The cut flower market around the globe is witnessing a boon as the global demand for arrangements of flowers for personal, corporate, and ceremonial purposes is witnessing a boom.

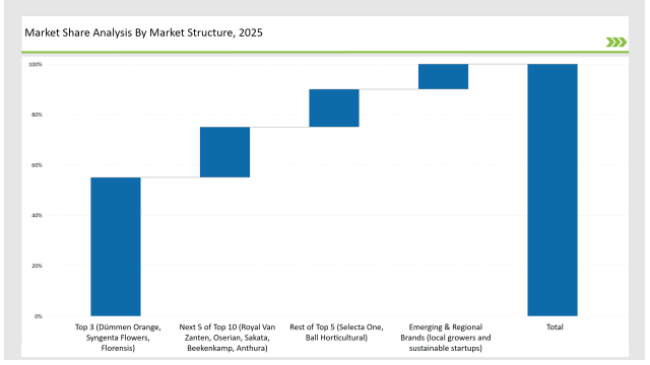

Leaders such as Dümmen Orange, Syngenta Flowers, and Florensis top the list using new breeding methods and having a tight supply chain at their disposal and are holding on to 55% of market share. Region-specific growers and wholesalers make up for 35%, while sustainable newcomers with an eco-friendly alternative make 10%.

Explore FMI!

Book a free demo

| Global Market Share2025 | Industry Share (%) |

|---|---|

| Top 3 (Dümmen Orange, Syngenta Flowers, Florensis) | 55% |

| Rest of Top 5 (Selecta One, Ball Horticultural) | 15% |

| Next 5 of Top 10 (Royal Van Zanten, Oserian, Sakata, Beekenkamp, Anthura) | 20% |

| Emerging & Regional Brands (local growers and sustainable startups) | 10% |

The cut flower market in 2025 is moderately fragmented, with no single entity holding a dominant market share. Global suppliers from the Netherlands, Colombia, and Kenya play significant roles, but a broad network of local growers, wholesalers, and online retailers contribute to competition. Seasonal demand fluctuations and regional preferences further diversify the market landscape.

The majority of sales account for supermarkets and retail stores at 40% since it is easily accessible and convenient. Online accounts for 35% because e-commerce continues to be enhanced, and services now offer same-day delivery. Florists top at 20%, as they are targeting the market for special and customized arrangements. Lastly, corporate and event planners take up 5% as they cater for bulk orders to be used in decor and ceremonies on such an occasion.

The cut flower market is divided into roses, chrysanthemums, lilies, carnations, and others. Roses are the largest with 50% of the market share, followed by its use on weddings and romantic occasions. Chrysanthemums make 20%, which has been mainly used due to cultural ceremonies and decorations. Lilies make 15% of the market, targeted at high-end floral arrangements. 10% comprise carnations, more for the reason of its affordability and practicality. Niche markets for 5% for orchids and tulips.

2024 is the last year for the cut flower industry in terms of sustainability, innovation, and consumer engagement. The major contributors include:

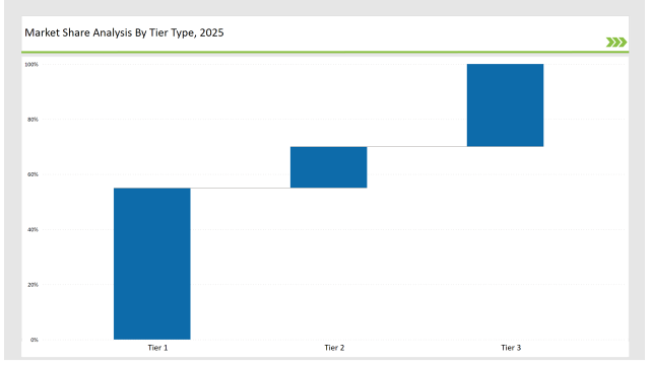

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Dümmen Orange, Syngenta Flowers, Florensis |

| Market Share % | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Selecta One, Ball Horticultural |

| Market Share % | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional growers, sustainable startups |

| Market Share % | 30% |

| Brand | Key Focus Areas |

|---|---|

| Dümmen Orange | Disease-resistant varieties and global breeding programs |

| Syngenta Flowers | High-yield blooms and premium quality |

| Florensis | Supply chain optimization and year-round availability |

| Selecta One | Eco-friendly campaigns and innovative marketing |

| Ball Horticultural | Ornamental variety expansion |

| Emerging Brands | Sustainable packaging and local sourcing |

The cut flower market will grow steadily through digital innovation, sustainability, and customization. Brands will look toward hybrid flower varieties, development of e-commerce capabilities, and enhancement of direct-to-consumer models. The partnership will continue to be a major driver for the sales in bulk with the event planners and corporate clients. Sustainability and local sourcing will dominate the market strategies.

Global flower suppliers such as Dümmen Orange, Syngenta Flowers, and Karuturi Global collectively hold about 55% of the market.

Regional suppliers and floriculture farms contribute around 30% of the market, catering to seasonal and local preferences.

Independent florists and high-end flower delivery services hold approximately 10% of the market.

Private labels, including supermarket-exclusive floral brands, hold about 5% of the market.

High for companies with 55%+, medium for 40-55%, and low for those under 30%.

Western Europe Women’s Footwear Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Korea Women’s Footwear Market Analysis - Size, Share & Trends 2025 to 2035

Japan Women’s Footwear Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Korea Garment Steamer Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.