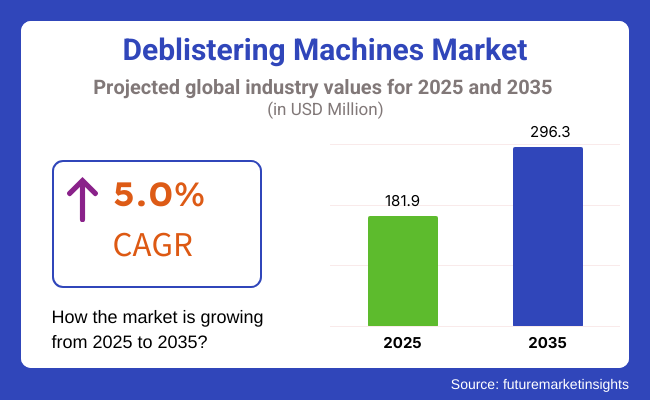

The market for deblistering machines is estimated to generate a market size of USD 181.9 million in 2025 and would increase to USD 296.3 million by 2035. It is expected to increase its sales at a CAGR of 5.0% over the forecast period 2025 to 2035. Revenue generated from deblistering machines in 2024 was USD 173.3 million.

Pharmaceutical will continue to hold over 51% of the deblistering machines market share in 2035. Pharmaceutical companies are the largest end-users of deblistering machines. Pharmaceutical companies need high-speed, automated equipment to reclaim defective or surplus tablets and capsules from blister packs effectively. Strict regulatory conditions for pharmaceutical manufacturing create a need for precise product recovery with minimal risk of contamination, and deblistering machines become part of their process.

Additionally, deblistering equipment to reduce waste packaging has added to demand since deblistering machines support the removal of excess drugs to be repacked or disposed of. With growing pharmaceutical manufacturing throughout the world, manufacturers continue to drive phenomenal demand for deblistering equipment with superior performance.

In the operating speed segment, deblistering machines at a working rate of 40 to 80 BPM are greatly favored due to their effectiveness for medium- to high-capacity pharmaceutical processes. They provide both speed and precision, making them suitable for hospitals, pharmacies, and manufacturers. Their capability for processing different materials of blister packs increases their diversity and demand.

The deblistering machines market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 123.1 million and will increase 1.7 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global deblistering machines market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 4.8% (2024 to 2034) |

| H2 | 5.2% (2024 to 2034) |

| H1 | 3.9% (2025 to 2035) |

| H2 | 6.1% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.8%, followed by a slightly higher growth rate of 5.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.9% in the first half and remain relatively moderate at 6.1% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 90 BPS.

Reducing Drug Waste and Increasing Recycling

Pharmaceutical companies, hospitals, and pharmacies worldwide are trying to minimize medicine waste and recycle more packaging. When medicines are blister-packed but cannot be used due to misprints, recalls, or damaged packaging, they must be safely extracted anyway. Deblistering machines assist in the removal of tablets and capsules from these packs without them being destroyed to enable them to be disposed of or recycled.

The majority of nations today have more stringent laws regarding the disposal of medical waste, and hence, companies have to recycle material from blister packs such as plastic and aluminum. As drug production expands globally, businesses are investing more in automatic deblistering machines to speed up the process, reduce wastage, and recover usable medicine efficiently.

Development of the Pharmaceutical Sector and Drug Repackaging

The global pharmaceutical industry is growing strongly due to a surge in chronic disease, growing elderly populations, and higher demands for healthcare. Along the way, there also comes a greater need for drug repackaging, wherein drugs are transferred from one packaging format to another-i.e., packaging tablets from blister packs into containers or bulk vessels. Deblistering machines help towards this end by de-pilling tablets quickly and safely without damaging them.

The machines are also employed by drug firms in quality control and recall cases where drugs have to be de-packaged due to errors. With more countries placing focus on streamlined drug handling and cost-cutting measures, deblistering machines become a critical component of pharmaceutical production and repackaging worldwide.

High Maintenance Cost of Machines

Deblistering machine industry is the high price of purchasing and maintaining these machines. Sophisticated deblistering machines, particularly completely automated machines, tend to be costly, and for smaller pharmacies and repackaging firms, they become challenging to purchase. Moreover, replacement and specialized parts are also necessary for these machines at periodic times, which may increase long-term expenses.

Traditional manual deblistering procedures are still chosen by some firms of developing nations due to lesser costs, albeit being slower and less effective. Moreover, upgrading the machines time and again with new pharmaceuticals packaging designs every now and then can be costlier. The high investment required in such machinery can hinder its adoption, especially in cost-conscious markets.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Automation & High-Speed Processing | Increasing demand for pharmaceutical recovery and repackaging requires automated deblistering machines to improve efficiency and reduce manual labor. |

| Versatility & Multi-Blister Compatibility | Machines capable of handling various blister pack designs, materials, and tablet/capsule sizes will enhance adaptability for different pharmaceutical applications. |

| Product Integrity & Damage Prevention | Investing in gentle yet effective deblistering mechanisms maintains product integrity, reducing breakage and waste. |

| Regulatory Compliance & Safety Standards | Compliance with FDA, GMP, and EU pharmaceutical regulations will be essential for machine acceptance in the pharmaceutical sector. |

| Sustainability & Material | Recovery Improving material separation capacity for efficient recycling of aluminum, plastic, and reclaimed medication will meet sustainability objectives and minimize waste. |

The global deblistering machines market achieved a CAGR of 3.7% in the historical period of 2020 to 2024. Overall, the deblistering machines market performed well since it grew positively and reached USD 173.3 million in 2024 from USD 148 million in 2020.

Deblistering machines industry went through consistent growth during the period of 2020 to 2024, spurred by growing demand for effective recovery of pharmaceutical packaging, rising emphasis on minimizing medication loss, and innovations in automation to ensure better accuracy and speed.

| Market Aspect | 2019 to 2024 (Past Trends) |

|---|---|

| Material Trends | Use of stainless steel and premium polymers because they are durable and simple to clean. |

| Regulatory Environment | Conformity with GMP (Good Manufacturing Practices) and FDA guidelines for the disposal of packaging wastes and safety. |

| Consumer Demand | Demand from pharmaceutical businesses for effective, safe, and reliable deblistering solutions. |

| Technological Developments | Introduction of semi-automatic and fully automatic deblistering machines for increased precision and quicker throughput. |

| Sustainability Initiatives | Focus on improving deblistering machine efficiency in order to reduce waste and energy consumption. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Material Trends | Shift towards green and recyclable materials for contribution towards sustainability in pharmaceutical packaging and deblistering. |

| Regulatory Environment | More rigid regulations aimed at cutting pharmaceutical waste and encouraging effective recycling methods, particularly for controlled substances. |

| Consumer Demand | Growing preference for automated, high-speed, and high-precision deblistering machines that minimize human error and risk of contamination. |

| Technological Developments | Application of AI, robotics, and IoT for real-time monitoring, predictive maintenance, and data-driven optimization in deblistering operations. |

| Sustainability Initiatives | Tremendous thrust for machines that enable recycling of blister packs, utilization of eco-friendly parts, and minimal environmental footprint in pharma manufacturing. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Speed, Accuracy, Recovery Rate) |

|

| Aesthetics & Branding |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Speed, Accuracy, Recovery Rate) |

|

| Aesthetics & Branding |

|

| Reusability & Circular Economy |

|

Between 2025 and 2035, demand for deblistering machines will increase as a result of increasing applications in pharmaceutical repackaging and recycling, increasing use of high-speed and GMP-compliant machines, and rising innovations in automated, non-destructive deblistering solutions to improve operational efficiency and product integrity.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Omnicell, Inc., Uhlmann Pac-Systeme GmbH & Co. KG, ACG Worldwide Private Limited, RBP Bauer GmbH.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Sepha Limited, Stripfoil Deblistering Technology, Jornen Machinery Co., Ltd., SaintyCo International Group, Elmach Packages India Pvt. Ltd, Nuova ICS Automazione, Pentapack NV.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Europe | Leading market due to strict EU pharmaceutical waste management regulations. |

| North America | High demand due to stringent pharmaceutical regulations on drug repackaging and recovery. |

| Latin America | Moderate market growth due to increasing pharmaceutical production in Brazil and Mexico. |

| Middle East & Africa | Demand driven by hospital and pharmacy sectors in the UAE and South Africa. |

| Asia Pacific | Growing focus on cost-efficient and high-capacity machines for mass production. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Europe | Strong focus on sustainable, energy-efficient, and recyclable deblistering processes. |

| North America | Growth in automated and robotic deblistering machines for higher efficiency. |

| Latin America | Expansion of local machine manufacturing to reduce costs. |

| Middle East & Africa | Expansion of semi-automatic and manual deblistering machines for cost-sensitive markets. |

| Asia Pacific | Expansion of local manufacturers producing affordable, high-performance machines. |

The section below covers the future forecast for the deblistering machines market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.9% through 2035. In Europe, Spain is projected to witness a CAGR of 4.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| Germany | 3.5% |

| China | 5.9% |

| UK | 3.4% |

| Spain | 4.6% |

| India | 6.1% |

| Canada | 3.7% |

Germany is the world leader in pharma manufacturing and automation, and its pharma industry is shifting towards end-to-end automated processes under Industry 4.0. High-speed deblistering machines with precision are being invested in by pharma companies that can be integrated into robotics, artificial intelligence (AI), and intelligent manufacturing systems. Germany has stringent Good Manufacturing Practice (GMP) and European Medicines Agency (EMA) regulations on the handling of drugs while packaging and repackaging.

To adhere to these regulations, pharmaceutical companies as well as German repackaging companies are getting high-quality deblistering machines installed so that efficiency would be enhanced, errors minimized, and wastage minimized. Owing to the focus of the country on technology advancement, demand for automated and intelligent deblistering systems in the German pharma sector is growing.

In America, there is a strong focus on waste reduction in the medical field and proper drug disposal. Hospitals, drugstores, and pharmaceutical industries are duty-bound to follow strictly FDA and DEA guidelines so that they do not waste medicine and dispose of unused or expired medicine safely. Deblistering machines play a vital role in this regard by pulling out pills from blister packs efficiently so that they are disposed of properly, re-packaged, or donated in compliance with laws.

The USA also experiences increasing pharmaceutical recalls, and thus manufacturers and pharmacies require quick and safe means of recovering drugs. Second, as the nation strives for more environmentally friendly drug packaging and recycling, automated deblister machines assist in salvaging materials such as plastic and aluminum, placing them at the center of industrial importance.

The section contains information about the leading segments in the industry. In terms of automation segment type, automatic deblistering machines is being estimated to account for a share of 48% by 2025. By operating speed, 40 to 80 BPM are projected to dominate by holding a share above 41.7% by the end 2025.

| Automation Segment | Market Share (2025) |

|---|---|

| Automatic Deblistering Machines | 48% |

Automatic deblistering machines are ruling the market because they are extremely efficient, involve very little manual effort, and can process high numbers of blister packs. Automatic deblistering machines are easily applied by pharmaceutical companies and large medical centers to retrieve capsules and tablets without causing any damage. The growing requirement to mechanize pharmaceutical packaging operations in order to reduce errors and improve efficiency has also spurred the use of automatic deblistering machines.

Moreover, the capability of handling intricate packaging material and delivering high-speed recovery is most suited for bulk pharma operations. Moreover, employing advanced technology, such as robotic automation and intelligent sensors, has maximized their accuracy and reliability, further augmenting their market share.

| Operating Speed Segment | Market Share (2025) |

|---|---|

| 40 to 80 BPM | 41.7% |

Deblistering machines with a speed capacity ranging from 40 to 80 BPM are industry leaders since They are used in the widest applications by medium- to large-scale pharmaceutical companies, pharmacies, and hospitals. Also, they have the ideal combination of speed and efficiency.

They are a cost-effective solution for deblistering tablets and capsules at moderate speed, delivering productivity as well as accuracy. With increased production of pharmaceuticals, these machines are the ideal solution without necessitating heavy capital investment in terms of high-speed machines. Being versatile to accept various forms of blister packs with ease of use and maintenance, they are the industry favorite.

Key players of global deblistering machines industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Deblistering Machines Market

| Manufacturer | Vendor Insights |

|---|---|

| Sepha Ltd. | Specializes in designing and manufacturing deblistering machines that ensure efficient and safe recovery of pharmaceuticals from blister packs. |

| Omnicell, Inc. | Offers automated deblistering solutions that integrate with pharmacy operations to enhance medication management and reduce waste. |

| RBP Bauer GmbH | Provides a range of deblistering machines known for their precision and adaptability to various blister pack formats, catering to both small and large-scale operations. |

| Stripfoil Deblistering Technology | Focuses on innovative deblistering equipment that accommodates diverse packaging types, emphasizing user-friendly designs and operational efficiency. |

| Uhlmann Pac-Systeme GmbH & Co. KG | Renowned for advanced packaging machinery, Uhlmann offers deblistering machines that combine high performance with flexibility to meet the evolving needs of the pharmaceutical industry. |

Key Players in Deblistering Machines Market

The global deblistering machines industry is projected to witness CAGR of 5.0% between 2025 and 2035.

The global deblistering machines industry stood at 173.3 million in 2024.

Global deblistering machines industry is anticipated to reach USD 296.3 million by 2035 end.

East Asia is set to record a CAGR of 6.1% in assessment period.

The key players operating in the global deblistering machines industry include Omnicell, Inc., Uhlmann Pac-Systeme GmbH & Co. KG, ACG Worldwide Private Limited, RBP Bauer GmbH.

The deblistering machines market is categorized based on automation into automatic, semi-automatic, and manual.

The market is segmented by operating speed into up to 40 BPM, 40 to 80 BPM, and above 80 BPM.

The end-use market includes pharmaceutical manufacturers, pharmacies, hospitals & clinical laboratories, and medical waste recyclers.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

North America PET Blow Molder Market Growth - Forecast 2025 to 2035

Liquid Capsule Filling Machines Market Trends – Growth & Forecast 2025 to 2035

Label Printers Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.