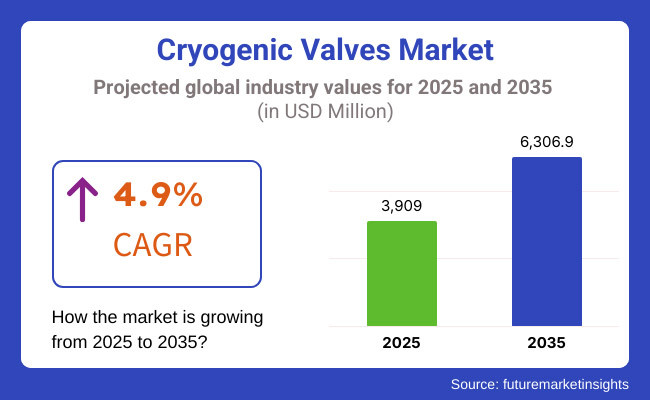

The cryogenic valves market is poised for significant growth, driven by the increasing demand for industrial gases, the expansion of LNG infrastructure, and the rise in cryogenic applications across various industries. With a projected market value of USD 3,909.0 million in 2025, the sector is expected to reach USD 6,306.9 million by 2035, growing at a CAGR of 4.9% over the forecast period. The increasing adoption of cryogenic technology in healthcare, energy, and space exploration industries is expected to contribute to this steady growth.

The reduction of cryogenic valves is the integral unit to the expansion of the cryogenic valves market based on the inductive boom that industrial applications of the cryogenic valve market experience owing to the increased demand for the safe management of cryogenic fluids. In power, healthcare, and aerospace industries, for instance, the fluids are used which are: LNG, oxygen, nitrogen, and hydrogen gas.

The concurrent journey to cleanliness is not only in cryogenic liquids but LNG and hydrogen energy as well which singularly appear to be the main drive of the market. What is more, the discovery of new materials for the cryogenic valve design and the increase in life cycle of the valve while making the handling of fluidic system safer are other reasons behind the getaway of the cooler valve range law.

LNG (liquefied natural gas) huge popularity as an alternative to dirty fuel is one of the key factors responsible for the growth of the cryogenic valves market. Controlling the flow and temperature of low gases in the oil field, gas, and chemical plants as well as in health care is one of the applications of these valves.

Beyond that, research about very low-temperature material and technology in the field of cryogenic storage and transportation is a driver for their development. The increase in space research and medical industries, as an example, the utilization of biotech cryogenic freezing, is boosting the market further.

The market is also propelling through the adoption of industrial automation and smart valve technologies that help in valve control efficiency. The IoT and AI-supported cryogenic storage and transport operational systems are not only improving safety but are also leading to energy savings.

Quantum computing and cryogenic biotechnology which are the increasing focus of research, are also widening the range of applications for cryogenic valves. Apart from other areas, government support in developing cryogenic infrastructure for hydrogen energy and space exploration lifts it further across multiple industries.

Explore FMI!

Book a free demo

North America can now be regarded as the primary market for cryogenic valves due to its fully developed LNG infrastructure and increasing hydrogen energy investments. The United States of America tops the cryogenic valve market in production and supply, and the rise in LNG exportation has been observed along with a rise in demand for high-performance cryogenic valves for related tasks of gas processing, storage, and transportation.

Moreover, the area is at the cutting edge of space exploration with NASA and private companies like SpaceX and Blue Origin using cryogenic technologies for rocket propulsion. Also, growth in the healthcare business has been evidenced by the cryogenic storage of biopharma and organ transplant applications.

Technologies are expected to emerge in the next ten years that will automate processes and improve valve materials and workloads in ways that will support government policies and the clean energy industry.

As the EU with its firm commitment to the green energy sector increases its demand for Cryogenic storage, the cryogenic valves market has solid growth in the region. Environmental regulations imposed by the European Union and the drive for carbon neutrality have indeed led to the promotion of LNG adoption as an alternative fuel source.

Germany, France, and the Netherlands alongside their investments in hydrogen technology, which safe storage and transportation cryogenic solutions beget, further stimulate the market. The aviation industry in the region undergoes a fast advancement stage where the European Space Agency (ESA), and moreover, the companies working alongside them are shifting to using cryogenic propulsion systems.

On top of that, the healthcare industry in Europe has been increasing the range of medical gases and biological research done in cryogenic environments. The above-mentioned facts together serve as the foundation for the regional steady increase of cryogenic valves.

Asia-Pacific is the region with the fastest growth rate of the cryogenic valves market which is mainly fueled by the rapid industrial growth rate, the increasing demand for energy, and also the tremendous rise in the liquefied natural gas (LNG) business. Similar to China, Japan, and India are at the very forefront with major investments towards identities such as LNG that are cleaner than coal along with related infrastructures.

Hydrogen energy production is heavily invested in China, and the government even has plans related to car transportation and electricity generation by hydrogen, all of which lead to more demand for cryogenic valves. Japan is also catching up in the cryogenic theme as they are developing their space technology in which they use satellites and space shuttles embedded with cryogenic technology.

The healthcare industries are also booming, resulting in higher demands for cryogenic storage solutions due to medical gases and pharmaceutical applications. The government will continue to promote market growth through the commitment of boost in cleaner energy and industrial development.

The cryogenic valves market in the rest of the world, including Latin America, the Middle East, and Africa, is quickly taking the front row due to the growing commitment of companies to LNG and industrial gas applications. The Arab Gulf is expanding its natural gas sector and hydrogen production as part of its long-term energy diversification strategy, while countries like Qatar and Saudi Arabia are in the process of investing in a series of massive cryogenic infrastructure projects.

For instance, industrial gas applications in healthcare and the manufacturing process in Latin America are continuously increasing at quite a speed. African countries, which are considered at an early stage, are making attempts to adopt LNG in power generation and transportation.

While the shortage of infrastructure and regulation are two factors that are a hindrance to the region's development, the switch on focusing on energy alternatives allows the door to be opened for the cryo valve manufacturers.

High Costs and Technical Complexity

The production, installation, and maintenance of cryogenic valves involve high costs as there is a need for specialized materials and precise engineering. The cryogenic valve should be able to work under high temperature latches so a few types of alloys need to be high quality, as well as advanced sealing mechanisms.

The technical complexity of designing valves that can operate efficiently in cryogenic environments poses further difficulties for manufacturers. The high cost of cryogenic facilities including storage tanks and pipelines has limited market entry for emerging economies greatly.

The adoption of cryogenic solutions by small and medium enterprises (SMEs) is hindered by financial constraints and a lack of technical know-how and this in turn affects the overall market growth, especially in regions where pricing is a major consideration.

Safety and Regulatory Compliance

Cryogenic valves need to comply with strict safety and regulatory requirements for their protection against the harmful effects of handling extremely low-temperature fluids. And should a mark-off or leakage occur, the situation could be troublesome with operational inadequacies involving the failure of equipment and even accidents of employees.

Following the international standards like ISO 21011 as well as ASME B31.3 make the safety valve design and manufacturing more complicated, so the regulatory approval process takes a lot of time and is quite costly.

There are also other hurdles like the difference in regional regulations which call for companies to adjust production processes. Issues related such as proper insulation to ensure there is no cryogenic embrittlement, temperature fluctuation mitigation risks, and others are the reasons which need close attention on safety in cryogenic valves market and this could be a hindrance to innovation and product development.

Expansion of Hydrogen Energy Infrastructure

The renewables transition across the globe is driving the hydrogen energy cryogenic valves market. The hydrogen cryogenic valves are used for the transport, storage, and use of hydrogen safe, secure, and hazardous-free. This necessity of hydrogen storage, transportation, and distribution with safety and efficiency means there will be a huge demand for cryogenic valves.

Investments fostered by government and industries around the globe on hydrogen production, storage, and distribution are notable in Europe, North America, and Asia-Pacific the most. Countries like Germany, Japan, and South Korea are mainly realizing the benefits associated with decreased carbon emissions, and in turn, the market is getting a lift.

The hydrogen fuel cell vehicle projects and power generation facilities that are incoming will inevitably move the focus towards cryogenic handling systems. As the energy sector transitions to hydrogen, the cryogenic valve manufacturers will have the chances to pioneer and introduce new advanced cryogenic valve technologies for hydrogen applications.

Advancements in Smart and Automated Valves

The penetration of smart technology into the cryogenic valve production process marks a ground-breaking change and allows for operational control, efficiency, and safety. The Internet-of-Things (IoT) as well as Artificial Intelligence (AI) driven monitoring schemes embody the time-tracking valve performance leakage detection the need for maintenance and are facilitating an interconnected world.

This technology cutting-edge stuff will lead to malfunction time reduction in LNG cryogenic, industrial gases, and medical application systems, and even increase the safety of the machines. Airspace, healthcare, and energy sectors will see the rise of smart systems in the cryogenic storage and transportation spaces, thus increasing the demand for intelligent valve solutions.

Automated cryogenic valves are a breakthrough in low-temperature fluids control as they consume less manpower and lower operational risk. As the digital transformation process accelerates in industries, the need for sophisticated, connected cryogenic valves will create a massive opportunity for the growth.

Cryogenic valves market has significantly added to its growth from 2020 to 2024 by factors like the sheer demand on behalf of LNG, healthcare, and aerospace industries. The increase in global LNG trade, together with technological advancements in cryogenic storage and the necessity for cryogenic equipment in the medical sector led to the markets well-praised rise. Rules framed for energy saving and environmental protection have also played a role in the technological advancements in cryogenic valve design.

The cryogenic valves market will keep changing in the coming years with a focus on the hydrogen kick-off as an alternative fuel, space exploration expansions, and improvements in cryogenic processing for pharmaceuticals and biotechnology. The advancements in both materials science and smart valve technologies will increase performance, safety, and efficiency.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Environment | Regulatory measures related to LNG safety, protection of the environment and industries. |

| Technical Progress | Developed valve sealing technologies, more thermal efficiency, and the use of corrosion-resistant materials. |

| Sector-Specific Target | Dominantly, they are used in LNG, medical cryogenics, and aerospace industries. |

| Sustainability & Circular Economy | First steps for the reduction of cryogen leakage and energy efficiency improvement. |

| Movers in the Market | Growth of the LNG industry, increased use of cryogenics in healthcare, and space missions, and rising demand for industrial gases. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Environment | More stringent hydrogen and LNG safety norms, sustainability initiatives, and the aerospace sector's shifting principles. |

| Technical Progress | Installation of intelligent monitoring systems, maintenance based on AI-prognostics, and the employment of advanced composite materials. |

| Sector-Specific Target | Construction of hydrogen fuel infrastructure, quantum computing devices, and biopharmaceutical manufacturing are the main sectors. |

| Sustainability & Circular Economy | More attention on low-emission cryogenic systems, sustainable production materials, and energy-efficient valve operations. |

| Movers in the Market | Hydrogen economy expansion, advancements in space exploration, newly emerging medical applications, and smart valve technologies. |

The United States is in the forefront of the cryogenic valves market due to the high level of LNG exportation, the rapidly developing aerospace sector, and the increase in the demand for industrial gases, it is experiencing. The country is making huge investments in LNG infrastructure as part of its strategy to become a top global exporter, which in turn is resulting in a rise in the cryogenic valves market in terms of storage and transportation applications.

Space exploration, which is at its forefront with NASA and private companies like Space and Blue Origin, is fundamentally driving the market. The healthcare sector also plays a role as it increases the use of cryogenic applications in MRI technology and cryopreservation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United states | 5.2% |

The UK cryogenic valves market is examining the moderate development, which is based on the hydrogen economy initiatives of the country and the import of LNG, and the improvement of cryogenic medical application. As the UK moves towards a low-carbon economy, the infrastructure for hydrogen storage and transportation is being heavily invested in, which is consequently boosting the demand for cryogenic valves.

Moreover, the increase in LNG imports as a means of replacing traditional fossil fuels is resulting in a higher requirement for efficient cryogenic handling systems. The Compound Annual Growth Rate (CAGR) of the UK market in the coming years is going to be about 4.5%, demonstrating stable growth in both energy and health sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The European Union (EU) cryogenic valves market has been on the rise due to the initiatives for the hydrogen economy, the import of LNG, and the increasing demand for industrial gases in the manufacturing and energy sectors. The expansion of hydrogen fuel and LNG infrastructure in the EU has been primarily driven by the bloc's vision of a carbon-neutral world by 2050, and both of these developments will need further advanced cryogenic handling systems.

The semiconductor and automotive sectors' contribution is also significant, as they create more and more cryogenic gases for manufacturing processes through technological innovation. The forecasted growth rate (CAGR) for the EU market is 4.7%, which is indicative of a positive policy-driven growth trend as well as the adoption of new technology.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The hydrogen energy leadership, LNG imports, and the progress in semiconductor manufacturing are the key factors that drive Japan's cryogenic valve market. The country is the leading player in hydrogen fuel cell technology and is attracting more and more investment in the field of hydrogen storage and transportation.

Japan's LNG dependence on energy security is being further pushed by the expansion, which in turn requires advanced cryogenic valve solutions. The semiconductor industry, the third ranking exports of Japan, also improves the growth of the cryogenic valve sector as it uses high purity cryogenic gases. It is expected that the CAGR (Compound Annual Growth Rate) for the cryogenic valves market in Japan will be 4.8%, which is buoyed by energy and high-tech industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The growth of South Korea's cryogenic valves market is mainly attributed to its commanding position in the LNG shipbuilding, hydrogen energy infrastructure, and semiconductor manufacturing sectors. As one of the major players in the world LNG carrier manufacturing market, South Korea has a significant demand for advanced cryogenic valves for the proper functioning of LNG storage and transport.

The government has committed to hydrogen energy, which is also majorly responsible for the investments in hydrogen storage and refuelling infrastructure. At the same time, the electronics and semiconductor industries need huge amounts of high-purity cryogenic gases that also increase market demand. The solubilisation of South Korea's cryogenic valves industrial sector is conned with the expected CAGR of 4.6%.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Globe Valve Dominates Due to Precise Flow Control

Globe valves are the most commonly used cryogenic valves because of their excellent flow control ability to handle high pressure and low temperature applications as well. These are perfect for employing with cryogenic fluids like liquefied natural gas (LNG), liquid oxygen and liquid nitrogen which requires regular adjustments.

Their strong order provides minimal leakage which is important in healthcare and chemicals industries where it is very significant to keep cryogenic temperatures. The growing need for safety regulations in energy and healthcare sectors is resulting in the development of knowledge for globe valves, particularly in North America and Europe.

With the increasing expansion of LNG infrastructure and among other initiatives where cryogenic medical technologies are applied, the globe valve segment is anticipated to see continuous growth in the next few years.

Ball Valve Gains Traction for Quick Shut-Off Needs

Ball valves are getting attention in cryogenic applications due to their quick shut-off functionality and minimal pressure drop. They have a wide application spectrum in energy & power, particularly in the case of LNG production and transportation. They are widely selected due to their robustness and ability to operate under significantly varying conditions, such as high-flow applications.

The new generation of ball valves in cryogenic technology, such as longer bonnets and specially designed seats, is added to be their performance in cold environments. Due to the rising number of investments in LNG terminals and the rising trend of renewable energy sources, the ball valve market is growing. The Asia-Pacific region is regarded as an important market for ball valves, especially in China and India due to the rapid increase in industrial activities and energy demands.

Energy & Power Sector Leads Due to LNG Expansion

The cryogenic valves' largest customer base is the energy & power industry, as it is the main end-user thanks to the growth of LNG use as a cleaner fuel alternative. Cryogenic valves are the primary equipment used in LNG liquefaction facilities, storage sites, and transportation networks to efficiently control and safely handle ultra-low temperature cold gases.

LNG as a clean fuel gas natural is being promoted by governments all around the world which is increasing the need for cryogenic valves even more. The growth of hydrogen energy infrastructure, primarily in Europe and North America, is giving a further boost to the market.

The development of equipment that is both reliable and efficient in extreme conditions tends to promote the use of cryogenic valves in the energy sector which in turn makes this area the most important in the market.

Healthcare Industry Experiences Growth Due to Medical Cryogenics

The healthcare field is now seen as an essential buyer of cryogenic valves driven by the continuous increase of cryogenic gases in medical applications. Liquefied gases like Oxygen, Helium, and Nitrogen are actively used in medical operations and devices like cryo-surgery systems and MRI machines which need considerable cryogenic valve solutions.

Hospitals, which use more oxygen than usual because of COVID-19, have recently increased funds in cryogenic storage and distribution networks. Also, since the pharma has been investing more in the storing of vaccines in an ultra-low environment as well as the biopharmaceutical it has helped further the demand.

There has been a notable increase in the market for cryogenic valves in this section which is due to the continued technological advancements and the rising levels of investment in healthcare infrastructure mainly in developed regions such as North America and Europe.

The Cryogenic Valves market is witnessing growth as a result of industrial gas emissions, healthcare applications, and technological advancements such as aerospace. The global relocation towards clean energy methods of including hydrogen and LNG is moving the adoption forward. The high need for safe and smart low-temperature fluid handling equipment in industries such as oil and gas, pharmaceuticals, and chemical processing brings the growth of cryogenic ball valves.

There are advancements in technology for smart valves to have higher efficiency and safety. The market players are focusing on R&D, digital automation, and sustainability solutions to keep their competitiveness. The strict regulations related to cryogenic fluid storage and transportation are also a driving force for the market innovations and the development of high-performance cryogenic valves.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Emerson Electric Co. | 15-20% |

| Flowserve Corporation | 12-16% |

| Parker Hannifin Corp | 10-14% |

| Velan Inc. | 8-12% |

| Herose GmbH | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Emerson Electric Co. | Advanced cryogenic valve solutions for LNG, industrial gases, and aerospace. Strong R&D investments. |

| Flowserve Corporation | Specializes in high-performance flow control solutions, including cryogenic valves for extreme conditions. |

| Parker Hannifin Corp | Develops compact, high-efficiency cryogenic valves for LNG, aerospace, and medical applications. |

| Velan Inc. | Focuses on precision-engineered cryogenic valves for energy, petrochemical, and industrial gas markets. |

| Herose GmbH | European leader in cryogenic valve manufacturing, emphasizing safety and energy efficiency. |

Key Company Insights

Emerson Electric Co.

Emerson Electric Co. is a world-renowned producer cryogenic valve products, meeting the needs of industries like LNG, industrial gases, and aerospace. The company is making considerable investments in smart solutions, digital monitoring technologies, and automation to increase efficiency of operations. With a commitment to environmentally friendly practices, Emerson has set out to design and manufacture low-emission valve systems and has entered the renewable energy sector.

Thanks to the unmatched R&D efforts, the company remains at the forefront of innovation and is capable of delivering state-of-the-art cryogenic solutions globally. The latest mergers and partnerships clearly highlight its power on the market, especially in the countries with the burgeoning LNG infrastructure.

Flowserve Corporation

Flowserve Corporation is focused on providing high-performance flow control solutions, including cryogenic valves for very low-temperature applications. The company has significant involvement in the oil & gas, LNG, and power generation sectors. Flowserve’s research-driven policy is centered around the production of long-lasting and energy-saving cryogenic valves that comply with global safety standards.

Moreover, it is directing investments in predictive maintenance and digital valve solutions that serve to increase parts and assembly systems productivity and continuity. Through its diversified worldwide supply chain, Flowserve assures its product availability in all strategic markets. Its long-term environmental commitment and ecological products lead to being one of the chief actors in the clean energy transition process.

Parker Hannifin Corp

Parker Hannifin Corp specializes in the manufacture of compact, high-performance, and cryogenic valves that are mainly used in industries like LNG, aerospace, and medical gases. The company is introducing new products to support the growing hydrogen economy besides bringing high-performance valves for hydrogen fuel applications. Parker's robust emphasis on exactness in engineering and material creativity assures that their valves are longer-lasting and perform better.

Their IoT and remote monitoring technologies are now being implemented in the products for a better predictive maintenance. Parker Hannifin with its wide distribution spectrum and significant partnerships is both a powerful adversary in the developed countries and a fierce competitor in the emerging markets.

Velan Inc.

Velan is a precision-engineered cryogenic valves manufacturer and a trusted name in North America for petrochemical, LNG, and industrial gas applications. The company has an established repute in the manufacture of custom-engineered solutions to meet the needs of industrial customers. With high-pressure and ultra-low-temperature valve designs as its specialties, Velan is able to deliver quality and durability to its critical end-users.

The company's vision for its products is technological breakthroughs, including: zero-leakage valve technology, limited time cryogenic product testing. Velan is growing its global influence, especially in the Asia Pacific where the LNG infrastructure is growing rapidly, as well as in the Middle East.

Herose GmbH

Herose GmbH is a premier manufacturer in Europe that focuses on the production of cryogenic safety valves. The company excels in providing highly efficient energy solutions for the industrial gases, LNG, and hydrogen sectors while maintaining high-quality standards. With an eye on international market compliance, Herose is ensuring that its products meet the required safety standards.

The company also aims to invest in green energy technologies while focusing on the cryogenic valve area which is highly sought in the hydrogen sector. Herose’s customer-centric approach, which is matched by its commitment to being sustainable, has made it the vendor of choice for companies that prioritize safety and environmental responsibility.

The global Cryogenic Valves market is projected to reach USD 3,909.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.9% over the forecast period.

By 2035, the Cryogenic Valves market is expected to reach USD 6,306.9 million.

The Globe Valve segment is expected to dominate the market, due to its precise flow control, reliability in extreme cryogenic conditions, widespread use in LNG and industrial gas applications, superior sealing capabilities, and compliance with stringent safety standards.

Key players in the Cryogenic Valves market include Emerson Electric Co., Flowserve Corporation, Parker Hannifin Corp, Velan Inc., Herose GmbH

In terms of Valve Type, the industry is divided into Globe Valve, Gate Valve, Check Valve, Ball Valve, Others

In terms of End Use, the industry is divided into Food & Beverage, Healthcare, Chemicals, Energy & Power, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.