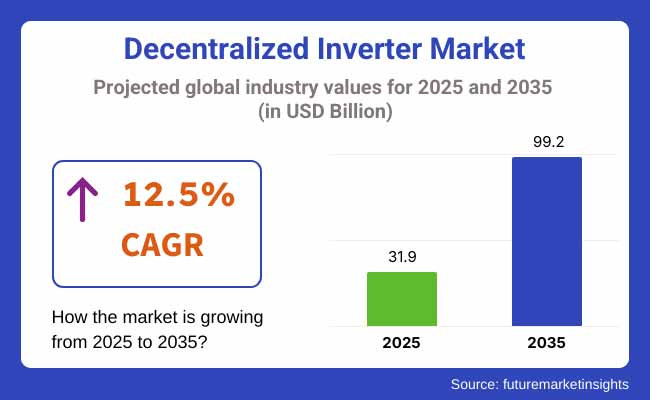

The decentralized inverter market is valued at USD 31.9 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 12.5% and reach USD 99.2 billion by 2035. In 2024, the industry saw significant developments, driven by both technological advancements and regulatory support.

Manufacturers made strides in improving inverter efficiency by adopting advanced semiconductor materials like silicon carbide (SiC), which enhanced thermal management and power density. This led to a broader application of decentralized inverters across residential, commercial, and industrial sectors.

Governments, particularly in Europe and North America, introduced or extended renewable energy incentives, including rebates and tax credits, further boosting demand for decentralized solutions. However, despite progress, the industry faced ongoing supply chain challenges, particularly with semiconductor shortages and the rising cost of raw materials, which caused delays in large-scale installations and project timelines.

Looking ahead to 2025 and beyond, the industry is expected to continue expanding, fueled by the growing adoption of solar power systems and a heightened focus on energy independence. Decreasing costs and increasing efficiency will make decentralized inverters more accessible, particularly for residential consumers.

Additionally, the integration of AI and IoT technologies will enable smarter inverters capable of real-time monitoring and optimization, further improving their efficiency and value. The market is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2025 to 2035.

Emerging industries, especially in Asia and Africa, will play a key role in the industry's growth, as these regions increasingly shift toward decentralized energy solutions to bypass traditional grid infrastructure and meet their renewable energy goals.

This industry is rapidly expanding as demand for renewable energy solutions and energy independence grows, driven by advancements in technology and supportive government policies. Key drivers include falling costs of solar power and increasing consumer demand for smarter, more efficient energy systems.

Companies that innovate in energy storage, smart inverters, and AI integration stand to benefit, while those unable to adapt to evolving regulatory and technological trends may struggle to maintain industry share.

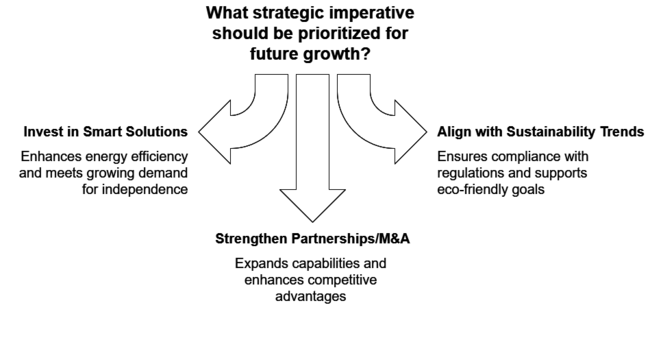

Invest in Smart, Scalable Solutions

To stay ahead, executives should prioritize investment in intelligent, scalable energy conversion systems that integrate AI and IoT for real-time monitoring and optimization. These smart systems will not only improve energy efficiency but also cater to the growing demand for residential and commercial energy independence. Expanding R&D efforts in this area will position the company to lead in next-gen energy solutions.

Align with Sustainability and Regulatory Trends

Focus on aligning product offerings with evolving environmental regulations and sustainability goals. With governments worldwide increasing renewable energy incentives and tightening carbon emission standards, companies must ensure that their solutions meet these regulatory requirements. Prioritizing eco-friendly, efficient, and regulatory-compliant products will drive industry acceptance and open up new opportunities in both mature and emerging industries.

Strengthen Partnerships and Explore M&A

Strategic partnerships with energy storage providers, technology firms, and key stakeholders in the renewable energy sector are essential to expand capabilities. Additionally, executives should explore mergers and acquisitions to gain access to new technologies, enhance product portfolios, and scale production capacity. This will allow for faster industry penetration, especially in emerging regions, and bolster competitive advantages in a rapidly evolving industry.

| Risk | Probability - Impact |

|---|---|

| Supply Chain Disruptions | High Probability - High Impact |

| Regulatory Uncertainty | Medium Probability - High Impact |

| Technological Obsolescence | Medium Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Enhance Product Innovation | Run feasibility on nickel-based insert sourcing for advanced inverters. |

| Expand Market Presence | Launch aftermarket channel partner incentive pilot to boost regional sales. |

| Improve Energy Efficiency | Develop energy-efficient inverter solutions with smart grid integration. |

To capitalize on the growing demand for this industry, the company must prioritize strategic investments in intelligent, scalable energy systems that leverage AI and IoT for real-time optimization. The evolving regulatory landscape and rising consumer demand for energy independence signal an urgent need to align product development with sustainability goals and compliance standards.

Immediate action should include ramping up R&D in smart inverter technologies, securing robust supply chain partnerships, and positioning the company as a leader in energy storage and grid integration.

The roadmap should shift to focus on innovation in next-gen energy solutions, while also actively engaging with policymakers and industry stakeholders to stay ahead of regulatory changes. By doing so, the company will not only differentiate itself in a rapidly expanding industry but also secure long-term growth in a competitive landscape.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, system integrators, and end-users in the US, Western Europe, Japan, and South Korea)

Key Priorities of Stakeholders

Adoption of Advanced Technologies

Material and Design Preferences

Price Sensitivity

Pain Points in the Value Chain

Future Investment Priorities

Regulatory Impact

Conclusion: Variance vs. Consensus

| Countries | Policies, Regulations, and Certifications |

|---|---|

| The USA | Federal and state incentives like ITC and PTC promote decentralized solar and storage. Inverters must meet UL 1741 and IEEE 1547 standards. California requires CEC compliance for grid-connected inverters. |

| UK | Clean Growth Strategy and SEG incentivize decentralized energy. Inverters need MCS certification and must comply with G59/3 for grid connection. |

| France | Energy Transition for Green Growth Act drives demand for decentralized systems. Inverters require QualiPV certification and must meet NF C 15-100 standards. |

| Germany | Energiewende promotes decentralized energy. Inverters must comply with VDE-AR-N 4105 and VDE 0126-1-1 standards. Feed-in tariffs are provided under EEG. |

| Italy | National Energy Strategy supports decentralized energy. Inverters need CE marking and must meet CEI 0-21 for grid connection. |

| South Korea | Renewable energy policies and incentives for solar and storage. Inverters must meet KTL certification for grid compliance. |

| Japan | Government promotes decentralized solar through FIT programs. Inverters must comply with JIS C 8961 for grid compliance. |

| China | National Renewable Energy Law and incentives promote decentralized energy. Inverters must meet GB/T 19939 and grid connection standards. |

| Australia-NZ | Renewable energy targets encourage decentralized systems. Inverters must comply with AS 4777 for grid connection in Australia and NZS 4777 standards in New Zealand. |

String inverter dominates the industry due to their cost-effectiveness and scalability in residential and small commercial installations. Microinverters are growing rapidly, especially in residential systems, for their ability to optimize energy from each panel, improving overall system performance.

Central inverters are mainly used in large-scale commercial projects, though their growth is slower compared to string and microinverters due to the increasing demand for modular solutions. Hybrid systems combining inverters with energy storage are gaining traction, particularly in regions with unstable grids or high electricity prices, as they offer enhanced energy management and backup capabilities.

Single-phase inverters are primarily used in residential applications where energy demand is lower, making them a cost-effective option. This segment is growing rapidly as more homeowners install solar power systems, driven by incentives and environmental awareness. Three-phase inverters are favoured in commercial and industrial sectors due to their ability to handle higher power loads and ensure stable energy distribution.

The demand for three-phase inverters is expected to rise as larger solar systems and energy storage solutions become more prevalent in commercial applications, offering greater energy independence and efficiency.

Low-output inverters (up to 10 kW) dominate the residential sector, as they provide an affordable and efficient option for smaller solar systems. As solar energy adoption continues to grow, these inverters are seeing increased demand, particularly in regions with high residential solar penetration. Medium-output inverters (10-50 kW) are expanding rapidly in small and medium-sized commercial applications, offering a balance between power capacity and cost-effectiveness.

High-output inverters (above 50 kW) are essential for large-scale solar farms and utility-scale projects, where the ability to handle significant power generation is crucial for grid integration. With increasing investments in large solar infrastructure, this segment is expected to experience steady growth.

From 2025 to 2035, the global decentralized inverter market is set to experience robust growth across both the standalone and on-grid segments. The on-grid segment will continue to dominate, fueled by the increasing adoption of large-scale solar installations, energy storage systems, and government incentives promoting renewable energy integration into the grid. Technological advancements in smart grids and energy management will further enhance the demand for on-grid inverters.

Meanwhile, the standalone segment will see accelerated growth, particularly in remote and off-grid areas, driven by the need for energy independence, stable power supply, and the growing adoption of hybrid solar systems. Both segments are poised for expansion as the world moves toward more sustainable and resilient energy solutions.

The industry in USA is growing at a CAGR of 8.5% between 2025 and 2035. The ITC, PTC and a backdrop of strong government incentives have all driven this growth, enabling an explosion of renewable energy systems like solar to come online.

These systems rely heavily on decentralized inverters for optimal energy transformation and Grid coupling. As the demand for (renewable) energy increases, more of these inverters will be needed. While challenges such as materials costs and supply chain disruptions will persist, industry growth will be supported by innovation and policy.

This industry in the UK is anticipated to grow at a CAGR of 7.5% from 2025 to 2035. The UK's commitment to reducing carbon emissions and promoting renewable energy through policies like the Smart Export Guarantee (SEG) is accelerating the adoption of decentralized energy solutions.

These systems require efficient inverters for energy conversion, and these inverters are becoming essential as more residential and commercial users install solar power and energy storage systems. Although grid integration and balancing challenges persist, the UK's renewable energy targets will keep driving demand for decentralized inverters over the next decade.

In France, the industry is projected to grow at a CAGR of 8.0% from 2025 to 2035. The country's strong focus on increasing its renewable energy share and reducing reliance on nuclear energy is promoting the adoption of decentralized systems, including solar installations that rely on inverters for efficient operation.

Government incentives such as the Energy Transition for Green Growth Act encourage the use of decentralized energy solutions. As the demand for solar power and energy storage systems increases, decentralized inverters will play a critical role in managing these systems and ensuring their compatibility with the grid.

The industry in Germany is expected to expand at a CAGR of 7.8%from 2025 to 2035. Germany’s Energiewende (Energy Transition) policy, which aims to reduce carbon emissions and transition to renewable energy, continues to drive the adoption of decentralized systems, especially solar power. Decentralized inverters are crucial in managing distributed energy sources and ensuring their integration into the grid.

The Feed-in Tariff (FiT) and industry premiums further incentivize solar adoption, driving demand for inverters. However, challenges such as grid integration and ensuring stability with a growing share of distributed energy will need to be addressed, but the overall industry outlook remains strong.

In Italy, the industry is expected to grow at a CAGR of 7.2% during the forecast period between 2025 and 2035. Italy's abundant solar resources make it an ideal industry for deploying decentralized systems, solar installations, and efficient inverters in combination systems. Incentives such as the Green New Deal and Conto Energia program are responsible for promoting the adoption of solar power solutions, resulting in a demand for these inverters.

Over the months as inverters become increasingly decentralized, they will become crucial in managing the influxes of solar energy into the grid as the country strives to meet ambitious renewable energy targets. The industry will continue to be influenced by growing challenges related to grid stability and integration with existing storage infrastructure, but overall growth is expected.

The South Korean industry is forecasted to grow at a CAGR of 9.5% from 2025 to 2035. The Green New Deal and the Energy Transition Roadmap of the government are fuelling the change of energy generation to clean energy, so decentralized inverters also play a critical role in solar and energy storage systems.

Considering South Korea’s severe population density and land limitations, decentralized systems can address energy demand in an efficient manner. There is a need for compact, high-efficiency inverters for energy conversion and grid stability. However, potential adopters will need to overcome challenges such as high costs and technical complexities in system integration.

Japan's industry is projected to grow at a 9.0% CAGR between 2025 and 2035. Japan is transitioning to renewable energy after Fukushima, making decentralized inverters crucial for the advancement of solar and energy storage systems. With the Feed-in Tariff (FIT) program still in place, the flow of solar installations continues, but energy conversion and grid integration is efficiently performed by inverters.

Japan is challenged by the need for compatibility with the grid, in addition to significant upfront costs for decentralized systems. Japan’s drive for energy independence and growing renewable energy capacity will maintain healthy demand for these inverters.

The industry in China is expected to grow at a CAGR of 10% from 2025 to 2035. China’s aggressive renewable energy policies, such as the Renewable Energy Law, are pushing for rapid adoption of decentralized energy solutions, including solar power.

Inverters are critical in managing distributed energy generation, and as China continues to invest heavily in solar infrastructure, demand for decentralized inverters will remain high. Grid integration challenges persist due to the scale of the energy transition, but China's focus on developing smart grids and energy storage will continue to drive the industry forward.

The industry in inverter industry in Australia and New Zealand is expected to grow at a CAGR of 8.1% from 2025 to 2035. Both countries have ambitious renewable energy targets, and decentralized energy systems, especially solar power, are becoming increasingly popular.

Inverters play a vital role in optimizing energy conversion and ensuring grid stability. Australia’s Renewable Energy Target (RET) and New Zealand’s solar incentives continue to drive growth in the industry. As more residential and commercial buildings adopt solar and storage solutions, the demand for high-efficiency inverters will grow, though grid challenges and system integration remain key concerns.

Huawei Technologies launched its Fusion Solar Smart PV Solution, integrating AI-powered inverters for energy optimization in large-scale commercial projects. This solution focuses on predictive maintenance and smart grid integration, strengthening Huawei’s global presence.

Sungrow Power Supply introduced a 1500V solar inverter for utility-scale projects, emphasizing efficiency, grid integration, and energy storage optimization. The company has focused on expanding integrated energy solutions, particularly in North America.

SMA Solar Technology updated its Sunny Highpower PEAK3 inverter series for large-scale applications, improving performance and integration with energy storage. Their strategy involves increasing their global footprint through enhanced smart inverter technology.

Power Electronics launched a modular inverter system for solar farms, offering increased flexibility and grid reliability. The new design caters to the growing demand in emerging industrys like India and Latin America. FIMER introduced a next-gen residential inverter, focusing on higher efficiency and smarter grid integration. Their approach targets growing residential and small commercial energy solutions, especially in Europe and North America.

TMEIC introduced a hybrid inverter system combining solar and energy storage solutions, aimed at large-scale renewable energy projects, offering improved grid stability. Ginlong Technologies expanded in North America with smart inverters for residential and commercial applications.

Huawei Technologies Co. Estimated Share: ~20-25%

A global leader in the decentralized inverter market, Huawei continues to dominate with its innovative string inverter solutions and strong presence in both residential and commercial segments. In 2024, Huawei expanded its product portfolio with next-generation inverters featuring enhanced AI-driven energy optimization.

Sungrow Power Supply Co., Ltd. Estimated Share: ~15-20%

Sungrow remains a key player, focusing on cost-effective and high-efficiency inverters. In 2024, the company announced a strategic partnership with a major European energy provider to supply decentralized inverters for large-scale solar projects.

SolarEdge Technologies, Inc. Estimated Share: ~10-15%

SolarEdge continues to innovate with its power optimizer technology, catering to residential and commercial industrys. In 2024, the company launched a new line of inverters with integrated battery storage solutions, targeting the growing demand for energy independence.

SMA Solar Technology AG Estimated Share: ~10-12%

SMA Solar maintains a strong foothold in the European industry. In 2024, the company introduced a new hybrid inverter series designed for seamless integration with renewable energy systems and grid stability.

Growatt New Energy Estimated Share: ~8-10%

Growatt has been expanding its global presence, particularly in emerging industrys. In 2024, the company announced the opening of a new manufacturing facility in Southeast Asia to meet rising demand.

GoodWe Estimated Share: ~7-9%

GoodWe has been gaining traction with its reliable and affordable inverters. In 2024, the company launched a new line of microinverters aimed at residential solar installations.

Fronius Estimated Share: ~6-8%

Fronius continues to focus on high-quality inverters for residential and commercial applications. In 2024, the company introduced a new inverter model with enhanced grid-support functionality.

Sineng Electric Co., Ltd. Estimated Share: ~5-7%

Sineng has been expanding its presence in international industries. In 2024, the company secured a major contract to supply inverters for a utility-scale solar project in the Middle East.

Ginlong Technologies Estimated Share: ~5-6%

Ginlong (Solis) has been focusing on innovation and reliability. In 2024, the company launched a new series of inverters with advanced monitoring and diagnostics capabilities.

ABB Estimated Share: ~4-6%

ABB remains a significant player, particularly in the industrial and utility segments. In 2024, the company announced a collaboration with a major utility provider to develop grid-friendly inverters.

The industry is bifurcated into string, micro.

The landscape is bifurcated into single phase, three phase.

The industry is bifurcated into standalone, on-grid.

The market is segmented into <= 0.5KW, 0.5-3 KW, 3-33KW, 33-110KW, >110KW.

The industry is categorized into residential, commercial & industrial, utilities.

The industry is studied across North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltics, East Asia, South Asia & Pacific, The Middle East & Africa.

They are used in solar energy systems to convert DC electricity to AC for grid integration.

The industry is expected to reach a value of USD 99.2 billion by 2035.

The major manufacturers of the industry include Huawei Technologies Co., Sungrow Power Supply Co., Ltd., SMA Solar Technology AG, Power Electronics S.L., FIMER S.p.A., TMEIC, Ginlong Technologies, Growatt New Energy, SolarEdge Technologies, Inc., Sineng Electric Co., Ltd., GoodWe, ABB, Fronius, Sofar.

The on-grid segment will continue to dominate, fueled by the increasing adoption of large-scale solar installations, energy storage systems, and government incentives.

The major applications of the decentralized inverters are solar power plants, residential solar installations, and commercial solar projects are the main users.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 & 2032

Table 3: Global Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 4: Global Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 5: Global Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 6: Global Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 7: Global Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 8: Global Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 9: Global Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 10: Global Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 11: Global Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 12: Global Market Volume (Units) Forecast by Application, 2017 & 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 14: North America Market Volume (Units) Forecast by Country, 2017 & 2032

Table 15: North America Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 16: North America Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 17: North America Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 18: North America Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 19: North America Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 20: North America Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 21: North America Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 22: North America Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 23: North America Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 24: North America Market Volume (Units) Forecast by Application, 2017 & 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 26: Latin America Market Volume (Units) Forecast by Country, 2017 & 2032

Table 27: Latin America Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 28: Latin America Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 29: Latin America Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 30: Latin America Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 32: Latin America Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 33: Latin America Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 34: Latin America Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 36: Latin America Market Volume (Units) Forecast by Application, 2017 & 2032

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2017 & 2032

Table 39: Western Europe Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 40: Western Europe Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 41: Western Europe Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 42: Western Europe Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 43: Western Europe Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 44: Western Europe Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 45: Western Europe Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 46: Western Europe Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 47: Western Europe Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 48: Western Europe Market Volume (Units) Forecast by Application, 2017 & 2032

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2017 & 2032

Table 51: Eastern Europe Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 52: Eastern Europe Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 53: Eastern Europe Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 54: Eastern Europe Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 56: Eastern Europe Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 58: Eastern Europe Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 60: Eastern Europe Market Volume (Units) Forecast by Application, 2017 & 2032

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 62: East Asia Market Volume (Units) Forecast by Country, 2017 & 2032

Table 63: East Asia Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 64: East Asia Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 65: East Asia Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 66: East Asia Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 67: East Asia Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 68: East Asia Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 69: East Asia Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 70: East Asia Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 71: East Asia Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 72: East Asia Market Volume (Units) Forecast by Application, 2017 & 2032

Table 73: South Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 74: South Asia Market Volume (Units) Forecast by Country, 2017 & 2032

Table 75: South Asia Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 76: South Asia Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 77: South Asia Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 78: South Asia Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 79: South Asia Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 80: South Asia Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 81: South Asia Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 82: South Asia Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 83: South Asia Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 84: South Asia Market Volume (Units) Forecast by Application, 2017 & 2032

Table 85: MEA Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 86: MEA Market Volume (Units) Forecast by Country, 2017 & 2032

Table 87: MEA Market Value (US$ Million) Forecast by By Product, 2017 & 2032

Table 88: MEA Market Volume (Units) Forecast by By Product, 2017 & 2032

Table 89: MEA Market Value (US$ Million) Forecast by By Phase, 2017 & 2032

Table 90: MEA Market Volume (Units) Forecast by By Phase, 2017 & 2032

Table 91: MEA Market Value (US$ Million) Forecast by Connection, 2017 & 2032

Table 92: MEA Market Volume (Units) Forecast by Connection, 2017 & 2032

Table 93: MEA Market Value (US$ Million) Forecast by Nominal Output, 2017 & 2032

Table 94: MEA Market Volume (Units) Forecast by Nominal Output, 2017 & 2032

Table 95: MEA Market Value (US$ Million) Forecast by Application, 2017 & 2032

Table 96: MEA Market Volume (Units) Forecast by Application, 2017 & 2032

Figure 1: Global Market Value (US$ Million) by By Product, 2022 & 2032

Figure 2: Global Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 3: Global Market Value (US$ Million) by Connection, 2022 & 2032

Figure 4: Global Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 5: Global Market Value (US$ Million) by Application, 2022 & 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 & 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 8: Global Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 12: Global Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 16: Global Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 20: Global Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 24: Global Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 28: Global Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 31: Global Market Attractiveness by By Product, 2022 to 2032

Figure 32: Global Market Attractiveness by By Phase, 2022 to 2032

Figure 33: Global Market Attractiveness by Connection, 2022 to 2032

Figure 34: Global Market Attractiveness by Nominal Output, 2022 to 2032

Figure 35: Global Market Attractiveness by Application, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by By Product, 2022 & 2032

Figure 38: North America Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 39: North America Market Value (US$ Million) by Connection, 2022 & 2032

Figure 40: North America Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 41: North America Market Value (US$ Million) by Application, 2022 & 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 & 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 44: North America Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 48: North America Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 52: North America Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 56: North America Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 60: North America Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 64: North America Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 67: North America Market Attractiveness by By Product, 2022 to 2032

Figure 68: North America Market Attractiveness by By Phase, 2022 to 2032

Figure 69: North America Market Attractiveness by Connection, 2022 to 2032

Figure 70: North America Market Attractiveness by Nominal Output, 2022 to 2032

Figure 71: North America Market Attractiveness by Application, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by By Product, 2022 & 2032

Figure 74: Latin America Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 75: Latin America Market Value (US$ Million) by Connection, 2022 & 2032

Figure 76: Latin America Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 77: Latin America Market Value (US$ Million) by Application, 2022 & 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 & 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 84: Latin America Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 88: Latin America Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 92: Latin America Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 96: Latin America Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 100: Latin America Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 103: Latin America Market Attractiveness by By Product, 2022 to 2032

Figure 104: Latin America Market Attractiveness by By Phase, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Connection, 2022 to 2032

Figure 106: Latin America Market Attractiveness by Nominal Output, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Western Europe Market Value (US$ Million) by By Product, 2022 & 2032

Figure 110: Western Europe Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 111: Western Europe Market Value (US$ Million) by Connection, 2022 & 2032

Figure 112: Western Europe Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 113: Western Europe Market Value (US$ Million) by Application, 2022 & 2032

Figure 114: Western Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Western Europe Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 120: Western Europe Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 123: Western Europe Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 124: Western Europe Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 127: Western Europe Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 128: Western Europe Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 131: Western Europe Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 132: Western Europe Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 135: Western Europe Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 136: Western Europe Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 139: Western Europe Market Attractiveness by By Product, 2022 to 2032

Figure 140: Western Europe Market Attractiveness by By Phase, 2022 to 2032

Figure 141: Western Europe Market Attractiveness by Connection, 2022 to 2032

Figure 142: Western Europe Market Attractiveness by Nominal Output, 2022 to 2032

Figure 143: Western Europe Market Attractiveness by Application, 2022 to 2032

Figure 144: Western Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: Eastern Europe Market Value (US$ Million) by By Product, 2022 & 2032

Figure 146: Eastern Europe Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 147: Eastern Europe Market Value (US$ Million) by Connection, 2022 & 2032

Figure 148: Eastern Europe Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 149: Eastern Europe Market Value (US$ Million) by Application, 2022 & 2032

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 156: Eastern Europe Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 160: Eastern Europe Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 164: Eastern Europe Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 168: Eastern Europe Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 172: Eastern Europe Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 175: Eastern Europe Market Attractiveness by By Product, 2022 to 2032

Figure 176: Eastern Europe Market Attractiveness by By Phase, 2022 to 2032

Figure 177: Eastern Europe Market Attractiveness by Connection, 2022 to 2032

Figure 178: Eastern Europe Market Attractiveness by Nominal Output, 2022 to 2032

Figure 179: Eastern Europe Market Attractiveness by Application, 2022 to 2032

Figure 180: Eastern Europe Market Attractiveness by Country, 2022 to 2032

Figure 181: East Asia Market Value (US$ Million) by By Product, 2022 & 2032

Figure 182: East Asia Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 183: East Asia Market Value (US$ Million) by Connection, 2022 & 2032

Figure 184: East Asia Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 185: East Asia Market Value (US$ Million) by Application, 2022 & 2032

Figure 186: East Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 188: East Asia Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 189: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 190: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: East Asia Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 192: East Asia Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 193: East Asia Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 194: East Asia Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 195: East Asia Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 196: East Asia Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 197: East Asia Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 199: East Asia Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 200: East Asia Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 201: East Asia Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 202: East Asia Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 203: East Asia Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 204: East Asia Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 205: East Asia Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 206: East Asia Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 207: East Asia Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 208: East Asia Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 209: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 210: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 211: East Asia Market Attractiveness by By Product, 2022 to 2032

Figure 212: East Asia Market Attractiveness by By Phase, 2022 to 2032

Figure 213: East Asia Market Attractiveness by Connection, 2022 to 2032

Figure 214: East Asia Market Attractiveness by Nominal Output, 2022 to 2032

Figure 215: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 216: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 217: South Asia Market Value (US$ Million) by By Product, 2022 & 2032

Figure 218: South Asia Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 219: South Asia Market Value (US$ Million) by Connection, 2022 & 2032

Figure 220: South Asia Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 221: South Asia Market Value (US$ Million) by Application, 2022 & 2032

Figure 222: South Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 223: South Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 224: South Asia Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 225: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 226: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 227: South Asia Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 228: South Asia Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 229: South Asia Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 230: South Asia Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 231: South Asia Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 232: South Asia Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 233: South Asia Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 234: South Asia Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 235: South Asia Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 236: South Asia Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 237: South Asia Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 238: South Asia Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 239: South Asia Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 240: South Asia Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 241: South Asia Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 242: South Asia Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 243: South Asia Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 244: South Asia Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 245: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 246: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 247: South Asia Market Attractiveness by By Product, 2022 to 2032

Figure 248: South Asia Market Attractiveness by By Phase, 2022 to 2032

Figure 249: South Asia Market Attractiveness by Connection, 2022 to 2032

Figure 250: South Asia Market Attractiveness by Nominal Output, 2022 to 2032

Figure 251: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 252: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 253: MEA Market Value (US$ Million) by By Product, 2022 & 2032

Figure 254: MEA Market Value (US$ Million) by By Phase, 2022 & 2032

Figure 255: MEA Market Value (US$ Million) by Connection, 2022 & 2032

Figure 256: MEA Market Value (US$ Million) by Nominal Output, 2022 & 2032

Figure 257: MEA Market Value (US$ Million) by Application, 2022 & 2032

Figure 258: MEA Market Value (US$ Million) by Country, 2022 & 2032

Figure 259: MEA Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 260: MEA Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 261: MEA Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 262: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 263: MEA Market Value (US$ Million) Analysis by By Product, 2017 & 2032

Figure 264: MEA Market Volume (Units) Analysis by By Product, 2017 & 2032

Figure 265: MEA Market Value Share (%) and BPS Analysis by By Product, 2022 & 2032

Figure 266: MEA Market Y-o-Y Growth (%) Projections by By Product, 2022 to 2032

Figure 267: MEA Market Value (US$ Million) Analysis by By Phase, 2017 & 2032

Figure 268: MEA Market Volume (Units) Analysis by By Phase, 2017 & 2032

Figure 269: MEA Market Value Share (%) and BPS Analysis by By Phase, 2022 & 2032

Figure 270: MEA Market Y-o-Y Growth (%) Projections by By Phase, 2022 to 2032

Figure 271: MEA Market Value (US$ Million) Analysis by Connection, 2017 & 2032

Figure 272: MEA Market Volume (Units) Analysis by Connection, 2017 & 2032

Figure 273: MEA Market Value Share (%) and BPS Analysis by Connection, 2022 & 2032

Figure 274: MEA Market Y-o-Y Growth (%) Projections by Connection, 2022 to 2032

Figure 275: MEA Market Value (US$ Million) Analysis by Nominal Output, 2017 & 2032

Figure 276: MEA Market Volume (Units) Analysis by Nominal Output, 2017 & 2032

Figure 277: MEA Market Value Share (%) and BPS Analysis by Nominal Output, 2022 & 2032

Figure 278: MEA Market Y-o-Y Growth (%) Projections by Nominal Output, 2022 to 2032

Figure 279: MEA Market Value (US$ Million) Analysis by Application, 2017 & 2032

Figure 280: MEA Market Volume (Units) Analysis by Application, 2017 & 2032

Figure 281: MEA Market Value Share (%) and BPS Analysis by Application, 2022 & 2032

Figure 282: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 283: MEA Market Attractiveness by By Product, 2022 to 2032

Figure 284: MEA Market Attractiveness by By Phase, 2022 to 2032

Figure 285: MEA Market Attractiveness by Connection, 2022 to 2032

Figure 286: MEA Market Attractiveness by Nominal Output, 2022 to 2032

Figure 287: MEA Market Attractiveness by Application, 2022 to 2032

Figure 288: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decentralized Packaging Kiosks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Decentralized Social Network Market Size and Share Forecast Outlook 2025 to 2035

Decentralized Finance Technology Market Trends - Growth & Forecast 2025 to 2035

Inverter Duty Motor Market Size and Share Forecast Outlook 2025 to 2035

PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Solar Inverter Market Growth - Trends & Forecast 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Digital Inverter Market Report – Growth & Forecast 2017-2027

PV Micro Inverters Market Trends & Forecast 2025 to 2035

Portable Inverter Generators Market Analysis by Power Rating, Power Source, Application, and Region through 2035

Traction Inverter Market

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Solar Microinverter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Inverters Market

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA