Countertop Pizza Warmers and Merchandisers Market target low-profile, warm display solutions to convenience stores, restaurant operations, catering events, and food courts. The solutions keep pizzas hot and fresh while maximizing visual product merchandising to induce impulse buying.

Enhanced demand for quick-serve foods and grab-and-go, refreshed utilization of product display merchandising solutions, and innovative energy-efficient warming technologies drive market growth. The growth of food ordering apps, cloud kitchens, and self-service food counters is also driving the market.

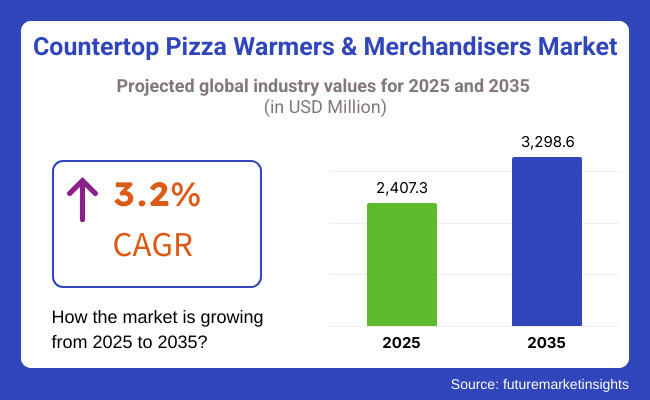

The global countertop pizza warmers and merchandisers market will be around USD 2,407.3 million in 2025 and will grow to around USD 3,298.6 million in 2035 at a Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period.

The anticipated CAGR is affected by the increasing frequency of quick-service restaurants (QSRs), increasing need for food presentation solutions in bakeries and retail, and increased consumer demand for hot ready-to-consume food. Moreover, advances like digital temperature control and humidity control will enable improved product performance and acceptability.

Explore FMI!

Book a free demo

North America holds a notable share of the countertop pizza warmers and merchandisers market owing to high number of pizza chains, convenience stores and foodservice operators in the region. As grab-and-go food trend is on the rise, demand for compact and energy-efficient pizza warmers is increasing over the United States and Canada. Moreover, increasing adoption of gas station foodservice and expansion gas station retail food display solutions will have a positive impact on the market.

Italy, Germany, and the United Kingdom are the top Pizza-eating and food retail Update countries, implying that Europe accounts for a considerable part of the market. Growing demand for pizza warming solutions with humidity control ability is being driven through the region’s growing focus on quality food display and heat absorption method. Meanwhile, growing takeaway and delivery food segments are further supporting wider adoption of compact warming and merchandising units.

Based on the region, Asia-Pacific is anticipated to have the highest growth in the countertop pizza warmers and merchandisers market due to increased urbanization, incomes, and Western-style fast food's popularity in China, India, and Japan. High growth of quick-service restaurant sector and increasing convenience stores along with the demand for economical food warming solution are some of the key factors driving the market growth. Moreover, the implementation of government initiatives aimed at ensuring food hygiene and safety standards is contributing to the adoption of regulated heating and merchandising solutions.

Challenges

High Energy Consumption and Limited Space Efficiency

Electricity consumption at the countertop pizza warmers and merchandisers in those pizzerias, convenience and food courts can be high particularly for the commercial-grade models. Heat retention inefficiencies can result in uneven warming, less pizza goodness, and higher energy bills. Moreover, a small footprint is a disadvantage in small food establishments where kitchens vary in dimensions, and adoption isn't always scalable enough for businesses with small, tight layouts.

Opportunity

Growth in Energy-Efficient, Compact, and Smart Merchandisers

Over recent years, bustling quick-service restaurants (QSRs), convenience stores, and supermarkets have led to an ever-increasing demand for pizza that is fresh and ready to serve, facilitating the evolution of cooking equipment in the form of countertop pizza warmers that are compact, space-efficient, and aesthetically pleasing. Recent innovations leverage infrared heating, humidity control, and AI-prompted temperature adjustments to increase food quality and reduce energy use in the process. Also, the advancement of digital displays, LED lighting, and IoT-connected smart warmers are improving merchandising effectiveness and sales monitoring.

From 2020 to 2024, the explosion of takeout, delivery and self-service food retail led to growing demand for countertop pizza warmers. But heat distribution inefficiency, high operational costs, and no sustainable initiatives led to incremental adoption, especially in small-scale businesses.

In 2025 to 2035 countertop pizza warmer market to move towards energy-efficient, automated and smart countertop pizza warmers. Self-cleaning technology will help us improve performance, food safety, and energy efficiency, alongside the adoption of AI-driven heating control and modular designs for space optimization. Trends for sustainability leans include biodegradable pizza packaging and cranked up green heating solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety and energy efficiency standards |

| Technology Innovations | Use of traditional heating elements with limited heat retention |

| Market Adoption | Growth in QSRs, food courts, and gas stations |

| Energy Efficiency & Performance | High power consumption and heat loss issues |

| Market Competition | Dominated by food equipment manufacturers (Hatco, Nemco, Winco, APW Wyott) |

| Sustainability Trends | Introduction of energy-efficient heating elements |

| Consumer Trends | Increased demand for hot, grab-and-go pizza options in retail and QSR chains |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on low-energy heating elements, food waste reduction, and eco-friendly materials |

| Technology Innovations | Advancements in infrared and AI-controlled heating, humidity-balanced warmers, and self-cleaning designs |

| Market Adoption | Expansion into automated convenience stores, hybrid restaurant-retail spaces, and smart vending concepts |

| Energy Efficiency & Performance | Development of low-energy, programmable warmers with real-time temperature optimization |

| Market Competition | Rise of smart kitchen startups integrating IoT, digital merchandising, and modular space-saving designs |

| Sustainability Trends | Large-scale adoption of eco-friendly heating solutions, compostable pizza packaging, and smart inventory tracking to reduce food waste |

| Consumer Trends | Growth in self-service, AI-driven merchandising solutions with interactive digital displays |

United States countertop pizza warmers and merchandisers market provides an in depths analysis of the market dynamics across the globe. This is mainly due to the increase in the number of convenience stores, food courts, and pizzerias adding countertop warmers in order to maintain the freshness and visual appeal of pizzas and, therefore, drive the market.

The trend of self-serve food stations at retail outlets and gas stations is accelerating this process and consequently endorsing LED pizza warmers for wide-scale implementation. Moreover, technological developments, including energy-efficient heating elements and humidity control features, are increasing product efficiency and boosting sales. Moreover, government regulations surrounding food safety as well as temperature maintenance for prepared foods are driving businesses to purchase high quality countertop pizza warmers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

Due to growing demand for hot and ready-to-eat food in convenience stores, bakeries, and supermarkets, the UK countertop pizza warmers and merchandisers market is evolving. The increasing popularity of takeaway and delivery services are prompting food establishments to invest in efficient food warming solutions.

An additional driver for this market is the increasing number of independent pizzerias and artisan bakeries serving ready-made pizza slices. Also, market trends are being influenced by energy efficiency regulations and the demand for compact space-saving food warming equipment. Countertop pizza warmers are also gaining traction among retail and food service operators in the UK to improve the presentation of food and to broaden the range of pizzas consumed on the shelf life.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.0% |

The European Union (EU) countertop pizza warmers and merchandisers market is the most powerful due to the growing number of quick-service restaurants, supermarkets, and gas station food retailers selling pre-cooked pizza. Also, expansion of fast-food and casual dining spending trends across Europe is also driving the pizza warmer market in place of countertop warmer market.

Essential markets to mention include Germany, France, and Italy, that share a stronger pizza consumption history and an increasing number of food retailers are now integrating their own warming and merchandising solutions. Strict EU food law practices on hot food storage are also forcing businesses to purchase high performing hot holding implements. Market dynamics within the region are also influenced by increased demand for energy-efficient and sustainable food service equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 2.9% |

The Japan countertop pizza warmers and merchandisers market is growing as Western-style fast food and meals prepared in convenience stores become more popular. The country’s robust convenience store (konbini) culture is helping spur adoption of compact and efficient food warmers that ensure pizzas remain fresh as they’re eaten on-the-go by consumers.

Advances of food warming technologies, like infrared heating and humidity-controlled pizza warmers, are increasing the product appeal and extending shelf life. Furthermore, the increasing demand for frozen and ready-to-bake pizza products available at grocery stores is also driving the market growth. Furthermore, growing adoption of smart food warming solutions in both vending machines and self-serve food kiosks is further driving the market progress in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

The countertop pizza warmers and merchandisers in South Korea are growing at a quick rate, owing to the increasing occurrence of cafes and fast foods in the nation. Market demand is being driven by the growing trend of shopping for non-cooked foods and ready-to-use pizza in food sectors such as supermarkets, bakeries and gas stations.

Market trends are also being influenced by the development of compact and smart heating solutions, including food warmer with touch screen controls. Moreover, the increasing demand from home-grown pizza chains and international QSR franchises entering South Korea is further boosting the demand for countertop food merchandising equipment. The emphasis of hygiene standards and quality food presentation is also motivating the enterprises to invest in upgraded pizza warming solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Electric pizza warmers have become popular among restaurants, pizzerias, and convenience stores for their energy efficiency, user-friendliness, and temperature adjustment capabilities. These warmers include electric heating elements designed to maintain pizzas within the ideal temperature range for serving, keeping them fresh without cooking more.

One of the essential benefits of electric pizza warmers is their reliable heating, which keeps the texture of pizza as it prevents moisture loss. Because of this, the automatic temperature control will keep pizzas crispy on the outside and soft inside, making it a great option for fast-paced food services.

Electric variants also have plug-and-play capability, with little to no installation and maintenance, making it more feasible for small cafes, food kiosks, and quick-service restaurants. They also have adjustable shelving and interior lighting, making the displayed pizza look attractive and drawing customers' attention.

In high-volume commercial kitchens, where the speed of heating and consistent warming is essential, gas-powered pizza warmers have become the equipment of choice. These warmers utilize natural gas or propane burners to create a heating environment where your pizzas can stay warm without the sogginess that comes from certain heating methods.

High heat efficiency is one of the biggest advantages of gas pizza warmers, as they can hold a significant number of pizzas at the same time, perfect for restaurants, catering services, and pizzerias processing large orders. When compared with electric models, gas models heat faster, helping businesses serve up customers quickly during busy rushes.

Gas pizza warmers provide reliable performance in low-energy places, which are common for outdoor food stalls, mobile catering, and special event venues.

Gas-powered models have their advantages but need adequate ventilation and routine maintenance in order to operate safely. This trend toward sustainability continues, and we are seeing manufacturers develop hybrid gas electric solutions that can reduce carbon emissions while maintaining peak performance.

Conveyor pizza warmers have been widely accepted in quick-service restaurants, large pizzerias, and chain food with massive volume, and speed and consistency are of the utmost importance. These warmers use conveyor belts that automatically move pizzas through a temperature-controlled chamber, allowing for uniform heating while reducing the risk they will overheat or dry out.

The conveyor warmers can also cook up a number of pizzas at once, making them an excellent option for commercial operations serving large numbers of people. The auto-heating process minimizes the manual intervention needed, meaning staff have more time to focus on customer service and order fulfilment.

Moreover, conveyor models allow the speed to be adjusted, giving businesses the ability to control the length of time pizzas are heated based on their size and thickness. This versatility ensures thin-crust, deep-dish and stuffed-crust pizzas are all heated to perfection.

Conveyor pizza warmers, on the other hand, take up a lot of counter space and involve greater upfront expenditure, thus not being very viable for small scale food operations. To address this, this limitation, compact conveyor models are being developed by manufacturers which are capable of doing the same, while minimizing space utilization and maximum efficiency.

The most important advantage of display warmers is their ability to create impulse purchases. Freshly displayed pizzas are generally more attractive, hence a valuable asset at cafés, delis and food courts. Businesses can show multiple types of pizza with the multi-tier shelving system, which maximises up-sell potential.

The newer display warmers are also fitted with humidity systems that regulate the temperature in a display to keep pizza from drying out or becoming stale. This technology retains the moisture and freshness in pizzas for much longer than before and is perfect for self-service food stations and grab-and-go outlets.

While display warmers do have some advantages, they can be difficult to keep clean, as grease and food particles build-up on both the glass panels and heating surfaces. To ease maintenance while ensuring long-term reliability, many manufacturers now offer easy-to-clean, removable trays and automated temperature controls.

The global market for countertop pizza warmers and merchandisers is on the rise, driven by increased demand for space-saving, practical, and attractive food warming products in quick service restaurants (QSR), convenience stores, pizzerias, bakeries, and catering service providers.

The growing trend for fresh, hot and ready-to-eat food is fuelling greater use of pizza warmers that offer advanced temperature control, LED lighting and energy efficient heating elements. Moreover, there is substantial growth in the trend of self-service food merchandising and impulse purchase solution is further driving the growth of the market.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hatco Corporation | 18-22% |

| Nemco Food Equipment Ltd. | 14-18% |

| APW Wyott (Star Holdings Group) | 12-16% |

| Winco | 10-14% |

| Wisco Industries, Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hatco Corporation | Specializes in high-efficiency pizza warmers with precision temperature control and LED display. |

| Nemco Food Equipment Ltd. | Provides compact and high-capacity pizza merchandisers with rotating racks and humidity control. |

| APW Wyott (Star Holdings Group) | Manufactures stainless steel countertop pizza warmers with even heat distribution technology. |

| Winco | Offers affordable, space-saving pizza warmers designed for small pizzerias, delis, and convenience stores. |

| Wisco Industries, Inc. | Develops digital pizza merchandisers with customizable shelving and energy-efficient heating elements. |

Key Market Insights

Hatco Corporation (18-22%)

Hatco Corporation leads the countertop pizza warmers market with its high-performance, durable warmers designed for continuous food service operations. The company’s solutions include advanced temperature regulation, LED-lit displays, and energy-efficient technology.

Nemco Food Equipment Ltd. (14-18%)

Nemco specializes in compact pizza warmers with rotating racks, ensuring uniform heating and maximum product visibility for self-service environments in cafeterias, QSRs, and convenience stores.

APW Wyott (Star Holdings Group) (12-16%)

APW Wyott offers stainless steel countertop pizza warmers with even heat distribution and quick-heating features, ideal for high-volume food service businesses.

Winco (10-14%)

Winco provides affordable and space-efficient pizza warmers designed for small pizzerias, concession stands, and food retailers. Their models focus on ease of use and portability.

Wisco Industries, Inc. (8-12%)

Wisco Industries specializes in digital pizza merchandisers with customizable shelving, adjustable temperature settings, and energy-efficient heating elements.

Other Key Players (26-32% Combined)

Several emerging and regional players are strengthening the market with cost-effective and customized pizza warming solutions, including:

The overall market size for countertop pizza warmers and merchandisers market was USD 2,407.3 million in 2025.

The countertop pizza warmers and merchandisers market is expected to reach USD 3,298.6 million in 2035.

The growth of the countertop pizza warmers and merchandisers market will be driven by increasing demand for ready-to-eat food solutions, advancements in heating and display technologies, and rising adoption in convenience stores, quick-service restaurants, and food kiosks for enhanced product visibility and freshness retention.

The top 5 countries which drives the development of countertop pizza warmers and merchandisers market are USA, European Union, Japan, South Korea and UK.

Display warmers to command significant share over the assessment period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.