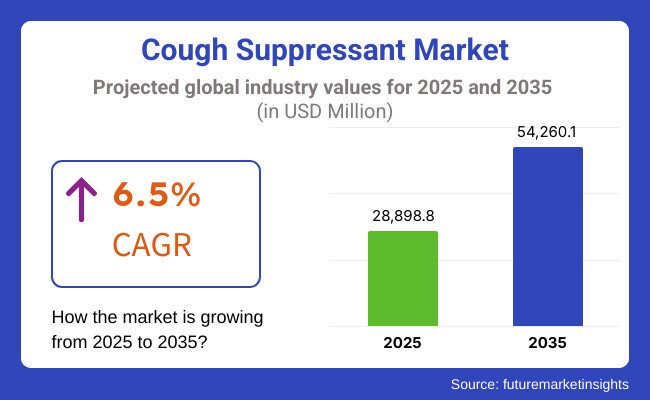

The global cough suppressant market is poised for significant growth over the next decade. In 2025, the market is estimated to reach USD 28,898.8 million, with projections indicating a rise to USD 54,260.1 million by 2035. This expansion is driven by a CAGR of 6.5%, reflecting increasing demand for cough remedies worldwide. The rising prevalence of respiratory infections, lifestyle-induced chronic coughs, and innovations in pharmaceutical formulations contribute to this market surge.

Growing awareness about self-care treatment and over-the-counter treatments is fueling the demand for cough suppressants. Additionally, advancements in drug delivery systems, increasing healthcare expenditure, and the expanding geriatric population are key factors supporting market growth.

Explore FMI!

Book a free demo

Between 2020 and 2024, the global cough suppressant market experienced significant growth, driven by rising respiratory illnesses, heightened awareness of cough management, and the widespread availability of over-the-counter remedies. The market expanded from approximately USD 20.53 billion in 2019 to an estimated USD 27.14 billion in 2024, reflecting a CAGR of 6.5%.

Factors contributing to this growth included the increasing prevalence of respiratory conditions such as asthma, COPD, and seasonal infections, leading to higher demand for cough suppressants. Consumers also became more health-conscious, opting for quick and effective solutions to manage cough symptoms, which boosted sales of OTC medications. Additionally, the ease of access to these products through pharmacies and online platforms further propelled market expansion.

Looking ahead to 2025 to 2035, the market is projected to continue its upward trajectory, reaching approximately USD 50.95 billion by 2034, maintaining a CAGR of 6.5%. Key trends shaping this growth include advancements in formulations, such as extended-release syrups and lozenges, which improve efficacy and patient compliance.

The rising demand for natural and herbal cough remedies is also expected to influence product innovation. Furthermore, evolving regulatory frameworks regarding certain cough suppressant ingredients may lead to reformulations, impacting market dynamics. As consumer preferences shift towards safer and more effective solutions, industry players must adapt through innovation and regulatory compliance to sustain growth.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on ensuring the safety and efficacy of over-the-counter cough suppressants, with regulations governing labeling and permissible ingredients. |

| Technological Advancements | Introduction of combination products that address multiple symptoms, such as cough and congestion, in a single formulation. |

| Consumer Demand | Increased reliance on over-the-counter solutions for immediate relief from cough symptoms, driven by greater health awareness and accessibility. |

| Market Growth Drivers | Rising prevalence of respiratory ailments, coupled with seasonal outbreaks of cold and flu, lead to sustained demand for cough suppressants. |

| Sustainability | Initial efforts towards environmentally friendly packaging and manufacturing processes, with some companies adopting recyclable materials and reducing waste. |

| Supply Chain Dynamics | Predominantly traditional distribution channels, with a growing influence of e-commerce platforms expanding product reach and consumer convenience. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Anticipated implementation of stricter guidelines concerning the use of specific active ingredients, potentially leading to reformulations and increased monitoring of adverse effects. |

| Technological Advancements | Development of advanced drug delivery systems, including sustained-release formulations and novel administration routes, to improve therapeutic outcomes and patient adherence. |

| Consumer Demand | Growing preference for personalized medicine, with consumers seeking products tailored to their specific health profiles, and a shift towards natural and organic remedies as part of a broader trend towards holistic health and wellness. |

| Market Growth Drivers | Expansion into emerging markets with improving healthcare infrastructure, alongside continuous product innovation to meet diverse consumer preferences and address unmet medical needs. |

| Sustainability | Comprehensive integration of sustainable practices across the supply chain, including the use of biodegradable packaging, carbon-neutral production methods, and ethical sourcing of raw materials, in response to increasing consumer and regulatory pressures. |

| Supply Chain Dynamics | Enhanced supply chain resilience through digitalization and real-time monitoring, adoption of direct-to-consumer models, and strategic partnerships to mitigate disruptions and meet evolving consumer expectations. |

| Challenges | Opportunities |

|---|---|

| Stringent regulatory requirements for opioid-based suppressants. | Increasing consumer preference for scientifically backed and natural cough suppressants. |

| Potential concerns over drug interactions and side effects. | Development of innovative formulations with enhanced effectiveness. |

| Competition from alternative therapies such as herbal medicine and home remedies. | Expansion of e-commerce channels for direct product distribution. |

| Compliance with safety regulations and ingredient restrictions varies across regions. | Rising popularity of personalized respiratory health solutions. |

| Counterfeit and low-quality cough suppressants undermine consumer trust. | Collaborations between respiratory specialists and pharmaceutical brands for clinically validated solutions. |

| Tighter restrictions on codeine-based formulations due to opioid misuse concerns. | Expansion of subscription-based medicine delivery services and auto-refill programs. |

| Shift toward holistic healthcare challenges conventional cough suppressant formulations. | AI-powered health analysis tools enabling targeted product recommendations. |

| Need for innovation to integrate alternative ingredients. | Introduction of immunity-boosting cough formulations with vitamins, antioxidants, and adaptogenic herbs. |

The North American market is expected to dominate due to high consumer awareness regarding respiratory health, increasing demand for OTC medications, and widespread availability of advanced cough suppressant formulations. The presence of leading pharmaceutical companies, coupled with increasing disposable income, is fuelling market growth.

Additionally, the rising adoption of natural and herbal-based cough suppressants is shaping consumer preferences. The expansion of online pharmacies and direct-to-consumer (DTC) sales channels is making these products more accessible, particularly in the USA and Canada.

The increasing focus on self-care treatment and preventive healthcare solutions is further contributing to market expansion. Furthermore, stringent FDA regulations on opioid-based suppressants are encouraging manufacturers to develop alternative, non-addictive formulations. The growing popularity of subscription-based wellness programs and personalized supplement regimens is enhancing consumer engagement.

Europe represents a mature market with strong regulatory oversight ensuring product safety and efficacy. Countries such as Germany, France, and the UK are seeing increasing adoption of cough suppressants, particularly among aging populations and individuals prone to seasonal allergies. The rising trend of preventive healthcare and herbal medicine is contributing to market growth.

Additionally, European consumers are prioritizing sustainability, driving demand for eco-friendly and organic cough remedies. Retail pharmacies, health stores, and e-commerce platforms are key distribution channels supporting product penetration.

The presence of stringent regulations governing the use of opioids in cough suppressants is encouraging the development of alternative, non-addictive formulations. The demand for plant-based and sugar-free formulations is increasing, as consumers seek healthier options free from artificial additives and preservatives.

The Asia-Pacific region is anticipated to witness the highest growth due to increasing disposable incomes, rising awareness of respiratory health, and expanding retail access to pharmaceutical and herbal medications. Markets such as China, India, and Japan are seeing a surge in demand for traditional herbal cough remedies, reflecting consumer preference for natural solutions.

The growing popularity of homeopathic and Ayurvedic cough suppressants and the expansion of online health and wellness platforms are further accelerating market penetration. Manufacturers in the region are developing cost-effective, multifunctional respiratory care solutions to cater to a broad consumer base.

Additionally, government initiatives promoting affordable healthcare and herbal medicine are fuelling market growth. The rising prevalence of air pollution and respiratory conditions in urban centres is further driving demand for effective and accessible cough suppressants.

Dry and wet cough suppressants are key segments in the cough suppressant market, driven by rising respiratory conditions, pollution, and consumer preference for effective treatments. Dry cough suppressants, containing ingredients like dextromethorphan and pholcodine, are popular for seasonal allergies and throat irritations, with North America and Europe leading sales.

Wet cough suppressants, often combined with expectorants like guaifenesin, treat productive coughs linked to colds and chronic conditions. Asia-Pacific is witnessing rapid growth in both segments due to pollution and infections. Future innovations include AI-driven personalized dosing, herbal formulations, biodegradable syrups, and symptom-tracking apps, enhancing efficiency and consumer experience.

OTC cough suppressants dominate the market due to their accessibility, affordability, and widespread use in self-care treatment. Popular in North America and Europe, these include syrups, lozenges, and herbal alternatives, with growing demand in Asia-Pacific for Ayurvedic remedies. Prescription suppressants, including opioid-based (codeine) and non-opioid (benzonatate) formulations, treat severe and chronic coughs, with North America leading in sales under strict regulations.

Market trends focus on AI-powered cough monitoring, hybrid probiotic cough relief, AI-assisted prescription tracking, and novel non-opioid therapies for safer, long-lasting efficacy. Sustainability efforts like eco-friendly packaging and gene-based respiratory treatments are also gaining traction.

The USA cough suppressant market is set to grow steadily, driven by rising respiratory conditions and proactive health management. In 2025, the market is projected to reach USD 28.6 billion, expanding to USD 48.2 billion by 2035, with a CAGR of 6.4%. Increasing cases of respiratory ailments, an aging population, and greater consumer reliance on over the counter (OTC) remedies fuel this growth.

Seasonal flu outbreaks and environmental factors like pollution further drive demand. Companies are innovating with natural formulations, AI-powered symptom tracking, and sustainable packaging, shaping the future of cough suppressants in the United States.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 28.6 |

| CAGR (2025 to 2035) | 6.4% |

| Year | 2035 |

|---|---|

| Market Size (USD Billion) | 48.2 |

| CAGR (2025 to 2035) | 6.4% |

Germany’s cough suppressant market will grow moderately, driven by a strong healthcare system and increasing health awareness. From 2025 to 2035, the market is set to expand at a CAGR of 3.1%, supported by the rising prevalence of respiratory illnesses, especially during colder months.

Consumers are actively choosing OTC remedies, boosting market demand. An aging population and environmental factors like pollution further contribute to sustained growth. Companies are focusing on natural formulations, regulatory compliance, and innovative delivery methods to meet evolving consumer preferences and strengthen their market presence in Germany.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 4.64 |

| CAGR (2025 to 2035) | 3.1% |

| Year | 2035 |

|---|---|

| Market Size (USD Billion) | 6.30 |

| CAGR (2025 to 2035) | 3.1% |

China’s cough suppressant market will expand significantly from 2025 to 2035, driven by rapid urbanization, worsening air pollution, and a growing middle-class population. The market will grow at a CAGR of 6.9%, fueled by the rising prevalence of respiratory diseases and increasing health awareness. Improved access to healthcare services and government initiatives to strengthen healthcare infrastructure will further boost demand.

Consumers actively seek both traditional and modern cough remedies, supporting market diversification. Companies are focusing on innovation, AI-driven diagnostics, and herbal formulations to meet evolving consumer needs and sustain long-term growth in China.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 8.77 |

| CAGR (2025 to 2035) | 6.9% |

| Year | 2035 |

|---|---|

| Market Size (USD Billion) | 17.08 |

| CAGR (2025 to 2035) | 6.9% |

India’s cough suppressant market will grow steadily from 2025 to 2035, driven by rising pollution levels, a high prevalence of respiratory diseases, and increasing health awareness. The market will expand at a CAGR of 7.3%, supported by the growing adoption of e-commerce platforms and the widespread availability of over the counter (OTC) medications. Regulatory bodies are enforcing stricter standards to combat counterfeit medications, ensuring product safety and efficacy.

Pharmaceutical companies are introducing herbal formulations, AI-driven diagnostics, and personalized treatments to meet evolving consumer needs. As demand surges, market players will focus on innovation and accessibility to sustain long-term growth.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 6.01 |

| CAGR (2025 to 2035) | 7.3% |

| Year | 2035 |

|---|---|

| Market Size (USD Billion) | 12.16 |

| CAGR (2025 to 2035) | 7.3% |

Brazil’s cough suppressant market will grow steadily from 2025 to 2035, driven by rising respiratory infections, worsening urban air pollution, and a growing preference for over the counter (OTC) medications. Seasonal flu outbreaks, particularly during winter and transitional periods, will fuel demand for effective cough remedies.

Consumers are increasingly opting for natural and herbal-based treatments, prompting pharmaceutical companies to innovate new formulations. With a projected CAGR of 6.1%, market players will focus on expanding distribution networks, enhancing product accessibility, and introducing advanced cough relief solutions to cater to evolving consumer preferences and healthcare needs.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 3.2 |

| CAGR (2025 to 2035) | 6.1% |

| Year | 2025 |

|---|---|

| Market Size (USD Billion) | 5.79 |

| CAGR (2025 to 2035) | 6.1% |

Advancements in Pharmaceutical Formulations

The introduction of next-generation cough suppressants with improved efficacy, such as extended-release formulas and dual-action suppressants, is enhancing product effectiveness. The integration of clinically proven herbal extracts such as liquorice root, ginger, and honey are driving the development of premium, natural cough remedies. Innovations in flavour and texture are also enhancing consumer acceptance, especially among paediatric populations.

Growth in Non-Drowsy and Alcohol-Free Cough Suppressants

The increasing number of consumers seeking non-drowsy and alcohol-free cough remedies is boosting demand for safe and effective alternatives, particularly among working professionals and parents buying for children. The market is witnessing a shift toward sugar-free and preservative-free formulations to cater to health-conscious consumers.

Regulatory and Policy Developments

Stricter safety regulations by governing bodies such as the FDA and EMA are ensuring higher standards for cough suppressants, leading to improved consumer confidence and product transparency. Compliance with sustainability initiatives and eco-friendly packaging regulations is further influencing product innovation and brand positioning. Brands are focusing on biodegradable and recyclable packaging solutions to align with global environmental sustainability trends.

Rise of Personalized Respiratory Health Solutions: Advances in AI-driven health diagnostics and genetic research are enabling the development of customized respiratory care regimens tailored to individual health needs. Brands are leveraging consumer health data to create subscription-based, custom-formulated cough relief solutions. The use of microbiome research to develop gut-lung axis-based formulations is gaining traction, enhancing product effectiveness.

Integration of Smart Health Technologies: The development of digital respiratory health monitoring tools and AI-powered wellness tracking apps is allowing consumers to monitor cough frequency and receive personalized product recommendations. Wearable respiratory monitors and real-time health tracking are expected to complement cough suppressant usage in preventive healthcare strategies. Smart inhalers and digital cough assessment tools are also becoming key elements in the broader respiratory wellness ecosystem.

The cough suppressant market is highly competitive, driven by rising incidences of respiratory infections, increasing consumer preference for over the counter (OTC) medications, and advancements in cough relief formulations. Companies are investing in combination therapies, natural ingredient-based suppressants, and extended-release formulations to maintain a competitive edge.

The market is shaped by well-established pharmaceutical brands, consumer health companies, and natural remedy manufacturers, each contributing to the evolving landscape of cough management solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Reckitt Benckiser (Mucinex, Delsym) | 22-26% |

| Procter & Gamble (Vicks) | 18-22% |

| Haleon (Robitussin) | 10-14% |

| Perrigo Company | 8-12% |

| Pfizer (Theraflu) | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Reckitt Benckiser (Mucinex, Delsym) | Market leader offering dextromethorphan-based and extended-release cough suppressants. |

| Procter & Gamble (Vicks) | Specializes in menthol and honey-based cough relief products, including lozenges and syrups. |

| Haleon (Robitussin) | Develops a wide range of cough suppressants, including alcohol-free and sugar-free formulations. |

| Perrigo Company | Manufactures private-label and generic cough suppressants for various retailers and pharmacies. |

| Pfizer (Theraflu) | Provides combination cold and cough medications, integrating cough suppression with multi-symptom relief. |

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The industry is growing due to rising respiratory infections, pollution, increased consumer awareness, and demand for OTC and natural remedies.

North America and Europe dominate the market, while Asia-Pacific and Latin America are witnessing rapid growth due to urbanization and pollution.

Trends include herbal-based formulations, AI-driven symptom tracking, and combination therapies for improved efficacy.

Stricter rules on opioid-based suppressants and ingredient transparency are influencing product formulations and availability.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.