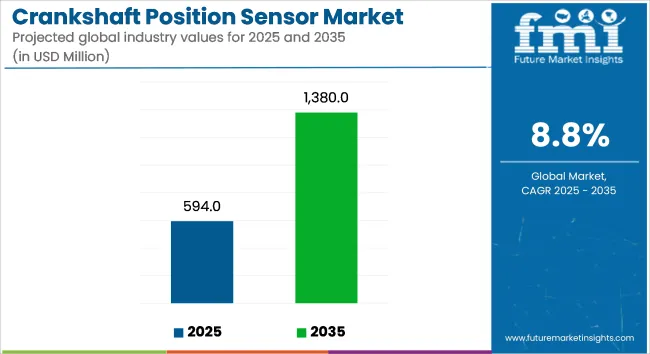

The crankshaft position sensor market is estimated at USD 594 million in 2025 and is projected to reach USD 1,380 million by 2035, reflecting a CAGR of 8.8% during the forecast period. Growth is being supported by stricter emission regulations, increased deployment of electronic engine control units, and advances in powertrain sensing technologies.

In 2024, Standard Motor Products expanded its sensor portfolio by introducing over 150 new crankshaft and camshaft SKUs tailored for both hybrid and internal combustion engine platforms in North America and Europe. The additions were validated using OBD-II diagnostic benchmarks and designed to meet precision sensing needs in emission-critical systems.

Allegro MicroSystems unveiled a new line of inductive position sensors in the same year. These were engineered for high-temperature and high-RPM environments, featuring solid-state magnetic detection. The sensors supported wide air-gap tolerances and were compatible with ASIL-B safety protocols, making them suitable for integration into crankshaft sensing rings and hybrid starter-generator modules.

Applications in ignition timing, fuel injection synchronization, and variable valve timing (VVT) systems have expanded. In modern V6 and turbocharged I4 configurations, these sensors have been integrated to monitor misfire events and crankshaft acceleration. Belt starter-generator (BSG) modules and mild hybrid systems have also adopted these technologies, as confirmed by technical datasheets released by Tier-1 suppliers in early 2025.

OEMs have increasingly specified dual-output crankshaft sensors to enhance redundancy for brake-by-wire and engine torque request systems. Sensor housings have been developed using thermally robust, EMI-resistant materials, while sensing elements have incorporated magneto-resistive or Hall-effect technologies depending on rotational speed and space constraints.

Installation protocols have been aligned with ISO 26262 functional safety requirements. In the aftermarket segment, demand has been shaped by diagnostic needs for camshaft-crankshaft phasing issues, particularly in cases where sensor degradation has impacted idle quality and emission compliance.

Continued innovation is being driven by the electrification of auxiliary systems and the demand for high-resolution rotational sensing across diverse combustion and hybrid engine architectures.

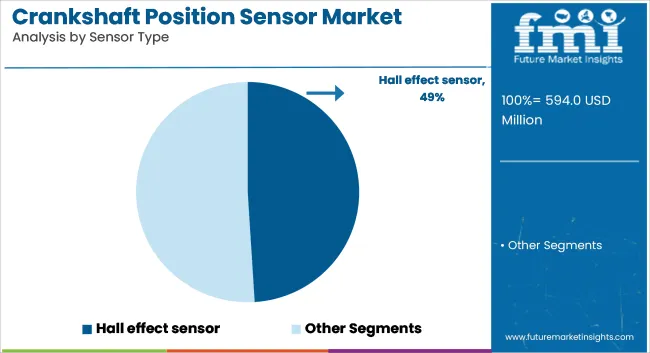

In 2025, Hall effect sensors hold approximately 49% of the global market share by sensor type and are projected to grow at a CAGR of 8.9% through 2035. Adoption is driven by their cost efficiency, compact form factor, and high reliability in detecting position, speed, and rotational movement.

These sensors are widely used across powertrain, braking, and chassis systems in internal combustion engine (ICE) vehicles, and increasingly in electric vehicles (EVs) for motor position sensing, regenerative braking control, and pedal response systems.

In 2025, Hall effect sensors are integrated into wheel speed sensors, electric power steering, and battery management systems. Their non-contact operation, immunity to dust and vibration, and compatibility with harsh automotive environments continue to support their widespread use across passenger and commercial vehicles.

Passenger vehicles hold the largest share of the automotive sensor market in 2025 and are projected to grow at a CAGR of 9.0% through 2035. Growth is supported by increasing integration of electronic control systems in both ICE and EV platforms.

In 2025, sensors are used for monitoring motor position, battery status, brake function, and cabin environment, alongside core applications like throttle-by-wire and steering control. In EVs, Hall effect and magneto-resistive sensors play a critical role in rotor position sensing, accelerator pedal modules, and thermal management systems.

OEMs continue to scale sensor usage in mid-size SUVs, sedans, and electric passenger cars to meet global emissions, safety, and performance regulations. This segment remains a key driver of innovation and volume demand in the global automotive sensor ecosystem.

High Manufacturing Costs and Complex Sensor Integration

Challenges in the Crankshaft position sensor Market High manufacturing costs of advanced sensor technologies and precision engineering may hinder market growth. These sensors need high-quality materials, complex calibration, and durability in extreme temperature and mechanical stress conditions in automotive applications.

Furthermore, crankshaft position sensors are integrated with modern engine control units (ECUs) and advanced driver-assistance systems (ADAS) which may increase the complexity of vehicle design and diagnostics. Manufacturers to alleviate these concerns should focus on the development of cost-effective production techniques, standardization and plug-and-play integration to improve compatibility and reduce the development costs.

Supply Chain Disruptions and Semiconductor Shortages

However, global supply chain disruptions, semiconductor shortages and price volatility of raw materials are major challenges present in the Crankshaft position sensor market. Auto companies rely on a consistent supply of microelectronics, integrated circuits, and magnetic sensing products to manufacture dependable sensors.

But geopolitical issues, trade restrictions, and semiconductor fab production delays have caused sensor availability that has increased costs and extended lead times. In order to address these threats, global companies have to use multiple sourcing strategies, continue investment in local manufacturing and take in other sensor technology to prevent supply chain disruptions.

Rising Adoption of Electric and Hybrid Vehicles

Growing adoption of electric vehicles (EV) and hybrid electric vehicles (HEV) is expected to create new opportunities for the Crankshaft position sensor market. Conventional internal combustion engine (ICE)-based vehicles depend on these sensors for adjustments of ignition timing and control of fuel injection, while hybrid powertrains require precise monitoring of rotational speed to ensure seamless operation as the powertrain alternates between electric and combustion modes.

By 2030, 50% of new car sales are anticipated to be electric, which means that innovative manufacturers who adopt innovative high-precision, energy efficient sensors, and design for the future of hybrid and electric powertrains will have a competitive advantage in the evolving landscape.

Advancements in Smart Sensors and IoT Integration

Advancements such as smart sensors, IoT functionalities, and predictive maintenance capabilities are helping radix Crankshaft position sensor market. Introducing next-generation sensors with self-diagnostics, real-time performance monitoring, and wireless connectivity can help with predictive fault detection and remote diagnostics.

Such innovations make vehicles more reliable, lower maintenance costs, and provide a better driving experience. Manufacturers that create AI-powered and cloud-based crankshaft position sensors, accompanied by rich data analytics functions, will find themselves aligned with growing trends in predictive maintenance and smart vehicle monitoring.

Changes in Crankshaft position sensor market (2020 to 2024) and Future Trends (2025 to 2035) Between 2020 to 2024, the Crankshaft position sensor market focused on the growth fueled by the rise in vehicle production, stringent emission regulations, and improvements in engine efficiency.

Advancements in smart engine control technologies, alongside last-minute real-time diagnostic tools, lightweight sensor materials also enhanced sensor accuracy and durability. Nevertheless, supply chain disruptions, semiconductor shortages and raw material price fluctuations introduced some market uncertainties. Instead, businesses adopted new approaches like modular sensor designs and automated manufacturing techniques, or invested in alternative semiconductor sourcing to streamline production efficiency.

In 2025 to 2035, we can anticipate a significant evolution of AI-powered engine diagnostics, solid state sensor devices and ultra-low-power sensing solutions on the market. When fully autonomous vehicles, electric drivetrains, and blockchain-based automotive supply chains become the norm, sensor requirements will evolve, as well.

Further enhancing efficiency and reliability will be self-learning algorithms, cloud-based performance tracking, next-generation magnetic and optical sensors, etc. Technologies supporting AI enhancement, sustainable manufacturing and real time data analytics will drive next level innovations.

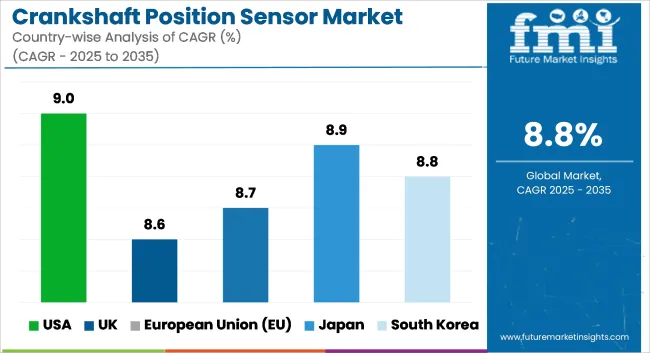

By geography, the Crankshaft position sensor market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. North America holds the highest market share in the Crankshaft position sensor market due to rising demand for advanced engine management systems, increasing vehicle production, and stringent emission control regulations in the USA Key players in the automotive manufacturers along with the advancements of sensor technologies are expected to drive the market further in future.

Increasing consumer preferences for fuel-efficient cars and the availability of high-precision, durable, and temperature resistance sensors are additional factors further supporting market growth. Furthermore, the fusion of IoT-integrated diagnostics systems, AI-based predictive maintenance, and real-time engine performance tracking is contributing to the greater efficiency of vehicles.

In line with this, companies are also working on the introduction of lightweight, compact sensors that offer high-sensitivity properties for the automotive end-use segment. Moreover, growing usage of electric and hybrid vehicles combined with increasing proliferation of autonomous driving is also driving more demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.0% |

The crankshaft position sensor market in the United Kingdom is expected to perform well due to increasing demand for high-performance vehicles, growing investments in automotive research and development, and increasing adoption of stringent emission control technologies. Other market growth drivers include the shift towards hybrid and electrification powertrains.

Supportive fuel efficiency policies by the government along with sensor miniaturization and AI-based engine monitoring pave the way for market growth. In addition, advancements in Hall-effect and magneto resistive sensor technologies that enhance precision and durability are witnessing increasing acceptance.

So companies are investing in self-diagnosing crankshaft position sensors to make preventive maintenance strategies possible. Additionally, the United Kingdom is also witnessing a shift towards low-emission and hybrid vehicles, along with increased investments in connected car technologies that are eventually leading to higher adoption in the country. Furthermore, the rise of advanced driver-assistance systems (ADAS) is driving the need for highly responsive sensors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.6% |

Some of the major contributing factors for the significant growth in the European Crankshaft position sensor market are the strong automotive manufacturing in Germany, France, and Italy, the increasing demand for precision engine control systems, and the strict regulatory standards for vehicle emissions.

Proliferation of Need for Fuel Efficiency, Lower Carbon Footprints, and Next-Gen Engine Technologies in the EU Accelerates the Market Growth Moreover, AI-powered engine monitoring systems, real-time data analytics, and enhanced sensor integration in hybrid powertrains are aiding in performance improvements.

The increasing preference for fuel-efficient combustion engines, plug-in hybrid vehicles, and electric powertrains is also contributing to the growth of the market. The growth of digital automotive diagnostics and sensor-based engine calibration is also driving adoption in the EU. And the drive for Euro 7 emission legislation is speeding investment in high-precision crankshaft sensors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.7% |

The market for crankshaft position sensor in Japan is growing with shifting focus of the country towards automotive innovation, rising penetration of hybrid and electric vehicles, and development in real-time engine monitoring technologies. Rising demand for energy-efficient, high performance engine components is set to aid market growth.

Precision engineering is deeply entrenched in the country, and the deployment of AI-driven sensor calibration and predictive maintenance analytics is driving innovation. In addition, stricter government norms on fuel efficiency and emission reduction is pushing companies into manufacturing high sensitivity and long life crankshaft sensors.

This trend is driving the rapid growth of the automotive market in Japan, as next-generation vehicles increasingly require lightweight and low-power-sensing solutions. Japan’s investment in autonomous driving and intelligent vehicle diagnostics is also shaping the future of engine sensor technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.9% |

In South Korea, crankshaft position sensors are gaining traction due to a growing automotive industry, increasing adoption of smart vehicle technologies, and continued government support for fuel-efficient and electric vehicles.

The growing adoption of new technologies is further fueled by rising interest in stringent emission regulations and demand for advanced engine control systems. Now the country is making an effort to integrate AI-based sensors into vehicles, which is making real-time diagnostics and improved sensor durability are some prominent projects enhancing competitiveness.

Secondly, increase in demand for crankshaft position sensors in hybrid cars, electric cars, high-performance sports cars, and heavy-duty commercial vehicles is driving the market adoption. To maximize sensor performance, companies are investing in advanced sensor materials, integration of wireless diagnostics, and enabling technologies for high-temperature resistance. The evolution of smart mobility solutions and autonomous vehicle technologies in South Korea is also fueling growth in demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.8% |

Growing demand for improved fuel efficiency and stringent emission regulations in the automotive industry are driving the growth of the Crankshaft position sensor market. Manufacturers are working on precision sensors, integration into ECUs, and designing parts that can withstand heat and be durable. "But in addition to this, we are seeing key trends such as smart sensors, contactless sensing technology, and improved diagnostics."

Other Key Players

Crankshaft position sensor innovations are being driven by a variety of global and regional manufacturers, including precision, durability, and smart sensing technology. Key players include:

The overall market size for Crankshaft position sensor market was USD 594 Million in 2025.

The Crankshaft position sensor market expected to reach USD 1,380 Million in 2035.

Some of the factors contributing to the growth of Crankshaft Position Sensor market are growing vehicle production, increasing adoption of advanced engine management systems, rise in demand for fuel-efficient and low emission vehicles, technological advancements in automotive electronics as well as the growth in electric as well as hybrid vehicle usage requiring precise monitoring of engine.

The top 5 countries which drives the development of Crankshaft position sensor market are USA, UK, Europe Union, Japan and South Korea.

Hall effect and inductive sensors drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Position Servo System Market Size and Share Forecast Outlook 2025 to 2035

Repositionable Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Repositionable Labels Manufacturers

Repositioning and Offloading Market – Trends & Forecast 2024 to 2034

Repositioning & Offloading Devices Market – Demand & Forecast 2024 to 2034

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

X-Ray Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Spine Positioning Devices Market

Multi-Position Cylinder Market

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Global Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Positioning System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Position Sensor Market

Seating And Positioning Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA