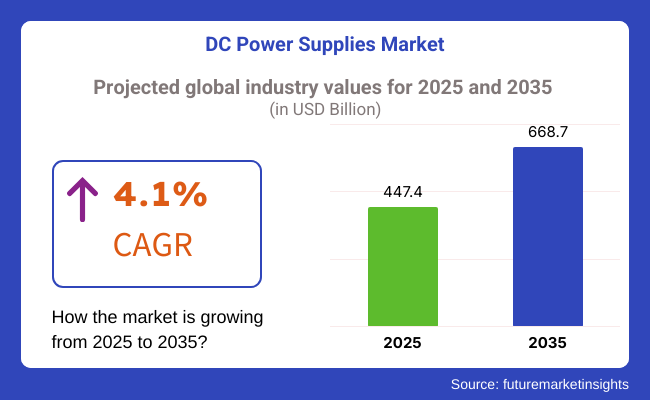

The DC power supplies market is expected to grow from USD 447.4 billion in 2025 to USD 668.7 billion by 2035. The market is steady to expand at a CAGR of 4.1% during the forecast period. Growth is fueled by rising industrial automation, EV adoption, and expansion of renewable energy systems.

China will lead in terms of absolute market size, driven by large-scale manufacturing and EV infrastructure. India, on the other hand, is projected to be the fastest-growing country between 2025 and 2035, owing to its accelerating digitalization, expanding telecom networks, and increasing demand for high-efficiency, compact power supplies across automotive and industrial sectors. Additionally, supportive government policies, Make-in-India initiatives, and investments in smart grid infrastructure are catalyzing local production.

The market is undergoing rapid transformation, driven by surging demand from electric vehicles, industrial automation, and next-generation telecom infrastructure. The proliferation of semiconductor-based systems, battery storage platforms, and high-density computing is pushing manufacturers to deliver compact, modular, and high-efficiency power solutions.

Key trends include the adoption of programmable power supplies, integration of AI-enabled diagnostics, and transition toward wide-bandgap semiconductor materials like GaN and SiC for better thermal and energy performance. However, market expansion is restrained by fluctuating raw material costs, complex regulatory standards, and design challenges in achieving high-voltage isolation within compact footprints.

The market is expected to witness sustained innovation and structural transformation. The shift toward electrified transport, AI-enabled manufacturing, and decentralized power systems will intensify the demand for programmable, high-efficiency DC units with remote monitoring and adaptive control capabilities.

Emerging sectors such as EV fast charging, renewable microgrids, and 5G infrastructure will require higher voltage, compact, and thermally optimized supplies. Regulatory pressure to improve energy efficiency and reduce electronic waste will further push innovation in design and recyclability. As industries transition toward digital, connected operations, DC power supplies will evolve into intelligent systems embedded within broader automation and control ecosystems.

The DC power supplies market is segmented based on type, output power, application, and region. By type, the market is segmented into AC-DC and DC-DC power supplies. Based on output power, the market is categorized into low output (up to 10 kW), medium output (10 to 100 kW), and high output (100 to 250 kW).

By application, the market is segmented into aerospace, defense & government services, automotive, energy, wireless communication & infrastructure, and others, which include industrial automation, semiconductor equipment, research labs, and medical systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The AC-DC segment currently leads the market and is projected to remain dominant through 2035. This is attributed to its essential role in converting grid-level alternating current into regulated direct current, used extensively in electronics assembly lines, telecom base stations, medical devices, and automotive control units, growing at a CAGR of 3.8%. This segment’s growth is driven by increased deployment of digitally controlled units with universal AC inputs, programmable outputs, and energy-saving features such as soft start, remote sensing, and PFC circuits.

Meanwhile, the DC-DC segment, though smaller in base value, is gaining traction in high-growth verticals like electric mobility, aerospace systems, and edge computing. Demand for isolated, high-efficiency, and high-frequency DC-DC converters is intensifying, especially for modular integration in EV battery packs and onboard electronics. As decentralized electronics and power-dense environments expand, both segments are expected to complement each other, with AC-DC dominating traditional power infrastructure and DC-DC driving future-ready applications.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| AC-DC | 3.8% |

The medium output segment is projected to be the most lucrative, driven by the rising deployment of EV charging stations, smart grid infrastructure, and high-capacity industrial automation systems, and accelerating at a CAGR of 5.2%. Medium output supplies strike the ideal balance between scalability and efficiency, making them suitable for EV powertrains, robotics, and energy storage systems. These supplies support dynamic voltage needs and are being designed with programmable interfaces and remote diagnostics for real-time monitoring.

While the low output segment leads in volume due to its extensive use in telecom, labs, and consumer electronics, its growth is steady but moderate. On the other hand, the high output segment is growing from a small base, supported by fast-charging EV hubs, aerospace testing rigs, and large industrial loads. Overall, medium output power supplies are emerging as the performance backbone for scalable electrification. Increasing integration of AI-based power management and advanced thermal control further enhances the reliability and efficiency of medium output supplies.

Manufacturers are also focusing on modular designs to facilitate easier upgrades and maintenance, catering to evolving industrial demands. These trends position the medium output segment as a critical enabler for the energy transition and Industry 4.0 adoption.

| Output Power Segment | CAGR (2025 to 2035) |

|---|---|

| Medium Output | 5.2% |

Among these segments, automotive emerges as the most lucrative application segment, registering a CAGR of 5.5%, outpacing the global average of 4.1%. This growth is driven by soaring demand for onboard chargers, battery management systems, thermal controls, and EV test benches. As electric vehicles proliferate across both consumer and commercial fleets, demand for stable, compact, and intelligent DC power modules has surged. Further, OEMs are increasingly investing in 800V architecture systems, requiring high-frequency, high-reliability DC supplies.

While other segments such as aerospace and defense remain critical to market diversification, they offer lower scalability compared to the mass adoption potential in automotive. The infrastructure buildout for charging stations and intelligent power control is also reinforcing automotive’s dominance.

With higher volume, integration intensity, and application diversity, automotive is set to lead DC power supply revenue generation over the forecast period. Additionally, continuous advancements in semiconductor technologies and power electronics are enabling automotive systems to achieve greater efficiency and durability. These innovations further solidify automotive’s role as the growth engine within the market.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive | 5.5% |

Challenges

Opportunities

DC Power Supplies Market Highlights the United States DC Power Supplies Market is poised for steady growth, fuelled by increasing industrial automation, an upsurge in demand for electric vehicles, and advancements in renewable energy integration. DC power supplies are a key device in modern infrastructure for R&D applications, battery charging, telecommunications, and industrial equipment.

The rapid growth of EV manufacturing and charging infrastructure is one of the main market drivers. An increasing number of DC fast chargers need high-efficiency DC power supplies to charge, and the US government has allocated 7.5 billion to build EV charging infrastructure under the Bipartisan Infrastructure Law.

Another important element is the expansion of data centers. The boom in cloud computing and AI applications has prompted companies like Google, Amazon and Microsoft to scale up their data centre capabilities, resulting in increased deployment of high-efficiency DC power solutions for nonstop power delivery to these operations.

The American industrial automation market, worth more than 220 billion, is also driving demand for equipment like programmable DC power supplies used in robotics, semiconductor testing and process control systems.

Moreover, the rollout of 5G networks is driving the telecommunications sector to adopt DC power solutions for remote and backup power applications that ensure continuous connectivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

Driven by the rising adoption of renewable energy, increasing electric vehicle penetration, and advancements in industrial electronics, the UK DC Power Supplies Market is flourishing. The UK government’s commitment to achieving net-zero emissions by 2050 has led to investments in renewable energy storage and power management solutions to drive demand for DC power systems.

EV charging infrastructure has been the major driving factor, and the UK is aiming for 300,000 public charging stations by 2030. These systems require high-performance solutions such as highly efficient DC power supplies for high-power DC fast chargers and battery management systems.

Programmable dc power supplies are increasingly used in industry, especially in automation and semiconductor manufacturing for testing and production.

Besides, the increasing focus on smart grids and microgrids is further boosting the demand for DC power solutions in distributed energy systems, facilitating optimizing energy storage and grid stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The transition toward electrification and investment in renewables, as well as demand for industrial automation in the European Union, are contributing to the growth of the DC Power Supplies market. They drive the integration of solar and wind power with the EU’s Green Deal and Renewable Energy Directive, opening up a huge requirement for DC power solutions in energy storage and power distribution systems.

Instead, countries like Germany, France, and the Netherlands are the leaders in electric vehicles and must deploy large amounts of DC fast chargers. The demand for DC power supplies in both charging infrastructure and automotive manufacturing is increasing as the European Union (EU) seeks to mandate a ban on new petrol and diesel vehicles from 2035.

In Europe, which has big names such as Siemens, ABB, Schneider Electric ensures the industrial automation landscape snippet, the demand for high-precision DC power for robotics, semiconductor testing, and process automation is strong.

Moreover, the increasing installations of 5G networks and smart cities to supplement the market, propelling telecom operators to deploy DC power backup systems for free network functioning.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan DC Power Supplies Market Overview The framework conditions for growth in Japan are excellent as new inventions, renewable energy sources, and electric cars are rising. Japan’s target of 36-38% renewables by 2030 motivates demand for DC power solutions for energy storage, smart grids, and microgrid projects.

Japan dominates electric and hybrid vehicle production, as companies like Toyota, Nissan, and Honda chiefly invest in solid-state battery technology, chiniensonchargers.com. As a result, the demand for DC power supplies used in EV battery development, charging stations, and energy management systems has seen remarkable growth.

Another big driver is the robotics and industrial automation market, led by Japan, which manufactures factory automation and semiconductors. Programmable high-precision DC power supplies are widely used in applications such as chip tests, automatic production lines, process control, etc.

Japan’s disaster resilience efforts have also led to investments in off-grid and backup power systems, in which DC microgrids and battery storage solutions are essential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The expansion of semiconductor manufacturing, electric vehicle complex and exotic telecommunications framework has allowed the industry to grow exponentially in South Korea. DC Power Supplies Market is a high-quality premium report published by one of the world's leading market research firms. It is useful for growing market segments with the innovation of new jobs. SCM is a leader in semiconductor production, with some of the biggest manufacturers in the world that rely on factories dedicated to producing chips, often highly specialized.

Another pivotal element is the government’s 40 billion bet on renewable energy, as South Korea aims for renewable energy sources to make up 35% of the power mix by 2040. And this is driving demand for DC power supplies in energy storage and microgrid systems.

Hyundai and Kia’s electrification strategies create strong demand for DC fast chargers and power management solutions in automotive R&D, resulting in a strong EV market in South Korea.

It also cited the acceleration in adopting DC power solutions in telecom infrastructure, data centers, and urban energy management, driven by South Korea's 5G rollout and smart city projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

There is a growing demand for energy-efficient power solutions, industrial automation, and electronic testing applications, driving the DC power supply market's growth. Companies refine power conversion for high efficiency, programmable DC power systems, and a combination of smart monitoring technologies for enhanced reliability, energy savings, and precision voltage control. This market features global leaders and specialist manufacturers driving DC power management, modular power systems, and industrial AC-DC power solutions.

Keysight Technologies (12-17%)

Keysight Technologies is one of the top players in the DC power supplies domain, providing highly accurate, programmable power systems for electronics testing, R&D, and industrial applications. It specializes in real-time monitoring and AI-driven power optimization solutions.

TDK-Lambda Corporation (10-14%)

TDK-Lambda develops DC power supply systems serving high-efficiency and industrial-grade applications, including medical, defense, and factory applications. The company composite designs for critical power applications offering low-noise and high reliable solutions.

XP Power (8-12%)

XP Power designs energy-efficient, high-density DC power supply systems for the renewable energy, electric vehicle and automation markets. The firm invests in modular power solutions and high-efficiency power conversion.

Delta Electronics, Inc. (7-11%)

Delta Electronics is a global leader in power, thermal management, and intelligent human-machine interface solutions. The commence also provides smart monitoring and predictive maintenance capabilities to improve power efficiency.

Mean Well Enterprises Co., Ltd. (5-9%)

Simply-Controlled provides low-cost high-power density DC power supplies to the LED lighting IoT devices and small industrial sectors Mean Well Enterprises. It provides standardized electric power solutions and very durable products.

OTHER KEY PLAYERS (45-55% COMBINED)

Several vendors work on tailored power solutions, high-efficiency DC converters, and scalable power management solutions. These include:

DC Power Supplies Market have been 2025 USD 447.4 Billion.

The DC Power Supplies Market to grow at a CAGR of 4.1% from 2023 to 2035.

The industrial automation, consumer electronics, electric vehicles (EVs) and telecommunication sectors are expected to witness significant growth, which is further expected to drive the need for DC power supplies along with increasing need for well-matched power sources for research and developmental applications.

The leading five countries which contributes the growth of DC Power Supplies Market includes USA, UK, Europe Union, Japan and South Korea.

AC-DC and DC-DC Power Supply-types to remain prominently contribute to control over the assessment timeframe.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Output Power, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Output Power, 2023 to 2033

Figure 19: Global Market Attractiveness by Application , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Output Power, 2023 to 2033

Figure 39: North America Market Attractiveness by Application , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Output Power, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Output Power, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Output Power, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Application , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Output Power, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Output Power, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Application , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Output Power, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Application , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Output Power, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Output Power, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Output Power, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Output Power, 2023 to 2033

Figure 159: MEA Market Attractiveness by Application , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA