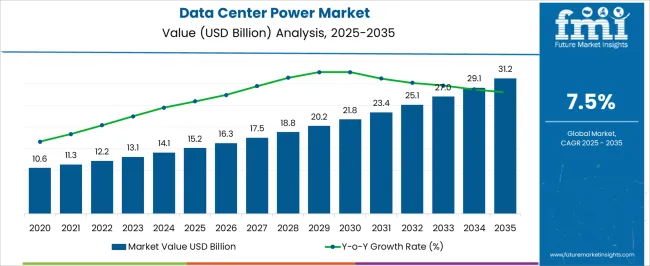

The data center power market is estimated to be valued at USD 15.2 billion in 2025 and is projected to reach USD 31.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The market share erosion or gain analysis shows a steady increase in market value over time, driven by demand for efficient, scalable, and reliable power solutions for data centers. From 2021 to 2025, the market grows from USD 10.6 billion to 15.2 billion, passing through intermediate values of USD 11.3 billion, 12.2 billion, 13.1 billion, and 14.1 billion. This early growth phase is characterized by moderate gains as data centers focus on enhancing their energy efficiency, driven by rising energy costs and environmental sustainability regulations. The growth is led by innovations in power management and distribution technologies, with a focus on reducing carbon footprints and optimizing energy usage.

Between 2026 and 2030, values rise from USD 15.2 billion to 21.8 billion, with intermediate values passing through USD 16.3 billion, 17.5 billion, and 18.8 billion. In this phase, the market experiences a more rapid expansion, largely fueled by the increasing adoption of cloud computing, AI, and big data analytics, all of which demand greater power capacity and efficiency. From 2031 to 2035, the market progresses from USD 23.4 billion to 31.2 billion, with intermediate values at USD 25.1 billion, 27.0 billion, and 29.1 billion.

The data center power market is driven by five key parent markets that collectively shape its growth, demand, and technological advancements. The data center infrastructure market contributes the largest share, about 28-32%, as power solutions such as uninterruptible power supplies (UPS), generators, and power distribution units (PDU) are critical for maintaining continuous operations and ensuring reliability in large-scale data centers.

The cloud computing market adds approximately 20-24%, as the expanding use of cloud-based services increases the need for high-capacity, reliable, and energy-efficient power systems to support growing data storage and processing demands. The telecommunications and networking market contributes around 15-18%, with the rise of 5G networks, IoT devices, and network infrastructure requiring robust power solutions to ensure smooth, uninterrupted connectivity and low-latency performance in data centers.

The renewable energy integration market accounts for roughly 12-15%, as data centers increasingly adopt clean energy solutions like solar and wind power, reducing carbon emissions while ensuring sustainable, cost-effective power supply. The industrial and commercial energy market represents about 8-10%, as large corporations and industries with heavy data storage and processing needs require specialized power solutions to ensure operational efficiency and minimize downtime.

| Metric | Value |

|---|---|

| Data Center Power Market Estimated Value in (2025 E) | USD 15.2 billion |

| Data Center Power Market Forecast Value in (2035 F) | USD 31.2 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The data center power market is expanding at a steady pace, driven by the rising demand for high-capacity and energy-efficient infrastructure to support global data traffic growth. Industry announcements and technology reports have emphasized the critical role of reliable and scalable power systems in maintaining uptime, optimizing energy usage, and meeting sustainability goals for modern data centers. The acceleration of cloud computing, artificial intelligence, and big data analytics has intensified power consumption, prompting operators to invest in advanced power distribution, backup, and monitoring solutions.

Regulatory pressures for reduced carbon footprints, alongside corporate commitments to renewable energy integration, have influenced power system design and deployment strategies. Furthermore, hyperscale and colocation data centers are driving large-scale investments in intelligent power management to optimize operational costs.

Future growth is expected to be shaped by advancements in modular power solutions, AI-enabled energy optimization, and increased adoption of renewable energy sources, with notable momentum in solution-based offerings, IT & telecom applications, and hyperscale facility developments.

The data center power market is segmented by component, application, data center, and geographic regions. By component, data center power market is divided into solution and services. In terms of application, data center power market is classified into IT & telecom, BFSI, colocation, energy, government, healthcare, manufacturing, and others. Based on data center, data center power market is segmented into hyperscale, colocation, edge, and enterprise. Regionally, the data center power industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

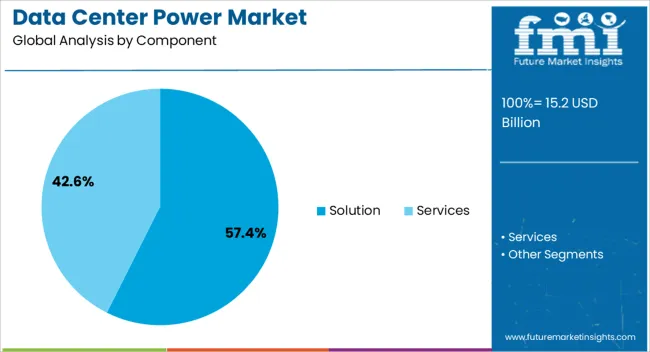

The solution segment is projected to account for 57.4% of the data center power market revenue in 2025, maintaining its lead due to comprehensive offerings that address power supply, distribution, and backup needs. Growth in this segment has been fueled by demand for integrated systems such as uninterruptible power supplies (UPS), power distribution units (PDUs), and generators, which ensure operational continuity in mission-critical environments. Data center operators have increasingly adopted advanced solutions with features like remote monitoring, load balancing, and modular scalability to align with evolving capacity needs. Vendor investments in energy-efficient designs and low-maintenance systems have further driven adoption, reducing total cost of ownership. Additionally, the shift toward edge computing and hybrid cloud infrastructure has amplified the need for robust, space-efficient power solutions, reinforcing the segment’s leadership.

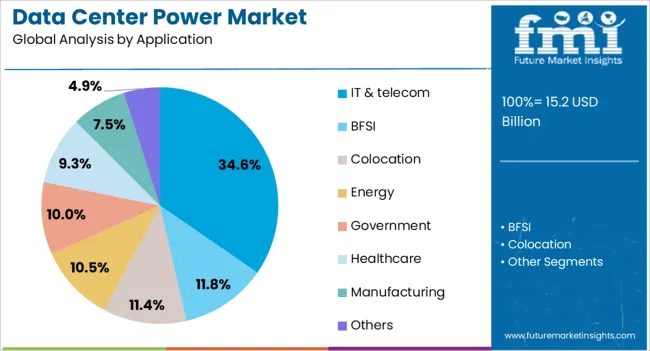

The IT & telecom segment is expected to hold 34.6% of the data center power market revenue in 2025, reflecting its central role in supporting global connectivity and digital infrastructure. The segment’s prominence has been shaped by rapid growth in mobile data usage, streaming services, and enterprise cloud adoption, all of which require high-reliability data processing and storage facilities. Telecom operators and IT service providers have prioritized power systems that deliver uninterrupted performance and support scalability to meet fluctuating workloads. Industry developments have shown increased investment in energy-efficient power infrastructure to manage operational expenses and comply with sustainability commitments. The expansion of 5G networks and the rise of edge data centers have further heightened demand for reliable, low-latency power systems, solidifying the IT & telecom sector’s strong position.

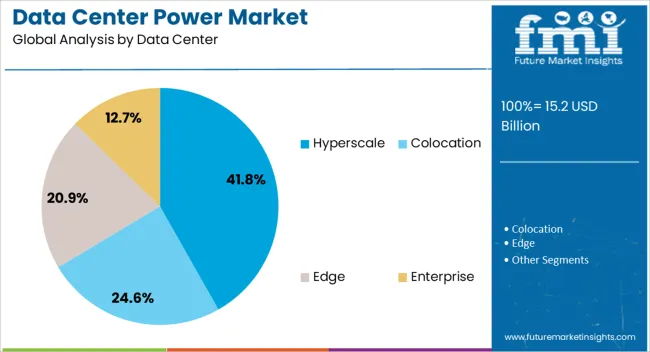

The hyperscale segment is projected to contribute 41.8% of the data center power market revenue in 2025, underscoring its dominance in large-scale, high-performance computing environments. Growth in this segment has been driven by the rapid expansion of global cloud service providers and content delivery networks, which require massive and resilient power infrastructures. Hyperscale operators have invested heavily in redundant power systems, renewable energy integration, and AI-driven energy management tools to improve efficiency and sustainability. The economies of scale in hyperscale facilities allow for adoption of advanced power technologies and custom-built solutions, ensuring optimal performance at lower operational costs per unit of computing capacity. With continuous growth in AI workloads, data storage needs, and global internet traffic, hyperscale data centers are expected to remain at the forefront of market demand for sophisticated and scalable power infrastructure.

The data center power market is growing due to rising demand for power-efficient, reliable solutions to support the expanding digital landscape. Challenges include high energy consumption, environmental impact, and regulatory compliance. Opportunities exist in the integration of renewable energy sources, energy storage systems, and advanced cooling technologies. Innovations in power distribution, AI-driven automation, and energy-efficient designs are reshaping the market. Companies investing in renewable energy integration, energy storage, and energy-efficient power systems are best positioned to succeed in this competitive and rapidly growing market, particularly in North America, Europe, and Asia-Pacific.

The data center power market is expanding as the demand for high-performance data centers continues to rise, fueled by the increasing adoption of cloud computing, big data analytics, AI, and IoT. Data centers require large amounts of electricity to power servers, cooling systems, and backup power infrastructure. The growth of e-commerce, social media, and streaming services has further amplified the need for robust power solutions. Major players like Schneider Electric, ABB, and Eaton are investing in innovative power distribution systems, backup generators, and energy-efficient technologies to ensure continuous power supply for these power-hungry facilities. Rising digital transformation in industries such as finance, healthcare, and retail will continue driving the demand for power in data centers.

Despite strong growth, the data center power market faces challenges related to high energy costs, environmental impact, and regulatory compliance. Power consumption in data centers accounts for a significant portion of their operational expenses, and energy-efficient solutions are becoming a top priority. The increasing focus on reducing carbon footprints is driving investments in green energy sources, such as wind and solar power, and advanced cooling technologies. Compliance with environmental regulations, such as the EU’s Green Deal or local emission reduction standards, adds operational complexity for data center operators. Manufacturers must balance the need for cost-effective power solutions with the push toward sustainability and environmental responsibility.

Opportunities in the data center power market are driven by the increasing adoption of renewable energy sources and energy storage solutions. Many data center operators are transitioning to renewable power sources to reduce operational costs and comply with environmental regulations. Solar and wind power are being integrated into data center power systems, especially in regions with abundant renewable resources. Additionally, energy storage solutions like batteries and flywheels are gaining popularity to manage power demand, reduce dependency on grid power, and provide backup during outages. Data center operators seeking to improve efficiency and sustainability are investing in hybrid power models that combine renewable energy and energy storage technologies.

Technological trends in the data center power market include advancements in power distribution, cooling systems, and automation. Modern data centers are increasingly using DC-powered equipment, integrated power distribution units (PDUs), and modular power systems to enhance energy efficiency. Advanced cooling systems, such as liquid cooling and immersion cooling, are also being implemented to reduce the energy required to maintain optimal operating temperatures for servers. Automation technologies, including AI and machine learning, are being deployed for predictive maintenance, load balancing, and real-time monitoring to optimize energy consumption and improve operational efficiency. These innovations are expected to increase energy efficiency, reduce costs, and ensure uninterrupted power supply for critical data center operations.

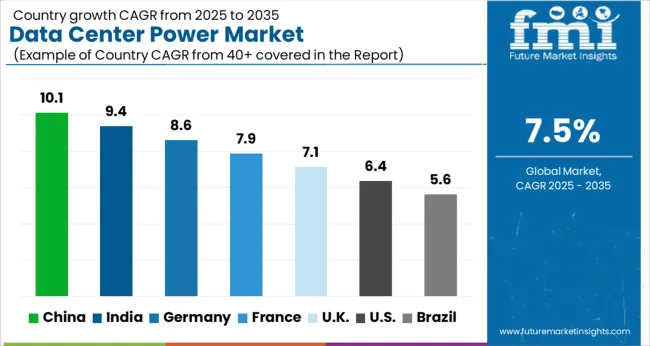

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

Global demand for data center power is projected to grow at a CAGR of 7.5% from 2025 to 2035. Among the profiled markets, China leads with a growth rate of 10.1%, followed by India at 9.4% and Germany at 8.6%, while the UK and the USA trail with 7.1% and 6.4% respectively. These variations highlight local growth drivers: rapid digitalization and cloud service adoption in China and India, industrial data processing needs in Germany, and sustainable energy efforts in the UK and USA The data center power market is primarily driven by the rise of cloud computing, AI, IoT, and the need for reliable, efficient, and sustainable energy solutions. The analysis spans over 40+ countries, with the leading markets shown below.

The data center power market in China is expected to grow at a CAGR of 10.1% from 2025 to 2035, driven by the country’s rapid digital transformation and its status as a global tech powerhouse. The rapid expansion of cloud services, e-commerce, and artificial intelligence (AI) are key drivers of the demand for power in data centers. As China’s economy continues to digitize, the need for local data storage, processing power, and reliable power infrastructure has increased. China’s government initiatives, such as "Made in China 2025," are driving investments in tech and data centers, further boosting demand for power. With large urban centers like Beijing and Shenzhen becoming major data hubs, the market for efficient power systems in data centers continues to grow.

The data center power market in India is projected to grow at a CAGR of 9.4% from 2025 to 2035, driven by rapid digitization across the country. The rise of e-commerce, mobile apps, IoT, and digital content consumption has led to a significant increase in data traffic, pushing the demand for local data center infrastructure. India’s booming startup ecosystem, along with the rapid adoption of cloud services, is fueling the growth of data centers. The government’s initiatives, such as the "Digital India" program, further support investments in data centers and digital infrastructure. To keep up with the growing demand for digital services, India’s data centers require high-performing, reliable, and energy-efficient power solutions. Additionally, the country is focusing on sustainable energy sources for data centers, which is expected to drive innovation in energy-efficient power systems.

The data center power market in Germany is expected to grow at a CAGR of 8.6% from 2025 to 2035. The country’s strong industrial base, advanced technology sector, and strategic location within Europe continue to make it a hub for data center operations. With Germany leading the European digital economy, the demand for data centers is high, particularly for sectors like automotive, manufacturing, and financial services, which require real-time data processing. Germany’s commitment to renewable energy and sustainability is encouraging the adoption of green data centers, which is driving demand for efficient power systems. The rise of 5G networks and IoT in Germany is expected to increase the need for data processing capabilities, further boosting the demand for data center power. The country’s regulatory landscape, which emphasizes compliance and energy efficiency, is shaping the market dynamics.

The UK’s data center power market is projected to grow at a CAGR of 7.1% from 2025 to 2035. As one of the leading digital economies in Europe, the UK continues to experience a high demand for data processing and storage solutions, especially in cloud computing, AI, and big data analytics. The market faces maturity, with established data center infrastructure in key urban areas such as London, Manchester, and Edinburgh. Nevertheless, growing demands for low-latency services, especially in the financial services and tech sectors, are driving the need for more efficient data center power systems. Moreover, the UK government’s strong push for sustainability and its focus on energy-efficient technologies are contributing to the market’s transformation. With the increasing emphasis on data sovereignty and regulatory compliance, demand for localized, efficient power solutions in the UK’s data centers will continue to rise.

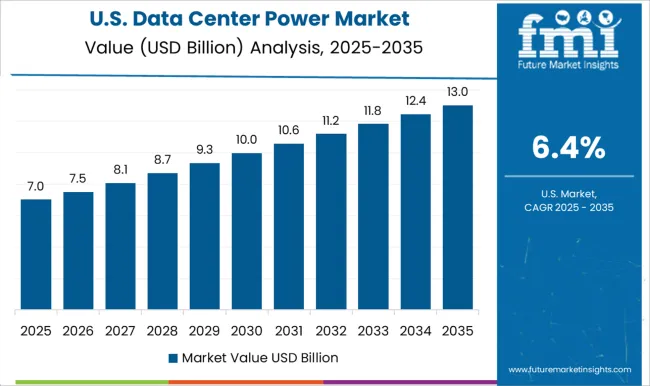

The USA data center power market is expected to grow at a CAGR of 6.4% from 2025 to 2035. The USA is home to the largest number of data centers globally, serving as the backbone for a wide range of industries, including tech, finance, and healthcare. The need for efficient, scalable, and reliable power systems in data centers is vital to meet the increasing demands of cloud services, IoT, AI, and big data analytics. Despite the mature market, growth is sustained by technological innovations and advancements in energy efficiency. The adoption of renewable energy in data centers, especially in states like California and Oregon, is expected to continue increasing. Data centers in the USA are focusing on reducing operational costs and improving power efficiency through modern cooling solutions and energy management practices.

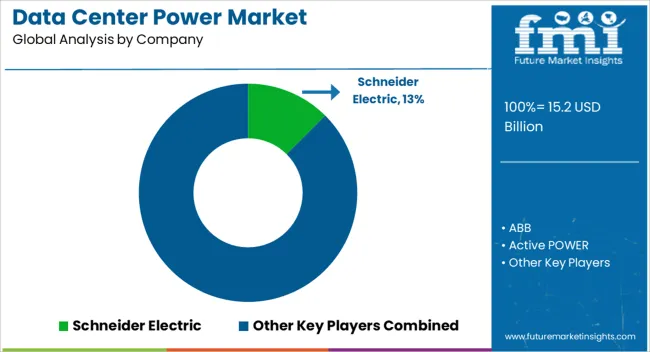

The data center power market is highly competitive, driven by the demand for reliable, energy-efficient, and scalable solutions. Key players such as Schneider Electric, ABB, Active Power, Belkin International, Black Box, Caterpillar, Delta Electronics, Eaton, Huawei Technologies, and Vertiv lead the market with innovative products designed to support the growing data center infrastructure. Schneider Electric offers a wide range of energy management solutions, emphasizing integrated power distribution and management systems.

Their product brochures highlight sustainability, energy optimization, and real-time monitoring capabilities, making them a top choice for data centers seeking reliability and efficiency. ABB, known for its expertise in automation and power technologies, delivers high-performance uninterruptible power supply (UPS) systems and power distribution units (PDUs). Their brochures emphasize modularity, scalability, and energy savings, appealing to large-scale data centers that require robust power systems for continuous operations. Active Power focuses on green power solutions, including flywheel-based energy storage systems for backup power.

Their brochures highlight energy efficiency, lower operational costs, and the environmental benefits of using their systems compared to traditional battery-based solutions. Belkin International and Black Box provide cost-effective power distribution solutions tailored to smaller and mid-sized data centers. Their brochures showcase reliable PDUs, rack-mounted units, and surge protection solutions, ensuring uptime and ease of maintenance for businesses with less demanding power needs. Caterpillar specializes in backup power generators, offering scalable solutions for large data centers. Their brochures emphasize high-capacity generators, fuel efficiency, and long-term durability, designed to meet the high demands of critical data center applications. Delta Electronics and Eaton provide energy-efficient power systems, including UPS and PDUs, designed to reduce carbon footprints and optimize energy use. Eaton’s product brochures focus on integrated power management, while Delta highlights advanced UPS technology and smart power solutions.

Huawei Technologies offers innovative energy-saving solutions, including modular power systems and smart grid technologies. Their brochures showcase cutting-edge, scalable solutions tailored to modern data centers. Vertiv rounds out the competitive landscape, focusing on modular, scalable power solutions that are both energy-efficient and reliable, with brochures targeting edge data centers and growing demand for flexible, high-performance power systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.2 billion |

| Component | Solution and Services |

| Application | IT & telecom, BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, and Others |

| Data Center | Hyperscale, Colocation, Edge, and Enterprise |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Active POWER, Belkin International, Black Box, Caterpillar, Delta Electronics, Eaton, Huawei Technologies, and Vertiv |

| Additional Attributes | Dollar sales by product type (UPS systems, backup generators, PDUs, cooling solutions), technology type (battery-based, diesel-based, hybrid), and power capacity (small, medium, large). Demand in the data center power market is driven by the growing digital transformation, the increasing need for reliable power systems, and the rise of cloud computing and edge data centers. Regional trends indicate growth in North America, Europe, and Asia-Pacific, with high demand for energy-efficient power solutions to meet sustainability goals and operational needs. |

The global data center power market is estimated to be valued at USD 15.2 billion in 2025.

The market size for the data center power market is projected to reach USD 31.2 billion by 2035.

The data center power market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in data center power market are solution, power distribution units (pdus), ups, and others.

In terms of application, IT & telecom segment to command 34.6% share in the data center power market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Market Growth – Demand, Trends & Forecast 2025–2035

Data Center Power Management Market Insights – Demand & Growth 2024-2034

Data Center Power Solutions Market

Data Center LV/MV Power Distribution Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

On-Site Solar Power Market Growth – Trends & Forecast 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA