The decorative car accessories market is estimated to be USD 282.2 billion in 2025 and is expected to reach USD 496.5 billion by 2035, at a CAGR of 5.9% during the forecast period. This growth will underline an enormous increase in the demand for car customization options in both developed and developing nations.

Decorative car accessories include interior and exterior, such as seat covers, steering covers, LED lighting, decals, chrome trims, spoilers, and dashboards. It has become a key aspect of the entire experience of owning a vehicle. Consumers are inclining more toward representing their personalities and styles through their cars, creating a very thriving demand for decorative car accessories.

There are numerous factors responsible for this strong industry growth. Rising disposable income among the populace of developing and emerging countries like India, China, Brazil, and Southeast Asian nations has made it possible to spend more and more disposable income on a car upgrade that is not mandatory, yet appealing.

The rising number of owned vehicles, including the booming e-commerce sector, has made decorative accessories convenient for more consumers. Now, online platforms are outfitted with multiple brands and customizable types of accessories from which consumers can make their choices with much ease.

In addition, factors like rapid urbanization and the growing global youth population also drive consumer behavior. Young drivers give more importance to making their vehicles stylish by putting trendy, colorful, and tech-integrated accessories into their cars. As a result, there was more innovation combined with competition between manufacturers of new materials, designs, and smart accessories that reflected both form and functionality.

Some of these products being developed for the industry are also centered on environmental sustainability. More companies are using eco-friendly materials and sustainable production in compliance with global sustainability goals. Lately, this has been underpinned by some government policies that require the use of recyclable materials and reduce environmental effects due to automotive production.

The growing trend of electric vehicles (EVs), however, has opened new frontiers in decorative accessories to be found in specific interiors and exteriors of EVs. EV adoption will grow, and simultaneously, so will the demand for such accessories that match the futuristic look of these vehicles and their advanced features.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 282.2 billion |

| Industry Value (2035F) | USD 496.5 billion |

| CAGR (2025 to 2035) | 5.9% |

Explore FMI!

Book a free demo

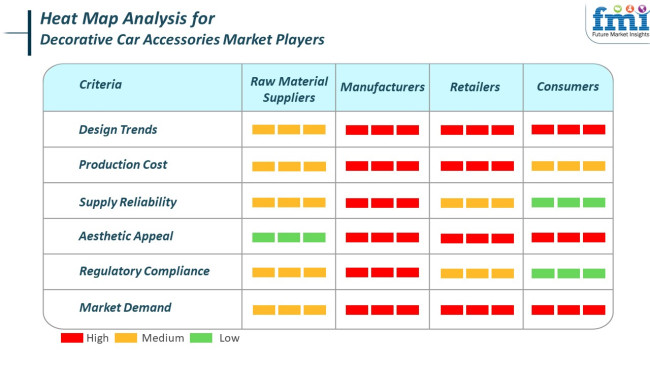

Aesthetic appeal, style trends, and consumer preferences for personalization drive demand in the industry. Manufacturers and retailers weigh design trends, aesthetic appeal, and industry demand (red) heavily as they directly determine product relevance and turnover. The second key driving force considered by both manufacturers and retailers is production cost, as it correlates directly with profit margins and pricing strategies in terms of retailing.

Raw material suppliers would place a moderate emphasis on production costs and supply reliability, ensuring that all plastics, metals, or sustainable alternatives are consistently delivered affordably. Consumers would consider design, aesthetic values, and industry demand (red) as the primary features of their making.

This shows the role of fashion and identity in vehicle customization. Regulatory compliance would be something the upstream actors are concerned with but less so for end users (green). This stakeholder segmentation reveals the industry as a mesh of practical and style-driven decisions.

What occurred from 2020 to 2024: The decorative car accessories industry quickly grew, with most industry proceedings rising because of improved car possession post-pandemic, rising dispensable income, and growing personalization of car owners. Once the interior was delivered, customers became ever more adept at customizing it, with steering wheel covers, seat covers, LED lighting, air fresheners, dashboard trim and so on.

Online stores were then introduced to offer a wider reach, featuring a range of beauty and utility products. Demand here was largely fashion-driven, there was no trivial technology integration, and the environmental issue didn't exist.

2025 to 2035: The industry will converge toward personalization, intelligent technology, and sustainability. Depending on the trim, smart ambient lighting, AI-reactive interior design and voice control updates will be integrated even further. Eco-conscious shoppers will want biodegradable vegan leather and trim made from recycled material.

The trim will also feature augmented reality head-up displays (HUDs), personalized digital instrument panels, and modular décor panels. With EVs and driverless car interiors, comfort and vehicle design preferences will be upended as car cabins become smartphone-style, user-centric smart spaces with preferred niceties.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Personalization trend, online retail expansion, rise in car ownership. | Intelligent interiors, integration of EV, need for intelligent and sustainable personalization. |

| Steering wraps, seat covers, LED lights, cushions, decals, and fresheners. | Intelligent LED designs, AI- interactable trims, modular, customizable dashboards, sustainable material finishes. |

| Underlying LED lights or Bluetooth-capable accessories. | Voice-interactive ambient settings, touch-sensitive décor, AR HUDs, interior styling enabled with IoT. |

| Sporty, luxurious, or themed looks (racing, vintage, etc.). | Hyper-personalized, modular, and intelligent themes with user behavior and driving mode. |

| PU leather, plastics, and man-made fibers. | Vegan leather, biodegradable fibers, recycled composites, and 3D-printed personal materials. |

| Motor sport enthusiasts and youth with emphasis on styling. | Mass consumer base with involvement of EV owners, tech-oriented families, and ecologically-friendly customers. |

| E-commerce and aftermarket retail oversaturated. | Direct OEM customization, AR-enabled online configurators, and subscription-based accessory upgrades. |

| Minimal-limited to some eco-friendly packaging. | Central to product design-low-impact materials, upcycled elements, and circular economy initiatives. |

| Low-mostly suited to manual or semi-automatic vehicles. | High compatibility with electric, autonomous, and connected cars for seamless décor-tech integration. |

| Counterfeit products, inconsistent quality, and short product life cycle. | Ensuring durability of tech-based accessories, cost control for smart materials, and personalization-security trade-offs. |

The industryconsists of a variety of risks that may have a bearing on growth and sustainability. Consumer preference volatility is one of the most prominent industry risks. Trends in automotive aesthetics are very quick, most particularly in the case of younger consumers, the view of car designs moves away from the shiny and flashy, or old-fashioned.

This requires manufacturers to keep up with the evolving tastes through trend analysis and product innovation. Moreover, economically hard times will probably lead consumers to essential spending on their budgets at the expense of nonessential decorative items. This calls for value-based characteristics and diversification in both decorative and functional accessories.

Competitive risks stand out in this industry because of the various players competing with a plethora of small, unorganized players who bring benchmark prices down and intensify competition. Brands need to differentiate themselves in terms of quality, technology integration, and sustainability.

Another thing is that OEMs are increasingly incorporating these decorative features directly into their car models. This could cause a decline in demand from aftermarket buyers unless high-end or personalized options are developed by accessory makers that typical OEMs will not offer.

Opportunities and threats emerge rapidly with technological advancement. With smart accessories such as LED lighting or app-enabled devices getting into everyday consumer lives, companies will have to continue updating their portfolios. It may be a challenge to ensure these products adapt well across a wide range of vehicle makes and models. The risk may be minimized by investing in modular or universal designs and providing clear compatibility guides. Regulatory risks are also relevant.

Governments across the board have been tightening up regulations with respect to automotive safety and environmental impact. Fines could be incurred for safety violations or non-sustainable materials, both posing potential threats to consumer confidence. This means manufacturers should be punishing themselves on the compliance path while adding eco-friendly materials like recycled plastics or biodegradable components.

The industry has supply chain disruptions, such as uncertainties in the sources of raw materials in plastics, leather, or electronic components. Disruption in the supply chain itself can arise from geopolitical tension, especially in a country hosting major manufacturing hubs such as China and India. Developing resilient supply lines through diversified sources and localization of production strategies will be helpful in reducing such vulnerabilities.

Finally, among the operational risks is the general quality and installation control, where accessories of very poor quality may tarnish the brand image and finally end up causing expensive returns, even liability issues with safety. Most such high-quality accessories require professional installation and are thus a deterrent to DIY customers. Brands can mitigate "poor-quality accessory" realistic accidents with a combination of quality and installation.

In the industry by vehicle type, passenger cars will dominate the industry with a 50% share in 2025, while light commercial vehicles (LCVs) constitute only 30%. The increasing demand for passenger cars is due to the ever-growing demand for personalizing vehicles among young urban consumers who relate their cars to an extension of their personality and lifestyle.

High demand for interior LED lighting, premium seat covers, dashboard trims, steering wheel wraps, and fancy alloy wheels characterize the passenger car category. Some of the recognized names in this space include Momo, 3D MAXpider, and those from the Auto Ventshade (AVS) line.

For instance, well-known high-end steering wheels and interior accents by Momo appeal to a certain kind of performance-oriented and style-focused driver. 3D MAXpider industries pleasing floor mats and sunshades with real custom fits that not only enhance the overall aesthetic view of the car interior but also offer some really useful value.

Light commercial vehicles, even if there are fewer in this sector, are still an important industry in themselves. Demand here is more functional, yet aesthetics still play an important role in creating vehicles for small businesses and fleet operators wanting to improve the brand image or increase driver comfort. Branded decals, utility-based trims, protective seat covers, and rugged floor mats typically fall into this category of accessories.

Some companies focusing on the specific LCV industry segments are WeatherTech, Putco, and Lund International. As in the case of WeatherTech, they offer hardwearing and good-looking, visually shiny accessorials such as mud flaps and floor liners that suit the very extensive use of commercial vehicles but keep them looking neat and professional.

In a nutshell, light commercial vehicles might have their relevance in certain utility-driven industries. Yet, the segment of passenger cars will cater primarily to the decorative accessories industry in 2025 due to the overwhelming customer thirst for aesthetic customization and luxurious in-car experiences.

In 2025, the offline store segment will surpass online stores in sharing the industry according to distribution channel, as it accounts for a whopping 60% share in the industry, while online stores only reap the remaining 40%. Most consumers still prefer the purchase of car accessories from offline retail outlets for seeing the product physically, for immediate installation, and for face-to-face consultations with sales personnel.

Major retail channels include Pep Boys, AutoZone, and NAPA Auto Parts, with thousands of products in stock, such as custom seat covers and dashboard trims with chrome enhancements, many of which are renovated with in-store assistance or installation services. AutoZone lets its customers gain hands-on experience pertaining to shopping, such as giving them the opportunity to assess the fitting and finish of accessories before buying them. Especially interesting is for customers who modify their cars for the first time or are prone to quality assurance.

While the brick and mortar have been leading the pack, online sites are coming up fast with the times, holding sway by virtue of e-commerce development and changing consumer behavior. Over 40% of the industry is digital, catering to the younger consumers who are more tech-savvy and prefer shopping from home for a diverse selection.

Some of the most important players are Amazon, CARiD, and Auto Anything. CARiD, of course, offers a large range of interior and exterior accessories for cars. Other major factors of interest are detailed specifications on products, customer reviews, and virtual customization to inform buyers better.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.6% |

| Germany | 5.8% |

| Italy | 5.4% |

| South Korea | 6.1% |

| Japan | 5.5% |

| China | 7.5% |

| Australia | 5.2% |

| New Zealand | 4.9% |

The USAindustry is projected to achieve a CAGR of 6.8% between 2025 to 2035, spurred by a strong automotive aftermarket and a growing consumer demand for vehicle personalization. Greater penetration of e-commerce platforms and a wide variety of interior and exterior accessories are further expanding the industry. Consumer demand for stylish car interiors, as well as growing ownership of luxury and sports cars, is pushing product diversification.

The main industry players in the USA are Covercraft, AutoZone, and Weather Tech. Competitive advantage is established through material innovation and environmentally friendly products. Moreover, increasing social media influence and websites are enhancing the visibility of the product and user interaction, providing fertile ground to grow further in this segment.

The UK industry is anticipated to expand at 5.9% CAGR from 2025 to 2035. Growing demand for personalization and aftermarket upgrades by younger car buyers is fueling industry growth. Access to locally specific accessory styling, coupled with increasing used car purchasing, is fueling appearance-enhancing product demand.

Major players in the UK industry include Halfords Group, Ring Automotive, and Richbrook. Product innovation based on green materials and web-based customization tools is helping brands extend their reach to a wider consumer base. Increasing vehicle ownership among suburban dwellers and increased interaction through online shopping channels are further fueling industry penetration.

France is expected to register a CAGR of 5.6% in the industry between 2025 to 2035. Growing concern for car appearances among urban buyers and demand for personal mobility are driving the adoption of decorative upgrades. The increasing demand for electric and hybrid cars, which offer new opportunities in interior and exterior customization, is also driving the industry.

Major players in France include Norauto, Feu Vert, and Valeo. Product differentiation and integration with advanced vehicle technologies are gaining popularity. The local industry is dominated by straightforward designs, which have influenced product strategy formulation and inventory choices across store channels.

Germany is most expected to observe a CAGR of 5.8% during the period between 2025 and 2035 in the industry. Dominant vehicle culture and the presence of luxury car brands have driven it to be a significant user of high-quality decorative accessories. The demand continues to be robust through segments of ambient light systems, seat improvement, and steering wheel covers.

Key players driving industry growth include Bosch, WALSER GmbH, and Dometic Group. Craftsmanship quality and technological development continue to be the key drivers of competitive industry positioning. Infotainment and navigation systems are being combined with decorative features, boosting the appeal of a hybrid segment of functional aesthetic accessories.

Italy's industry is expected to grow at a CAGR of 5.4% from 2025 to 2035. The industry is fueled by a keen love for cars, particularly stylish and high-performance cars. Design aesthetic inclination is promoting the trend for customized interior trim, upgraded dashboards, and colored LED lights.

Key players in the industry include Sparco, Lampa S.p.A., and Momo Italy. Trends in the industry are moving towards a blend of traditional Italian design motifs with contemporary-day customization options. Distribution through specialist auto boutiques and web-based channels is supplementing the availability and scope of products offered to the local consumer industry.

The South Korean industry is forecast to record a CAGR of 6.1% through 2035 in the automotive decorative accessories sector. A tech-savvy consumer base and high indigenous automotive manufacturing industry are fueling demands for enhanced automobile interiors in terms of aesthetics. Customized seat covers, headrest displays, and interior LED usage are in rising demand among urban drivers.

Major players in the industry include Hyundai Mobis, Autocraft, and Auto Clover. Spending on online shopping websites and influencer marketing campaigns is paying off in attracting consumer attention. Furthermore, the integration of technology with aesthetics, such as intelligent lighting systems, is redefining the expectations of products among different consumer groups.

Japan is expected to capture a CAGR of 5.5% in the industry for decorative car accessories during the forecast period. Strong demand for kei and compact cars among buyers has stimulated demand for fashionable and space-efficient accessories. The cleanliness of interiors and ergonomic design influence product portfolios in local brands.

Major industry companies include Autobacs Seven Co., Seiko Sangyo, and Croooober. Increasing demand for multifunctional ornament products, such as storageable mats and upgradeable modular seats, is spearheading the differentiation of the industry. The retail marketplace is also being supported by rewards programs and auto-owner clubs that encourage repeat purchasing.

China leads the industry in terms of growth with a forecasted CAGR of 7.5% between 2025 and 2035. Rapid growth of the automotive sector, increasing middle-class incomes, and increased consumer demand for automobile aesthetics are key drivers of growth. E-commerce websites such as JD.com and Alibaba are contributing significantly towards making decorative accessories affordable and accessible.

Some of the key industry players include Wanli, Yuwei, and Coverking China. Product innovation that emphasizes digital integration and cultural designs is heightening product appeal. Additionally, growing interest in vehicle lifestyle content is further enhancing the trend of personalization, especially in Tier 1 and Tier 2 cities among younger consumers.

The Australian industry is expected to grow at a CAGR of 5.2% during the forecast period. An expanding automotive aftermarket and rising demand for recreational and off-road vehicles are driving demand for interior and exterior accessories. Decorative dash cams, lighted scuff plates, and tough-themed interior trims are gaining popularity.

Industry leaders include Supercheap Auto, Aerpro, and Projecta. Strategic partnerships with global manufacturers and increasing product variety across online and store channels are propelling overall industry growth. Seasonal promotions and loyalty-based schemes are also encouraging consumer engagement in this segment.

New Zealand is projected to grow at a 4.9% CAGR in the industry over 2025 to 2035. Increasing awareness regarding car personalization and steady growth in the number of private vehicles are propelling industry growth. Aesthetically and functionally upgrading accessories for utility and family vehicles are seeing growing demand among consumers.

The bigger players in the industry are Mount Shop, Repco, and FitMyCar. The products that resonate with the driving tastes of the suburban and rural, i.e., weather-resistant seat covers and aesthetic storage units, are selling well. Additionally, the expansion of online auto accessory platforms is facilitating access to an expanded range of designs as well as types of products.

The industry is highly competitive due to the efforts of the major players to differentiate themselves through unique designs, materials ideas, and smart integration. For instance, leading companies such as Delphi Automotive, Robert Bosch GmbH, and Continental AG have deepened their expertise in providing premium aesthetic enhancements well-integrated within the overall vehicle architecture of interiors and exteriors.

Progressive trends emerging from leading competitors are the installation of smart decorative accessories like LED mood lighting in the interior of the vehicle and digital instrument clusters. The other ways in which the companies have attempted to achieve brand differentiation are by providing customized solutions and prestigious finishes.

Global players in the industry can keep their edge owing to strategic collaboration and acquisitions. For example, Robert Bosch GmbH strengthened its portfolio in customizability for decorative components through advanced infotainment systems. In contrast, Denso Corporation has applied newly presented IoT-enabled accessories that are compatible with modern vehicle architectures.

Highly sophisticated capabilities are currently being added within organizations that innovate lightweight materials with their sustainable materials-in-carbon-fiber trims, electrochromic surfaces, and, perhaps most notably, 3D-printed typically designed for maximum aesthetic appeal and functional enhancement.

Competition is created differently by OEM and aftermarket players. OEMs prefer factory-fitted accessories as integrated accessories, while aftermarket ones, such as 3D Carbon Automotive Corp. and Carroll Shelby International Inc., emphasize look- performance-oriented such as body kits, spoilers, and chrome accents.

Aftermarket players employ the direct-to-consumer (DTC) model, where customization can be done through e-business and authorized substations. It is the interplay between OEM-equivalent accessories and aftermarket modification that generates a vibrant industry.

Geographical strategies also delineate industry positioning: North America is all about muscle cars; Europe is luxury interiors; Asia builds affordable yet tech-rich accessories. Of course, sustainable innovations remain high-priority cilantro, while smart could gain stupendous ground, including biodegradable interior trims. With the processes of digital customization and even greener materials taking strides, companies are preparing for industry evolution by positioning themselves for long-term growth.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Delphi Automotive | 14-18% |

| Robert Bosch GmbH | 12-16% |

| Continental AG | 10-14% |

| Denso Corporation | 9-13% |

| Magna International | 8-12% |

| Combined Others | 30-40% |

| Company Name | Offerings & Activities |

|---|---|

| Delphi Automotive | High-end LED lighting, premium dashboard trims, and advanced infotainment bezels. |

| Robert Bosch GmbH | Smart ambient lighting, infotainment integration, and custom dashboard aesthetics. |

| Continental AG | Digital displays with customizable skins, touch-sensitive control panels, and chrome accents. |

| Denso Corporation | IoT -based decorative accessories, electrochromic panels, and smart surface integration. |

| Magna International | Performance-oriented spoilers, aerodynamic trims, and lightweight carbon fiber applications. |

Key Company Insights

Delphi Automotive (14-18%)

Delphi leads with high-tech decorative solutions, integrating LED ambient lighting, smart dashboard trims, and AI-enhanced personalization features for a premium experience.

Robert Bosch GmbH (12-16%)

Bosch enhances vehicle interiors with customizable digital displays, RGB ambient lighting, and AI-driven climate control panels tailored for luxury and performance vehicles.

Continental AG (10-14%)

Continental innovates in touch-sensitive interior trims, offering gesture-controlled panels, illuminated branding, and high-resolution infotainment aesthetics for modern vehicles.

Denso Corporation (9-13%)

Denso pioneers IoT-integrated decorative accessories, including electrochromic panels, smart infotainment bezels, and real-time lighting customization via mobile apps.

Magna International (8-12%)

Magna specializes in performance-based exterior styling, including aerodynamic trims, high-quality spoilers, and lightweight carbon fiber enhancements for enhanced aesthetics.

Other Key Players

In 2025, the industry is expected to be valued at USD 282.2 billion.

By 2035, the industry is projected to reach USD 496.5 billion, driven by increased personalization trends and rising disposable incomes.

China is expected to grow at a CAGR of 7.5%, fueled by a booming automotive aftermarket and consumer preference for stylish passenger vehicles.

The passenger vehicle segment holds a significant share, as consumers seek to enhance comfort, aesthetics, and functionality.

Leading players include Delphi Automotive, Robert Bosch GmbH, Continental AG, Denso Corporation, Magna International, Aisin Seiki Co. Ltd, Tenneco Inc., Federal-Mogul Corp., 3D Carbon Automotive Corp., and Carroll Shelby International Inc.

By product type, the industry is segmented into interior and exterior.

By vehicle type, the industry is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

By distribution channel, the industry is segmented into online store and offline store.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.