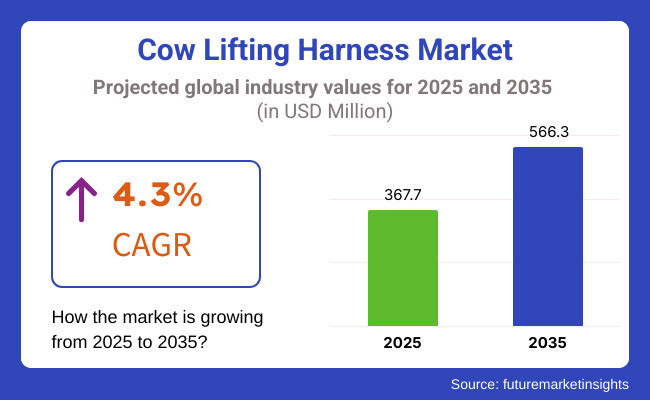

The cow lifting harness market is anticipated to be valued at USD 367.7 million in 2025. It is expected to grow at a CAGR of 4.3% during the forecast period and reach a value of USD 566.3 million in 2035.

The cow-lifting harness is a specialized contraption specifically designed for the purpose of lifting weak, injured, or recuperating cattle while safely supporting at the same time to allow for assistance in movement and rehabilitation. It enjoys widespread application in veterinary care, dairy farming, and livestock management for the purposes of getting cows with injuries, after-surgery recovery, or mobility issues, thereby ensuring animal welfare.

The cow lifting harness market includes specialized devices designed to support and lift weak or injured cattle for rehabilitation. Market growth is driven by increasing livestock welfare awareness, rising veterinary care adoption, and the need for efficient farm management solutions, with technological advancements enhancing durability, comfort, and ease of use in dairy and livestock farming.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth due to rising awareness about livestock health and rehabilitation. | Advanced growth with innovations in materials, automation, and smart monitoring technologies. |

| Traditional heavy-duty nylon and polyester-based harnesses with basic structural support. | Lightweight, ergonomic, and smart-fabric-based harnesses with enhanced durability and comfort. |

| Limited use of technology, with manual lifting and adjustable straps. | AI-driven automated lifting mechanisms, smart sensors for monitoring recovery progress, and real-time data tracking. |

| Farmers and veterinarians increasingly recognized the importance of lifting harnesses in livestock recovery. | Standardized usage across large-scale dairy farms with precision veterinary recommendations based on AI diagnostics. |

| Some efforts to develop reusable and washable harnesses to reduce waste. | Widespread adoption of biodegradable, eco-friendly, and recycled-material harnesses to minimize environmental impact. |

| Online sales and direct farm supplies boosted accessibility. | AI-driven predictive supply chains and direct-to-farm subscription-based deliveries. |

| Basic industry standards focused on safety and durability. | Stricter global regulations ensuring animal welfare, ethical production, and standardization of lifting equipment. |

| High costs, availability issues, and lack of awareness in smaller farming communities. | Cost reduction through mass production, increased accessibility, and enhanced farmer education on harness usage. |

Ergonomic and Animal-Welfare-Focused Designs

Consumers now seek cow lifting harnesses, which are more comfortable and cause less stress to injured or weak animals. Manufacturers are making harnesses with ergonometric padding, adjustable support systems, and breathable materials for gentle but effective lifting. Farmers and veterinarians now prefer designs that promote faster recovery while reducing strain on the cow’s body. With a growing focus on animal welfare, people demand innovative solutions that enhance both safety and ease of use in livestock care.

Smart Monitoring and Load-Balancing Technology

Consumers are adopting cow lifting harnesses equipped with smart sensors that track weight distribution, body movement, and rehabilitation progress. This new-generation harness utilizes real-time information to maximize lift angles and prevent additional injury to enable more efficient recovery. Farmers and animal caretakers desire harnesses now that interface with mobile apps for immediate feedback and remote monitoring. Harness solutions are expected, which combine technology with efficiency for better animal care and management, as precision livestock farming takes root.

This segment will lead the market due to the high durability, flexibility, and future assurances of wearing and tearing in nylon. A nylon harness can carry the animal's weight evenly, making it an ideal characteristic for use in safely lifting injured or weak cows. They are lightweight but have very sturdy structure constructions, thus ensuring comfort and preventing strain on the animal.

The nylon harness is moisture-resistant and has easy cleaning properties that make it appropriate for nearly all farm conditions. Its long durability and cost-effectiveness can attract farmers towards those durable and reusable solutions. More harnesses are increasingly being used in adopting animal welfare practices, and this is increasing demand for softer, less abrasive, and adjustable nylon harnesses for use among livestock.

As per FMI estimation, the small-sized cow lifting harness segment is crucial for assisting young calves and smaller breeds facing mobility issues. Gentle but firm support guarantees safe lifting and regains its rehabilitation. Farmers and vets apply small harnesses to treat injured or weak calves to prevent long-term problems.

Small harnesses are comfort-designed but in such a way that they are secured with adjustable straps and soft padding so as not to injure or cause discomfort. The increasing focus on neonatal calf care and post-birth assistance has led to higher adoption of small-sized lifting harnesses, supporting early-stage mobility recovery and improved survival rates in young cattle.

Amazing Investment Possibilities Entice the USA Market

The USA is anticipated to witness steady growth, with technological innovation and product development leading market growth. Firms such as Lift-All, Bovine Solutions, and Balchem are setting the pace by bringing on board high-quality, ergonomic designs that promote safety as well as efficiency in handling cattle. The demand for durable and easy-to-use lifting equipment has been increasing, supported by the modernization of dairy farms and livestock management practices.

The market's growth is also fueled by rising investments in agricultural infrastructure and an increasing emphasis on animal welfare regulations. Emergence of lifting harnesses in logistics, in warehouse operations, continues to broaden the scope of opportunity in the market. Being that technology keeps evolving in the USA market, so is the expectation of continuous demand from manufacturers for innovative and sustainable solutions.

The Trend for Battery-Powered Cow Lifting Harness Observes High Adoption in the UK

An advanced livestock management solution is rapidly becoming the UK's order of the day. Increasing dairy farms and awareness of animal welfare have significantly impacted the consistent growth in the market. Battery-powered lifting harnesses are notably popular because of the great efficiency and humane method of handling cattle-in reducing strain both on animals and handlers.

Regulatory regimes encouraging animal well-being and protection continue to develop market demand. Farmers spend on technologically innovative equipment for enhanced livestock care and operational effectiveness. This trend will continue to prevail in the UK market, which is likely to witness continued growth based on these developments, with automation in harness systems and AI-based technology further enhancing acceptance.

Germany Cow Lifting Harness Industry: Leading Market in Europe

Germany leads the European market, with the market eager for advanced dairy equipment. In this country, dairy farming is well organized, and efficiency is of prime concern. As a result, the adoption of lifting harnesses that facilitate injury prevention and better cattle management is well established. Increasing cattle population together with the demands for high-quality dairy products are the key drivers for market growth.

Government subsidies and research into sustainable livestock husbandry promote innovation in harness technology. The integration of intelligent monitoring systems with AI-driven lifting mechanisms improves both dairy operations' safety and efficiency. As an evolution, there will be an increase in high-performing lifting harnesses tailored for dairy farm operations, further consolidating Germany's important market in Europe.

Government Support Encourages the Cow Lifting Harness Companies in China to Invest Heavily

The government aims to enhance agricultural efficiency and farmer welfare through many support-based initiatives, thus enhancing the speed of the deeply developing Chinese economy. Following the Chinese Rural Revitalization Plan, investments were made in modern farming machines like lifting harnesses. The government introduced subsidies and farmer education programs to ensure affordability and accessibility, thereby promoting their adoption.

Major Chinese companies like Beijing Jiliangzhi, Wuxi Yitian, and Shanghai Yitian are innovative in their products, which will add durability and user-friendliness to the harnesses. Increasing need for high-quality dairy products and improved cattle handling practices drive the market. Enhanced harnessing technology and continuously mounting encouragement by the government will support the development of the Chinese market.

Indian Cow Lifting Harness Industry's Big Brands Focus on Product Development

This is a very busy developmental phase for India, with larger corporations constantly developing their product range to suit the evolving needs of the industry. Market leaders such as Dhanjal Industries, Mahindra & Mahindra Ltd., and Durga Enterprises are expanding their product lines to high-lift harnesses, which provide improved safety and comfort to cattle. Such companies should establish a niche for themselves in the competitive market place through product innovations and customizations.

The growth of India’s dairy industry and increasing awareness of livestock welfare are key factors driving demand for lifting harnesses. Government initiatives promoting modern dairy farming practices are also contributing to market expansion. As dairy farms continue to scale up operations, the demand for efficient and ergonomic lifting harnesses is set to grow, making India a promising market in the coming decade.

Japan Cow Lifting Harness Goal: Risk-less Harnesses Design

Japan pursues a strong commitment to research and development for safety and efficiency improvement. Leading the pack are companies including Nippon Steel, Shimano, and Daiwa, whose innovations in harness designs reduce stresses, lowering injury risks. Moreover, the introduction of new advanced lifting mechanisms and their effectiveness at the cow-hands has been best observed through Clever Cow Harness by Nippon Steel.

As Japan actively promotes animal rights and efficient farming solutions, it is becoming increasingly clear that there exists within the country larger needs for advanced technological know-how related to lifting harnesses. Support from the government in such agricultural innovations is already providing impetus to the technological improvement of livestock handling equipment, which in turn will speed up its adoption by farmers. With precision farming and smart livestock management emerging as the biggest trends, Japan seems to be all set for steady growth in the coming years.

The industry of cow lifting harnesses is fragmented, with a myriad of regional manufacturers competing amongst themselves on designs, durability, and pricing. The agricultural machine suppliers have devised these harnesses using advanced materials and ergonomic designs such that no harm will ever come to the animals being lifted. Their focus on veterinary-approved designs and compatibility to be worked with lifting machinery only enhances their appeal among the farms, veterinary clinics, and animal rescue operations, thus maintaining a steady demand by livestock owners and professionals.

These companies invest time and money to enhance the carrying capacity, adjustability, and usability of their harnesses. They have made an international name for themselves through the introduction of various lightweight, weather-engineered material, which are functionally effective measures. The larger known popular brand names are busy making fronted associations with large-scale chain farms and veterinary supplies, while the smaller manufacturers sustain themselves with tailor-made solutions that attend to specific livestock needs and operational budgets.

The constitution of this market is among the mixtures of multinational brands and independent manufacturers, leading to high variability in pricing and distribution strategies. On the one hand, some large businesses are enjoying the advantages of economies of scale by large-scale production with least pricing; on the other hand, small players are enjoying the distinction of special designs made available for horse harnesses. The competition is very much alive with no one entity being perceived as a major innovator. Therefore, new entrants are able to offer innovations and easy access to the wider market.

The country boosting the growth of cow lifting harness is due to increased awareness of animal welfare as well as effective livestock management. Key players would look at ergonomic designs and advanced materials focusing on safety and comfort for animals and handlers alike. Such trend is seen to be strong in regions with developed dairy industries.

The largest share of the market is in Germany, attributed to modern dairy equipment and the large number of dairy cows operating in the country. Companies are investing heavily in research and development to come up with harnesses adhering to stringent safety standards as well operational efficiency because the country emphasizes higher quality dairy production.

The growth of that market is also experiencing boost from government programs such as the Rural Revitalization Plan aimed at increasing farmers' income and elevating the modernisation of farming among farmers. Those harnesses with advanced functionality are manufactured by businessmen in their localities, exhibiting the intent of the country towards agriculture modernization.

Such growth also represents the tendency towards mechanization in livestock farming. The major companies in India introducing their new innovative designs in harnesses are targeted towards small and medium-scale farmers by making the products affordable as well as durable. This approach is essential in a market characterized by a large number of smallholder farmers.

The market is expected to reach USD 367.7 million in 2025 and grow to USD 566.3 million by 2035 at a CAGR of 4.3%.

The future prospects for sales are strong, driven by advancements in ergonomic designs, smart monitoring technologies, and increasing livestock welfare awareness.

Key manufacturers include O'Donnell, Vink Cow Lift, Biomin Holding GmbH, KERBL COW LIFT, MS Schippers, Bakhsish Industry, Coburn, S.A. Christensen & Co., Royal Livestock Farms, and Real Tuff Livestock Equipment.

China is expected to generate lucrative opportunities for market players due to government-backed agricultural initiatives, modernization efforts, and rising demand for advanced livestock management solutions.

The market is segmented by material type into nylon, leather, and others.

Based on the size, the market is segmented into small, medium, and large.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.