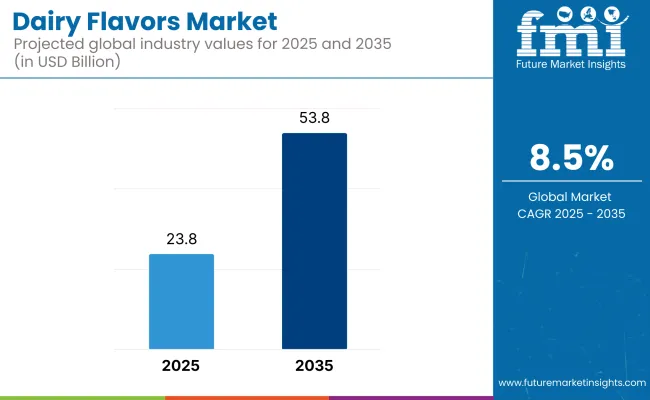

The global dairy flavors market is expected to reach USD 53.8 billion by 2035, rising from USD 23.8 billion in 2025, expanding at a CAGR of 8.5% during the forecast period. Growth is being driven by consumer demand for authentic, indulgent, and clean-label taste experiences across bakery, confectionery, beverages, and ready meals. Organic dairy flavors will dominate the nature segment, while powdered formats are projected to lead in terms of application due to their shelf stability and versatility across instant mixes and dry-blend products.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 23.8 billion |

| Projected Market Size in 2035 | USD 53.8 billion |

| CAGR (2025 to 2035) | 8.5% |

Key market trends include a sharp shift toward powdered flavor formats, which offer long shelf life and processing convenience. These are in high demand across instant soups, dry mixes, and protein-enhanced products. Organic dairy flavors are growing faster than conventional ones, owing to regulatory support, expanding certification standards, and strong consumer pull for sustainably sourced dairy ingredients. Additionally, the convergence of dairy with health and nutrition-such as functional smoothies and plant-based alternatives-is further widening the application base of dairy flavor innovations.

Between 2025 and 2035, the dairy flavors market is expected to witness significant transformation through the integration of AI-driven flavor formulation and precision fermentation techniques. These technologies are enabling manufacturers to engineer clean-label, lactose-free, and plant-based dairy flavors that mimic traditional profiles with enhanced stability and reduced fat content. As demand grows for dairy-free yet indulgent experiences, new product development will increasingly center around hybrid formats combining dairy and non-dairy inputs, particularly in beverages, spreads, and desserts.

In the coming decade, flavor manufacturers are projected to prioritize encapsulation and bio-fermentation technologies to extend shelf life, improve heat resistance, and support controlled release in complex food matrices. The rise of functional foods and nutritional supplements will also drive demand for dairy flavors with added health benefits, including those enriched with protein, probiotics, and vitamins.

With governments tightening regulations around ingredient transparency and sustainability claims, companies that can deliver traceable, AI-optimized, and carbon-neutral dairy flavor solutions will be best positioned to capture emerging demand.

The dairy flavors market has been segmented based on nature, form, application, and flavor type to provide a comprehensive view of industry dynamics. By nature, the market includes organic and conventional dairy flavors. In terms of form, it is categorized into powder, paste, liquid, and solid. Based on application, the dairy flavors market covers snacks, bakery, confectionery, soups and sauces, dairy products, flavored milk, yogurt, ice cream and desserts, spreads, others (baby food, sour cream, etc.), dietary supplements and sports nutrition, and beverages. Flavor types within the market include cheese, cream, yogurt, butter, milk, and others (such as cottage cheese).

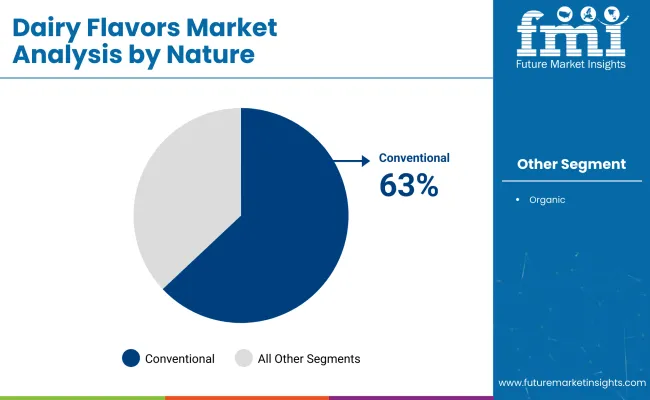

The conventional dairy flavors segment is projected to dominate the nature category with an estimated 63% market share in 2025. These flavors remain the preferred choice for large-scale food manufacturers due to their cost-efficiency, longer shelf life, and compatibility with high-volume processing systems. Widely used across mass-market bakery goods, processed dairy products, sauces, and ready-to-eat meals, conventional flavors provide consistent taste and texture with minimal formulation challenges.

Despite the rise of organic and clean-label trends, the reliability and affordability of conventional dairy flavor systems continue to appeal to producers targeting value-conscious consumers. Their established use in both emerging and mature markets reinforces their commercial viability across global supply chains.

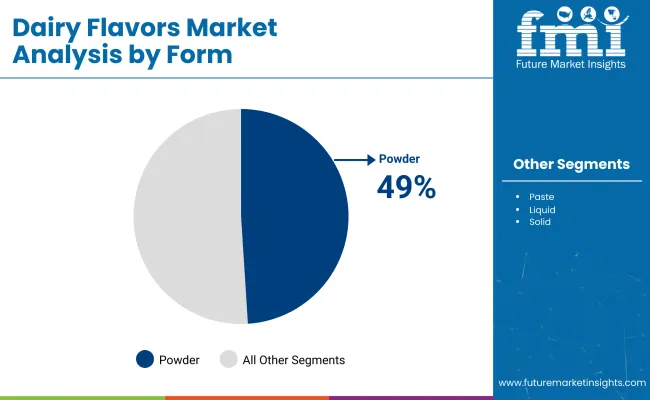

Powdered dairy flavors are expected to lead the form segment, capturing approximately 49% of the market share in 2025. Their popularity stems from superior solubility, extended shelf stability, and ease of incorporation into dry-blend food systems. These formats are widely used in products such as seasoning mixes, powdered soups, protein powders, snack coatings, and dairy-based creamers where moisture control and long shelf life are critical.

The powder form is especially suited for bulk processing and industrial-scale applications, where uniform distribution and efficient storage are essential. With advances in spray drying and microencapsulation techniques, flavor integrity is preserved over time, making powdered formats the go-to choice for manufacturers aiming for both performance and scale.

Cheese flavors are projected to dominate the flavor type segment, securing an estimated 32% market share in 2025. Their widespread application across snacks, sauces, bakery items, dairy spreads, and ready meals makes them the most versatile and commercially successful dairy flavor type. These flavors are used to replicate or enhance the sharpness, creaminess, and umami depth found in natural cheese, offering both indulgence and familiarity to consumers.

From cheddar and parmesan to processed cheese analogues, manufacturers continue to innovate with enzyme-modified and fermentation-derived cheese flavors that deliver authenticity while addressing shelf life and fat reduction goals. Cheese flavors are also being actively incorporated into plant-based formats and protein-enriched foods.

Bakery remains the leading application segment in the dairy flavors market, accounting for an estimated 21% market share in 2025. Dairy flavors are extensively used in breads, pastries, biscuits, and cakes to impart rich, creamy, and buttery profiles that enhance both taste and aroma. Their ability to replicate fresh dairy notes while maintaining product stability during baking processes makes them an essential ingredient for bakery manufacturers.

As consumer demand rises for indulgent, clean-label, and shelf-stable bakery goods, dairy flavors especially in powdered and encapsulated formats-are being utilized in artisanal and industrial bakery applications alike. Their role is not limited to conventional baked goods but is also growing in protein-rich and gluten-free formulations.

Rising Raw Material Costs, Regulatory Restrictions, and Competition from Plant-Based Alternatives

The dairy flavors market has a few challenges, namely the rising prices of raw materials such as milk, butter, cheese, and cream derivatives for flavor extraction. Dairy commodities, affected by climate change, supply chain disruptions and government trade policies, have volatile prices that affect production costs.

Another major concern is regulatory compliance, with agencies like the FDA, EFSA and FSSAI imposing strictures over labeling, clean-label transparency and natural vs artificial flavor differentiation. The rising popularity of plant-based dairy substitutes has also been influencing consumer tastes and preferences toward vegan and non-dairy flavor formulations, redirecting sales away from traditional dairy-based ingredients.

Growth in Clean-Label Flavors, Functional Dairy Ingredients, and AI-Optimized Flavor Engineering

Such challenges boost the dairy flavors market due to a surge in demand for clean-label, natural, and functional dairy flavors. The demand for other flavors such as butter, cheese, and milk-based flavors is increasing in snacks, beverages, bakery, and confectionery products as consumers are looking for authentic dairy taste experiences.

Advances in flavor engineering (via AI), bio-fermentation dairy flavors, and encapsulated flavor technologies are furthermore allowing for enhanced flavor stability, improved shelf life, and lower-fat dairy formulations. The growing variety of plant-based dairy flavors in vegan cheese, dairy-free ice cream, and lactose-free beverages is also creating new market opportunities.

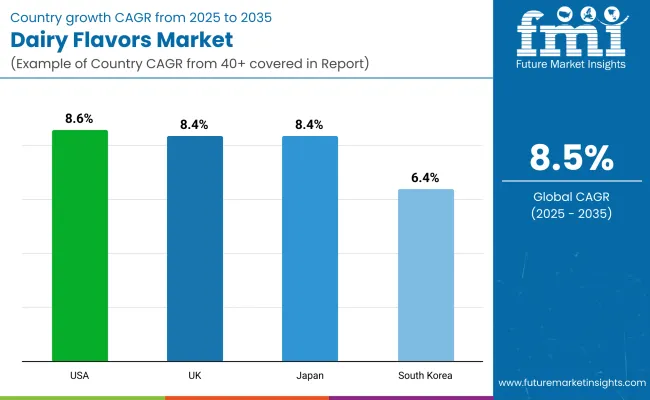

The USA dairy flavors market is anticipated to expand at a CAGR of 8.6% from 2025 to 2035, driven by strong demand for indulgent, rich-tasting food and beverage offerings. As clean-label trends grow, USA manufacturers are turning to enzyme-modified and AI-optimized dairy flavors to deliver creaminess and depth without artificial additives. The surge in plant-based and hybrid dairy beverages has further expanded the scope of application for both conventional and organic dairy flavors.

The UK dairy flavors market is projected to grow at a CAGR of 8.4% through 2035, backed by rising demand for clean-label and organic food products. Consumers increasingly seek rich dairy taste profiles in bakery, sauces, and ready meals without artificial enhancers. The growing popularity of flexitarian diets is fueling interest in dairy flavors for both traditional and plant-based applications.

Japan’s dairy flavors market is forecasted to grow at a CAGR of 8.4% through 2035, supported by demand for mildly flavored, umami-rich profiles in beverages, confections, and sauces. Dairy fermentation and enzyme-modified techniques are widely used to create subtle yet deep flavor experiences. The fusion of Western dairy notes with local taste preferences continues to shape product development.

South Korea’s dairy flavors market is set to expand at a CAGR of 8.6% between 2025 and 2035. Functional food innovation, combined with evolving consumer taste preferences for indulgent and health-forward dairy products, is propelling flavor demand. The shift toward clean-label and premiumization trends is supporting broader usage across snacks, beverages, and dairy substitutes.

The global dairy flavors market is witnessing intensified innovation as leading companies invest in advanced flavor technologies, AI-powered formulation systems, and clean-label product development. While Tier 1 players like Kerry Group, Givaudan, and IFF are focusing on enzyme-modified dairy flavors (EMDFs), encapsulation, and AI optimization, Tier 2 firms and specialty suppliers are targeting region-specific formulations, cost-effective blends, and hybrid dairy-alternative applications.

The market structure is a mix of global flavor houses, dairy ingredient manufacturers, and emerging bioflavor startups. Companies are prioritizing sustainability, traceability, and extended shelf life, with increased use of microencapsulation and fermentation-derived flavor bases. New entrants are also leveraging precision fermentation and plant-based dairy mimics to create non-dairy yet authentic flavor systems.

Key Strategic Themes Among Players:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 23.8 billion |

| Projected Market Size (2035) | USD 53.8 billion |

| CAGR (2025 to 2035) | 8.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for value |

| By Nature | Organic, Conventional |

| By Form | Powder, Paste, Liquid, Solid |

| By Flavor Type | Cheese, Cream, Yogurt, Butter, Milk, Others |

| By Application | Snacks, Bakery, Confectionery, Soups & Sauces, Dairy Products, Flavored Milk, Yogurt, Ice Cream & Desserts, Spreads, Others (e.g., baby food), Dietary Supplements & Sports Nutrition, Beverages |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | USA, UK, Germany, France, Netherlands, Japan, South Korea, China, India, Brazil, GCC countries |

| Key Players Profiled | Kerry Group Plc, Givaudan S.A., IFF, Symrise AG, Sensient Technologies Corp., Firmenich, Takasago, Prova, Edlong, Dairy Chem Inc. |

| Additional Attributes | Market trends by region and form, flavor technology innovations, plant-based dairy flavor integration, AI-driven flavor design |

The dairy flavors market is expected to reach USD 53.8 billion by 2035, driven by strong demand for clean-label, indulgent, and functional food applications.

Powdered dairy flavors dominate the form segment with a 49% market share in 2025 due to their superior stability, shelf life, and processing flexibility.

Consumer preference for non-GMO, clean-label, and ethically sourced ingredients is boosting the demand for organic dairy flavors across beverages, snacks, and plant-based products.

Leading players in the dairy flavors market include Kerry Group, Givaudan, International Flavors & Fragrances (IFF), Symrise, and Sensient Technologies Corporation, known for AI-powered flavor innovation and clean-label solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA