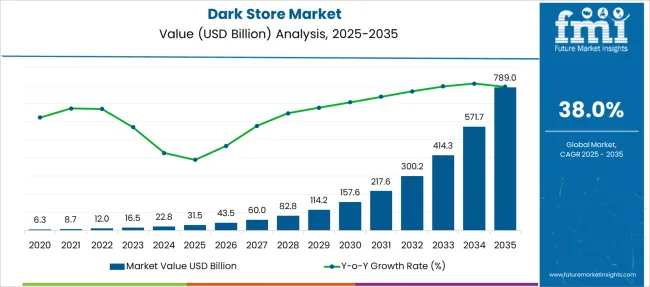

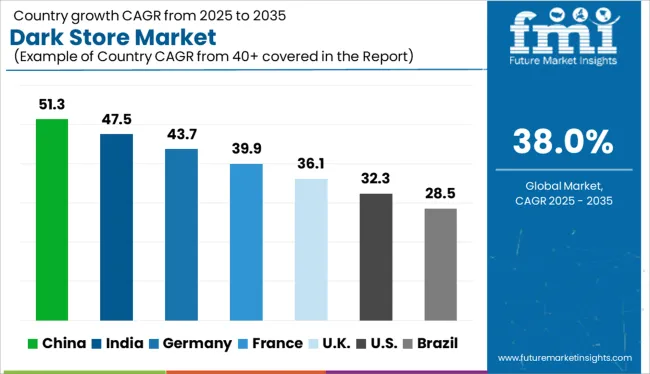

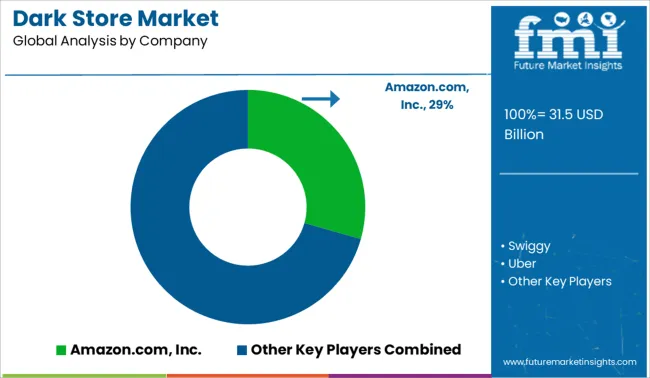

The Dark Store Market is estimated to be valued at USD 31.5 billion in 2025 and is projected to reach USD 789.0 billion by 2035, registering a compound annual growth rate (CAGR) of 38.0% over the forecast period.

| Metric | Value |

|---|---|

| Dark Store Market Estimated Value in (2025 E) | USD 31.5 billion |

| Dark Store Market Forecast Value in (2035 F) | USD 789.0 billion |

| Forecast CAGR (2025 to 2035) | 38.0% |

The dark store market is expanding rapidly as consumer expectations for speed, convenience, and contactless fulfillment continue to reshape the retail landscape. These purpose built facilities, optimized exclusively for online order picking and delivery, are enabling faster last mile operations and improved inventory control.

As traditional retail faces increasing pressure from e commerce channels, dark stores are being leveraged to meet growing demand for same day and next hour delivery services. Technological integration such as AI powered inventory systems and automated picking solutions is further enhancing operational efficiency.

Additionally, changes in consumer behavior following global disruptions have made contactless shopping a long term preference, reinforcing investment in dark store infrastructure. The market outlook remains strong, driven by demand for seamless digital fulfillment, space optimization, and logistics adaptability in densely populated urban zones.

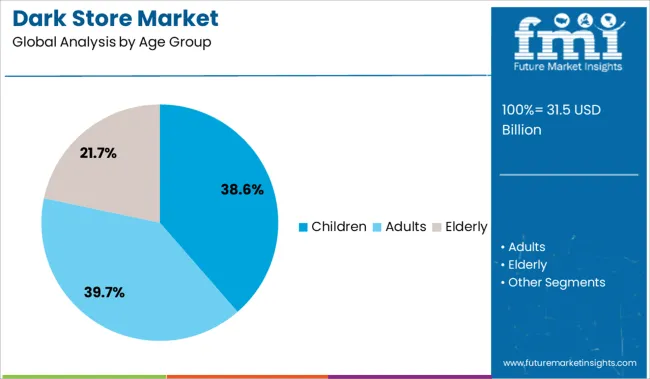

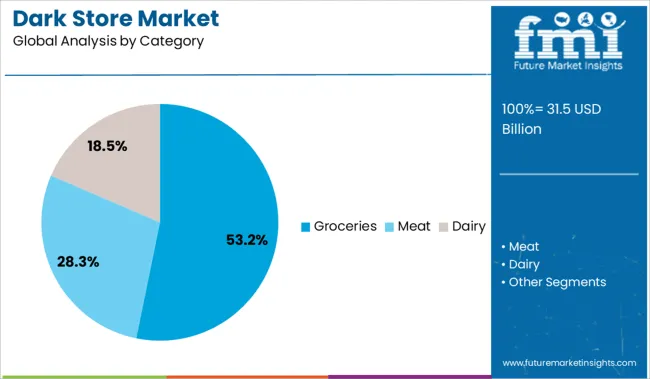

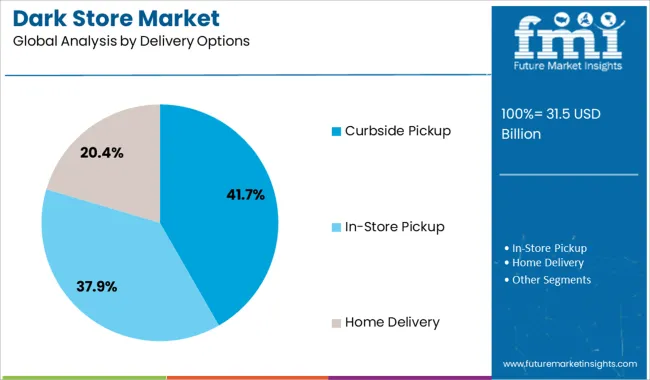

The market is segmented by Age Group, Category, Delivery Options, and Non-Food Products and region. By Age Group, the market is divided into Children, Adults, and Elderly. In terms of Category, the market is classified into Groceries, Meat, and Dairy. Based on Delivery Options, the market is segmented into Curbside Pickup, In-Store Pickup, and Home Delivery. By Non-Food Products, the market is divided into Cleaning, Essentials, and Bath & Body. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The children age group segment is projected to hold 38.60% of market revenue by 2025, making it the leading segment by age group. This dominance is attributed to the high frequency of purchases made by households with children, especially in essential categories such as food, baby care, and hygiene products.

Parents are more likely to rely on fast, reliable, and convenient delivery services that dark stores offer to meet immediate needs without visiting physical locations. The ability to schedule deliveries at preferred times and access real time inventory updates has further increased adoption among this demographic.

As families prioritize safety, routine, and time saving conveniences, demand from the children segment continues to drive sustained growth in dark store usage.

The groceries category accounts for 53.20% of total market revenue, positioning it as the most prominent category within the dark store ecosystem. This is due to the consistent consumer demand for fresh and packaged food items, coupled with the need for frequent restocking.

Groceries form the backbone of everyday consumption, and dark stores provide the operational scalability needed to fulfill large volumes of orders quickly and accurately. The ability to manage perishable inventory, integrate with supply chain systems, and ensure quality control has made groceries the central product focus of most dark store operations.

The shift toward online grocery shopping, especially post pandemic, continues to reinforce this segment’s dominance.

The curbside pickup delivery option is projected to contribute 41.70% of the market share by 2025, emerging as a leading fulfillment method. Its popularity stems from the balance it offers between online convenience and offline immediacy, allowing consumers to place orders digitally and collect them without entering the store.

This model reduces delivery costs, minimizes human contact, and supports flexible scheduling, which aligns with modern shopping preferences. Retailers benefit from increased throughput and reduced last mile logistics burden.

As health consciousness and efficiency remain key drivers of consumer behavior, curbside pickup is expected to remain a preferred channel within the dark store market.

The global dark store market was thriving at a CAGR of 24.5% between 2020 and 2025. The comparatively lower CAGR was attributed to the building phase of the market. COVID-19 has had a positive impact on the dark store market. Even in some parts of the world, the requirement of dark stores serving in a D2C manner was triggered due to the rising virus threat. Companies introduce their dark stores to reach customers directly from the production facility.

As per the report, multiple D2C brands in India have crossed Rs 100 crore in revenue in 3-5 years after their introduction. The market holds numerous opportunities for the future as it is anticipated to rise at a CAGR of 38% during the forecast period, attributing its growth to faster deliveries and a highly interactive shopping experience.

Drivers:

The rising demand for dark stores is attributed to the benefits related to the concept of a dark store, such as quick and contact-free shopping, enhanced distribution and quicker delivery, a wide audience, improved SKU management, and extended distribution channels. The need for social distance and contactless transactions.

Dark stores let end users purchase their groceries or food item without letting them enter the dark store. The increased number of physical stores transformed into dark stores due to the higher sales and better showcasing of the products. The higher adoption of dark stores as the space lets you cater to a much larger potential audience due to the availability of 24/7. The advanced 5G networks with smartphones penetrating the urban strata of the regions push the demand for dark stores. Better stock-keeping unit management through enhanced click-and-collect capabilities helps the market perform better. The busy lifestyle of end users has let them shop through these dark store portals.

Restraints:

The major restraints for the market are lower awareness and people preferring conventional methods over virtual shopping. Furthermore, the major restriction for the market is the challenge of perishability. The location of the dark store should be in the high-order prone areas, which is not always possible for the supplier.

The age group category is divided into children, adults, and the elderly. The adult segment holds the higher traction for the dark store market, followed by the elderly age group. The adult segment has the highest access to the internet, and it follows most of the online shopping trends. At the same time, the elderly age group looks for ease when it comes to ordering groceries and household stuff through dark stores.

The Kesari Mahratta Trust reports that the adult age group holds a share of 42% (31-40 years old), while the elderly class holds a share of 16% (Above 60 years) and 15.1% (Between 41-50 years).

The delivery option category is led by the online delivery option due to ease and time-saving process. Curbside pickup is also considered to be an easy option though COVID-19 and longer lockdowns have made end users habitual to the easy online delivery options when it comes to getting something online.

North America, with a rising number of dark stores due to the higher per capita income and increased penetration of smartphones, leads the market. It holds a share of 35.8% in 2025, owing to the presence of major brands with multi-dimensional distribution channels along with the busy schedule of people residing in the region. FMI explains that the adult population living in the USA makes more than 30 online purchases every month.

The rising number of brands that adopt the concept of the dark store is due to the easy availability of the product coupled with the cost-friendly setup. The dark store provides online delivery of the desired items. Thus, the pandemic has fuelled the usage of dark stores though dark stores have witnessed backlash among the cities across Europe as the locals complain of traffic and trash.

India and China are increasing the per capita income of their citizens. Thus, technological adoption is also higher than its counterparts. India’s digital economy has expanded its boundaries and has attracted concepts like dark stores. With thousands of startups working, dark store startups are also booming in the urban part of the country. While China, with a more enclosed economy, has launched its own platforms for the regulation of dark stores, easing the process of enlisting the products and delivering them.

The competitors focus on making stores with better accessibility and availability. The brands providing n number of payment options and delivery options while also providing same-day delivery options fuels the market competition. Furthermore, the key players adopt the strategy of acquisition, merger, and other expansionist tricks to strengthen their supply chain.

Recent Market Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; and Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, and United Arab Emirates(UAE) |

| Key Segments Covered | Product, Grade, Source, Form, Applications, and Region |

| Key Companies Profiled | Amazon.com, Inc.; Swiggy; Uber; Ola Foods; Supermarket Grocery Supplies Pvt Ltd.; Walmart, Inc.; Target Brands, Inc; Dunzo Daily; Instacart; Auchan; Wolt; Flipkart; Grab |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global dark store market is estimated to be valued at USD 31.5 billion in 2025.

The market size for the dark store market is projected to reach USD 789.0 billion by 2035.

The dark store market is expected to grow at a 38.0% CAGR between 2025 and 2035.

The key product types in dark store market are children, adults and elderly.

In terms of category, groceries segment to command 53.2% share in the dark store market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dark Fiber Market Forecast and Outlook 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Dark Circle Treatments Market Size and Share Forecast Outlook 2025 to 2035

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Dark Rum Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glow in the Dark Cosmetics Market

In-Store Theater Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in In-Store Theater Packaging Market

Smart Retail – AI-Powered Store Management Solutions

In-Store Analytics Market

In store signage Market

App Store Optimization Software Market Size and Share Forecast Outlook 2025 to 2035

Out Store Signage Market

Real-Time Store Monitoring Platform Market Outlook - Demand, Trends & Forecast 2025 to 2035

Pharmacy and Drug Store Franchises Market is segmented by Type and Age Group from 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA