The Cutlery Market shows sustained expansion prospects from 2025 to 2035 due to developing consumer needs in domestic settings and hospitality services and foodservice restaurants. Mandatory for dining and kitchenware operations are cutlery items which consist of knives combined with forks and spoons along with unique utensils.

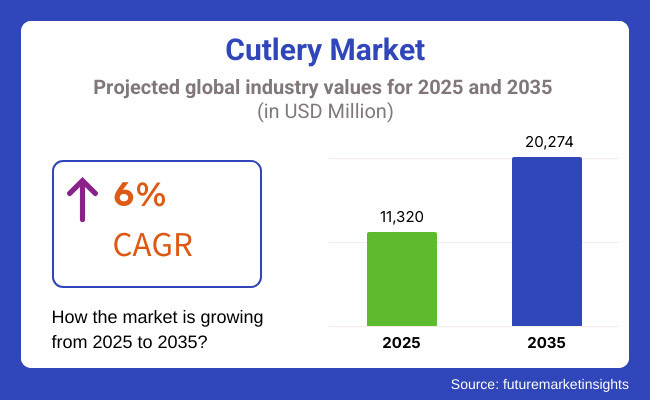

The Cutlery Market will rise to USD 20,274 million by 2035 from its initial USD 11,320 million value in 2025 with an estimated compound annual growth rate (CAGR) of 6%.

The market expansion is accelerating because consumers increasingly opt for premium and designer cutlery while seeking sustainable and eco-friendly materials and a growing trend towards premium cutlery exists. The stainless steel and ceramic cutlery production sector advances while the market for disposable and biodegradable products expands as major industry drivers.

Raw material prices volatility together with rising low-cost alternative competition might restrain market expansion. The manufacturing industry developing innovative designs as well as durable materials with enhanced functionality to satisfy changing customer needs.

The cutlery market analysis is segmented based on material type and end-user applications. The major styles get to be stainless steel, plastic, ceramic, and wooden cutlery. Based on material type, stainless steel has the largest share in the market owing to its durability and corrosion resistance properties and varying applications in commercial and residential buildings. There is also growing need for eco-friendly wooden and biodegradable cutlery, especially in foodservice.

On the basis of end-user application, the market for household sector has held a large market share, with increasing number of cutlery consumer’s spending money in getting best in class and aesthetically beautiful cutlery. Hotels, restaurants, catering services, and other major sectors in the hospitality industry are also great consumers, with a strong demand for high-end and custom-made cutlery. Moreover, the growth of takeout and food delivery services has paved the way for disposable and compostable cutlery solutions.

Owing to the significant presence of the hospitality industry, and increasing consumer spending on kitchenware, North America represents a significant market for cutlery. Rising demand for premium cutlery in the luxury dining and home kitchen segments is driving the market in the United States and Canada. Furthermore, increasing preference towards eco-friendly and non-harmful cutleries are further propelling the market growth in the region.

The cutlery market is significantly consolidated in Europe, due to high consumer preference towards high-quality dining utensils, along with rigid environmental legislation on single-use plastics in the region. Germany, France and the UK are advanced in adopting bio-derived and biodegradable cutlery as part of the EU’s circular economy approach. Rising trends of fine dining and artisanal tableware are also fuelling demand for higher quality cutlery across the region.

The Asia-Pacific region is expected to experience the fastest growth in the cutlery market, driven by rapid urbanization, rising disposable income levels, and an expanding foodservice sector. This very factor is pushing the cutlery market in countries such as China, Japan, India, and South Korea to see the demand growth for both high-end and low-cost cutlery solutions. In addition, increasing e-commerce platform and rising inclination towards home cooked meals is adding to the growth of the market in the region.

Challenge: Rising Raw Material Costs and Sustainability Regulations

The cutlery market is going through challenging times, owing to volatile price of raw materials and growing regulatory pressure on the use of plastic and metals. Sky-high prices of stainless steel, aluminium and eco-friendly substitutes such as bamboo and bioplastics have eaten into the profit margins of manufacturers.

Moreover, worldwide bans on single-use plastic cutlery and stricter environmental policies have forced businesses to shift towards eco-friendly substitutes which, in turn, resulted in higher production costs. Each problem must be tackled by investing in cost-effective materials sourcing, biodegradable cutlery options, and new-age manufacturing techniques to minimise waste while maintaining strength.

Opportunity: Growing Demand for Sustainable and Smart Cutlery Solutions

This transition towards sustainable lifestyle trends and smart dining experience offers tremendous growth opportunity for cutlery market. Consumers are now favouring cutlery options made from wood, bamboo, and even plant-based compounds, as they turn to more compostable, reusable, and biodegradable alternatives.

Also, the emergence of smart cutlery antimicrobial-coated utensils, temperature-sensitive spoons and ergonomic designs, to name a few presents new potential revenue streams. Players targeting innovations that are environmentally friendly, highly customizable attributes and high-quality, multi-functional cutlery will definitely have the competitive edge when it comes to household as well as commercial dining.

The cutlery market experienced growth in demand for sustainable alternatives between 2020 and 2024, fuelled by worldwide plastic bags and environmentally aware consumers. Restaurants, catering companies and homes migrated to durable, reusable products, while improvements in biodegradable materials made products better overall. But increasing raw material costs and supply chain disruptions created challenges for manufacturers.

Between 2025 and 2035, disruptions spanning innovations in material science, AI-powered production, and smart cutlery solutions will turn the market on its head. Companies will focus on new small design trends like self-sanitizing, lightweight, and ergonomic designs in response to newly emerging consumer preferences, while circular economy strategies will also drive larger changes in how cutlery is produced and disposed of.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Sustainability Trends | Growth in biodegradable and reusable cutlery options. |

| Material Innovation | Transition from plastic to bamboo, wood, and bioplastics. |

| Smart Cutlery Integration | Early-stage testing of self-cleaning and ergonomic designs. |

| Consumer Preferences | Preference for reusable and eco-friendly alternatives. |

| Foodservice Industry Demand | Restaurants and cafes adopted compostable utensils to meet sustainability goals. |

| Regulatory Compliance | Regional bans on single-use plastic cutlery encouraged alternative materials. |

| Production & Supply Chain Efficiency | Supply chain disruptions affected raw material availability and costs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Sustainability Trends | Mainstream adoption of circular economy practices and zero-waste manufacturing. |

| Material Innovation | Development of ultra-lightweight, heat-resistant, and antimicrobial smart materials. |

| Smart Cutlery Integration | Widespread use of temperature-sensitive, AI-assisted, and smart-connected cutlery. |

| Consumer Preferences | High demand for multifunctional, customizable, and interactive dining experiences. |

| Foodservice Industry Demand | AI-driven inventory management optimizes cutlery use and waste reduction. |

| Regulatory Compliance | Global policies mandate sustainable cutlery usage and full lifecycle transparency. |

| Production & Supply Chain Efficiency | AI-driven supply chain optimization ensures cost-effective material sourcing and production. |

The USA cutlery market expands because consumers seek better premium kitchenware and sustainable dining solutions and high-end stainless steel cutlery. Modern, ergonomic pieces of cutlery with contemporary designs now appeal to home and commercial consumers because food trends and lifestyle improvements continue to rise.

The market focuses strongly on sustainability because manufacturers experience heightened interest in biodegradable and wooden cutlery solutions especially for foodservice and takeaway establishments. Luxury dining as well as fine-dining restaurants drive market expansion for custom and gold-plated cutlery sets.

The market benefits from improved product manufacturing techniques including precision forging combined with laser engraving technology which enhances product design and durability. The market evolves because consumers care about hygiene and convenience so manufacturers introduce antibacterial-coated smart-cutlery with ergonomic grips.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

Demand for durable, stylish, and sustainable cutlery solutions has fuelled growth in the UK’s cutlery market. There is a growing need for stainless steel and ceramic coated cutlery in particular in high-end restaurants and hospitality as well as home dining.

As we become increasingly aware of the negative impacts of plastic on the environment, bamboo, wooden, and compostable cutlery is fast becoming the norm, especially in the catering and takeaway industries. Luxury home dining experience trends are driving brands to experiment with customizable, engraved and heritage-inspired cutlery designs.

In addition, the increasing popularity of modern kitchen decor and minimalistic dining trends is fuelling the need for sleek and lightweight cutlery sets. The international availability of premium brands specializing in cutlery is boosting the market further.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The cutlery market is steadily growing with Germany, France, and Italy leading the way, supported by a rich culture of fine dining and premium tableware consumption. There is growing emphasis on sustainable and reusable cutlery, which is driving the industry trend, and regulations governing the use of single-use plastics are fuelling the switch to wooden and biodegradable cutlery.

Despite the presence of cheap and mediocre ranges, the new age consumers choose cutlery that is made of high-quality stainless steel, silver-plated, and handcrafted and much of the demand is for custom-designed and artisanal cutlery. Rising-oriented luxury kitchenware brands and home décor trends are further contributing to the demand for decorative and contemporary cutlery designs.

Aside from that, anti-rust coatings, dishwasher-safe materials and lightweight alloy cutlery are helping companies improve the product functionality and durability, and making them more attractive to consumers and the hospitality sector alike.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

Japan's cutlery market is developing, with increasing demand for high-precision, aesthetically-exquisite, and light cutlery designs. Japanese consumers prefer minimalist, traditional and ergonomic cutlery made of materials such as stainless steel, titanium and ceramic-coated.

The preference for utensils that are versatile and multipurpose is therefore in greater demand, as these generation of fusion dining and more western-style table arrangement become more popular. Furthermore, the increasing number of health niche consumers is gaining traction of hygienic cutleries coatings and antibacterial ones as well.

Others experiencing growth include sustainable materials like bamboo and lacquered wooden cutlery, used for eco-friendly dining solutions. Hand-forged Japanese kitchen knives are becoming the favourite cutlery choice among fine-dining and world-wide exports due to growing luxury and artisanal production of cutlery.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korea’s cutlery market is experiencing growth driven by several factors, such as modern kitchen aesthetics, sustainable alternatives and the demand for premium stainless steel cutlery. An emerging café and fine-dining culture is driving brands to produce high-end, elegant cutlery sets that go beyond traditional offerings to suit modern dining styles.

It is a targeted trend as the country tightens polices regarding plastic waste reduction and eco-friendly packaging, which is leading to rising popularity of biodegradable and plant-based cutlery. Furthermore, consumers are now driven towards environment-friendly products that incorporate ergonomic design concepts to reduce the physical stress on the body while increasing the flexibility of kitchen utensils.

Cutlery sets are also beginning to feature Korean motifs, with brands offering up traditional designs, engraved chopsticks, modernized spoon sets, and other elements of tradition. Anticipatory growth in the market is also being derived from growing e-commerce avenues owing to untapped markets along with emerging international collaborations that are rendering accessibility of these premium range of cutlery brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

As a result, the stainless-steel cutlery segment and offline distribution table control a sizable share of the cutlery market. This means that cutlery products are a vital aspect of all three sectors, hence they encompass a pivotal component of restaurants, hotels, catering services as well as households worldwide.

Amidst selective consumer eating trends towards social experience, and premium tableware goes hand-in-hand with sustainability, manufacturers are investing in sustained product durability, ergonomics, and distribution.

Steel cutlery is one of the most popular product types in the cutlery market, owing to its durability, aesthetics, rust resistance, and corrosion resistance properties. Stainless steel cutlery is a long-term sustainable dining option free from plastic or throwaway alternatives for casual or fine dining, providing a premium dining experience with minimal environmental footprint.

Increasing adoption of premium quality stainless steel cutlery incorporating ergonomic designs, polished finishes and eco-friendly manufacturing processes will fuel growth. Some researchers have reported that over 70% of consumers and food service providers use cutleries made of stainless steel due to the ability to retain its shine, resist repeated use and favourable compatibility with varying table settings which is likely to keep the segment as a highly sought segment in the upcoming time.

The demand for premium dining experiences, along with trends like modern tableware aesthetics, improved range of kitchen essentials and environmentally conscious consumer trends, have solidified demand in the market and created pathways for considerable adoption of stainless steel cutlery across fine dining restaurants, hospitality chains and home kitchens.

From initial adoption, AI-assisted manufacturing (automated polishing + follow-on engraving of precision metal forming for branding and personalization) has pushed widespread adoption, maximizing product coherence, customization and market scalability.

For example: Sustainable stainless cutlery set, made through recycled steel material, that can yield lesser impact on production and more biodegradable packages that are more sustainable aligned with green consumerism and corporate social responsibility and such Minimizing brands will more fit for optimizing the market growth (Source: saltwater. Supply)

The Stainless Steel Cutlery Segment While stainless steel cutlery has long-lasting durability, which eliminates the need for single-use plastic, and provides a premium dining experience, the segment faces challenges including higher initial costs, shifting consumer preferences to luxury finishes-including gold-plated cutlery-and competition from substitutes like bamboo and bioplastics.

However, new stainless steel alloy improvements, intelligent antimicrobial coatings and AI-based cutlery design will ensure an increase in the functionality of the finished product, while enhancing market appeal, thereby providing steady growth of stainless steel cutlery in the market worldwide.

Stainless steel cutlery is also driven by the acceptance of restaurants and hospitality industry verticals as industries not doing well quality-based fine tableware solutions with inferior aesthetic properties and are estimated on the basis of aesthetic properties complement propel the stainless steel unsecured solutions market.

Packaged and stored in bulk, stainless steel cutlery surely enhances the dining experience regardless of price when compared with disposable or low-end options, but particularly for a captivating strength, long-lasting effectiveness, consumer engagement, and acceptance and worth to cutlery producers.

Premium stainless-steel cutlery with a mirror-polished finish, ergonomic shape, and branding options have increased adoption. As per studies, more than 75% of the top hotels & restaurants in the country, use stainless steel for cutlery considering the decorum it gives to the fine dining tables along with strength, beauty and easy to wash thus a strong segment in steel as cutlery.

The strength has also been attributed to the fast-evolving luxury dining trends that feature gold-accented stainless steel cutlery, modern minimalist designs and multifunctional utensil sets and have penetrated the market significantly never and will ensure greater consumer engagement and blur the line of product differentiation.

Immersive smart kitchen innovations, tracking inventories on cutlery sets with Artificial Intelligence, self-sterilizing storage solutions, and longer-lasting materials lead you to make smarter restaurant choices, driving the penetration even at commercial food service operations for better efficiency, greater amenities consumers.

Although the stainless steel cutlery segment has numerous advantages like enhancing the looks of the table setting, lowering the overall dining expenditure in the long run, and guaranteeing diners' solutions sustainability, there are some developing problems of concern such as increasing businesses proposing other renewable materials, changing preferences of diners to high-end utensils made by small artisans, and fluctuating prices of crude materials.

However, the introduction of custom laser etching, smart-cutlery integrated with connected kitchens, and antimicrobial metal enhancers are technologizing cutlery functionalities, protecting their country-proof devices, further allowing their seamless global market penetration.

Consumer confidence, instant product access, and luxury cutlery all benefit from brick-and-mortar stores

This sales channel is one of the most popular segments in the cutlery market, as it allows retailers, manufacturers, and brands to provide a hands-on experience to customers in terms of quality evaluation, ensure higher-end customer service, and improve brand credibility through in-store shopping. Offline retail, in contrast to online sales channels, provides direct consumer interaction, instant product availability, and the capability to evaluate product quality prior to purchase, which guarantees enhanced consumer trust and increased conversion rates.

Because of this, high-end cutlery sets with multiple knives are even more demanded (in-person product demonstration, custom recommendations, specifically curated fine dining collection). According to research, more than 65% of consumers on average favour the purchase of premium cutlery from offline stores as it allows customers to analyse the design, weight, and feel, which will ensure a strong demand for this segment.

Additionally, the proliferation of specialty kitchenware retail outlets across major geographical areas, including high-end cutlery displays, brand collaborations, and curated gift packaging services, has topically fuelled market demand that should help to expand the footprint of offline distribution models for premium cutlery brands.

Adoption has been further accelerated by the incorporation of smart retail technology, characterized by AI-powered in-store recommendations, touchless payment solutions, which provide improved consumer interaction, greater ease of shopping, and increased brand loyalty.

The expansion of partnerships with luxury department stores, high-end cutlery brand collaborations, exclusive product launches, and experiential dining-enriched general retailing concepts has realized market potentialization, and provided the opportunity for better alignment to evolving demands for premium and artisanal kitchenware.

However, while it's beneficial for consumers due to greater confidence and opportunities for high-end shopping, as well as product testing, the offline distribution segment is significantly hampered by higher operating costs and intense competition from online retailers, in addition to a steady shift in consumer preferences towards e-commerce.

Meanwhile, because of new phygital retail experiences, AI-enabled customer service, and in-store AR product technology, the efficiency of offline retailing is being drastically improved, unlocking consumer engagement and sustaining the growth of in-store cutlery sales globally.

The offline distribution channel is growing rapidly in adoption amongst specialty kitchenware retailers, luxury home goods stores, and professional hospitality suppliers, which are progressively focusing on customer experience, upscale Product presentation, and product trial to convert potential sales.

Offline retail offers in-person shopping experience that is very similar to online shopping, such as being able to compare cutlery styles, looking at craftsmanship, and getting personalized recommendations from the sales representatives, leading to better consumer satisfaction and greater brand loyalty.

Adoption has been driven by demand for high-touch offline retail experiences with premium store layouts, interactive product demonstrations, and personalized tableware curation services. Research suggests that more than 70% of premium cutlery buyers prefer to purchase their high-end, long-lasting kitchen and dining essentials offline, providing strong demand for this segment.

While the offline distribution segment offers benefits such as enriching premium shopping journeys, leveraging brand credibility, and providing instant product access, it grapples with operational cost challenges, changing consumer preferences for direct-to-consumer (DTC) models, and growing e-commerce ease.

Emerging innovations like AI-augmented customer analytics platforms, online product trial solutions, and Omni channel retail strategies are working wonders in improving offline retail sustainability, scaling the sales efficiency indexes and achieving continued growth in in-store cutlery distribution globally.

The market is driven by constant demand from households, and food service industries such as restaurants, catering services, and hospitality sectors. Increasing disposable incomes, changing consumer inclination towards premium & designer cutleries, and the growth of sustainable & eco-friendly options are some of the important growth drivers for the market. Newer compositions of materials, including stainless steel, titanium-coated, ceramic and biodegradable cutlery are transforming the market dynamics.

Moreover, increasing trends of luxury dining, personalized engravings, and multifunctional cutlery sets are significant factors involved in the growth of the market. Top manufacturers are targeting the evolving consumer preferences by offering ergonomic designs, enhanced durability, and eco-cognizant production systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Oneida Group | 18-22% |

| Fiskars Group (Gerber, Royal Doulton, Waterford) | 15-19% |

| Zwilling J.A. Henckels | 12-16% |

| Tramontina | 9-13% |

| Robert Welch Designs Ltd. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Oneida Group | Specializes in stainless steel and silver-plated cutlery sets for both casual and luxury dining. |

| Fiskars Group (Gerber, Royal Doulton, Waterford) | Provides premium cutlery, including professional knives and high-end tableware. |

| Zwilling J.A. Henckels | Develops high-quality kitchen knives, flatware, and cutlery sets with precision craftsmanship. |

| Tramontina | Offers affordable yet durable stainless steel and forged cutlery for home and professional kitchens. |

| Robert Welch Designs Ltd. | Focuses on contemporary and classic cutlery designs with a strong emphasis on ergonomic functionality. |

Key Company Insights

Oneida Group (18-22%)

They are well-known for their stainless steel durability and stylish elegant designs, and Oneida is a leading brand in both casual and luxury flatware.

Fiskars Group (Gerber, Royal Doulton, Waterford) (15-19%)

Fiskars owns a number of premium brands, making upscale cutlery sets comprising commercial quality knives and luxury tableware, suitable for fine dining.

Zwilling J.A. Henckels (12-16%)

Zwilling is an international manufacturer of high-precision utensils, producing top-quality knives and cutlery.

Tramontina (9-13%)

Tramontina is known for its budget-friendly and durable stainless steel utensils for home and commercial kitchens.

Robert Welch Designs Ltd. (7-11%)

Robert Welch focuses on a range of modern and minimalist cutlery; its clean and contemporary style utilises the latest technologies and craftsmanship to ensure high performance.

Other Important Figures (30-40% Combined)

Beyond the more renowned name brands and artisanal cutlery makers, many other companies have a foot, so to speak, in the cutlery market, offering lower-cost and/or green cutlery options. Notable players include:

The overall market size for Cutlery Market was USD 11,320 Million in 2025.

The Cutlery Market is expected to reach USD 20,274 Million in 2035.

The demand for the cutlery market will grow due to increasing consumer preference for premium and sustainable dining products, rising demand from the hospitality sector, growing influence of home dining trends, and advancements in eco-friendly and disposable cutlery solutions.

The top 5 countries which drives the development of Cutlery Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Stainless Steel Cutlery and Offline Distribution to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Commercial Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Competitive Breakdown of Disposable Cutlery Providers

Biodegradable Cutlery Market

Japan Disposable Cutlery Market Analysis by Product Type, Fabrication Process, Cutlery Type, Sales Channel, End Use, and Region Forecast through 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Bagasse Disposable Cutlery

Demand and Trend Analysis of Disposable Cutlery in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Disposable Cutlery in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA