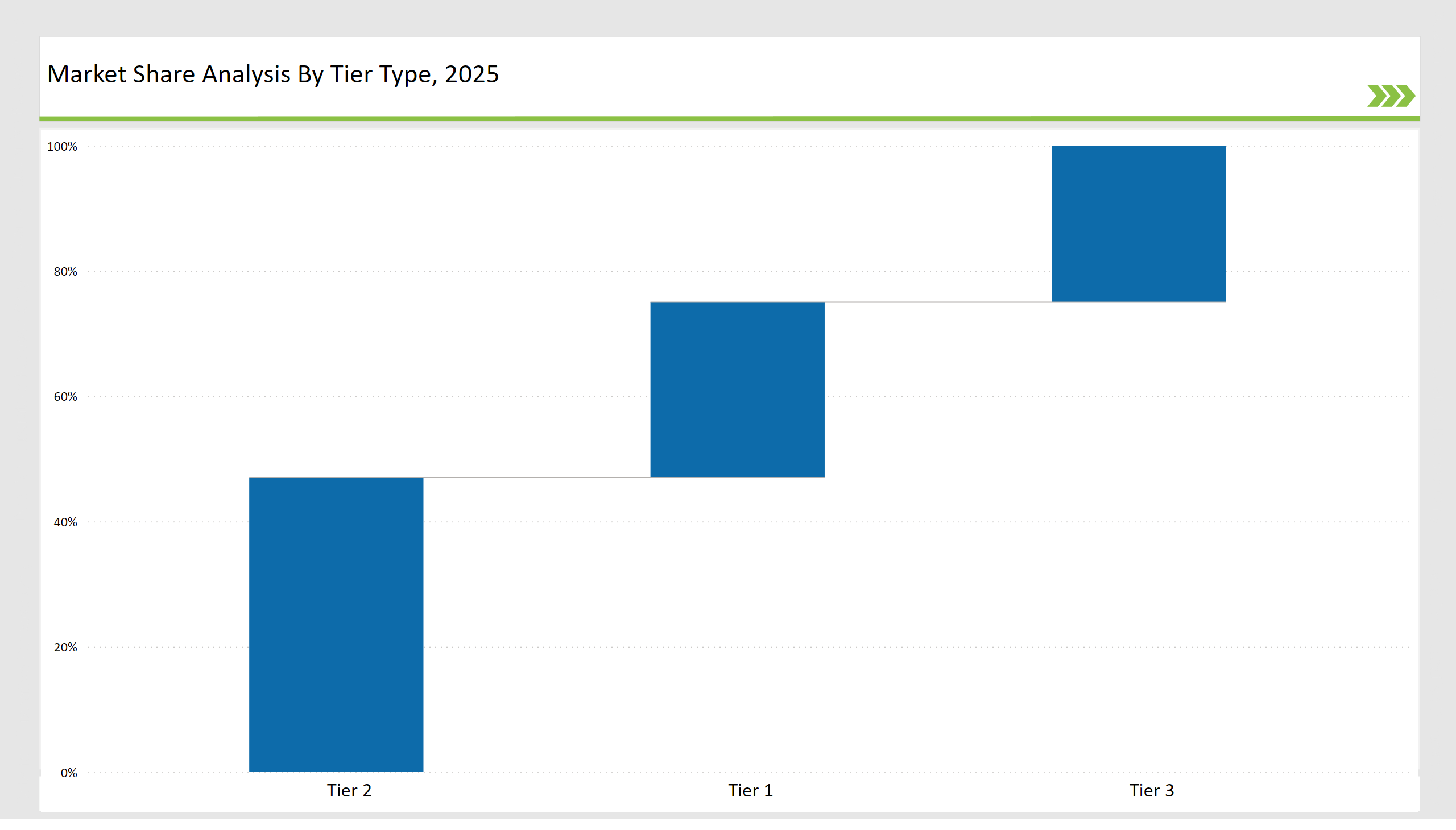

The Cryogenic Ampoules Market is highly competitive. The industry has Tier 1, Tier 2, and Tier 3 players in it based on market presence, innovation, and scale of operations. Key players like Thermo Fisher Scientific, Corning Incorporated, and DWK Life Sciences dominate this market as Tier 1 manufacturers and account for about 60% of total market share.

The companies also have been exploiting economies of scale, advanced R&D, and a strong global distribution network. Sustainability programs, advanced cryopreservation, and strategic partnerships have allowed these firms to maintain their premium pricing with the strong demand in the biomedical, pharmaceutical, and research sectors.

Tier 2 players, including Nalgene, Sumitomo Bakelite, and CellPath, contribute around 25% to the global market share. These companies focus on mid-sized businesses and specialized applications, offering cost-effective and customizable cryogenic storage solutions. Their growth strategies include operational efficiency improvements and expansion in emerging markets.

Tier 3 players, consisting of smaller regional manufacturers, startups, and niche specialists, collectively hold approximately 15% of the market. These companies cater to localized needs, focusing on innovations such as eco-friendly ampoule materials and customized cryogenic storage solutions for cost-conscious clients. Despite limited resources, Tier 3 players’ agility allows them to capture market gaps and compete effectively.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences) | 12% |

| Rest of Top 5 (Nalgene, Sumitomo Bakelite) | 9% |

| Next 5 of Top 10 (CellPath, Greiner Bio-One, Eppendorf, CryoBio, Wheaton) | 7% |

The market remains concentrated at the top, with Tier 1 players holding a global advantage, while Tier 3 players focus on localized innovation and specialization.

Industry Share by Player Tier (%), 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 28% |

| Next 20 Players | 47% |

| Remaining Players | 25% |

Biomedical Research: Increasing demand for cryogenic storage in stem cell research, tissue preservation, and biobanking.

Standard Cryogenic Ampoules: Designed for secure storage of biological samples at ultra-low temperatures.

Under these categories, vendors are integrating advanced technologies, such as real-time monitoring, RFID tracking, and AI-based temperature control systems.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences |

| Tier 2 | Nalgene, Sumitomo Bakelite, CellPath |

| Tier 3 | CryoBio, Wheaton, Greiner Bio-One, Eppendorf |

| Manufacturer | Latest Developments (Month, Year) |

|---|---|

| Thermo Fisher Scientific | January 2024: Launched AI-integrated cryogenic tracking. |

| Corning Incorporated | March 2024: Expanded ultra-low temperature ampoule production. |

| DWK Life Sciences | February 2024: Introduced biodegradable cryogenic ampoule solutions. |

| Nalgene | June 2024: Developed modular cryogenic systems. |

| Sumitomo Bakelite | April 2024: Introduced compact, high-durability ampoules. |

| CryoBio | May 2024: Focused on advanced RFID tracking. |

| Wheaton | July 2024: Expanded product line for high-capacity storage. |

The Cryogenic Ampoules Market is poised for significant expansion based on technological improvement, strategic application of automation, and sustainability, while the accentuates the importance of proper designing in predictive maintenance systems.

Moreover, the adoption of IoT-enabled solutions to monitor samples in real-time has become the new standard with a decrease in errors and increased reliability, further raising the demand for personalized medicine, stem cell research, and bio-storage. Sustainability concerns are driving manufacturers toward developing biodegradable ampoules and environmentally friendly alternatives for the changing needs of the industry.

The leading manufacturers of the market include Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences, Nalgene, and Sumitomo Bakelite.

The top 10 players collectively account for approximately 28% of the global market.

Market concentration in the Cryogenic Ampoules industry for 2025 is assessed by the dominance of Tier 1 players, who control 31% of the market.

Tier-3 companies, including startups and regional players, contribute 25% by offering localized and specialized solutions.

Automation, sustainability, and advanced cryopreservation techniques are the key drivers of innovation in the industry.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.