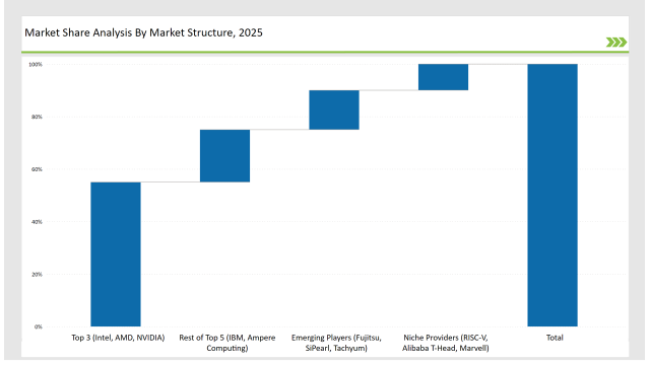

There is a massive evolution happening in the Data Center CPU Market, driven by the growing demand for high-performance computing, AI workloads, and processing the data coming from cloud. For example, the top three vendors in terms of market share, Intel, AMD and NVIDIA collectively dominate its market with a share of 55%, offering first-of-their-kind x86, ARM and GPU-based processors. IBM and Ampere Computing round out the top five, capturing 20% as they focus on enterprise-scale performance, custom cloud workloads and ARM-based power efficiency.

Innovations in HPC (high-performance computing), exascale computing, and cloud-native architectures are being driven by the 15% of the market currently held by emerging players such as Fujitsu, SiPearl, and Tachyum. On the other hand, niche vendors (RISC-V ecosystem players, Alibaba's T-Head, and Marvell) occupy another 10% of the market with their optimized CPUs designed for hyperscale cloud providers and edge computing.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Intel, AMD, NVIDIA) | 55% |

| Rest of Top 5 (IBM, Ampere Computing) | 20% |

| Emerging Players (Fujitsu, SiPearl, Tachyum) | 15% |

| Niche Providers (RISC-V, Alibaba T-Head, Marvell) | 10% |

The Data Center CPU market is highly consolidated, with a significant presence of top players while allowing room for disruptive newcomers and specialized architectures. Leading companies hold around 60%-70% market share.

AI-Powered Data Center Optimization

AI-driven CPU scheduling and workload balancing are enhancing data center efficiency. Intel, NVIDIA, and AMD are integrating AI-specific accelerators within their CPU architectures to optimize inference and deep learning applications.

Chiplet-Based CPU Architectures

Leading CPU manufacturers are transitioning to chiplet-based designs, improving modular scalability. AMD’s EPYC Genoa and Intel’s Sapphire Rapids leverage this innovation for better performance-per-watt ratios.

ARM’s Expanding Market Share

Major cloud providers (AWS Graviton, Google Cloud, Microsoft Azure) continue adopting ARM-based CPUs due to cost efficiency and energy savings, challenging x86 dominance.

Rise of RISC-V for Custom Compute

RISC-V is gaining traction in hyperscaler-driven and open-source computing, with Alibaba and Western Digital leading development efforts.

Quantum & Neuromorphic Computing Implications

While not a mainstream solution yet, early investments in quantum-inspired and neuromorphic computing architectures are shaping the future landscape.

Integration with Cloud and Edge Computing

Data Center CPUs are increasingly optimized for cloud-native applications and edge computing. AI inference workloads demand lower latency, prompting real-time processing capabilities directly at the edge.

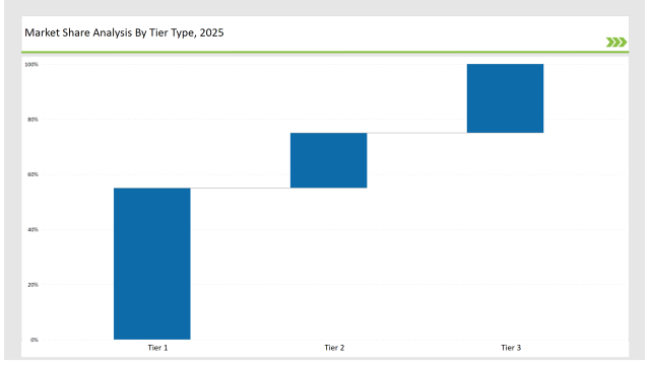

| Tier | Tier 1 |

|---|---|

| Vendors | Intel, AMD, NVIDIA |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | IBM, Ampere Computing, Fujitsu |

| Consolidated Market Share (%) | 20% |

| Tier | Tier 3 |

|---|---|

| Vendors | SiPearl, Tachyum, RISC-V players, Marvell |

| Consolidated Market Share (%) | 25% |

| Vendor | Key Focus |

|---|---|

| Intel | AI acceleration, power-efficient Xeon processors |

| AMD | 3D V-Cache for HPC, AI workload optimization |

| NVIDIA | Grace CPU Superchip for AI & cloud hyperscalers |

| IBM | Power10 processors for enterprise and quantum computing |

| Ampere Computing | ARM-based cloud processors with high core counts |

| SiPearl | Custom HPC processors for European supercomputing |

| Tachyum | Universal Processing Units (UPU) for AI/HPC |

The next evolution in Data Center CPUs will focus on

Intel, AMD, and NVIDIA collectively hold 55% of the market.

The market is categorized as medium concentration, with the top 10 players controlling 60-70%.

AI workloads drive demand for CPU-GPU hybrid processing, AI acceleration features, and optimized power efficiency.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.