The global dairy enzymes market is projected to grow steadily, fueled by increasing consumer demand for diverse dairy products, improved processing efficiency, and the rising prevalence of lactose-free and reduced-lactose options Dairy enzymes are broadly used in the production of designed dairy products for cheese, yogurt, milk-based drinks, and whey proteins.

Because of their ability to improve flavor, texture and nutrition along with specific health and dietary needs, soluble fiber continues to play an important role in the production of modern dairy foods. And, with the global dairy industry never-endingly developing with new formulations and clean-label products, the uptake of advanced enzyme technologies is in ascension.

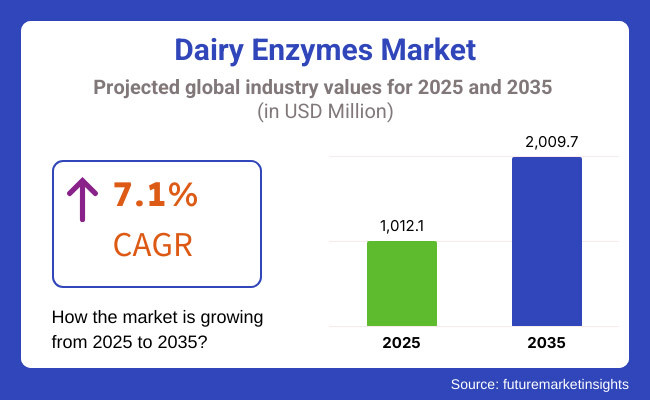

These, along with continuous research and development on enzyme functionality are estimated to contribute towards the dairy enzymes market’s growth for the upcoming 2035. The global dairy enzymes market is estimated to be valued at approximately USD 1,012.1 Million in 2025. The market is expected to be worth about USD 2,009.7 Million by 2035, growing with a CAGR of 7.1%.

This strong growth is backed by the expansion of dairy and dairy products portfolios, increasing consumer demand for lactose-free products, and advancements in enzyme production and applications.

Explore FMI!

Book a free demo

The North America region continues to be the most prominent market for dairy enzymes, with rising consumer demand for new dairy products and a mature dairy processing industry in the region contributing to the same.

Due to this consumer demand, as well as the all-around increasing interest in lactose-free and functional dairy products, manufacturers across the United States and Canada have begun adopting enzymatic solutions. The market for dairy enzymes in the region is gaining traction due to the growing trend of clean-label products and efficient production processes in the region.

Europe represents another key market with its deep dairy tradition and supportive regulatory climate for natural and sustainable ingredients. Holland, Germany and France lead the way in their adaptation of enzymes in making both traditional and modern dairy.

On account of the increasing consumer preference for natural, organic, and health-oriented dairy products, demand for enzyme-based processing solutions is growing across the region.

The Asia-Pacific market is anticipated to be the most lucrative, per capita dairy consumption is increasing across the region, coupled with rising urbanization and disposable incomes, leading to increasing middle-class population.

So we have countries such as China, India and Japan are experiencing a rapid upsurge in demand for quality dairy products, particularly functional and fortified dairy products. The growing dairy processing sector, along with increasing focus on dietary and digestive health, are likely to drive dairy enzymes uptake across the region.

Challenges

High Production Costs, Regulatory Compliance, and Plant-Based Dairy Alternatives

Lactase and other dairy enzymes like protease, lipase, and rennet, need specialized fermentation and biotechnological processes, which increase operational costs. A major challenge is compliance with regulations: food safety organizations like the FDA, EFSA and FSSAI have strict standards related to enzyme purity, microbial sourcing and allergen labeling, not to mention the effects on the end product.

We also expect some pressure from decreasing demand from the rising plant-based dairy alternatives trend resulting in shifting consumer preferences away from traditional dairy processing and leading to the lower demand for certain enzymes used in cheese, yogurt and milk-based products.

Opportunities

Growth in Lactose-Free Dairy, Functional Dairy Products, and Enzyme Innovation

However, these challenges are outweighed by the growing demand for lactose-free products, functional dairy formulations, and advanced enzyme technology in the food industry which businesses in dairy enzyme market can leverage upon. The growing incidence of lactose intolerance is driving up the need for lactase enzymes, which allow dairy producers to market their products to lactose-intolerant customers.

Texture, flavor, and digestibility enzymes are also sought after for high-protein dairies, probiotic-rich yogurts, as well as premium cheeses. Innovative microbial fermentation systems, as well as genetically engineered enzymes and AI-driven optimizations of those enzymes, are improving processing efficiencies and sustainability in producing dairy products as well.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety, enzyme purity, and allergen labeling standards. |

| Consumer Trends | Demand for lactose-free dairy, functional dairy, and digestive-friendly formulations. |

| Industry Adoption | High usage in cheese ripening, yogurt fermentation, and milk lactose breakdown. |

| Supply Chain and Sourcing | Dependence on microbial fermentation, genetically modified organisms (GMOs), and enzyme engineering. |

| Market Competition | Dominated by dairy enzyme manufacturers, biotech firms, and food ingredient suppliers. |

| Market Growth Drivers | Growth fueled by rising lactose intolerance, demand for high-quality dairy, and enzymatic processing efficiency. |

| Sustainability and Environmental Impact | Moderate adoption of biodegradable enzyme extraction and water-efficient fermentation methods. |

| Integration of Smart Technologies | Early adoption of enzyme-optimized cheese aging and automated dairy processing. |

| Advancements in Enzyme Technology | Development of high-yield lactase enzymes and non-animal rennet for vegetarian cheese production. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter biotech-based enzyme regulations, sustainability requirements, and GMO enzyme transparency laws. |

| Consumer Trends | Growth in precision fermentation-based enzymes, AI-assisted enzyme engineering, and smart dairy processing. |

| Industry Adoption | Expansion into smart enzyme-controlled dairy processing, vegan dairy fermentation, and AI-driven food enzyme customization. |

| Supply Chain and Sourcing | Shift toward precision fermentation, bioengineered enzyme solutions, and plant-based enzyme alternatives. |

| Market Competition | Entry of synthetic biology startups, AI-driven enzyme optimization firms, and biotech-based dairy innovators. |

| Market Growth Drivers | Accelerated by AI-powered enzyme selection, sustainable dairy processing, and protein-enhancing enzymatic technologies. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral enzyme production, waste-free dairy processing, and AI-driven sustainability tracking. |

| Integration of Smart Technologies | Expansion into IoT-enabled fermentation tracking, blockchain-based enzyme traceability, and real-time enzymatic quality control. |

| Advancements in Enzyme Technology | Evolution toward next-gen bioengineered dairy enzymes, AI-powered enzyme customization, and alternative protein fermentation. |

The USA dairy enzymes market has also seen a steady growth owing to the growing demand for lactose-free dairy products, clean-label ingredients, and functional dairy formulations. Increasing usage of enzyme processing solution in cheese making, yogurt fermentation, milk processing is supporting market growth. Moreover, the industry growth is further supported by advancements in biotechnology and enzyme optimization.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

United Kingdom, the increasing demand for plant-based dairy substitutes, as well as the growing tendency of low-fat or digestive-friendly dairy products, are driving the expansion of the dairy enzymes sector.

With growing consumer demand for lactose-free, high-protein dairy products, enzyme innovation continues to drive innovation. Moreover, the increasing focus of regulatory authorities on food safety, along with the growing adoption of sustainable dairy processing methods is supporting the growth of enzymatic solutions in dairy industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The dairy enzymes market is developing consistently throughout Europe due to dairy producers focusing on advanced processing technology to improve the quality and sustainability of products.

The growing consumer inclination towards probiotic-enriched and functional dairy products is shaping the demand for enzymes for fermentation and milk processing. Changes in the realigning landscape to give clearer shape of market trends are the of the stringent food additive regulation of EU and dairy product formulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

The market for dairy enzymes in Japan is growing at moderate rate, driven by rising demand for functional and digestive-health dairy derivatives. Industry growth is propelled by the popularity of yogurt with enzymes, fermented dairy, and lactose-free milk. Other drivers include innovations in enzyme engineering and probiotic-enhanced dairy formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The increasing use of fermented dairy items and plant-based dairy substitutes is boosting growth in the dairy enzymes market in South Korea. A heightened consumer interest in gut health and digestive wellness is driving the demand for enzyme-based dairy innovations. Furthermore, government initiatives supporting biotechnology and enzyme research are driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Dairy enzymes are growing their applications widely as dairy manufacturers, food technologists, and nutrition-centric companies leverage enzymes extensively to achieve desired dairy texture and better digestibility along with improved production efficiency.

The dairy enzymes are important in lactose hydrolysis, protein breakdown and fat modification, resulting in the production of low-lactose dairy, high-protein formulations and functional dairy products. Growing availability of clean-label, plant-based, and high-nutritious dairy alternatives is driving manufacturers towards the development of advanced enzyme formulations along with the usage of sustainably sourced enzymes.

The market is segmented by Product (Carbohydrate Dairy Enzymes, Protease Dairy Enzymes, Polymerase & Nuclease Dairy Enzymes, Lipase Dairy Enzymes, Phytase Dairy Enzymes, Other Dairy Enzymes) and Source (Plant-Based, Animal and Micro-organisms Based)

Protease dairy enzymes are expected to lead the market, owing to integral nature of this enzyme to cheese production, milk protein hydrolysis, and fermented dairy processing.

Protease enzymes provide benefits by cleaving the casein and whey proteins into smaller peptide chains, resulting in improved texture, flavor and digestibility of dairy products including cheese, yogurt and protein-fortified milk. The growing consumption of protein-rich dairy products and the increasing number of functional dairy beverages are favoring the uptake of protease-based dairy enzymes.

Protease enzymes have also applications in dairy alternatives derived from plant-based sources, as they help enhance almond milk, oat milk, and soy-based dairy formulations with respect to protein solubility, emulsification, and mouthfeel. With increasing interest in enzymatic modification of proteins for improved nutritional properties, the demand for highly specific proteases is predicted to grow in the dairy industry.

The carbohydrate dairy enzymes segment commands a notable market share as well, particularly in the production of lactose-free dairy. The carbohydrate enzyme lactase is critical for the hydrolysis of lactose into glucose and galactose, which promotes improved digestive properties in lactose-intolerant consumers.

As the market for lactose-free milk, cheese and yogurt continues to grow, manufacturers are increasingly utilizing carbohydrate dairy enzymes to enhance accessibility and health-related benefits for the consumer.

The segment for enzyme products originating from plant sources dominates the Dairy Enzymes Market as industries are moving toward sustainable enzyme solutions that are not sourced from animals for vegan & clean-label dairy processing. Plant-based enzymes are commonly utilized in non-dairy milk, plant-based cheeses, and fermented dairy alternatives, wherein it aids in texture and protein stabilization and flavors-from plant-based cultures.

The growing trend towards plant-based and flexitarian diets have increased demand for plant-derived dairy enzymes, especially for enzymatic milk processing and hydrolysis of plant-based protein. Increasing adoption of sustainable and non-GMO enzyme solutions is also fueling market growth in vegan-friendly dairy alternatives.

Dairy enzymes derived from animal and micro-organisms will prevail in cheese-making and yogurt fermentation as well as enzyme-modified dairy products. Microbial rennet comes from the fermentation of fungi and bacteria, widely used in cheese making as a non-animal alternative to calf rennet.

Using new fermentation technologies and enzyme engineering, manufacturers have been investigating dairy enzymes based on precision fermentation for improved functionality and sustainability.

Factors driving market growth include increasing lactose-free dairy product consumption, improved dairy processing efficiency, and clean-label food ingredients. AI led enzyme optimization, sustainable dairy fermentation practices, high yield enzyme formulations for improved product texture, digestion and shelf-life extension are some of the major focus areas of the companies.

Enzyme manufacturers, dairy processing companies, and biotechnology firms are among the key contributors in this market, facilitating technological progress such as the development of advanced enzymes, the improvement of dairy formulation through artificial intelligence (AI) technology, and the provision of sustainable solutions for processing lactose-free dairy.

Market Share Analysis by Key Players & Dairy Enzyme Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Chr. Hansen Holding A/S | 18-22% |

| Novozymes A/S | 12-16% |

| Kerry Group Plc | 10-14% |

| DuPont de Nemours, Inc. (IFF Nutrition & Biosciences) | 8-12% |

| DSM-Firmenich | 5-9% |

| Other Dairy Enzyme Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Chr. Hansen Holding A/S | Develops AI-optimized dairy enzyme solutions for lactose hydrolysis, cheese ripening, and probiotic dairy formulations. |

| Novozymes A/S | Specializes in sustainable lactase enzymes, AI-powered dairy fermentation, and high-efficiency enzyme extraction. |

| Kerry Group Plc | Provides enzymatic solutions for texture improvement, AI-assisted dairy ingredient optimization, and clean-label dairy product formulations. |

| DuPont de Nemours, Inc. (IFF Nutrition & Biosciences) | Focuses on next-generation dairy enzyme development, AI-driven yield maximization, and lactose-free dairy processing innovations. |

| DSM-Firmenich | Offers dairy enzymes for improved flavor profiles, AI-powered dairy stabilization, and functional protein processing solutions. |

Key Market Insights

Chr. Hansen Holding A/S (18-22%)

Chr. An industry leader in dairy enzymes, Hansen provides superior lactase enzymes, AI-based dairy fermentation optimization, and enzyme-based probiotic dairy formulations.

Novozymes A/S (12-16%)

Novozymes specializes in sustainable lactase enzyme development, ensuring AI-enhanced dairy processing efficiency, lactose-free product innovations, and cost-effective enzyme applications.

Kerry Group Plc (10-14%)

Kerry Group offers functional dairy enzymes, enabling AI-based optimization of cheese maturation, yogurt texture improvement, and shelf life extension.

DuPont de Nemours, Inc. (IFF Nutrition & Biosciences) (8-12%)

DuPont is next-gen enzyme based on dairy processing as it applies AI-assisted lactose reduction techniques and high-yield dairy fermentation technologies.

DSM-Firmenich (5-9%)

Clean Enzymatic Dairy Processing; DSM-Firmenich; AI-powered dairy protein stabilization; Dairy digestibility improvement; Plant-based proteins.

Other Key Players (30-40% Combined)

Several dairy processing enzyme manufacturers, biotechnology firms, and specialty ingredient companies contribute to next-generation enzyme innovations, AI-powered dairy fermentation advancements, and sustainable lactose-free dairy processing. These include:

The overall market size for dairy enzymes market was USD 1,012.1 Million in 2025.

Dairy enzymes market is expected to reach USD 2,009.7 Million in 2035.

The demand for dairy enzymes is expected to rise due to increasing consumption of dairy products, growing demand for lactose-free and functional dairy items, and advancements in enzyme technologies for improved texture, flavor, and digestion.

The top 5 countries which drives the development of dairy enzymes market are USA, UK, Europe Union, Japan and South Korea.

Protease dairy enzymes and plant-based enzymes to command significant share over the assessment period.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.