The Cryogenic Vial market is witnessing significant growth driven by the rising demand for advanced sample storage solutions in research, clinical, and pharmaceutical settings. The future outlook for this market is shaped by the increasing adoption of biobanking, cell and gene therapy research, and stringent regulatory requirements for biological sample preservation. Growing investments in biotechnology and life sciences research, coupled with advancements in cryopreservation technologies, are fueling the demand for high-quality cryogenic vials.

The market is also supported by the need for reliable, contamination-free storage solutions that maintain sample integrity over extended periods. In addition, the rising focus on personalized medicine and increasing global healthcare expenditure contribute to the market’s expansion.

Technological developments enabling automation and high-throughput sample processing are further enhancing operational efficiency in laboratories As the life sciences and pharmaceutical sectors continue to grow, cryogenic vials are expected to remain essential for sample management, storage, and transport, presenting sustained growth opportunities across global markets.

| Metric | Value |

|---|---|

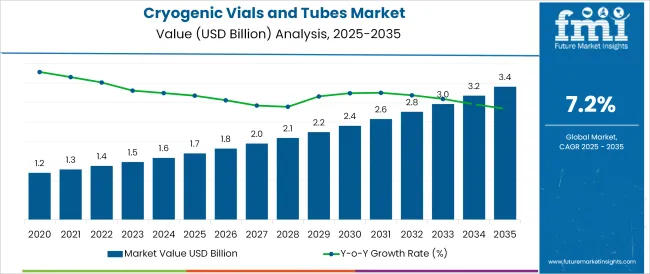

| Cryogenic Vial Market Estimated Value in (2025 E) | USD 172.4 million |

| Cryogenic Vial Market Forecast Value in (2035 F) | USD 262.7 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The market is segmented by Material, Product, Capacity, and End Use and region. By Material, the market is divided into Plastic and Glass. In terms of Product, the market is classified into Self-Standing Bottom and Round Bottom. Based on Capacity, the market is segmented into Up To 1 Ml, 1.1 To 2 Ml, 2 To 4 Ml, and Above 4 Ml.

By End Use, the market is divided into Research Organizations, Drug Manufacturers, and Healthcare Institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

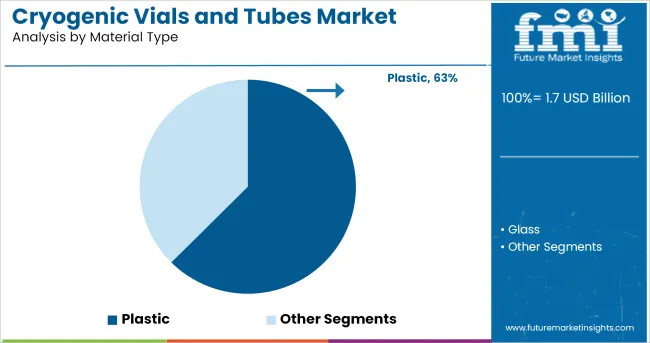

The plastic material segment is projected to hold 65.00% of the Cryogenic Vial market revenue share in 2025, making it the leading material type. This dominance is driven by the superior chemical resistance, durability, and cost-effectiveness offered by plastic vials compared to alternative materials. Plastic vials provide enhanced resistance to extreme temperatures, ensuring the stability and integrity of biological samples during storage and transportation.

Their lightweight design and compatibility with automated laboratory systems have further reinforced adoption in research and clinical applications. The segment’s growth is also supported by increasing demand for scalable and reliable storage solutions in biobanking and pharmaceutical workflows.

Moreover, plastic vials are easier to manufacture in various sizes and configurations, enabling customization to meet diverse laboratory requirements The widespread availability and consistent performance of plastic cryogenic vials make them a preferred choice among laboratories and healthcare facilities globally.

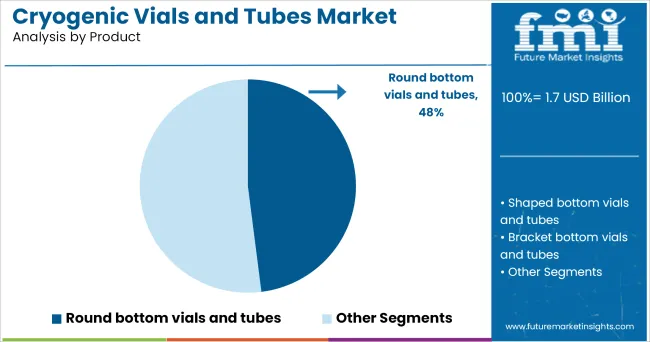

The self-standing bottom product segment is expected to capture 67.40% of the Cryogenic Vial market revenue share in 2025, establishing it as the leading product type. This growth is driven by the ease of handling and storage provided by self-standing designs, which allow vials to remain upright without additional support, reducing the risk of spillage and contamination.

The compatibility of self-standing vials with automated sample handling systems further enhances operational efficiency in laboratories. Additionally, the design facilitates organized storage in racks and cryogenic freezers, optimizing space utilization.

The adoption of self-standing vials is further supported by their ability to withstand extreme cryogenic temperatures while maintaining sample integrity The combination of reliability, ease of use, and scalability continues to drive the preference for self-standing bottom vials across research, clinical, and biopharmaceutical applications.

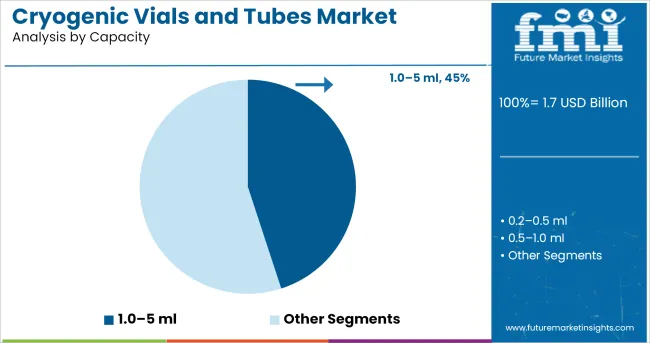

The up to 1 ml capacity segment is projected to account for 40.00% of the Cryogenic Vial market revenue share in 2025, making it the leading capacity type. This growth is driven by the increasing need for small-volume sample storage in clinical diagnostics, molecular biology, and cell-based research.

Smaller vials provide precise aliquoting of samples, reducing waste and enabling efficient sample management. The compact size also allows for high-density storage in cryogenic freezers, improving laboratory workflow and space utilization.

Additionally, the adoption of up to 1 ml vials is supported by their compatibility with automated handling systems and high-throughput screening applications Their reliability in maintaining sample integrity at extremely low temperatures, combined with operational convenience, continues to make up to 1 ml vials a preferred choice in research and healthcare laboratories globally.

The subsequent table projects the global market to report CAGRs based on various semi-annual periods from 2025 to 2035. The industry is projected to report a CAGR of 4.6% in the first half (H1) of the decade from 2025 to 2035 and 4.2% in the second half (H2) of the same decade, indicating the downfall in the requirement with 0.4%.

| Particular | Value CAGR |

|---|---|

| H1 | 4.6% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 4.4% (2025 to 2035) |

The vial market’s growth trajectory is estimated to shift somewhat during the succeeding decade. Predictions indicate that the CAGR will drop slightly from 4.2% to 4.1% in the first half (H1) of the period. Nevertheless, the second half (H2) is predicted to have a hike in demand at a CAGR of 4.4%. Such an industry trajectory indicates a decline of 40 BPS in H1, following an upsurge of 30 BPS in CAGR in H2.

Industry analysts credit several variables for the change, including the necessity of vials for medical checkups in H1, which might have affected demand. On the other hand, improvements in the research and development techniques in the H2 industry may spike up the growth trajectory.

Novel Research in Neurology and Cardiology Boost the Demand for Cryopreservation

Research in neurology and cardiology frequently uses hepatocytes, cardiomyocytes, and neural cells, which raises the need for cryopreservation. Because these topics allow for the recovery of biological components and maintain optimal storage conditions, cryogenic vials are crucial to cryopreservation techniques.

The process of cryopreservation is used to preserve biological material at very low temperatures in a variety of areas, including surgery, food sciences, molecular biology, biochemistry, and medicine. Researchers, medical professionals, and laboratory physicians may all benefit from this strategy since it lowers the costs involved in routinely replenishing inventory while maintaining consistency and reproducibility.

The need for cryogenic vials is rising in tandem with the growth of cryopreservation techniques, which is expected to propel the industry to substantial growth during the forecast period.

Adoption of Digital Storage Solution for Cryogenic Tubes

The increasing use of automation and LIMS systems is increasing the need for supplies that are simple to manage and record with little human intervention. International vendors anticipated to respond to this by upgrading their products with cutting-edge tracking technology, such as cryogenic vials with 1D and 2D barcoding.

Biobanks and cell banks are using such vials for cryopreservation of various biomaterials. The vials with printed barcodes are more durable and easier to identify and track biomaterials and samples. Automated data storage ensures a reliable chain of custody, lowering human error, maintaining reproducibility, and promoting collaboration among sample batches.

Data may be easily shared across end users thanks to barcode scanning and digital information storage. The growth and rising use of such items are anticipated to propel global expansion.

Limitation in Expenditure Create Hurdles in the Industry Growth

The cryogenic vials market is estimated to face constraints due to high costs, despite increasing demand in the healthcare, pharmaceuticals, and biotechnology industries. The elevated expenditures may deter potential customers and limit widespread adoption, particularly in smaller research facilities and institutions with limited budgets, which could hinder the market's expansion.

The cost of cryogenic vials is high due to the need for specialized storage equipment and handling procedures, making it less accessible for some organizations. Therefore, developing cost-effective solutions, efficient production processes, and innovative materials is vital for unlocking its full potential.

While the demand for cryogenic vessels remains strong, addressing the cost concerns is essential for sustained market growth and accessibility.

Cryogenic vial market size was estimated at USD 139.7 million in 2020 and is poised to register a CAGR of 2.9% from 2020 to 2025. Researchers are anticipated to utilize these vials, which are leak-proof, and ideal for long-term storage of specimens and biological materials at extremely low temperatures. Their rapid thread design facilitates removal, tightening and is typically packaged in tamper-proof, unique safety-lock bags.

Manufacturers are envisioned to boost the research and development on the features of cryo-tubes throughout the forecast timeframe. End users are spending an increasing amount of funds on specialized and sterile vials. By 2025, the market had grown to USD 157.9 million.

The evolving industry trends are guiding long-term strategies for businesses, both established and emerging. The global pandemic has significantly impacted the operations of these businesses, and its long-term effects are envisioned to impact industry growth. The demand of vials for research is continuously improving to address fundamental COVID-19 concerns and potential solutions.

With a projected CAGR of 4.3%, the industry is predicted to prosper in comparison to the previous market trajectory. Manufacturers are creating innovative designs based on practitioners’ demands. Among the few improvements that are anticipated to increase the global market are the installation of extra safety layers and advances in material science.

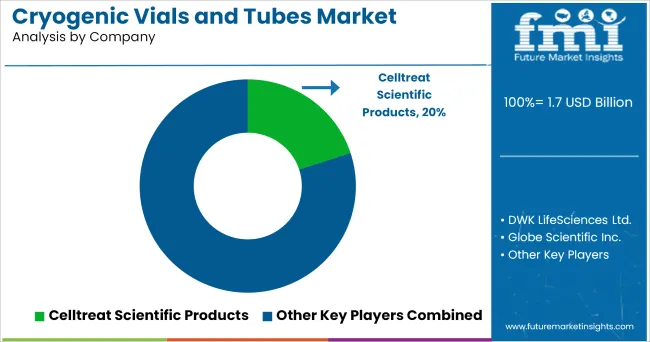

Firms with diverse product portfolios such as Thermo Fisher Scientific Inc, Corning Incorporated, Sigma-Aldrich Corporation, DWK Life Sciences GmbH, VWR International LLC, and others are renowned for their diverse product offerings and significant influence in their specialized markets. Tier 1 firms set the standard for unique solutions by offering a wide range of options across various industries.

Argos Technologies Inc., Azer Scientific Inc., E&K Scientific Products Inc., CELLTREAT Scientific Products, BIOLOGIX GROUP LTD., and Abdos Labtech Private Limited are companies in the Tier 2 category with a significant revenue share and strong regional presence. Despite not being as globally strong as companies in the Tier 1 category are, they remain competitive in the industry due to their specialized product offerings and regional influence.

Due to their niche product lines and little market presence, emerging players as well as companies with limited resources are categorized as firms in the Tier 3 category. Smaller or more specialized businesses with a narrower market focus or niche presence, sometimes catering to certain geographical markets or sectors, make up the Tier 3 companies.

The section below discusses the country-level forecast for the cryogenic vial industry. The analysis of the regional industries is estimated to project the demand across the regions such as North America, Europe as well as Asia-Pacific.

In the North America, the demand is anticipated to surge from the United States exhibiting a CAGR of 2.7% by 2035.

On the contrary, the demand from emerging regions of Asia-Pacific such as India and China is projected to thrive in the forthcoming decade, highlighting the CAGR of 6.7% and 5.9%, respectively.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.7% |

| Canada | 2.3% |

| United Kingdom | 2.6% |

| Spain | 3.4% |

| China | 5.9% |

| India | 6.7% |

The industry in the United States is predicted to report a CAGR of 2.7% during the forecast period 2025 to 2035.

In the United States, improvements in medical science are envisioned to propel the need for customized vials tailored for cryogenic experiments. As research and development in the medical field continue to progress, there is a growing demand for specialized vials that can effectively preserve biological materials at ultra-low temperatures.

Bespoke vials play an essential role in ensuring the integrity and viability of various biological samples used in research, diagnostics, and medical treatments.

The demand for personalized treatment and gene therapies has LED to a growing demand for innovative vial designs that meet the unique requirements of medical research and applications, which is anticipated to significantly influence cryogenic vial production and supply in the United States.

The industry in India is anticipated to register a CAGR of 6.7% by 2035. Government initiatives such as SERB International Research Experience (SIRE) and Promotion of University Research and Scientific Excellence (PURSE) are estimated to enlarge the consumer base for experimental vials for research purposes.

Research institutes in India such as the Indian Institute of Science (IISc) and IITs are anticipated to develop novel cures and solutions for the treatment of several issues, for that the demand for vials with temperature-adjustment features is estimated to boost in the forthcoming decade.

In the forthcoming decade, manufacturers in the industry are anticipated to develop standard vials, catering to the budding demand from the region.

The increased demand for genetic experimentation by institutions in China is predicted to increase the requirement for medical vials. The need for superior medical vials to preserve and transfer biological samples used in genetic research and experimentation is increasing as these studies proceed.

To satisfy the demands of Chinese institutions and research centers, manufacturers may decide to raise output, which might have a substantial influence on the worldwide medical vial supply chain. With improvements in the industry, the demand is anticipated to report a CAGR of 5.9% through 2035.

Improvements in vial technology and storage techniques that ensure the integrity and security of DNA material may also result from the initiative. China's growing involvement in cutting-edge scientific research is reflected in the rise in demand for medical vials there, which emphasizes the necessity of innovation and growth in the medical vial sector to support these initiatives.

The section contains information about the leading segments in the cryogenic vial industry. In terms of product, the self-standing bottom vail segment is estimated to account for a share of 67.4% in 2025. By end use, the research organization sector is projected to dominate by holding a share of 39.3% in 2025.

| Product | Self-Standing Bottom |

|---|---|

| Value Share (2025) | 67.4% |

In 2025, the demand for vials with self-standing bottoms is anticipated to cater to a revenue share of 67.4%. Over the subsequent decade, the global industry is anticipated to see an increase in demand for self-standing bottom vials, indicating a shift in consumer preferences and industry requirements, due to advancements in cryogenic technology and increased use of cryogenic applications.

The rise in demand for vials due to their self-standing bottoms could improve stability and ease of use, highlighting the need for innovation and adaptability in the sector. Manufacturers and suppliers must respond with tailored products and technical solutions.

| End Use | Research Organizations |

|---|---|

| Value Share (2025) | 39.3% |

The demand for cryogenic vials from research organizations is expected to experience substantial growth in 2025, attaining 39.3% of the industry share. Cryogenic containers are essential for maintaining low temperatures and controlling research environments in physics, chemistry, and materials science, with their need increasing with improvements.

Research organizations, including universities and laboratories, are increasingly recognizing the importance of cryogenic vials in their work, leading to a surge in demand for precise temperature control and material manipulation in extremely cold conditions. The demand is anticipated to increase orders and broaden the market reach for suppliers and manufacturers of vials.

Market players in the cryogenic vial market are estimated to push the limit of production by developing innovative product portfolios that can cater to multiple requirements of the users. The research and development of the novel and unique features of the vials are anticipated to help in the growing practices of research and development in other sectors.

Major players in the industry are envisioned to increase their market share on a global level by employing various strategic approaches. These may include engaging in mergers and acquisitions to consolidate their position, forming partnerships with niche markets to access new customer segments, and augmenting their footprint in different geographic regions to capture novel prospects.

Recent Industry Developments in Cryogenic Vial Market

In terms of material, the industry is bifurcated into plastic and glass.

In terms of products, the industry is divided into self-standing bottom and round bottom.

In terms of capacity, the industry is categorized as up to 1 ml, 1.1 to 2 ml, 2 to 4 ml, and above 4 ml.

End use industries of the sector are research organizations, drug manufacturers, and healthcare institutions.

Key countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA), have been covered in the report.

The global cryogenic vial market is estimated to be valued at USD 172.4 million in 2025.

The market size for the cryogenic vial market is projected to reach USD 262.7 million by 2035.

The cryogenic vial market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in cryogenic vial market are plastic and glass.

In terms of product, self-standing bottom segment to command 67.4% share in the cryogenic vial market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic vial rack Market

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Technology Market

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA