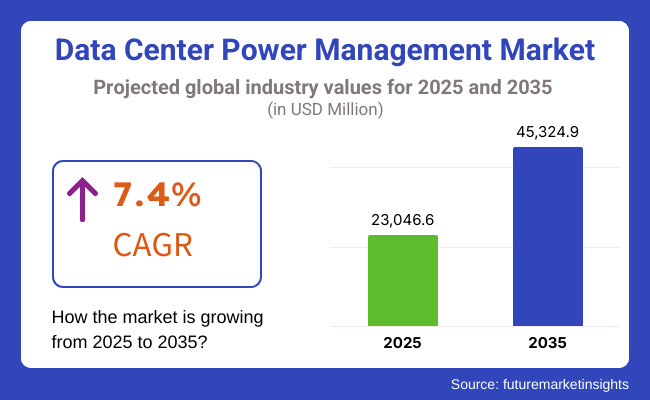

The global data center power management market is projected to grow from USD 23.04 billion in 2025 to USD 45.32 billion by 2035 at a CAGR of 7.4%. North America is expected to lead in 2025, capturing approximately 35 percent of global revenues. This growth is driven by rapid hyperscale data center expansions and enterprise cloud migrations in the United States. Installed IT capacity in the region has been forecast to grow at a five-year CAGR of 12.6% with sustained investment momentum.

Europe follows, driven by stringent EU regulations on energy efficiency and carbon neutrality. The European Commission’s Green Deal has prompted operators to upgrade legacy power infrastructure. A notable example is the Nvidia-Schneider Electric partnership to develop “digital twins” of AI data centers, which is expected to improve power consumption by enabling better design and operations, as reported by Barron’s.

Asia Pacific is expected to be the fastest-growing market, with annual growth rates above 8% projected through 2035. This uptrend is driven by large-scale hyperscale and edge data center rollouts in China and India, alongside smart-city and telecom modernization projects that demand resilient power solutions.

By component, uninterruptible power supplies (UPS) and power distribution units (PDU) together accounted for nearly 60% of revenues in 2025, with intelligent monitoring and analytics software platforms emerging as the fastest-growing segment. “Despite macroeconomic uncertainties, demand for intelligent power infrastructure remains strong,” said Giordano Albertazzi, CEO of Vertiv, following Vertiv’s record Q1 2025 results and emphasizing continued AI-driven deployment momentum in North America and Europe as per Investor's Business Daily.

Advances in AI-driven analytics, IoT-enabled controls, and renewable-friendly architectures-such as Schneider Electric’s EcoStruxure IT DCIM enhancements delivered in early 2025-are set to reinforce market resilience. These innovations will be essential to sustaining the 7.4% CAGR through 2035 and meeting the digital economy’s evolving power infrastructure needs as per Schneider Electric Blog.

The below table presents the expected CAGR for the global Data Center Power Management market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Data Center Power Management industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 6.6% followed by a slightly higher growth rate of 7.3% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.6% (2024 to 2034) |

| H2 2024 | 7.3% (2024 to 2034) |

| H1 2025 | 7.1% (2025 to 2035) |

| H2 2025 | 7.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.1% in the first half and remain higher at 7.6% in the second half. In the first half H1 the market witnessed an increase of 50 BPS while in the second half H2, the market witnessed an increase of 30 BPS.

The section provides detailed insights into key segments of the Data Center Power Management market. The Data Center Type category includes Modular Data Centers, Colocation Data Centers, Cloud Data Centers, Edge Data Centers, Hyper scale Data Centers and Micro Mobile Data Center.

Industry category such as BFSI, Healthcare, Manufacturing, IT & Telecom, Media & Entertainment, Retail, Government and Others. Among these, Hyper scale Data Centers are growing quickly. The IT & Telecom hold largest market share in Data Center Power Management.

Hyperscale data center growth is a major driver of demand for creative and energy-efficient power management solutions. Hyperscale data centers that store petabytes worth of servers and IT infrastructure need extensive amounts of power to remain up and running at all times.

These data centers are critical to cloud services, big data analytics and AI-powered applications as the digital economy expands. The efficiency of a power management system is one of the most critical parameters because it should be able to satisfy the energy requirements of mega systems and minimize the operational cost. To optimize energy usage, hyperscale data centers are adopting advanced power management technologies such as artificial intelligence (AI)-driven automation and integration into the smart grid.

Besides saving energy, these technologies help meet sustainability goals by reducing carbon footprints. As it stands, the USA Government is rewarding the large-scale data center to use renewable energy generation in the Green New Deal, thus fueling the demand for Power Management Solutions. Hyper Scale Data Center is anticipated to see substantial growth at a CAGR 9.0% from 2025 to 2035 in the Data Center Power Management market.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Hyper Scale Data Center (Data Center Type) | 9.0% |

IT and Telecommunication sector has the highest share in the global data center power management market owing to the growing dependency toward cloud computing, storage solutions and network infrastructure. As firms worldwide turn towards digital transformation, demand for data processing, cloud services and telecom infrastructure are all growing - and powering this section will require vastly more electricity and durable power supply solutions.

Growing workload is forcing IT and Telecom companies to spend heavily on data centers; a huge part of their expenditure is dedicated to efficient power management for powering the data centers (to ensure seamless business operations at an optimal cost). Smart automation and AI adoption are leading the way toward better power management in these data centers.

In the major markets such as USA and Europe, these efforts are aided by regulations and incentives instituted by the Government, to encourage industry players in the IT and Telecomm sectors to work towards energy efficiency. For instance, the USA has made investments in smart grids through its Energy Efficiency and Conservation Block Grant Program. IT & Telecom is projected to dominate the Data Center Power Management market, capturing a substantial share of 20.4% in 2024.

| Segment | Value Share (2025) |

|---|---|

| IT & Telecom (Industry) | 20.4% |

Rising energy consumption in data centers propelling the demand for efficient power management solutions

As the data center industry undergoes an exponential expansion, energy consumption is surging. According to estimates, global data centers consumed around 460 terawatt-hours (TWh) of electricity in 2022, which is about 2% of worldwide energy consumption.

This number is expected to more than double, reaching an estimated 1.1 petawatt-hours in 2026. Increasing energy needs are mainly attributed to the growing number of AI applications, cloud computing and data-intensive services that require a lot of computational power - and thus more energy.

Governments are launching initiatives to encourage energy efficiency in data centers in response to this trend. One example of this is the USA Federal Energy Management Program (FEMP), which motivates agencies to improve data center energy efficiency in ways that echo strategies for reducing total energy use.

Increasing adoption of AI and automation for real-time power monitoring and optimization

Artificial Intelligence (AI) and automation technologies are being integrated to transform power management on data center level using real-time monitoring and optimization. These AI-powered systems can quickly analyze thousands of terabytes of data, predict how much energy will be used, detect inefficiencies, and make adjustments without requiring human oversight.

Such a proactive approach ensures that energy efficiency is maximized while costs of operation are minimized and the risk of downtime is reduced. The USA Department of Energy has identified AI as a tool for improving data center operations and is advancing the adoption of such energy-efficient technologies via a broader energy efficiency policy agenda.

AI and Automation: With the collaboration of sensor technology and optimizing power usage to dynamic workloads, we can reduce the impact on the environment while ensuring reliability and availability in the data centers.

Expansion of modular and micro data centers, increasing the need for compact power solutions

Augmented Reality[Ar] and Virtual Reality[Vr] Conference meeting[5] is expanding Modular and micro data[6] centers are growing and demand for edge computing and low-latency service is increasing which is for deploying in high-variety locations. The challenges of these small facilities, which are energy-intensive and space-constrained, are best addressed with space-efficient and power-efficient power management solutions.

Conventional power gear is usually overly massive or rigid for these smaller deployment spaces, so clever energy distribution units (PDUs), uninterruptible energy provides (UPS), and cooling techniques are required designed for cramped quarters. You are also targeting sustainable development of data centers.

However, different regulations have (only recently) begun to come into play to mitigate the environmental impact of data centers, even for smaller facilities, to ensure that they meet energy efficiency standards. This transition is also a chance for the world of power management to think outside the box and come up with new solutions to specific challenges in these types of small revamps.

Challenges in Integrating Power Management Software with Legacy Systems and Cybersecurity Risks

Data center power management software adoption is mired in challenges related to integration with legacy systems, and ever growing cybersecurity threats. Most existing data centers operate on legacy infrastructure that makes it hard to apply modern power monitoring and optimization tools. Often remaining incompatible with the sophisticated software we're trying to use, these legacy systems can mean costly custom integrations or even a complete infrastructure overhaul.

Intel and Red Hat have partnered up to use intelligent power management solutions to help customers easily adopt power saving technologies without heavy cost or transition hurdles, in turn, allowing customers to spend less time worrying about compatibility and disruptions.

High total centricity - Split Existing infrastructure The growing base of old equipment, growth and demanding performance and different requirements, such as public time complexity data And with the tangle of proprietary competitive systems, public relationship for integrated software Hardware Etc systems.

The global data center power management market has seen steady growth from 2020 to 2024, owing to the increasing power requirements of hyper scale, colocation, and cloud data centers. Growing digitalization, cloud adoption, and AI-driven workload expansion led to consuming more power - which demanded efficient power management solutions.

The global market registered an estimated compound annual growth rate (CAGR) of 6.2%with sales that exceeded 21,638.0 million in 2024. Hardware elements, including UPS frameworks, PDUs, and cutting-edge cooling arrangements, represented a major segment of the income, while programming-based energy enhancement and mechanization moved forward.

However, the data center power management solutions market is expected to expand significantly from 2025 through 2035, fueled by growing regulatory pressure, increasing sustainability goals and the rapid growth of edge and modular data centers.

CAGR of 7.4%, and expected to reacht total sales greater than 45,324.9 million by 2035. The use of software-oriented energy monitoring and artificial intelligence (AI) driven automation will experience exponential uptake to consolidate power consumption across widespread data center architectures.

Global data center power management market is leading. Some major companies providing the aforementioned services are Schneider Electric, Eaton, ABB, Vertiv, and Siemens providing power management solutions from UPS systems and PDUs to cooling infrastructure and intelligent power monitoring software. Their dominance in the market can be attributed to their strong global presence, large R&D investments and well-established partnerships with hyper scale and colocation data centers.

The majority of the mid-sized companies focusing on specific power management solutions or targeting regional markets. Among them are Delta Electronics, Huawei Digital Power, Legrand, Tripp Lite and Mitsubishi Electric. Although they do not have the global capabilities of Tier 1 vendors, they are competitive in providing low-cost/mid-range and innovative power management solutions especially in emerging markets.

Tier 3 vendors consist of smaller companies and niche players that specialize in regional or bespoke power management solutions. These businesses target mostly small and medium-sized data centers, edge facilities, and certain industry specialties. These are smaller vendors and less visible in the market but key to partnering for addressing specific power efficiency challenges in regional and sector-specific deployments.

The section highlights the CAGRs of countries experiencing growth in the Data Center Power Management market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 11.6% |

| China | 9.8% |

| Germany | 5.1% |

| Japan | 7.6% |

| United States | 6.5% |

Fast-paced cloud migration and digital transformation drastically increasing demand for resilient and efficient power management solutions across data centers: Schneider India Since more and more enterprises are moving to the cloud and implementing digital-first business models, there’s an exponential need for a solid infrastructure to cater behind the scenes.

The growth of India’s data centers to support this increasing demand means demand for power management to ensure these centers run efficiently and sustainably is also on the rise. Governments are aware of this and encouraging the use of green energy sources to minimize the energy consumption. Policies like Digital India and National Policy on Electronics have led to the growth of the data center industry.

Moreover, according to recent reports, India's data center market is predicted to grow at a rate of 12% each year with businesses considering data storage, cloud-based services, and analytics to be essential.

In addition, the government of India is pushing for “Make in India” and the objective is not limited to manufacturing hardware but also to build products like locally produced data center power equipment, giving room to vendors to explore this growing market. India is anticipated to see substantial growth at a CAGR 11.6% from 2025 to 2035 in the Data Center Power Management market.

At the federal level, initiatives and investments in the United States are playing an important role in promoting sustainable and energy-efficient practices in the data center industry. With a growing focus on reducing carbon footprints and increasing sustainability in the USA, the government has put forward several programs to promote energy-efficient infrastructure.

For instance, the USA Department of Energy (DOE) is presently funding research into energy-saving technology and giving grants to organizations that implement sustainability programs in their operations. Furthermore, the USA has in place tax incentives available under the Investment Tax Credit (ITC) and Energy Efficient Commercial Buildings Tax Deduction programs that incentivize renewable energy and energy efficient technologies.

That is why the American data centers spend so much on compliance with their eco laws and do everything to lower power consumption - and so - fantastic need for a power management tools. Data centre power costs could be reduced by as much as 30% with improvements in energy efficiency.

Due to climate change policies encouraging a transition to renewable energy sources - USA data centers are investing in AI-driven solutions and advanced power management systems for greater efficiency. USA Data Center Power Management market is anticipated to grow at a CAGR 6.5% during this period.

China's data centers are steadily integrating renewable sources of energy and smart grid technologies to improve power efficiency. The largest digital economies in the world, China’s data center industry has boomed, driven by growing focus on reducing energy consumption and environmental impact. This shift has been driven in part by the Chinese government, which has led efforts to curb the use of fossil fuels in favor of cleaner energy.

Though they were already exploring the idea of a Green Energy Electricity Trading Platform, with the 13th Five-Year Plan of Ecological and Environmental Protection emphasis on carbon reduction and green technology. To this end, a great number of data centers in China are adopting renewable energy solutions such as solar and wind power, as well as smart grid solutions which allow them to track and optimize energy consumption in real-time.

Data centers can adopt these systems to effectively manage peak loads, improve operational efficiency, and minimize energy wastage to a greater degree. Adding to this, the government’s Green Data Center Initiative provides incentives to companies investing in energy-efficient technologies, which is propelling the adoption of these solutions. Consequently, data centers in China are achieving greater energy use efficiency, in support of the country's ambitious aim of meeting carbon neutrality by 2060.

The renewable energy integration is expected to grow annually by 15%, driving market demand for smart power management solutions in the future. China is anticipated to see substantial growth in the Data Center Power Management market significantly holds dominant share of 54.2% in 2025.

The Data Center Power Management market is managed by a wide collection of players, providing services and solutions to maximize the effectiveness of energy than hardware and software. Companies compete on factors such as innovation, cost-effectiveness, and their ability to integrate renewable energy and AI-driven solutions.

With the growth, vendors have been focusing more on scalable technologies to address the energy needs of growing data centers. Moreover, the trend of registering partnerships and collaborations is increasing as enterprises look toward improving their power management capabilities and sustainability initiatives.

Industry Update

| Report Attributes | Details |

|---|---|

| Projected Market Size (2025) | USD 23.04 billion |

| Projected Market Size (2035) | USD 45.32 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Components Analyzed (Segment 1) | Hardware, Software, Services |

| Data Center Types Analyzed (Segment 2) | Modular, Colocation, Cloud, Edge, Hyper Scale, Micro Mobile Data Centers |

| Industries Analyzed (Segment 3) | BFSI, Healthcare, Manufacturing, IT & Telecom, Media & Entertainment, Retail, Government, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Vertiv, Rittal, Huawei Technologies, General Electric, Delta Electronics, Cummins Inc. |

| Additional Attributes | Dollar sales are led by hyperscale data centers growing at 9% CAGR, supported by cloud adoption and AI compute expansion. IT & Telecom accounts for 20.4% market share in 2025 due to continuous digital infrastructure growth. Revenue is generated through integrated power backup systems, DCIM software, and power distribution units. Sustainability mandates, redundancy planning, and energy efficiency metrics drive innovation and monetization. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of component, the segment is divided into hardware, software and services.

In terms of data center type, the segment is segregated into Modular Data Centers, Colocation Data Centers, Cloud Data Centers, Edge Data Centers, Hyper scale Data Centers and Micro Mobile Data Center.

In terms of industry, the segment is segregated into BFSI, Healthcare, Manufacturing, IT & Telecom, Media & Entertainment, Retail, Government and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Data Center Power Management industry is projected to witness CAGR of 7.4% between 2025 and 2035.

The Global Data Center Power Management industry stood at USD 23.04 billion in 2025.

The Global Data Center Power Management industry is anticipated to reach USD 45.32 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.5% in the assessment period.

The key players operating in the Global Data Center Power Management Industry Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Vertiv, Rittal, Huawei Technologies, General Electric, Delta Electronics, Cummins Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 26: Europe Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 28: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 32: South Asia Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 34: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 43: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 45: Oceania Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 46: Oceania Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 47: Oceania Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 48: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 50: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 52: MEA Market Value (US$ Million) Forecast by Data Center Type, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Data Center Tier , 2018 to 2033

Table 54: MEA Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 56: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 29: Global Market Attractiveness by Component, 2023 to 2033

Figure 30: Global Market Attractiveness by Data Center Type, 2023 to 2033

Figure 31: Global Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 32: Global Market Attractiveness by Installation Type, 2023 to 2033

Figure 33: Global Market Attractiveness by End User , 2023 to 2033

Figure 34: Global Market Attractiveness by Industry, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 64: North America Market Attractiveness by Component, 2023 to 2033

Figure 65: North America Market Attractiveness by Data Center Type, 2023 to 2033

Figure 66: North America Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 67: North America Market Attractiveness by Installation Type, 2023 to 2033

Figure 68: North America Market Attractiveness by End User , 2023 to 2033

Figure 69: North America Market Attractiveness by Industry, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Data Center Type, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 102: Latin America Market Attractiveness by Installation Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 104: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 107: Europe Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 120: Europe Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 121: Europe Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 122: Europe Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 123: Europe Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 124: Europe Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 125: Europe Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 126: Europe Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 127: Europe Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 128: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 132: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 133: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 134: Europe Market Attractiveness by Component, 2023 to 2033

Figure 135: Europe Market Attractiveness by Data Center Type, 2023 to 2033

Figure 136: Europe Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 137: Europe Market Attractiveness by Installation Type, 2023 to 2033

Figure 138: Europe Market Attractiveness by End User , 2023 to 2033

Figure 139: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 140: Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 143: South Asia Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 144: South Asia Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 145: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 146: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 147: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 152: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 153: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 155: South Asia Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 156: South Asia Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 157: South Asia Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 161: South Asia Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 162: South Asia Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 163: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 164: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 165: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 166: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 167: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 168: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 169: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 170: South Asia Market Attractiveness by Data Center Type, 2023 to 2033

Figure 171: South Asia Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 172: South Asia Market Attractiveness by Installation Type, 2023 to 2033

Figure 173: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 174: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 175: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: East Asia Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 178: East Asia Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 179: East Asia Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 180: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 187: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 188: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 189: East Asia Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 190: East Asia Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 191: East Asia Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 192: East Asia Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 193: East Asia Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 194: East Asia Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 195: East Asia Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 199: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 200: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 201: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 202: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 203: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 204: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Data Center Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Data Center Tier, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Installation Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 209: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 212: Oceania Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 213: Oceania Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 214: Oceania Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 215: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 216: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 217: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 222: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 223: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 224: Oceania Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 227: Oceania Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 228: Oceania Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 229: Oceania Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 230: Oceania Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 231: Oceania Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 232: Oceania Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 233: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 234: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 235: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 236: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 239: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 240: Oceania Market Attractiveness by Data Center Type, 2023 to 2033

Figure 241: Oceania Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 242: Oceania Market Attractiveness by Installation Type, 2023 to 2033

Figure 243: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 244: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 245: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 246: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 247: MEA Market Value (US$ Million) by Data Center Type, 2023 to 2033

Figure 248: MEA Market Value (US$ Million) by Data Center Tier , 2023 to 2033

Figure 249: MEA Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 250: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 251: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 252: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 257: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 258: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 259: MEA Market Value (US$ Million) Analysis by Data Center Type, 2018 to 2033

Figure 260: MEA Market Value Share (%) and BPS Analysis by Data Center Type, 2023 to 2033

Figure 261: MEA Market Y-o-Y Growth (%) Projections by Data Center Type, 2023 to 2033

Figure 262: MEA Market Value (US$ Million) Analysis by Data Center Tier , 2018 to 2033

Figure 263: MEA Market Value Share (%) and BPS Analysis by Data Center Tier , 2023 to 2033

Figure 264: MEA Market Y-o-Y Growth (%) Projections by Data Center Tier , 2023 to 2033

Figure 265: MEA Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 266: MEA Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 267: MEA Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 268: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 269: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 270: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 271: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 272: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 273: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 274: MEA Market Attractiveness by Component, 2023 to 2033

Figure 275: MEA Market Attractiveness by Data Center Type, 2023 to 2033

Figure 276: MEA Market Attractiveness by Data Center Tier , 2023 to 2033

Figure 277: MEA Market Attractiveness by Installation Type, 2023 to 2033

Figure 278: MEA Market Attractiveness by End User , 2023 to 2033

Figure 279: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 280: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Market Insights – Demand & Growth 2024-2034

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA