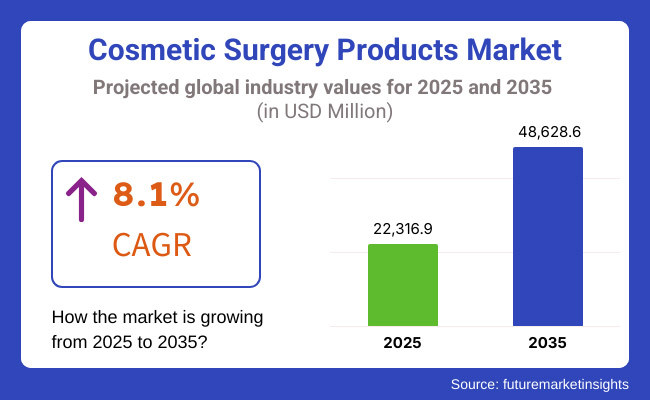

In the coming years, the cosmetic surgery products market is expected to reach USD 22,316.9 million by 2025 and is expected to steadily grow at a CAGR of 8.1% to reach USD 48,628.6 million by 2035. In 2024, cosmetic surgery products market have generated roughly USD 20,644.7 million in revenues.

Between 2025 and 2035, the cosmetic surgery products market is likely to expand substantially as a result of changing customer trends, technological innovation, and a changing culture of aesthetics. With regenerative aesthetics and AI-driven solutions redefining cosmetic augmentation, the sector will witness a new epoch of hyper-personalization as wellness and beauty converge with precision medicine.

The increasing demand for non-surgical and minimally invasive treatments is one of the most prevalent themes shaping the future of the industry. Speedy, risk-free, and downtime-free aesthetic treatments will increasingly be required as injectables, laser, and energy-based therapies keep evolving. Treatment planning will be transformed with the increasing use of smart technology, augmented reality (AR), and artificial intelligence (AI).

AI-powered 3D modelling will allow patients to see realistic outcomes of the procedure. The growing of technology in surgical implants and regenerative medicine will continue to redefine the marketplace. Second-generation biocompatible implants, tissue engineering, and bioengineered fillers will deliver longer, more natural-appearing outcomes with fewer adverse reactions.

Artificial intelligence-powered robotic surgery and precision-guided injectable systems will enhance procedural precision, delivering superior standards of safety and patient satisfaction.

The cosmetic surgery products market has expanded significantly in the last decade with evolving beauty standards, increasing disposable incomes, and advanced surgical techniques driving it. During the early 2010s, procedures were largely invasive and facelifts, liposuctions, and breast augmentations were the prevailing procedures. But with little downtime and fewer risks involved, non-invasive therapies like Botox, dermal fillers, and laser treatment began growing on their own.

They started in the mid-2010s with the changing market following technology advancements in new implant materials, advanced liposuction designs, and fat-grafting techniques. Social media and celebrities now created an ever-growing demand that went mainstream and became available.

An ever-growing number of male consumers who opted for aesthetic procedures added fuel to the growth of the market as well. Regenerative medicine-based products, bioengineered implants, and artificial intelligence for personalized treatment planning have developed over the last few years, providing means for future market growth.

Explore FMI!

Book a free demo

The North American cosmetic surgery product market is increasing tremendously because of higher consumer knowledge, growing aesthetic clinics, and more demand for surgical and non-surgical procedures. The United States holds the largest share in the market because of the progress in injectable and laser technology and the higher number of experienced cosmetic surgeons.

Key driving forces are significant market competition, strict FDA regulations to maintain product safety, and increased consumer demand for customized cosmetic procedure choices. Potential restraints could include insurance restrictions for elective surgeries along with high procedure costs. Very rapidly gaining popularity in North America are telemedicine and virtual consultations for cosmetic surgery.

Europe is a more developed market in the world of cosmetics, where nations like the UK, Germany, and France spearhead adoption for cosmetic surgeries. The use of non-surgical treatments on the continent, regulation standards rigorously enforced by the European Medicines Agency (EMA), as well as expanding demand for cosmetic change that manifests in natural changes to one's looks, is pushing growth in the region.

Expanding levels of medical tourism in the like of Spain and Turkey are equally contributing to rising market growth. However, economic uncertainty and ethical concerns surrounding cosmetic procedures may constrain market penetration.

Bioengineered implants and facial analysis for treatment planning using AI are shaping the European market. Energy-based aesthetic treatments, including laser and radiofrequency tightening, are increasingly being used and making procedures safer, faster, and more effective.

Asia-Pacific market is also projected to grow the fastest among cosmetic surgery product market due to such factors as increased disposable income, evolving trends of beauty, and medical tourism innovation. China, Japan, and South Korea lead in the art of beauty thanks to mounting requirements for injectable treatments, face tightening, and nose resurfacing.

In addition, the area is also experiencing advancements in minimally invasive and scarless surgery, which are gaining popularity among the youth. Market expansion may be avoided due to concerns about unregistered clinics and counterfeit cosmetics. Future demand in Asia-Pacific is anticipated to be driven by applications for non-invasive body contouring technologies and surgery planning employing AI and 3D imaging.

Challenges

Breaking Down Market Barriers: Challenges with Regulations, Issues with Compliance, and Risks after Surgery

The market for cosmetic surgical products, while growing at an extremely fast rate, has some compelling issues that may slow this growth. Compliance and barriers are concerning, as stringent approval processes and changing requirements for safety still affect this industry. There are regional discrepancies in the regulatory requirements, presenting hurdles for manufacturers trying to penetrate global markets.

The strict requirements of the FDA, EMA, and other regulatory agencies require long clinical trials and documentation, thus lengthening approvals and raising costs of bringing new products to market. Apart from compliance, there lies one more area of concern, the risk of post-surgical complications, which dismay potential customers.

All these issues affect the patient's decision and industry credibility: scarring, infections, implant rejection, and sensitivity to fillers. Long-term safety profiles of silicone implants, dermal fillers, and bioengineered substances meanwhile have increased the pressure on regulations.

Opportunities

Revolutionizing Cosmetic Surgery Products: Advancements in Minimally Invasive Techniques

Revolutionizing Cosmetic Surgery Products: New Frontiers in Minimally Invasive Techniques. Market opportunities are being formed with the booming demand for aesthetic treatments and technological advancement in the minimally invasive procedures. The advent of AI diagnostic tools, therapy methods in regenerative medicine, and personalized protocols are setting the stage for better surgical outcomes and satisfaction.

There is also an increase in demand for treatments among males-such as hair replacement and body contouring, which is impacting growth in the market. Moreover, increased medical tourism and financing options for aesthetic procedures make it accessible to a broader consumer base.

The industry is gradually moving towards more lasting and highly individualized treatment options powered by 3D bioprinting technology for repair procedures and regenerative aesthetic treatments that may cater to specific patient requirements.

Advances in Biocompatible Materials: The gradual introduction of next-generation implants and fillers from biocompatible and biodegradable materials is increasing safety and durability in aesthetic practice. Patients have been increasingly opting for silicone and hybrid implants with more durability for breast augmentation and facial contouring.

Boom of Non-invasive Procedures: With the popularity of laser skin resurfacing, ultrasound skin tightening, and RF energy treatments, there is a considerable dip in demand for surgical procedures. Among the non-invasive fat reduction procedures, cryolipolysis and high-intensity focused ultrasound (HIFU) are gaining popularity as alternatives to liposuction.

Policy and Regulatory Trends: Stricter FDA and EMA regulations are assuring product safety, whereas new ethical promotional and informed consent guidelines are impinging on practice within the industry. Increased scrutiny on medical tourism clinics will allow greater transparency and protection of patients, thereby minimizing the risk of receiving unregulated aesthetic treatments.

Aesthetic Surgery AI and 3D Imaginings: AI-based devices reassess facial and body contouring to enhance surgical planning and customizations. 3D images serve to refine pre-operative counselling by allowing the patient to view possible outcomes prior to the treatments. AI also aids in recommending tailor-made treatment courses, thereby minimizing subjective issues concerning cosmetic enhancements and improving patient satisfaction rates.

Tailored and Regenerative Aesthetic Interventions: Stem cell therapy, PRP treatment, and bioengineered skin grafts are hot on the cosmetic medicine pathways. Aesthetic results obtained are more natural and durable. With advances in autologous fat transfer, the procedure now permits individualized sculpting of the body, for increased aesthetics and safety.

The main growth driver will arise from an increased cost of demand for non-invasive and minimally invasive treatments as technology progress. This would, in effect, give rise to efficacious outcomes that require very short recovery times.

The aged population, particularly the baby boomers, may resort to cosmetic procedures to arrest the aging process, to look youthful, and to stay that way, which would further create demand for the market. Growth in medical tourism, due to the affordability of high-quality cosmetic surgery operations in countries such as Turkey, is expected to attract clientele from around the world and thus spur market growth.

Efficacy of procedures, along with patient satisfaction, has been improved through advancements in new implant materials, fat-grafting techniques, and body contour devices; however, high procedural costs, a potentially intense regulatory environment, and safety and post-operative complication concerns have somewhat limited growth of the market.

The increasing popularity of male cosmetic procedures, customized aesthetic treatments, and robotic surgery using AI will also fuel demand. Regulatory agencies are expected to rationalize approval processes without compromising safety standards. Furthermore, increased medical tourism and novel financing schemes will increase access to cosmetic procedures around the world. Sustainability will also gain prominence, promoting green products and responsible manufacturing processes.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on the safety and efficacy of novel cosmetic treatments, which are getting quicker approvals due to the regulatory agencies. |

| Technological Advancements | Using the latest imaging modalities and minimally invasive surgeries for better outcomes. |

| Consumer Demand | Enhanced patient awareness and increased demand for effective and less invasive therapies. |

| Market Growth Drivers | Increased incidence of cosmetic treatments and technological improvements in medical technology that allow for improved control over cosmetic treatments. |

| Sustainability | Early initiatives toward creating environmentally friendly manufacturing processes and minimizing the environmental footprint of medical devices. |

| Supply Chain Dynamics | Leaning on established distribution networks with an emphasis on assuring availability of treatments to major healthcare facilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Nevertheless, the safety and efficacy of treatments need to be guided by stringent guidelines for non-invasive devices and individualized treatment modalities, thus ensuring uniform care protocols. |

| Technological Advancements | The introduction of artificial intelligence into diagnostic and treatment planning will provide real-time assessment and individualized therapeutic suggestions. |

| Consumer Demand | Greater interest in home-based cosmetic procedures and customized care plans, with patients demanding procedures that fit their lifestyle and comfort. |

| Market Growth Drivers | Growth in healthcare infrastructure in emerging economies, rise in spending on research and development of new therapeutics, and strategic partnerships among medical device firms and healthcare providers. |

| Sustainability | Full-scale implementation of sustainable practices, such as green manufacturing technologies, use of biodegradable materials in device manufacturing, and application of energy-efficient processes across the supply chain. |

| Supply Chain Dynamics | Digital technologies are employed to optimize supply chains maximally in terms of efficiency and transparency, ensuring timely delivery of custom medications to an array of healthcare facilities, including the remote and disadvantaged. |

All considered, the cosmetic surgery goods market is expected to see steady growth due to technological advancements, customized treatment plans, and increasing access to more upscale medical care. Industry players must invest in R&D and remain resilient to regulatory changes to keep up with the changing consumer demand on the global front.

Market Outlook

Market Outlook The USA market for cosmetic surgery products keeps expanding gradually with an increased number of individuals going for surgical as well as non-surgical cosmetic enhancements. Developments in technology, like minimally invasive surgery, fillers that last longer, and the next-generation of implants, are becoming cosmetic procedures more readily available and attractive. Social media effect, beauty consciousness on the rise, and increasing popularity of aesthetic treatments among both women and men are contributing even more towards boosting demand.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.3% |

Market Outlook

The market for cosmetic surgery products in Germany is expected to witness steady growth owing to its well-established healthcare network and the increasing demand for aesthetic procedures. Advances in minimally invasive treatments, increased acceptance by society, and rising awareness have encouraged many people to seek cosmetic enhancement. Clinics and surgeons all over the country are adopting new technologies, like AI-assisted procedures and bioengineered implants to better outcomes for patients and more efficient procedures.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.9% |

Market Outlook

This growing market of cosmetic surgery in China is really moving at an impressive pace, in particular, with increased health expenditures and growing demand for aesthetic procedures. Many people now turn to cosmetic procedures that follow the trends in beauty, the influence of social media influences people's attitudes, and their knowledge of treatments has increased. Healthcare facilities across the country are jumping on board with this growing demand for various surgical and non-surgical procedures.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.7% |

Market Outlook

Forecast Market Out-look The Indian cosmetic surgery products industry is expanding rapidly as people are increasingly sensitive to appearance and health care facilities improving. The high penetration of advanced surgical and non-surgical solutions into the market and the growing awareness of and publicity for cosmetic procedures through social media are driving demand. With the availability of disposable income and an increasing middle-class population, individuals are now willing to spend on services such as Botox, fillers, rhinoplasty, and liposuction, among others.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.4% |

Market Outlook

The growing aesthetic improvement demands of a huge population are coupled with rapid advances in medical care, which primarily catapult the fast-rising Brazilian market for cosmetic surgery products. Currently, many people are turning to liposuction, breast enhancements, and rejuvenation treatments for the face that are non-surgical. This growth trend contributes to disposable income incomes, beauty culture, and availability of qualified plastic surgeons who abound.

Technological development creates a very vital dimension in the shaping of the market. Advancements in implant materials, lasers, and other minimally invasive techniques for the treatment are becoming more effective, safer, and with shorter healing periods.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.9% |

Injectables - Botulinum Toxin

Botulinum toxin, a very popular injectable cosmetic treatment for wrinkle and fine line reduction and reshaping of the face, is believed to be among the least powerful substances that cause temporary paralysis of muscular tissue after dynamic wrinkles. The demand for such interventions has surged now, with the influence of social media on taste and trends being magnified further and the growing acceptance. The younger generations are adopting them for preventive management of aging. North America and Europe are still at the pinnacle in botulinum toxin procedures; however, Asia-Pacific is steadily coming up with increasing disposable incomes and cultures that celebrate youthful skin. Future developments are likely to include longer-lasting botulinum formulations, the use of AI for facial assessments facilitating pinpoint injection delivery, and hybrid treatments combining neurotoxins and fillers to enhance anti-aging results.

Cosmetic Surgery Implants - Breast Implants

Nowadays, implanting breasts remains the most sought-after and performed of all cosmetic surgery procedures in which silicone and saline implants take up the most considerable market share in both augmentation and reconstruction markets. Growth factors for the market include the ever-increasing demand for body contouring, the heightened awareness of reconstructive breast surgery post-mastectomy, and advances in implant materials that give a more natural feel, such as cohesive silicone gel and textured implants. In North America, it is the high consumer demand alongside the presence of experienced plastic surgeons that drives the breast implant procedure. Future innovations might include bioengineered implants with lower risk for the development of capsular contracture, fat grafting for hybrid augmentation, and AI-assisted pre-surgical imaging for personalized implant selection.

Face

The fastest growing application segment for cosmetic facial procedures claims to be non-injectable facelifts and laser skin resurfacing; such as Botox and dermal fillers on chin augmentation and rhinoplasty, targeted towards anti-aging and contouring the face. Future trends may include AI analysis of facial symmetry for customized treatment, the rise of regenerative injectables using stem cells, and combination therapy with laser-filler-toxins.

Breasts

Breast enlargement, reduction, and even reconfiguration surgeries are considered the highest-ranking in terms of demand, along with the procedures and techniques of implanting synthetic materials and fat transfer in cosmetic surgery and post-mastectomy reconstruction. However, the younger part of society seems to have an increasing tolerance towards breast procedures, and all these above factors contribute to the further expansion of the market.

North America tops the list in this sector, with a high demand for augmentation procedures, while Asia-Pacific and Latin America are expected to create a future growth scenario due to the increased medical tourism and affordability of treatments.

The future innovations include developing bioabsorbable breast scaffolds for natural augmentation, AI-powered 3D imaging for personal sizing, and non-invasive breast-lifting procedures by using ultrasound and radiofrequency technology.

Competitive Insight The high-potent oral solid dosage (HPOSD) contract development and manufacturing market is competitive. The demand for special drug formulations is increasing, and there are regulatory requirements on how such high-potency compounds should be handled.

Besides, advances in containment and manufacturing technologies for such drugs have caused increased competition among HPOSD contractors. Companies continue investing in specialized containment facilities, advanced formulation techniques, and high scalability production capabilities to edge the competition. The well-established contract development and manufacturing organizations (CDMOs), pharmaceutical manufacturers, and niche service providers shape the market at the same time in preparing a competitive environment for HPOSD production.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AbbVie Inc. | 23.2% |

| Galderma SA | 19.0% |

| Johnson & Johnson Services, Inc. | 15.4% |

| Merz Pharma GmbH & Co. KGaA | 13.2% |

| Other Companies (combined) | 29.1% |

| Company Name | AbbVie Inc. |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Market leader providing high-containment HPOSD manufacturing, including highly potent APIs and finished dosage forms. |

| Company Name | Galderma SA |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Offers specialized development and manufacturing services for high-potency tablets and capsules, focusing on scalable production. |

| Company Name | Johnson & Johnson Services, Inc. |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Provides comprehensive HPOSD solutions, including formulation development, analytical services, and commercial production. |

| Company Name | Merz Pharma GmbH & Co. KGaA |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Develops complex HPOSD formulations with a focus on containment technologies and regulatory compliance. |

| Company Name | Cynosure LLC |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Specializes in highly potent drug manufacturing with expertise in oncology and other specialized therapeutic areas. |

Key Company Insights

Galderma SA

Galderma, the front-runner in global cosmetic surgery products, specializes in dermatological and aesthetic solutions. Galderma is a pioneering name that came out with injectable fillers and botulinum toxins and advanced skincare for medical and cosmetic applications.

Johnson & Johnson Services

As one of the world's biggest healthcare conglomerates, it is represented in aesthetics and reconstructive surgery by two subsidiaries: Mentor Worldwide, which is breastimplant-focused, and Ethicon, which is known for wound closure and skin-tightening technologies. Research and development cost consummate most of the investments which push the technologies in the domain of cosmetic surgery.

Merz Pharma GmbH & Co. KGaA

It ranges from medical aesthetics to neurotoxins. Merz Pharma has a very solid position in the arena of cosmetic surgery, endowed with an extensive botulinum toxin, dermal fillers, and antiaging product portfolios, all streamlined within penetrating levels within the USA and European markets.

Cynosure LLC

Being one of the largest healthcare conglomerates, this company forays into aesthetic and reconstructive surgery through its subsidiaries Mentor Worldwide, which focuses on breast implants and Ethicon, known for its technologies on wound closure and skin-tightening. Heavy investments in R&D take the lead in the advancement of technologies in cosmetic surgery.

Beyond the leading companies, several other contract manufacturers contribute significantly to the market, enhancing service diversity and technological advancements. These include:

These companies focus on expanding the reach of HPOSD manufacturing, offering competitive pricing, containment innovations, and regulatory-compliant solutions to meet diverse pharmaceutical industry needs.

The overall market size for Cosmetic Surgery Products Market was USD 22,316.9 million in 2025.

The Cosmetic Surgery Products Market is expected to reach USD 48,628.6 million in 2035.

Growing Preference for Non-Invasive and Minimally Invasive Procedures has significantly increased the demand for Cosmetic Surgery Products Market.

The top key players that drives the development of Cosmetic Surgery Products Market are AbbVie Inc., Galderma SA, Johnson & Johnson Services, Inc., Merz Pharma GmbH & Co. KGaA, Cynosure LLC.

Implants leading is Cosmetic Surgery Products Market is expected to command significant share over the assessment period.

Implants (Breast Implants, Chin & Cheek Implants, Buttock Implants and Calf Implants), Injectables (Botulinum Toxin, Soft Tissue Fillers, Dermal Fillers, Absorbable Fillers and Non-Absorbable Fillers), Cosmetic Surgery Lasers & Energy-Based Devices (Ablative Lasers, Non-Ablative Lasers, Radiofrequency (RF) Devices and Ultrasound-Based Devices) Skin Resurfacing & Rejuvenation Devices (Microdermabrasion Devices and Chemical Peeling Solutions), Body Contouring & Liposuction Equipment (Liposuction Machines and Cryolipolysis (Fat Freezing) Devices) , Cosmetic Surgery Services (Surgical Cosmetic Procedures and Non-Surgical Cosmetic Treatments)

Face, Upper Body, Breasts, Hands, Stomach and Lower Body

Hospitals, Ambulatory Surgical Centers, Clinics, Universities and Research Centers and Homecare Settings

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Bleeding Control Tablets Market Analysis - Growth, Applications & Outlook 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Genomic Urine Testing Market Trends - Size, Share & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.