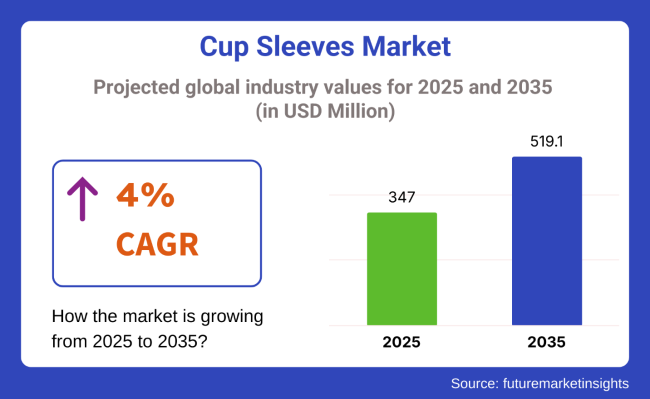

The cup sleeves market is projected to grow from USD 347 million in 2025 to USD 519.1 million by 2035, registering a CAGR of 4% during the forecast period. Sales in 2024 reached USD 333.1 million, reflecting steady demand driven by rising consumption of on-the-go beverages and growing focus on sustainable packaging.

This growth is driven by increasing consumer demand for takeaway beverages, the expansion of the food service industry, and a heightened focus on sustainable packaging solutions. The proliferation of coffee shops, quick-service restaurants, and food delivery services has led to a surge in on-the-go beverage consumption, thereby boosting the demand for cup sleeves.

In response to the escalating demand for sustainable packaging, leading companies are investing in eco-friendly cup sleeve solutions. The Beekman Group announced that an affiliate of Beekman Investment Partners II, LP completed the divestiture of BriteVision, the custom print and paper cup sleeve division of MesmerizeMedia LLC, to Vidya Brands Group, a family of companies that specialize in packaging, printing, and converting products for small to midsize growth-oriented enterprises.

Michael Ellis, President and COO of Mesmerize stated, “Vidya Brands Group is the ideal partner for the next chapter of BriteVision’s growth. Vidya has a strong track record in the packaging business, and we look forward to seeing the division’s future success.”

The cup sleeves market is witnessing a shift towards sustainable and innovative solutions. Manufacturers are focusing on developing cup sleeves using biodegradable and recyclable materials to reduce environmental impact.

Innovations such as heat-sensitive indicators and smart QR-coded sleeves are emerging, enhancing user experience and offering interactive branding opportunities. These advancements align with the growing consumer preference for eco-friendly and functional packaging.

Looking ahead, the cup sleeves market is poised for sustained growth, driven by the increasing demand for sustainable packaging and the expansion of the food and beverage industry. Companies that invest in eco-friendly materials, innovative designs, and customization are likely to gain a competitive edge. As environmental regulations become more stringent and consumer awareness of sustainability grows, the adoption of compostable and recyclable cup sleeves is expected to become a standard in the industry.

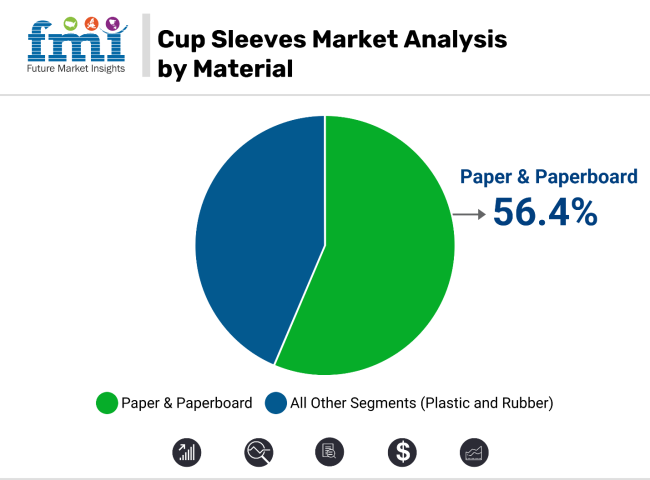

Paper and paperboard materials are set to lead the cup sleeves market by 2025, accounting for an estimated 56.4% market share, as brands and consumers continue to shift toward eco-conscious packaging solutions. These sleeves are widely used by cafés, QSR chains, and beverage retailers for hot drinks like coffee and tea, offering effective insulation and a tactile, organic feel that complements both artisan and branded beverage offerings.

One of the biggest advantages of paper and paperboard sleeves lies in their ability to support high-quality printing, which enables impactful branding, promotional messaging, and personalized designs. Their recyclability and composability make them a strong choice for businesses looking to align with environmental regulations and meet sustainability goals without sacrificing functionality or cost-efficiency.

With many suppliers now offering sleeves made from recycled content or certified paper sources (such as FSC or PEFC), paperboard sleeves are emerging as a low-impact, high-visibility packaging option. Their wide availability, ease of customization, and compatibility with automated sleeve dispensers further enhance operational efficiency for foodservice providers.

As the demand for disposable yet sustainable beverage accessories grows, paper and paperboard cup sleeves are expected to retain their dominance in both premium and high-volume service environments.

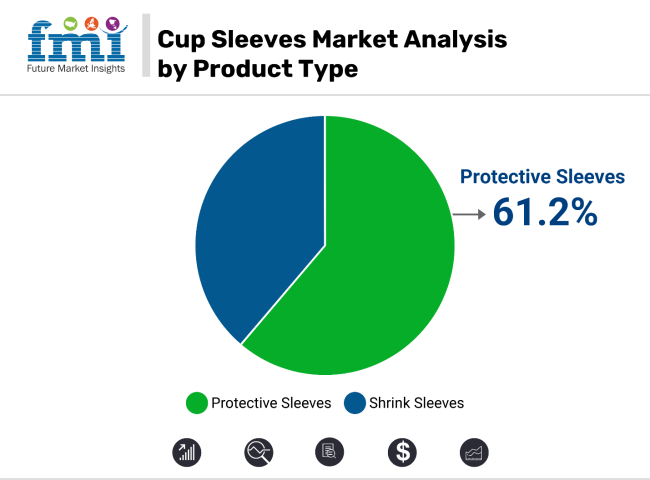

Protective sleeves are expected to be the top-performing product type in the cup sleeves market, with a projected 61.2% market share in 2025, owing to their seamless combination of protective utility and high-impact visual design.

These sleeves conform tightly to the shape of the cup using heat application, delivering a polished and tamper-evident fit that enhances both aesthetics and consumer trust. Used extensively in ready-to-drink beverages, retail promotions, and cold drink packaging, protective sleeves allow for full-body, 360-degree graphic coverage making them a favored choice for brands seeking shelf distinction. They also offer superior moisture resistance and durability, particularly in refrigerated or mobile service environments where conventional paper sleeves may degrade.

Manufacturers are increasingly integrating protective sleeves with recyclable materials and eco-friendly inks to balance performance with sustainability. Additionally, tamper-evident features like perforation lines and sealed edges are now standard, providing added safety assurance in both commercial retail and takeaway formats.

From functional protection to marketing versatility, protective sleeves serve as a high-value packaging component that supports brand identity, compliance, and convenience. As beverage packaging continues to evolve toward experiential and secure design, protective sleeves are set to remain the preferred solution for premium and fast-moving beverage brands worldwide.

Challenges

Sustainability and Environmental Regulations

As awareness of environmental conservation continues to rise globally, the cups sleeves market will come under increased pressure to decrease the usage of non-recyclable materials. Most conventional cup sleeves are made from polyethylene-coated paper or foam that are hard to recycle and go to landfills.

Stringent regulatory environment against single-use plastics and non-biodegradable packaging materials by governments and environmental organizations make compliance challenging for manufacturers. To do so, they will need to invest in alternatives for example, recycled paper, plant-based fibers, and compostable coatings that provide heat insulation and durability.

Opportunities

Growth in Customization and Branding

Takeaway culture, the online food delivery trend, and the growing consumption of specialty coffee are presenting new and monetarily attractive opportunities for sleeve cup printing. Cup sleeves have become more than just a practical accessory for businesses. Digital printing, augmented reality (AR) features, and eco-friendly inks for personalized cup sleeves take brand visibility and customer experience to the next level. Organizations that adopt these brand management approaches will have a greater competitive advantage in the ever-expanding food and beverage sector.

The United States cup sleeves market is witnessing steady growth, owing to the rising demand in sustainable and customized solutions for packaging. Thanks in part to the growing trend of takeaway drinks from such establishments as coffee shops, quick-service restaurants (QSRs), and convenience stores, cup sleeves have become a must-have accessory for hot beverages.

The gradual transition towards emerged as a major growth driver as biodegradable and recyclable cup sleeves become increasingly prevalent. Marketing plays a role too, with chains using personalized and themed cup sleeves for branding and advertising purposes in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The cup sleeves market is growing in the United Kingdom owing to a robust coffee culture and heightened adoption of eco-friendly packaging on the regional front. From major coffee chains to independent cafés, everyone is adopting compostable paper cups and recycled paper cup sleeves to avoid regulatory fines, avoid sustainability-conscious customers, or both.

The portable cup holders is a new trend in the market and has been spurred by environmental awareness campaigns. In addition, beverage brands use seasonal and promotional cup sleeve designs to increase customer engagement and boost sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

Germany, France, and Italy are among the leading countries in both the demand and supply for cup sleeves in the European region. The region is also enforcing stricter sustainability regulations, encouraging the use of compostable and non-plastic materials for the cup sleeves. The growing prevalence of specialty coffee cafes and takeaway beverage service also drive the market.

The sale of premium and artistic cup sleeves that cafés and restaurants use as a branding tool also contributes to sales. Additionally, on account of the rising adoption of reusable and fabric-based cup sleeves, especially in the urban areas, the growth trends of the market will be further influenced.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

The cup sleeves market in Japan exhibits slow growth due to tea and coffee consumption in the country. The market is seeing a rise in popularity for sleek, quality, and innovative cup sleeve designs, especially in upscale coffee shops and tea houses.

In Japan, eco-friendly initiatives are also driving companies to switch to biodegradable packing materials including cup sleeves. That demand is bolstered by the trend of brands and artists teaming up to create limited-edition cup sleeves.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The market for cup sleeves in South Korea is growing, driven partly by the nation’s café culture, along with an increase in consumers’ preference for stylish, collectible cup sleeves. Most often, beverage brands introduce seasonal and K-pop-themed cup sleeves each year, driving huge demand in the market.

Cup sleeve solutions that are recyclable and reusable are becoming a priority among businesses because of sustainability. Bubble tea and specialty coffee are also propelling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

Huhtamaki (20-25%)

As the global leader in sustainable cup sleeves, Huhtamaki develops innovative insulation technologies and premium branding solutions that drive performance in the food and beverage industry.

Pactiv Evergreen (15-20%)

Pactiv Evergreen is a key player in custom-printed and heat-insulating cup sleeves, catering to global coffeehouse chains and fast-food service providers.

International Paper (10-15%)

International Paper specializes in highly durable and recyclable cup sleeves, integrating advanced material technology to reduce environmental impact.

Benders Paper Cups (8-12%)

Benders Paper Cups focuses on cost-efficient, embossed cup sleeves, enhancing grip and user comfort for takeaway beverages.

Detpak (5-10%)

Detpak is committed to sustainable innovations, producing compostable and FSC-certified cup sleeves to support environmentally conscious businesses.

Other Key Players (30-40% Combined)

Some of the trends in the cup sleeves market are anticipated reusable cup sleeves, biodegradable coatings and better customization options for promotional campaigns. Other players include:

The overall market size for the cup sleeves market was USD 34,700 million in 2025.

The cup sleeves market is expected to reach USD 51,900 million in 2035.

The cup sleeves market is expected to grow at a CAGR of 4.0% during the forecast period.

The demand for the cup sleeves market will be driven by increasing global coffee consumption, rising demand for sustainable and eco-friendly packaging solutions, growing popularity of takeaway beverages, and the expansion of quick-service restaurants (QSRs) worldwide.

The top five countries driving the development of the cup sleeves market are the USA, China, Germany, Japan, and the UK

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End-User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End-User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cup Filling Machines Market from 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Holder Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Industry Share Analysis for Cup Fill and Seal Machine Companies

Market Share Breakdown of Cup Carrier Packaging Suppliers

Competitive Landscape of Cupcake Wrappers Manufacturers

Industry Share Analysis for Cupric Chloride Companies

Cupuacu Butter Market – Growth, Beauty Benefits & Market Demand

Cupcake Box Market Analysis – Growth & Forecast 2024-2034

Cupcake Tray Machines Market

Cup Filler Market

Occupancy Sensor Market Size and Share Forecast Outlook 2025 to 2035

PLA Cup Market Size and Share Forecast Outlook 2025 to 2035

PET Cup Market Trends & Industry Growth Forecast 2024-2034

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA