The cotton candy machines market includes the manufacturers, suppliers, and distributors of commercial cotton candy makers and household cotton candy makers that are used in food service and entertainment, carnivals, and amusement parks. The growth of the market is facilitated by growing demand for nostalgia and novelty food experiences, increasing disposable income, and expansion of food concession businesses.

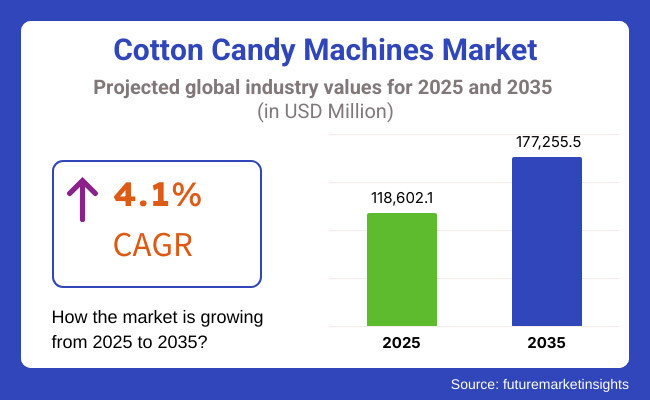

The global cotton candy machines market is about to reach approx. USD 1,18,602.1 million by the year 2025, at a CAGR of 4.1% by the year 2035.

The expected CAGR highlights the increasing demand for cotton candy as an iconic treat for fairs, parties, and amusement parks, along with increasing penetration of commercial grade cotton candy machines in foodservice and event enterprises. The response is also complemented by the rising availability of small cotton candy machines for home use, which is likely to supplement the market growth.

Explore FMI!

Book a free demo

North America dominates the share of cotton candy machines market due to the presence of large number of amusement parks, carnivals, and food concession stands. Demand for both commercial and home-use machines is strong and is being driven by increasing interest in nostalgic treats and “do-it-yourself” food experiences in the United States and Canada. Also, products like upscale cotton candy flavor options and organic sugar options is supporting market growth in region.

Europe commands a large share of this market, particularly Germany, France, and the UK, which are front-runners in foodservice innovations and confectionery through events. Demand for commercial cotton candy machines is growing with the Melissa brand, new businesses like mobile food trucks, dessert kiosks, and party equipment rentals. Moreover, the growing popularity of customized dessert experiences in weddings, fests, and corporate events is driving market growth.

The market for the cotton candy machines is anticipated to see the fastest CAGR in the Asia-Pacific region due to an increase in disposable incomes, rapid investment in amusement parks, coupled with increasing street food culture in China, India, and Japan. Growing middle class and advent of themed dessert shops and entertainment spots have resulted in rising demand for cotton candy machines across commercial as well as household segments. Also, backlash from affordable manufacturing and e-commerce in the region is fueling market opportunities.

Challenges

High Energy Consumption and Maintenance Costs

Cotton candy machines, particularly those that are commercial-grade that are often used at fairs, amusement parks and for large events, can consume a lot of power. Moreover, recurring maintenance challenges like clogging, heating unit failures, and sugar residue accumulation further strain the financial resources of vendors. Similar to home-use models, there has been limited innovation which has also hindered consumer adoption in the wider markets.

Opportunity

Growth in Compact, Smart, and Sustainable Cotton Candy Machines

The market is being boosted by the growing demand for energy-efficient, portable and smart cotton candy machines for commercial as well as home-use applications. LED-integrated machines, customizable flavor infusion systems, and sugar-free options are expanding consumer interest; and Compact, low-energy, and user-friendly designs are making these machines easier to have for home use and small businesses. In addition, sustainability trends with the addition of biodegradable cotton candy sticks and automated clean-up mechanisms.

Amusement parks, carnival operators, and event caterers supported steady demand from 2020 to 2024, while the DIY food trend on social media is likely to boost the sale of cotton candy machines for home use. But, challenges like limited product variety, maintenance issues, and high energy consumption still persisted.

The cotton candy machines produced during the year 2025 to 2035 are likely to be smart, compact, eco-friendly. Things like AI-powered temperature control, customization for multiple Flavors, and sugar-alternative cotton candy options will continue surging the market growth. Developments in smaller, battery-operated and cord-free devices will mean more users will include home users and mobile food vendors.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety and electrical safety standards |

| Technology Innovations | Basic heating element and spinning head designs |

| Market Adoption | Growth in commercial use at fairs, events, and theme parks |

| Sustainability Trends | Initial steps in reducing machine waste and improving energy efficiency |

| Market Competition | Dominated by commercial equipment manufacturers and online retail brands |

| Consumer Trends | Increased demand for DIY cotton candy kits and home-use machines |

| Regulatory Landscape | Compliance with food safety and electrical safety standards |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on energy efficiency, eco-friendly components, and sugar-free alternatives |

| Technology Innovations | Advancements in AI-controlled heat settings, LED-illuminated designs, and smart cleaning mechanisms |

| Market Adoption | Expansion into home-use, portable, and rechargeable cotton candy machines |

| Sustainability Trends | Large-scale adoption of biodegradable sticks, compostable packaging, and low-energy models |

| Market Competition | Rise of tech-driven food appliance startups focusing on smart, compact, and customizable cotton candy machines |

| Consumer Trends | Growth in customizable Flavors, sugar-free options, and mobile, rechargeable cotton candy makers |

| Regulatory Landscape | Stricter regulations on energy efficiency, eco-friendly components, and sugar-free alternatives |

The USA cotton candy machines market is projected to grow at a moderate rate over the next several years, fueled by the growing popularity of carnival-style snacks in the food industry at amusement parks, fairs, and events. Increasing demand for home-use cotton candy machines for parties and DIY treats is also driving market growth.

Sales of commercial-grade cotton candy machines are rising due to the presence of a well-established food service and concession stand industry. Moreover, the proliferation of social media trends and viral food creations have heighten consumer curiosity as it relates to cotton candy-making, creating a demand for more fun and easy-to-use machines. With a growing supply of compact, affordable models detailed for home use and retail sale, retail and e-commerce platforms are also a major driver of sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The UK cotton candy machines market is expected to grow, owing to rising demand for novelty food items at festivals, weddings and entertainment outlets. Market growth is driven by the rising preference for event catering businesses that include cotton candy machines.

The increasing number of home-based dessert businesses and DIY sweet-making kits are also fuelling the demand for compact and easy to operate cotton candy machines. Furthermore, the growing availability of online retail market with customizing and special Flavors of cotton candy is fuelling the market growth.This, coupled with food service regulations regarding better quality and hygiene in the food preparation equipment is also expected to augment sales of premium grade cotton candy machines in the commercial sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The cotton candy machines market of Europe is showcasing moderate growth on account of increasing demand for nostalgic and fun food experiences at fairs, theme parks, and shopping malls. Market growth is also being amplified by the increasing popularity of street food markets and pop-up dessert store.

Key markets include Germany, France and Italy, where demand for commercial cotton candy machines is driven by strong tourism and the events industry. Also, the rising popularity of gourmet cotton candy Flavors and organic sugar alternatives is adding to consumer interest.

Market growth across the EU is also being driven by the expansion of online sales channels and demand for compact home-use machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.8% |

The growing demand for high-quality, aesthetically pleasing, and customized cotton candy creations is fueling the growth of the Japan Cotton Candy Machines market. A strong culture of themed cafés, amusement parks and seasonal festivals in the country is fueling demand for high-quality and innovative cotton candy machines.

The exquisite and artistic features of Japanese food have driven the adoption of machines that can create multi-coloured and shaped cotton candy among Japanese consumers. Moreover, growing number of dessert shops and food trucks serving cotton candy as one of the specialty item is also driving the market growth.

In Japan market development, the upgradation of cotton candy machines to high-tech, compact, and low-power consumption machines with higher efficiency in terms of automated performance helps to bolster market progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The South Korea cotton candy machines market is witnessing steady growth, driven by the bustling street food scene in the country as well as the growing number of themed dessert cafés. Social media-driven food trends and influencer marketing are driving demand for Insta-friendly cotton candy treats.

Sales are also buoyed by the growth of entertainment districts, amusement parks and K-pop-themed venues featuring food stalls with cotton candy machines. Moreover, the rising availability of portable and easy-to-use cotton candy manufacturing machines for home applications is propelling the demand among younger customers and families. Furthermore, the introduction of sugar-free and flavoured cotton candy product variants is positively influencing the growth of the market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

Table top cotton candy machines have grown extremely popular among homemakers, hobbyists, and small-scale event organizers because of their affordable price some key players in the market are; the data is already up to October 2023This compact serving of fluff promises a tasty dessert for everyone. These machines are great for consumers who want the carnival experience at home, making them a favourite for birthday parties, family get-togethers and small social gatherings.

The growing domestic entrepreneurs and DIY preparing of food is one of the major drivers for the table top section. This is now leading a lot of people to start selling their own hand-crafted, flavoured, organic, or fun cotton candy items using compact, simple-to-use cotton candy machines. As a growing movement toward nutritious, whole food and natural ingredients influences diet, the table top cotton candy machine allows consumers to play with sugar substitutes, natural colouring agents and clever flavor infusions.

Additionally, manufacturers are upscaling features by including fewer louder motors, versified heating elements, and fast-paced suppliers to provide better user experience. The availability of affordable table top models through online marketplaces has further boosted the demand for this segment.

Alas, table top cotton candy machines are simply not rugged enough, nor are they large enough to handle big batches. Because their bowls are smaller and they have lower heating efficiency, they are not as practical for continuous use at commercial events or in high-traffic locations. Nevertheless, the restriction of functionality and features has not stopped the table top machines from being popular for casual users and people considering for an entry-level business in the cotton candy industry.

The cotton candy machine type used in the commercial sector is suitable for small to mid-sized businesses, event organizers, and food vendors offering cotton candy at fairs, amusement parks, festivals, and catering. Events. They are not only capable of producing more, have more robust construction, and faster heating systems, but are also designed to be able to be run continuously and are ideal for larger operations and high-traffic environments.

The increasing demand for cotton candy machines has been boosted by the rise of personalized and small-batch gourmet cotton candy options. So many vendors are playing with exotic and unexpected Flavors, organic ingredients and multi-color designs that lure shoppers looking for premium and Instagram-ready sweets.

With improved energy efficiency, lower sugar wastage and enhanced safety features, commercial cotton candy machine technology has evolved to become the machine of choice for mobile food vendors and concession stands. The stainless steel bowls, reinforced motors, and spinning heads at impressive rotations per minute deliver the quality and durability that can turn a profit in event catering and the entertainment space.

On the other hand, the rise in initial costs and maintenance needs challenge small business owner. Many venders are purchasing refurbished or rental commercial-grade machines to keep their costs down. That said, the segment keeps growing with the Food and beverage service sector growing, commercial-grade machines are a good investment.

With so many different e-commerce platforms available, consumers have different ways to shop for cotton candy machines. For individual buyers and small businesses, online retail provides more product options, competitive prices, and the convenience of home delivery, making online retail the distribution channel of choice.

Another significant trend driving online retail dominance is the rise in research-based purchasing decisions. Consumers research machine features, reviews from users, and video demonstrations to compare machines in depth prior to making a purchase. Sites like Amazon, eBay, Walmart, and Alibaba offer in-depth product descriptions, customer reviews, and packaging discounts that allow consumers to shop more wisely.

Then, there are online marketplaces that connect directly to the consumer, allowing manufacturers to cut out the middleman and sell for less. Today, there are many brands that provide superior discounts online, seasonal sales, and financing plans, making premium cotton candy machines more accessible for price-conscious clients.

Online retail having its benefits, also comes with some challenges like no physical product testing and a delay in the delivery. Most consumers prefer brick-and-mortar stores for immediate purchase and hands-on product inspection. Though this has been detrimental for sales in the past, consumers are becoming more assured about online shopping due to try-before-you-buy technologies and improved return policies.

Although online retail is on the rise, offline retail continues to be an important distribution channel, in particular in specialty kitchen appliance shops, wholesale markets, and purpose-built restaurant supply outlets. Many consumers still prefer in-person shopping experiences where they can visually inspect machine durability, size, and performance before investing in a purchase.

Some restaurant and catering businesses obtain products through direct buying agreements with specialist retailers, wholesale distributors, and their manufacturers, who usually are willing to negotiate bulk discounts, warranties, and on-site demonstrations. Also, commercial food equipment suppliers provide after-sales service, repairs, and maintenance contracts, which are appreciated by professional vendors and organizations as the supplier takes full responsibility for their products.

Meanwhile, a second contributor has been local business expos, trade shows, and equipment fairs have been on the rise, which feature manufacturers showcasing new product innovations and giving buyers a way to sample machines before placing bulk orders. The Face-to-Face Events, Customised Recommendations, and Flexible Payment Options make it the preferred mode of choice for the bulk buyers and professional event organizers.

On the other hand, offline retail is struggling with price and convenience. This is a massive disadvantage for physical retailers, as maintaining stores, inventory, and overhead employees is so much more expensive than just running a website where you are selling at higher profit margins than your competitors. Moreover, brick-and-mortar stores usually have limited stock, limiting variety for buyers.

The global cotton candy machines market has been forecasted to register steady growth on the back of increasing consumption in commercial as well as home environment, especially in amusement parks, carnivals, food vending, and event catering services. Moreover, popularity of do-it- yourself (DIY) cotton candy machines for party events, home entertainment and small businesses are expected to augment market growth. With innovations in technology such as automatic sugar spinning, multi-flavor fusion, and energy-efficient designs, the market was already taking a leap. Furthermore, there is an increasing number of compact, portable, and easy-to-clean models to accommodate the home-use segment.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Great Northern Popcorn Company | 18-22% |

| Nostalgia Products LLC | 14-18% |

| Paragon International, Inc. | 12-16% |

| VIVO | 10-14% |

| Olde Midway | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Great Northern Popcorn Company | Specializes in commercial-grade and home-use cotton candy machines with stainless steel construction. |

| Nostalgia Products LLC | Provides retro-style home-use cotton candy machines with compact and user-friendly designs. |

| Paragon International, Inc. | Offers high-performance cotton candy machines for professional and commercial use. |

| VIVO | Develops mid-range cotton candy machines designed for small businesses and home parties. |

| Olde Midway | Focuses on affordable, large-capacity cotton candy machines for carnivals, events, and party rentals. |

Key Market Insights

Great Northern Popcorn Company (18-22%)

Great Northern Popcorn Company is a leading manufacturer of commercial-grade cotton candy machines and adds home-use models with lasting stainless steel bowls and strong motors that are easy to clean. The company serves food service businesses, amusement parks, and home users.

Nostalgia Products LLC (14-18%)

Nostalgia is a pioneer in the home-use cotton candy machine market, and it aims compact, stylish, and inexpensive machines for DIY users. Her retro-themed designs attract casual users and party-goers.

Paragon International, Inc. (12-16%)

Paragon is a reputable manufacturer of high-output commercial cotton candy machines aimed at carnivals, concession stands, and food vendors. Their machines focus on performance, durability, and speed.

VIVO (10-14%)

VIVO manufactures mid-range cotton candy machines for home, small business or event catering. Prioritizing ease of use and portability.

Olde Midway (8-12%)

Olde Midway provides large-capacity cotton candy machines with commercial-grade construction for carnivals, fairs, and event planners. Their machines are known for affordability and efficiency.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding market opportunities with cost-effective and innovative cotton candy machine solutions, including:

The overall market size for cotton candy machines market was USD 1,18,602.1 million in 2025.

The cotton candy machines market is expected to reach USD 1,77,255.5 million in 2035.

The growth of the cotton candy machines market will be driven by increasing demand for commercial and home-use confectionery appliances, advancements in machine efficiency and portability, and rising popularity of nostalgic and novelty treats at events and amusement venues.

The top 5 countries which drives the development of cotton candy machines market are USA, European Union, Japan, South Korea and UK.

Table top cotton candy machines to command significant share over the assessment period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Catering Food Warmers Market Analysis by Product Type, End Use, Sales Channel, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.