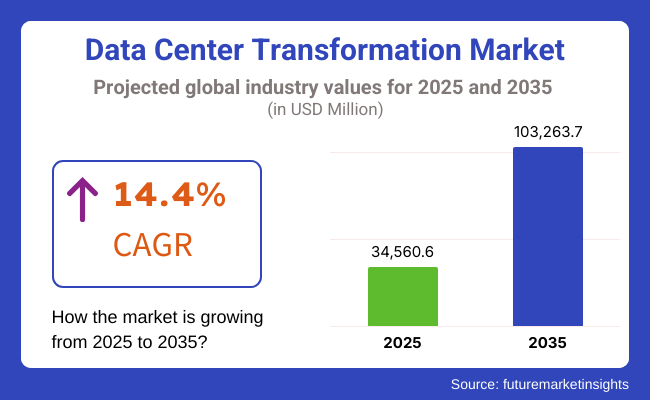

The global Data Center Transformation market is projected to grow significantly, from USD 34,560.6 Million in 2025 to USD 103,263.7 Million by 2035 an it is reflecting a strong CAGR of 14.4%. The emergence of cloud computing has given rise to Data Center Transformation Market in organizations of all implementation sectors like BFSI, healthcare, IT etc.

Expert Panel in the across geographical Europe, North America, Asia-Pacific prove the importance of Data Center Transformation systems as it allows higher scalability, operational efficiency and security. As organizations rely more than ever on 3rd party vendors for hardware upgrades, DCIM software, and managed services, transformation becomes essential for operational efficiency.

Data center management will increasingly need to facilitate compliance and address the challenges of changing regulatory environments (GDPR and CCPA). DCIM software facilitates this by providing automated monitoring, compliance reporting, and resource optimization to help adhere to strict regulations.

As digital transformation accelerates further, businesses lean on cloud services, on colocation and on hyperscale data centers. It drives the demand for next-gen hardware, like energy-efficient servers, storage, and networking solutions, as well as AI-driven software for automation and predictive maintenance.

As cyber threats increase, the need for data center security takes on an important path, leading to demand for real-time monitoring, risk assessment, and AI-backed threat detection among hardware, software, and managed services.

The North American region is the largest market for data center services globally due to strict regulatory requirements, a need for secure and safe storage of sensitive data, and the presence of many data center service providers. On the other hand, nations such as India and Australia are witnessing widespread acceptance of transformation solutions to cater to their expanding digital economies.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global Data Center Transformation market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Data Center Transformation industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 13.0%, followed by a slightly higher growth rate of 15.0% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 13.0% (2024 to 2034) |

| H2 2024 | 15.0% (2024 to 2034) |

| H1 2025 | 13.6% (2025 to 2035) |

| H2 2025 | 15.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 13.6% in the first half and remain higher at 15.2% in the second half. In the first half H1 the market witnessed an increase of 60 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

Rising demand for scalable and energy-efficient data center infrastructure

The increasing volume of data being processed and stored across various industries has resulted in growing demand for scalable and energy efficient data center infrastructure. With increasing workloads and demand for performance, enterprises are modernizing their data centers to optimally use and reduce operational cost.

Traditional Data Centers require huge amounts of power, leading to soaring energy bills and carbon footprints. To mitigate this, organizations are pursuing modular and liquid-cooled solutions to maximize scale and minimize power usage. Governments around the globe are implementing energy efficiency standards for data centers and rewarding the use of green infrastructure.

In 2024, the USA Department of Energy announced USD 500 million in grants for companies making energy-efficient cooling and power distribution a reality in data centers. In a similar vein, the European Commission also aims for data centers to be climate-neutral by 2030, meaning that operators would need to implement renewable energy systems. These challenges - combined with climbing power costs - drive businesses toward high-efficiency cooling systems, often integrated with renewable energy, and AI-based power optimization.

Growing need for AI-driven automation and predictive analytics in data centers

From AI-powered predictive analytics to smarter infrastructure management, artificial intelligence is changing the data center landscape for the better. As data centers asset become increasingly complex, AI-powered tools are being used to monitor, optimize, and predict system performance.

These solutions minimize downtime, improve workload distribution, and optimize cooling and energy consumption. Apart from efficient usage, AI-driven management aids in capacity planning, anticipating the infrastructure needs for the future based on usage trends.

They are also aware of the stake AI occupies on their social contracts as part of their governments’ investments and interest in AI; for the operation of a data center, where the data remains stable, AI can play a role as a cybersecurity safeguard and in improving energy efficiency (Yao et al. China’s Ministry of Industry and Information Technology allocated USD 1.2 billion toward AI-driven infrastructure projects, including automation of data centers, in 2023.

The Indian government eventually introduced AI to a data center on a public cloud, with an exciting initiative to improve computational efficiency and reduce power waste in data centers. Data Center Infrastructure Management (DCIM) software is also starting to build in predictive analytics, predicting real-time failures and automatically resolving issues, which will help cut down maintenance costs.

Increasing preference for hyperscale and modular data centers

Rising cloud usage, IoT expansion, and increased demand for real-time processing have led to a trend towards hyperscale and modular data centers. Hyperscale data centers run by AWS, Microsoft, Google, and other cloud giants grow in size to power high-performance workloads, artificial intelligence, and big data analytics.

Compared to conventional data centers, these facilities provide better scalability, efficiency, and cost-efficiency. Modular data centers, however, offer a modular, scalable solution that enables organizations to quickly and cost-effectively deploy infrastructure.

Hyperscale OTT cloud vendors are driving their expansion to enable low-latency service availability via government incentives, infrastructure projects, and investment. Earlier in 2024, Singapore also revealed USD 750 million worth of new data center projects, with stringent sustainability requirements.

A new initiative to reward modular data center projects for edge computing applications in relation to smart cities and 5G networks has also been launched by the European Union. There are more than 800 data centers in the hyperscale market, which is forecasted to grow to over 1,200 by the year 2026.

High initial investment in next-gen servers, cooling systems, and network infrastructure

For updating data center hardware components, such as the latest generation of servers, improved cooling systems, and other speedy networking technology all need massive amounts of capital for modernization.

As data grow, and the compute required to extract value from this data increases, organizations must deploy high-performance servers with greater processing power, storage capacity, and energy efficiency. Nonetheless, the significant per-server cost of such high-end units makes mass upgrades prohibitively costly and presents a difficulty for enterprise budgets.

Cooling systems represent another significant cost associated with data center transformation. The traditional cooling means tend to be inefficient and expensive, which increases energy consumption and operational costs.

In addition to the initial investment for the solutions, costs arise due to their installation complexities and maintenance requirements (liquid cooling and immersion cooling technologies). Moreover, modern data centers require organizations to seek investment in redundant power supplies, and energy-efficient cooling solutions to enhance both ensuring high availability high reliability.

Between 2020 and 2024, the global data center transformation market grew steadily and was driven by higher cloud adoption across sectors, AI-powered automation, and hyperscale and edge data centre requirements. The overall market revenue totaled 30,419.0 million in 2024, with the sales value of data center modernization solutions growing a history CAGR of approximately 12.8% during this time. Groups that did focus on an upgrade to the infrastructure, like next-gen servers, efficient cooling, rapid networking malted equipment.

The requirement on application programming interface (API) led to an increase in the need for cloud-based applications which further driven growth in need of data center infrastructure management (DCIM) software as enterprises looked to real time monitoring and automation tools to facilitate operational efficiency.

Flourishing a compound annual growth rate of 14.4%, the market is projected to exceed 103,263.7 million from 2025 to 2035. AI-driven automation, modular and hyperscale data centers, and sustainability initiatives will drive this growth. Demand will also pour in from investments in liquid cooling, advanced semiconductor process technology and HPC infrastructure. The future software will increasingly focus on SDLC (software defined life cycle), AI based data management solutions, requiring less hardware.

Vendor Tier 1 vendors are leading global companies with high technological capabilities and comprehensive service coverage. All these giants in any given industry leverage large R&D investments and wide-scale deployments to innovate and standardize for larger enterprises.

Tier 2 vendors, characterized by strong regional presence and specialized solutions designed for particular industry transitions. They are crucial in bridging the global gap with regional requirements due to their specialized services and ability to provide localized support for transforming businesses according to global standards.

Tier 3 vendors: often smaller, niche and/or local service providers. However, their smaller size means less complicated operations, and they are crucial in meeting the needs of a growing market and providing niche solutions. Overall, this combination of different tiers creates a balanced ecosystem around a rich set of customer needs, leading drove innovation and agility across the landscape of data center transformation.

The section highlights the CAGRs of countries experiencing growth in the Data Center Transformation market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.1% |

| China | 17.5% |

| Germany | 12.7% |

| Japan | 14.3% |

| United States | 13.8% |

Both the government initiatives and a booming digital economy are making India as the Promising Market for data center transformation. The Digital India initiative of the Indian government and policies such as the Data Center Policy 2020 have attracted investments into new generation data centers.

Cloud adoption has increased by 30% and AI workloads are becoming commonplace, leading enterprises to high-performance (HP) infrastructure to scale their businesses. Moreover, the push by India for data localization laws has increased the demand within India for data centers, causing enterprises to upgrade and expand their IT infrastructure.

In 2023, an investment of USD 1 billion was revealed from the Indian government in data centre parks to promote digital transformation and enhanced cloud infrastructure. This has prompted global players to set up hyperscale and edge data centers to address the country’s rising demand for low-latency, high-performance computing.

In addition, several state-level policies in Maharashtra, Tamil Nadu and Telangana offer tax incentives for emerging data center projects. India is anticipated to see substantial growth at a CAGR 15.1% from 2025 to 2035 in the Data Center Transformation market.

The USA leads the data center evolution with enterprises quickly moving to software-defined and AI-based associate management systems. The demand for automation, real-time monitoring, and predictive analytics is propelling the adoption of Software-Defined Data Centers (SDDCs).

These AI-powered solutions would help manage workload/working power distribution and security automation thereby delivering higher operational efficiency and minimizing downtime. To scale operations seamlessly, most of the major cloud providers and enterprises are relying on hyperconverged infrastructure (HCI).

Data center modernization has been a flat out supported theory by the USA government with energy effectiveness controls and cybersecurity strategies. The USA Department of Energy earmarked USD 500 million in 2023 for next-generation cooling technology research to help curb information center energy use. USA Data Center Transformation market is anticipated to grow at a CAGR 13.8% during this period.

The digital transformation is rapidly in China fueled through government-driven initiatives and cloud integration projects in China. The government’s 14th Five-Year Plan (2021 to 2025) focuses on the growth of intelligent data centers, supporting the nation’s transition toward an AI-powered, “cloud first” infrastructure.

However, with new data localization laws and increased regulatory oversight, enterprises are investing in next-generation data centers to address stringent cybersecurity needs while enabling high-performance computing.

China’s Ministry of Industry and Information Technology (MIIT) allocated USD 2 billion to the development of green data centers in 2024, and targets a 20% reduction in power consumption by large data centers by 2026.

Furthermore, significant investments in hyprescale data centers have been driven by the New Infrastructure Plan, particularly in Guangdong, Jiangsu and Zhejiang provinces. ISP) services and the aggressive push for 5G, AI and blockchain pen why cloud adoption is accelerating and businesses must modernize their network, storage and compute infrastructure. China is anticipated to see substantial growth in the Data Center Transformation market significantly holds dominant share of 54.2% in 2025.

The section provides detailed insights into key segments of the Data Center Transformation market. The Data Center Tier category includes Tier-1 Data Center, Tier-2 Data Center, Tier-3 Data Center and Tier-4 Data Center. Component category such as Hardware DCIM Software and Services. Among these, DCIM Software is growing quickly. The Tier 3 Data Center hold largest market share in Data Center Transformation.

With enterprises being more concerned about effective usage of energy and automation, Data Center Infrastructure Management (DCIM) software is emerging as the solution of choice to manage a large IT setup. DCIM solutions enable organizations to monitor, manage, and optimize their critical infrastructure, including power, cooling, and server utilization, from the same central location.

The acceleration of the cloud adoption trend and the increasing complexity of data center operation are boosting the market of DCIM (data center infrastructure management) solutions. Dual power systems with DCIM software provide immense value to businesses with high capacity data centers by optimizing resource allocation, minimizing downtime, and reducing operational costs through real-time monitoring and predictive analytics.

In 2023, USA government announced the investment of USD 600 million in the smart grid and energy efficiency projects for data center operations, with focus on AI based Data Center Infrastructure Management (DCIM) solutions to optimize energy consumption across the federal buildings.

Many of these regulations, including the Energy Star program and the Federal Data Center Optimization Initiative (DCOI), encourage federal agencies to consume increasingly intelligent DCIM tools to modernize their infrastructure. In addition, the growing adoption of DCIM solutions is being driven by the emergence of edge data centers and hyperscale data centers, which require enhanced management capabilities.

As companies pursue more operational efficiency and sustainability, the demand for DCIM software is likely to rise by 35% within 2030 on a global level. DCIM Software is anticipated to see substantial growth at a CAGR 15.8% from 2025 to 2035 in the Data Center Transformation market.

| Segment | CAGR (2025 to 2035) |

|---|---|

| DCIM Software (Component) | 15.8% |

The Tier 3 data centers dominating the global data center transformation market share, owing to their fault-tolerant architecture, redundant power supply, and advanced cooling technologies. These data centers provide N+1 redundancy, which means that when there is a sudden failure of hardware, operations continue without any interruption.

Tier 3 data centers are also driven by demand from enterprises requiring high uptime and handling critical workloads like cloud computing & enterprise applications. Tier 3 data centre is the most awaited solution for many sectors as they are evolving with time, While the need for a safe and scalable infrastructure has become more scalable due to ongoing technological changes.

A major driver of Tier 3 data center adoption has been the consolidation initiatives of the USA government's Federal Data Center Consolidation Initiative (FDCCI) that mandates federal agencies to migrate to mergers with data centers that are more efficient and resilient. Tier 3 Data Center is projected to dominate the Data Center Transformation market, capturing a substantial share of 38.4% in 2024.

| Segment | Value Share (2025) |

|---|---|

| Tier 3 Data Center (Data Center Tier) | 38.4% |

The Data Center Transformation market has been seeing substantial growth globally as it has progressed significantly in the last two decades. Innovative technologies like AI-powered automation, cloud integration and software-defined data centers can allow companies to achieve higher levels of performance and reliability. It’s a competitive environment, with companies racing to provide tailored solutions for a wide range of industries including cloud computing, telecom and healthcare.

Industry Update

The Global Data Center Transformation industry is projected to witness CAGR of 14.4% between 2025 and 2035.

The Global Data Center Transformation industry stood at USD 34,560.6 million in 2025.

The Global Data Center Transformation industry is anticipated to reach USD 103,263.7 million by 2035 end.

East Asia is set to record the highest CAGR of 16.9% in the assessment period.

The key players operating in the Global Data Center Transformation Industry Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, Nokia, Lenovo, Huawei Technologies, Cisco Systems, Dell Technologies, Schneider Electric.

In terms of component, the segment is divided into hardware, software and services.

In terms of data center type, the segment is segregated into Enterprise Data Centers, Edge Data Centers, Colocation Data Centers, Hyper scale Data Centers, Cloud Data Centers and Managed Data Centers.

In terms of data center tier, the segment is segregated into Tier-1 Data Center, Tier-2 Data Center, Tier-3 Data Center and Tier-4 Data Center.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.