The global Cuvette Caps Market is highly competitive, segmented into Tier 1, Tier 2, and Tier 3 players based on market presence and strategies. Key players such as Thermo Fisher Scientific, Eppendorf AG, and BrandTech Scientific, which occupy 60% of the market share, dominate as Tier 1 companies.

Such companies are enjoying the benefit of economies of scale, leading R&D, and strong global distribution networks. Their focus lies on sustainability initiatives and customized designs targeted at pharmaceutical, laboratory, and life sciences markets. Strategic partnerships and new-age practices help Tier 1 companies keep their premium price and high demand.

Tier 2 players, such as Greiner Bio-One and Cole-Parmer, represent 25% of the global market share. These players target medium-sized enterprises and regional sectors, focusing on cost-effective and customizable cuvette caps. By enhancing operational efficiency and offering personalized services, Tier 2 players have solidified their position in emerging markets.

Tier 3 players, including smaller regional manufacturers, startups, and private labels, contribute 15% to the global market share. These players cater to localized needs and specialize in niche markets. Many focus on eco-friendly designs, such as biodegradable or compostable cuvette caps, to attract environmentally conscious consumers.

Despite limited resources, Tier 3 players' agility allows them to address specific gaps in the market and compete effectively. Collectively, these three tiers drive a dynamic and evolving Cuvette Caps Market, emphasizing sustainability, innovation, and customization.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Thermo Fisher Scientific, Eppendorf AG, BrandTech Scientific) | 13% |

| Rest of Top 5 (Greiner Bio-One, Cole-Parmer) | 9% |

| Next 5 of Top 10 (Corning Incorporated, Globe Scientific, Heathrow Scientific, Mettler Toledo, DWK Life Sciences) | 10% |

The market remains consolidated at the top, with Tier 1 players benefiting from global reach, while Tier 3 players drive localized innovation and specialization.

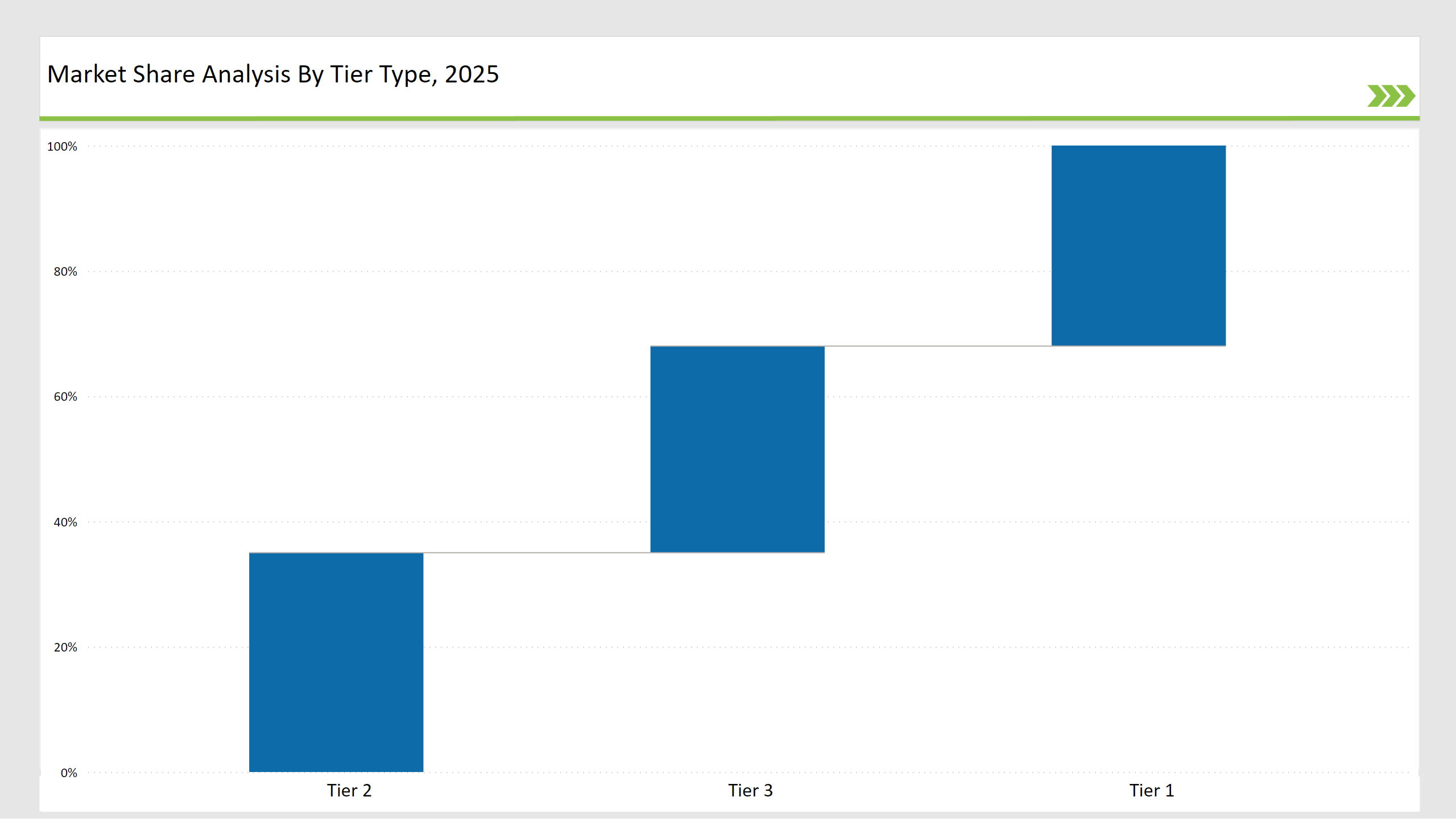

Type of Player & Industry Share (%), 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 32% |

| Next 20 Players | 35% |

| Remaining Players | 33% |

The Cuvette Caps Market is segmented based on its primary end-use industries, which include:

To meet the diverse and evolving industry needs, vendors offer customized and innovative products, including:

Manufacturers are integrating advanced technologies such as RFID tracking, AI-driven sample monitoring, and smart labeling systems to meet consumer and regulatory demands.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Thermo Fisher Scientific, Eppendorf AG, BrandTech Scientific |

| Tier 2 | Greiner Bio-One, Cole-Parmer |

| Tier 3 | Globe Scientific, Corning Incorporated, niche startups, Heathrow Scientific, DWK Life Sciences |

| Manufacturer | Latest Developments |

|---|---|

| Thermo Fisher Scientific | Launched biodegradable cuvette caps in January 2024. |

| Eppendorf AG | Expanded custom-printing capabilities in March 2024. |

| BrandTech Scientific | Invested in AI-driven sample monitoring solutions in February 2024. |

| Greiner Bio-One | Introduced tamper-proof medical-grade cuvette caps in June 2024. |

| Cole-Parmer | Focused on cost-effective, customizable caps in April 2024. |

| Globe Scientific | Developed RFID-enabled tracking cuvette caps in May 2024. |

| Corning Incorporated | Introduced smart-labeled caps with real-time monitoring in July 2024. |

The Cuvette Caps Market will evolve with innovative automation and Internet of Things for improved production efficiencies and on-demand customization. Eco-friendly packaging solution and recyclable materials are main areas of attention. Robotics and AI are in use to contain the cost of production while handling the increased volumes of smart tamper-proofing.

Smart techniques in manufacturing enable scalability and fewer lead times as well. The industry is also shifting towards regulatory compliance, ensuring that cuvette caps meet stringent safety and performance standards.

With growing investments in R&D, manufacturers are developing next-generation materials that offer enhanced durability and chemical resistance. Market players are increasingly integrating real-time data analytics to optimize production workflows and improve quality control.

The leading manufacturing companies include Thermo Fisher Scientific, Eppendorf AG, BrandTech Scientific, Greiner Bio-One, and Cole-Parmer.

The top 10 players altogether account for 32% of the global market.

The market remains medium concentration, with Tier 1 players holding 35% of the market.

Tier-3 companies contribute 10% of the market share, focusing on niche and sustainable solutions.

Automation, sustainability, and AI-integrated monitoring are key drivers of market growth.

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.