The Cutting Fluid Market will demonstrate gradual growth during the time period from 2025 to 2035 because the manufacturing and automotive and aerospace and metalworking sectors will raise their demands. Development of cutting fluids ensures crucial functions in machining which extend from cooling the process to lubrication and chip removal which directly boost tool survival and operational performance.

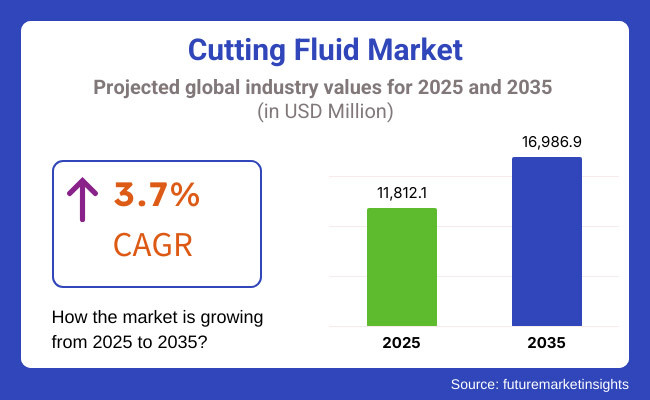

During 2025 to 2035 analysts estimate that the cutting fluid market will expand to USD 16,986.9 million from its 2025 value of USD 11,812.1 million as it registers a compound annual growth rate (CAGR) of 3.7%.

The market expansion occurs because manufacturers use high-performance metal cutting methods and develop both synthetic and bio-based cutting fluids. The market for cutting tools experiences positive growth because organizations focus on promoting workplace safety together with sustainability practices.

The market growth potential faces hurdles because of unstable raw material price fluctuations and strict waste disposal requirements and regular fluid servicing needs. The industry requires eco-friendly formulations that deliver better cooling and lubrication while increasing fluid life expectancy for evolving production needs.

The cutting fluid market is classified based on product type and end-user applications. Major product categories are segment into soluble oils, synthetic fluids, semi-synthetic fluids, and straight oils. The soluble oils are segment with largest share and are popular due to their good price and also offers good lubricating properties for metal cutting operations, followed by the synthetic and semi-synthetic fluids, which are used for their better lubrication and cooling properties.

In the end-user segment, manufacturing dominates the market as cut fluids are used in precision machining and metal shaping. Other important consumers are the automotive industry, which uses cutting fluids in engine component manufacturing, transmission systems, and chassis fabrication. Moreover, a growing aerospace and defence industry is boosting demand for high-performance cutting fluids to improve machining efficiency and meet strict quality standards.

Explore FMI!

Book a free demo

The cutting fluid market in North America is expected to be driven by the regions advanced manufacturing facilities, rising automotive production, and increasing use of sustainable machining solutions. With an emphasis on environmentally friendly and tool life extensions, more such metalwork’s fluids are being launched in the USA and Canada too. Moreover, market trends are also driven by regulatory frameworks related to worker safety and hazardous waste management.

The market in Europe is held accountable due to strict environmental regulations, the pressures from a strong industrial base, and an increasing demand for organically-based cutting fluids. Germany, France, and the UK lead in innovation in the metalworking fluids field, developing sustainable formulations to meet the EU environmental directives. The transition to electric vehicle (EV) production and lightweight materials is also impacting product demand in the country.

The cutting fluid market will experience its fastest expansion in Asia-Pacific through rapid industrialization and growing automotive production and increasing precision machining requirements in electronics and aerospace industries.

The growing investments in metal fabrication together with CNC machining throughout China Japan India and South Korea has led to rising cutting fluid adoption. The market continues to expand because of government support for sustainable manufacturing processes and advanced production technology development.

Challenge: Stringent Environmental Regulations and Disposal Concerns

Environmental regulations strengthen their monitoring of cutting fluid markets because of the disposal and handling issues which metalworking fluids present. The utilization of traditional petroleum fluids presents challenges because these chemicals poison soil and water which results in new regulations about waste disposal. Due to health concerns related to exposure risks from coolant additives many industries chose to migrate toward different safer fluid systems.

Manufacturers need to invest in environmentally friendly formulations composed of biodegradable as well as water-soluble cutting fluids that follow advancing environmental regulations. Fortified filtration systems together with waste processing methods enable end-users to cut down operational costs while diminishing waste generation.

Opportunity: Growing Demand for Bio-Based and High-Performance Cutting Fluids

Market expansion opportunities strongly correlate with the rising popularity of cutting fluids which come from bio-based sources alongside synthetic ones. Manufacturers are targeting sustainable cutting fluids with longer tool durations along with resistance to corrosion and minimum toxic hazards because industries need such solutions.

Manufacturers who create high-performance fluids with improved lubricity features alongside increased thermal stability and reduced mist emissions will achieve better market competitiveness. Manufacturing sectors using high-speed automation will expand the market demand for advanced cutting fluids which optimize both precision and durability standards.

Increased industrialization and technological advancements in machining processes propelled growth in the cutting fluid market from 2020 to 2024. However, environmental regulations challenged practices of disposing hazardous waste and pushed manufacturers toward bio-based and semi-synthetic formulations over time.

Between 2025 and 2035, the industry will transition from base oils and emulsifiers to sustainable long-life cutting fluids with maximum performance and minimal environmental burden. Advancements in nanotech-enabled systems, artificial intelligence - based fluid analytics techniques, and self-cleaning lubrication systems will transform the market sector by improving the circulation efficiency while minimizing the fluid consumption.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Sustainability Trends | Growing adoption of water-soluble and semi-synthetic fluids. |

| Regulatory Compliance | Stricter waste disposal regulations and worker safety guidelines. |

| Material Compatibility | Fluids optimized for general machining and ferrous metals. |

| Smart Fluid Technology | Initial use of fluid monitoring sensors for maintenance. |

| Manufacturing Efficiency | Cutting fluids improved tool life and reduced friction. |

| Health & Safety Concerns | Reduction of hazardous additives like chlorinated compounds. |

| Recycling & Waste Management | Increased use of filtration and reconditioning systems. |

| Market Shift | 2025 to 2035 |

|---|---|

| Sustainability Trends | Widespread use of biodegradable, low-toxicity, and eco-certified cutting fluids. |

| Regulatory Compliance | Global mandates for VOC-free, non-toxic metalworking fluids. |

| Material Compatibility | Advanced formulations tailored for aerospace alloys, composites, and high-strength materials. |

| Smart Fluid Technology | AI-driven fluid diagnostics, self-regulating lubrication, and real-time quality control. |

| Manufacturing Efficiency | Next-gen coolants enhance heat dissipation, minimize wear, and enable high-speed machining. |

| Health & Safety Concerns | Full transition to hypoallergenic, non-toxic formulations for worker safety. |

| Recycling & Waste Management | Circular economy models prioritize fluid reuse, extending lifespan and minimizing waste. |

The market for cutting fluid in the USA is witnessing good growth on the back of growing aerospace, automotive, and metal fabrication industries. According to the synthetic and semi-synthetic cutting fluids that provide better lubrication, cooling, and corrosion protection are being encouraged by the demand for high-precision machining and prolonged tool life.

This is leading intense pressure to manufacturers to move to low-toxicity, biodegradable, and water-based cutting fluids to meet stringent Environmental Protection Agency (EPA) requirements governing workplace safety and environmental regulations. In this regard, machining processes are becoming increasingly automated, which is also driving demand for high-performance fluids that improve efficiency in CNC machines.

Moreover, the progressive developments in nanotechnology and additives formulations are improving fluid stability, eliminating fluid waste, and curtailing disposal costs, thereby driving the adoption of sustainable cutting fluids in industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The UK cutting fluid market is expected to grow at a modest pace owing to the growth of metalworking, aerospace & heavy machinery sectors. With a focus on sustainable and energy-efficient machining operations, there is a growing demand for low-emission and eco-friendly cutting fluids among manufacturers.

The implementation of reach and other environmental regulations is prompting end-users to adopt bio-based cutting fluid and oil-free coolant, reducing the environmental footprint of machining processes. Further, increased adoption of smart manufacturing and Industry 4.0 technologies are driving the movement of companies towards high-performance synthetic fluids that augment tool life and accuracy.

Additionally, the production of electric vehicles (EV) is increasing demand for specialized lubricants that enable the machining of lightweight materials, including aluminium and composites, to provide improved machining of modern processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Germany, France, and Italy witness the most significant demand in the European Union’s cutting fluid market due to their extensive automotive, aerospace, and metal fabrication sectors. Increasing deployment of specialized, high-efficacy cutting fluids that enhance precision of well-illuminated processing and decreasing machining downtime is a consequence of the gradual trend toward automation and smart manufacturing.

The EU’s stringent environmental policies have industrial safety standards forcing manufacturers to develop non-toxic, low-emission, and biodegradable cutting fluids. As industries move from traditional petroleum-based fluids, water-miscible fluids and synthetic coolants are becoming increasingly common.

Also, increased production of electric vehicles and light materials are leading to the demand of cutting fluids aligned to the machining of aluminium, titanium and composite materials to improve dissipation of heat and final surface finish.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan's cutting fluid market in the advanced manufacturing and precision engineering segments The demand for high-lubricity, thermally stable cutting fluids is being driven by the growing utilization of high-speed machining and micro-cutting applications in industries like automotive, robotics, and electronics.

There is a shift in the Japan cutting fluid market towards water-based, synthetic and semi-synthetic cutting fluids, which is in line with the environmental sustainability goals of the country. With the advancements of low-foam, anti-rust, and antimicrobial cutting fluids, manufacturers can enjoy the efficiency of their equipment, alongside a cleaner shop.

Moreover, the adoption of smart machining systems is also increasing the incorporation of real-time fluid monitoring technologies, providing an opportunity for optimized fluid utilization and a longer tool life. This trend is fuelled by the increasing adoption of lightweight materials in electric vehicles and aerospace, which is driving demand for specialized cutting fluids that enable precision and reduce material waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The South Korean cutting fluid market grows because manufacturers within automotive shipbuilding and heavy industries require improving machining solutions. The national commitment to precision manufacturing leads to an increased implementation of cooling-efficient and low-viscosity cutting fluids thereby improving machine speed and tool lifetime.

Eco-friendly industrial requirements from the government force manufacturers to adopt water-soluble environmentally friendly cutting fluids that have low odor during production. The implementation of manufacturing automation and robotics systems drives the market to search for durable fluids with anti-corrosive properties which also have high heat dissipation capabilities for optimized CNC machining operations.

Modern IoT-based fluid management systems together with smart factories work to improve operational efficiency while reducing fluid wastage and enhancing cost-effectiveness in machining industries. Electric vehicles and lightweight materials processing encourage manufacturers to source innovative cutting fluids which yield superior surfaces and diminish manufacturing flaws.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Cutting fluids woven from water and synthetic sources account for the largest proportion of this market, as industries demand more cost-efficient, high-performance and eco-friendly lubrication solutions for metal working, machining and precision cutting applications. They are one of the key contributors to effective heat management, reducing friction and enhancing tool life, and thus very prominent in the industries like automotive, aerospace, heavy machinery and manufacturing worldwide.

With the evolution of sustainability concerns, machining advancements, and a robust regulatory framework, manufacturers are striving to develop next-generation formulations while enhancing fluid performance and improving workplace safety striv.

Cutting Fluids Derived from H2O Provide Enhanced Cooling, Reduced Viscosity, and Environment-Friendly Options

Among the various product types used for cutting fluids, water-based cutting fluids have gained prominence by providing excellent cooling, cost-effectiveness, and reduced environmental impact. Water-based cutting fluids, in contrast to oil-based alternatives, offer superior heat dissipation, enhanced chip evacuation, and lower smoke and mist emissions, which contributes to safer work environments.

Adoption has been driven by demand for advanced water-based cutting fluids with high-performance anti-corrosion additive, bio stability enhancement, and microbial growth inhibitors. According to studies, more than 70% of manufacturing plants and machining centres prefer water-based cutting fluids compared to conventional ones since they not only increase the lifespan of the tools but also keep the workplace cleaner and help to eradicate chances of fire, thereby creating steady demand for this segment.

The increase in precision machining applications such as CNC milling, turning, grinding, and drilling operations has driven the market demand and ensured higher penetration of water-based cutting fluids in high-velocity and automated metalworking setups.

The rise in adoption is also aided by the introduction of artificial intelligence integrated fluid monitoring systems that feature real-time concentration monitoring, automated pH stabilization and predictive contamination analysis ensuring extended fluid lifetimes along with minimized maintenance downtime and enhanced fluid performance.

During the past few years, a new generation of low-toxicity water-based cutting fluids containing biodegradable surfactants, plant-derived lubricity enhancers, and non-toxic corrosion inhibitors has been developed to optimize market growth while providing better compliance with stringent environmental regulations and enhanced worker safety.

While water-based cutting fluids offer benefits like improved cooling efficiency, cost-effectiveness, and minimizing workplace hazards, this segment is limited by issues such as evaporation, microbial contamination, and need for frequent fluid changes.

Nonetheless, recent advancements in nanoparticle-enabled water-soluble formulations, artificial intelligence (AI) based in-service fluid characterization, and blended emulsion technology are enhancing the stability of fluids while prolonging their service life, which is further fuelling the continued progression of water-based cutting fluids across the globe.

Water-based cutting fluids segment has received strong adoption, particularly in CNC machining centres, aerospace component manufacturers, and heavy industrial machining plants, with industries focusing on high-efficiency cooling solutions, improved lubrication performance, and reduced environmental impact. Water-soluble oil with inclusive handling and application methods leads to good chip flushing, high-quality surface finish, and low energy consumption and so leads to tool life improvement and high productivity in machining operations in contrast to oil-based formulations.

Adoption is driven by demand for next-gen water-based cutting fluids with synthetic polymer reinforcements, non-toxic rust inhibitors, and compatibility with smart recycling of fluids. According to the studies, more than 75% of the machine tool operators prefer the use of water-based cutting fluids, as they help in maintaining the same quality for high-speed machining, minimize any material wastage, and are safer to handle, thereby helping in maintaining a strong demand for this segment.

The market has witnessed an increased adoption of eco-friendly metalworking initiatives, comprising of water-based formulations of various fluids, which have no boron, chlorine, or agents that release formaldehyde, which has improved the industry alignment to the occupational safety guidelines and environmental sustainability agendas.

Higher adoption rates have been further promoted, driven by automated fluid conditioning systems that enable automated, AI-assisted concentration adjustments, remote contamination detection, and self-replenishing reservoirs for the same comfort in cost control, along with fluid longevity and production efficiency.

While water-based cutting fluids offer benefits like improved workplace safety, lower long-term operating costs, and improved thermal management, they encounter drawbacks like evaporation loss and contaminated fluid disposal higher costs, along with microbial growth challenges causing lubricant degradation. However, the advancements of biodegradable stabilizers, hybrid water-based synthetic formulations, and AI-enhanced fluid maintenance systems have opened up opportunities for improved fluid consistency, decreased overall waste, and ensured continued growth for water-based cutting fluids around the world.

Synthetic-Based Cutting Fluids Enhance Lubricating Properties, Last Longer, and Minimize Machine Wear

Synthetic-based cutting fluids segment is expected to be one of the most preferred source types among cutting fluid market players, for achieving superior lubrication, enhanced oxidation resistance, and reduced deposits in machining surfaces by manufacturers, automotive plants, and heavy machinery operators.

With properties such as higher stability to heat, improved compatibility with metals and lesser toxicity to the environment, synthetic-based cutting fluid alternative will ensure strong demand across precision engineering sectors over corresponding mineral oil-based fluids.

The market for high-efficiency synthetic-based cutting fluids has been driven by the need for additives containing nanotechnology in lubricants, long-lasting fluid, and nontoxic additive composition. Market Analysis and Insights: Synthetic & Semi-Synthetic Metal Cutting Fluids Market The global market for synthetic-based cutting fluids is being encouraged due to more than 65% of high-precision manufacturing industries using synthetic-based cutting fluids required to optimize machining speed and minimise heat generation, as well as fluid disposal cost.

Automated and high-speed machining processes such as are on the rise with AI-centric robotic milling, micro-finishing operations, and multi-axis CNC systems fuelling the market and ensuring wider adoption of synthetic-based cutting fluids for the upcoming manufacturing technologies.

Components such as smart cutting fluid management systems with automatic concentration management, metering of viscosity, and AI-based predictive maintenance have promotes adoption, leading to improved efficiency of fluid, reduced downtimes of machine, and high environmental compliance.

This development of low-emission synthetic cutting fluids with renewable base materials (i.e., plant-based or animal-based), increased biodegradability, and sustainable fluid recycling programs has ensured the maximization of market growth as these cutting fluids are more likely to cater to stringent global sustainability regulations and growing green manufacturing initiatives.

More often the synthetic-based cutting fluids segment provides advantages for improved machining precision, lower tool wear, and long-term fluid stability; however, it also faces limitations including higher initial costs, the limited availability of environmentally-friendly formulations, and regulatory scrutiny of their synthetic chemical compositions.

Nonetheless, new technology such as bio-synthetic cutting fluids, AI-based lubricant optimization and nano-technology based wear-reduction additives are enhancing fluid performance, sustainability compliance and the continued growth of synthetic based cutting fluids globally.

The synthetic type of cutting fluids segment has witnessed increased adoption and is primarily witnessing adoption among aerospace component manufacturers, high-performance automotive machining plants, and precision engineering companies, in lieu of increasing emphasis among industries on utilizing long-lasting high-performance lubrication solutions to enhance production efficiencies and minimize operational costs.

On the other hand, synthetic-based fluids contain no mineral oil which makes them more resistant to oxidation, lower evaporation rates and better lubrication for hard machining, thus better savings on cost and tool life.

Adoption is heightened by the burgeoning need for next-gen cutting fluids, namely synthetic-based cutting fluids (referred to as fluids equipped with unique properties including but not limited to AI-assisted fluid performance enhancement, real-time monitoring, and nano-lubricants).

Investments in Synthetic-based cutting fluids with technological and offer differences to help improve machining accuracy, an effect on cycle time, and minimal chance of contamination, provide a solid demand in aerospace and precision engineering which studies show to be over 80% of the market.

Although it offers significant benefits as a conventional metalworking fluid, including better long-term stability, reduced environmental toxicity, and improved metalworking performance, the synthetic-based cutting fluids segment also suffers some disadvantages, including its higher formulation costs, the increasing applicability of regulatory measures against some synthetic chemical additives, and increased market competition from bio-based cutting fluids.

Nevertheless, novel breakthroughs in lubricant monitoring, artificial intelligence (AI)-enabled fluid recycling, and ultra-low-emission synthetic formulations would be furthering fluid sustainability, presenting cost-effective solutions, and paving the way for the further growth of synthetic-based cutting fluids, globally.

The growing need of cutting fluids spreads across automotive, aerospace, metalworking and manufacturing sectors makes the market show significant advancement. The machining industry depends heavily on cutting fluids to decrease tool wear and heat generation and offer friction reduction during operations.

The cutting fluid market keeps growing due to synthetic and bio-based fluid innovation alongside broader adoption of automated machines and rising pressure from environmental regulations for non-toxic sustainable fluids. The market leaders direct their research toward creating sustainable fluid products that provide high lubricity alongside corrosion protection to boost machining speed and extend machining tools.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Quaker Houghton | 18-22% |

| ExxonMobil Corporation | 15-19% |

| FUCHS Group | 12-16% |

| BP plc (Castrol Limited) | 9-13% |

| TotalEnergies SE | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Quaker Houghton | Produces high-performance metalworking fluids with synthetic, semi-synthetic, and water-soluble formulations. |

| ExxonMobil Corporation | Offers advanced cutting fluids under the Mobilcut brand, enhancing machining performance and tool longevity. |

| FUCHS Group | Develops biodegradable and synthetic-based cutting fluids with superior lubrication and cooling properties. |

| BP plc (Castrol Limited) | Specializes in sustainable, high-efficiency metalworking fluids under the Castrol Hysol brand. |

| TotalEnergies SE | Provides eco-friendly and high-lubricity cutting fluids designed for precision machining applications. |

Key Company Insights

Quaker Houghton (18-22%)

Quaker Houghton is a global leader in metalworking fluids, offering cutting-edge formulations designed to improve machining efficiency, reduce tool wear, and comply with environmental standards.

ExxonMobil Corporation (15-19%)

ExxonMobil focuses on high-performance synthetic and semi-synthetic cutting fluids, enhancing lubrication, heat dissipation, and chip removal in machining processes.

FUCHS Group (12-16%)

FUCHS specializes in advanced bio-based and water-soluble cutting fluids, addressing sustainability concerns while maintaining high performance in industrial applications.

BP plc (Castrol Limited) (9-13%)

Castrol, a subsidiary of BP, is a key provider of high-efficiency cutting fluids, emphasizing sustainability, extended tool life, and reduced maintenance costs.

TotalEnergies SE (7-11%)

TotalEnergies offers innovative cutting fluids designed to optimize machining precision, minimize fluid consumption, and comply with environmental regulations.

Other Key Players (30-40% Combined)

Several other companies contribute to the cutting fluid market by offering industry-specific formulations, sustainable alternatives, and customized solutions. Notable players include:

The overall market size for Cutting Fluid Market was USD 11,812.1 Million in 2025.

The Cutting Fluid Market is expected to reach USD 16,986.9 Million in 2035.

The demand for the cutting fluid market will grow due to increasing adoption in the metalworking and manufacturing industries, rising demand for high-precision machining, advancements in bio-based and synthetic lubricants, and the need for enhanced tool life and operational efficiency.

The top 5 countries which drives the development of Cutting Fluid Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Water-Based Cutting Fluids and Synthetic-Based Sources to command significant share over the forecast period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.