The coumarin industry is worrying the manufacture, supply, and use of coumarin, a chemically synthesized and natural aromatic odoriferous compound utilized in perfumes, medicines, foodstuffs, and agrochemicals. Coumarin finds extensive applications in perfumes, scented items, and as a precursor in anticoagulant drugs like warfarin.

The market is being fueled by the increased demand for nature-based and nature-identical fragrances, increasing applications of the pharmaceuticals sector, and skyrocketing utilization in agricultural products. In addition, increasing capabilities in synthetically derived coumarin and food, cosmetic grades' approval in coumarin derivatives are driving growth in the market.

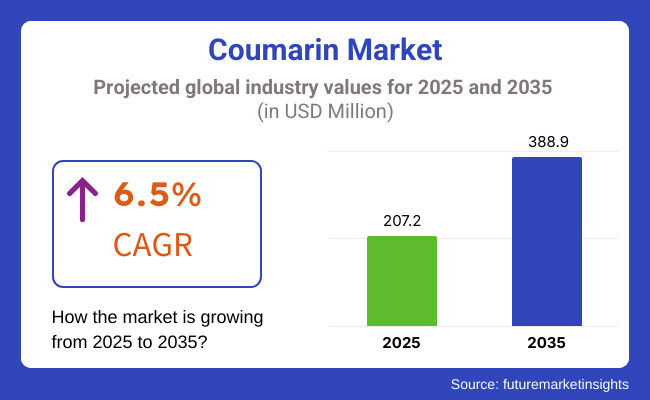

Worldwide coumarin market will be around USD 207.2 million by the year 2025 and increase to around USD 388.9 million by the year 2035 at a Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period.

The projected CAGR indicates the growing utilization of coumarin in cosmetics, pharmaceuticals, and agrochemicals along with heightened demand for natural, bio-based products in personal care and fragrances.

Explore FMI!

Book a free demo

The coumarin market in North America accounts for a major share owing to the high demand for coumarin from pharmaceutical and fragrance industries. Coumarin comes in the formulation of anticoagulant drugs, luxury perfumes, and skincare products, and it used to be prevalent in the USA and Canadian markets. Moreover, the existing regulatory control exercised by FDA and Health Canada impacts on the market dynamics for synthetic and natural coumarin applications.

Germany, France, and the United Kingdom are leaders in manufacturing fragrances and in pharmaceutical research and natural ingredients formulation and thus, Europe accounts for a significant share of the market. The European Union’s bans on synthetic fragrance compounds have increased the desirability of plant-derived coumarin in perfumes and food flavouring.

Asia-Pacific is anticipated to be the fastest growing coumarin market, mainly due to increasing consumption of personal care products along with rising pharmaceutical manufacturing and agrochemicals consumption in countries like China, India, and Japan. The rising middle class and increasing disposable income in the region is driving demand for premium fragrances as well as herbal medicinal formulations containing coumarin. China also accounts for a significant portion of synthetic coumarin production and exports, which can impact the international market as well.

Challenges

Regulatory Restrictions and Health Concerns

Coumarin usage in food and pharmaceuticals is regulated by stringent regulations hampering its adoption in the market. Synthetic coumarin manufacturers face scrutiny regarding the constituents of synthetic production, increasing interest in natural extraction methods despite their higher costs and lower scalability. Coumarin is used in fragrances, cosmetics, and pharmaceutical applications but is restricted in food products because of potential hepatotoxicity at high concentrations.

Opportunity

Expanding Applications in Pharmaceuticals, Fragrances, and Agrochemicals

However, regulatory hurdles have not dimmed the strong interest in coumarin for use in fragrances, cosmetics, and pharmaceutical preparations. The sustainable market growth will be driven by innovations related to biotechnology-based coumarin synthesis and eco-friendly extraction methods. Coumarin derivatives are also being extensively investigated for anti-inflammatory, anticoagulant, and anticancer activities, providing new avenues in drug development and functional ingredients. Growing demand for bio-based agrochemicals also acts as an avenue for growth for coumarin-based plant protection solutions.

Fragrances, personal care, and pharmaceutical intermediates remained in steady demand throughout 2020 to 2024. Nonetheless, strict food safety regulations, volatile raw material costs, and increasing apprehension about the toxicity of synthetic coumarin hindered widespread adoption.

The EU ban is expected to drive the market to bioengineered and naturally sourced coumarin by 2025 to 2035 to fit clean-label and sustainability standards, according to the report. Improved AI-Molecular Research by Utilization for Coumarin Derivatives in Pharmaceuticals and Biodegradable Agrochemicals - the rise of AI-assisted molecular research, when applied to pharmaceuticals and agrochemicals seeking biodegradable derivatives of coumarin, will increase the aforementioned market. Moreover, the increasing importance of green synthetic methodology will minimize environmental effects in coumarin construction.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EU and FDA restrictions on coumarin in food and cosmetics |

| Technology Innovations | Use of synthetic coumarin in fragrances and pharmaceuticals |

| Market Adoption | Strong demand in fragrances, pharmaceuticals, and personal care |

| Sustainability Trends | Limited focus on green synthesis and bio-based coumarin production |

| Market Competition | Dominated by fragrance ingredient suppliers and pharmaceutical intermediates producers |

| Consumer Trends | Demand for synthetic and naturally sourced coumarin in perfumes and skincare |

| Regulatory Landscape | Compliance with EU and FDA restrictions on coumarin in food and cosmetics |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations promoting bio-based and low-toxicity coumarin formulations |

| Technology Innovations | Advancements in biotech-based coumarin synthesis, AI-driven molecular drug discovery, and eco-friendly extraction methods |

| Market Adoption | Expansion into biodegradable agrochemicals, sustainable fragrances, and advanced therapeutics |

| Sustainability Trends | Large-scale adoption of enzymatic synthesis, circular economy models, and low-carbon extraction |

| Market Competition | Rise of biotech firms specializing in sustainable coumarin derivatives and pharmaceutical applications |

| Consumer Trends | Growth in clean-label, organic coumarin for cosmetics, food-safe alternatives, and sustainable agricultural applications |

| Regulatory Landscape | Stricter regulations promoting bio-based and low-toxicity coumarin formulations |

The United States coumarin market is expected to grow during the forecast period (2023 to 2028) owing to the increasing demand in the fragrance, pharmaceutical, and agrochemical industries. Increasing demand for natural and synthetic coumarin in fine fragrances and personal care products is driving market growth.

Additional market growth support may be attributable to the expansion of major cosmetic and perfume manufacturers, combined with stringent FDA regulations that promote the use of safe and high-quality ingredients. And the rising utilization of coumarin derivatives in anticoagulant drugs and herbal insecticides is propelling demand within the USA. Market growth is expected with the expansion of expansion of the flavor & fragrance industry and improvements in the production of synthetic coumarin.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The coumarin market in the UK is also being driven by the increasing demand for high-end perfumes and cosmetics. The penetration of premium fragrance brands in the country and the booming personal care industry are accelerating the use of coumarin as a primary ingredient for aromatic formulations.

Moreover, an increase in demand for coumarin-based anticoagulants from the pharmaceutical industry is also upscaling the market. Coumarin is equitably safe when used as a medicine, cosmetic, and fragrance agent following regulated usage imposed by regulatory organizations like the UK Medicines and Healthcare Products Regulatory Agency (MHRA). Increasing consumer demand for natural and organic fragrances is also driving research towards plant-based coumarin alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

EU regions hold a dominant position owing to the rising popularity of synthetic and natural fragrance ingredients. And stringent cosmetic and fragrance formulations regulations specific to the region under a REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) initiative is impacting where coumarin is used.

Germany has emerged as a leading market, with the demand for luxury perfume and cosmetics, growing rapidly in Europe along with France and Italy. Also, the rising utilization of coumarin in a variety of medicinal applications, such as in anticoagulants and anti-inflammatory drugs, is driving the market. The increasing trend towards Eco friendly and sustainable fragrances ingredients in EU is additionally affecting the coumarin production and innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.2% |

The growth of Japan’s coumarin market can be attributed to the country’s capabilities in the cosmetic and fragrance industries. Growing demand for more durable and refined fragrance formulations is licensing the use of fragrances in perfumes, deodorants, and scented personal products, thereby supplementing the market demand.

Coumarin derivatives are used extensively in anticoagulant drugs, making the pharmaceutical sector another major player. Moreover, Japan’s practical interests in only high-quality and safe beauty products push researchers to study the method of regulation and safety of coumarin in cosmetics. Additionally, growth of the market is also driven by the growing incorporation of plant-based coumarin in other natural perfumes and wellness products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

The South Korean coumarin market continues to grow, coumarin is widely adopted as a raw compound in fragrance applications due to the growing demand for innovative and premium quality cosmetic products such as perfumes and skincare formulations.

The increasing use of coumarin-based drugs in treating cardiovascular diseases is another factor that will take the pharmaceutical industry to great heights. Moreover, K-beauty expansion and the growing number of niche fragrance brands in South Korea are also driving the demand within the market. Furthermore, government regulations encouraging the safe utilization of synthetic fragrance compounds, along with the growth of research on bio-based coumarin, are anticipated to steer future market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Pharmaceutical-grade coumarin is in high demand as it exhibits anti-inflammatory, anticoagulant, and antimicrobial activities. It is key for designing drugs to improve cardiovascular health, to prevent blood clots and to treat cancer.

The main uses for pharmaceutical-grade coumarins are in the making of anticoagulant drugs, such as warfarin, which are used prescriptions to inhibit blood clot formation and may be used to prevent blood clot formation or to treat deep vein thrombosis (DVT) as well as stroke. The growing prevalence of cardiovascular disorders and thrombus-associated conditions have significantly propelled the coumarin-based drug solutions demand.

Similarly, the anticancer effects of coumarin derivatives were also reported by even recent oncology studies that have led to the incorporation of coumarin in clinical drug forms including as anti-tumor growth and immune modulators. The pharmaceutical segment is expected to progress with major progress due to factors such as ongoing clinical trials, and increasing fundings and investments in the field of natural compound-based medicine.

It has several medical applications; however, its potential toxicity in high doses led to its use being tightly regulated, with strict guidelines on the use of coumarin. Regulations such as those employed by governing bodies such as the FDA and EMA are intense, holding drug safety and dosage tightly to prevent adverse health effects. To enhance the potency and safety of drug, the manufacturers collaborating with new purification techniques and synthetic modification.

In perfumery, skincare and personal care products, cosmetic-grade coumarin is very often found as an active. As a fragrance-enhancer for luxury perfumes, deodorants and scented lotions, it is desired with a warm, sweet and vanilla-like aroma.

Increasing Demand for Natural or Plant Based Ingredients in Beauty Products Coumarin functions as a fixative and scent modifier, used in many high-end fragrance brands which promises to retain the fragrance for a long time. And coumarin’s mild antiseptic and tranquilizing properties render it a perfect ingredient in soaps, body washes and cosmetic creams. Besides, the growing global trend for organic and herbal skincare is also making a switch towards naturally sourced coumarin extracts all over, which is an important factor that drives this market.

However, allergic reactions and regulatory restrictions have hindered the cosmetic grade segment a little. Certain countries (for instance, in the European Union) have limits on coumarin concentrations particular to their use in skincare and perfumes due to the potential risk for skin sensitization. With this in mind, manufacturers have directed their efforts toward low-concentration formulas and synthetic coumarin substitutes that are able to match the quality of the fragrance.

However, allergic reactions and regulatory restrictions have posed challenges for the cosmetic-grade segment. Some countries, including those in the European Union, have imposed usage limitations on coumarin concentrations in skincare and perfumes due to potential skin sensitization risks. Manufacturers are working on low-concentration formulations and synthetic coumarin alternatives to address these concerns while maintaining fragrance quality.

The biggest user of coumarin lies with the perfumery and fragrance industry, leveraging the warm slightly spicy, and vanilla scent profile to formulate complex long-lasting fragrances.

Fine perfume houses and mass-market fragrance brands use coumarin in fine perfumes, colognes, deodorants and home fragrances, because it imparts longevity and complexity to scents. It is used as a fixative in oriental, fougeré and floral fragrance; it gives rich and noble lasting note to the fragrance.

Natural and botanical perfumery has additionally driven the demand for tonka beans amongst other botanicals as a source of coumarin, along with lavender and cinnamon bark. Brands are being pressured by consumers to reconsider the inclusion of synthetic fragrance in their products in favour of biodegradable and/or novel plant-derived coumarin formulations as consumers are focusing in on eco-friendly and sustainable fragrance ingredients.

However, as concern over the health effects of coumarin has led to a restriction on its levels in perfumes, fragrance manufacturers also expedited investigating for synthetic alternatives or reformulations in a bid to address safety concerns without sacrificing olfactory appeal.

Coumarin is a significant biomedical entity and has been added to API preparation. It is almost unavoidable in the pharmaceutical industry, as it is widely used in anti-inflammatory, antifungal, and anticoagulant drugs. In addition, the rising implementation of natural bioactive entities in drug discovery should also boost the API market of this API through the usages of coumarin derivatives. However, challenges like side effects, dose-dependent toxicity and regulatory approvals of high-complexity combinatorial formulations pose hurdles that require visionary formulation evolution.

Coumarin has several applications and the market is expected to grow at a healthy rate during the forecast period. Growing demand of synthetic and natural coumarin in the cosmetics, tobacco and perfumery industries is the key factor driving the growth of the market. Market growth is also being boosted by the rising use of coumarin derivatives as anticoagulant drugs, UV absorbers, and dyes. Growth is also being boosted by developments in extraction and organic synthesis technologies.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Yingyang Flavors & Fragrance Co., Ltd. | 14-18% |

| Atlas Fine Chemicals | 12-16% |

| N.S.Chemicals | 10-14% |

| Omkar Speciality Chemicals Ltd. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| BASF SE | Manufactures synthetic coumarin for fragrance, pharmaceutical, and agrochemical applications. |

| Yingyang Flavors & Fragrance Co., Ltd. | Specializes in high-purity coumarin for perfumes, food flavouring, and cosmetics. |

| Atlas Fine Chemicals | Provides industrial-grade and pharma-grade coumarin for multiple industries. |

| N.S.Chemicals | Develops natural and synthetic coumarin derivatives for pharmaceuticals and coatings. |

| Omkar Speciality Chemicals Ltd. | Offers custom synthesis of coumarin compounds for perfumery and chemical applications. |

Key Market Insights

BASF SE (18-22%)

BASF controls the coumarin sector with its high-quality human-made coumarin, broadly employed in perfumery, fine chemicals, and commercial make use of. An organization specializes in top-quality EDW production and sustainable solutions.

Yingyang Flavors & Fragrance Co., Ltd. (14-18%)

Yingyang is a major supplier of flavor and fragrance-grade coumarin, with clients in the cosmetics, tobacco, and food industries. The fi rm is growing its market presence in the Asia-Pacific and European markets.

Atlas Fine Chemicals (12-16%)

Atlas Fine Chemicals offers pharmaceutical- and industrial-grade coumarin derivatives, for use in medical research, dyes, and agrochemical formulations.

N.S.Chemicals (10-14%)

N.S.Chemicals develops customized coumarin formulations used in pharmaceuticals, coatings, and personal care products. The company emphasizes organic synthesis and green chemistry solutions.

Omkar Speciality Chemicals Ltd. (8-12%)

Omkar Speciality Chemicals is a supplier of synthetic and natural coumarins for the fragrance, pharmaceutical and industrial sectors, with a focus on high-efficiency production methods.

Other Key Players (26-32% Combined)

Several emerging and regional players are strengthening the market with affordable and specialized coumarin products, including:

The overall market size for coumarin market was USD 207.2 million in 2025.

The coumarin market is expected to reach USD 388.9 million in 2035.

The growth of the coumarin market will be driven by increasing demand in fragrance and flavor industries, advancements in pharmaceutical applications, and rising adoption in cosmetics and agrochemicals for its aromatic and bioactive properties.

The top 5 countries which drives the development of coumarin market are USA, European Union, Japan, South Korea and UK.

Cosmetic-Grade Coumarin to command significant share over the assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.