The world's emerging global cytokine release syndrome (CRS) management market has shaped up for steady growth. This is largely or directly due to the increasing acknowledgment regarding the fact that CRS, a severe immune response to offending factors such as certain cancer therapies, autoimmune disorders, and infections, is being encountered more frequently.

The advent of next-generation immunotherapies including chimeric antigen receptor (CAR) T-cell therapy has underscored the importance of effective management of CRS to maintain patient safety and enhance therapeutic response. This has led to increasing use of targeted therapies, such as IL-6 inhibitors, corticosteroids and other anti-inflammatory agents.

Ongoing research on new therapeutic approaches and standardized management protocols are also driving the market. With the development of novel cancer therapies and immunotherapies continuing, and the need for improved CRS management solutions will only increase, and this will drive growth up until 2035.

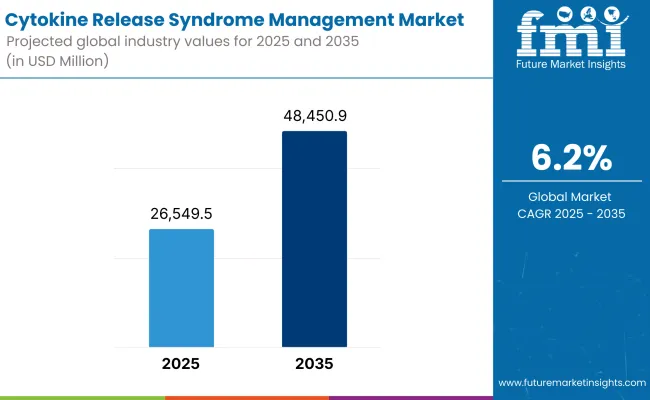

According to 2025 analysis, the global CRS management expectedly cost more than USD 26,549.5 Million. It is projected to be worth USD 48,450.9 Million by 2035, at a CAGR of 6.2%. Such a consistent growth is induced by the rising adoption of novel immunotherapies, growing number of clinical trials, and awareness about CRS management options.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 26,549.5 Million |

| Projected Market Size in 2035 | USD 48,450.9 Million |

| CAGR (2025 to 2035) | 6.2% |

North America is a major market for CRS management solutions since the region has high penetration of biopharmaceutical companies, comprehensive and advanced cancer therapy options, and well-established healthcare facilities. In particular, the United States has led the way in developing and commercializing host-modulating therapies for CRS, backed by clinical trial evidence and regulatory approvals of targeted therapeutics.

Another regional market that contributes to the global CRS management software market is Europe, with a robust healthcare system and growing use of immunotherapy for treating cancer.

Germany, the UK and France are among these countries taking the lead in implementing CAR T-cell therapies and related CRS management protocols. The region's heavy emphasis on research and innovation coupled with regulatory frameworks fostering patient safety is creating the demand for CRS therapies.

Asia-Pacific countries, increasing healthcare access, and rising adoption of novel drugs are expected to accelerate the growth of the market for CRS management. In particular, countries such as China, Japan, and South Korea are advancing rapidly in the fields of immunotherapy development and clinical applications of immunotherapy, thereby creating a greater need for effective strategies to manage CRS.

With enhancement of regional healthcare infrastructure and expansion of the pharmaceutical companies within the region, the Asia-Pacific market will account for the highest growth in the forthcoming years.

Challenges

High Treatment Costs, Complex Disease Management, and Limited Awareness

The main challenges faced by the CRS management market are high treatment prices of monoclonal antibodies, corticosteroids and immunomodulatory therapy. Other advanced biologics including tocilizumab (IL-6 inhibitors) and JAK inhibitors are also majorly unaffordable and administering them would also need specialized procedures in hospital settings, which serves as a barrier to visit journeys for a diagnosis for a huge group of patients.

CRS management represents another big hurdle, as it requires multidisciplinary care, real-time monitoring and rapid treatment of severe cases, particularly in patients receiving CAR-T cell therapy. Moreover, low awareness and late diagnosis by the non-specialist healthcare provider could result in suboptimal patient outcomes; thus, early detection as well as risk stratification is necessary for enhanced management of CRS.

Opportunities

Growth in CAR-T Cell Therapy, AI-Driven Diagnostics, and Personalized Medicine

Despite these challenges, the CRS management market is expected to grow significantly owing to packaging of CAR-T cell therapy in oncology, rise in demand AI-based diagnostics, advancements in precision medicine. The permeation of cell and gene therapy is creating a need for effective CRS mitigation methods, with innovations in cytokine profiling, biomarker-directed patient stratification and multiplexed targeted immunotherapy approaches.

Digital health tools and AI-led early detection algorithms are also helping in CRS monitoring and control which aid in early intervention and better patient prognosis. This encompasses the growing practice of clinical trials; the regulation of novel immunosuppressive agents.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA and EMA guidelines for CRS management in CAR-T cell therapy. |

| Consumer Trends | Demand for targeted immunotherapy, biologics, and precision medicine approaches. |

| Industry Adoption | Use in CAR-T cell therapy, autoimmune diseases, and inflammatory disorders. |

| Supply Chain and Sourcing | Dependence on monoclonal antibody production and biologics manufacturing. |

| Market Competition | Dominated by pharmaceutical companies developing IL-6 inhibitors, corticosteroids, and JAK inhibitors. |

| Market Growth Drivers | Growth fueled by expanding CAR-T cell therapy applications, inflammatory disease research, and regulatory approvals. |

| Sustainability and Environmental Impact | Moderate adoption of green biopharmaceutical manufacturing practices. |

| Integration of Smart Technologies | Early adoption of real-time cytokine monitoring and machine learning for CRS prediction. |

| Advancements in CRS Treatment | Development of novel biologics and immunosuppressant for CRS management. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter post-marketing surveillance, real-world evidence collection, and AI-powered safety monitoring. |

| Consumer Trends | Growth in AI-based predictive analytics, biomarker-driven therapy selection, and decentralized patient monitoring. |

| Industry Adoption | Expansion into oncology supportive care, AI-assisted CRS diagnosis, and precision-driven therapeutic interventions. |

| Supply Chain and Sourcing | Shift toward next-gen biologics, AI-optimized supply chain logistics, and cell therapy-integrated CRS management. |

| Market Competition | Entry of biotech firms specializing in AI-driven CRS prediction, digital therapeutics, and next-gen cytokine-modulating agents. |

| Market Growth Drivers | Accelerated by AI-powered real-time patient monitoring, digital biomarkers for CRS risk prediction, and gene-editing-based immune modulation. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral bioprocessing, AI-driven drug repurposing, and sustainability-focused clinical trials. |

| Integration of Smart Technologies | Expansion into AI-powered treatment optimization, block chain-enabled patient data tracking, and decentralized care platforms. |

| Advancements in CRS Treatment | Evolution toward personalized immunomodulation, gene therapy-based CRS prevention, and AI-driven CRS risk stratification. |

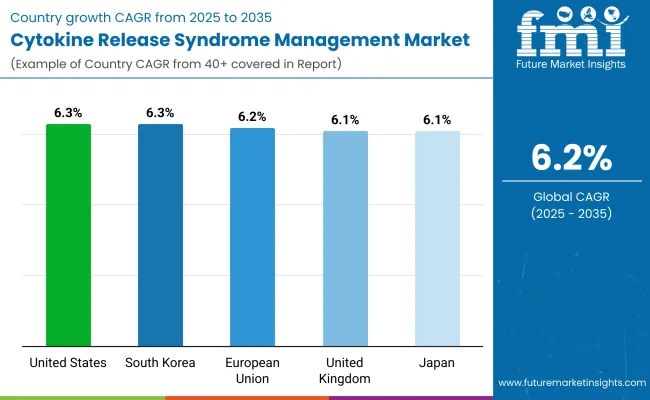

The USA cytokine release syndrome (CRS) management market is expanding due to the increasing CAR-T cell therapies, monoclonal antibodies and immunotherapy. The increasing incidence of hematological cancers and autoimmune disorders is further propelling the demand for effective CRS management solutions.

Moreover, increased government funding for cancer research coupled with the presence of major biopharmaceutical companies are driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

The market is being driven in the United Kingdom with the adoption of advanced immunotherapies for cancer and inflammatory diseases. To mitigate CRS, the National Health Service (NHS) is looking at investing in novel biologics and supportive care treatments. Moreover, clinical trials and research alliances pursue to lessen CRS severity, further aiding market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

The cytokine release syndrome management market is expanding across Europe as regulatory agencies approve new immunotherapies and biologicals for cancer and autoimmune diseases. Market demand is driven by the growing number of clinical trials to evaluate CRS management strategies.

Investing in personalized medicine and developing hospital-based CRS treatment protocols are improving patient outcomes and further propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

Cytokine release syndrome management in Japan is losing out in terms to moderate growth due to country's recent advancements in immuno-oncology and precision. The growing adoption of CAR-T cell therapies and targeted biologics for the treatment of cancer is fuelling the need for CRS management solutions. Moreover, advancements in cytokine modulation therapies and hospital-based supportive care are fueling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea cytokine release syndrome management market is being driven by growing investments in biopharmaceutical research and increasing adoption of advanced immunotherapies. The government initiatives promoting precision medicine and cancer immunotherapy treatments are growing the need for CRS management solutions. Moreover, the market is driven by collaboration between biotech companies and research institutes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The CRS management market is propelled by surging arrival of cytokine storms unionized by immunotherapy, autoimmune ailments alongside glandular supplies. CRS, an acute inflammatory state driven by excessive quantities of cytokines, requires specific treatment approaches such as immunosuppressive medications, corticosteroids, and specialized targeted biologics.

As CAR-T cell therapy, monoclonal antibodies and immune checkpoint inhibitors become more widely used in oncology, there is an increasing need for cytokine-target therapies targeted and precision medicine bolstering.

The market is also segmented based on Cytokine Type (Tumor Necrosis Factor-TNF, Interleukins-II, Interferons-IFN, Epidermal Growth Factor-EGF) and Therapeutic Application (Cancer, Asthma, Airway Inflammation, Arthritis, Others).

Interleukins-II segment accounted for a major proportion of the CRS management market, as IL-2 is a central factor in immune activation, T-cell proliferation, and pathogenesis of cytokine storm. Interleukin-2 (IL-2) pathway targeting has been crucial in addresses CRS triggered by CAR-T cell therapy, organ transplant rejection, and autoimmune conditions.

To mitigate severe immune responses and maintain therapeutic activity, biopharmaceutical companies have developed IL-2 blockers, mAbs, and cytokine modulation drugs.

The demand for IL-2 pathway inhibitors and therapies that fine-tune cytokine modulation will likely increase due to the growing number of patients experiencing CRS driven by cancer immunotherapy, sepsis-related cytokine storms or severe viral infections. Rather, with investigations of such low-dose IL-2 therapies, as well as next-generation cytokine inhibitors, the scope of IL-2 modulation in the clinic is continuing to expand.

In particular, the Tumor Necrosis Factor (TNF) segment commands a large share, especially in inflammatory disorders, autoimmune diseases, and the management of CRS in sepsis. TNF is a critical mediator of inflammation and immune dysregulation, thus the use of TNF inhibitors has become obligatory in the treatment of CRS primed by infections, cancer immunotherapy, and chronic inflammatory diseases.

The segment has been benefitting from the broad uptake of TNF-blocking biologics, including infliximab and etanercept, especially in rheumatoid arthritis, Crohn’s disease and cases of severe CRS.

The cancer treatment segment dominates the CRS management market owing to the fact that Cytokine storms are common side effects of advanced forms of immunotherapy, such as monoclonal antibody therapy, CAR-T cell therapy, and immune checkpoint inhibitors.

It is important that oncologists learn how to manage CRS in oncology patients receiving immunotherapy in order to safe life threatening complications, as well as patient outcomes, and to ensure delivery of the therapy.

As personalized cancer immunotherapy, combination biologics, and targeted cytokine inhibitors become increasingly more prominent, several pharmaceutical companies are pursuing innovative and next-generation CRS management strategies to reduce the risk of treatment-related toxicities.

Selective cytokine blockers, corticosteroid alternatives (especially in the hematological malignant), IL-6 inhibitors are some of the new aspects which will define the market landscape of the market in oncology.

The airway inflammation segment is seeing significant demand as well, particularly in the areas of asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections.

Cytokine-directed therapies are being investigated to mitigate inflammation, limit airway remodeling, and enhance pulmonary function in individuals experiencing asthmatic exacerbations and cytokine storms due to COVID-19. Cytokine-modulating therapies are projected to witness some innovation owing to increasing biological therapy focus for respiratory inflammatory conditions.

The cytokine release syndrome (CRS) management market is expanding due to the increasing incidence of CRS in immunotherapy, CAR-T cell therapies, and infectious diseases such as COVID-19. Companies are focusing on AI-driven drug discovery, targeted immunosuppressive therapies, and precision medicine advancements to enhance treatment efficacy, patient safety, and response monitoring.

The market includes pharmaceutical companies, biotechnology firms, and clinical research organizations, each contributing to therapeutic advancements in CRS management, AI-powered drug development, and next-generation immunomodulatory treatments.

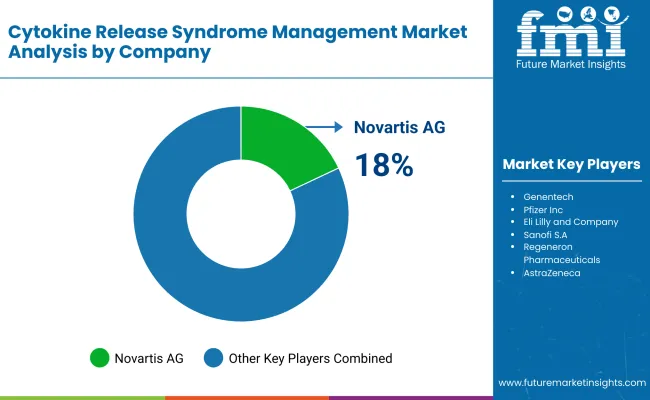

Market Share Analysis by Key Players & CRS Management Drug Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG | 18-22% |

| Genentech (Roche Holding AG) | 12-16% |

| Pfizer Inc. | 10-14% |

| Eli Lilly and Company | 8-12% |

| Sanofi S.A. | 5-9% |

| Other Biopharmaceutical & Immunotherapy Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG | Develops IL-6 inhibitors (Tocilizumab), AI-powered drug response monitoring, and CRS-specific immunotherapy solutions. |

| Genentech (Roche Holding AG) | Specializes in Actemra (Tocilizumab), AI-assisted CRS severity analysis, and CAR-T therapy safety protocols. |

| Pfizer Inc. | Provides JAK inhibitors, AI-enhanced cytokine storm prediction, and monoclonal antibody-based CRS management. |

| Eli Lilly and Company | Focuses on anti-inflammatory biologics, AI-driven patient stratification, and CRS-targeted immunosuppressive therapies. |

| Sanofi S.A. | Offers IL-1 receptor antagonists (Anakinra), AI-powered biomarker tracking, and next-generation cytokine modulation treatments. |

Key Market Insights

Novartis AG (18-22%)

In the CRS management space, Novartis is the leader, selling IL-6 inhibitors (e.g. Tocilizumab), AI-driven treatment response monitoring, and a focused immunotherapy safety boost.

Genentech (Roche Holding AG) (12-16%)

Genentech focuses on Actemra (Tocilizumab) as a primary CRS treatment, incorporating AI-supported severity analysis, CAR-T therapy integration and response protocols.

Pfizer Inc. (10-14%)

Pfizer provides JAK inhibitors and targeted biologics, optimizing AI-driven cytokine storm prediction models and real-time patient monitoring solutions.

Eli Lilly and Company (8-12%)

Eli Lilly is another player in anti-inflammatories biologic drugs, and they also benefit from AI driven patient risk assessment, targeting molecular drivers with precision medicine, and targeted cytokine blockade.

Sanofi S.A. (5-9%)

IL-1 receptor antagonists, examples include Anakinra, AI-powered biomarker tracking integration, personalized CRS treatment approaches, immune modulation advancements.

Other Key Players (30-40% Combined)

Several biopharmaceutical companies, immunotherapy firms, and biotech research organizations contribute to next-generation CRS management innovations, AI-powered immunomodulatory advancements, and targeted biologic therapy solutions. These include:

The overall market size for cytokine release syndrome management market was USD 26,549.5 Million in 2025.

Cytokine release syndrome management market is expected to reach USD 48,450.9 Million in 2035.

The demand for cytokine release syndrome management is expected to rise due to increasing adoption of immunotherapy treatments, growing prevalence of autoimmune and inflammatory diseases, and advancements in targeted drug therapies.

The top 5 countries which drives the development of cytokine release syndrome management market are USA, UK, Europe Union, Japan and South Korea.

Interleukins-II and cancer treatment drive to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Cytokine Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Biomarker Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 25: Global Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 29: Global Market Attractiveness by End-User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 55: North America Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: North America Market Attractiveness by End-User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 115: Europe Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 116: Europe Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 149: South Asia Market Attractiveness by End-User, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 179: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by End-User, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 209: Oceania Market Attractiveness by End-User, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Cytokine Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Biomarker Type, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by End-User, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Cytokine Type, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Cytokine Type, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Cytokine Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Biomarker Type, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Biomarker Type, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Biomarker Type, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 235: MEA Market Attractiveness by Cytokine Type, 2023 to 2033

Figure 236: MEA Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 237: MEA Market Attractiveness by Biomarker Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 239: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cytokine Storm Therapy Market

Release Tapes Market Size and Share Forecast Outlook 2025 to 2035

Release Agent Market – Trends & Forecast 2025 to 2035

Release Liner Recycling Market

PET Release Liner Market

Heat Release Tester Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Smart-Release Moisture-Boosting Technology Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Wrinkle Release Spray Market Analysis - Trends, Growth & Forecast 2025 to 2035

Extended Release Drugs Market Size and Share Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Silicone Release Liners Market Insights - Growth & Demand 2025 to 2035

Silicone Release Films Market

Sustained Release Excipients Market Report – Trends & Industry Forecast 2018-2026

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Deep dive into the Food Grade Release Agent Market by Product Type, Form, Application, Distribution Channel, and Region through 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Soft Tissue Release Systems Market

Carpal Tunnel Release System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fluorosilicone Release Coating Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA