal demand for these products in furnishing homes, wallpaper printing, and artwork décor. |

| Smart Printing Solutions | IoT-based automated and high-precision ink application solutions. |

The EU is a selective industry, based on environmental regulation and technology pressure. The EU Green Deal and Circular Economy are focused on the sustainable manufacturing of ink, and the area leads in sustainable decorative ink technology. FMI is of the opinion that the decorative ink market in the European Union is slated to grow at 10% CAGR during the study period.

Growth factors in European Union

| Key Drivers | Details |

|---|---|

| EU Green Deal & Circular Economy | Promoting sustainable production and recycling of ink to preserve waste and pollution. |

| Development of Textile Printing Industry | Increased demand for sustainable inks in fashion, upholstery, and other decorative textiles sectors. |

| Development of Smart Packaging | Application of these products in smart packaging, such as interactive labeling functionality (QR codes, thermos-chromic effects). |

| Growth in Digital Printing | Adoption of faster digital printing technologies (inkjet, screen printing, flexographic) for increased efficiency in production. |

| Luxury & Special Printing Needs | Intense demand for decorative, embossed, and specially printed inks for luxury and high-fashion products. |

China is the biggest market due to its fast industrialization, consumer goods boom, and technological developments in printing. The industry is dominated by packaging, electronics, textiles, and automotive uses. This, along with heightened demand in various industries is slated to bolster the demand for the product. FMI is of the opinion that the Chinese industry is slated to witness 11% CAGR during the study period.

Growth factors in China

| Key Drivers | Details |

|---|---|

| Exponential Growth in Packaging | Heavy demand for decorative inks in food & beverage, personal care, and cosmetic packaging for appearance. |

| New Ink Formulations | Innovations and R&D in waterborne, biodegradable, and environmentally friendly inks to meet emission norms. |

| Electronic Printed Products | Growing demand for these products in electronic circuits, smart labels, and flexible display screens. |

| Government Schemes on Sustainability | Government policies in support of using green inks with reduced VOC emissions. |

Japan's decorative ink market thrives with precision engineering, technological innovations, and superior printing solutions. Automotive, electronics, and textiles are key segments with excellent demand. The surging focus on bio-based inks is further fueling the demand for the product. FMI states that the Japanese industry is slated to observe 9.3% CAGR during the forecast period.

Growth factors in Japan

| Key Drivers | Details |

|---|---|

| Automotive and Electronics Segment | Buoyant demand for these products used in automotive interior, dashboard, and electronic screen printing applications. |

| Eco-Friendly Developments | Emphasis on water-based, bio-based, and low-VOC inks in decorative printing. |

| Expansion of Ceramics and Textiles | Growing use of these products in luxury glassware, ceramic, and textile printing applications. |

| Growth of 3D Printing | Growing use of these products in 3D printing and additive manufacturing. |

South Korea's industry for decorative ink is growing as electronics, automotive, and packaging sectors increase. South Korea is embracing green and smart print technology to enhance efficiency and make products more beautiful. This, along with the deployment of the product in the automotive sector is anticipated to fuel industry growth in the country. FMI states that the South Korean industry is poised to register 10.5% CAGR during the forecast period.

Growth factors in South Korea

| Key Drivers | Details |

|---|---|

| Smart Packaging & Display Trends | There is increasing need for interactive branding and OLED displays, where these products are applied. |

| E-commerce & Retail Packaging | Growing demand for strong, branded packaging as online shopping websites increase. |

| Environmentally Friendly Inks | Continuous efforts towards low-VOC, soy-based, and water-based inks. |

| Expansion in Automotive and Consumer Goods | Use of these products in automobile branding, interior coating, and cosmetics. |

| Export of High-End Printing Technology | South Korea's leadership in high-end printing technologies simplifies its export. |

Reasons for the North American industry to be the key growth driving include demand in packaging, automotive, and industrial printing applications. Use of sustainable ink solutions is drastically changing the situation in the USA and Canada as enterprises push towards high-end packaging, personalization branding, and quality digital printing. Among the region's countries, the United States has the biggest share of the pie as its packaging, advertising, and commercial printing industries are very well established.

Moreover, the country is laying the foundation for the rapid assumption of custom inks among the brands due to e-commerce and retail industries being exceptionally active. In Canada, sustainability motives, and an ecological printing trend are dictating the low-VOC and water-based inks, with the luxury packaging and food labeling industries being at the forefront.

Europe still is among the important markets that are being impacted by tight environmental regulations, the growth of digital printing, and more companies choosing sustainable packaging practices. The most promising countries are Germany, France, Italy, and the UK, which are technological frontiers and are advancing the use of eco-friendly inks.

As an industrial printing and premium packaging center, Germany has recently experienced a surge of demand for luxury biodegradable and UV-resistant inks in the automotive sector and home décor. The fashion sector in France is quickly consuming inks in apparel, textiles, and high-end retail; with the brands, in question, printing on clothing, product labels, and promotional materials.

Italy is setting the pace in the luxury fashion, interior design, and packaging industry while also becoming the main source of investments in the sustainable and digital decorative ink solutions. The UK industry is also under great pressure to adopt green rings and recycle inks since the regulations are even stricter making companies trace the environmental impact of their operations.

The Asia Pacific region is envisioned to be the most rapidly evolving industry, mechanized by the quick industrialization, retail industry expansion, and the rise in textile and packaging production. High-performance inks are in high demand across a range of industries, including textiles, consumer electronics, luxury branding, and vehicle detailing.

The top four countries are China, India, Japan, and South Korea. Because of its dominance in mass production and printing. China has a significant demand for these products that are both high-quality and cheaply priced. These inks are currently receiving increased attention in the areas of interactive branding and smart packaging.

The Indian textile and fashion sectors emerge as a huge growth driver through the demand for digitally printed fabrics, and custom-printed textiles. Japan and South Korea are the fore runners when it comes to high-end automotive, consumer electronics, and smart printing technologies and thus they are increasing their investments in UV-curable, wear-resistant, and specialty inks.

Middle East, Latin America, and Africa are trending as nascent markets with luxury packaging, customizing the automobile industry, and elevating branding being the main drivers. Countries like Brazil and Mexico can be easily seen as affording more funds in packaging, advertisement, and textile printing, especially in the food, beverage, and retail sectors.

High-end retail together with luxury branding in the Middle East is leading in customer preferences for metallic, gold, and high-gloss inks, especially in cities like the United Arab Emirates and Saudi Arabia. The widening printing and packaging industry in Africa is also a factor to mention, with South Africa and Nigeria being the prime markets for affordable yet quality decorative ink solutions.

Sakata INX, Toyo Ink, and Sun Chemical are the industry leaders who have been dominating this particular arena owing to their innovation in technology, wide-reaching distribution network, and product development based on compliance. Huge investments are made by these companies in customization, high-speed printing compatibility, and sustainable formulations for unique clients' needs.

On the other hand, they are staking their market spaces in specialized niche applications and also in meeting specific regional requirements where they are able to solve problems in localized industries. The more high-quality inks with eco-friendliness, the more businesses inclined toward research-driven formulation advancements, adaptability to regulations, and incorporation of digital printing will contribute to shaping the competitiveness.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Sakata INX | 18-22% |

| Toyo Ink | 12-16% |

| Sun Chemical | 10-14% |

| Zeller+Gmelin | 8-12% |

| Siegwerk | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sakata INX | Provides high-performance inks for packaging, labels, and commercial printing applications. |

| Toyo Ink | Develops sustainable, low-VOC inks with advanced pigment dispersion for enhanced color vibrancy. |

| Sun Chemical | Offers innovative, environmentally friendly inks with superior durability and compliance. |

| Zeller+Gmelin | Specializes in tailored inks for high-precision printing and unique applications. |

| Siegwerk | Focuses on safe and sustainable ink solutions with customized formulations for various industries. |

Key Company Insights

Sakata INX (18-22%)

Sakata INX remains a leader in the decorative inks market with its extensive product portfolio and commitment to innovation in high-performance ink formulations.

Toyo Ink (12-16%)

Toyo Ink prioritizes eco-friendly printing solutions, focusing on advanced dispersion technology and sustainable ink formulations.

Sun Chemical (10-14%)

Sun Chemical is a key player with its strong R&D capabilities, providing durable and regulatory-compliant decorative inks for multiple applications.

Zeller+Gmelin (8-12%)

Zeller+Gmelin stands out for its specialty decorative inks, catering to niche industries with high-quality, custom solutions.

Siegwerk (6-10%)

Siegwerk enhances market competitiveness by offering sustainable and innovative ink technologies for both mass-market and specialized applications.

The industry is expected to be valued at USD 1.8 billion in 2025.

The value of the industry is projected to reach USD 4.9 billion by 2035.

China, slated to grow at 11% CAGR during the study period, is poised to witness fastest growth.

Key companies in the industry include Sakata INX, Toyo Ink, Sun Chemical, Zeller+Gmelin, Siegwerk, BASF, Nazdar, Micromark, DIC Corporation, Epple Druckfarben, Fujifilm, Colorobbia Holdings S.p.A, Fritta, Esmalglass - Itaca Grupo, Kao Chimigraf, Ferro Corporation, Sicer S.P.A, Tecglass, Torrecid Group, and Zschimmer & Schwarz.

These inks are widely used for ceramic tiles.

Based on application, the industry is classified into ceramic tiles, glass printing, food container printing, and other applications.

By region, the industry is divided into North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.