The market for cranes is expected to register rapid growth in 2025 to 2035 because more infrastructural construction, factory buildings, and investments are made in further green energy projects. A primitive device to lift and move massive loads, the demand for cranes is surging across numerous sectors such as building construction, shipping, mines, and oil & gas. As a result of the global urbanization that has been ongoing, the demand for technologically advanced and capacity-based cranes grows on a continuous basis and thereby makes the market expand in the future.

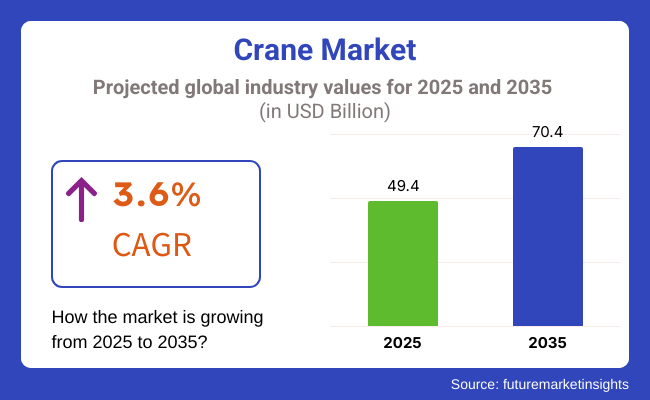

The size of the market for the crane industry was around USD 49.4 Billion in 2025. It would rise to USD 70.4 Billion by 2035, increasing at a 3.6% compound growth. It has been estimated based on crane technology, i.e., automation and smart sensors used, and energy-efficient construction. Other than that, stringent security regulation and increasingly so the requirement for clean equipment are compelling suppliers to design more responsive and efficient products.

Explore FMI!

Book a free demo

North America is a prospective market for cranes with the advanced building sector in the region and massive infrastructure development. Continuous investment by the United States government in transport infrastructure such as highways, roads, and bridges is fueling demand for all types of various cranes.

Increased activity in the oil & gas sector, especially on the Gulf of Mexico, has also increased the demand for heavy-lift equipment. Its evolution in North American markets is also driven by the requirement to integrate intelligent technologies into cranes to enhance efficiency and safety.

European markets for cranes are dominated by the enormous demand from off-shore ship and clean energy sector. United Kingdom, Germany, and the Netherlands are heavily investing in off-shore wind farms, which demand advanced crane technologies for installation and maintenance of turbines.

Focus on emission-saving equipment and emissions reduction has made it invest in electric and hybrid cranes. Also prevalent is the reconstruction of aging buildings and urban landscape in European capital cities and creating continuous demand for specialized cranes mounted in small hoods and performing complex hoists.

The Asia-Pacific region is also expected to witness peak growth in the global crane market. The high percentage and absolute magnitude of indigenous urbanization in China, India, and Southeast Asia is driving mobile cranes as well as fixed crane demand. The domestic economy, along with residential and commercial and real property development, is driving the building construction industry that serves as an essential driver behind the sales of cranes.

Aside from this, improvement in port terminals to accommodate higher volumes of trade has stimulated the need for port cranes with productivity improvement. Broader utilization of telematics and automation for crane control has been the most applicable driving force for the dynamism of the expansion trend of the area.

Challenge

Safety Regulations and High Maintenance Costs

The Crane Market encounters issues such as high maintenance costs, demanding safety regulations, and increased operational efficiency requirements. Cranes are critical to construction, shipping, and manufacturing, but mechanical wear and tear, high energy usage and compliance with safety standards such as OSHA, ISO and ANSI increase operating costs.

Moreover, aging crane fleets across various sectors need to be upgraded or replaced regularly, further fuelling capital expenditure. In order to tackle these issues, organisations need to deploy predictive maintenance systems, AI-based load monitors, and energy-efficient crane designs that are durable, increase mechanical uptime, and lower operational risks.

Opportunity

Expansion in Smart Lifting Technologies and Infrastructure Development

Growing projects in construction sites and commodities is also contributing to the higher demand for smart lifting solutions, automation, and large-scale INFRASTRUCTURE projects, thus fuelling the growth of the crane market. With investment in smart cities, renewable energy initiatives and tall buildings around the world, the clean chassis is driving demand for high-tech cranes.

AI-enabled remote monitoring, IoT-based load management, and autonomous crane operations will change the landscape of material handling and safety. I also see the emergence of electric and hybrid cranes, alongside digital twin technology for real-time load simulations, which improves efficiency and sustainability. The future will see automation, advanced sensors (e. g., temperature, vibration, etc.) and energy-efficient crane systems integrated, which will remain at the cutting edge of the market.

In recent years, the Crane Market has witnessed robust growth due to factors such as increasing investments in infrastructure, urban development, and the need for automation between 2020 and 2024. Strong demand for high-capacity cranes in logistics, renewable energy and heavy industries. But production and maintenance costs were affected by supply chain disruptions, rising steel prices and labour shortages. In response, firms rolled out modular crane designs, AI-assisted diagnostics, and remote monitoring through telematics to maximize efficiency and minimize downtime.

As we start to look forward to 2025 to 2035, radical change in the market will come through the incorporation of robotics, machine learning, and electrification into the process. Cranes will leverage AI to inform predictive maintenance, autonomous lifting, and digital twin innovation.

Moreover, the adoption of carbon-neutral construction practices and sustainable lifting solutions will accelerate the market for energy-efficient electric and hybrid cranes. As industries move towards modernization of the material handling operations, the demand for smart cranes with hands-free real-time to column and increased automated load balancing, cloud-based monitoring of performance, etc., will continue rising. The next era of the Crane Market comes with several opportunities and challenges for the companies that are a part of it.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety standards and emissions regulations |

| Technological Advancements | Growth in high-capacity, remote-controlled cranes |

| Industry Adoption | Increased use in construction, logistics, and energy sectors |

| Supply Chain and Sourcing | Dependence on traditional steel components and hydraulic systems |

| Market Competition | Development of New Crane Manufacturers vs Dominance of Established Crane Manufacturers |

| Market Growth Drivers | Demand for commercial construction projects, urbanization, and infrastructure development |

| Sustainability and Energy Efficiency | Early adoption of low-energy hydraulic systems |

| Integration of Smart Monitoring | Limited real-time diagnostics and efficiency tracking |

| Advancements in Material Handling | Use of conventional lifting methods with manual oversight |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance tracking, automation safety mandates, and sustainability policies. |

| Technological Advancements | Widespread adoption of AI-driven lifting, autonomous cranes, and smart load distribution. |

| Industry Adoption | Expansion into offshore wind farms, robotics-driven warehouses, and AI-assisted infrastructure projects. |

| Supply Chain and Sourcing | Shift toward lightweight, high-strength composite materials and modular crane manufacturing. |

| Market Competition | Emergence of next-gen crane solution providers, digital twin-enabled lifting systems, and AI-driven safety monitoring |

| Market Growth Drivers | Further investment in AI predictive maintenance, self-operating cranes, and energy-efficient lifting solutions. |

| Sustainability and Energy Efficiency | Deployment of electric cranes, lifting solutions powered by renewable energy, and regenerative braking technology on a large scale |

| Integration of Smart Monitoring | AI-powered load sensing, predictive maintenance, and cloud-integrated crane operations. |

| Advancements in Material Handling | Deployment of autonomous crane fleets, real-time safety monitoring, and voice-command-enabled lifting solutions. |

The United States crane market is growing steadily due to increasing investments in infrastructure projects, rising adoption of cranes among oil & gas and logistics end-user industries, and surging demand for high-capacity cranes for renewable energy projects. Tower and mobile cranes are in demand for bridge and highway construction due to the Bipartisan Infrastructure Law (BIL) as well as various development programs at the state level.

Another important driver is the port and logistics sector, where rising investment in automated container handling systems is bolstering demand for overhead and gantry cranes. Moreover, the growth of modular construction and prefabricated buildings is further driving the demand for advanced lifting solutions.

The USA crane market is forecasted to grow at a steady rate, on the back of technological advancements in autonomous and AI-powered crane systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The growth of the United Kingdom crane market can be attributed to the increasing commercial and residential construction, growing infrastructure investments, and rising adoption of automation in material handling equipment. Tower cranes and mobile cranes are in demand due to UK government plans to expand infrastructure, including road, rail and smart city projects.

Shifting to electric and hybrid cranes in order to meet sustainability targets is also fueling market growth. Moreover, the logistics and warehousing sector is creating demand for automated overhead cranes and gantry cranes propelled by e-commerce sales growth.

The UK crane market will grow moderately, with increasing investments in urbanization and industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

The European Union crane market is growing on account of large-scale construction projects, increasing automation in industrial lifting operations, and stringent safety regulations. Germany, France and Italy are dominating the market with high demand for tower cranes used for urban construction and crawler cranes used for infrastructure development.

These high-capacity lifting equipment are being developed as new opportunities continue to arise from the EU focus on renewable energy and offshore wind farm projects. In addition, the growing implementation of smart factories and Industry 4.0 is contributing to the demand for automated overhead and gantry cranes in manufacturing plants.

The EU crane market is anticipated to witness consistent growth with rising investments in superior lifting technologies and green crane solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Demand for advanced lifting solutions in the construction, automotive, and shipbuilding sectors has driven the expansion of the Japanese crane market. Tower cranes and mobile cranes are in demand in high-rise building and transportation projects as Japan’s aging infrastructure and urban redevelopment projects continue.

Demand for AI-powered and remote-controlled cranes - especially in manufacturing and logistics applications - is being buoyed by the country’s emphasis on robotics and automation. Also, increasing investment for earthquake-resistant building technologies, is also increasing the demand for specialized lifting equipment.

Japanese crane market continues to grow steadily on the back of automation and smart lifting solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The demand for cranes in South Korea is also growing as construction and shipbuilding sector in the country is booming along with increase in need of mechanized material handling in the heavy industry. Demand for tower and crawler cranes is being driven by South Korea’s smart city projects and large-scale infrastructure investments.

Shipbuilding and heavy machinery industries top consumers of high-capacity gantry cranes and bridge cranes, led by Hyundai Heavy Industries and Daewoo Shipbuilding In addition, increasing demand for robotic overhead cranes is driven by smart warehouses and logistics automation.

The market for cranes in South Korea is projected to grow at a steady rate on the back of increasing adoption of AI based crane monitoring systems and continuous infrastructure development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

Tower Cranes & Crawler Cranes are the one of the prominent segments in the crane market, as industries are continuously investing in the heavy-lifting solutions to ensure construction, infrastructure & large scale industrial projects. As these high-capacity lifting machines help in development of cities, construction of high-rise buildings and such engineering projects, they find crucial role in all industrial sectors which have need of handling material, structural assembly and transporting heavy machines.

Tower cranes have become one of the most important cranes in the world with their unbeatable lifting height, controllability and stability for the construction of tall buildings and colossal infrastructure projects. Unlike mobile cranes, tower cranes are immobile at construction sites, and are thus able to execute vertical lifting which is useful for tall buildings, bridges and skyscrapers.

Driven by the increasing need for urban infrastructure such as skyscrapers, smart cities, and commercial complexes, the demand for tower cranes has emerged as several construction companies focus on efficient material lifts and high-altitude assembly of structures. According to studies, more than 65% of high-rise construction projects use tower cranes, which means that demand for advanced equipment for lifting will remain high.

The rise of modular construction consisting of prefabricated components that need heavy-duty lifting has fuelled market demand, leading to a wider deployment of high-capacity tower cranes.

Moreover, the adoption of smart crane technology, which includes real-time load monitoring, AI-based crane operation optimization, and automated safety systems, has further increased adoption for enhanced efficiency and accident prevention.

Energy-efficient electrical tower cranes are being developed with battery-fuelled lifting machines and hybrid power solutions that have been helping them grow faster in the market and that aligns better with global sustainability initiatives.

The growing adoption of remote-controlled tower cranes, with precision joystick manipulation and AI-assisted movement for lifting manoeuvres, has further solidified market expansion to ensure better adaptability for complex construction environments.

While offering benefits such as vertical lifting, high capacity load handling, and compatibility with automation, the tower crane segment is challenged by high installation costs coupled with space limitations in congested urban areas and a high degree of safety regulation, which stifles growth opportunity. As a result, numerous innovations and improvements related to AI-based crane automation, modular crane construction, and digital twin-updated lifting simulations are adding to tower crane systems efficiency, scalability, and operational flexibility, leading to sustained market growth.

Crawler cranes are indoctrinating extensively into the market, majorly across heavy engineering, bridge construction, and power plant installation, as industries are actively pouring investments into heavy-duty, mobile lifting solutions to handle the oversized load as well as the large structural components. In contrast to tower cranes, crawler cranes are mobile, with tracks that offer stability on uneven ground making them the best option for infrastructure development and energy projects.

The growing demand for heavy-lifting solutions in infrastructure and energy projects, such as wind turbine installation, bridge construction, oil & gas refinery development, etc., has led to the acceptance of crawler cranes, as contractors are increasingly looking for versatile, high-performance lifting equipment. According to research studies, more than 50% of heavy engineering projects utilize crawler cranes for heavy-load lifting, leading to an ever-increasing demand for mobile heavy-duty lifting solutions.

With the advancement of offshore and energy sector projects, which include oil rig assembly, wind farm installation, and nuclear power plant construction, the market demand is significantly aggravated, leading to rising adoption of crawler cranes with an extensive boom configuration.

The adoption is further driven by the advent of digital load management systems, ensuring weight distribution in real-time with AI-based stability control systems ensuring better safety and operational efficiencies.

Owing to low-emission engines and improved load balancing, the development of high-performance crawler cranes with self-assembly capabilities has optimized market growth, which in turn facilitates greater sustainability and operational flexibility.

Adoption of modular boom designs with extendable and interchangeable crane booms as per lifting requirements has solidified market growth, as it ensures better compatibility across several different industries.

While offering great capabilities in terms of mobility, heavy-load capacity, and lifting stability during off-road applications, the crawler crane segment suffers from disadvantages including high fuel consumption, restricted road mobility due to size constraints, and high transportation costs for long-distance deployments. However, innovative advancements in hybrid-powered crawler cranes, AI-led efficiency improvement solutions, and automation-assisted lift solutions are enhancing efficiency, sustainability, and cost-effectiveness, maintaining growth for crawler crane systems.

Two of the primary market drivers are the construction and heavy engineering segments, as industries increasingly incorporate high-performance cranes to maximize large-scale infrastructure development, industrial assembly and structural material handling.

This crane technology has turned the construction industry into one of the fastest-growing applications with high-efficiency material lifting, structural components assembly, and large-scale infrastructure project implementation. Construction cranes offer high-capacity, precision-controlled lifting for bridges, buildings and industrial complexes, unlike smaller-scale lifting equipment.

The growing demand for high-rise buildings and commercial infrastructure is driving the growth of urban redevelopment projects, mixed-used commercial spaces, and smart city construction, all of which have adopted tower and mobile cranes as they keep prioritizing efficient material handling and simplification of the structural assembly processes. According to multiple studies, tower cranes are used in over 75% of high-rise projects around the world, which establishes a strong demand for advanced construction crane solutions.

The development of public infrastructure, including transport interfaces, bridges, and roadways, has reinforced market demand, ensuring increased uptake of crawler cranes and rough terrain lifting solutions.

Adoption has also been propelled by the inclusion of AI-powered construction automation such as intelligent crane management systems and on-site safety monitoring solutions, which work toward improved efficiency and reduced accidents.

Cold-formed steel, plastic and others are widely used to reduce on-site working distances, thus limiting energy consumption; the rapid trend toward this kind of material has been driven by the emergence of electric cranes with a low carbon footprint, helping to ensure compliance with the full range of global market regulations in a comprehensive and well-rounded manner.

Adoption of prefabrication and modular construction with heavy lifting of pre-assembled building components have also further helped in strengthening growth in the market while helping ensure better efficiencies with shorter construction timelines.

While it enjoys benefits like the ability to be implemented in large-scale projects, efficient material handling, and the potential for automation, the construction segment suffers from challenges like changing raw material prices, fluctuations in regulatory safety requirements, and labour shortages in crane operation. But with new developments like crane monitoring through AI, automated material handling, and lifting simulation, the cranes on the market will improve with efficiency, safety, and cost-effectiveness, making sure that the market grows alongside the construction industry.

Heavy engineering has a strong market adoption in power plants, industrial manufacturing and large equipment assembly, as more companies invest in crane-combined lifting solution for heavy machinery and structural components. Heavy engineering cranes differ from traditional construction cranes in that they must fulfil the requirements of high-load precision lifting and complex material transport.

Growing need for high-performance lifting solutions in manufacturing and industrial assembly, along with custom-made crane configurations and specialized lifting mechanism, has increased adoption for advanced crane systems as industry is focusing on automation and efficiency.

The rising market demand is the result of the upswing of large-scale industrial projects such as power plant installations, heavy machinery transportation, and refinery construction that are driving the adoption of crawler and overhead cranes.

Smart load balancing systems utilizing algorithms for real-time weight measurement and predictive maintenance have played an additional role for increased adoption, as end-users can ensure the required lifting safety and operational efficiency.

Hybrid-powered cranes with low-carbon lifting solutions and battery-assisted crane operation have also paved the way for optimized growth in the market to ensure increased sustainability in heavy engineering applications.

Although it adds value through industrial efficiency, accurate material handling, and automation integration, heavy engineering segment faces challenges with significant capital investment, coordination complexity between different projects, and regulatory challenges in transportation of heavy machinery. However, advent of new solutions around AI-based lifting optimization, modular crane assembly and next-gen industrial automation is improving efficiency, cost optimization and scalability, making sure that crane systems would continue to grow in heavy engineering applications.

With the growing demand for infrastructure development, industrial automation, and smart lifting solutions in construction, manufacturing, shipping, and logistics industries, the crane market is on an upward slope. The deployment of AI-powered crane automation, the introduction of electric and hybrid lifting solutions, and the use of IoT-integrated predictive maintenance have become top priorities for companies seeking to enhance efficiency, safety, and cost-effectiveness in their operations.

The market features international heavy machinery producers, tailored crane solution providers, and smart construction equipment companies, all driving innovation across mobile cranes, tower cranes, crawler cranes and overhead cranes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Liebherr Group | 15-20% |

| Konecranes Plc | 12-16% |

| Terex Corporation | 10-14% |

| Manitowoc Company, Inc. | 8-12% |

| Tadano Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Liebherr Group | Develops tower cranes, crawler cranes, and mobile cranes with AI-powered load management and automation. |

| Konecranes Plc | Specializes in overhead cranes, gantry cranes, and smart lifting solutions with IoT-enabled monitoring. |

| Terex Corporation | Manufactures hydraulic mobile cranes, rough terrain cranes, and high-capacity lifting equipment. |

| Manitowoc Company, Inc. | Provides crawler cranes, all-terrain cranes, and telescopic boom cranes with smart lifting technologies. |

| Tadano Ltd. | Offers compact and all-terrain cranes, integrating eco-friendly lifting solutions and remote diagnostics. |

Key Company Insights

Liebherr Group (15-20%)

Liebherr is a leading branded company for high-performance lifting solutions with AI-load balancing and automation technologies.

Konecranes Plc (12-16%)

They make smart lifting, and Konecranes crances have IoT connected monitoring and predictive maintenance.

Terex Corporation (10-14%)

Terex brings higher reaching mobile and rough ground cranes, maximizing heavy raising procedures across areas.

Manitowoc Company, Inc. (8-12%)

Manitowoc makes crawler and all-terrain cranes, embedding intelligent telematics to speed remote diagnostics and serial maintenance

Tadano Ltd. (5-9%)

Tadano makes mobile and telescopic boom cranes and works to keep emissions low, which means that this equipment is well-suited for green construction projects.

Other Key Players (40-50% Combined)

Next-Gen Crane Technology, AI-Driven Automation, and Energy-Efficient Lifting Solutions Key Innovations from Heavy Machinery Manufacturers and Industrial Equipment Companies These include:

The overall market size for Crane Market was USD 49.4 Billion in 2025.

The Crane Market is expected to reach USD 70.4 Billion in 2035.

The demand for the crane market will grow due to increasing construction and infrastructure projects, rising investments in industrial expansion, advancements in crane technology, and growing demand for efficient material handling solutions in sectors like shipping, mining, and manufacturing.

The top 5 countries which drives the development of Crane Market are USA, UK, Europe Union, Japan and South Korea.

Tower Cranes and Crawler Cranes Drive Market to command significant share over the assessment period.

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.