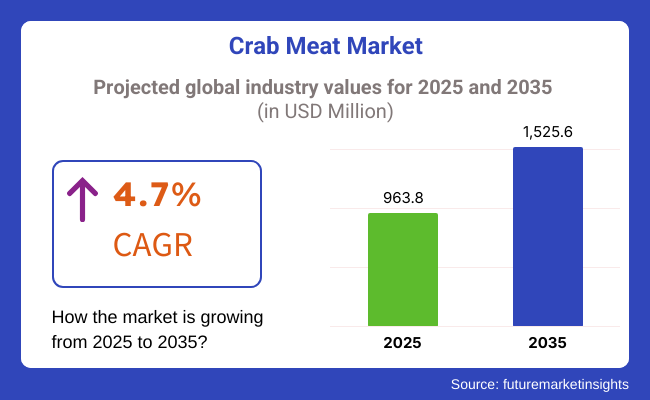

The crab meat market is likely to witness long-term growth potential, with a projection of USD 963.8 million by 2025. The overall market is anticipated to follow a CAGR of 4.7% from 2025 to 2035, as per the predictions. The net value of the market is expected to reach the USD 1,525.6 million mark by the year 2035.

Eating crabs is popular besides being delicious and nutritious. It causes an increase in demand in a lot of countries worldwide. One of the factors enhancing the crab meat market is the preference of people towards protein-based products, which also support weight loss. Moreover, the interest in making seafood preparations and gourmet dishes has elevated the sales expansion.

The growing market is mainly based on increased seafood consumption, which is very relevant to Asia Pacific and North America. People are turning more to consuming crabs, as they are loaded with omega-3 fatty acids, vitamins, and minerals, and they also support heart health and general well-being. This trend also includes the food service sector, which has developed a lot, for instance, restaurants and hotels that display themselves as high quality and offer lots of premium seafood.

Sustainability and responsible sourcing practices are driving the main factors influencing the crab meat market. Fisherman farms and aquaculture are focused on ensuring a stable supply of top-notch meat instead of overfishing and environmental impact concerns. Environmental bodies like the Marine Stewardship Council (MSC) are the ones who directly or indirectly assure builders of consumer trust and preference.

Even with the industry’s capacity to expand, it is compromised by obstacles like changing seafood prices, supply chain difficulties, and governing bodies. The meat of the crabs is delicate and has a short shelf life, making the journey through supply chains costly, which in turn requires proper handling, storage, and transportation. Moreover, the problems with seafood fraud and mislabeling are affecting the consumer confidence and the transparency of the industry.

On the contrary, the conditions still sufficiently provide expansion opportunities throughout the year. The newly added processed and ready-to-eat seafood items continue to benefit from the quick and convenient consumer-oriented products trend. The technological strides made in the methods of freezing and packaging are improving the shelf life and availability in study stores and e-commerce websites. Also, increased awareness among customers about seafood's health advantages is anticipated to keep the business flourishing in the long term.

Explore FMI!

Book a free demo

During the period from 2020 to 2024, the crab meat market registered gradual growth as a result of increased consumer demand for quality seafood and an interest in high-protein, low-fat foods. The growing use of this meat in high-end dining, sushi, and seafood appetizers propelled growth.

Easy meal solutions and changes in lifestyles heightened consumers' demands for ready-to-eat and frozen products, thus propelling their sales. Processors emphasized improved processing techniques to provide freshness, taste, and texture and satisfy high food safety requirements. Traceability and sustainable seafood sources were crucial with customers and regulating bodies trying to determine sustainable seafood sources. Unstable crab stocks, environmental issues, and production costs are too high and act as barriers to stability.

From 2025 to 2035, the crab meat market will grow steadily on the back of technological advancements in aquaculture and processing. Crab farming development and upgrading of environmentally friendly fishing operations will stabilize supply and reduce the impact on the environment. Process technologies like flash freezing and vacuum sealing will enhance the shelf life and freshness of the product.

Plant- and cell-based seafood products to mimic crab meat will also be produced, according to consumer trend towards sustainable and ethical seafood. Supply chain management by use of AI and blockchain-based tracing systems will also further ensure consumer trust in the authenticity and origin of the product. Increasing demand for high-protein, low-fat seafood, and functional seafood foods will drive the production of supplemented products with enhanced nutrients. Increased business collaboration between retail chains and seafood companies will bring the product out to more outlets and global industries.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained but steady growth through more consumption of seafood and gourmet appetites. | Steady growth fueled by sustainable processes and innovation in products. |

| Focus on high-end taste, texture, and nutritional content. | Increased emphasis on sustainability, traceability, and ethical sourcing. |

| Fresh, frozen, and ready-to-eat products. | Involvement in plant-based and cultured crab alternatives. |

| High demand in North America, Europe, and Asia-Pacific. | Expansion internationally to new markets with locally supplied product alternatives. |

| Compliance with regulations regarding fishing quotas and seafood safety. | Strict controls on sustainable fishing and aquaculture practices. |

| Seafood supermarkets, retailers, and online. | Omni-channel distribution with food service and direct-to-consumer affiliation. |

| Improved freezing and processing techniques to maintain freshness. | Supply chain management with blockchain and AI traceability. |

| Competition from traditional seafood producers and specialty brands. | Market consolidation through acquisitions and joint ventures. |

| Focus on convenience, premium quality, and freshness. | Focus on sustainability, ethical sources, and functional benefits. |

| Shifting crab stocks, environmental factors, and high production volumes. | Maintaining stability in supply, product quality, and sustainability success. |

The crab meat market is expanding rapidly with the rise in customer demand for quality seafood, the expansion of demand for high-end restaurants, and the expansion of the processed seafood business.

The food service sector appreciates freshness, quality, and sustainable sourcing, and hotels and restaurants seek high-quality lump crab meat to be incorporated into gourmet foods. Retail consumers, however, are looking for economical, pre-packaged, and convenient meat, and in many cases, will choose pasteurized or frozen products.

Seafood processors emphasize bulk buying and effective processing methods to supply ready-to-eat and canned seafood products. Health-conscious consumers are demanding high-protein, low-fat meat with high omega-3 fatty acid content, preferring wild-caught and organic products.

Sustainability remains a key issue, further inspiring growth in eco-labels, traceability, and sustainable harvesting practices. The sector is also seeing innovation in value-added products and packages, such as crab cakes, surimi, and value-added seasoned seafood products, due to shifting consumers' palates.

The crab meat market is flourishing, with consumer demand for seafood and protein-rich diets increasing. However, the most serious threats to the stability of supply include overfishing and environmental regulations. The market's long-term viability and the prevention of resource depletion require sustainable fishing practices, aquaculture investments, and adherence to international seafood guidelines.

Supply chain disruptions, which include seasonal availability and transportation challenges, play a role in the market dynamics. Price volatility may result from climate change, ocean pollution, and geopolitical tensions influencing crab-producing regions. In order to keep a steady supply, firms should introduce pluralistic sourcing strategies, support cold-chain logistics, and cooperate with certified sustainable fisheries.

Food safety regulations and quality control standards bring additional challenges. Risks of contamination, improper handling, and processing, besides recalls and loss of reputation, are issues that the company has to face not only with the implementation of strict quality assurance measures but also with complying with seafood safety regulations as well as investment in traceability technologies for the consumer trust and compliance.

Movable fluctuations of consumer preferences and pricing pressures influence growth. The most premium meat undergoes strife with different seafood options and plant-based substitutes. To keep themselves competitive, companies should work on the creation of value-added products, efficiency in the performance of environmentally-friendly packaging, and novel marketing strategies demonstrating the freshness, sustainability, and nutrition of the products.

The period of inflation with economic downturns can be the time when the demand is lower, particularly in premium seafood segments. The businesses should level financial risks through recycling product ranges, implementing the right time pricing policies, and constructing the statues of distribution across the sectors of e-commercial and food service through the cooperation with the partnering business.

The global crab meat market is segmented into lump crab meat and claw crab meat, which are used in various cooking applications and consumer preferences.

The best type is lump, which has large, firm white pieces from the body of the crab. It's valued for its sweet, delicate taste and versatility in high-end dishes like crab cakes, seafood salads, pasta, and soups. Demand from fine dining restaurants, seafood processors, and retail consumers has put the lump segment on the top. The lump segment is projected to gain around 60% share by 2025 due to increasing consumer inclination toward high-quality seafood, as well as premium-grade products. Well-known names like Phillips Foods, Chicken of the Sea, and Handy Seafood produce lump crab meat, fresh and canned, to satisfy the demand.

Claw meat, which comes from the legs and claws, has a darker color and more intense flavor and is better suited for dishes where a stronger seafood flavor is desired. It is used in crab soups, dips, stews, and sushi. Compared to lump meat, claw meat is less expensive and in higher demand among mass food services and in industrial food processing. Companies such as Blue Star Foods, Pontchartrain Blue Crab, and Seaprimexco Vietnam widely supply claw meat, which in 2025 is expected to account for about 40% of the share.

The industry can be further divided into segments based on product type: fresh as well as pasteurized/canned meat, both of which are supplied through different consumer channels.

Meat harvested fresh from live crabs has a sweet and delicate taste and finely textured meat, which is why it's standard in pricey restaurants and seafood stores. It is usually sold refrigerated, has a short shelf life, and must be handled carefully and consumed quickly. The most common type of crab used for crab cakes, seafood salads, and gourmet dishes, especially in seafood-rich countries such as the United States, Japan, and Southeast Asia, is fresh meat.

The fresh meat segment is anticipated to account for around 55% of the total market share in 2025, possessing a significant share due to the changing consumer preference toward fresh and minimally processed seafood. Specializing in wholesale distribution to restaurants and specialty retailers are Phillips Foods, Handy Foods, and Blue Star Foods.

Pasteurized or canned meat is heat treated and, therefore, has much more shelf life than a fresh catch, yet retains much of its flavor and texture. This method is convenient, less expensive, and has a lower risk of spoilage, which is why supermarkets and export markets will like it. High consumption of pasteurized meat is ascribed to ease of storage and preparation of ready-to- eat products that could be used in dips, soups, dips, pasta, processed seafood products. It is projected to represent ~45% of the share by 2025 due to the increasing demand for long-shelf-life seafood. Leaders in the pasteurized and canned supply include Chicken of the Sea, Seaprimexco Vietnam, and Crown Prince, and the global supply comes from such brands that provide premium meat products.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 4.9% |

| France | 4.5% |

| Germany | 4.6% |

| Italy | 4.4% |

| South Korea | 5.5% |

| Japan | 5.2% |

| China | 6.3% |

| Australia | 4.8% |

| New Zealand | 4.2% |

Between 2025 and 2035, the USA is expected to expand at a CAGR of 5.8% in this market, fueled by consistent demand from consumers and restaurants for premium seafood and from food service outlets and consumers looking for premium seafood choices. The Chesapeake Bay and Gulf Coast-origin crabs still lead, with blue crab species becoming increasingly popular due to their taste. Companies like Phillips Foods, headquartered in Maryland, have driven national prominence and established standards for packaged seafood quality.

Restaurants and grocery stores are increasing their menus, taking advantage of the consumer desire for pre-cooked or ready-to-eat meat. Sustainability also influences purchasing decisions, with consumers favoring wild-caught, traceable products. The high-protein diet trend favors steady consumption, particularly among fitness enthusiasts. Also, technological advances in cold chain logistics provide extended shelf life and greater geographic availability, further enhancing sales. USA importers are increasingly sourcing from Asia-Pacific regions to meet year-round demand, diversify supply chains, and maintain competitive pricing.

The UK market will grow at a 4.9% CAGR from 2025 to 2035 due to a well-established culture of seafood consumption and increasing demand for exotic flavors. Brown crab, which is usually harvested from the Scottish and Welsh shores, continues to be part of household food and upscale dining menus. Players like The Blue Sea Food Company have focused on sustainable harvesting as well as environment-friendly packaging to suit consumer conscience.

More and more consumers are trying crab-based dishes, following cooking programs and international food trends. Retailers such as Tesco and Sainsbury's have launched varied formats, ranging from white meat portions to potted varieties and frozen products. The growth in health-oriented consumption, with crabs being perceived as a lean protein, underpins market momentum. In addition, export markets, especially to EU nations, have prompted local manufacturers to raise quality and certification levels, driving growth and competitiveness on a wider scale.

France's market is anticipated to register a CAGR of 4.5% between 2025 and 2035, driven by the country's robust gastronomic culture and focus on premium seafood quality. French customers value artisanal, minimally processed meat from nearby coastal areas like Brittany. Businesses such as Armorique have gained a faithful customer base due to conventional processing methods and concern for flavor genuineness.

Bistros and restaurants add crabs to seasonal dishes, which has an impact on consumer interest in replicating the same dishes at home. Moreover, France's strong gourmet food retail sector permits high-end pricing with an emphasis on traceability and organic certification. French eating habits focusing on freshness and quality drive the demand for chilled rather than frozen. Seasonal festivals and seafood markets also add to visibility and stimulate consumption at peak times, sustaining steady interest and supporting modest but consistent growth throughout the nation.

Germany is estimated to record a CAGR of 4.6% between 2025 and 2035, driven by increasing interest in global cuisine and health-conscious eating. Germany is not historically a crab-eating nation, but its urban consumers are adopting varied seafood. Seafood, including crab, has been promoted by brands such as Gosch Sylt through restaurant chains and packaged ready-to-eat food products.

Retail chains are expanding their seafood offering, stocking pasteurized and frozen formats to suit convenience-driven consumers. The wellness appeal of crabs as a low-fat protein source is well-aligned with Germany's wellness-driven market. At the same time, eco-labels and sustainable sourcing continue to be important drivers of purchasing decisions. Media campaigns, food festivals, and tourism exposure also fuel rising interest in exotic seafood, stimulating new consumer groups to try this category. Growth is consistent as domestic processing capacity grows, decreasing import dependence and enhancing supply reliability.

Italy’s market is forecasted to grow at a CAGR of 4.4% through 2035, supported by regional coastal traditions and a culture that values fresh, high-quality seafood. While crabs are not as prominent as fish or shellfish in Italian cuisine, coastal regions like Veneto and Liguria incorporate them into regional dishes. Italian companies such as Delicious have ventured into offering gourmet seafood products, including marinated and preserved crab options.

Restaurants highlight seasonal, locally produced ingredients, fueling demand during peak fishing seasons. In addition, consumers are increasingly trying non-traditional ingredients, opening up opportunities for increased retail sales. The health value of crab meat, especially its omega-3 content, appeals to Italian consumers interested in Mediterranean diets. With culinary tourism on the rise, exposure to varied seafood products stimulates broader domestic consumption, supporting market growth albeit at a cautious rate.

South Korea is poised for a 5.5% CAGR from 2025 to 2035, driven by high seafood consumption and a cultural preference for crab dishes like ganjang gejang (soy-marinated crab). Domestic brands such as Sajo Daerim have established strong market positions, offering a wide array of ready-to-eat products that blend convenience with traditional flavors. The use of live and fresh crabs in home cooking continues to grow, supported by robust seafood distribution networks.

E-commerce is also key, with sites shipping fresh and processed crabs across the country. South Korean consumers also desire functional benefits and perceive crabs as a protein and nutrient source. Seasonal festivals, including the Yeongdeok Snow Crab Festival every year, create awareness and drive consumption, and packaging and storage innovations also aid year-round consumption. The combination of traditional dishes with contemporary diet trends assists in maintaining consumer interest across generations.

Japan is projected to expand at a CAGR of 5.2% over 2025 to 2035, underpinned by a seafood-rich diet and preference for regional crab species such as Hokkaido's red king crab. Japanese businesses such as Maruha Nichiro have brought a range of processed items, ranging from fake crab sticks to high-end fresh ones, suited to various price points and eating habits.

Hotpot dishes and sushi with crab meat popularity drive recurring demand, especially in high-frequency dining-out cities. Japan's convenience store culture also propels pre-packed seafood meal sales, and crabs are made easily available to time-strapped consumers. Culinary tourism also contributes to the market, with tourists in search of authentic seafood experiences, further driving demand. Environmental awareness shapes purchasing behavior, prompting brands to pursue sustainable fishing and environmentally friendly packaging to meet consumer expectations.

China will drive expansion at a 6.3% CAGR between 2025 and 2035, driven by robust domestic demand and cultural preference for seafood, particularly hairy crabs. Demand is driven by an increasing middle class that purchases premium meat as gifts for festivals such as Mid-Autumn. Domestic players like Zhangzidao Group dominate production and distribution, with a focus on freshness and local sourcing.

Online shopping is also key, with websites such as JD Fresh and Tmall selling live and frozen crabs to customers' doorsteps. Consumers are particularly interested in product origin, with homegrown varieties beating imports as a guarantee of freshness. Health trends are also shaping consumer behavior, with meat regarded as a healthy food that appeals to the precepts of traditional Chinese medicine. Expansion is also facilitated by government efforts to promote the modernization of aquaculture, boosting domestic supply and making it available in major cities throughout the year.

Australia's market will expand at a CAGR of 4.8% during 2025 to 2035, fueled by strong seafood consumption and export demand. Mud crabs, especially from the Northern Territory and Queensland, are still popular among locals. Austral Fisheries and other companies have invested in sustainable harvesting, which attracts eco-friendly consumers. Demand for fresh and cooked crabs is particularly high in urban coastal hubs such as Sydney and Melbourne.

Health-aware consumers prefer crab meat due to its lean protein composition, and multiculturalism has created new culinary uses outside of conventional Australian cuisine. Asia, particularly China, and Japan, are major export markets, generating substantial revenues that induce investment in quality control and cold chain logistics. Local sales also find encouragement through developing a gourmet food culture, with chefs presenting innovative recipes and stimulating wider consumer acceptance across markets.

New Zealand is expected to expand at a CAGR of 4.2% until 2035, driven by moderate domestic consumption and export operations. Spanner and paddle crabs are some of the major types produced, with an emphasis on sustainability and conservation. Companies such as Talley's Ltd. hold premium quality paramount and supply domestic markets and overseas buyers, particularly in the Asia-Pacific region.

Kiwis esteem seafood for health and freshness factors and crabs are catching on as there is increased interest in varied sources of protein. Limited but expanding retail availability in ready-to-consume and frozen forms stimulates experimentation among consumers. The nation's image for the production of clean and green food bolsters international competitiveness. Initiatives to increase aquaculture production and enhance education about seafood are likely to influence future demand, although the diminutive population size indicates incremental over-explosive growth.

The crab meat market is showing growth due to factors such as an increase in consumer demand for premium seafood, increased interest in high-protein diets, and an increase in food service and retail distribution channels. An increase in awareness about the sustainability of seafood, processing, and packaging technologies is also shaping the industry.

The industry, being led by players such as Phillips Foods, Blue Star Foods, Newport International, Thai Union Group, and Handy Seafood, optimizes its supply chain through product diversification and sustainable sourcing initiatives. Start-ups and niche players are creating their niche by supplying specialty crab products, traceability solutions, and innovative ready-to-eat formats that appeal to the ever-changing preferences of consumers.

Major offerings comprise fresh, frozen, canned, pasteurized, and imitation meat, catering to both B2B segments (food service, restaurants, and seafood processing) and B2C segments (retail consumers and online grocery platforms). Companies are working on value-added products like flavored meat and pre-marinated and ready-to-cook meal kits to enhance sales.

Strategic issues defining competition concern sustainability certifications (MSC, ASC), norms and regulations in international trade, and raw material prices due to seasonal availability. Companies are investing in advanced freezing technology, sustainable packaging, and a direct-to-consumer (DTC) distribution model to ensure sustainable competitive advantages. As demand for crab increases in North America, Europe, and Asia-Pacific, there are vertical integration strategies, partnerships with fisheries, and automation in processing for product quality as well as supply chain efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Phillips Foods Inc. | 18-22% |

| Blue Star Foods Corp. | 14-18% |

| Newport International | 10-14% |

| Thai Union Group | 8-12% |

| Handy Seafood | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Phillips Foods Inc. | A premier supplier of fresh and pasteurized meat, with a concentration on high-quality blue crab and robust food service relationships. |

| Blue Star Foods Corp. | Expert in sustainably caught, traceable meat with environmentally friendly packaging and processing technology. |

| Newport International | Provides premium pasteurized crab meat through the Chicken of the Sea Frozen Foods brand to retail and food service markets. |

| Thai Union Group | A seafood industry leader with investments in responsible sourcing and sustainability programs and a robust global distribution network. |

| Handy Seafood | Specializes in value-added meat items such as crab cakes and frozen seafood specialties for both retail and food service markets. |

Key Company Insights

Phillips Foods Inc. (18-22%)

The leading premium supplier with a powerful brand name within the food service market and retail channels.

Blue Star Foods Corp. (14-18%)

Sourcing seafood that is sustainable and traceable is what sets us apart and includes Fair Trade Certified meat.

Newport International (10-14%)

Attains a sales outlet by virtue of the Chicken of the Sea Frozen Foods production of high-quality pasteurized crab meat for retail and food service.

Thai Union Group (8-12%)

A seafood giant in the world that pursues sustainable seafood practices by enhancing responsible sourcing and establishing ethical seafood production.

Handy Seafood (6-10%)

Innovates value-added crab products such as ready-to-eat and frozen offerings that cater to emerging trends for convenient food.

Other Key Players

The industry is expected to generate USD 963.8 million, driven by increasing demand for premium seafood, rising health consciousness, and the growing popularity of crab-based cuisines.

The market is projected to reach USD 1,525.6 million by 2035, growing at a CAGR of 4.7%, supported by sustainable fishing practices, advancements in seafood processing, and expanding global trade.

Key players in the market include Phillips Foods Inc., Blue Star Foods Corp., Newport International, Thai Union Group, Handy Seafood, Supreme Crab & Seafood, Harbour House Crabs, Bumble Bee Seafoods, Ocean Legacy, and Twin Tails Seafood.

North America and Europe lead the market due to high seafood consumption, strong supply chains, and increasing demand for sustainable and premium seafood options.

Fresh and frozen crab meat dominate the market, catering to foodservice and retail sectors.

It's classified as lump crab meat, claw crab meat, and backfin crab meat.

It's classified as fresh crab meat, pasteurized/canned crab meat, and frozen crab meat.

It's classified as foodservice (HoReCa), retail, supermarkets, hypermarkets, convenience stores, specialty seafood stores, and online retailers.

It's divided into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.