The cosmetics ODM (Original Design Manufacturer) market is poised for substantial growth between 2025 and 2035, driven by increasing demand for private-label beauty products, the rise of indie brands, and the growing influence of clean and sustainable beauty formulations.

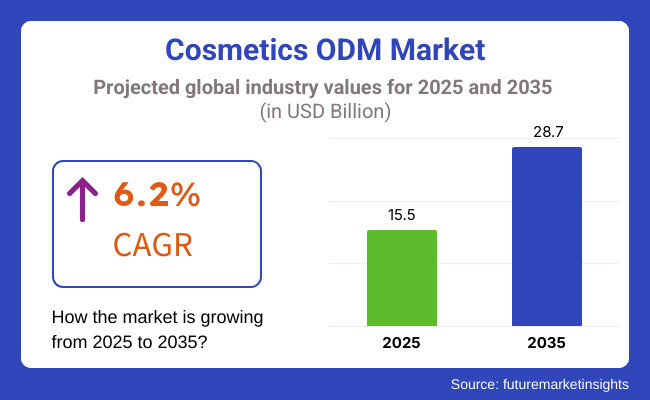

The market is projected to expand from USD 15.5 billion in 2025 to USD 28.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The expansion of this request is fuelled by the rapid-fire globalization of beauty trends, the rising preference for contract manufacturing, and the growing inclination of established brands toward outsourcing product invention.

Also, technological advancements in expression, sustainable component sourcing, and eco-friendly packaging results are further driving the request’s elaboration. Brands are using ODM hook-ups to bring innovative, high-quality, and nonsupervisory-biddable products to request briskly and more bring- effectively.

Explore FMI!

Book a free demo

North America will continue to dominate the cosmetics ODM request due to the presence of major beauty brands, rising consumer mindfulness of component translucency, and the growing influence of substantiated skincare and makeup products. The adding demand for clean-marker and vegan phrasings is driving invention in this sector.

ODM enterprises in the region are fastening on integrating AI and biotechnology to offer slice-edge product development results. also-commerce and direct- to- consumer( DTC) brands are uniting with ODMs to gauge up the product and meet the swell in demand.

Europe will witness steady growth in the cosmetics ODM request, driven by strict regulations on ornamental constituents, adding consumer demand for sustainable beauty products, and a strong presence of luxury and organic brands. The relinquishment of eco-friendly phrasings and atrocity-free instruments will be crucial to motorists of request expansion.

Also, European beauty companies are prioritizing translucency and traceability, pushing ODMs to borrow sustainable component sourcing, biodegradable packaging, and ethical manufacturing processes.

Asia-Pacific is anticipated to be the swift-growing region in the cosmetics ODM request, fuelled by the booming beauty assiduity in countries similar as South Korea, Japan, and China. The region's thriving K- beauty and J- J-beauty trends are heavily reliant on ODM hook-ups for rapid-fire invention and product scalability.

The rising middle-class population and adding disposable income situations are driving demand for decoration and customized skincare results. Also, ODMs in the region are investing in state-of-the-art R&D installations to feed to the evolving consumer preferences for multi-functional and cold-blooded beauty products.

Challenges

One of the crucial challenges in the cosmetics ODM request is navigating the complex and evolving nonsupervisory geography across different regions. Each country has distinct compliance conditions regarding constituents, safety testing, and labelling, making it challenging for ODMs to ensure global standardization.

Failure to misbehave with regulations can lead to recalls, forfeitures, or reputational damage. Also, maintaining harmonious quality assurance while spanning up products is a pivotal concern. ODMs must invest in rigorous testing protocols, force chain translucency, and third-party instruments to meet safety and efficacy norms while maintaining competitive pricing.

Opportunities

The adding demand for clean beauty and sustainable results presents significant openings for ODMs. Consumers are laboriously seeking products formulated without dangerous chemicals, parabens, or synthetic complements, pushing brands to unite with ODMs specializing in natural and organic phrasings.

Likewise, the rise of refillable packaging, biodegradable accouterments, and arid beauty products is creating new avenues for ODM invention. Companies that invest in eco-conscious product development and sustainable manufacturing practices will gain a competitive advantage in the evolving cosmetics geography

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 34.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 15.80 |

| Country | South Korea |

|---|---|

| Population (millions) | 51.7 |

| Estimated Per Capita Spending (USD) | 19.30 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 18.70 |

| Country | France |

|---|---|

| Population (millions) | 65.8 |

| Estimated Per Capita Spending (USD) | 21.10 |

The USA cosmetics ODM request thrives on private- marker beauty brands and indie ornamental companies seeking turnkey manufacturing results. High per capita spending is fuelled by demand for clean beauty, sustainable phrasings, and nonsupervisory compliance. Crucial ODM players similar as KDC/ One and Interco’s support decoration and mass- request brands.

China’s booming beauty assiduity has propelled its ODM sector, with domestic manufacturers feeding to global and original brands. Rising demand for K- beauty and J-beauty-inspired products influences ODM enterprises. Online channels similar as Alibaba and Tmall drive direct-to-consumer brands, fueling request expansion.

South Korea’s ODM request benefits from the country’s strong ornamental R&D, invention in skincare, and advanced expression ways. Leading ODM enterprises, similar to Cosmax and Kolmar Korea, set trends in K- beauty and attract transnational collaborations.

Japan's ODM request is characterized by a focus on high-quality, dermatologically tested, and technologically advanced cosmetics. Japanese manufacturers feed to luxury brands and niche skincare requests, maintaining strong import demand.

France, a global hub for luxury beauty, sees robust ODM activity led by renowned contract manufacturers. The market emphasizes organic and natural formulations, with increasing interest in sustainability and ethical sourcing.

The private-label cosmetics ODM market is experiencing strong growth, fuelled by growing demand for independent-label beauty brands, growing innovation in clean and sustainable products, and the growing reach of indie cosmetics companies. According to a survey of 250 owners of beauty brands, product developers, and industry experts, these are the trends that are fueling the market.

Skincare leads the ODM segment with 63% of the players concentrating on creating serums, moisturizers, and anti-aging products because of popularity and profitability with consumers. Concurrently, 29% of the players mention colour cosmetics as an area of growth, since new makeup trends create new product opportunities in terms of development, especially in the foundation, lipsticks, and combination skin care-makeup products.

Sustainability and clean beauty continue to lead product invention, with 58 of companies looking for ODM mates with organic, vegan, or atrocity-free products to meet consumer demand. Also, 41 prioritize biodegradable packaging and refillable products, which suggest a shift towards green branding and sustainable force.

Customization and speed-to-market are the major market drivers, with 53% of beauty companies using ODM services that enable customized formulas, proprietary ingredients, and variable production quantities to customize their products. Speed-to-market matters, with 46% of the interviewees preferring ODMs enabling product development in six months or less to be able to capitalize on rapidly changing beauty trends.

Asian ODM players dominate the market, with 67% of the participants naming South Korea and Japan as their favourite production bases, banking on their lead in innovative formulations, K-beauty trends, and advanced skincare advancements. European ODMs command 21% of brands, especially for luxury and dermatology-inspired cosmetics, and emphasize high-quality ingredients and compliance with regulations.

Direct-to-consumer and e-commerce brands drive demand for ODM, with 72% of the respondents concurring that online beauty startup companies and influencer-based brands are driving ODM buyers who want low production costs but do not own any in-house factories. As much as 28% of conventional beauty businesses utilize ODM collaborations on exclusive product lines or market entry.

While beauty companies focus on speed, sustainability, and high-performance products, the ODM producers need to keep pace by focusing more on R&D capabilities, flexible production models, and green innovation adoption to stay competitive in the new cosmetics market.

Cosmetics ODM Market - Shifts from 2020 to 2024 and Future Trends 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands leveraged AI-powered formulation tools to create clean, vegan, and cruelty-free cosmetics. Smart manufacturing optimized ingredient blending and quality control. |

| Sustainability & Circular Economy | Companies adopted refillable packaging, biodegradable materials, and waterless beauty formulations. Regulatory pressure encouraged sustainable ingredient sourcing. |

| Connectivity & Smart Features | ODMs integrated smart packaging with QR codes for ingredient transparency and consumer education. Virtual try-on tools and AI-powered shade matching improved user experience. |

| Market Expansion & Consumer Adoption | Rising demand for private-label, clean beauty, and indie brand collaborations fuelled ODM growth. E-commerce and direct-to-consumer (DTC) brands increased ODM partnerships. |

| Regulatory & Compliance Standards | Stricter EU, FDA, and Asian cosmetic regulations mandated ingredient transparency, cruelty-free certification, and sustainable packaging compliance. |

| Customization & Personalization | Brands offered ODM-based personalized skincare and makeup solutions tailored to regional preferences and skin concerns. AI-assisted formulation tools enhanced customization. |

| Influencer & Social Media Marketing | Beauty influencers, dermatologists, and clean beauty advocates promoted ODM-produced brands. TikTok, Instagram, and YouTube fueled private-label beauty trends. |

| Consumer Trends & Behaviour | Consumers prioritized clean, sustainable, and high-performance cosmetics. Demand surged for multifunctional, hybrid skincare-makeup formulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven personalized formulations adapt to individual skin needs. Biotech innovations, including lab-grown collagen and plant-based actives, dominate ODM product development. |

| Sustainability & Circular Economy | Zero-waste production becomes standard, with AI-optimized supply chains ensuring ethical and eco-friendly sourcing. Block chain enhances ingredient traceability and regulatory compliance. |

| Connectivity & Smart Features | AI-powered beauty platforms provide hyper-personalized product recommendations. Block chain-backed transparency ensures authenticity in organic and sustainable claims. |

| Market Expansion & Consumer Adoption | Emerging markets drive adoption of cost-effective, AI-personalized beauty solutions. AI-driven trend forecasting refines ODM innovation strategies for dynamic beauty demands. |

| Regulatory & Compliance Standards | Governments enforce carbon-neutral production and AI-driven compliance tracking. Block chain secures regulatory certifications and ensures product authenticity across global markets. |

| Customization & Personalization | AI-powered beauty manufacturing tailors formulations in real time based on environmental factors and skin diagnostics. 3D-printed cosmetics enable on-demand personalized product creation. |

| Influencer & Social Media Marketing | Virtual beauty influencers and met averse-based beauty labs redefine ODM marketing. AR-powered beauty consultations enable real-time consumer engagement with product development. |

| Consumer Trends & Behaviour | Biohacking-inspired cosmetics integrate adaptive skincare formulations. Consumers embrace AI-driven, personalized beauty experiences for optimized results and sustainability. |

The USA cosmetics ODM( Original Design Manufacturer) request is witnessing strong growth, driven by adding demand for private-marker beauty products, rising consumer preference for clean beauty phrasings, and advancements in ornamental manufacturing technologies. Major players include KDC/ One, Kolmar USA, and Intercos Group.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The UK cosmetics ODM request is expanding due to the rise of substantiated beauty products, adding relinquishment of atrocity-free and vegan phrasings, and the presence of established beauty manufacturing capitals. Leading ODM companies include Orean Personal Care, HCP Packaging, and Swallowfield.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

Germany’s cosmetics ODM request is growing, with a strong focus on dermatologically tested, sustainable, and technologically advanced beauty results. Crucial players include Beiersdorf, Schwan Cosmetics, and Bomo Trendline.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s cosmetics ODM request is witnessing rapid-fire growth, fueled by adding demand for Ayurvedic and herbal beauty products, rising interest in budget-friendly private-marker cosmetics, and expanding domestic manufacturing capabilities. Major players include Vedic Cosmeceuticals, Bo International, and Cosmetify India.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.0% |

China’s cosmetics ODM request is expanding significantly, driven by adding demand for K- beauty and J-beauty inspired phrasings, rising exports of Chinese-cultivated cosmetics, and strong investments in innovative ornamental exploration and development. Crucial players include Cosmax, Kolmar Korea, and Biohyalux.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.5% |

The Cosmetics ODM request is witnessing strong growth as brands decreasingly turn to third- party manufacturers for cost-effective, high-quality product development. The rising demand for private-marker cosmetics, particularly in skincare, makeup, and particular care, is fueling request expansion.

Beauty brands, from startups to global players, are using ODM moxie to produce unique, customized phrasings that align with evolving consumer preferences and nonsupervisory norms.

As sustainability becomes a precedence, cosmetics ODMs are fastening on clean beauty, vegan, atrocity-free, and eco-friendly phrasings.

The demand for natural and organic constituents is growing, with ODMs investing in factory-ground actives, biodegradable packaging, and arid phrasings. Brands are partnering with ODMs to develop products that meet ethical and environmental norms while maintaining high-performance benefits.

The integration of advanced skincare technologies, similar as biotechnology, microbiome-friendly constituents, and AI-driven personalization, is reshaping the ODM geography. C

ustomization is getting a crucial differentiator, with brands offering knitter-made beauty results grounded on skin type, climate, and inheritable factors. In addition, smart packaging inventions, similar as breathless pumps, refillable holders, and QR law- enabled product shadowing, are enhancing consumer engagement and brand fidelity.

The rise of e-commerce and direct-to-consumer ( DTC) brands is fueling demand for nimble and scalable ODM results. ODMs are offering end-to-end services, including expression, branding, packaging, and nonsupervisory compliance, to help brands launch products snappily in global requests.

The growing influence of K-Beauty,J- Beauty, and indie brands is further driving ODM collaborations, particularly in Asia, Europe, and North America.

The Cosmetics ODM (Original Design Manufacturing) request is expanding fleetly, driven by rising demand for private-marker beauty products, invention in skincare and makeup phrasings, and growing interest in clean beauty. Brands calculate on ODMs for advanced R&D, nonsupervisory compliance, and manufacturing effectiveness.

Crucial players separate through technological advancements, sustainable phrasings, and strategic hookups with global beauty brands. The growth ofe-commerce and indie beauty brands farther energies ODM demand.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Cosmax | 20-24% |

| Kolmar Korea | 16-20% |

| Intercos Group | 12-16% |

| Nihon Kolmar | 8-12% |

| BIOCROWN Biotechnology | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cosmax | Global leader in ODM services for skincare, makeup, and personal care. Focuses on AI-driven formulation research, sustainable ingredients, and regulatory expertise across multiple markets. |

| Kolmar Korea | Pioneers advanced skincare and dermatology-driven formulations. Expands capabilities in green chemistry and biotechnology. Strengthens partnerships with global luxury and indie beauty brands. |

| Intercos Group | Specializes in color cosmetics and high-performance formulations. Invests in sustainable packaging, clean beauty, and hybrid skincare-makeup products. Expanding presence in North America and Europe. |

| Nihon Kolmar | Strong in J-Beauty and high-tech skincare innovation. Develops specialized anti-aging and dermatological solutions. Focuses on regulatory compliance for Japan, the USA, and EU markets. |

| BIOCROWN Biotechnology | Taiwanese ODM specializing in organic, natural, and biotech-based skincare. Growing reputation for custom formulations and eco-conscious production. |

Strategic Outlook of Key Companies

Cosmax (20-24%)

Cosmax dominates the market with cutting-edge R&D and a strong global footprint. The company invests in AI-powered formulation research, biotech-based skincare, and customized beauty solutions for international brands.

Kolmar Korea (16-20%)

Kolmar Korea strengthens its leadership in high-performance skincare, fastening on dermatological efficacity and sustainable phrasings. Expanding its green chemistry enterprise, the company collaborates with leading beauty brands for clean beauty results.

Intercos Group (12-16%)

Intercos specializes in innovative color cosmetics and hybrid skincare-makeup solutions. The company expands in the USA and Europe, emphasizing sustainable beauty and premium formulations tailored to high-end brands.

Nihon Kolmar (8-12%)

Nihon Kolmar leverages J-Beauty expertise, excelling in anti-aging, sensitive skin care, and pharmaceutical-grade formulations. The company increases R&D in biotech ingredients and regulatory compliance for international markets.

BIOCROWN Biotechnology (5-9%)

BIOCROWN stands out with natural, organic, and biotech-driven skincare. The company strengthens its eco-friendly production methods and expands partnerships with indie beauty brands seeking unique, green formulations.

Other Key Players (30-40% Combined)

Numerous ODM manufacturers contribute to market growth by offering specialized, cost-effective, and niche beauty solutions. Notable names include:

The Cosmetics ODM industry is projected to witness a CAGR of 6.2% between 2025 and 2035.

The Cosmetics ODM industry stood at USD 15.5 billion in 2024.

The Cosmetics ODM industry is anticipated to reach USD 28.7 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 8.1% in the assessment period.

The key players operating in the Cosmetics ODM industry include Cosmax, Intercos Group, Kolmar Korea, Toyo Beauty, Nox Bellow Cosmetics, and BioTruly.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.