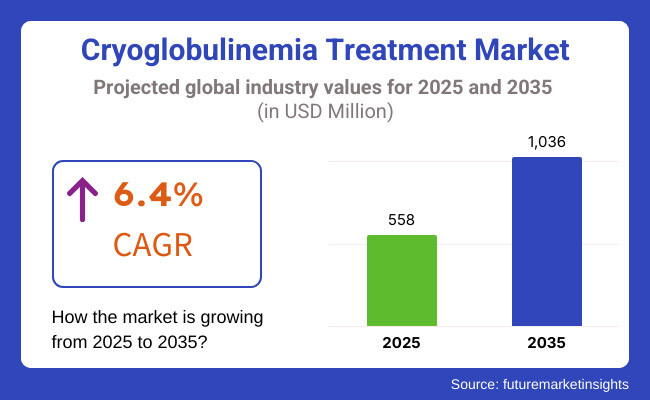

The cryoglobulinemia treatment market will witness robust growth between 2025 and 2035 as a result of the increasing incidence of cryoglobulinemia and the development of targeted therapies. The market will be around USD 558 million in 2025 and is anticipated to reach as high as USD 1,036 million by 2035 with a compound annual growth rate (CAGR) of 6.4% during the forecast period.

There are numerous drivers for this revolution in the market. One of the key explanations for this is the increased prevalence of cryoglobulinemia due to hepatitis C infection, autoimmune and hematologic diseases. Increasingly specialist drug regimens are being utilized by doctors, and consequently, more demand is arising for biologic medications such as rituximab and other monoclonal antibodies.

Its prohibitively expensive cost and potential side effects are a hindrance to widespread adoption, however. Therefore, the pharma industry is making R&D investments with a goal to provide cost-effective as well as less toxic versions that have similar treatment activity.

Market then splits into many different treatment options as well as treatment modes and treatment regimes. Immunosuppressive drugs, antiviral therapy, biologic therapy, and plasmapheresis are notable treatment modes. Rituximab, a frequently employed monoclonal antibody, is now drug of choice for the management of severe cryoglobulinemia due to its B-cell selectivity.

Cyclophosphamide and corticosteroids remain used in patients with systemic manifestations of vasculitis. Treatment with antiviral drugs, particularly in the case of cryoglobulinemia of hepatitis C origin, includes DAAs such as sofosbuvir-ledipasvir, which have been extremely successful in viral etiology clearance. Plasmapheresis is a useful adjunct to treatment in life-threatening complications of the patient since it rapidly reduces circulating cryoglobulins and immune complexes from the circulation.

Treatment of cryoglobulinemia has its main market in North America because of highly advanced health care facilities, increased awareness rates, and increasing uses of biologic therapy. The United States also occupies a high market share with a robust pipeline of clinical trials of new biologic drugs and new immunotherapies.

Moreover, the rising incidence of hepatitis C and autoimmune disorders fuel growth in the market. The only issue with high prices is the costliness of biologics, and insurers and hospitals look for reimbursement programs and patient support programs.

The major market of Europe for the treatment of cryoglobulinemia is controlled by Germany, France, and the United Kingdom. Market growth is initiated by the development of the regional healthcare system and the rise in research focused on the treatment of autoimmune diseases.

Antiviral therapy offers the chance to treat cryoglobulinemia, particularly in Spain and Italy with comparatively high hepatitis C rates. Similarly, the European Medicines Agency (EMA) is already evaluating new biologics and targeted immunotherapies that will shape next-generation therapy models.

Therapies of cryoglobulinemia in the Asia-Pacific countries will experience highest growth due to wider access to healthcare, increasing rates of autoimmune disorders, and governments supporting high-end medical treatments. China, India, and Japan are driving immunology innovation and drug R&D investments. Japan itself is the leader in new biologic adoption due to the availability of a strong pharma industry. The area of drug price and access, however, is an innovation barrier in cost and regulation.

Challenge

Extremely High Cost of Treatment

Biologic drugs are all found to be effective autoimmune disease therapies, like cryoglobulinemia, but at very high expense, and it is one that acts as a barrier to access everywhere. The expenses that accompany these treatments typically are unaffordable for the majority of health care systems and patients.

Reimbursement issues exacerbate the issue, particularly in countries with or without universal health coverage. Most of the patients are thus forced to pay for the expenses out of pocket, which is expensive for them. Due to this irony, pressure is mounted on the drugmakers to develop cheaper substitutes such as biosimilars. These biosimilars, designed to produce similar impacts as actual biologics, can reduce the expenses without compromising safety and effectiveness of treatment.

Opportunity

Advances in Precision Medicine

Precision medicine, in which treatment is individualized for every patient based on their molecular and genetic profiles, has a huge potential to maximize treatment outcomes of autoimmune diseases, including of cryoglobulinemia. Precision medicine can make treatments more effective and nontoxic by directing treatments towards specific biomarkers.

Personalization in this way will be able to optimize the utilization of biologics, in a way that they are not only more effective but also less harmful to patients. Other than that, further research in gene therapy as well as regenerative medicine has the potential to revolutionize the management of autoimmune diseases. These breakthroughs could lead to even more groundbreaking treatments, healing patients not just with better outcomes but with complete cures for the underlying cause of their disease.

Between 2020 and 2024, revolutionary advancements in biologic medication and antiviral therapy were available in the market for the treatment of cryoglobulinemia. DAAs emerged and revolutionized treatment of hepatitis C-related cryoglobulinemia to such an extent that disease management was improved and recurrence decreased. Biologic medication continued to be the trailblazer in non-viral etiology-related disorders, i.e., autoimmune disorders and hematologic system neoplasia.

Forward to 2025 to 2035, the market will be revolutionized with high focus on precision medicine, biosimilars, and targeted immunotherapies. Therapeutic performance with new promising biologic drugs and gene therapies in development will be further enhanced, making cryoglobulinemia treatment market a significant share of the autoimmune disease therapy market. In addition, continued research on the pathophysiology of cryoglobulinemia will definitely unveil additional therapeutic targets and new frontiers towards drug development and targeted therapies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory approvals for treatment of cryoglobulinemia were aimed mainly at corticosteroids and immunosuppressants. There were few advancements in some therapies. |

| Technological Advancements | Immunosuppressive treatments and plasma exchange procedures were developed with better disease control but were still mainly symptomatic. |

| Therapeutic Developments | Rituximab and corticosteroids were the mainstay treatments and were the first-line options, with few studies in new mechanisms. |

| Diagnostics Evolution | Cryoglobulin detection employed standard serological methods with long turnaround times, influencing timely management. |

| Market Access & Affordability | High costs of biologics and low insurance coverage placed limitations on access to advanced therapies. Generic corticosteroids remained the first line of treatment in most regions. |

| Environmental & Sustainability Trends | Immunotherapy waste therapy and plasma exchange were creating challenges for medical waste disposal. |

| Production & Supply Chain Dynamics | Supply chain disruptions due to pandemics affected availability, with regional shortages influencing patient treatment. |

| Market Growth Drivers | Increasing awareness, advanced diagnostic skills, and rising healthcare infrastructure drove market growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulatory systems enable focused biologic therapy and individualized care. Governments emphasize early detection and enhanced access to treatment to alleviate disease burden. |

| Technological Advancements | Gene therapy and precision medicine fuel innovation, with novel monoclonal antibodies and RNA therapies in development, with cure potential. |

| Therapeutic Developments | Combination therapies pairing biologics with small-molecule inhibitors maximize response to treatment. AI-facilitated drug discovery accelerates new candidate identification. |

| Diagnostics Evolution | Microfluidics and AI-aided analysis of rapid diagnostic tests provide earlier diagnosis and tailored treatment plans. |

| Market Access & Affordability | Increased adoption of biosimilars and policy-managed drug pricing decreases costs. Reforms of health insurance enhance reimbursement for innovative drugs. |

| Environmental & Sustainability Trends | Renewable pharmacy manufacturing processes diminish the environmental impact, with biodegradable pharmaceuticals increasingly becoming adopted. |

| Production & Supply Chain Dynamics | De-centralized manufacturing and AI-powered logistics maximize efficiency in drug delivery. Local health system collaborations with biotech companies provide supply security. |

| Market Growth Drivers | Targeted therapy innovation, regulatory incentives for orphan drug development, and increasing autoimmune disease prevalence drive market growth. |

The USA market for the treatment of cryoglobulinemia is growing more and more with increasing numbers of autoimmune disease cases and with acceptance of biologic therapy such as rituximab, and next-generation immunomodulators. With a well-developed healthcare system with strong research base support for research investment, drug development is enhanced while patients' access is eased to new treatment. Biologics lead with over 60% of treatment share, factoring in that expansion of indications for monoclonal antibodies is an investment-sunk bet.

Precision medicine is increasingly picking up steam through AI-enabled diagnostic machines driving better early detection and treatment outcomes. Government support through orphan drug designations and rare disease funds is also significant in further fueling the growth. Pharmaceutical industry collaboration with universities through research is also critical in accelerating the treatment process. The market will grow with such trends continuing to increase, providing more effective and efficient treatment to patients with cryoglobulinemia.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

United Kingdom's cryoglobulinemia treatment market is growing due to enhanced government spending towards treating rare diseases as well as research into immunosuppressive drugs. The National Health Service (NHS) makes it easier to promote cost-saving therapy, which in turn makes the introduction of biosimilars and new biologics easier.

Rituximab, and other new monoclonal antibodies, are increasingly being prescribed, especially in the context of resistant disease when alternative treatment has been ineffective. Targeted therapies are becoming more prevalent in the UK, and incentives to regulation have made targeted treatments more accessible to more patients.

International clinical trials in the UK are enhancing research capacity and patient access to treatment of developments. These encompass leading a rising market that is increasingly oriented towards delivering targeted, affordable, and new treatments to patients with cryoglobulinemia. The regulatory climate and demand for therapy of orphan diseases in the country position it in the lead in this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

European Union's cryoglobulinemia treatment market is being significantly reformed by stringent regulatory guidelines favoring the use of biosimilars and rare disease treatment reimbursement. Germany, France, and Italy, with their well-established biopharmaceutical sectors, are driving growth in these large markets.

The future development will be affected by innovation in cell-based therapies and second-generation biologics, and new and better treatments being available to patients. The EU is more interested in personalized medicine, and this also stimulates market growth. Greater investment is placed in biomarker-based treatment strategies that facilitate more targeted strategies.

EMA orphan drug guidelines also stimulate the development of treatments for rare diseases at a more accelerated pace. Japan's leadership position with respect to prominent biotech companies and research entities promotes alliances which further increase the research capacity and place the EU on a position of note with respect to producing cryoglobulinemia treatment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Its aging population and growing demand for the treatment of autoimmune diseases are the factors dominant in the market for treatment in Japan for cryoglobulinemia. Japan's advanced medical technology, such as AI-based diagnostic devices, is improving disease diagnosis and treatment, thereby driving the market's growth.

The government's heavy investment in advanced treatments such as biologics and gene therapies is also improving treatment for the patient. Regenerative medicine is also being heavily invested in by Japan, which may provide new channels of treatment for autoimmune diseases such as cryoglobulinemia.

AI-based diagnostics also reduce misdiagnosis rate, which is the most important thing in being in a position to properly treat this orphan disease. Japan's progressive health care industry and future-facing philosophy toward innovation keep it ahead of autoimmune disease treatment of illnesses such as cryoglobulinemia. Japan's investment in leading-edge therapy and medical technology is poised to keep fueling growth and patient benefits.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The South Korean market for the treatment of cryoglobulinemia is growing due to high investment in the production of biologics and biosimilars. Promotion of rare disease development and innovation of drug production by the government is propelling growth. The nation is focusing on innovation of sustainable production processes and immunotherapies, critical for the production of treatments against diseases like cryoglobulinemia.

The South Korean biopharmaceutical sector is growing at a high growth rate, with major investment in monoclonal antibody drugs. The efforts of the country to create new biologics and biosimilars have resulted in improved treatment for patients with cryoglobulinemia.

Collaborations between global pharmaceutical companies and local biotech start-ups are further fueling growth and innovation in the market. Besides, drug discovery strategies using AI embraced by South Korea will be in a position to enhance innovation in new therapy discovery to fill the unmet needs for the patient population of cryoglobulinemia. All this has made South Korea a huge player in the global autoimmune disease treatment market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Mixed cryoglobulinemia (Type II & Type III) has the highest market share in the market for the treatment of cryoglobulinemia because of its increasing prevalence and multifactorial etiology, most commonly with chronic infections such as hepatitis C. Patients with mixed cryoglobulinemia usually need a combination of immunosuppressive drugs, corticosteroids, and antiviral therapy to manage symptoms and avoid widespread organ damage.

Increased awareness of autoimmune-related cryoglobulinemia and increasing diagnostic appliances drive the treatment market. In addition, the mixed cryoglobulinemia disease, which could manifest in the form of systemic vasculitis, needs long-term medical intervention and hence represents an meaningful market segment.

Antiviral drugs are the preferred treatment for cryoglobulinemia, particularly for HCV infection. Sofosbuvir and ledipasvir, both being direct-acting antivirals, have reduced the severity of the disease to a large extent by curing the causative agent responsible for the infection and, consequentially, bringing down the symptoms by half, in addition to inhibiting immunosuppressive therapy.

Antiviral drugs continue to be the drug of first choice even in the presence of other therapies since they can induce sustained virologic response (SVR) and decrease cryoglobulin complications. This segment's dominance is also attributed by the growing utilization of combination antiviral therapy, particularly in Europe and North America.

Hospitals are the largest end-users of cryoglobulinemia therapy because cryoglobulinemia is usually diagnosed in hospitals. This is attributed to specialized services, complicated diagnostic equipment, and multidisciplinary management methods being required.

Severe cryoglobulinemia patients can need in-hospital plasma exchange therapy, immunosuppressive therapy, and close monitoring to prevent renal or neurological complications. Enhanced hospital availability of biologic medications and newer immunomodulatory therapies further stimulates growth in the segment. Experience in treating rare autoimmune diseases at tertiary care centers also helps hospitals as the most potent end-user segment in the market.

Biologic agents like monoclonal antibodies rituximab are experiencing unprecedented growth in the market for the treatment of cryoglobulinemia. Targeted drugs address B-cell-mediated immune response to deliver a more focused and potent action against the treatment of cryoglobulinemia, especially refractory.

As there will be increased clinical trials for evaluating new biologics in autoimmune vasculitis, demand for targeted therapy will grow. The transition towards personalized medicine and the reduced side effects of biologic drugs compared to traditional immunosuppressants also drive their use, and they represent a key growth segment in the market.

The cryoglobulinemia treatment market is a competitive and growth-oriented market dominated by major drug companies and a mix of biotech companies with new treatments under development. There are multinationals dominating the market here with a bias towards cutting-edge biologics, target therapies, and immunomodulatory agents with a focus on treating the multi-dimensional pathophysiology of cryoglobulinemia.

Companies are emphasizing key research on monoclonal antibodies, plasma exchange methods, and combination therapy to maximize patient care. The market is comprised of established pharma multinationals and emerging biotechs, both of which have an important influence on industry direction and drug development.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Holding AG | 15-20% |

| Bristol-Myers Squibb | 12-16% |

| Pfizer Inc. | 10-14% |

| GlaxoSmithKline plc | 7-11% |

| Biogen Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Holding AG | Pursues the development of targeted biologics like Rituximab for treating cryoglobulinemia. Targets growing indications and individualized treatment approaches. |

| Bristol-Myers Squibb | Offers immunosuppressive treatments, such as corticosteroids and immunomodulators. Performs clinical tests on new combination therapies. |

| Pfizer Inc. | Provides anti-inflammatory and immunosuppressive medications. Makes investments in research for next-generation biologics for autoimmune diseases. |

| GlaxoSmithKline plc | Expertise in antiviral and immunotherapy-directed therapies. Enhances R&D for treatment efficacy enhancement in mixed cryoglobulinemia. |

| Biogen Inc. | Creates novel monoclonal antibodies and neuroimmunology treatments. Specializes in precision medicine strategies for rare autoimmune disorders. |

Key Company Insights

Roche Holding AG (15-20%)

Roche holds a monopoly for treating cryoglobulinemia with its leading biologic, Rituximab, which is well accepted as the gold-standard drug for the disease. Roche combines cutting-edge monoclonal antibody research with treatment protocols to provide high efficacy and low relapse rates.

Roche Yes, Roche relentlessly invests in clinical trials to widen Rituximab indications and streamline dosing regimens for individualized treatment approaches. Through its wide global presence, Roche goes on to lead the treatment of autoimmune and orphan diseases.

Bristol-Myers Squibb (12-16%)

Bristol-Myers Squibb leads the immunosuppressive treatment of cryoglobulinemia, offering life-sustaining corticosteroids and immunomodulators to control symptoms. It is involved in developing novel combination regimens with biologics and existing immunosuppressants to further enhance outcomes. Active clinical trials investigate next-generation small molecules for disease activity suppression with minimal late-onset adverse effects.

Pfizer Inc. (10-14%)

Pfizer is also a leading player in the management of cryoglobulinemia with immunosuppressive and anti-inflammatory medications that top the most severe complications of vasculitis. The firm is not sitting back on its success in developing investments into biologics and emerging immunotherapies that target autoimmune disease mechanisms at their origins. Pfizer has a huge R&D pipeline with new products intended to maximize compliance and long-term disease management by patients.

GlaxoSmithKline plc (7-11%)

GlaxoSmithKline is well-placed in the cryoglobulinemia market, especially through antiviral and immunotherapy medications. Since Hepatitis C virus is a leading etiology of mixed cryoglobulinemia, GSK targets novel antiviral therapies and immune regulation therapy. The company continues to research with the aim of optimizing disease growth-suppressing treatment regimens with less immune side effects.

Biogen Inc. (5-9%)

Biogen is piling against monoclonal antibodies and neuroimmunology therapy and is an emerging star in cryoglobulinemia therapy. Biogen is changing the dynamics of precision medicine therapy, pushing forward immunotherapy strategies based on the unique patient subtype. Biogen's focus on treating rare autoimmune disease will drive innovation and improve patient health in cryoglobulinemia treatment.

Other Key Players (40-50% Combined)

Beyond these dominant companies, several pharmaceutical and biotech firms collectively contribute to innovation in the cryoglobulinemia treatment market. These include:

The overall market size for cryoglobulinemia treatment market was USD 558 million in 2025.

The cryoglobulinemia treatment market is expected to reach USD 1,036 million in 2035.

The rising prevalence of cryoglobulinemia, advancements in biologic therapies, and increasing awareness about autoimmune disorders are key factors driving the Cryoglobulinemia treatment market during the forecast period.

The top 5 countries which drive the development of the cryoglobulinemia treatment market are the USA, Germany, France, Japan, and China.

On the basis of treatment type, biologic therapies are expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type , 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End-Users , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type , 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 17: Global Market Attractiveness by Type , 2023 to 2033

Figure 18: Global Market Attractiveness by Treatment Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End-Users , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type , 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 37: North America Market Attractiveness by Type , 2023 to 2033

Figure 38: North America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End-Users , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type , 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type , 2023 to 2033

Figure 58: Latin America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-Users , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type , 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 77: Europe Market Attractiveness by Type , 2023 to 2033

Figure 78: Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-Users , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type , 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type , 2023 to 2033

Figure 98: South Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End-Users , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type , 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type , 2023 to 2033

Figure 118: East Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-Users , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type , 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type , 2023 to 2033

Figure 138: Oceania Market Attractiveness by Treatment Type, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End-Users , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type , 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End-Users , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type , 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End-Users , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-Users , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-Users , 2023 to 2033

Figure 157: MEA Market Attractiveness by Type , 2023 to 2033

Figure 158: MEA Market Attractiveness by Treatment Type, 2023 to 2033

Figure 159: MEA Market Attractiveness by End-Users , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Algae Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Water Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Anemia Treatment Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA