The Cutter box Films Market will maintain stable growth during the 2025 to 2035 period because its demand continues to rise within the foodservice and retail and industrial packaging fields. The market value for Cutter box films that act as protective wrappers for perishable food and preserve freshness continues to rise because of their efficient and affordable features.

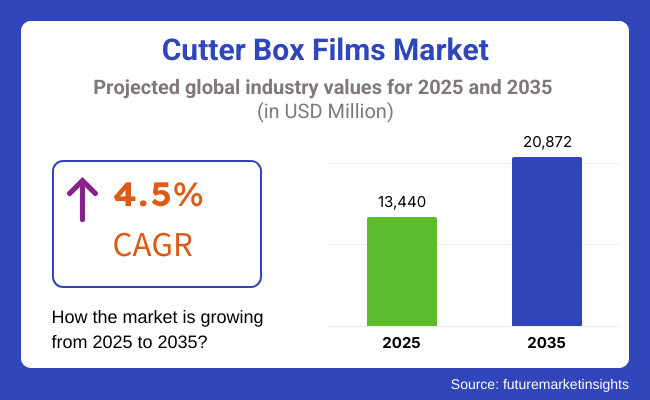

The market valuation for Cutter box Films is expected to achieve USD 13,440 million in 2025 yet it will rise to USD 20,872 million by 2035 at a compound annual growth rate (CAGR) of 4.5%.

Food safety requirements and priorities for hygiene alongside product longevity drive market growth due to increased demand. The market trends emerge from the present shift toward sustainable biodegradable packaging materials.

Market development faces possible obstacles from the combination of unstable raw material pricing and environmental concerns regarding plastic-based packaging films. Manufacturers dedicate their efforts to developing recyclable materials together with durable packaging films and user-friendly packaging dispenser options toward meeting current market demands from customers.

On the basis of material type, the cutter box films market is segmented into: The main polymer types are polyethylene (PE), polyvinyl chloride (PVC) and biodegradable films. Polyethylene films account for a large share of the market, owing to their flexibility, durability, and economical pricing, followed by biodegradable films, driven on the basis of sustainability.

Based on the end-user applications, the foodservice segment holds the most of the market share owing to the usage of cutter box films for wrapping the food like fresh products, baked goods, and to-go meals. The other major contributor would be the retail segment that employs these films for providing shelf-ready packaging of goods and product preservation.

Cutter box films can also be utilized for protective wrapping and contamination prevention in industrial applications such as manufacturing and healthcare, further contributing to the growth of this market.

Explore FMI!

Book a free demo

North America is expected to be another lucrative market for cutter box films, attributed to stringent food safety regulations in the region, increasing demand for convenient packaging, and growing adoption of sustainable film materials. WE and Canadian investments continue to rise into greater recyclable and compostable film options, while foodservice businesses are looking at rules regarding disposable cups and other plastic waste.

Environment and health regulations in the European region are very stringent which drives the market for Europe to hold a good proportion of the cutter box films. Germany, France and the UK are at the forefront of sustainable packaging innovation, with businesses focusing on eco-friendly films to meet EU directives to reduce plastic. Additionally, the regions mature food retail and hospitality sectors help drive market growth.

Asia-Pacific is expected to be the fastest-growing region in the cutter box films market, owing to rapid urbanization, growing food delivery services and increasing need for convenient packaging solutions. Flexible packaging films are being widely adopted in retail as well as foodservice in countries such as Japan, South Korea, China, and India. Moreover, the growth of biodegradable cutter box film solutions is aided by government initiatives aimed toward sustainable packaging practices.

Challenge: Rising Costs of Raw Materials and Environmental Regulations

The rising costs of raw materials like polyethylene, polyvinyl chloride (PVC), and biodegradable alternatives are an emerging challenge for manufacturers operating in the cutter box films market. Rising oil prices, supply chain snags and stricter environmental regulations on plastic use have compounded production costs.

Also, countries around the world are placing increasingly stricter bans on single-use plastics which is forcing foodservice businesses, retailers, and packaging companies to look for sustainable films instead. In this context, manufacturers need to find cost-efficient, recyclable & compostable film solutions, also optimizing the production process to reduce material waste and regulatory risk.

Opportunity: Increasing Demand for Sustainable and High-Performance Packaging Films

A key opportunity in the cutter box films market lies in the increasing demand for sustainable and high-performance packaging films. The trends towards using compostable and recyclable films in the food packaging and wrapping applications are causing food service providers, supermarkets and households to switch.

Moreover, the development of high-barrier films, antimicrobial coatings, and perforated films extends product shelf-life and maintains freshness, gaining interest from companies aiming to optimize packaging processes. Sustainable cutter box films, smart dispensing systems, and wear/damage-resistant, thick, multi-layered materials are the foundation for the future, giving competitive advantage to first movers to the new packaging market paradigm.

In 2020 to 2024, the cutter box films market developed due to the surging food packaging, catering, and retail sector. The growth of online grocery shopping and takeout services increased film consumption, while regulation around the use of plastic waste pushed for early adoption of sustainable alternatives. But high production costs and supply chain volatility posed challenges for manufacturers.

2025 to 2035 market extended sustainable & adaptive packaging solution on biodegradable film, Artificial Intelligence (AI), and customized dispensing technology. It is also expected that the industry will adopt smart films with active freshness indicators, ultra-thin materials for waste minimization, and fully recyclable packaging solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Sustainability Trends | Initial adoption of biodegradable and recyclable cutter box films. |

| Material Innovation | Shift from traditional PVC and PE films to bio-based alternatives. |

| Smart Packaging Integration | Limited use of antimicrobial and breathable films. |

| Food & Retail Industry Demand | Strong demand from food packaging, grocery stores, and food delivery services. |

| Regulatory Compliance | Stricter bans on non-recyclable plastics in some regions. |

| Production & Cost Efficiency | High material costs and supply chain disruptions affected profitability. |

| Consumer Awareness | Growing preference for eco-friendly packaging but limited availability. |

| Market Shift | 2025 to 2035 |

|---|---|

| Sustainability Trends | Widespread use of compostable, plant-based films with zero-waste production. |

| Material Innovation | Development of ultra-thin, high-barrier films with enhanced durability. |

| Smart Packaging Integration | Advanced smart films with freshness indicators, oxygen barriers, and temperature sensitivity. |

| Food & Retail Industry Demand | Expansion into AI-driven inventory management for optimized packaging usage. |

| Regulatory Compliance | Global mandates for sustainable packaging and full lifecycle traceability. |

| Production & Cost Efficiency | AI-powered supply chain optimization reduces costs and improves material sourcing. |

| Consumer Awareness | High demand for sustainable, customizable, and high-performance cutter box films. |

This trend of rising cutter box films market is particularly observed in the United States coupled with the growth of demand from foodservice, hospitality, and packaging industries. Increase in common commercial food wrap demand for plastic wrap, aluminium foil and parchment paper is driving the market growth. Durable and easy-to-dispense films help food preservation, hygiene, and operational efficiency for restaurants, catering businesses, and grocery stores.

Sustainability also is emerging as an important enabler, with increasing demand for biodegradable and compostable cutter box films made from plant-based, recyclable materials. Growing preference for BPA-free, food grade certified films are also changing the purchasing behaviour.

Moreover, product convenience and safety (adding elderly-friendly dispensers) will further push the growth of the segment, due to the evolving cutting mechanisms. The increasing trend of pre-packaged meal services and food delivery solutions also lends support for the enhanced demand for high-quality, tear-tolerant films that keep food fresh.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

British cutter box films are in the growth stage as there is a rise for food-grade, biodegradable, and sturdy packaging solutions. Key consumers in foodservice, retail, and hospitality are using these films for food wrapping, portion control, and hygienic storage.

The need to reduce plastic waste and use more recyclable materials, compounded by sustainability regulations, is spurring innovations in features such as biodegradable films and compostable alternatives. In turn, businesses are moving toward PVC-free and chlorine-free wraps to meet EU and UK food safety regulations.

Growing demand for grab-and-go meal services, premium grocery packaging, and takeout among consumers also boost the market. They are also being equipped with modern dispensing systems which allow them to be used in commercial kitchens, as well as easy-cut designs for home use.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

Finally, the EU region is an emerging market for cutter box films due to the booming demand for cutter box films for food and beverages industries; driven through food safety, sustainability, & other premium packaging solution are the key market drivers which are responsible for the growth of the market. Rigorous EU environmental regulations are prompting manufacturers to create compostable, recyclable and low carbon footprint replacements for traditional types of plastic films.

The food processing industry is a significant consumer and uses cutter box films for meat, dairy, and bakery packaging to prolong shelf life, ensuring food freshness. Furthermore, the growing adoption of online grocery shopping and food delivery services has boosted the demand for durable and tamper-proof film solutions. It also drives companies to adopt smart packaging functions like biodegradable adhesives, easy-peel sealing, and perforated dispenser boxes to add function and pare down waste.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The cutter box films market in Japan has been steadily on the rise, driven by demand from convenience stores, food processing units and the hospitality industry. Hygienic and moisture-resistant films are an essential element for keeping foods fresh in the pre-packaged meal sector, including bento boxes and sushi packaging.

Advancements in heat-sealable films, self-cling properties, and antibacterial coatings are enhancing the functional efficacy of films and extending shelf life. There is a growing interest among the market participants in eco-friendly alternatives as manufacturers are developing biodegradable and plant-based films in accordance with Japan's sustainability initiatives.

Adoption of automated food packaging systems in large-scale food production facilities is surging and complementing demands for cut-to-size and high-performance cutter box films for seamless integration with automated dispensers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

South Korea has a growing cutter box films market spurred on by the expansion of food delivery services, supermarkets and quick-service restaurants (QSRs). Demand for strong, puncture-resistant films with longer barrier properties against air and moisture is being driven by the growing preference for pre-portioned and grab-and-go meal packaging.

The industry is undergoing a transformation in sustainability, making an effort to invest in biodegradable plastic films and reusable film dispensers. The government’s stringent policies for reducing plastic waste are driving businesses to move towards compostable food wraps and low-impact packaging solutions. Meanwhile, innovations in dual-layer and multi-texture films are improving durability while ensuring easy-to-use dispensing systems.

In the food packaging segment, rtb's technologies for incorporating recycled-content cutter box films are also catching on, as companies in this space look to innovative solutions that are not only sustainable but also affordable.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The cutter box films market has a dominant share on the basis of two major segments such as polyethylene (PE) and 31 to 60 microns thickness, as the various industries have started preferring economic, functional, and durable film solutions for its applications in food wrapping, industrial wrapping, and commercial storage. Cutter box films are indispensable in food service, retail packaging and logistics, making them a critical component for restaurants, catering services, supermarkets and industrial supply chains.

As Food Safety Regulations, sustainability and packaging efficiency have evolved, manufacturers have become more focused on improving film strength, barrier properties and thickness to achieve maximum versatility over a range of industries.

Polyethylene Cutter box Films Provide High Flexibility, Moisture Resistance and High Transparency

Polyethylene (PE) segment, in terms of material types, has gained widespread popularity in the cutter box films market space owing to exceptional flexibility, cost-effectiveness and high resistance to dirt and moisture. PE cutter box films are compatible with the stretch ability needed to minimize food waste.

Adoption has been fuelled by the demand for high-performance PE cutter box films, including anti-fog coatings, increased puncture- and high-clarity transparency. PE cutter box films accounted for the largest share of the overall market by value in 2023, with over 60% of food service providers and commercial packaging industries opting for this type of product due to their ability to adapt their products to various packaging needs while maintaining cost effectiveness, which is projected to exert a steady demand pull for this segment in the near future.

The broadening array of fresh food preservation applications with cling films for produce, meat, and bakery items has bolstered market demand, driving higher uptake of PE cutter box films for perishable goods storage.

With real-time optimization of film thickness, automatic defect detection, and predictive material strength analysis, the integration of AI-powered extrusion technology has been another contributor to the spike in adoption, ultimately ensuring better film consistency, decreased production waste, and increased efficiency in high-volume packaging operations.

The disposal of PE cutter box films has been driven by sustainable development priorities with recyclable formulations, bio-based polyethylene alternatives, and reduced plastic consumption strategies to optimize market growth, enabling better alignments with eco-friendly packaging goals and changing consumer sensibilities.

While it offers advantages with film versatility, cost-effective mass production, and high clarity for visual appeal in products, the polyethylene (PE) segment is fraught with challenges, such as recycling complexity, rising regulatory restraints on plastic waste, and increasing consumer consciousness for biodegradable options.

This is having an adverse effect on the growth of PE cutter box films worldwide, hindering packaging effectiveness, but evolving inventions like biodegradable PE variants, AI-aided material enhancement, and hybridizer films blending practices are surging sustainability in terms of material quality.

Guaranteed the most superior adoption within the polyethylene (PE) segment bolstered mainly by meals emotion enterprise, retail packaging suppliers, and industrial present chain forwards, as industries rapidly adapt to versatile, cost-effective, and excessive clarity packaging movies to retain product integrity and lengthen shelf life. PE cutter box films offer better adaptability, superior moisture resistance, enhanced stretch ability, etc., unlike traditional hard/rigid packaging products, significantly improving product protection as well as easy application in diverse industries.

This, along with the growing popularity of customized PE cutter box films (e.g. tack-free cross-linked UV resistant coatings, high tensile strength reinforcements, heat-sealable formulations) has driven adoption. Research studies show that PE cutter box films remain the most preferred choice by over 75% of commercial packaging providers owing to their ability to cater a multitude of wrapping needs with least material wastage, thereby ensuring that this segment witnesses significant demand.

Increased compliance with global food safety regulations has improved market competitiveness, with food-grade film-adoption extending to freezer-compatible wraps, microwave barrier films, and biodegradable PE film alternatives.

Additionally, the incorporation of AI-powered material performance analytics, which enables speedier prediction of film degradation, automatic optimization of materials and cloud-based tracking of production, has increased adoption, offering enhanced quality assurance, increased film life and optimized supply chain efficiency.

Key insights of the global polyethylene (PE) segment include a combination of increasing exposure with lightweight packaging solutions; broad commercial uses and mass-scale applications; and difficulty with plastic reduction mandates, raw material pricing pressures, and the search for sustainable packaging alternatives.

And without their correction, flexible packaging would face severe restrictions, as scattered PE-based dense and resinous products in the environment become a major threat, which will inevitably put pressure on product sustainability, so emerging innovations in compostable PE-based films, AI-enhanced recycling integration, and bio-derived material sourcing will improve market adaptability, reduce plastic waste impact, and ensure that PE cutter box films worldwide will still get the double-coriander on their toes.

Estimated dimension: A new series of mid-range thickness cutter box films provide strength, enhanced barrier properties and high-volume packaging versatility.

Among the thickness segments, the 31 to 60 microns thickness segment is anticipated to be one of the most preferred thickness segments in the cutter box films market that provides the food service sector, logistics companies and industrial packaging businesses with the right amount of flexibility and resistance to allow users to effectively wrap the product while maintaining sufficient durability of the wrapping.

Mid-range thickness cutter box films with excellent mechanical strength, puncture resistance, and cling properties are experiencing strong demand from industries compared to ultra-thin and heavyweight film alternatives.

Adoption is primarily driven by demand for medium thickness cutter box films, which offer better stretch ability, advanced puncture resistance, and multi-layer lamination for improved performance. In food packaging and the industrial supply chain, cutter box films that are 31 to 60 microns thick are the preferred choice of more than 70% of businesses because of their ability to withstand tough handling while retaining packaging flexibility, leading to a strong demand for this segment.

With the growing demand for high-performance packaging applications including moisture-resistant produce wraps, tear-resistant shipping films and microwave-compatible food packaging, which is expected to further strengthen the performance of the super coextruded thin films market, the prime opportunity the super coextruded thin films market would also ensure greater adoption of mid-range thickness films for large-scale packaging operations.

AI-assisted film thickness optimization (including real-time gauge monitoring, automatic strength assessment and defect-detection scanning) integration has also contributed to increased uptake, enabling better production consistency, less material wastage and, ultimately, more satisfied end users.

Production of multi-functional mid-thickness cutter box films, with anti-static coatings, oxygen-barrier properties and antimicrobial additives, has fuelled market progression imperative to greater flexibility for sensitive product packaging across pharmaceutical and perishable food storage applications.

Although it offers benefits such as enhancing film durability, improving packaging security, and supporting versatile wrapping applications, the 31 to 60 microns thickness segment will face hurdles stemming from increasing regulation on plastic consumption, rising consumer demand for minimal packaging waste, and competition from ultra-thin biodegradable films.

However, advancements in film material additives such as nanotechnology-based film reinforcement, hybrid polymer layering, and AI-based reduction in utilization of certain materials are increasing film efficiency, minimum environmental footprint, and overall ensuring a steady increase in the global mid-high thickness cutter box film market product sales.

The 31 to 60 microns thickness segment has witnessed high adoption owing to restaurant chains, grocery retailers and industrial packaging businesses as industries continue to focus on reliable, cost-effective, and high-strength packaging films to ensure safety, decrease damage and ensure storage stability.

Thin plastic films tear too easily while the thicker options increase costs - cutter box films in the mid-range thickness offer the ideal middle ground, combining strength, flexibility and a price that makes it more versatile for manual and automated wrapping systems.

Adoption is driven by demand for next-generation mid-thickness cutter box films incorporating technology including smart anti-fog, high-elasticity polyethylene blends, and integration of compostable biopolymer. More than 80% of high-volume packaging operations utilize 31 to 60 microns thick films per these studies to strike a balance between efficiency of the material used and product protection thus paving way to higher demand for this segment.

However, while its benefits of enhancing packaging strength, optimizing film application efficiency, and enabling better control and cost containment for businesses have been greatly appealing, the 31 to 60 microns thickness prod segment is challenged by factors such as growing concern over environmental impact of single use plastics, increasing competition from biodegradable film alternatives, and evolving regulatory compliance requirements.

Yet advances in bio derived polymer engineering, intelligent material degradation monitoring and machine-learning assisted packaging sustainable initiatives are driving film recyclability, minimising environmental waste and assuring ongoing growth for mid-thickness cutter box films globally.

The cutter box films market is experiencing steady growth due to increasing demand from food service, hospitality, and retail sectors. Cutter box films, primarily used for wrapping and preserving food, provide convenience with built-in cutting edges that enhance usability and efficiency.

The market is driven by rising awareness of food safety, extended shelf-life requirements, and innovations in sustainable and biodegradable film materials. Manufacturers are focusing on high-performance films with improved puncture resistance, cling properties, and easy-dispensing features to cater to various industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Berry Global Inc. | 18-22% |

| Reynolds Consumer Products | 15-19% |

| AEP Industries (Inteplast Group) | 12-16% |

| Wrapex Limited | 9-13% |

| Anchor Packaging Inc. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Berry Global Inc. | Produces premium cutter box cling films with high clarity, durability, and sustainability features. |

| Reynolds Consumer Products | Specializes in food-grade aluminium foil and plastic cutter box films for commercial and household applications. |

| AEP Industries (Inteplast Group) | Develops high-performance cutter box stretch films with advanced cling technology. |

| Wrapex Limited | Focuses on recyclable and compostable cutter box films for foodservice and catering industries. |

| Anchor Packaging Inc. | Provides high-quality food wrap solutions with enhanced barrier properties for extended shelf life. |

Key Company Insights

Berry Global Inc. (18-22%)

Berry Global is a market leader in food packaging films, offering high-quality cutter box films with superior strength, clarity, and eco-friendly alternatives.

Reynolds Consumer Products (15-19%)

Reynolds is a key player in the food wrap market, providing cutter box plastic and aluminium films known for their ease of use and high durability.

AEP Industries (Inteplast Group) (12-16%)

AEP Industries focuses on food-safe, high-cling cutter box films designed for commercial kitchens and food packaging applications.

Wrapex Limited (9-13%)

Wrapex specializes in sustainable cutter box films, introducing recyclable and compostable solutions for the foodservice industry.

Anchor Packaging Inc. (7-11%)

Anchor Packaging offers high-barrier cutter box films, ensuring extended food freshness and minimizing waste.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the cutter box films market by providing innovative, cost-effective, and sustainable solutions. Notable players include:

The overall market size for Cutter box Films Market was USD 13,440 Million in 2025.

The Cutter box Films Market is expected to reach USD 20,872 Million in 2035.

The demand for the cutter box films market will grow due to increasing use in food packaging, rising demand for convenient and efficient wrapping solutions, expanding adoption in commercial kitchens and food service industries, and advancements in sustainable and biodegradable packaging materials.

The top 5 countries which drives the development of Cutter box Films Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Polyethylene (PE) and 31 to 60 Microns Thickness to command significant share over the forecast period.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.